- Home

- »

- Healthcare IT

- »

-

Medical Billing Software Market Size & Share Report, 2030GVR Report cover

![Medical Billing Software Market Size, Share & Trends Report]()

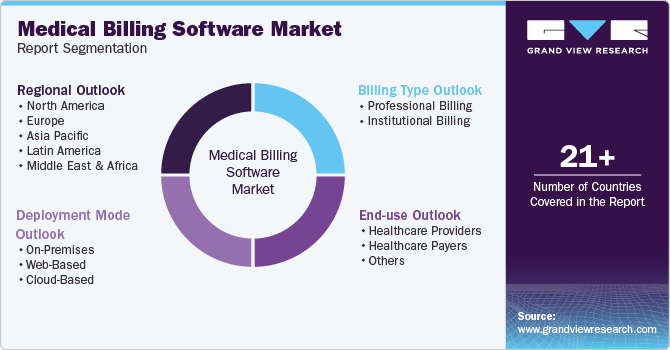

Medical Billing Software Market (2024 - 2030) Size, Share & Trends Analysis Report By Billing Type (Professional Billing, Institutional Billing), By Deployment Mode (Web-based, Cloud-based), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-449-9

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Billing Software Market Summary

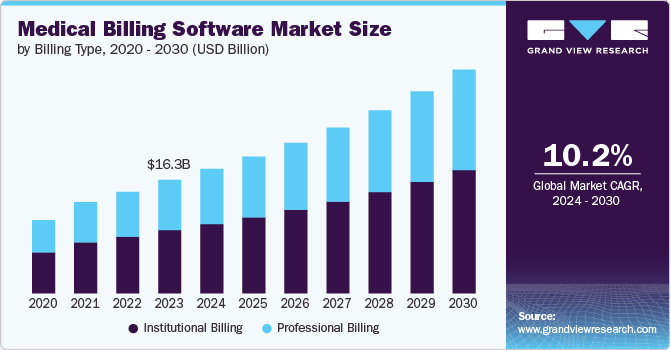

The global medical billing software market size was estimated at USD 16.34 billion in 2023 and is projected to reach USD 32.18 billion by 2030, growing at a CAGR of 10.2% from 2024 to 2030. The increasing demand for efficient healthcare management, technological advancements, and the growing regulatory compliance are some of the factors contributing to market growth.

Key Market Trends & Insights

- North America region held the largest share of 39.4% in 2023.

- Medical billing software market in the U.S.held the largest revenue share in 2023.

- Based on billing type, the institutional billing segment held the largest revenue share in 2023.

- Based on deployment mode, the web-based segment held the largest revenue share in 2023.

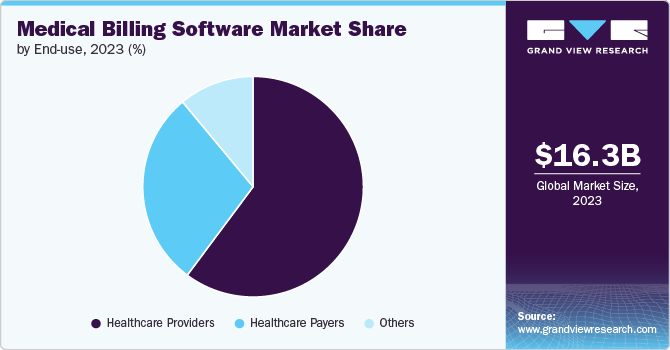

- Based on end use, the healthcare providers segment held the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 16.34 Billion

- 2030 Projected Market Size: USD 32.18 Billion

- CAGR (2024-2030): 10.2%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The increasing prevalence of chronic and infectious diseases is driving the demand for medical billing software, as healthcare facilities seek to improve care quality, operational efficiency, and cost management.

Further, healthcare providers are progressively refining their operations to improve administrative load and enhance cash flow. This shift is particularly visible among small-to-medium sized practices that need assistance with their manual billing routines. By implementing advanced software, these practices are empowered to automate claims submission, more efficiently monitor payments, and reduce the mistakes typically linked with manual data entry. Therefore, incorporating medical billing software into their systems facilitates revenue cycle management and allows healthcare providers to assign more of their resources and attention to patient care rather than administrative tasks.

Moreover, technological advancements are significant in propelling the market. The integration of artificial intelligence (AI), machine learning (ML), and cloud computing into billing systems has significantly transformed how healthcare organizations manage their financial activities. Thus, implementing AI-driven solutions allows for real-time tracking of billing processes, enhancing transparency, and efficiency. Furthermore, automation reduces human error and accelerates processing times for claims submissions and payments. As healthcare providers increasingly seek to leverage these technologies to improve their operational capabilities, the demand for advanced software continues to rise, marking a significant trend in the market.

The growing prominence on compliance with healthcare regulations is driving the market. As healthcare systems evolve, providers are progressively involved with billing practices and patient data management. Medical billing software helps organizations navigate these regulatory landscapes by ensuring adherence to various compliance requirements, such as HIPAA and ICD coding standards. Maintaining compliance helps reduce the risk of penalties and improves healthcare organizations' overall financial health. As a result, an increasing demand for medical billing solutions prioritizing compliance is expected to strengthen market growth in the forecast years.

The COVID-19 pandemic has significantly accelerated the demand for medical billing software, as healthcare providers faced challenges in managing patient care and billing processes. With the rapid shift towards telehealth services, there was an urgent need for efficient billing solutions that could accommodate remote consultations. This surge in demand stimulated many healthcare organizations to invest in advanced medical billing software that could streamline operations, reduce errors, and enhance revenue cycle management.

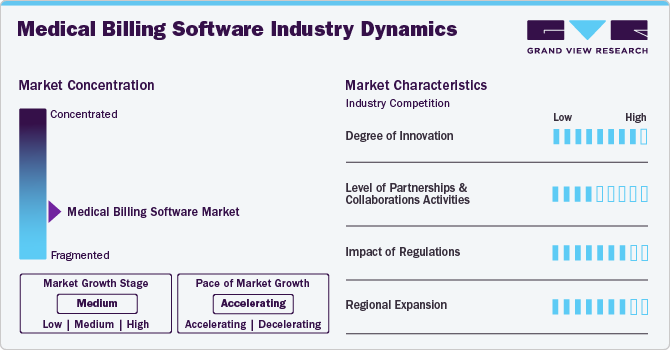

Market Concentration & Characteristics

The medical billing software market is fragmented, with the presence of several emerging solution providers dominating the market. The degree of innovation is high, and the level of partnerships & collaboration activities is moderate. The impact of regulations on the industry and the regional expansion of the industry is high.

The degree of innovation in the industry is high. The healthcare sector is undergoing a digital transformation that enhances patient care delivery through improved access to data and streamlined administrative processes. AI technologies are being integrated into medical billing systems to automate repetitive tasks such as coding and claims processing. The industry is experiencing a shift towards cloud-based medical billing solutions due to their cost-effectiveness, and ease of access compared to traditional on-premises systems.

The industry's level of partnerships & collaborations is moderate. This is due to several factors, including the desire to gain a competitive advantage in the industry, enhance technological capabilities, and the need to consolidate in a rapidly growing market. For instance, in August 2023, a cloud-based ambulatory software company, RXNT, partnered with American Business Systems, LLC, to provide comprehensive, connected Medical Billing and EHR software.

The medical billing software market is significantly influenced by multiple regulations that govern the healthcare industry. These regulations are designed to ensure compliance, protect patient data, and enhance the overall efficiency of healthcare delivery systems. The use of personal health data necessitates strict adherence to privacy regulations such as HIPAA in the U.S. and GDPR in Europe. Furthermore, the Centers for Medicare & Medicaid Services (CMS) establishes guidelines that govern billing practices for Medicare and Medicaid services.

The level of regional expansion in the industry is high, driven by an increasing customer base for advanced billing and RCM solutions. The increasing prevalence of diseases contributes to healthcare systems, creating opportunities for integrated billing solutions. Furthermore, software providers are integrating new technologies targeting service providers and professional organizations to reduce the medical billing process. For instance, in August 2024, MediPortal PTY LTD. (MediPortal) launched an AI-based medical platform for general practitioners in Australia and New Zealand. This platform includes medical billing, in addition to an AI-supported care plan generator & speech-to-text medical scribing.

Billing Type Insights

The institutional billing segment held the largest revenue share in 2023. Institutional medical billing services are more prone to errors compared to professional billing. While professional billing can have errors due to technical issues or other factors, institutional billing services are not completely error-free. However, many hospitals and healthcare facilities still choose institutional billing services because they specialize in this area. The institutional billing industry is larger in size compared to professional physician billing. This trend is expected to continue as more hospitals and major clinics adopt institutional billing services. This growth in institutional billing is projected to impact and expand the overall medical billing segment throughout the forecast period.

The professional billing segment is anticipated to grow at the fastest growth rate over the forecast period. Professional billing focuses on services provided by healthcare professionals, such as physicians and specialists, ensuring that claims are accurately submitted to insurance companies for reimbursement. Moreover, the growth of this segment is further attributed to the increasing number of healthcare providers opting for independent practice, the rise of value-based care models, and the increasing need for precise billing practices.

Deployment Mode Insights

The web-based segment held the largest revenue share in 2023. The web-based platforms allow healthcare providers to access billing systems via a web browser, eliminating the need for extensive local installations and reducing IT overhead. The increasing demand for efficiency, scalability, and accessibility in healthcare operations drives the shift towards web-based solutions. As medical practices seek to streamline their billing processes, web-based platforms offer an applicable option for reducing billing processes. Further, compliance with regulations such as HIPAA has propelled the adoption of web-based systems in medical billing.

The cloud-based segment is anticipated to grow at the fastest growth rate during the forecast period, owing to its flexibility, scalability, and cost-effectiveness. Cloud solutions often come with built-in compliance features that reduce the burden on healthcare providers. Furthermore, the evolution of billing has transformed it from a standalone back-office function into a vital part of the entire statement process, particularly with the advent of cloud technology. Cloud billing services are enabling organizations to reduce expenses while enhancing customer service. For instance, a 2021 Flexera study revealed that 93% of organizations have adopted cloud-based technologies, with 73% aiming to optimize their cloud usage for cost efficiency. This trend boost the growing demand for cloud-based billing solutions, driven by the need for lower capital and operational costs.

End-use Insights

The healthcare providers segment held the largest revenue share in 2023. The growth of the segment is supported by the implementation of stringent regulatory measures in various countries, including the U.S. However, this segment faces challenges primarily due to limitations in IT infrastructure in emerging markets. A significant barrier to the adoption of advanced technologies, such as claims processing software, is the associated costs, which remain a major barrier for many providers.

The healthcare payers’ segment is expected to register the fastest growth rate during the forecast period. Healthcare payers are responsible for processing claims, managing reimbursements, and ensuring compliance with regulatory standards. The increasing complexity of healthcare billing processes has imposed the adoption of advanced software solutions that streamline operations and enhance efficiency. Healthcare payers have supported providers by offering a cloud-based and web-based portal that delivers accurate and timely information, not only regarding the pandemic but also in managing medical billing and related claims. However, the rise in data breaches and loss of confidentiality, along with the transition from legacy systems, may pose challenges to the growth of healthcare payers in the market.

Regional Insights

North America region held the largest share of 39.4% in 2023. This is due to the enhanced healthcare infrastructure, increased adoption of technology for better and more precise healthcare outcomes, and advancements in healthcare systems. In addition, developments in technology, such as cloud computing and artificial intelligence (AI), have made it easier for healthcare organizations to implement and utilize medical billing software.

U.S. Medical Billing Software Market Trends

Medical billing software market in the U.S.held the largest revenue share in 2023, owing to the increasing complexity of healthcare regulations, the rise in patient volume, and the growing demand for efficient revenue cycle management (RCM). Additionally, as telehealth services gain popularity, there is a growing need for billing solutions that can accommodate remote consultations and digital health services. Cloud-based solutions are becoming increasingly popular due to their scalability, cost-effectiveness, and ease of access from multiple locations.

Europe Medical Billing Software Market Trends

Medical billing software market in Europeis driven by the increasing number of elderly individuals in Europe, particularly in countries like Italy, which has the second-largest geriatric population globally, is leading to more hospital visits and admissions. This demographic trend necessitates efficient medical billing solutions to manage the rising demand for healthcare services. In addition, widespread digitalization initiatives, strong regulatory frameworks, and substantial investments in healthcare IT are favorable for market growth.

The UK medical billing software market held the largest market share in 2023 owing to the rapid adoption of digital solutions in healthcare which 36has led to a greater need for efficient medical billing systems. This is crucial for managing patient data, billing information, and insurance claims effectively, thereby reducing administrative errors. GP-Billing is a recently launched innovative and easy-to-use financial software solution specifically designed for NHS General Practices in the UK.

It helps streamline all private, third party and insurance billing.On average, GP-Billing can save a practice approximately 50 days annually by automating and streamlining the billing process. Practices like Northgate Surgery is already using GP-Billing to increase data accuracy and capture income from various streams. Thus, the introduction of new medical billing products is expected to drive market growth significantly.

Medical billing software market in Germany is expected to grow over the forecast period. The growth is driven by various factors including increasing healthcare expenditures, technological advancements, and regulatory reforms. The increasing digitalization of healthcare processes is enhancing the efficiency of medical billing systems, leading to reduced administrative errors and improved claim processing times.

Asia Pacific Medical Billing Software Market Trends

Medical billing software marketin Asia Pacific is expected to witness the fastest growth of CAGR over the forecast period owing to the growing geriatric population and chronic diseases in countries such as Japan, China, and India, elevating the need for hospital admissions, which exerts operational pressure on healthcare infrastructure, thereby leveraging the need to streamline operations using efficient and advanced billing solutions. In addition, increasing healthcare expenditures and rising adoption of cloud-based solutions are expected to drive market growth.

The China medical billing software market is expected to grow significantly from 2024 to 2030. This growth is fueled by the increasing number of patients and the expansion of health insurance coverage, which necessitates more efficient billing processes. Despite the positive growth outlook, the market faces challenges, particularly concerning cybersecurity threats. The increasing incidence of cybercrimes raises concerns about the privacy and security of patient data, which can hinder market expansion

Medical billing software market in India is driven by increasing disposable income, rising healthcare expenditure, and the growing prevalence of chronic and infectious diseases.Many healthcare providers are increasingly opting to outsource their medical billing processes to reduce operational costs. This allows them to focus on patient care while ensuring accurate and timely billing. Furthermore, the rising adoption of telemedicine services has created a need for adaptable medical billing solutions that can efficiently handle remote consultations and digital health services.

Latin America Medical Billing Software Market Trends

The medical billing software market in Latin America is being significantly driven by recent launches and innovations. The complexity of healthcare billing processes has led to a rising demand for automated solutions. Many new software products are being developed to streamline billing operations, reduce manual errors, and enhance efficiency in RCM. For instance, DreamSoft4u medical billing software offers a comprehensive suite of features including advanced reporting, automated claim processing, centralized billing, and cloud hosting.Key functionalities include an A/R control center, medical coding tools, and integration with EHR systems, making it suitable for practices of all sizes.

Brazil medical billing software marketis anticipated to grow significantly due to the significant reforms in their healthcare systems, which are driving the demand for medical coding. For instance, Brazil’s Unified Health System (SUS) is continually being refined to improve efficiency and coverage, necessitating the use of accurate coding to manage patient data, billing, and compliance with national health policies.

The Middle East & Africa Medical Billing Software Market Trends

Medical billing software market in The Middle East & Africa is expected to grow significantly due to technological advancements and increasing healthcare demands. However, addressing challenges related to costs and data security will be crucial for sustained success in this evolving landscape.

Saudi Arabia medical billing software market is anticipated to grow significantly over the period owing to increased investment in healthcare services as part of the country's national development initiatives, such as Saudi Arabia's Vision 2030. Saudi Arabia's Vision 2030 aims to enhance healthcare infrastructure and integrate advanced technologies. As part of this initiative, there is a significant investment in smart healthcare solutions, including medical billing software. These efforts are designed to improve patient safety and care through innovative technologies. For instance, in June 2023, SANTECHTURE revenue cycle management solution launched AI and predictive analytics-based products supporting insurance and medical rule validation processes targeting improvement in clinical documentation improvement at the HealthTech Summit & Expo in Riyadh, Saudi Arabia.

Key Medical Billing Software Company Insights

The market is fragmented, with several large and emerging players operating in the market, adopting various strategies such as collaborations, acquisitions, partnerships, and launching new devices. Some emerging players into the market includes ChiroTouch, GeBBS, and Healthray.

Key Medical Billing Software Companies:

The following are the leading companies in the medical billing software market. These companies collectively hold the largest market share and dictate industry trends.

- Kareo, Inc.

- WebPT, Inc.

- athenahealth

- ADT

- Cognizant

- Epic Systems Corporation.

- GeBBS

- Healthray

- DrChrono (EverHealth Solutions Inc.)

- AGS Health

- CompuGroup Medical

- AdvancedMD, Inc.

- Digitech Computer LLC

- Compulink Advantage

- Medusind

Recent Developments

-

In March 2024, the pharmacy software provider DocStation collaborated with the U.S. pharmacy network CPESN to provide solutions for pharmacists to submit medical claims online.

-

In January 2024, a Perelman School of Medicine resident developed an AI-based dictation software, Pocket Scribe, to ease transcription, note-taking, and seamless billing and reimbursement procedures.

-

In August 2023, FareMD launched an AI-driven platform to streamline medical billing in the U.S.

-

In February 2023, Elation Health, a technology company, acquired Lightning MD, a cloud-based medical billing and payer company. This acquisition helped Elation expand its technology solution offerings for primary care practices.

Medical Billing Software Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 17.92 billion

Revenue forecast in 2030

USD 32.18 billion

Growth rate

CAGR of 10.2% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Billing type, deployment mode, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Kareo Inc.; WebPT, Inc.; athenahealth; ADT; Cognizant; Epic Systems Corporation.; GeBBS; Healthray; DrChrono (EverHealth Solutions Inc.); AGS Health; CompuGroup Medical; AdvancedMD, Inc.; Digitech Computer LLC; Compulink Advantage; Medusind

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Billing Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical billing software market report based on billing type, deployment mode, end-use, and regions:

-

Billing Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Professional Billing

-

Institutional Billing

-

-

Deployment Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Premises

-

Web-Based

-

Cloud-Based

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare Providers

-

Healthcare Payers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical billing software market size was estimated at USD 16.34 billion in 2023 and is expected to reach USD 17.92 billion in 2024.

b. The global medical billing software market is expected to grow at a compound annual growth rate of 10.25% from 2024 to 2030 to reach USD 32.18 billion by 2030.

b. Based on billing type, the institutional billing segment held the largest revenue share of 55.73% in 2023. Many hospitals and healthcare facilities still choose institutional billing services because they specialize in this area. The institutional billing industry is larger in size compared to professional physician billing. This trend is expected to continue as more hospitals and major clinics adopt institutional billing services. This growth in institutional billing is projected to impact and expand the overall medical billing segment throughout the forecast period.

b. Some prominent players in the medical billing software market include Kareo, Inc.; WebPT, Inc.; athenahealth; ADT; Cognizant; Epic Systems Corporation.; GeBBS; Healthray; DrChrono (EverHealth Solutions Inc.); AGS Health; CompuGroup Medical; AdvancedMD, Inc.; Digitech Computer LLC; Compulink Advantage; Medusind.

b. The growth of the medical billing software industry is expected to be driven by several key factors, such as the rising prevalence of chronic diseases, growing geriatric population, and the need for regulatory-compliant sophisticated healthcare management solutions powered with advanced technologies. Moreover, the growing demand for telemedicine services is expected to fuel market growth further.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.