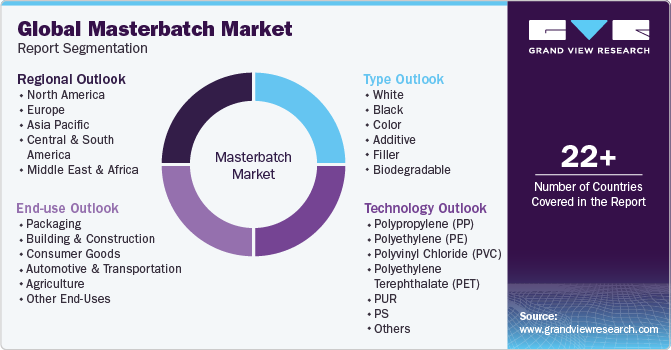

Masterbatch Market Size, Share & Trends Analysis Report By Type (Black, Filler), By Carrier Polymer (Polypropylene, Polyethylene), By End Use (Packaging, Automotive & Transportation), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-205-1

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Masterbatch Market Size & Trends

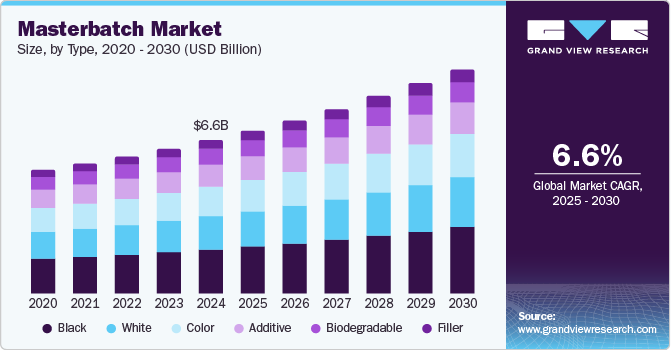

The global masterbatch market size was valued at USD 6.60 billion in 2024 and is expected to grow at a CAGR of 6.6% from 2025 to 2030. The replacement of metal with plastics in the end-use industries, including automotive and transportation, building and construction, consumer goods, and packaging, is expected to be a key factor driving the global market in the forecast period. Furthermore, masterbatches enhance the properties of polymers, such as providing antistatic, antifog, UV stabilization, and flame retardant qualities, thereby driving market expansion.

Masterbatch is a concentrated mixture of pigments and additives encapsulated within a carrier resin, which is then used to impart color or specific properties to plastics. The plastic packaging industry is experiencing substantial growth, driven by evolving retail formats and increasing sales rates. Organized retail expansion is boosting the demand for attractive packaging. The food and beverage sector significantly contributes to this surge as plastic packaging enhances food quality and extends shelf life. Packaged foods are becoming increasingly popular. In addition to food and beverage, the pharmaceutical industry relies heavily on packaging for preserving and marketing products, complying with regulations, and ensuring patient safety.

In addition, increasing expertise in packaging for various industries, including food and beverage, pharmaceuticals, and home and personal care, is facilitating the rapid expansion of plastic packaging. Furthermore, masterbatch is used with base polymers to give the plastic specific qualities and functionalities. It is the most effective method for coloring plastic, providing both functional and coloring characteristics and accelerating the degradation of plastics.

Moreover, the automotive industry also boosts the growth of the plastic packaging market. The quantity of plastics used in vehicle parts is increasing, and the need for lightweight materials encourages the substitution of metals with plastics. Color is one of the most important aspects of vehicles, adding visual appeal, market value, and versatility. Masterbatch enhances reliability, pliability, and corrosion resistance and provides flame retardancy. It is commonly used for vehicle interiors and exteriors, improving the overall quality and appeal of vehicles.

Type Insights

The black type dominated the market with a revenue share of 28.6% in 2024. This growth can be attributed to the increasing demand for black masterbatch and the high demand for tires, PVC containers, and other products for application in the automotive and transportation, building and construction, agriculture, and packaging industries. In addition, the growing need for agricultural products such as drip irrigation tubing and tape, greenhouse films, shade cloth, and geomembranes is also projected to boost market growth over the forecast period.

Due to its broad applicability and versatility, white masterbatch is expected to grow at a CAGR of 7.0% over the forecast period. It is a foundational base for creating diverse color shades and is widely used in the packaging and textile industries. In addition, the opacity it provides enhances the visual appeal of products. Furthermore, white masterbatch offers UV protection, which is essential for applications in agriculture and construction, thus expanding its demand.

Carrier Polymer Insights

The polypropylene (PP) carrier polymer segment dominated the global masterbatch industry with the highest revenue share of 26.7% in 2024, primarily driven by the excellent mechanical strength and flexibility offered by polypropylene. In addition, polypropylene also enhances the quality of surfaces. It is lightweight and is used to replace metal components in the automotive industry. Furthermore, the extensive use of polypropylene in consumer goods contributes to the growth of product demand. It has antimicrobial and antibacterial properties, making it helpful in manufacturing various products related to building and construction.

The polyethylene (PE) segment is expected to grow at the fastest CAGR of 7.1% from 2025 to 2030, primarily driven by the increasing demand for durable, lightweight materials. In addition, polyethylene's affordability, ease of production, and ability to improve mechanical, thermal, and chemical properties make it suitable for performance polymers used in masterbatches. Furthermore, polyethylene enhances chemical, thermal, and environmental resistance when blended with certain additives, making it a preferred polymer resin for masterbatch production.

End Use Insights

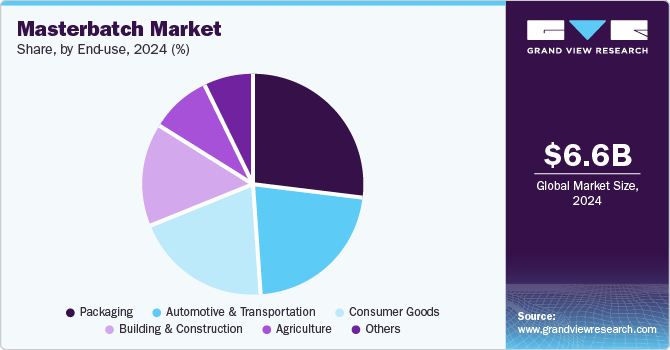

The packaging masterbatch segment dominated the market with a revenue share of 27.0% in 2024. Its high share can be attributable to the packaging industry, which includes retail, industrial, and consumer packaging and includes flexible and rigid options. A rise in the number of city inhabitants who require packaged goods is resulting in an increased demand for packaging. Consumers need convenient, sustainable, flexible packaging, offers protection, and is easily traceable. As plastic packing fulfills all these needs, its demand is expected to grow, which is, in turn, projected to result in the growing demand for the product.

The automotive and transportation segment is expected to grow at a CAGR of 6.9% over the forecast period. Plastics are replacing metals to create lighter vehicles, enhancing fuel efficiency. Masterbatches improve the pliability, corrosion resistance, and flame retardancy of vehicle components, adding visual appeal and versatility. In addition, the rising demand for electric vehicles is also boosting the use of plastics for better insulation. Furthermore, the need for customized interiors and exteriors further stimulates the demand for masterbatches in the automotive sector.

Regional Insights

Asia Pacific masterbatch market dominated the global market and accounted for the largest revenue share of 30.6% in 2024. This growth can be attributed to the presence of several end-use industries, including automotive and transportation, packaging, building and construction, and consumer goods. The growth of these industries is expected to fuel the demand for the product over the next eight years. Furthermore, increasing urbanization, improved living standards, and the rising need for cost-effective and sustainable materials have contributed to market growth. Moreover, the expanding plastics industry, alongside growing consumer demand for custom colors and additives, further supports the development of the masterbatch market in this region.

China Masterbatch Market Trends

The masterbatch market in China led the Asia Pacific market and accounted for the largest revenue share in 2024, due to the country’s robust manufacturing sector, particularly in electronics, automotive, and packaging. In addition, the increasing focus on improving the quality and efficiency of plastic products is pushing the demand for advanced masterbatches. Furthermore, China’s shift towards eco-friendly materials and sustainable production processes has increased demand for biodegradable masterbatches. Moreover, the large-scale production of consumer goods and electronics, combined with the country's strong export market, has significantly boosted the growth of the masterbatch industry.

Europe Masterbatch Market Trends

Europe masterbatch market is expected to grow at a CAGR of 6.7% over the forecast period, owing to stringent plastic use and sustainability regulations. In addition, the increased focus on recycling and reducing environmental impact has accelerated the adoption of eco-friendly masterbatches, such as biodegradable and recycled content masterbatches. Furthermore, the rising demand for high-quality plastic products in industries such as packaging, automotive, and construction is supporting the market. Moreover, well-established manufacturing industries in countries such as Germany, France, and Italy have further enhanced the market demand for specialized and customized masterbatch solutions.

North America Masterbatch Market Trends

The masterbatch market in North America is expected to grow significantly over the forecast period, primarily driven by the increasing demand for high-quality plastic products in automotive, packaging, and healthcare sectors. In addition, the focus on product differentiation, driven by consumer preferences for customized colors, additives, and functional properties, is enhancing the demand for masterbatches. Furthermore, the region’s focus on sustainability and environmental concerns has led to introducing eco-friendlier and recycled content masterbatches.

U.S. Masterbatch Market Trends

The U.S. masterbatch market led the North American market and accounted for the largest revenue share in 2024, driven by rising demand from diverse industries such as automotive, packaging, and healthcare. In addition, the country’s extensive consumer goods sector and emphasis on innovative, high-quality plastic products have increased the need for masterbatches. Furthermore, the growing adoption of recycled plastics and government regulations promoting sustainability are fueling the market, alongside the ongoing growth in manufacturing and production capabilities.

Key Masterbatch Company Insights

Key players in the global masterbatch industry include Clariant AG, Hubron International Ltd., Penn Color, Inc., and others. These companies comply with regulatory policies and are engaged in research and development activities to develop innovative products. They also focus on strategies such as product innovation, expanding production capacity, and enhancing sustainability efforts. Furthermore, they invest in research and development to offer customized solutions, strengthen supply chains, and improve cost-efficiency while meeting regulatory standards.

-

Cabot Corporation specializes in manufacturing performance materials, including a broad range of masterbatches. The company offers solutions in color, additives, and specialty plastic formulations, catering to industries such as packaging, automotive, and consumer goods. Operating in the specialty chemicals segment, the company focuses on providing high-quality, innovative products that enhance the properties of plastics, such as durability, UV protection, and color consistency.

-

Clariant AG manufactures various masterbatch solutions, including colors, additives, and custom formulations tailored for sectors such as automotive, packaging, and textiles. Operating within the specialty chemicals segment, the company focuses on providing sustainable and high-performance solutions that improve the functionality and aesthetics of plastic products. Their offerings include eco-friendly and innovative products designed to meet the evolving demands of the global market.

Key Masterbatch Companies:

The following are the leading companies in the masterbatch market. These companies collectively hold the largest market share and dictate industry trends.

- Schulman, Inc.

- Ampacet Corporation

- Cabot Corporation

- Clariant AG

- Global Colors Group

- Hubron International Ltd.

- Penn Color, Inc.

- Plastiblends India Ltd.

- PolyOne Corporation

- Tosaf Group

View a comprehensive list of companies in the Masterbatch Market

Recent Developments

-

In May 2024, Cabot Corporation launched new universal circular black masterbatches under the REPLASBLAK product family, certified by ISCC PLUS and powered by EVOLVE Sustainable Solutions. These masterbatches utilize mechanically recycled polymers, catering to the automotive industry's demand for sustainable materials. The new REPLASBLAK reUN5285 and reUN5290 masterbatches offer high gloss, jetness, and superior color performance, comparable to standard universal black masterbatches. These solutions allow for efficient material management with a single masterbatch suitable for various polymers and automotive applications, enhancing sustainability in the product manufacturing process.

-

In January 2024, Hubron International Ltd. and Black Swan Graphene Inc. entered a commercial agreement to expedite the use of Black Swan's graphene products. Hubron, a specialist in plastic masterbatch and conductive compounds, incorporates graphene to improve functionality in masterbatch solutions. This collaboration aims to integrate graphene into various sectors such as automotive, construction, and packaging, leveraging Hubron's market reach and expertise in masterbatch production.

-

In February 2023, Penn Color launched a new range of high-performance pigment dispersions at the European Coatings Show 2023. The expanded product line includes water-based, solvent-based, and energy-curable options designed for enhanced pigment loading and color accuracy. These dispersions cater to automotive, architectural, and industrial coatings. Penn Color also supplies colors and functional additives in masterbatches and compounds for thermoplastics.

Masterbatch Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 7.01 billion |

|

Revenue forecast in 2030 |

USD 9.65 billion |

|

Growth Rate |

CAGR of 6.6% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Volume in Kilotons, Revenue in USD Million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, carrier polymer, end use, region. |

|

Regional scope |

North America, Asia Pacific, Europe, Latin America, Middle East and Africa. |

|

Country scope |

U.S., Germany, UK, France, China, India, Japan, Malaysia, Indonesia, Vietnam, Singapore, Philippines, Thailand, and Brazil. |

|

Key companies profiled |

Schulman, Inc.; Ampacet Corporation; Cabot Corporation; Clariant AG; Global Colors Group; Hubron International Ltd.; Penn Color, Inc.; Plastiblends India Ltd.; PolyOne Corporation; Tosaf Group. |

|

Customization scope |

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Masterbatch Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global masterbatch market report based on type, carrier polymer, end use, and region.

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

White

-

Black

-

Color

-

Additive

-

Filler

-

Biodegradable

-

-

Carrier Polymer Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polypropylene (PP)

-

Polyethylene (PE)

-

Polyvinyl Chloride (PVC)

-

Polyethylene Terephthalate (PET)

-

Biodegradable Plastics

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Building & Construction

-

Consumer Goods

-

Automotive & Transportation

-

Agriculture

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Southeast Asia

-

Malaysia

-

Indonesia

-

Vietnam

-

Singapore

-

Philippines

-

Thailand

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Executive Summary

2.1. Market Insights

2.2. Segmental Outlook

2.3. Competitive Outlook

Chapter 3. Masterbatch Market Variables, Trends & Scope

3.1. Global Masterbatch Market Outlook

3.2. Industry Value Chain Analysis

3.3. Regulatory Framework

3.3.1. Policies and Incentive Plans

3.3.2. Standards and Compliances

3.3.3. Regulatory Impact Analysis

3.4. Market Dynamics

3.4.1. Market Driver Analysis

3.4.2. Market Restraint Analysis

3.4.3. Industry Challenges

3.5. Porter’s Five Forces Analysis

3.5.1. Supplier Power

3.5.2. Buyer Power

3.5.3. Substitution Threat

3.5.4. Threat from New Entrant

3.5.5. Competitive Rivalry

3.6. PESTEL Analysis

3.6.1. Political Landscape

3.6.2. Economic Landscape

3.6.3. Social Landscape

3.6.4. Technological Landscape

3.6.5. Environmental Landscape

3.6.6. Legal Landscape

Chapter 4. Masterbatch Market: Type Outlook Estimates & Forecasts

4.1. Masterbatch Market: Type Movement Analysis, 2024 & 2030

4.1.1. White

4.1.1.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

4.1.2. Black

4.1.2.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

4.1.3. Color

4.1.3.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

4.1.4. Additive

4.1.4.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

4.1.5. Filler

4.1.5.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

4.1.6. Biodegradable

4.1.6.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

Chapter 5. Masterbatch Market: Carrier Polymer Outlook Estimates & Forecasts

5.1. Masterbatch Market: Carrier Polymer Movement Analysis, 2024 & 2030

5.1.1. Polypropylene (PP)

5.1.1.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

5.1.2. Polyethylene (PE)

5.1.2.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

5.1.3. Polyvinyl Chloride (PVC)

5.1.3.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

5.1.4. Polyethylene Terephthalate (PET)

5.1.4.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

5.1.5. Biodegradable Plastics

5.1.5.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

Chapter 6. Masterbatch Market: End Use Outlook Estimates & Forecasts

6.1. Masterbatch Market: End Use Movement Analysis, 2024 & 2030

6.1.1. Packaging

6.1.1.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

6.1.2. Building & Construction

6.1.2.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

6.1.3. Consumer Goods

6.1.3.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

6.1.4. Automotive & Transportation

6.1.4.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

6.1.5. Agriculture

6.1.5.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

6.1.6. Others

6.1.6.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

Chapter 7. Masterbatch Market Regional Outlook Estimates & Forecasts

7.1. Regional Snapshot

7.2. Masterbatch Market: Regional Movement Analysis, 2024 & 2030

7.3. North America

7.3.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

7.3.2. Market Estimates and Forecast, By Type, 2018 - 2030 (Kilotons) (USD Million)

7.3.3. Market Estimates and Forecast, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

7.3.4. Market Estimates and Forecast, By End Use, 2018 - 2030 (Kilotons) (USD Million)

7.3.5. U.S.

7.3.5.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

7.3.5.2. Market Estimates and Forecast, By Type, 2018 - 2030 (Kilotons) (USD Million)

7.3.5.3. Market Estimates and Forecast, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

7.3.5.4. Market Estimates and Forecast, By End Use, 2018 - 2030 (Kilotons) (USD Million)

7.4. Europe

7.4.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

7.4.2. Market Estimates and Forecast, By Type, 2018 - 2030 (Kilotons) (USD Million)

7.4.3. Market Estimates and Forecast, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

7.4.4. Market Estimates and Forecast, By End Use, 2018 - 2030 (Kilotons) (USD Million)

7.4.5. Germany

7.4.5.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

7.4.5.2. Market Estimates and Forecast, By Type, 2018 - 2030 (Kilotons) (USD Million)

7.4.5.3. Market Estimates and Forecast, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

7.4.5.4. Market Estimates and Forecast, By End Use, 2018 - 2030 (Kilotons) (USD Million)

7.4.6. UK

7.4.6.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

7.4.6.2. Market Estimates and Forecast, By Type, 2018 - 2030 (Kilotons) (USD Million)

7.4.6.3. Market Estimates and Forecast, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

7.4.6.4. Market Estimates and Forecast, By End Use, 2018 - 2030 (Kilotons) (USD Million)

7.4.7. France

7.4.7.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

7.4.7.2. Market Estimates and Forecast, By Type, 2018 - 2030 (Kilotons) (USD Million)

7.4.7.3. Market Estimates and Forecast, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

7.4.7.4. Market Estimates and Forecast, By End Use, 2018 - 2030 (Kilotons) (USD Million)

7.5. Asia Pacific

7.5.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

7.5.2. Market Estimates and Forecast, By Type, 2018 - 2030 (Kilotons) (USD Million)

7.5.3. Market Estimates and Forecast, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

7.5.4. Market Estimates and Forecast, By End Use, 2018 - 2030 (Kilotons) (USD Million)

7.5.5. China

7.5.5.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

7.5.5.2. Market Estimates and Forecast, By Type, 2018 - 2030 (Kilotons) (USD Million)

7.5.5.3. Market Estimates and Forecast, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

7.5.5.4. Market Estimates and Forecast, By End Use, 2018 - 2030 (Kilotons) (USD Million)

7.5.6. India

7.5.6.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

7.5.6.2. Market Estimates and Forecast, By Type, 2018 - 2030 (Kilotons) (USD Million)

7.5.6.3. Market Estimates and Forecast, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

7.5.6.4. Market Estimates and Forecast, By End Use, 2018 - 2030 (Kilotons) (USD Million)

7.5.7. Japan

7.5.7.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

7.5.7.2. Market Estimates and Forecast, By Type, 2018 - 2030 (Kilotons) (USD Million)

7.5.7.3. Market Estimates and Forecast, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

7.5.7.4. Market Estimates and Forecast, By End Use, 2018 - 2030 (Kilotons) (USD Million)

7.6. Southeast Asia

7.6.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

7.6.2. Market Estimates and Forecast, By Type, 2018 - 2030 (Kilotons) (USD Million)

7.6.3. Market Estimates and Forecast, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

7.6.3.1. Market Estimates and Forecast, By End Use, 2018 - 2030 (Kilotons) (USD Million)

7.6.4. Malaysia

7.6.4.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

7.6.4.2. Market Estimates and Forecast, By Type, 2018 - 2030 (Kilotons) (USD Million)

7.6.4.3. Market Estimates and Forecast, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

7.6.4.4. Market Estimates and Forecast, By End Use, 2018 - 2030 (Kilotons) (USD Million)

7.6.5. Indonesia

7.6.5.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

7.6.5.2. Market Estimates and Forecast, By Type, 2018 - 2030 (Kilotons) (USD Million)

7.6.5.3. Market Estimates and Forecast, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

7.6.5.4. Market Estimates and Forecast, By End Use, 2018 - 2030 (Kilotons) (USD Million)

7.6.6. Vietnam

7.6.6.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

7.6.6.2. Market Estimates and Forecast, By Type, 2018 - 2030 (Kilotons) (USD Million)

7.6.6.3. Market Estimates and Forecast, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

7.6.6.4. Market Estimates and Forecast, By End Use, 2018 - 2030 (Kilotons) (USD Million)

7.6.7. Singapore

7.6.7.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

7.6.7.2. Market Estimates and Forecast, By Type, 2018 - 2030 (Kilotons) (USD Million)

7.6.7.3. Market Estimates and Forecast, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

7.6.7.4. Market Estimates and Forecast, By End Use, 2018 - 2030 (Kilotons) (USD Million)

7.6.8. Philippines

7.6.8.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

7.6.8.2. Market Estimates and Forecast, By Type, 2018 - 2030 (Kilotons) (USD Million)

7.6.8.3. Market Estimates and Forecast, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

7.6.8.4. Market Estimates and Forecast, By End Use, 2018 - 2030 (Kilotons) (USD Million)

7.6.9. Thailand

7.6.9.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

7.6.9.2. Market Estimates and Forecast, By Type, 2018 - 2030 (Kilotons) (USD Million)

7.6.9.3. Market Estimates and Forecast, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

7.6.9.4. Market Estimates and Forecast, By End Use, 2018 - 2030 (Kilotons) (USD Million)

7.7. Latin America

7.7.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

7.7.2. Market Estimates and Forecast, By Type, 2018 - 2030 (Kilotons) (USD Million)

7.7.3. Market Estimates and Forecast, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

7.7.4. Market Estimates and Forecast, By End Use, 2018 - 2030 (Kilotons) (USD Million)

7.7.5. Brazil

7.7.5.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

7.7.5.2. Market Estimates and Forecast, By Type, 2018 - 2030 (Kilotons) (USD Million)

7.7.5.3. Market Estimates and Forecast, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

7.7.5.4. Market Estimates and Forecast, By End Use, 2018 - 2030 (Kilotons) (USD Million)

7.8. Middle East & Africa

7.8.1. Market Estimates and Forecast, 2018 - 2030 (Kilotons) (USD Million)

7.8.2. Market Estimates and Forecast, By Type, 2018 - 2030 (Kilotons) (USD Million)

7.8.3. Market Estimates and Forecast, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

7.8.4. Market Estimates and Forecast, By End Use, 2018 - 2030 (Kilotons) (USD Million)

Chapter 8. Competitive Landscape

8.1. Recent Developments & Impact Analysis, By Key Market Participants

8.2. Vendor Landscape

8.2.1. Company Categorization

8.2.2. List of Key Distributors and Channel Partners

8.2.3. List of Potential Customers/End Users

8.3. Competitive Dynamics

8.3.1. Competitive Benchmarking

8.3.2. Strategy Mapping

8.3.3. Heat Map Analysis

8.4. Company Profiles/Listing

8.4.1. Schulman, Inc.

8.4.1.1. Participant’s Overview

8.4.1.2. Financial Performance

8.4.1.3. Product Benchmarking

8.4.1.4. Strategic Initiatives

8.4.2. Ampacet Corporation

8.4.2.1. Participant’s Overview

8.4.2.2. Financial Performance

8.4.2.3. Product Benchmarking

8.4.2.4. Strategic Initiatives

8.4.3. Cabot Corporation

8.4.3.1. Participant’s Overview

8.4.3.2. Financial Performance

8.4.3.3. Product Benchmarking

8.4.3.4. Strategic Initiatives

8.4.4. Clariant AG

8.4.4.1. Participant’s Overview

8.4.4.2. Financial Performance

8.4.4.3. Product Benchmarking

8.4.4.4. Strategic Initiatives

8.4.5. Global Colors Group

8.4.5.1. Participant’s Overview

8.4.5.2. Financial Performance

8.4.5.3. Product Benchmarking

8.4.5.4. Strategic Initiatives

8.4.6. Hubron International Ltd.

8.4.6.1. Participant’s Overview

8.4.6.2. Financial Performance

8.4.6.3. Product Benchmarking

8.4.6.4. Strategic Initiatives

8.4.7. Penn Color, Inc.

8.4.7.1. Participant’s Overview

8.4.7.2. Financial Performance

8.4.7.3. Product Benchmarking

8.4.7.4. Strategic Initiatives

8.4.8. Plastiblends India Ltd.

8.4.8.1. Participant’s Overview

8.4.8.2. Financial Performance

8.4.8.3. Product Benchmarking

8.4.8.4. Strategic Initiatives

8.4.9. PolyOne Corporation

8.4.9.1. Participant’s Overview

8.4.9.2. Financial Performance

8.4.9.3. Product Benchmarking

8.4.9.4. Strategic Initiatives

8.4.10. Tosaf Group

8.4.10.1. Participant’s Overview

8.4.10.2. Financial Performance

8.4.10.3. Product Benchmarking

8.4.10.4. Strategic Initiatives

List of Tables

Table 1 List of Abbreviations

Table 2 Masterbatch Market Estimates and Forecasts, By Type, 2018 - 2030 (Kilotons) (USD Million)

Table 3 Masterbatch Market Estimates and Forecasts, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

Table 4 Masterbatch Market Estimates and Forecasts, By End Use, 2018 - 2030 (Kilotons) (USD Million)

Table 5 Masterbatch Market Estimates and Forecasts, By Region, 2018 - 2030 (Kilotons) (USD Million)

Table 6 North America Masterbatch Market Estimates and Forecasts, By Country, 2018 - 2030 (Kilotons) (USD Million)

Table 7 North America Masterbatch Market Estimates and Forecasts, By Type, 2018 - 2030 (Kilotons) (USD Million)

Table 8 North America Masterbatch Market Estimates and Forecasts, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

Table 9 North America Masterbatch Market Estimates and Forecasts, By End Use, 2018 - 2030 (Kilotons) (USD Million)

Table 10 U.S. Masterbatch Market Estimates and Forecasts, By Type, 2018 - 2030 (Kilotons) (USD Million)

Table 11 U.S. Masterbatch Market Estimates and Forecasts, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

Table 12 U.S. Masterbatch Market Estimates and Forecasts, By End Use, 2018 - 2030 (Kilotons) (USD Million)

Table 13 Europe Masterbatch Market Estimates and Forecasts, By Country, 2018 - 2030 (Kilotons) (USD Million)

Table 14 Europe Masterbatch Market Estimates and Forecasts, By Type, 2018 - 2030 (Kilotons) (USD Million)

Table 15 Europe Masterbatch Market Estimates and Forecasts, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

Table 16 Europe Masterbatch Market Estimates and Forecasts, By End Use, 2018 - 2030 (Kilotons) (USD Million)

Table 17 Germany Masterbatch Market Estimates and Forecasts, By Type, 2018 - 2030 (Kilotons) (USD Million)

Table 18 Germany Masterbatch Market Estimates and Forecasts, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

Table 19 Germany Masterbatch Market Estimates and Forecasts, By End Use, 2018 - 2030 (Kilotons) (USD Million)

Table 20 UK Masterbatch Market Estimates and Forecasts, By Type, 2018 - 2030 (Kilotons) (USD Million)

Table 21 UK Masterbatch Market Estimates and Forecasts, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

Table 22 UK Masterbatch Market Estimates and Forecasts, By End Use, 2018 - 2030 (Kilotons) (USD Million)

Table 23 France Masterbatch Market Estimates and Forecasts, By Type, 2018 - 2030 (Kilotons) (USD Million)

Table 24 France Masterbatch Market Estimates and Forecasts, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

Table 25 France Masterbatch Market Estimates and Forecasts, By End Use, 2018 - 2030 (Kilotons) (USD Million)

Table 26 Asia Pacific Masterbatch Market Estimates and Forecasts, By Country, 2018 - 2030 (Kilotons) (USD Million)

Table 27 Asia Pacific Masterbatch Market Estimates and Forecasts, By Type, 2018 - 2030 (Kilotons) (USD Million)

Table 28 Asia Pacific Masterbatch Market Estimates and Forecasts, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

Table 29 Asia Pacific Masterbatch Market Estimates and Forecasts, By End Use, 2018 - 2030 (Kilotons) (USD Million)

Table 30 China Masterbatch Market Estimates and Forecasts, By Type, 2018 - 2030 (Kilotons) (USD Million)

Table 31 China Masterbatch Market Estimates and Forecasts, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

Table 32 China Masterbatch Market Estimates and Forecasts, By End Use, 2018 - 2030 (Kilotons) (USD Million)

Table 33 India Masterbatch Market Estimates and Forecasts, By Type, 2018 - 2030 (Kilotons) (USD Million)

Table 34 India Masterbatch Market Estimates and Forecasts, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

Table 35 India Masterbatch Market Estimates and Forecasts, By End Use, 2018 - 2030 (Kilotons) (USD Million)

Table 36 Japan Masterbatch Market Estimates and Forecasts, By Type, 2018 - 2030 (Kilotons) (USD Million)

Table 37 Japan Masterbatch Market Estimates and Forecasts, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

Table 38 Japan Masterbatch Market Estimates and Forecasts, By End Use, 2018 - 2030 (Kilotons) (USD Million)

Table 39 Southeast Asia Masterbatch Market Estimates and Forecasts, By Country, 2018 - 2030 (Kilotons) (USD Million)

Table 40 Southeast Asia Masterbatch Market Estimates and Forecasts, By Type, 2018 - 2030 (Kilotons) (USD Million)

Table 41 Southeast Asia Masterbatch Market Estimates and Forecasts, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

Table 42 Southeast Asia Masterbatch Market Estimates and Forecasts, By End Use, 2018 - 2030 (Kilotons) (USD Million)

Table 43 Malaysia Masterbatch Market Estimates and Forecasts, By Type, 2018 - 2030 (Kilotons) (USD Million)

Table 44 Malaysia Masterbatch Market Estimates and Forecasts, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

Table 45 Malaysia Masterbatch Market Estimates and Forecasts, By End Use, 2018 - 2030 (Kilotons) (USD Million)

Table 46 Indonesia Masterbatch Market Estimates and Forecasts, By Type, 2018 - 2030 (Kilotons) (USD Million)

Table 47 Indonesia Masterbatch Market Estimates and Forecasts, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

Table 48 Indonesia Masterbatch Market Estimates and Forecasts, By End Use, 2018 - 2030 (Kilotons) (USD Million)

Table 49 Vietnam Masterbatch Market Estimates and Forecasts, By Type, 2018 - 2030 (Kilotons) (USD Million)

Table 50 Vietnam Masterbatch Market Estimates and Forecasts, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

Table 51 Vietnam Masterbatch Market Estimates and Forecasts, By End Use, 2018 - 2030 (Kilotons) (USD Million)

Table 52 Singapore Masterbatch Market Estimates and Forecasts, By Type, 2018 - 2030 (Kilotons) (USD Million)

Table 53 Singapore Masterbatch Market Estimates and Forecasts, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

Table 54 Singapore Masterbatch Market Estimates and Forecasts, By End Use, 2018 - 2030 (Kilotons) (USD Million)

Table 55 Philippines Masterbatch Market Estimates and Forecasts, By Type, 2018 - 2030 (Kilotons) (USD Million)

Table 56 Philippines Masterbatch Market Estimates and Forecasts, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

Table 57 Philippines Masterbatch Market Estimates and Forecasts, By End Use, 2018 - 2030 (Kilotons) (USD Million)

Table 58 Thailand Market Estimates and Forecasts, By Type, 2018 - 2030 (Kilotons) (USD Million)

Table 59 Thailand Masterbatch Market Estimates and Forecasts, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

Table 60 Thailand Masterbatch Market Estimates and Forecasts, By End Use, 2018 - 2030 (Kilotons) (USD Million)

Table 61 Latin America Masterbatch Market Estimates and Forecasts, By Country, 2018 - 2030 (Kilotons) (USD Million)

Table 62 Latin America Masterbatch Market Estimates and Forecasts, By Type, 2018 - 2030 (Kilotons) (USD Million)

Table 63 Latin America Masterbatch Market Estimates and Forecasts, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

Table 64 Latin America Masterbatch Market Estimates and Forecasts, By End Use, 2018 - 2030 (Kilotons) (USD Million)

Table 65 Brazil Masterbatch Market Estimates and Forecasts, By Type, 2018 - 2030 (Kilotons) (USD Million)

Table 66 Brazil Masterbatch Market Estimates and Forecasts, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

Table 67 Brazil Masterbatch Market Estimates and Forecasts, By End Use, 2018 - 2030 (Kilotons) (USD Million)

Table 68 Middle East & Africa Masterbatch Market Estimates and Forecasts, By Type, 2018 - 2030 (Kilotons) (USD Million)

Table 69 Middle East & Africa Masterbatch Market Estimates and Forecasts, By Country, 2018 - 2030 (Kilotons) (USD Million)

Table 70 Middle East & Africa Masterbatch Market Estimates and Forecasts, By Carrier Polymer, 2018 - 2030 (Kilotons) (USD Million)

Table 71 Middle East & Africa Masterbatch Market Estimates and Forecasts, By End Use, 2018 - 2030 (Kilotons) (USD Million)

List of Figures

Fig. 1 Market Segmentation

Fig. 2 Information Procurement

Fig. 3 Data Analysis Models

Fig. 4 Market Formulation and Validation

Fig. 5 Market Snapshot

Fig. 6 Segmental Outlook- Type, Carrier Polymer, End Use, and Region

Fig. 7 Competitive Outlook

Fig. 8 Value Chain Analysis

Fig. 9 Market Dynamics

Fig. 10 Porter’s Analysis

Fig. 11 PESTEL analysis

Fig. 12 Masterbatch Market, By Type: Key Takeaways

Fig. 13 Masterbatch Market, By Type: Market Share, 2024 & 2030

Fig. 14 White Market, 2018 - 2030 (Kilotons) (USD Million)

Fig. 15 Black Market, 2018 - 2030 (Kilotons) (USD Million)

Fig. 16 Color Market, 2018 - 2030 (Kilotons) (USD Million)

Fig. 17 Additive Market, 2018 - 2030 (Kilotons) (USD Million)

Fig. 18 Filler Market, 2018 - 2030 (Kilotons) (USD Million)

Fig. 19 Biodegradable Market, 2018 - 2030 (Kilotons) (USD Million)

Fig. 20 Masterbatch Market, By Carrier Polymer: Key Takeaways

Fig. 21 Masterbatch Market, By Carrier Polymer: Market Share, 2024 & 2030

Fig. 22 Polypropylene (PP) Market, 2018 - 2030 (Kilotons) (USD Million)

Fig. 23 Polyethylene (PE) Market, 2018 - 2030 (Kilotons) (USD Million)

Fig. 24 Polyvinyl Chloride (PVC) Market, 2018 - 2030 (Kilotons) (USD Million)

Fig. 25 Polyethylene Terephthalate (PET) Market, 2018 - 2030 (Kilotons) (USD Million)

Fig. 26 Biodegradable Plastics Market, 2018 - 2030 (Kilotons) (USD Million)

Fig. 27 Masterbatch Market, By End Use: Key Takeaways

Fig. 28 Masterbatch Market, By End Use: Market Share, 2024 & 2030

Fig. 29 Packaging Market, 2018 - 2030 (Kilotons) (USD Million)

Fig. 30 Building & Construction Market, 2018 - 2030 (Kilotons) (USD Million)

Fig. 31 Consumer Goods Market, 2018 - 2030 (Kilotons) (USD Million)

Fig. 32 Automotive & Transportation Market, 2018 - 2030 (Kilotons) (USD Million)

Fig. 33 Agriculture Market, 2018 - 2030 (Kilotons) (USD Million)

Fig. 34 Others Market, 2018 - 2030 (Kilotons) (USD Million)

Fig. 35 Masterbatch Market, By Region: Key Takeaways

Fig. 36 Masterbatch Market, By Region: Market Share, 2024 & 2030

Fig. 37 North America Masterbatch Market, 2018 - 2030 (Kilotons) (USD Million)

Fig. 38 US Masterbatch Market, 2018 - 2030 (Kilotons) (USD Million)

Fig. 39 Europe Masterbatch Market, 2018 - 2030 (Kilotons) (USD Million)

Fig. 40 Germany Masterbatch Market, 2018 - 2030 (Kilotons) (USD Million)

Fig. 41 UK Masterbatch Market, 2018 - 2030 (Kilotons) (USD Million)

Fig. 42 France Masterbatch Market, 2018 - 2030 (Kilotons) (USD Million)

Fig. 43 Asia Pacific Masterbatch Market, 2018 - 2030 (Kilotons) (USD Million)

Fig. 44 China Masterbatch Market, 2018 - 2030 (Kilotons) (USD Million)

Fig. 45 India Masterbatch Market, 2018 - 2030 (Kilotons) (USD Million)

Fig. 46 Japan Masterbatch Market, 2018 - 2030 (Kilotons) (USD Million)

Fig. 47 Southeast Asia Masterbatch Market, 2018 - 2030 (Kilotons) (USD Million)

Fig. 48 Malaysia Masterbatch Market, 2018 - 2030 (Kilotons) (USD Million)

Fig. 49 Indonesia Masterbatch Market, 2018 - 2030 (Kilotons) (USD Million)

Fig. 50 Vietnam Masterbatch Market, 2018 - 2030 (Kilotons) (USD Million)

Fig. 51 Singapore Masterbatch Market, 2018 - 2030 (Kilotons) (USD Million)

Fig. 52 Philippines Masterbatch Market, 2018 - 2030 (Kilotons) (USD Million)

Fig. 53 Thailand Masterbatch Market, 2018 - 2030 (Kilotons) (USD Million)

Fig. 54 Latin America Masterbatch Market, 2018 - 2030 (Kilotons) (USD Million)

Fig. 55 Brazil Masterbatch Market, 2018 - 2030 (Kilotons) (USD Million)

Fig. 56 Middle East and Africa Masterbatch Market, 2018 - 2030 (Kilotons) (USD Million)

Market Segmentation

- Masterbatch Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- White

- Black

- Color

- Additive

- Filler

- Biodegradable

- Masterbatch Carrier Polymer Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Polypropylene (PP)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Biodegradable Plastics

- Masterbatch End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Packaging

- Building & Construction

- Consumer Goods

- Automotive & Transportation

- Agriculture

- Others

- Masterbatch Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- North America

- North America Masterbatch Market, By Type

- White

- Black

- Color

- Additive

- Filler

- Biodegradable

- North America Masterbatch Market, By Carrier Polymer

- Polypropylene (PP)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Biodegradable Plastics

- North America Masterbatch Market, By End Use

- Packaging

- Building & Construction

- Consumer Goods

- Automotive & Transportation

- Agriculture

- Others

- U.S.

- U.S. Masterbatch Market, By Type

- White

- Black

- Color

- Additive

- Filler

- Biodegradable

- U.S. Masterbatch Market, By Carrier Polymer

- Polypropylene (PP)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Biodegradable Plastics

- U.S. Masterbatch Market, By End Use

- Packaging

- Building & Construction

- Consumer Goods

- Automotive & Transportation

- Agriculture

- Others

- U.S. Masterbatch Market, By Type

- North America Masterbatch Market, By Type

- Europe

- Europe Masterbatch Market, By Type

- White

- Black

- Color

- Additive

- Filler

- Biodegradable

- Europe Masterbatch Market, By Carrier Polymer

- Polypropylene (PP)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Biodegradable Plastics

- Europe Masterbatch Market, By End Use

- Packaging

- Building & Construction

- Consumer Goods

- Automotive & Transportation

- Agriculture

- Others

- Germany

- Germany Masterbatch Market, By Type

- White

- Black

- Color

- Additive

- Filler

- Biodegradable

- Germany Masterbatch Market, By Carrier Polymer

- Polypropylene (PP)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Biodegradable Plastics

- Germany Masterbatch Market, By End Use

- Packaging

- Building & Construction

- Consumer Goods

- Automotive & Transportation

- Agriculture

- Others

- Germany Masterbatch Market, By Type

- UK

- UK Masterbatch Market, By Type

- White

- Black

- Color

- Additive

- Filler

- Biodegradable

- UK Masterbatch Market, By Carrier Polymer

- Polypropylene (PP)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Biodegradable Plastics

- UK Masterbatch Market, By End Use

- Packaging

- Building & Construction

- Consumer Goods

- Automotive & Transportation

- Agriculture

- Others

- France

- France Masterbatch Market, By Type

- White

- Black

- Color

- Additive

- Filler

- Biodegradable

- France Masterbatch Market, By Carrier Polymer

- Polypropylene (PP)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Biodegradable Plastics

- France Masterbatch Market, By End Use

- Packaging

- Building & Construction

- Consumer Goods

- Automotive & Transportation

- Agriculture

- Others

- France Masterbatch Market, By Type

- Europe Masterbatch Market, By Type

- Asia Pacific

- Asia Pacific Masterbatch Market, By Type

- White

- Black

- Color

- Additive

- Filler

- Biodegradable

- Asia Pacific Masterbatch Market, By Carrier Polymer

- Polypropylene (PP)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Biodegradable Plastics

- Asia Pacific Masterbatch Market, By End Use

- Packaging

- Building & Construction

- Consumer Goods

- Automotive & Transportation

- Agriculture

- Others

- China

- China Masterbatch Market, By Type

- White

- Black

- Color

- Additive

- Filler

- Biodegradable

- China Masterbatch Market, By Carrier Polymer

- Polypropylene (PP)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Biodegradable Plastics

- China Masterbatch Market, By End Use

- Packaging

- Building & Construction

- Consumer Goods

- Automotive & Transportation

- Agriculture

- Others

- China Masterbatch Market, By Type

- India

- India Masterbatch Market, By Type

- White

- Black

- Color

- Additive

- Filler

- Biodegradable

- India Masterbatch Market, By Carrier Polymer

- Polypropylene (PP)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Biodegradable Plastics

- India Masterbatch Market, By End Use

- Packaging

- Building & Construction

- Consumer Goods

- Automotive & Transportation

- Agriculture

- Others

- Japan

- Japan Masterbatch Market, By Type

- White

- Black

- Color

- Additive

- Filler

- Biodegradable

- Japan Masterbatch Market, By Carrier Polymer

- Polypropylene (PP)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Biodegradable Plastics

- Japan Masterbatch Market, By End Use

- Packaging

- Building & Construction

- Consumer Goods

- Automotive & Transportation

- Agriculture

- Others

- Japan Masterbatch Market, By Type

- Asia Pacific Masterbatch Market, By Type

- Southeast Asia

- Southeast Asia Masterbatch Market, By Type

- White

- Black

- Color

- Additive

- Filler

- Biodegradable

- Southeast Asia Masterbatch Market, By Carrier Polymer

- Polypropylene (PP)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Biodegradable Plastics

- Southeast Asia Masterbatch Market, By End Use

- Packaging

- Building & Construction

- Consumer Goods

- Automotive & Transportation

- Agriculture

- Others

- Malaysia

- Malaysia Masterbatch Market, By Type

- White

- Black

- Color

- Additive

- Filler

- Biodegradable

- Malaysia Masterbatch Market, By Carrier Polymer

- Polypropylene (PP)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Biodegradable Plastics

- Malaysia Masterbatch Market, By End Use

- Packaging

- Building & Construction

- Consumer Goods

- Automotive & Transportation

- Agriculture

- Others

- Malaysia Masterbatch Market, By Type

- Indonesia

- Indonesia Masterbatch Market, By Type

- White

- Black

- Color

- Additive

- Filler

- Biodegradable

- Indonesia Masterbatch Market, By Carrier Polymer

- Polypropylene (PP)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Biodegradable Plastics

- Indonesia Masterbatch Market, By End Use

- Packaging

- Building & Construction

- Consumer Goods

- Automotive & Transportation

- Agriculture

- Others

- Vietnam

- Vietnam Masterbatch Market, By Type

- White

- Black

- Color

- Additive

- Filler

- Biodegradable

- Vietnam Masterbatch Market, By Carrier Polymer

- Polypropylene (PP)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Biodegradable Plastics

- Vietnam Masterbatch Market, By End Use

- Packaging

- Building & Construction

- Consumer Goods

- Automotive & Transportation

- Agriculture

- Others

- Vietnam Masterbatch Market, By Type

- Singapore

- Singapore Masterbatch Market, By Type

- White

- Black

- Color

- Additive

- Filler

- Biodegradable

- Singapore Masterbatch Market, By Carrier Polymer

- Polypropylene (PP)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Biodegradable Plastics

- Singapore Masterbatch Market, By End Use

- Packaging

- Building & Construction

- Consumer Goods

- Automotive & Transportation

- Agriculture

- Others

- Philippines

- Philippines Masterbatch Market, By Type

- White

- Black

- Color

- Additive

- Filler

- Biodegradable

- Philippines Masterbatch Market, By Carrier Polymer

- Polypropylene (PP)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Biodegradable Plastics

- Philippines Masterbatch Market, By End Use

- Packaging

- Building & Construction

- Consumer Goods

- Automotive & Transportation

- Agriculture

- Others

- Philippines Masterbatch Market, By Type

- Thailand

- Thailand Masterbatch Market, By Type

- White

- Black

- Color

- Additive

- Filler

- Biodegradable

- Thailand Masterbatch Market, By Carrier Polymer

- Polypropylene (PP)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Biodegradable Plastics

- Thailand Masterbatch Market, By End Use

- Packaging

- Building & Construction

- Consumer Goods

- Automotive & Transportation

- Agriculture

- Others

- Southeast Asia Masterbatch Market, By Type

- Latin America

- Latin America Masterbatch Market, By Type

- White

- Black

- Color

- Additive

- Filler

- Biodegradable

- Latin America Masterbatch Market, By Carrier Polymer

- Polypropylene (PP)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Biodegradable Plastics

- Latin America Masterbatch Market, By End Use

- Packaging

- Building & Construction

- Consumer Goods

- Automotive & Transportation

- Agriculture

- Others

- Brazil

- Brazil Masterbatch Market, By Type

- White

- Black

- Color

- Additive

- Filler

- Biodegradable

- Brazil Masterbatch Market, By Carrier Polymer

- Polypropylene (PP)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Biodegradable Plastics

- Brazil Masterbatch Market, By End Use

- Packaging

- Building & Construction

- Consumer Goods

- Automotive & Transportation

- Agriculture

- Others

- Brazil Masterbatch Market, By Type

- Latin America Masterbatch Market, By Type

- Middle East & Africa

- Middle East & Africa Masterbatch Market, By Type

- White

- Black

- Color

- Additive

- Filler

- Biodegradable

- Middle East & Africa Masterbatch Market, By Carrier Polymer

- Polypropylene (PP)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Biodegradable Plastics

- Middle East & Africa Masterbatch Market, By End Use

- Packaging

- Building & Construction

- Consumer Goods

- Automotive & Transportation

- Agriculture

- Others

- Middle East & Africa Masterbatch Market, By Type

- North America

Report content

Qualitative Analysis

- Industry overview

- Industry trends

- Market drivers and restraints

- Market size

- Growth prospects

- Porter’s analysis

- PESTEL analysis

- Key market opportunities prioritized

- Competitive landscape

- Company overview

- Financial performance

- Product benchmarking

- Latest strategic developments

Quantitative Analysis

- Market size, estimates, and forecast from 2018 to 2030

- Market estimates and forecast for product segments up to 2030

- Regional market size and forecast for product segments up to 2030

- Market estimates and forecast for application segments up to 2030

- Regional market size and forecast for application segments up to 2030

- Company financial performance

Research Methodology

Grand View Research employs comprehensive and iterative research methodology focused on minimizing deviance in order to provide the most accurate estimates and forecast possible. The company utilizes a combination of bottom-up and top-down approaches for segmenting and estimating quantitative aspects of the market. In Addition, a recurring theme prevalent across all our research reports is data triangulation that looks market from three different perspectives. Critical elements of methodology employed for all our studies include:

Preliminary data mining

Raw market data is obtained and collated on a broad front. Data is continuously filtered to ensure that only validated and authenticated sources are considered. In addition, data is also mined from a host of reports in our repository, as well as a number of reputed paid databases. For comprehensive understanding of the market, it is essential to understand the complete value chain and in order to facilitate this; we collect data from raw material suppliers, distributors as well as buyers.

Technical issues and trends are obtained from surveys, technical symposia and trade journals. Technical data is also gathered from intellectual property perspective, focusing on white space and freedom of movement. Industry dynamics with respect to drivers, restraints, pricing trends are also gathered. As a result, the material developed contains a wide range of original data that is then further cross-validated and authenticated with published sources.

Statistical model

Our market estimates and forecasts are derived through simulation models. A unique model is created customized for each study. Gathered information for market dynamics, technology landscape, application development and pricing trends is fed into the model and analyzed simultaneously. These factors are studied on a comparative basis, and their impact over the forecast period is quantified with the help of correlation, regression and time series analysis. Market forecasting is performed via a combination of economic tools, technological analysis, and industry experience and domain expertise.

Econometric models are generally used for short-term forecasting, while technological market models are used for long-term forecasting. These are based on an amalgamation of technology landscape, regulatory frameworks, economic outlook and business principles. A bottom-up approach to market estimation is preferred, with key regional markets analyzed as separate entities and integration of data to obtain global estimates. This is critical for a deep understanding of the industry as well as ensuring minimal errors. Some of the parameters considered for forecasting include:

• Market drivers and restrains, along with their current and expected impact

• Raw material scenario and supply v/s price trends

• Regulatory scenario and expected developments

• Current capacity and expected capacity additions up to 2030

We assign weights to these parameters and quantify their market impact using weighted average analysis, to derive an expected market growth rate.

Primary validation

This is the final step in estimating and forecasting for our reports. Exhaustive primary interviews are conducted, on face to face as well as over the phone to validate our findings and assumptions used to obtain them. Interviewees are approached from leading companies across the value chain including suppliers, technology providers, domain experts and buyers so as to ensure a holistic and unbiased picture of the market. These interviews are conducted across the globe, with language barriers overcome with the aid of local staff and interpreters. Primary interviews not only help in data validation, but also provide critical insights into the market, current business scenario and future expectations and enhance the quality of our reports. All our estimates and forecast are verified through exhaustive primary research with Key Industry Participants (KIPs) which typically include:

• Market leading companies

• Raw material suppliers

• Product distributors

• Buyers

The key objectives of primary research are as follows:

• To validate our data in terms of accuracy and acceptability

• To gain an insight in to the current market and future expectations

Data Collection Matrix

|

Perspective |

Primary research |

Secondary research |

|

Supply side |

|

|

|

Demand side |

|

|

Industry Analysis Matrix

|

Qualitative analysis |

Quantitative analysis |

|

|

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."