- Home

- »

- Communication Services

- »

-

MEA Technical And Vocational Education Market, Industry Report 2030GVR Report cover

![MEA Technical And Vocational Education Market Size, Share & Trends Report]()

MEA Technical And Vocational Education Market (2025 - 2030) Size, Share & Trends Analysis Report By Course Type (STEM, Non-STEM), By Learning Mode (Online, Offline), By Organization, By End-use, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-488-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

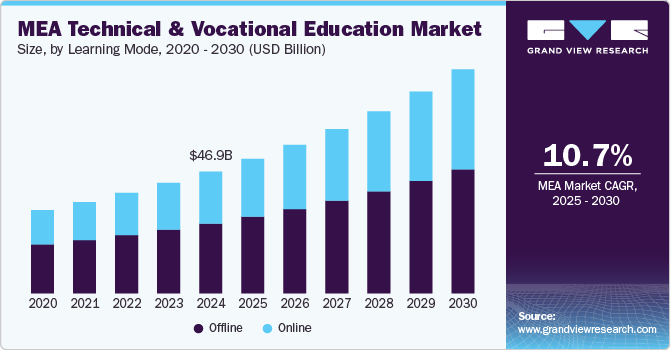

The MEA technical and vocational education market size was estimated at USD 46.90 billion in 2024 and is projected to grow at a CAGR of 10.7% from 2025 to 2030. Factors such as government initiatives and national vision programs, labor market needs and economic diversification, youth population, and high unemployment rate drive market growth. The rise of Industry 4.0, with technologies such as AI, robotics, and cybersecurity, created demand for specialized training programs. Digital and tech-focused vocational courses are gaining traction in MEA as industries modernize and automation increases. This shift also includes adopting online and blended learning platforms, which expand access to technical education across remote and underserved areas.

The region has a high youth population and unemployment rates; MEA countries are focused on vocational training to improve employability. Vocational and technical education programs are tailored to offer practical skills that align with job market needs, aiming to address youth unemployment. Moreover, the rise of Industry 4.0, with technologies such as AI, robotics, and cybersecurity, creates the demand for specialized training programs. Digital and tech-focused vocational courses are gaining traction in MEA as industries modernize and automation increases. This shift also includes adopting online and blended learning platforms, which expand access to technical education across remote and underserved areas.

Environmental initiatives are growing, especially in the UAE and Saudi Arabia, focusing on sustainable energy and green technology. This shift has led to the development of vocational programs that provide training in renewable energy, environmental management, and sustainable infrastructure, aligning education with sustainable economic goals. Moreover, the MEA region invests in educational infrastructure, particularly technical and vocational institutions. This includes new campuses, training centers, and up-to-date equipment, supported by government funding and foreign aid.

Course Type Insights

The STEM education segment led the market in 2024, accounting for over 75% of global revenue share. Countries such as KSA and the UAE established numerous national development strategies, such as Saudi Vision 2030 and UAE Vision 2021, prioritizing building knowledge-based economies. A strong emphasis on STEM education is crucial to these plans, as they aim to reduce reliance on oil by developing high-tech, innovative industries that require skilled professionals in STEM fields.

The non-STEM segment is predicted to foresee significant growth in the coming years. MEA nations, particularly in the Gulf Cooperation Council (GCC), focus on economic diversification away from oil dependence. This shift has increased the demand for skills in various fields, such as business, finance, social sciences, law, media, and the arts, to support new sectors. Education programs in these areas aim to create a workforce that meets the needs of a diversified economy. Moreover, a growing interest is in developing cultural and creative sectors in various countries such as KSA and the UAE. This includes investments in arts, media, and entertainment to support tourism, media production, and cultural initiatives.

Learning Mode Insights

The offline segment dominated the market in 2024. Technical and vocational education (TVE) often requires practical, hands-on training in fields such as engineering, healthcare, automotive, construction, and information technology. Offline learning allows students to gain direct, supervised experience with equipment, machinery, and real-world scenarios, essential for mastering technical skills. In several parts of the MEA region, digital infrastructure for online education remains limited, particularly in remote and rural areas. Offline learning addresses this challenge by providing access to quality education and training through physical institutions, making TVE accessible to a broader population.

The online segment is predicted to foresee the highest growth in the coming years. The MEA region is investing heavily in digital infrastructure, with more countries rolling out high-speed internet and mobile connectivity, which are essential for online learning. Improved access to affordable internet, especially through mobile devices, enables a broader reach for online vocational education in urban and remote areas. Moreover, online learning offers flexibility that suits the diverse demographics of the MEA region. It enables students, particularly working professionals, youth, and individuals in rural areas, to access technical and vocational education programs without needing to relocate or adhere to rigid schedules.

Organization Insights

The public institution segment dominated the market in 2024. MEA governments prioritize technical and vocational education as part of their national development agendas. Increased public funding for educational institutions, infrastructure development, and vocational training programs aims to enhance the quality and accessibility of vocational education. Public institutions often align with national initiatives such as Saudi Vision 2030 and UAE Vision 2021, focusing on economic diversification, job creation, and reducing unemployment. This alignment fosters a supportive environment for public vocational education programs to develop skills relevant to the labor market.

The private institution segment is anticipated to grow significantly in the coming years. There is a growing recognition of the importance of quality vocational training. Private institutions often provide specialized programs that align closely with industry needs, offering courses more relevant to the job market than traditional public education systems. Moreover, private institutions are often more agile in adopting innovative teaching methods and technologies, such as blended learning and online courses. This adaptability allows them to provide updated curricula incorporating the latest industry trends and technologies, appealing to a tech-savvy student demographic.

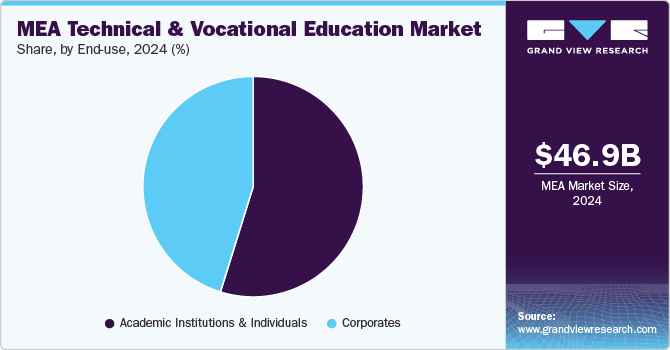

End-use Insights

The academic institutions & individuals segment dominated the market in 2024. Academic institutions are adapting their curricula to align with industries' evolving needs. Collaboration with local businesses ensures that training programs are relevant, equipping students with skills that match labor market demands. This industry-academic partnership enhances employability for graduates. Various governments and educational bodies in the MEA region are implementing quality assurance frameworks to enhance vocational education standards.

The corporate workers segment is anticipated to exhibit a significant CAGR over the forecast period. Companies recognize that investing in employee training and development is crucial for retaining talent. By offering vocational education and skill enhancement programs, organizations can increase employee job satisfaction and loyalty, reducing turnover rates and associated recruitment costs. Moreover, corporations are partnering with vocational training institutions to ensure that the skills taught are directly aligned with industry needs. This collaboration helps create customized training programs that address specific employee skills gaps, enhancing productivity and operational efficiency.

Country Insights

UAE dominated the MEA technical and vocational education market in 2024. The UAE government has prioritized education reform as part of its long-term strategic plans, such as the UAE Vision 2030 and the Centennial Plan 2071. These initiatives aim to foster a knowledge-based economy by developing skills that align with market needs and technological advancements. Moreover, the rapid expansion of the construction, IT, hospitality, and healthcare industries has created a high demand for skilled professionals. Technical and vocational training institutions are essential for preparing the workforce with practical skills that meet industry standards.

KSA is anticipated to exhibit a significant CAGR over the forecast period. The Saudi Vision 2030 framework emphasizes human capital development and aims to create a diversified and knowledge-based economy. This initiative drives significant investment in technical and vocational education and training (TVET) to upskill the workforce and align with the economic diversification goals. With the expansion of industries like oil & gas, construction, renewable energy, information technology, and manufacturing, there is an increasing demand for a skilled workforce trained in specific technical and vocational areas. This demand is propelling growth in TVET enrollments.

Key MEA Technical And Vocational Education Company Insights

Some key players in the market are the Technical and Vocational Training Corporation and the ADNOC Technical Academy. These companies led the market due to their significant roles in workforce development, government support, and industry alignment.

-

Technical and Vocational Training Corporation leads with its extensive network of training programs designed to support Saudi Arabia's Vision 2030, focusing on diversifying the economy and boosting human capital. It collaborates with international institutions and adapts global best practices to ensure comprehensive, high-quality training.

-

ADNOC Technical Academy provides specialized programs tailored to the energy sector, backed by the Abu Dhabi National Oil Company (ADNOC). This connection ensures an industry-aligned curriculum and practical training, preparing a skilled workforce for the region's critical oil and gas industry.

Key MEA Technical And Vocational Education Companies:

- ADNOC Technical Academy

- City & Guilds Group

- Dubai College of Tourism

- NetDragon Websoft Holdings Limited

- New Horizons Worldwide, LLC

- NIIT Limited

- Pearson

- South African Qualifications Authority

- Technical and Vocational Training Corporation

- The Institute of Chartered Accountants in England and Wales

Recent Developments

-

In May 2024, The Royal Commission for AlUla inaugurated the AlUla Academy, an innovative initiative aspiring to lead the region in providing top-tier vocational training within the tourism sector. Officials highlighted its role as a central hub on a global scale, catering to individuals actively engaged in creating unforgettable experiences for a wide range of visitors to AlUla from all corners of the world.

-

In April 2024, the Saudi Ministry of Industry and Mineral Resources signed an agreement with Elsewedy Technical Academy (STA) to cultivate and execute cutting-edge programs and initiatives in the TVET sector in Egypt, KSA, and the broader Middle Eastern region.

-

In February 2024, Tenaris unveiled the Tenaris Lab at the ITQAN Institute in Juaymah, Saudi Arabia. This cutting-edge facility incorporates advanced equipment generously provided by Tenaris through its Technical Gene Program. The initiative aims to enrich students' theoretical and hands-on understanding by granting them access to specialized industrial machinery.

MEA Technical And Vocational Education Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 51.78 billion

Revenue forecast in 2030

USD 86.25 billion

Growth rate

CAGR of 10.7% from 2025 to 2030

Actual data

2017 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Course type, learning mode, organization, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

ADNOC Technical Academy; City & Guilds Group; Dubai College of Tourism; NetDragon Websoft Holdings Limited; New Horizons Worldwide, LLC; NIIT Limited; Pearson; South African Qualifications Authorit; Technical and Vocational Training Corporation; The Institute of Chartered Accountants in England and Wales

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

MEA Technical And Vocational Education Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the MEA technical and vocational education market report based on course type, learning mode, organization, end-use, and country:

-

Course Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

STEM

-

Non-STEM

-

-

Learning Mode Outlook (Revenue, USD Billion, 2017 - 2030)

-

Online

-

Offline

-

-

Organization Outlook (Revenue, USD Billion, 2017 - 2030)

-

Public

-

Private

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Academic Institutions & Individuals

-

Corporates

-

-

Country Outlook (Revenue, USD Billion, 2017 - 2030)

-

UAE

-

South Africa

-

KSA

-

Turkey

-

Frequently Asked Questions About This Report

b. The MEA technical and vocational education market size was estimated at USD 46.90 billion in 2024 and is expected to reach USD 51.78 billion in 2025.

b. The MEA technical and vocational education market is expected to grow at a compound annual growth rate of 10.7% from 2025 to 2030 to reach USD 86.25 billion by 2030.

b. STEM course type segment dominated the MEA technical and vocational education market with a share of 80.5% in 2024. Various countries such as KSA and the UAE established numerous national development strategies such as, Saudi Vision 2030 and UAE Vision 2021 that prioritize building knowledge-based economies. A strong emphasis on STEM education is crucical to these plans, as they aim to reduce reliance on oil by developing high-tech, innovative industries that require skilled professionals in STEM fields.

b. Some key players operating in the MEA technical and vocational education market include ADNOC Technical Academy; City & Guilds Group; Dubai College of Tourism; NetDragon Websoft Holdings Limited; New Horizons Worldwide, LLC; NIIT Limited; Pearson; South African Qualifications Authority; Technical and Vocational Training Corporation; and The Institute of Chartered Accountants in England and Wales.

b. Various factors such as government initiatives and national vision program, labor market needs and economic diversification, and youth population and high unemployment rate are driving the growth of the MEA technical and vocational education market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.