- Home

- »

- Advanced Interior Materials

- »

-

Medical Alloys Market Size, Share & Growth Report, 2030GVR Report cover

![Medical Alloys Market Size, Share & Trends Report]()

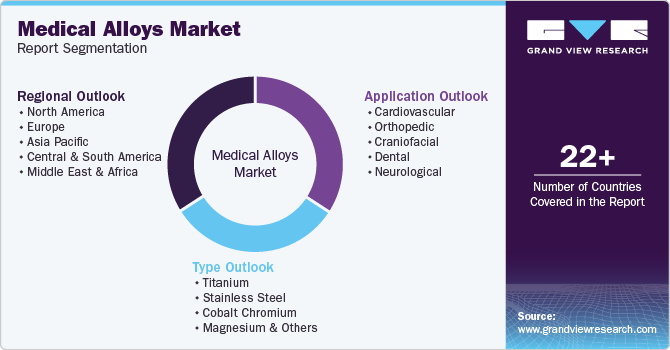

Medical Alloys Market Size, Share & Trends Analysis Report By Type (Titanium, Stainless Steel), By Application (Orthopedic, Neurological, Dental, Craniofacial), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-431-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Medical Alloys Market Size & Trends

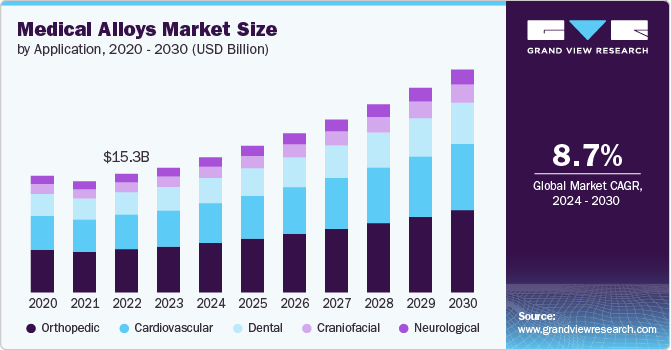

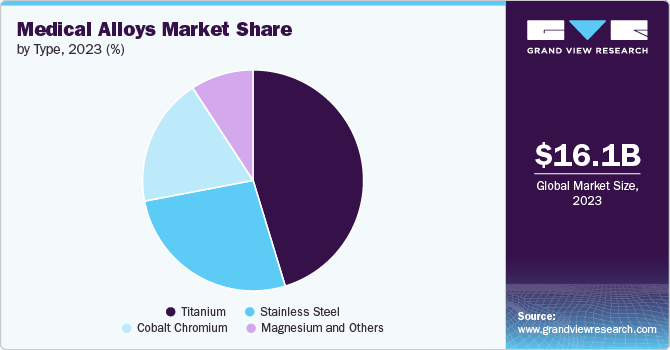

The global medical alloys market size was estimated at USD 16.12 billion in 2023 and is projected to grow at a CAGR of 8.7% from 2024 to 2030. The key market driver is the growing demand for medical implants due to rising chronic diseases and aging populations. Conditions such as osteoporosis and cardiovascular diseases are boosting the need for durable, biocompatible materials like titanium and cobalt chromium, especially with advancements in minimally invasive surgeries and innovative implant technologies.

Innovations such as biodegradable magnesium alloys for temporary implants and advanced alloys for specific applications like cobalt chromium stents are driving growth. Ongoing R&D and new product launches are expanding the use of medical alloys in modern healthcare.

Drivers, Opportunities & Restraints

The growing demand for medical implants and devices, particularly in orthopedics, cardiovascular, and dental applications, is a significant driver of the medical alloys market. Rising incidences of age-related disorders like osteoporosis and cardiovascular diseases, coupled with advancements in medical technology, are increasing the need for durable and biocompatible materials such as titanium, stainless steel, and cobalt chromium. For instance, as the global geriatric population increases, so does the need for hip and knee replacement surgeries, boosting the demand for titanium-based implants.

The growing demand for medical implants and devices, particularly in orthopedics, cardiovascular, and dental applications, is a significant driver of the medical alloys market. Rising incidences of age-related disorders like osteoporosis and cardiovascular diseases, coupled with advancements in medical technology, are increasing the need for durable and biocompatible materials such as titanium, stainless steel, and cobalt chromium. For instance, as the global geriatric population increases, so does the need for hip and knee replacement surgeries, boosting the demand for titanium-based implants.

The market presents growth opportunities driven by the increasing adoption of bioresorbable and biodegradable alloys such as magnesium. These materials, which gradually dissolve in the body after fulfilling their purpose, are opening new avenues in temporary implant applications. For instance, the development of magnesium stents, which dissolve after restoring normal blood flow, eliminates the need for subsequent surgeries, marking a significant innovation in cardiovascular care.

Type Insights

“Titanium segment held the largest revenue share of medical alloys market in 2023.”

Titanium dominates the medical alloys market due to its exceptional biocompatibility, corrosion resistance, and high strength-to-weight ratio. These properties make it ideal for implants such as hip and knee replacements, dental implants, and bone plates. The increasing prevalence of orthopedic disorders, advancements in implant technology, and a growing aging population are key drivers for the demand for titanium alloys. Additionally, titanium’s ability to osseointegrate effectively with bones has further solidified its use in critical medical applications.

Magnesium alloys are emerging as a fast-growing segment due to their lightweight nature, biodegradability, and the ability to support temporary implants that dissolve in the body over time. These alloys are particularly attractive for pediatric patients or cases where secondary surgeries to remove implants can be avoided. The increasing focus on reducing surgical invasiveness, combined with growing research in bioresorbable materials, is propelling this segment forward.

Application Insights & Trends

“Orthopedic segment held the largest revenue share of medical alloys market in 2023.”

The orthopedic segment holds the largest share of the medical alloy market, driven by the rising incidence of musculoskeletal conditions and bone fractures, particularly among the elderly. The use of medical alloys in orthopedic implants, such as joint replacements, bone screws, and pins, is substantial, with titanium and stainless steel alloys being primary materials. Continued advancements in minimally invasive surgery and the increasing demand for durable, long-lasting implants are further fueling growth in this segment.

The cardiovascular segment is expected to witness the fastest growth, driven by the rising prevalence of heart disease and the increasing use of stents, pacemakers, and other cardiovascular implants. Cobalt chromium and titanium alloys are commonly used in this segment due to their strength, corrosion resistance, and ability to withstand the dynamic environment within blood vessels. The growing demand for minimally invasive cardiac procedures, along with technological innovations in alloy materials, supports rapid expansion in this area.

Regional Insights

“North America dominated the revenue share of the global medical alloys market.”

North America dominates the medical alloys market, driven by the high prevalence of chronic diseases, advanced healthcare infrastructure, and a significant aging population. The strong presence of key market players and high investment in medical technology further bolster the market in this region.

U.S. Medical Alloys Market Trends

The U.S. remains the largest market in North America, supported by extensive R&D in medical devices and a growing number of surgical procedures. Additionally, government initiatives to improve healthcare access and the increasing trend of minimally invasive surgeries are boosting the demand for advanced medical alloys.

Asia Pacific Medical Alloys Market Trends

Asia Pacific is experiencing rapid growth, fueled by increasing healthcare spending, growing awareness of advanced medical procedures, and rising incidences of age-related conditions. Countries like China and India are witnessing heightened demand for medical implants, supported by improving healthcare infrastructure and a burgeoning middle-class population.

Europe Medical Alloys Market Trends

Europe holds a significant share of the market due to its well-established healthcare system and increasing focus on medical innovation. Germany, the UK, and France are leading markets, driven by a strong medical device industry, aging populations, and the growing adoption of advanced medical alloys for orthopedic and cardiovascular applications.

Key Medical Alloys Company Insights

Some of the key players operating in the market include Carpenter Technology Corporation and ATI Specialty Alloys Components.

-

Carpenter Technology Corporation is a key player in the medical alloys market, specializing in high-performance alloys, including titanium, cobalt chromium, and stainless steel. The company serves various industries, with its medical segment focused on providing materials for implants, surgical instruments, and other medical devices. Its expertise lies in developing corrosion-resistant and biocompatible alloys, which are critical for medical applications. Their extensive R&D capabilities enable them to innovate and create materials that meet the stringent demands of the healthcare industry.

-

ATI Specialty Alloys Components is a prominent company involved in the production of advanced specialty materials, including medical-grade titanium and other alloys for the healthcare sector. The company operates across multiple segments, including aerospace, defense, and medical. ATI’s medical materials division offers high-performance alloys used in orthopedic implants, surgical devices, and dental applications.

Key Medical Alloys Companies:

The following are the leading companies in the medical alloys market. These companies collectively hold the largest market share and dictate industry trends.

- Ametek Specialty Products

- Aperam SA

- ATI Specialty Alloys Components

- Carpenter Technology Corporation

- Ford Wayne Metals

- Johnson Matthey PLC

- Materion Corporation

- Questek Innovations LLC

- Royal DSM

- Supra Alloys Inc.

Recent Developments

-

In February 2024, Zeda, Inc. acquired an orthopedic implant company to boost its additive manufacturing capabilities. This move strengthens Zeda's position in the medical alloys market by enabling the production of customized, high-performance implants using advanced 3D printing technology.

-

In August 2023, OssDsign launched a new product aimed at facilitating additional surgical procedures. This development expands OssDsign’s product portfolio within the medical alloys market, particularly in the craniofacial and neurological sectors. The new product enhances surgical outcomes by providing better integration with bone structures, thus supporting OssDsign's focus on advanced biomaterials and innovative solutions for complex surgical challenges.

Medical Alloys Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 17.48 billion

Revenue forecast in 2030

USD 28.83 billion

Growth rate

CAGR of 8.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative Units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; France; Italy; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

Carpenter Technology Corporation; Questek Innovations LLC; Ametek Specialty Products; Aperam SA; ATI Specialty Alloys Components; Johnson Matthey PLC; Ford Wayne Metals; Supra Alloys Inc.; Royal DSM; Materion Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Alloys Market Report Segmentation

This report forecasts revenue growth at global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical alloys market report based on type, application, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Titanium

-

Stainless Steel

-

Cobalt Chromium

-

Magnesium & Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cardiovascular

-

Orthopedic

-

Craniofacial

-

Dental

-

Neurological

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global medical alloys market size was estimated at USD 16.12 billion in 2023 and is expected to reach USD 17.48 billion in 2024.

b. The global medical alloys market is expected to grow at a compound annual growth rate of 8.7% from 2024 to 2030 to reach USD 28.83 billion by 2030.

b. By type, titanium dominated the market with a revenue share of over 45.0% in 2023

b. Some of the key vendors in the global medical alloys market are Carpenter Technology Corporation, Questek Innovations LLC, Ametek Specialty Products, Aperam SA, ATI Specialty Alloys Components, Johnson Matthey PLC, Ford Wayne Metals, Supra Alloys Inc., Royal DSM, Materion Corporation, among others.

b. The key factor driving the growth of the global medical alloys market is attributed to the growing demand for medical implants due to rising chronic diseases and aging populations.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."