- Home

- »

- Consumer F&B

- »

-

Meat Flavors Market Size, Share & Growth Report, 2030GVR Report cover

![Meat Flavors Market Size, Share & Trends Report]()

Meat Flavors Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Natural Flavor, Artificial Flavor), By Form (Liquid, Powder, Paste), By Source, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-418-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Meat Flavors Market Size & Trends

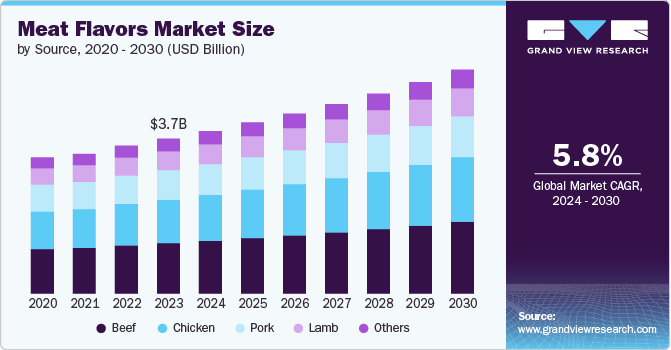

The global meat flavors market size was estimated at USD 3.68 billion in 2023 and is expected to grow at a CAGR of 5.8% from 2024 to 2030.The demand for meat flavors is rising, driven by significant shifts in consumer preferences and broader industry trends. One of the primary factors fueling this demand is the growing popularity of convenience foods. As urban lifestyles become increasingly fast-paced, consumers seek quick and easy meal options that don’t compromise taste. Ready-to-eat meals, snacks, and instant foods have become staples in many households, and these products often rely on rich, savory meat flavors to enhance their appeal. The ability to replicate the taste of freshly cooked meat in processed foods has made meat flavors essential in the convenience food sector.

In addition to the convenience factor, there is a rising demand for meat flavors in plant-based and meat-alternative products. As more consumers adopt vegetarian or flexitarian diets, the need for flavors that mimic the taste of meat has grown. Meat flavors are now commonly used in plant-based burgers, sausages, and other vegetarian dishes to provide meat's familiar and satisfying taste without the actual animal content. This trend is particularly prominent in regions like North America and Europe, where plant-based eating is gaining popularity for health, ethical, and environmental reasons.

Consumers are also increasingly seeking bold and authentic flavors in their food, leading to a higher demand for complex meat flavors. Whether in gourmet sauces, premium snacks, or restaurant-quality ready meals, consumers seek products that deliver rich, multi-dimensional taste experiences. The desire for more intense and satisfying flavors has driven food manufacturers to incorporate sophisticated meat flavors into a wide range of products, catering to a market that values culinary quality and depth of flavor.

Another significant driver is the expansion of the global food service industry, including fast-food chains and quick-service restaurants. These establishments heavily rely on meat-flavored seasonings, sauces, and marinades to create standardized and appealing flavors across their menus. As the food service sector grows, particularly in emerging markets, the demand for meat flavors is expected to rise, reflecting the industry's need for consistent and cost-effective flavor solutions.

Moreover, the shift towards natural and clean-label products has also impacted the market. Consumers are increasingly aware of the ingredients in their food and prefer products that feature natural flavors derived from real meat or other natural sources. This trend is especially strong in North America and Europe, where clean-label products are gaining significant market share. As a result, the demand for natural meat flavors is increasing as they align with consumer preferences for healthier and more transparent food options.

Type Insights

Natural meat flavors accounted for a share of 65.40% in 2023. Consumers are becoming more conscious of the ingredients in their food, leading to a strong preference for clean-label products that contain natural ingredients. Natural meat flavors, derived from real meat sources, are perceived as healthier and more transparent compared to artificial flavors. This aligns with the desire for food products free from synthetic additives, artificial preservatives, and chemicals, making natural meat flavors increasingly popular.

Artificial meat flavor is expected to grow at a CAGR of 6.1% from 2024 to 2030. Artificial meat flavors are often more stable and have a longer shelf life than natural flavors, making them ideal for processed foods, snacks, and shelf-stable products. This extended shelf life reduces the risk of flavor degradation over time, ensuring the product retains its intended taste even after extended storage. For consumers, this means enjoying a flavorful product that remains fresh-tasting for longer periods.

Source Insights

Beef meat flavors accounted for a revenue share of 32.40% in 2023. As consumers become more health-conscious and seek out clean-label products, there is an increasing preference for natural and authentic flavors derived from real beef. This trend is particularly strong in markets like North America and Europe, where consumers increasingly scrutinize ingredient lists and opt for products that offer genuine meat flavors without artificial additives. Beef-sourced flavors meet this demand by providing an authentic taste that resonates with consumers looking for quality and transparency in their food choices.

Chicken meat flavors is expected to grow at a CAGR of 6.5% from 2024 to 2030. Chicken is one of the most widely consumed meats globally, enjoying broad appeal across different cultures and regions. Its universal acceptance makes chicken flavors popular for manufacturers looking to create products with mass-market appeal. Whether in Asian stir-fries, European casseroles, or American grilled dishes, chicken flavors are a safe bet for satisfying a wide range of consumer tastes.

Distribution Channel Insights

Supermarkets & hypermarkets accounted for a revenue share of 29.87% in 2023. These stores typically stock a broad range of meat flavor products, catering to diverse consumer preferences and needs. Whether consumers are looking for natural or artificial flavors, powders, liquids, or specific meat types like beef or chicken, these stores provide a wide selection. This variety allows consumers to compare brands and products in one place, enhancing the shopping experience.

Online is expected to grow at a CAGR of 7.8% from 2024 to 2030. Online shopping offers the convenience of purchasing meat flavors from the comfort of home. Online platforms often provide a broader range of meat flavor products than physical stores, including niche or specialty items that may not be available locally. Consumers can access a diverse selection of brands, flavor profiles, and formats (such as liquid, powder, or paste) from around the world. This extensive variety allows consumers to find what they’re looking for, catering to specific dietary needs or culinary preferences.

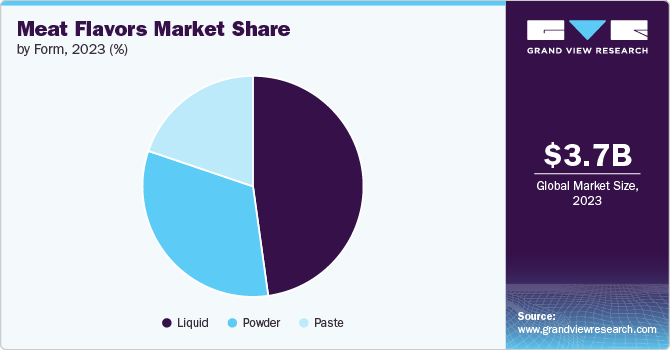

Form Insights

Liquid meat accounted for a share of 47.80% in 2023. The solubility of liquid meat flavors in water- and oil-based products enhances their usability in different culinary applications. This characteristic is particularly valuable in food products like dressings, dips, and emulsified items, where maintaining a consistent flavor profile without altering the product's texture is essential. The superior solubility of liquids ensures that the flavor is effectively incorporated without compromising the final product's quality.

Powdered meat flavor is expected to grow at a CAGR of 6.2% from 2024 to 2030. Powdered meat flavors offer a longer shelf life than liquid or paste forms, making them a preferred choice for consumers and manufacturers. The stability of powdered flavors ensures that they maintain their potency and taste over extended periods, even under varying storage conditions. This makes them ideal for dry mixes, seasoning blends, and packaged foods where durability is essential.

Regional Insights

The meat flavors market in North America accounted for a revenue share of 25.40% in 2023. Many consumers in North America seek to enhance the flavor of their dishes with the rich, savory taste of meat. Meat flavors offer a convenient way to add depth and authenticity to a wide range of foods, from soups and sauces to snacks and ready meals. The appeal of achieving a restaurant-quality taste at home drives the demand for these flavors, especially in products like gravies, broths, and marinades.

U.S. Meat Flavors Market Trends

The meat flavors market in the U.S. is facing intense competition due to innovation in meat flavor varieties. Busy lifestyles and the demand for quick, convenient meal solutions have increased the use of meat flavors. These flavors simplify cooking by eliminating the need for lengthy preparation times associated with traditional meat dishes, allowing consumers to enjoy the taste of meat with minimal effort. Whether used in pre-packaged meals or as a quick seasoning, meat flavors offer a convenient way to enhance meals without the need for fresh meat.

Europe Meat Flavors Market Trends

The meat flavors market in Europe is expected to grow at a CAGR of 6.6% during the forecast period. European consumers have a strong interest in culinary exploration and gourmet cooking. Meat flavors offer an easy way to experiment with different cuisines and create complex, rich dishes without the need for fresh meat. This interest in flavor innovation drives the demand for meat flavors, especially in sauces, soups, and ready-to-eat meals that require authentic, deep flavors.

Asia Pacific Meat Flavors Market Trends

The meat flavors market in Asia Pacific is expected to grow at a CAGR of 5.5% from 2024 to 2030. Many cuisines in the Asia-Pacific region heavily feature meat as a primary ingredient, and meat flavors are essential to replicating traditional dishes, particularly in countries like China, Japan, and Korea. Additionally, with a growing trend towards vegetarianism and veganism, meat flavors are used in plant-based products to satisfy the palate of consumers who still crave the taste of meat without consuming animal products.

Key Meat Flavors Company Insights

The market is characterized by dynamic competitive dynamics shaped by a combination of factors, including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality products.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising consumer awareness of the ambiguity of ingredients while strictly adhering to international regulatory standards.

Key Meat Flavor Companies:

The following are the leading companies in the meat flavors market. These companies collectively hold the largest market share and dictate industry trends.

- Givaudan

- Kerry Group

- International Flavors & Fragrances Inc. (IFF)

- Symrise AG

- Firmenich SA

- Sensient Technologies Corporation

- Takasago International Corporation

- Robertet Group

- Mane SA

- Frutarom Industries Ltd. (Now part of IFF)

Recent Developments

-

In January 2024, IFF, a global leader in food and beverage, home and personal care, and health, has partnered with Unilever and Wageningen University & Research (WUR) on a collaborative research initiative to tackle flavor challenges in plant-based meat alternatives. Plant proteins often produce many off-notes and lingering bitterness in these products. While manufacturers typically mask these unpleasant attributes with added flavors, this approach can lead to unwanted aroma characteristics.

Meat Flavors Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.87 billion

Revenue forecast in 2030

USD 5.43 billion

Growth rate

CAGR of 5.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, source, form, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; UAE

Key companies profiled

Givaudan; Kerry Group; International Flavors & Fragrances Inc. (IFF); Symrise AG; Firmenich SA; Sensient Technologies Corporation; Takasago International Corporation; Robertet Group; Mane SA; Frutarom Industries Ltd. (Now part of IFF)

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Meat Flavors Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global meat flavors market report based on type, source, form, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural Flavor

-

Artificial Flavor

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Beef

-

Chicken

-

Pork

-

Lamb

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid

-

Powder

-

Paste

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Convenience stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global meat flavors market size was estimated at USD 3.68 billion in 2023 and is expected to reach USD 3.87 billion in 2024.

b. The global meat flavors market is expected to grow at a compounded growth rate of 5.8% from 2024 to 2030 to reach USD 5.43 billion by 2030.

b. Natural meat flavor accounted for a share of 65.4% in 2023. Natural meat flavors are often richer and more complex in taste compared to their artificial counterparts, providing a more authentic and satisfying flavor experience. Consumers seeking genuine taste experiences are drawn to products that use natural flavors, as they replicate the true taste of meat more accurately. This demand for authenticity is especially strong in premium and gourmet food segments, where flavor quality is paramount.

b. Some key players operating in meat flavors market include Givaudan, Kerry Group, International Flavors & Fragrances Inc. (IFF), Symrise AG, Firmenich SA, and others.

b. Key factors that are driving the market growth include rising processed food consumption among consumers and increasing health consciousness among consumers

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.