- Home

- »

- Food Safety & Processing

- »

-

Meat Processing Equipment Market Size, Share Report, 2030GVR Report cover

![Meat Processing Equipment Market Size, Share & Trends Report]()

Meat Processing Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Equipment (Slicing, Bending, Dicing, Grinding, Massaging & Marinating), By Meat Type, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-366-9

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Meat Processing Equipment Market Summary

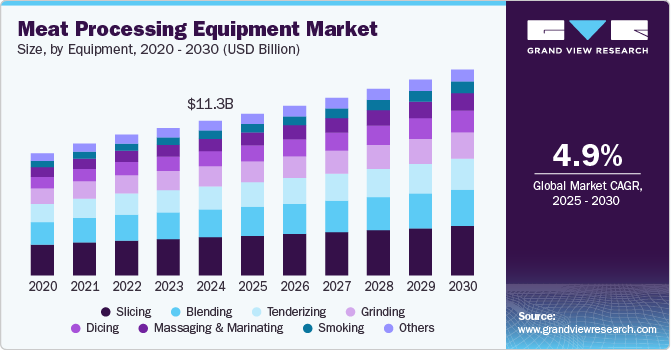

The global meat processing equipment market size was estimated at USD 11,276.7 million in 2024 and is projected to reach USD 15,037.4 million by 2030, growing at a CAGR of 4.9% from 2025 to 2030. Increasing demand for processed meat products, fueled by changing consumer lifestyles and preferences for convenience foods, has spurred investment in efficient processing technologies.

Key Market Trends & Insights

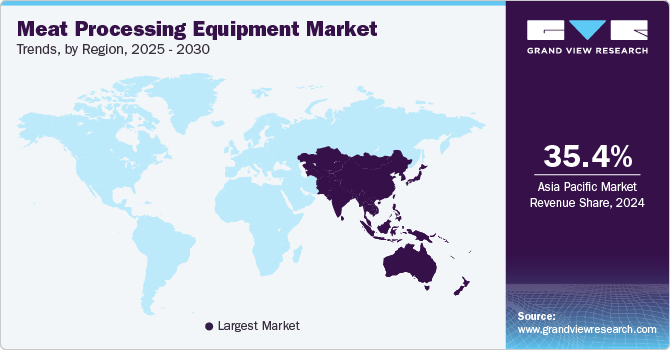

- Asia Pacific dominated the meat processing equipment market with the largest revenue share of 35.44% in 2024.

- The India meat processing equipment market accounted for the largest market share of 17.8% in 2024.

- Based on equipment, the slicing segment led the market with the largest revenue share of 24.6% in 2024.

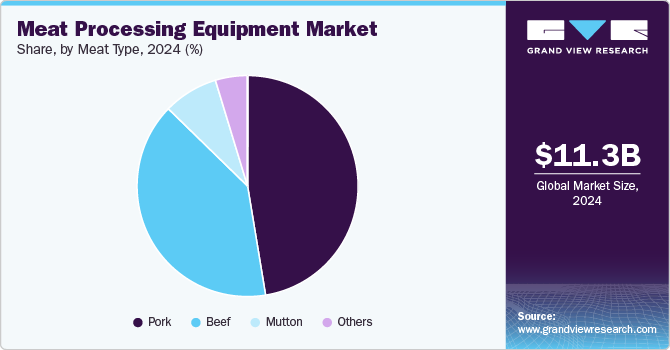

- Based on meat type, the beef segment led the market with the largest revenue share of 39.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 11,276.7 Million

- 2030 Projected Market Size: USD 15,037.4 Million

- CAGR (2025-2030): 4.9%

- Asia Pacific: Largest market in 2024

As populations grow and urbanization accelerates, the need for sustainable meat production and processing methods becomes more pressing, prompting producers to adopt advanced equipment that enhances efficiency and reduces waste.

Technological advancements in meat processing equipment also play a significant role in market growth. Innovations such as automation, smart technologies, and improved food safety standards are encouraging manufacturers to upgrade their processing facilities, leading to increased demand for modern equipment.

Drivers, Opportunities & Restraints

The expansion of the food service sector, including restaurants and catering businesses, contributes to the demand for meat processing equipment, as these establishments require reliable and efficient systems to meet consumer demands. Growing awareness of health and nutrition is also influencing consumer preferences toward leaner meat products, driving meat processors to adopt equipment that can efficiently process various types of meat while meeting these evolving dietary trends.

Fluctuating prices of raw materials, such as meat and packaging supplies, can affect profitability and make it challenging for manufacturers to maintain stable pricing for equipment. Stringent regulations regarding food safety and environmental sustainability also impose additional compliance costs and operational complexities, potentially discouraging some businesses from upgrading their equipment

Increasing consumer interest in sustainable and ethically sourced meat products encourages producers to invest in more efficient and environmentally friendly processing technologies. In addition, the growing focus on automation and smart technology in food processing offers opportunities for companies to enhance productivity and reduce labor costs.

Equipment Insights

“The dicing segment is expected to grow at a significant CAGR of 6.4% from 2025 to 2030 in terms of revenue”

Based on equipment, the slicing segment led the market with the largest revenue share of 24.6% in 2024. In the slicing equipment segment, the demand is largely fueled by the rising popularity of pre-packaged and processed meat products. Consumers are seeking convenience, and sliced meats are essential for ready-to-eat options like sandwiches and salads. The focus on food safety and hygiene also drives investment in high-quality slicing machinery that minimizes contamination risk while maximizing efficiency. Furthermore, innovations in slicing technology, such as automatic and adjustable slicers, are enhancing production capabilities and meeting diverse consumer preferences.

The market growth of the dicing equipment segment is driven by the increasing demand for uniform meat products that enhance presentation and cooking consistency. Dicing allows for versatile applications, such as ready-to-eat meals and convenience foods, which are gaining popularity among consumers. In addition, advancements in technology are enabling more efficient and precise dicing processes, making it easier for processors to meet quality standards and reduce waste.

Meat Type Insights

"The demand for the pork segment is expected to grow at a rapid CAGR of 5.3% from 2024 to 2030 in terms of revenue.”

Based on meat type, the beef segment led the market with the largest revenue share of 39.9% in 2024. In the beef segment, growth is propelled by the enduring popularity of beef as a staple protein in many diets. The increasing consumption of processed beef products, such as ground beef and beef jerky, is driving demand for efficient processing equipment. In addition, health trends favoring leaner cuts of beef are pushing processors to adopt technologies that allow for better yield and quality. The global market's expansion, particularly in developing regions where beef consumption is on the rise, further contributes to the growth of this segment.

The growth of the pork segment is influenced by its popularity as a protein source in many regions, particularly in Asia and Europe. The increasing demand for processed pork products, including sausages, ham, and cured meats, is driving investments in processing technologies. In addition, the trend toward premium and specialty pork products, driven by consumer interest in quality and flavor, encourages processors to adopt advanced equipment that can meet these demands.

Regional Insights

The meat processing equipment market in North America is driven by the strong demand for processed and convenience foods, alongside a focus on food safety and quality. The region’s advanced technology adoption facilitates automation and efficiency in processing operations, while stringent regulations on food safety standards compel manufacturers to invest in modern equipment. In addition, the growing popularity of premium meat products enhances the need for sophisticated processing solutions.

U.S. Meat Processing Equipment Market Trends

The meat processing equipment market in the U.S. accounted for the revenue share of 57.6% in North America in 2024, driven by robust demand for processed and convenience foods, supported by busy lifestyles and a focus on food safety. The adoption of automation and advanced technologies enhances operational efficiency and productivity, while strict regulatory standards compel manufacturers to invest in modern equipment. In addition, the growing consumer preference for premium and organic meat products encourages innovation in processing techniques.

Asia Pacific Meat Processing Equipment Market Trends

Asia Pacific dominated the meat processing equipment market with the largest revenue share of 35.44% in 2024. Rapid urbanization and rising disposable incomes are significant factors driving the market growth. The increasing demand for processed meat products, particularly in countries like China and India, is boosting investments in processing technologies. In addition, changing dietary preferences, with a growing inclination toward protein-rich diets, further accelerates the demand for efficient meat processing solutions.

The meat processing equipment market in China is expected to grow at a significant CAGR of 6.3% over the forecast period, owing to rapid urbanization and rising disposable incomes, leading to increased meat consumption, particularly processed meat products. The shift in dietary preferences toward protein-rich diets is prompting investments in efficient meat processing technologies. Furthermore, the government's initiatives to improve food safety standards and quality assurance encourage modernization in processing facilities to meet consumer expectations.

The India meat processing equipment market accounted for the largest market share of 17.8% in 2024. In India, rapid urbanization and changing lifestyles are significant factors driving the demand for meat processing equipment. The growing middle class and increased disposable incomes lead to higher meat consumption and demand for processed products. In addition, the rise of organized retail and food service sectors encourages investments in modern processing technologies. The government’s initiatives to improve food safety and quality further drive the need for efficient meat processing solutions in the region.

Europe Meat Processing Equipment Market Trends

The meat processing equipment market in Europe benefits from a high level of consumer awareness regarding health and sustainability. There is a strong push for organic and ethically sourced meat products, which encourages meat processors to adopt innovative technologies to meet these demands. Furthermore, stringent EU regulations on food safety and environmental sustainability drive investments in advanced processing equipment that ensures compliance while enhancing production efficiency.

The Germany meat processing equipment market is expected to expand at a considerable CAGR of 5.1% over the forecast period. Germany's market growth is influenced by strong consumer awareness regarding health, sustainability, and quality. The demand for organic and ethically sourced meat drives investments in processing technologies that meet stringent EU regulations. In addition, Germany's advanced Beef sector fosters innovation in meat processing equipment, contributing to increased efficiency and competitiveness in both domestic and export markets.

The meat processing equipment market in the UK accounted for the market share of 20.9% in 2024. The market is driven by several key factors. Increasing consumer demand for high-quality, ethically sourced meat products is compelling producers to invest in advanced processing technologies that ensure sustainability and compliance with stringent food safety regulations. The rise in popularity of convenience foods, including ready-to-eat and processed meat options, is further boosting demand for efficient processing solutions.

Middle East Meat Processing Equipment Market Trends

The meat processing equipment market in Middle East and Africa is supported by a growing population and rising meat consumption. The region’s expanding food service sector, driven by tourism and urbanization, is creating demand for processed meat products. In addition, increased awareness of food safety and quality standards encourages investment in modern processing technologies to meet consumer expectations and regulatory requirements.

Latin America Meat Processing Equipment Market Trends

The meat processing equipment market in Latin America is anticipated to grow at the fastest CAGR during the forecast period. The growth is driven by the region's rich livestock resources and a strong cultural affinity for meat consumption. The increasing demand for processed and value-added meat products, coupled with rising exports, stimulates investments in meat processing technologies. In addition, the growing trend of modernization in food processing facilities is pushing companies to adopt advanced equipment to improve efficiency and quality, catering to both domestic and international markets.

Key Meat Processing Equipment Company Insights

Some of the key players operating in the market include ENTACT and WSP among Massaging & Marinating.

-

Mepaco is a prominent brand in the food processing equipment industry, specializing in tailored solutions for essential food producers across various sectors. Founded with a focus on supplying equipment primarily to dairy and cheese processors, its product line encompasses a wide range of equipment designed to meet the specific needs of food processors. This includes blending and cooking equipment that is essential for thermal processing and blending, particularly in prepared foods. The company is also engaged in the design and manufacture of meat and poultry solutions, providing equipment for grinding, blending, and formulating protein systems.

-

The Middleby Corporation operates across three business segments, each supported by multiple brands. Its food service and beverage segment include bakery equipment, broilers, and combi ovens, and these products are sold under various brands including, but not limited to, Anets, APW Wyott, and Bakers Pride. Residential and food processing are its other two segments. The company draws sales from multiple countries in different regions, such as Europe, North America, Asia, the Middle East, and Latin America.

Key Meat Processing Equipment Companies:

The following are the leading companies in the meat processing equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Mepaco

- Minerva Omega Group s.r.l.

- Tomra Systems ASA

- JBT.

- Nemco Food Equipment, LTD.

- RAM Beef Equipment, LLC

- The Middleby Corporation

- Marel

- Equipamientos cárnicos, S.L. (MAINCA)

- Bettcher Industries, Inc.

- Fortifi Food Processing Solutions.

Recent Developments

-

In July 2024, Fortifi Food Processing Solutions acquired LIMA S.A.S., a French company engaged in the design and manufacture of meat production equipment. This move enhances Fortifi's protein processing capabilities and aligns with its growth strategy, expanding its portfolio alongside brands such as Bettcher Industries and Frontmatec.

-

In May 2022, Bettcher Industries, Inc acquired Frontmatec, a manufacturer of automated protein processing equipment. This acquisition aims to enhance Bettcher's capabilities in the protein processing sector and expand its product offerings. The integration of Frontmatec's technology is expected to strengthen Bettcher's position in the market, providing customers with advanced solutions for protein processing.

Meat Processing Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11,814.9 million

Revenue forecast in 2030

USD 15,037.4 million

Growth rate

CAGR of 4.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Equipment, meat type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; Russia; Italy; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; and Saudi Arabia.

Key companies profiled

Mepaco; Minerva Omega Group s.r.l.; Tomra Systems ASA; JBT.; Nemco Food Equipment, LTD.; RAM Beef Equipment, LLC; The Middleby Corporation; Marel; Equipamientos cárnicos; S.L. (MAINCA); Bettcher Industries, Inc.; and Fortifi Food Processing Solutions.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Meat Processing Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global meat processing equipment market report based on the equipment, meat type, and region:

-

Equipment Outlook (Revenue, USD Million; 2018 - 2030)

-

Slicing

-

Bending

-

Dicing

-

Grinding

-

Massaging & Marinating

-

Smoking

-

Tenderizing

-

Others

-

-

Meat Type (Revenue, USD Million; 2018 - 2030)

-

Beef

-

Mutton

-

Pork

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

Russia

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global meat processing equipment market size was estimated at USD 11,276.7 million in 2024 and is expected to reach USD 11,814.9 million in 2025.

b. The global meat processing equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.9% from 2025 to 2030 to reach USD 15,037.4 million by 2030.

b. The slicing segment dominated the market in 2024 accounting for 24.6% of overall revenue share. The growing trend of meal kits and prepared meal solutions. As more consumers turn to convenient meal options that require minimal preparation, there is an increasing demand for pre-sliced meats that can be easily incorporated into these kits.

b. Some of the key players operating in the meat processing equipment market are Mepaco, Minerva Omega Group s.r.l., Tomra Systems ASA, JBT., Nemco Food Equipment, LTD., RAM Beef Equipment, LLC, The Middleby Corporation¸Marel, Equipamientos cárnicos, S.L. (MAINCA), Bettcher Industries, Inc., and Fortifi Food Processing Solutions.

b. The key factors that are driving the meat processing equipment market include the high demand for processed hygienic meat that is free from impurities and rapid mechanical innovations in meat processing equipment technology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.