- Home

- »

- Next Generation Technologies

- »

-

Mechanical Control Cables Market Size & Share Report 2030GVR Report cover

![Mechanical Control Cables Market Size, Share & Trends Report]()

Mechanical Control Cables Market Size, Share & Trends Analysis Report By Type, By Platform, By Material (Wire Material, Jacket Material), By Application, By End User, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-417-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Mechanical Control Cables Market Trends

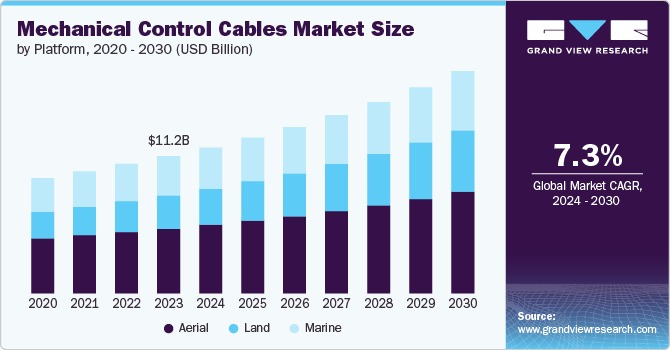

The global mechanical control cables market size was estimated at USD 11.21 billion in 2023 and is expected to grow at a CAGR of 7.3% from 2024 to 2030. Mechanical control cables, essential components in transmitting force and motion, find widespread applications in the automotive, aerospace, industrial machinery, and marine sectors. One of the primary growth drivers is the increasing demand for advanced and efficient automotive systems. As the automotive industry evolves with the adoption of electric and autonomous vehicles, the need for precise and reliable control systems becomes paramount, boosting the demand for mechanical control cables. Furthermore, the rising trend of urbanization and infrastructural development worldwide necessitates advanced construction equipment, incorporating mechanical control cables for enhanced performance and safety.

The market is experiencing positive growth, propelled by increasing investments in various end-use industries and technological advancements. One significant driver is the burgeoning demand for enhanced control systems in agriculture and construction machinery. As these sectors adopt more advanced and automated equipment, the need for precise and reliable mechanical control cables is escalating. Furthermore, the expansion of the robotics and automation industry is fueling market growth. With industries like manufacturing and logistics increasingly integrating automated systems, the demand for high-performance control cables that ensure accuracy and efficiency is rising.

Furthermore, the global push for sustainability also plays a crucial role. Green initiatives and the development of eco-friendly vehicles and machinery demand lightweight, durable, and efficient control cables, contributing to market growth. Additionally, emerging economies are witnessing rapid industrialization and urbanization, leading to heightened infrastructure development and, consequently, increased demand for mechanical control cables.

Type Insights

The push-pull segment led the market in 2023, accounting for over 63.0% share of the global revenue, owing to its superior performance and versatility across various applications. This type of control cable is highly favored in the automotive, aerospace, and industrial machinery sectors due to its ability to transmit motion efficiently in both push and pull directions, ensuring precise control. Its robust construction and reliability make it ideal for critical applications where precision and durability are paramount. Additionally, the increasing adoption of automation and advanced machinery, which require precise control mechanisms, has further boosted the demand for push-pull cables.

The pull-pull segment is predicted to foresee significant growth in the coming years. This type of cable is particularly favored in the aerospace and automotive sectors, where it is essential for controlling flight control surfaces and throttle systems. The pull-pull design offers superior accuracy and responsiveness, which is critical for high-stakes applications. Additionally, its lightweight and flexible nature makes it ideal for complex routing in tight spaces, further enhancing its utility.

Platform Insights

The aerial segment accounted for the largest market revenue share in 2023. Aerial platforms, such as boom lifts and scissor lifts, rely heavily on mechanical control cables for precise and safe operation of lifting and maneuvering mechanisms. The growth in urbanization and infrastructure development projects worldwide has significantly increased the usage of aerial platforms, driving the demand for reliable and efficient control cables. Moreover, the emphasis on worker safety and the need for high-performance, durable control systems in these applications have further propelled the adoption of mechanical control cables. Innovations in cable technology, enhancing flexibility and strength, have also contributed to their preference for aerial platforms.

The land segment is predicted to foresee significant growth in the coming years.This segment encompasses a wide range of vehicles and machinery, including agricultural equipment, construction vehicles, and military vehicles, all of which rely heavily on mechanical control cables for precise operation. The surge in infrastructure development and agricultural activities globally has driven the need for advanced machinery, which in turn fuels the demand for mechanical control cables. Additionally, the growing emphasis on enhancing vehicle performance and safety features has further contributed to the preference for high-quality control cables in land platforms.

Application Insights

The flight control segment accounted for the largest market revenue share in 2023.Mechanical control cables are essential for the accurate transmission of control inputs from the pilot to various flight control surfaces, such as ailerons, elevators, and rudders. The aviation industry’s emphasis on safety, performance, and efficiency has heightened the demand for high-quality control cables that can withstand the rigorous conditions of flight. Moreover, advancements in aerospace technology and the continuous development of new aircraft models further fuel the need for sophisticated control systems, including mechanical cables.

The engine control segment is anticipated to witness significant growth in the coming years. Mechanical control cables are essential for managing throttle, fuel injection, and other engine functions, ensuring optimal performance and efficiency. The automotive, aerospace, marine, and industrial machinery sectors, which heavily rely on robust engine control systems, have significantly contributed to this segment's growth. The continuous advancement in engine technologies, focusing on increased power, efficiency, and emissions reduction, has heightened the demand for high-quality control cables. Additionally, the growing adoption of automated and electronically controlled engines further highlights the need for dependable mechanical control cables.

End User Insights

The defense segment accounted for the largest market revenue share in 2023.Mechanical control cables are crucial in various defense equipment, including aircraft, naval vessels, armored vehicles, and missile systems, where precision and dependability are paramount. The constant need for modernization and maintenance of defense equipment drives the demand for advanced control cables that can withstand extreme conditions and rigorous use. Additionally, the growing defense budgets globally and increased focus on enhancing military capabilities have further propelled the adoption of high-performance mechanical control cables. These cables ensure accurate control of critical systems, contributing to operational efficiency and safety in defense operations.

The commercial segment is anticipated to exhibit the highest CAGR over the forecast period. Mechanical control cables are essential for numerous commercial applications, including HVAC systems, elevators, and heavy machinery, where precise control and reliability are critical. The increasing demand for advanced machinery and equipment in the construction and manufacturing sectors, fueled by rapid urbanization and industrialization, has significantly boosted the need for robust control systems. Additionally, the growth of the automotive industry, particularly with the rise of electric and autonomous vehicles, has further amplified the demand for high-quality mechanical control cables.

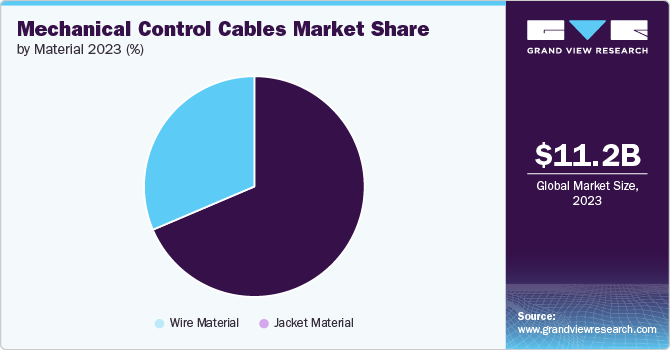

Material Insights

The wire material segment accounted for the largest market revenue share in 2023. Wire materials, such as steel, stainless steel, and various alloys, provide the necessary strength and flexibility required for precise motion transmission in automotive, aerospace, and industrial machinery. The demand for high-quality wire materials is driven by the need for robust and resilient control cables that can withstand harsh operating conditions and extended use. Additionally, advancements in wire material technology have enhanced cable performance, contributing to their widespread adoption.

The jacket material segment is anticipated to witness significant growth in the coming years. The jacket material, typically made from high-quality polymers such as PVC, polyurethane, or neoprene, provides critical protection against environmental factors like moisture, chemicals, and abrasion. This ensures the longevity and reliability of control cables, especially in harsh operating conditions found in automotive, aerospace, and industrial machinery. The increasing focus on durability and safety in equipment has heightened the demand for advanced jacket materials that offer superior resistance to wear and tear.

Regional Insights

North America dominated with a revenue share of over 35.0% in 2023. The region's advanced automotive industry, particularly in the U.S., drives significant demand for mechanical control cables used in various vehicle control systems. Additionally, North America's robust aerospace sector, with major manufacturers and a high volume of aircraft production and maintenance activities, further fuels the need for reliable and high-performance control cables. The region's focus on technological innovation and the continuous development of advanced machinery and equipment also contribute to the market's growth.

U.S. Mechanical Control Cables Market Trends

The U.S. mechanical control cables market is expected to grow significantly from 2024 to 2030, driven by its extensive industrial activities and strong presence in key sectors such as automotive, aerospace, and defense. The country's advanced automotive industry, with a high demand for precision control systems in both traditional and electric vehicles, significantly contributes to the market's growth. Additionally, the U.S. aerospace sector, renowned for its innovation and large-scale aircraft production, relies heavily on mechanical control cables for flight and engine control systems.

Europe Mechanical Control Cables Market Trends

The mechanical control cables market in the European region is expected to witness significant growth over the forecast period. The region's commitment to technological innovation and stringent safety and quality standards also enhances the adoption of advanced mechanical control cables. Furthermore, the industrial machinery and automation sectors in Europe are highly developed, driving demand for durable and efficient control systems.

Asia Pacific Mechanical Control Cables Market Trends

The mechanical control cables market in the Asia Pacific region is anticipated to register rapid growth over the forecast period, driven by rapid industrialization, urbanization, and significant growth in the automotive and manufacturing sectors. Countries like China, India, and Japan have seen substantial investments in infrastructure and industrial projects, boosting the demand for mechanical control cables.

Key Mechanical Control Cables Company Insights

Key mechanical control cables companies include Crane Aerospace & Electronics, Triumph Group, and Elliott Manufacturing active in the mechanical control cables market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product development. For instance, in March 2024, French electrical and digital building infrastructure company Legrand SA announced its acquisition of Mechanical Support Systems, a designer and supplier of cable management solutions for the mechanical and electrical sectors. This acquisition will enable Legrand SA to target better the infrastructure, commercial, and data center verticals.

Key Mechanical Control Cables Companies:

The following are the leading companies in the mechanical control cables market. These companies collectively hold the largest market share and dictate industry trends.

- Crane Aerospace & Electronics

- Triumph Group

- Elliott Manufacturing

- Orscheln Types.

- Curtiss-Wright Corporation

- Cablecraft

- HENGTONG GROUP CO., LTD.

- KÜSTER Group

- TE Connectivity.

- LEXCO CABLE

Recent Developments

-

In June 2024, Covestro AG, a materials manufacturer, introduced its new Desmopan FR (Flame Retardant) thermoplastic polyurethane (TPU) series. This versatile plastic material is engineered for high-performance flame-retardant cable jackets, catering to industries where fire safety is paramount, such as automotive charging and consumer electronics.

-

In March 2024, Remsons Industries, a prominent automotive cable supplier, partnered with Switzerland's Aircom Group to form Aircom Remsons Automotive (ARAPL). This collaboration aims to revolutionize tire mobility with innovative kits that include puncture repair solutions, air compressors, and sealants. These kits cater to vehicles with and without spare tires, focusing on enhancing efficiency and convenience. This partnership is set to capture a significant market share in the tire mobility sector, aligning with luxury car manufacturers and integrating advanced tire solutions for better fuel efficiency and overall driving experience.

Mechanical Control Cables Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.93 billion

Revenue forecast in 2030

USD 18.18 billion

Growth rate

CAGR of 7.3% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, platform, material, application, end user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Crane Aerospace & Electronics; Triumph Group; Elliott Manufacturing; Orscheln Types; Curtiss-Wright Corporation; Cablecraft; HENGTONG GROUP CO., LTD.; KÜSTER Group; TE Connectivity; LEXCO CABLE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mechanical Control Cables Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global mechanical control cables market report based on type, platform, material, application, end user, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Push-pull

-

Pull-pull

-

-

Platform Outlook (Revenue, USD Million, 2017 - 2030)

-

Aerial

-

Land

-

Marine

-

-

Material Outlook (Revenue, USD Million, 2017 - 2030)

-

Wire Material

-

Jacket Material

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Engine Control

-

Auxiliary Control

-

Landing Gears

-

Brake Control

-

Others

-

-

End User Outlook (Revenue, USD Million, 2017 - 2030)

-

Commercial

-

Defence

-

Non-aero Military

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global mechanical control cables market size was estimated at USD 11.21 billion in 2023 and is expected to reach USD 11.93 billion in 2024.

b. The global mechanical control cables market is expected to grow at a compound annual growth rate of 7.3% from 2024 to 2030 to reach USD 18.18 billion by 2030.

b. North America dominated the mechanical control cables market with a share of 35.6% in 2023. The region's advanced automotive industry, particularly in the U.S., drives significant demand for mechanical control cables used in various vehicle control systems. Additionally, North America's robust aerospace sector, with major manufacturers and a high volume of aircraft production and maintenance activities, further fuels the need for reliable and high-performance control cables.

b. Some key players operating in the mechanical control cables market include Crane Aerospace & Electronics, Triumph Group, Elliott Manufacturing, Orscheln Types., Curtiss-Wright Corporation, Cablecraft, HENGTONG GROUP CO., LTD., KÜSTER Group, TE Connectivity., LEXCO CABLE

b. Key factors that are driving the mechanical control cables market growth include increasing demand for advanced vehicle control systems, and rising automation in manufacturing and machinery requiring durable control mechanisms.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."