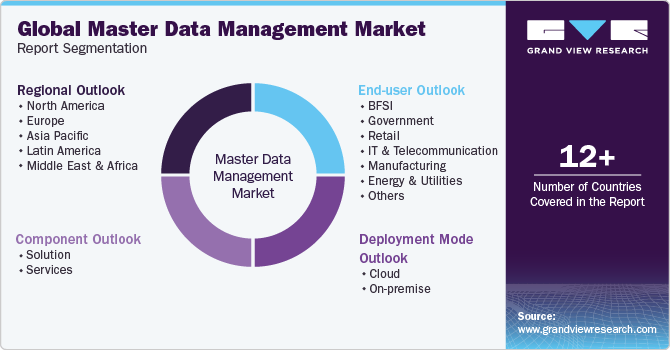

Master Data Management Market Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment Mode (Cloud, On-premise), By End-user, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-305-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Master Data Management Market Trends

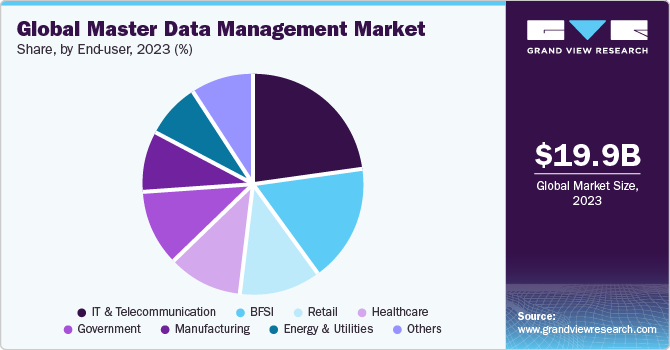

The global master data management market size was estimated at USD 19.9 Billion in 2023 and is projected to grow at a CAGR of 17.4% from 2024 to 2030. The rise of cloud computing and hybrid IT environments is driving the adoption of master data management market (MDM) solutions that can seamlessly integrate with diverse systems and platforms. MDM solutions offer flexible deployment mode options, scalability, and interoperability with cloud services, and on-premises infrastructure is in high demand. These solutions empower organizations to leverage their data assets across hybrid environments, enabling real-time insights, improved collaboration, and agility in responding to evolving business needs.

The growing emphasis on data-driven digital transformation initiatives fuels investment in MDM solutions. MDM enables enterprises to break down data silos, harmonize disparate data sources, and create a unified view of customers, products, and operations. This view of data enhances business intelligence, enables personalized customer experiences, supports agile decision-making, and facilitates innovation in product development, marketing, and supply chain management.

The increasing adoption of omnichannel marketing strategies and e-commerce platforms drives the demand for MDM solutions that effectively manage product data across multiple channels and touchpoints. MDM solutions with product information management (PIM) capabilities enable organizations to centralize and manage product data, attributes, and digital assets, ensuring consistency and accuracy across all channels. It facilitates efficient product launches, enhances brand visibility, and improves customer satisfaction and loyalty.

The COVID-19 pandemic had a negative impact on the master data management sector. The COVID-19 pandemic increased data privacy and security concerns, further complicating MDM efforts. The rapid proliferation of digital communication tools and collaboration platforms introduced new entry points for cyber threats, necessitating enhanced security measures and data protection protocols. However, the urgency of addressing immediate operational challenges during the pandemic often took precedence over long-term cybersecurity considerations, leaving organizations vulnerable to data security risks.

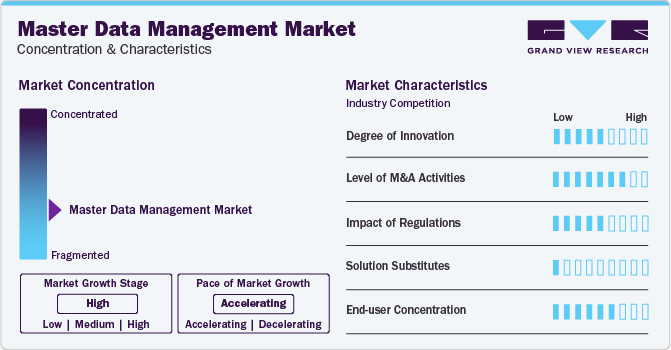

Market Concentration & Characteristics

The master data management industry is significantly fragmented in nature. However, the growth stage of the industry is high with an accelerating pace. The degree of innovation is high due to the integration of emerging technologies such as blockchain and IoT (Internet of Things) into data management processes. Blockchain technology offers immutable and transparent data records, which enhance the integrity and traceability of master data, particularly in industries such as supply chain management and healthcare. Similarly, IoT devices generate vast amounts of data leveraged for MDM purposes, enabling organizations to enrich their master data with real-time sensor data and telemetry information, leading to more accurate and dynamic data insights.

The industry is fragmented, featuring several global and regional players. The market players are entering into partnerships and mergers & acquisitions as the market is characterized by innovation, disruption, and rapid change. For instance, in May 2021, Syndigo, a SaaS company specializing in product information and syndication, acquired Riversand, a cloud-native MDM and PIM solutions provider. This acquisition strengthens Syndigo's global presence and offers expanded PIM capabilities and flexible MDM across various domains and systems. It also enables Syndigo to provide its custom syndication and analytics services to Riversand's clientele, facilitating seamless information transfer within the product ecosystem. Combining Riversand's MDM and PIM expertise with Syndigo's content, syndication, and analytics capabilities ensures enhanced and more reliable data for all clients.

Components Insights

Based on component, the market is further bifurcated into solutions and services. The solution segment held the largest revenue share of 59.1% in 2023. The increasing focus on customer experience and personalization is driving demand for MDM solutions that enable organizations to gain a unified view of customer data across channels and touchpoints. With customers expecting seamless and personalized experiences across all interactions with a brand, organizations need MDM solutions that can consolidate and harmonize customer data from various sources, including CRM systems, marketing platforms, and e-commerce platforms. By leveraging MDM to create a comprehensive view of the customer, organizations can deliver personalized marketing campaigns, improve customer service, and drive customer loyalty and retention.

The service segment is expected to grow at the fastest CAGR during the forecast period. The increasing complexity of data ecosystems and the rise of data-driven business models are driving demand for MDM service providers that offer expertise in data strategy and innovation. Organizations are increasingly recognizing the strategic importance of master data as a key asset for driving business growth and innovation. MDM service providers offer strategic consulting services to help organizations develop data management strategies aligned with their business objectives, identify opportunities for innovation, and leverage master data to create new products, services, and revenue streams.

Deployment Mode Insights

Based on deployment mode, the market is further bifurcated into cloud and on-premise segments. The cloud segment held the largest revenue share in 2023 and is expected to grow at the fastest CAGR during the forecast period. Cloud deployment mode in master data management (MDM) is a growing trend that leverages the benefits of cloud technology to enhance data management practices. Cloud Master Data Management (Cloud MDM) integrates the scalability, flexibility, and cost-efficiency of cloud computing with traditional MDM principles. Profisee offers a cloud-native platform that allows easy MDM deployment in various cloud environments such as Azure, Amazon Web Services (AWS), and Google Cloud. Their Platform as a Service (PaaS) model enables scalability and lower costs while providing complete control over the solution configuration and usage.

The on-premise segment is expected to grow at a significant CAGR during the forecast period. Data residency requirements and cross-border data transfer restrictions drive organizations to choose on-premise MDM solutions to maintain compliance with local regulations and contractual obligations. Some countries impose restrictions on transferring personal or sensitive data outside their borders, necessitating data processing and storage infrastructure localization. On-premise solutions enable organizations to keep their master data within designated geographical boundaries, ensuring compliance with data residency requirements while facilitating cross-border operations.

End-user Insights

Based on end-user, the market is further bifurcated into BFSI, Government, retail, IT & telecom, manufacturing, energy & utilities, healthcare, and others. The IT & telecom segment held the largest revenue share in 2023. The convergence of IT and telecom services and the rise of new technologies such as 5G, IoT, and edge computing are driving the demand for MDM solutions. As IT and telecom companies expand their service offerings to include cloud computing, cybersecurity, connected devices, and digital transformation solutions, they require MDM platforms that adapt to evolving business models and technological landscapes. MDM solutions with flexible data models, API integrations, and support for real-time data processing enable IT and telecom companies to manage diverse data types and emerging use cases effectively.

Based on end-user, the market is further bifurcated into BFSI, Government, retail, IT & telecom, manufacturing, energy & utilities, healthcare, and others. The IT & telecom segment held the largest revenue share in 2023. The convergence of IT and telecom services and the rise of new technologies such as 5G, IoT, and edge computing are driving the demand for MDM solutions. As IT and telecom companies expand their service offerings to include cloud computing, cybersecurity, connected devices, and digital transformation solutions, they require MDM platforms that adapt to evolving business models and technological landscapes. MDM solutions with flexible data models, API integrations, and support for real-time data processing enable IT and telecom companies to manage diverse data types and emerging use cases effectively.

The manufacturing segment is expected to grow at a significant CAGR during the forecast period. Regulatory compliance and quality management require manufacturers to implement MDM solutions that ensure data accuracy, traceability, and compliance with industry standards and regulations. Retail companies operate in highly regulated environments, with stringent requirements for product safety, quality assurance, and regulatory compliance. MDM solutions offer capabilities for managing bill of materials (BOM), product specifications, quality control data, and compliance documentation. It enables manufacturers to maintain data integrity and demonstrate compliance with regulations such as ISO 9001, FDA, and RoHS.

Regional Insights

North America master data management market dominated globally with a revenue share of 38.9% in 2023. The proliferation of data-driven technologies such as IoT, AI, and big data analytics fuels the demand for MDM solutions in North America. MDM solutions enable organizations to integrate and harmonize data from IoT sensors, CRM systems, ERP platforms, and other sources, providing a unified view of data across the enterprise. By leveraging MDM solutions, North American organizations utilize the full potential of their data assets, derive actionable insights, and drive informed decision-making across business functions.

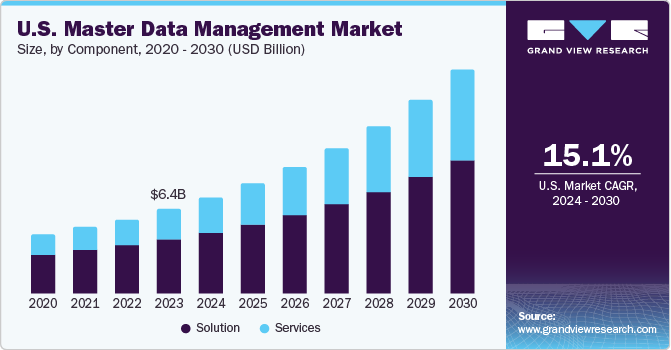

U.S. Master Data Management Market Trends

The master data management market in the U.S. held the largest revenue share of over 32% in the North America region in 2023. The growing adoption of data analytics and business intelligence (BI) solutions fuels the demand for MDM in the U.S. MDM solutions enable businesses to cleanse, standardize, and enrich their master data, ensuring its suitability for advanced analytics and BI applications. By providing a consistent and trustworthy data infrastructure, MDM solutions enable businesses to unlock the full capability of their data assets, gain a competitive edge, and drive innovation in their respective markets.

Asia Pacific Master Data Management Market Trends

The master data management market in the Asia Pacific is anticipated to grow with the rise of online shopping, digital payments, and mobile commerce. Businesses generate vast amounts of customer data that must be managed effectively. MDM solutions provide the foundation for integrating and harmonizing customer data from various online channels, enabling businesses to gain a unified view of their customers' preferences, behaviors, and purchase histories. By leveraging MDM solutions, businesses in Asia Pacific can personalize marketing campaigns, improve customer engagement, and drive sales growth in the highly competitive e-commerce landscape.

The China master data management market is witnessing a rise in smart manufacturing, and Industry 4.0 initiatives drive the demand for MDM solutions in China's manufacturing sector. With the increasing adoption of IoT devices, sensors, and connected technologies in factories and production processes, manufacturers generate vast amounts of data that must be managed effectively. MDM solutions enable manufacturers to integrate and harmonize data from diverse sources, such as production equipment, supply chain systems, and quality control processes, into a centralized repository.

The master data management market in India is driven by the rise of digital transformation initiatives across various sectors in India. As businesses digitize their operations and processes, they accumulate vast amounts of data from different sources and systems. MDM solutions help organizations manage this data effectively by ensuring its accuracy, consistency, and reliability. It allows companies to leverage their data assets more efficiently, streamline operations, and enhance productivity. In addition, MDM solutions facilitate interoperability between different applications and systems, enabling seamless data exchange and integration across the organization's digital ecosystem.

Latin America Master Data Management Market Trends

The master data management market in Latin America is driven by the growing complexity of supply chain networks and logistics operations, which necessitate the adoption of MDM solutions. With the expansion of global trade, increased consumer demand, and supply chain disruptions, organizations face challenges in managing master data related to suppliers, products, and inventory. MDM solutions enable organizations to gain visibility and control over their supply chain data, ensuring accuracy and consistency across distributed networks. By centralizing master data management processes, companies optimize inventory levels, reduce lead times, and enhance collaboration with suppliers and partners. It enables Latin American businesses to improve supply chain resilience, minimize risks, and deliver superior customer experiences in a dynamic and competitive market environment.

Key Master Data Management Companies & Market Share Insights

Some of the key players operating in the market include IBM Corporation, Oracle, and SAP.

-

IBM Corporation is a global technology and consulting company. IBM Corporation operates in various sectors, including technology, software, hardware, and services. IBM Corporation provides MDM solutions designed to address various data management challenges across industries. These solutions encompass data governance, data quality, data integration, and data security capabilities to ensure the accuracy, consistency, and reliability of master data across the enterprise.

-

Oracle Corporation is a multinational computer technology corporation and one of the world's largest software companies. It offers a wide range of integrated cloud applications and platform services. Oracle's MDM solutions help organizations create and maintain a single, accurate, consistent view of master data across the enterprise, ensuring data integrity and reliability.

-

SAP is a multinational software corporation. SAP's MDM solutions provide a centralized platform for creating, storing, and governing master data, enabling businesses to establish a single source of truth across their operations. SAP offers various tools and functionalities to support master data management within its ERP ecosystem. These include SAP Master Data Governance (MDG), SAP Master Data Services (MDS), SAP Information Steward, and SAP Data Services.

Key Master Data Management Companies:

The following are the leading companies in the master data management market. These companies collectively hold the largest market share and dictate industry trends.

- IBM Corporation

- Oracle

- SAP

- TIBCO Software Inc

- Semarchy

- Informatica Inc.

- Reltio

- SAS Institute Inc.

- Stibo Systems

- Syndigo LLC

- Pimcore

- Profisee

- Ataccama

Recent Developments

-

In February 2024, Semarchy, a provider of master data management (MDM) and data integration solutions, announced the launch of its new Acceleration Toolkit. This toolkit is designed to assist businesses in creating a compelling rationale for MDM adoption, enhancing user uptake and trust, and expediting the realization of value. Semarchy is dedicated to exceeding customer expectations, and the Acceleration Toolkit reflects its dedication to simplifying MDM deployment for organizations of various scales.

-

In December 2023, TimeXtender, a data management and automation software provider, acquired Exmon, a company specializing in data governance and master data management software. This strategic acquisition aligns with TimeXtender's Product Vision, enhancing its offerings to bolster Data Quality, Master Data Management, Governance, and Compliance. This acquisition reflects TimeXtender's commitment to simplifying data management through automation, enabling businesses to leverage clean, reliable, and actionable data to enhance operational efficiency.

-

In November 2023, Informatica, an enterprise cloud data management company, collaborated with MongoDB. This partnership enables clients to effectively develop industry-specific applications leveraging MongoDB Atlas and a secure bedrock of reliable data from Informatica’s leading AI-driven master data management (MDM) solution. The collaboration of MongoDB and Informatica MDM allows developers and enterprises to build applications prioritizing data, wherein data dictates user functionalities and actions, opening up avenues for increased automation.

-

In May 2023, Informatica partnered with Google Cloud to launch two new developments: Informatica's Intelligent Master Data Management Software-as-a-Service (Intelligent MDM) directly on Google Cloud and the rollout of Informatica's comprehensive Intelligent Data Management Cloud (IDMC) on Google Cloud is specifically tailored for the European market. Informatica's Intelligent MDM SaaS, powered by AI and capable of managing multiple domains, empowers customers by offering a unified and reliable perspective of their entire data landscape, encompassing various business domains such as customers, suppliers, products, employees, locations, and industry-specific assets.

-

In January 2023, Semarchy, a data integration and master data management company, launched data-driven workflows within its xDM module. These workflows enable organizations to collectively oversee, refine, and coordinate raw data, consolidating it into a unified single source of truth golden records for numerous use cases. Integrated seamlessly with Semarchy's leading master data management platform, these workflows streamline processes, minimizing the burden of data ownership.

Master Data Management Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 23.2 billion |

|

Revenue forecast in 2030 |

USD 60.7 billion |

|

Growth rate |

CAGR of 17.4% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment mode, end-user, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Netherlands; China; Japan; India; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

IBM Corporation; Oracle; SAP; TIBCO Software Inc; Semarchy; Informatica Inc.; Reltio; SAS Institute Inc.; Stibo Systems; Syndigo LLC; Pimcore; Profisee; Ataccama |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Master Data Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global master data management marketreport based on component, deployment mode, end-user, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Solution

-

Services

-

Consulting

-

Integration Services

-

Training and Support

-

-

-

Deployment Mode Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-premise

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

Government

-

Retail

-

IT & Telecommunication

-

Manufacturing

-

Energy & Utilities

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global master data management market size was estimated at USD 19.9 million in 2023 and is expected to reach USD 23.2 million in 2024

b. The global master data management market is expected to grow at a compound annual growth rate of 17.4% from 2023 to 2030 to reach USD 60.7 million by 2030

b. North America dominated the master data management market with a share of 38.9% in 2023. The proliferation of data-driven technologies such as IoT, AI, and big data analytics fuels the demand for MDM solutions in North America.

b. Some key players operating in the master data management market include IBM Corporation, Oracle, SAP, TIBCO Software Inc, Semarchy, Informatica Inc., Reltio, SAS Institute Inc., Stibo Systems, Syndigo LLC, Pimcore, Profisee, Ataccama

b. Factors such as rise of e-commerce and digital platforms and rise of data monetization strategies are driving the market growth

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."