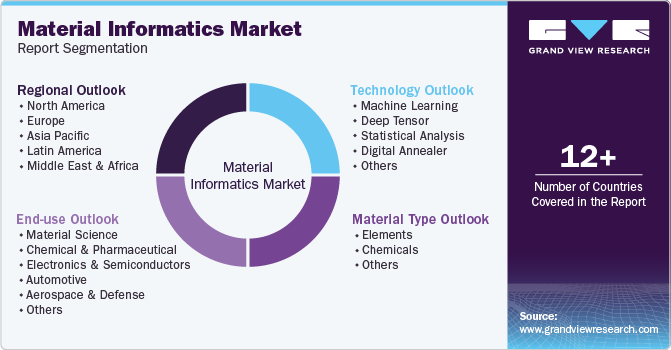

Material Informatics Market Size, Share & Trends Analysis Report By Material Type (Elements, Chemicals), By Technology (Machine Learning, Deep Tensor), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-428-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Material Informatics Market Size & Trends

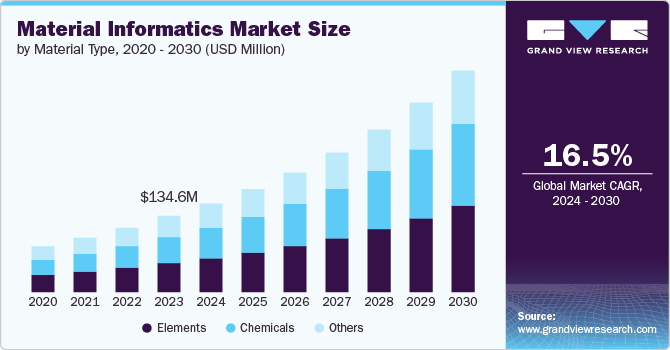

The global material informatics market size was estimated at USD 134.6 million in 2023 and is projected to grow at a CAGR of 16.5% from 2024 to 2030. The increasing complexity of materials used across industries demands sophisticated tools for analysis and development. Advanced materials are integral to innovations in sectors such as electronics, aerospace, automotive, and healthcare. The need for efficient material discovery and optimization methods, which can handle vast datasets and predict material behaviors, is propelling the market forward.

With the proliferation of data generated from experiments and simulations, material informatics offers solutions for managing and interpreting this information effectively. Moreover, the integration of machine learning and artificial intelligence enhances predictive capabilities, allowing for faster and more accurate material discovery. These technological advancements enable researchers to accelerate the development of new materials with customized properties, driving market growth.

The rise in collaborative and interdisciplinary research also contributes to the growth of the market. As materials science intersects with fields such as computational science, data analytics, and engineering, there is a growing need for integrated tools that facilitate collaboration across disciplines. Material informatics platforms enable researchers from diverse fields to share data, models, and insights, promoting innovation and accelerating discoveries. This collaborative approach enhances the development of new materials and optimizes existing ones, driving demand for advanced material informatics solutions. The trend toward interdisciplinary research highlights the increasing importance of material informatics in addressing complex scientific and engineering challenges.

The growing emphasis on sustainability and environmental impact is shaping the material informatics industry. Industries face increasing pressure to develop materials that are high-performing and environmentally friendly. Material informatics tools assist in the design and optimization of sustainable materials by predicting their lifecycle impacts and identifying eco-friendly alternatives. This focus on sustainability drives the adoption of material informatics solutions that support green chemistry and circular economy principles. As companies and researchers work to meet environmental regulations and achieve sustainability goals, the demand for material informatics technologies that support these objectives continues to rise. This trend toward sustainability is a significant factor contributing to the market's growth.

Material Type Insights

The elements segment led the market and accounted for 38.0% of the global revenue share in 2023. The elements segment dominates the market due to its foundational role in materials science and engineering. Elements are the basic building blocks for developing and understanding materials, making their study essential for material discovery and optimization. Advanced analytical tools and databases for elements enable researchers to precisely determine material properties and behaviors. The ability to analyze elemental composition and interactions allows for the design of materials with targeted performance characteristics. As a result, the focus on elemental analysis and its integration with material informatics tools significantly drives the growth and dominance of this segment.

The chemicals segment is anticipated to experience notable growth over the forecast period due to increasing complexity in chemical formulations and applications. Advancements in computational chemistry and data analytics are enhancing the ability to predict chemical behaviors and interactions. This growth is fueled by demand for more efficient and innovative chemical products across various industries, including pharmaceuticals, agriculture, and manufacturing. Material informatics tools that provide insights into chemical properties and reactions are becoming essential for accelerating product development and optimizing formulations. As industries seek to innovate and improve chemical processes, the role of material informatics in the chemical segment continues to expand.

Technology Insights

The machine learning segment accounted for the largest market revenue share in 2023. The machine learning segment leads the market because it can analyze extensive datasets and reveal patterns that traditional methods may overlook. Machine learning algorithms enhance predictive modeling and speed up material discovery by processing complex and voluminous data. Automating data analysis through machine learning significantly cuts down the time and cost of material research and development. As industries increasingly rely on data-driven insights, machine-learning tools have become essential for advancing material informatics. Continuous improvements in algorithms and computing power further solidify the dominance of this segment.

The statistical analysis segment is predicted to foresee significant growth over the forecast period. The statistical analysis segment is expanding due to its vital role in interpreting experimental data and validating predictive models. Advanced statistical methods offer more precise assessments of material properties and performance, supporting better decision-making in material design. Integrating sophisticated statistical techniques with material informatics tools enhances the ability to manage and interpret complex datasets. As the need for accurate data interpretation grows, so does the demand for robust statistical analysis. This trend reflects the increasing importance of high-quality analysis in supporting material development and innovation.

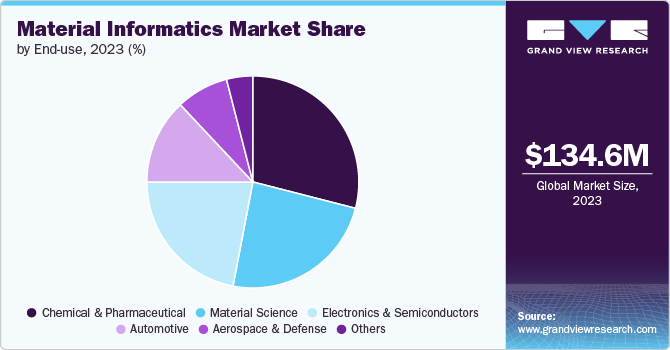

End-use Insights

The chemical and pharmaceutical segment held the largest market revenue share in 2023 due to its extensive use of material data for drug discovery and chemical formulation. Advanced informatics tools enable precise modeling of chemical reactions and properties, enhancing R&D efficiency. The high demand for new and optimized chemicals and pharmaceuticals drives significant investment in material informatics solutions. Innovations in this segment help streamline the development of new compounds and formulations. Consequently, the chemical and pharmaceutical sector continues to be a key driver in advancing material informatics technologies.

The electronics and semiconductors segment is projected to grow significantly over the forecast period. This growth can be attributed to the increasing complexity of electronic devices and components. Advancements in material informatics support the development of new materials with tailored properties for enhanced performance. The need for more efficient and reliable electronic components drives the demand for sophisticated informatics solutions. This growth is fueled by the continuous innovation and miniaturization trends in the electronics industry. As technology evolves, the role of material informatics in optimizing electronic materials becomes increasingly crucial.

Regional Insights

The North America material informatics market dominated globally and held a 39.6% share in 2023.North America market growth is driven by its leadership in technological innovation and substantial investment in research and development. The region's advanced academic institutions and major technology companies, particularly in the U.S., are advancing material informatics. Strong industry-academia collaborations facilitated the rapid adoption of advanced informatics technologies. Moreover, a supportive regulatory environment and significant industrial applications further solidified North America's leading position in the market.

U.S. Material Informatics Market Trends

The material informatics market in the U.S. is seeing growing industrial adoption of material informatics across sectors such as aerospace, electronics, and pharmaceuticals, as these industries demand advanced materials with specific properties. In aerospace, it helps develop lightweight, durable materials, while in electronics, it supports the discovery of new materials for advanced technologies. The pharmaceutical industry benefits from faster drug discovery through optimized chemical formulations. Moreover, the U.S. focuses on sustainability and advanced manufacturing technologies, such as 3D printing, which is further fueling the growth of material informatics.

Europe Material Informatics Market Trends

The material informatics market in Europe is driven by robust research funding and government initiatives in material science, which significantly fuel market growth. The region's emphasis on innovation and integration of material informatics into industrial applications further strengthens its market position. This strategic focus enhanced Europe's overall presence in the material informatics industry.

Asia Pacific Material Informatics Trends

Asia Pacific material informatics market is anticipated to register the fastest CAGR over the forecast period. Asia-Pacific market has witnessed substantial growth due to rapid industrialization and technological advancements. Increased investments in research and development, particularly in countries such as China and Japan, have driven significant progress. The region's expanding manufacturing sector and technological innovation support the growing demand for material informatics solutions.

Key Material Informatics Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations, as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, in October 2023, NobleAI announced a collaboration with Azure Quantum Elements, a cloud-based service from Microsoft. NobleAI's Science-Based AI solutions integrate with Microsoft's cloud-based service to accelerate chemical and material discovery through advanced molecular simulation, high-performance computing, and AI. This collaboration aims to transform R&D by enabling faster time-to-discovery, multi-scale modeling, and groundbreaking innovation at a massive scale.

Key Material Informatics Companies:

The following are the leading companies in the material informatics market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Citrine Informatics

- Dassault Systèmes

- Elsevier

- Hitachi High-Tech Corporation

- International Business Machines Corporation

- Lattice Technology, Inc.

- Microsoft

- Phaseshift Technologies Inc.

- Schrodinger, Inc.

Recent Developments

-

In May 2024, Hitachi High-Tech Corporation and Hitachi, Ltd. initiated a collaborative project with Taiwan's Industrial Technology Research Institute (ITRI) to integrate Hitachi's Materials Informatics solutions with ITRI's AI-driven "MACSiMUM" platform, aiming to enhance digital transformation in materials R&D. This partnership seeks to optimize analytics, reduce experimental workloads, and accelerate the development of new materials, thereby advancing sustainable industrial practices in Taiwan.

-

In December 2023, ABB Robotics and XtalPi, a China-based pharmaceutical technology company, partnered to develop automated laboratory workstations in China. Through advanced automation, they aim to enhance R&D productivity in biopharmaceuticals, chemical engineering, and new energy materials. This collaboration utilizes GoFa cobots to streamline experimentation and data generation, potentially revolutionizing lab research and accelerating drug and material development.

-

In September 2023, Sion Power Corporation, an Arizona battery manufacturer, partnered with Citrine Informatics to use the Citrine Platform for AI-guided product development, focusing on digitalizing R&D workflows. This collaboration aims to accelerate the creation of advanced lithium metal batteries with twice the energy density of conventional lithium-ion batteries, enhancing efficiency and development cycles.

-

In May 2023, Mitsui Chemicals, Inc. and IBM Japan, Ltd. collaborated by integrating Generative AI, specifically GPT, with IBM Watson Discovery to enhance the discovery of new applications for Mitsui Chemicals' products. This collaboration aims to boost sales and revenue through digital transformation by utilizing AI to analyze extensive external data and integrate insights across various business units and R&D, thus accelerating application discovery and optimizing corporate transformation.

Material Informatics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 156.2 million |

|

Revenue forecast in 2030 |

USD 390.8 million |

|

Growth rate |

CAGR of 16.5% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Material type, technology, end-use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, China, Japan, India, South Korea, Australia, Brazil, KSA, UAE, South Africa |

|

Key companies profiled |

ABB; Citrine Informatics; Dassault Systemes; Elsevier; Hitachi High-Tech Corporation; International Business Machines Corporation; Lattice Technology, Inc.; Microsoft; Phaseshift Technologies Inc.; Schrodinger, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Material Informatics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global material informatics market report based on material type, technology, end-use, and region.

-

Material Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Elements

-

Chemicals

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Machine Learning

-

Deep Tensor

-

Statistical Analysis

-

Digital Annealer

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Material Science

-

Chemical and Pharmaceutical

-

Electronics and Semiconductors

-

Automotive

-

Aerospace and Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

- Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global material informatics market size was estimated at USD 134.6 million in 2023 and is expected to reach USD 156.2 million in 2024.

b. The global material informatics market is expected to grow at a compound annual growth rate of 16.5% from 2024 to 2030 to reach USD 390.8 million by 2030.

b. North America dominated the material informatics market with a share of 39.6% in 2023. This is attributable to the region's early adoption of advanced AI and machine learning technologies in material science and the strong presence of leading technology companies and academic institutions.

b. Some key players operating in the material informatics market include ABB, Citrine Informatics, Dassault Systemes, Elsevier, Hitachi High-Tech Corporation, International Business Machines Corporation, Lattice Technology, Inc., Microsoft, Phaseshift Technologies Inc., and Schrodinger, Inc.

b. Key factors driving market growth include technological advancements in AI and machine learning, increased R&D investments, growing demand for advanced materials, strong industry-academia collaborations, and supportive government policies and funding.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."