Material Handling Equipment Telematics Market Size, Share & Trends Analysis Report By Product (Earthmoving Equipment, Tractors, Trucks, Cranes, Forklifts, Telehandlers, Others), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-780-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

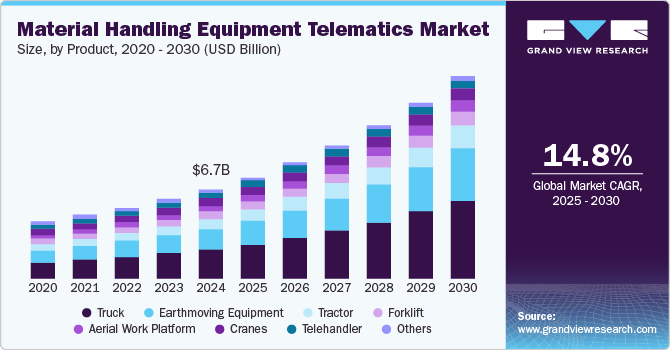

The global material handling equipment telematics market size was valued at USD 6.70 billion in 2024 and is expected to grow at a CAGR of 14.8% from 2025 to 2030. This growth is attributed to the increasing demand for operational efficiency across various industries, particularly in logistics and construction. As companies strive to optimize their operations, telematics solutions are essential for monitoring equipment performance, enhancing safety, and improving overall productivity.

The rise of e-commerce has led to heightened demand for efficient goods transportation and inventory management, further driving the material handling equipment telematics industry. With more businesses relying on automated systems to streamline operations, the need for advanced telematics solutions has surged. For instance, companies are now using telematics to track vehicle location and monitor fuel consumption, which helps reduce operational costs while improving service delivery.

Technological advancements have played a crucial role in the growth of the material handling equipment telematics industry. Innovations such as Internet of Things (IoT) integration and artificial intelligence (AI) enable real-time data collection and analysis, allowing businesses to make informed decisions based on actionable insights. These technologies facilitate predictive maintenance, which minimizes equipment downtime by alerting operators about potential issues before they escalate into costly repairs.

Moreover, the increasing focus on sustainability is driving companies to adopt eco-friendly practices within their operations. Telemetry systems can help organizations monitor energy usage and emissions, supporting their efforts to reduce their environmental footprint. For instance, a logistics company might implement telematics to optimize its fleet routes, resulting in lower fuel consumption and reduced greenhouse gas emissions, aligning with global sustainability goals.

Product Insights

The trucks segment dominated the material handling equipment telematics industry with the largest revenue share of 33.3% in 2024, owing to the rise of e-commerce, which has significantly increased the demand for efficient goods transportation, leading to higher adoption of telematics solutions in trucks. These solutions enable fleet operators to monitor vehicle performance, optimize routes, and reduce fuel consumption, which is crucial for maintaining competitiveness in a fast-paced market. In addition, advancements in road infrastructure have facilitated smoother logistics operations, further driving the need for telematics in trucks. For instance, companies can now utilize real-time data to improve delivery schedules and enhance customer satisfaction.

The earthmoving equipment segment is expected to grow at a significant CAGR over the forecast period due to the increasing demand for infrastructure development and urbanization worldwide. As countries invest heavily in building roads, bridges, and urban centers, the need for efficient earthmoving machinery becomes critical. For instance, major initiatives such as India's Smart Cities Mission aim to enhance urban infrastructure, directly driving the demand for excavators and bulldozers essential for construction tasks. Technological advancements also contribute to the growth of material handling equipment telematics industry, as modern earthmoving equipment now features enhanced capabilities such as GPS tracking and automated controls. These innovations improve operational efficiency and reduce labor costs, making them attractive to construction companies.

Regional Insights

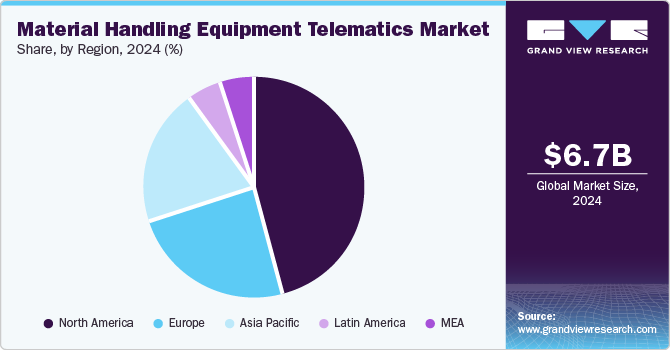

The North America material handling equipment telematics market dominated with a revenue share of 46.1% in 2024 due to the region's advanced technological landscape, characterized by robust IT infrastructure and high-speed internet connectivity, which facilitates the implementation of telematics solutions. Companies in North America are increasingly adopting these systems to enhance operational efficiency, reduce costs, and improve safety standards in material handling processes. In addition, the presence of major players and ongoing investments in research and development contribute to market leadership.

U.S. Material Handling Equipment Telematics Market Trends

The material handling equipment telematics market in U.S. dominated North America in 2024 owing to its strong technological infrastructure and high adoption rates of advanced telematics solutions. Moreover, the growing demand for automation in the logistics and manufacturing sectors drives the need for telematics solutions to optimize fleet management and reduce operational costs. For instance, companies are increasingly using telematics to track vehicle locations and monitor fuel consumption, which leads to improved route planning and reduced emissions.

Asia Pacific Material Handling Equipment Telematics Market Trends

APAC material handling equipment telematics market is expected to grow at the fastest CAGR over the forecast period due to rapid industrialization and significant investments in infrastructure development across the region. Countries such as China and India are experiencing a surge in construction projects driven by government initiatives aimed at improving transportation networks and urban infrastructure. In addition, the booming e-commerce sector is fueling the need for efficient logistics and supply chain management, further driving the adoption of telematics systems. These systems enable businesses to optimize their operations by providing real-time data on equipment performance and location tracking.

The China material handling equipment telematics market dominated Asia Pacific in 2024 with the largest revenue share due to the implementation of the Belt and Road Initiative, which has led to extensive infrastructure development, enhancing logistics capabilities across the region. In addition, China's position as the world's largest manufacturer fosters a robust logistics and warehousing industry, which relies heavily on telematics for operational efficiency and real-time monitoring of equipment usage. The growing focus on automation within warehouses further propels the adoption of telematics solutions as businesses seek to improve productivity and reduce labor costs.

Europe Material Handling Equipment Telematics Market Trends

The Europe material handling equipment telematics market is expected to grow significantly over the forecast period, due to technological advancements in telematics systems, including GPS and IoT integration, enhance operational efficiency by enabling real-time data monitoring and predictive maintenance. This allows businesses to optimize their equipment usage and reduce downtime, which is crucial in competitive environments. For instance, automated guided vehicles (AGVs) equipped with telematics can predict maintenance needs, thus preventing costly breakdowns. Furthermore, stringent regulatory compliance regarding safety standards compels companies to adopt telematics solutions that ensure adherence while enhancing productivity.

Key Material Handling Equipment Telematics Company Insights

Some key companies in the material handling equipment telematics industry are Toyota Material Handling, The Raymond Corporation, CLARK, and Konecranes. These companies in the material handling equipment telematics market are leveraging advanced technologies to enhance operational efficiency and improve equipment performance. They focus on integrating telematics solutions with existing systems, enabling real-time monitoring and predictive maintenance capabilities.

-

Caterpillar offers a comprehensive telematics solution that empowers equipment owners with real-time data to enhance operational efficiency. By integrating advanced technologies, Caterpillar enables users to track equipment location, monitor performance, and receive maintenance alerts through an intuitive online dashboard. This system minimizes downtime with remote troubleshooting capabilities and allows customizable reporting and analytics.

-

Toyota Material Handling focuses on providing cutting-edge telematics solutions that enhance fleet management and operational efficiency. Their telematics systems integrate seamlessly with existing equipment, offering real-time insights into machine performance, location tracking, and predictive maintenance alerts. By leveraging advanced data analytics, Toyota empowers businesses to make informed decisions that boost productivity and reduce costs.

Key Material Handling Equipment Telematics Companies:

The following are the leading companies in the material handling equipment telematics market. These companies collectively hold the largest market share and dictate industry trends.

- Caterpillar

- Toyota Material Handling

- The Raymond Corporation

- CLARK

- MLE B.V.

- Konecranes

- Hiab

- MCE (Mahindra Construction Equipment)

- Doosan Corporation

- HD Hyundai Construction Equipment India Private Limited

- Trackunit Corporation

- JLG Industries

- ZTR Control Systems LLC

Recent Developments

-

In December 2024, Mahindra unveiled its new CEV5 range of construction equipment at the Bauma Conexpo 2024 exhibition. This latest offering includes upgraded RoadMaster and EarthMaster models that meet CEV5 compliance, featuring advanced telematics systems and enhanced operator cabins.

-

In October 2024, ZAPI GROUP announced the acquisition of UBIQUICOM, a prominent Real-Time Locating Systems (RTLS) provider for manufacturing, transportation, and logistics. This strategic acquisition enhances ZAPI for improved access to robust automation solutions that promote efficiency and safety in material handling operations.

Material Handling Equipment Telematics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 7.57 billion |

|

Revenue forecast in 2030 |

USD 15.12 billion |

|

Growth rate |

CAGR of 14.8% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil |

|

Key companies profiled |

Caterpillar; Toyota Material Handling; The Raymond Corporation; CLARK MLE B.V.; Konecranes.; Hiab; MCE (Mahindra Construction Equipment); Doosan Corporation; HD Hyundai Construction Equipment India Private Limited; JLG Industries; Trackunit Corporation; ZTR Control Systems LLC |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Material Handling Equipment Telematics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global material handling equipment telematics market report based on product, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Aerial Work Platform

-

Forklift

-

Truck Mounted Forklift

-

Articulated Forklift

-

Side Loader

-

Other

-

-

Cranes

-

Port Crane

-

Truck-mounted Crane

-

Others

-

-

Earthmoving Equipment

-

Spreader

-

Articulated Wheel Loader

-

Farm Implements

-

Road Work Vehicle

-

Self-propelling AG machine

-

Others

-

-

Truck

-

Military Vehicle

-

Trailer

-

Others

-

-

Tractor

-

Terminal Tractor

-

Tow Tractor

-

Others

-

-

Telehandler

-

Others

-

Sweeper & Scrubber

-

Personnel & Burden Carrier

-

Power Generation/Light Station

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."