- Home

- »

- Plastics, Polymers & Resins

- »

-

Mechanical Recycling Of Plastics Market Share Report, 2030GVR Report cover

![Mechanical Recycling Of Plastics Market Size, Share & Trends Report]()

Mechanical Recycling Of Plastics Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (PE, PET), By Application (Packaging, Automotive), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-453-6

- Number of Report Pages: 111

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Mechanical Recycling Of Plastics Market Summary

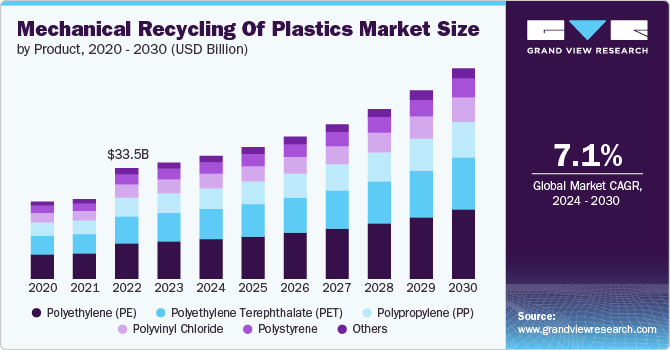

The global mechanical recycling of plastics market size was estimated at USD 35,170.05 million in 2023 and is projected to reach USD 63,768.52 million by 2030, growing at a CAGR of 9.36% from 2024 to 2030. Rising non-biodegradable plastic pollution globally is increasing the threat of various ill effects caused by this pollution, leading to a surge in the demand for sustainable actions to manage plastic pollution effectively.

Key Market Trends & Insights

- Europe mechanical recycling of plastics market dominated globally with the largest revenue share of 34.11% in 2023.

- Germany's mechanical plastics recycling market thrives on advanced infrastructure and strong environmental leadership.

- Based on product, the polyethylene (PE) segment led the market with a share of 31.96% in terms of revenue in 2023.

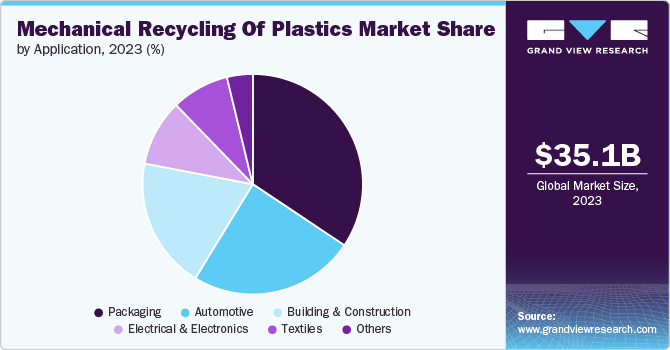

- Based on application, the packaging segment dominated the market with the largest revenue share of 34.36% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 35,170.05 Million

- 2030 Projected Market Size: USD 63,768.52 Million

- CAGR (2024-2030): 9.36%

- Europe: Largest market in 2023

In recent years, the market has seen a shift towards circular economy models, where plastics are reused and recycled multiple times. Governments, particularly in Europe and North America, are pushing for stricter regulations on plastic waste management, encouraging industries to adopt sustainable recycling practices.

Large consumer brands are also pledging to increase the use of recycled plastics in their packaging, boosting demand for mechanical recycling. The trend towards greater transparency and traceability in recycling processes is also growing, with companies investing in technologies that ensure the quality and purity of recycled plastics.

Drivers, Opportunities & Restraints

Growing environmental awareness and regulatory pressure to reduce plastic waste are major market drivers. Governments globally are implementing stringent regulations, such as extended producer responsibility (EPR) schemes and bans on single-use plastics, which force manufacturers to invest in recycling solutions. In addition, consumers are demanding eco-friendly products, pushing companies to incorporate recycled materials into their goods. This has significantly increased the demand for mechanical recycling services as businesses aim to meet both regulatory requirements and consumer expectations.

Emerging markets in Asia, Central & South America, and South Africa present a significant opportunity for the mechanical recycling of plastics. As urbanization and industrialization continue to grow in these regions, so does the generation of plastic waste. Governments in these areas are now recognizing the importance of managing waste sustainably, opening doors for investment in local recycling infrastructure. Companies specializing in mechanical recycling can expand into these markets, providing the expertise and technology needed to establish efficient recycling systems while benefiting from the increased demand for recycled materials.

Despite its potential, the market faces challenges that could hinder its growth. One key restraint in the mechanical recycling of plastics is the contamination of waste streams. Mixed plastics, dirty or food-contaminated plastics, and the presence of non-recyclable materials pose challenges in the recycling process, leading to a reduction in the quality of the final recycled product. In addition, the high cost of sorting and cleaning these materials makes the recycling process less economically viable, particularly in regions where collection systems are inefficient. This limits the scalability of mechanical recycling solutions and hinders their widespread adoption across industries.

Product Insights

Based on product, the polyethylene (PE) segment led the market with a share of 31.96% in terms of revenue in 2023. This can be attributed to the rising global production and consumption of PE, especially in packaging, which is a significant driver for the mechanical recycling of PE plastics. PE, being one of the most commonly used plastics, contributes a substantial portion of plastic waste. Governments and regulatory bodies are setting stricter recycling targets for PE materials, particularly in the packaging sector, which relies heavily on PE for products like plastic bags, bottles, and wraps. Moreover, brand owners and retailers are committing to incorporating higher percentages of recycled PE into their products, driven by consumer demand for sustainable packaging solutions. This is increasing the need for effective mechanical recycling technologies that can process PE efficiently and produce high-quality recycled material suitable for reuse in new products.

The polyethylene terephthalate (PET) segment is expected to grow at a significant rate over the forecast period. The surge in demand for sustainable packaging, particularly in the beverage and food industries, is a major driver for the mechanical recycling of PET plastics. PET is widely used in the production of bottles, containers, and packaging films, making it a significant contributor to plastic waste. As consumers and regulatory bodies push for eco-friendly packaging, brands are increasingly using recycled PET (rPET) to reduce their environmental footprint. Government regulations, such as mandatory recycled content in packaging, are further fueling the demand for PET recycling. The clear recyclability of PET, combined with its ability to retain quality through multiple recycling cycles, positions it as a key material in the transition towards a circular economy, boosting the need for advanced mechanical recycling processes.

Application Insights

Based on application, the packaging segment dominated the market with the largest revenue share of 34.36% in 2023.The push for reducing plastic waste and creating more sustainable packaging solutions is a key driver in the mechanical recycling of plastics within the packaging market. Packaging is one of the largest contributors to plastic waste, with single-use plastics being a major concern. Governments worldwide are imposing stricter regulations on the use of virgin plastics, encouraging the use of recycled materials in packaging production. In addition, global brands and retailers are committing to ambitious sustainability goals, such as using 100% recyclable or reusable packaging by 2030. This is increasing the demand for mechanical recycling solutions, which can transform post-consumer packaging waste into high-quality recycled materials, reducing reliance on virgin plastics and contributing to a more circular economy.

The flame retardants segment is poised to grow at the fastest CAGR from 2024 to 2030. The increasing focus on sustainability and lightweighting in the automotive industry is a significant driver for the mechanical recycling of plastics. Automakers are under growing pressure to reduce the environmental impact of their vehicles, both during production and at the end of their life cycle. Mechanical recycling offers an efficient way to reuse plastic components from scrapped vehicles, such as bumpers, interior panels, and under-the-hood parts. Furthermore, regulatory mandates in regions like Europe are promoting the use of recycled materials in vehicle manufacturing, aiming to lower carbon emissions and meet circular economy goals. The ability to recycle and reuse automotive plastics not only reduces waste but also helps automakers cut material costs while enhancing their sustainability credentials, driving increased demand for mechanical recycling solutions in the sector.

Regional Insights

The North America mechanical recycling of plastics market is boosted by the drive towards corporate sustainability commitments and extended producer responsibility (EPR) programs. Major consumer brands and manufacturers are facing growing pressure from both consumers and regulators to reduce their use of virgin plastics and increase the incorporation of recycled content.

U.S. Mechanical Recycling Of Plastics Market Trends

The U.S. mechanical recycling of plastics market is propelled by the drive to reduce plastic waste. It is increasingly influenced by state-level legislation, particularly in states like California and New York, which have enacted ambitious recycling mandates and plastic waste reduction targets. Companies are facing mounting pressure from environmental groups and eco-conscious consumers to adopt sustainable practices, pushing the demand for mechanically recycled plastics.

Europe Mechanical Recycling Of Plastics Market Trends

Europe mechanical recycling of plastics market dominated globally with the largest revenue share of 34.11% in 2023.Europe’s stringent regulatory landscape is a major driver for the mechanical recycling of plastics. The European Union's policies, such as the Circular Economy Action Plan and the Single-Use Plastics Directive, are pushing industries to drastically reduce plastic waste and increase recycling rates. These regulations are coupled with aggressive recycling targets, requiring member states to implement robust mechanical recycling systems.

Germany mechanical recycling Of plastics market is driven by the well-established recycling infrastructure and leadership in environmental policies, which are key drivers for the market growth. The country has implemented one of the most advanced waste management systems globally, driven by stringent recycling laws like the Verpackungsgesetz (Packaging Act), which enforces high recycling quotas for plastic packaging. German industries, particularly automotive and packaging, are adopting recycled plastics to meet sustainability targets and reduce reliance on virgin materials.

Asia Pacific Mechanical Recycling Of Plastics Market Trends

Asia Pacific mechanical recycling of plastics market is driven by the rapid industrialization and urbanization across Asia Pacific, which require efficient plastic waste management, making mechanical recycling a key solution. With countries like China, India, and Southeast Asian nations producing vast amounts of plastic waste, governments are implementing stricter regulations and waste management policies to address this growing environmental challenge.

Key Mechanical Recycling Of Plastics Company Insights

The market is highly competitive, with several key players dominating the landscape. Major companies include BASF, TOMRA Systems ASA, Trinseo, TotalEnergies, Eastman Chemical Company, Dow, Coperion GmbH, Covestro AG, LG Chem, and LyondellBasell Industries Holdings B.V. The market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Mechanical Recycling Of Plastics Companies:

The following are the leading companies in the mechanical recycling of plastics market. These companies collectively hold the largest market share and dictate industry trends.

- BASF

- TOMRA Systems ASA

- Trinseo

- TotalEnergies

- Eastman Chemical Company

- Dow

- Coperion GmbH

- Covestro AG

- LG Chem

- LyondellBasell Industries Holdings B.V

Recent Developments

-

In January 2024, IIT Bombay, India announced the development of a new single screw extruding mechanical recycling machine named GolDN. It enables continuous melt mixing of waste polymers and inorganic fillers, simulating real-life processing conditions more effectively than conventional machines. This innovation significantly reduces costs, making the equipment approximately 6-8 times cheaper, at around INR 500,000 (approximately USD 6,000), by simplifying the design and utilizing local manufacturing.

-

In October 2020, LyondellBasell Industries, a global player in the chemical industry, signed a Memorandum of Understanding (MoU) with Shakti Plastic Industries, India's prominent plastic recycler. This collaboration aims to establish a fully automated mechanical recycling plant in India, which will process post-consumer rigid plastic waste and produce 50,000 tons of recycled PE and polypropylene (PP) annually. This output is equivalent to the plastic waste generated by 12.5 million people.

Mechanical Recycling Of Plastics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 37,273.22 million

Revenue forecast in 2030

USD 63,768.52 million

Growth rate

CAGR of 9.36% from 2024 to 2030

Historical data

2018 - 2022

Base Year

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Norway; Sweden; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

BASF; TOMRA Systems ASA; Trinseo; TotalEnergies; Eastman Chemical Company; Dow; Coperion GmbH; Covestro AG; LG Chem; LyondellBasell Industries Holdings B.V

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mechanical Recycling Of Plastics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented Mechanical Recycling of Plastics market report on the basis of Product, Application, and Region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyethylene (PE)

-

Polyethylene Terephthalate (PET)

-

Polypropylene (PP)

-

Polyvinyl Chloride

-

Polystyrene

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Automotive

-

Building & Construction

-

Electrical & Electronics

-

Textiles

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global mechanical recycling of plastics market size was estimated at USD 35,170.05 million in 2023 and is expected to reach USD 37,273.22 million in 2024.

b. The global mechanical recycling of plastics market is expected to grow at a compound annual growth rate of 9.36% from 2022 to 2030 to reach USD 63,768.52 million by 2030.

b. Based on application, the packaging segment dominated the market with the largest revenue share of 34.36% in 2023. The push for reducing plastic waste and creating more sustainable packaging solutions is a key driver in the mechanical recycling of plastics within the packaging market.

b. Major companies include BASF; TOMRA Systems ASA; Trinseo; TotalEnergies; Eastman Chemical Company; Dow; Coperion GmbH; Covestro AG; LG Chem; and LyondellBasell Industries Holdings B.V.

b. Rising non-biodegradable plastic pollution globally is increasing the threat of various ill effects caused by this pollution leading to a surge in the demand for sustainable actions to effectively manage plastic pollution.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.