MEA Hip And Knee Reconstruction Devices Market Size, Share & Trends Analysis Report By Technique (Joint Replacement, Osteotomy, Arthroscopy, Resurfacing, Arthrodesis), By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-433-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

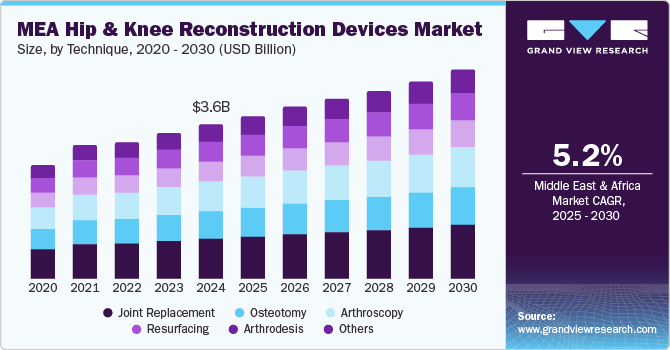

The MEA hip and knee reconstruction devices market size was estimated at USD 3.62 billion in 2024 and is projected to grow at a CAGR of 5.2% from 2025 to 2030. The increasing prevalence of orthopedic conditions, particularly knee osteoarthritis, which is spurring demand for joint replacement surgeries across the region, is driving market growth worldwide. The aging population, with countries such as South Africa reporting high rates of osteoarthritis, necessitates a proactive approach towards orthopedic interventions. This rising demand signifies a critical need for advanced reconstruction devices that can meet the growing challenges posed by these orthopedic disorders.

Technological advancements play a pivotal role in shaping the future of the hip and knee reconstruction devices market. Innovations such as minimally invasive surgical techniques, advanced implant designs, and the integration of 3D printing technologies are transforming surgical practices and improving patient outcomes. Personalized implants tailored to individual anatomical needs not only enhance the effectiveness of procedures but also elevate patient satisfaction. As healthcare stakeholders prioritize safety and efficacy, these technological developments are set to determine the competitive edge in the market.

The incidence of lifestyle disorders, particularly obesity, is also driving market growth. With rising obesity rates in multiple MEA countries, the demand for orthopedic interventions is anticipated to increase, as obesity is a well-documented risk factor for various joint conditions. As healthcare providers recognize the link between lifestyle and orthopedic health, targeted initiatives to mitigate these disorders are likely to amplify the need for reconstruction devices in the region. Consequently, in November 2023, Aman Hospital pioneered Qatar’s first minimally invasive hip and knee replacement, led by Dr. Feras Ashouri, enabling rapid recovery and elevating healthcare standards in the region.

Investment in healthcare infrastructure across the MEA region continues to enhance access to surgical procedures and rehabilitation services. This commitment to improving healthcare standards is expected to yield better surgical outcomes and patient care, further promoting the adoption of reconstruction devices. In tandem with an increase in patient awareness and acceptance of joint surgeries, these factors are establishing a robust framework for sustained growth in the hip and knee reconstruction devices market in the Middle East and Africa.

Technique Insights

Joint replacement led the market with a revenue share of 25.4% in 2024, driven by the rising prevalence of orthopedic conditions such as osteoarthritis, which require surgical intervention. Furthermore, advancements in surgical methodologies, coupled with an aging population, are significant contributors to segment growth.

Arthrodesis is expected to grow at the fastest CAGR of 5.3% over the forecast period, fueled by its efficacy in addressing severe joint pain and instability. As orthopedic conditions such as arthritis become more widespread, patients are increasingly pursuing surgical options that offer long-term relief and enhanced functionality, thereby enhancing the appeal of this technique.

Country Insights

South Africa hip and knee reconstruction devices market dominated the Middle East & Africa market with a revenue share of 12.3% in 2024. The country is witnessing a high prevalence of osteoarthritis among its aging population. Contributing factors include increased healthcare investments and advancements in surgical techniques, which are enhancing the demand for effective joint replacement solutions. This positions South Africa as a leader within the MEA region for orthopedic interventions.

The hip and knee reconstruction devices market in Israel is expected to grow at the fastest rate of 5.8% over the forecast period, supported by escalating obesity rates that heighten the need for joint surgeries. Moreover, continuous investments in healthcare infrastructure and the introduction of innovative products by key industry players are expanding treatment options, further propelling market growth within the region.

Key MEA Hip And Knee Reconstruction Devices Company Insights

Some key companies operating in the market include Enovis; Smith+Nephew; Zimmer Biomet; B. Braun SE; CONMED Corporation. Strategic initiatives encompass product launches, geographic expansions, and collaborations designed to improve market penetration and meet the increasing demand for innovative orthopedic solutions in the region.

-

Smith+Nephew provides innovative orthopedic solutions, including hip and knee implants, robotic-assisted technologies, and trauma products. Their state-of-the-art offerings are designed to enhance surgical precision and improve patient outcomes.

-

B. Braun SE offers a diverse portfolio that includes surgical instruments and implants. The company is dedicated to enhancing surgical efficiency and patient safety through its innovative solutions.

Key MEA Hip And Knee Reconstruction Devices Companies:

The following are the leading companies in the MEA hip and knee reconstruction devices market. These companies collectively hold the largest market share and dictate industry trends.

- Enovis

- Smith+Nephew

- Zimmer Biomet

- B. Braun SE

- CONMED Corporation

- DePuy Synthes (Johnson & Johnson Services, Inc.)

- Meril Life Sciences Pvt. Ltd.

- Arthrex, Inc.

Recent Developments

-

In December 2024, Zimmer Biomet announced FDA clearance for the Persona SoluTion PPS Femur, providing a cementless knee implant alternative for patients with sensitivities to bone cement and metal.

-

In January 2024, Fortius Clinic showcased advanced robotic technology for hip and knee replacement surgery at Arab Health 2024, enhancing surgical precision and promoting faster recovery for patients with chronic joint issues.

MEA Hip And Knee Reconstruction Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 3.81 billion |

|

Revenue forecast in 2030 |

USD 4.90 billion |

|

Growth rate |

CAGR of 5.2% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Technique, country |

|

Regional scope |

MEA |

|

Country scope |

South Africa, Saudi Arabia, Israel, Egypt, Oman, Kuwait, Bahrain, Lebanon, Qatar, Iran |

|

Key companies profiled |

Enovis; Smith+Nephew; Zimmer Biomet; B. Braun SE; CONMED Corporation; DePuy Synthes (Johnson & Johnson Services, Inc.); Meril Life Sciences Pvt. Ltd.; Arthrex, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

MEA Hip And Knee Reconstruction Devices Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the MEA hip and knee reconstruction devices market report based on technique, and country:

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Joint Replacement

-

Implants

-

Bone Graft

-

Allograft

-

Synthetic

-

-

-

Osteotomy

-

Arthroscopy

-

Resurfacing

-

Arthrodesis

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

South Africa

-

Saudi Arabia

-

Israel

-

Egypt

-

Oman

-

Kuwait

-

Bahrain

-

Lebanon

-

Qatar

-

Iran

-

Frequently Asked Questions About This Report

b. The MEA hip & knee reconstruction devices market size was estimated at USD 3.6 billion in 2024 and is expected to reach USD 3.8 billion in 2025.

b. The MEA hip & knee reconstruction devices market is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2030 to reach USD 4.9 billion by 2030.

b. In 2024, South Africa held the largest revenue share of over 12.3%in the MEA hip & knee reconstruction devices market. This is attributable to the rising prevalence of osteoarthritis.

b. Some key players operating in the MEA hip & knee reconstruction devices market include DJO, LLC, Smith + Nephew, Zimmer Biomet, B.Braun Melsungen AG, Conmed Corporation, DePuy Synthes, Meril Life Sciences Pvt Ltd, and Arthrex, Inc.

b. Key factors driving the MEA hip & knee reconstruction devices market growth include technological advancements, the prevalence of orthopedic conditions, the incidence of lifestyle disorders, and the target population.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."