Mass Flow Controller Market Size, Share & Trends Analysis Report By Type (Thermal, Coriolis, Differential Pressure), By Flow Element (Liquid, Gas), By Flow Rate, By End-user, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-263-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Mass Flow Controller Market Size & Trends

The global mass flow controller market size was estimated at USD 1.49 billion in 2023 and is projected to grow at a CAGR of 13.3% from 2024 to 2030. The mass flow controller (MFC) market is driven by the rising demand for automation and the globalization of industries. Moreover, the increasing investment in the technological advancements is also driving the market growth.

Mass Flow Controllers are precision instruments designed to measure and control the flow rate of gases in various industrial processes. These devices are critical in ensuring accurate and consistent fluid flow, essential for maintaining optimal conditions in applications ranging from semiconductor manufacturing to healthcare and environmental monitoring. MFCs are equipped with a specialized flow rate measurement section comprising a sensor, a bypass, a flow rate control valve, and specialized circuitry. The gas input is directed through an inlet joint, which splits the gas flow to pass over the flow rate sensor and bypass. The sensor gauges the mass flow rate of the gas, and the flow rate control valve adjusts the flow rate to achieve a zero difference between the measured flow rate and the rate of flow received from the external flow rate-setting signal.

The increasing trend towards industrial automation across various sectors is driving the demand for the mass flow controller market. As industries aim for greater efficiency, reliability, and precision in their processes, the role of automated systems becomes crucial. Mass flow controllers precisely control gas flows within automated processes, ensuring consistency and accuracy. In industries such as semiconductor manufacturing, pharmaceuticals, and biotechnology, where precision is of the utmost importance, integrating mass flow controllers into automated systems enhances the overall efficiency of production lines. Adopting automation improves the repeatability of processes and reduces the risk of human errors. This trend is expected to persist as industries continue to embrace Industry 4.0 principles and smart manufacturing, further fueling the growth of the mass flow controller market.

There has been a constant increase in globalization. The process of globalization brought about a heightened level of standardization and harmonization across borders. As businesses expand globally, one of the challenges they encounter is maintaining consistent and reliable manufacturing processes. Mass flow controllers provide a standardized approach to gas flow control and ensure uniformity in production facilities worldwide. In global industries such as electronics, where manufacturing plants are distributed globally, mass flow controllers play a vital role in achieving a consistent level of precision in gas handling, regardless of geographical location. This standardization ensures high-quality products and simplifies maintenance and troubleshooting processes.

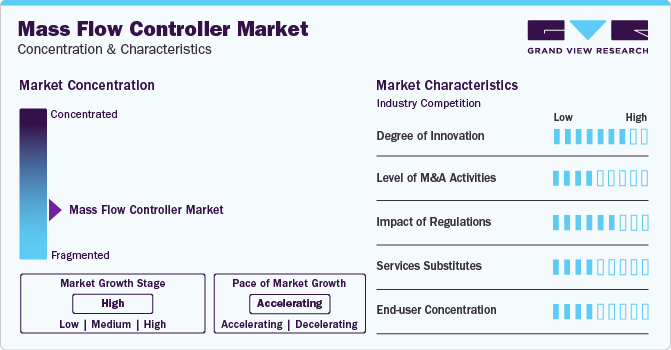

Market Concentration & Characteristics

The global mass flow controller market is fragmented. The market players are investing in research & development to develop advanced solutions and gain a competitive edge. Regulatory standards significantly influence the mass flow controllers market in various industries, including semiconductors, manufacturing, and healthcare.

The market growth stage is high, and the pace is accelerating. The MFC market is characterized by a high degree of innovation driven by technological advancements in sensor accuracy, communication protocols, and control algorithms. Companies continually strive to enhance precision, reliability, and responsiveness in MFC designs to meet the evolving demands of various industries. In March 2023, Sensirion launched the SFC6000, a new mass flow controller boasting an improved price-to-performance ratio, reduced delivery time, and enhanced repeatability, accuracy, control range, and speed capabilities.

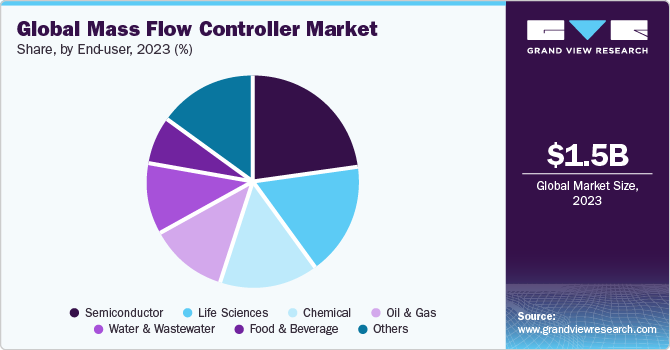

MFC caters to a wide range of industries, including semiconductor manufacturing, healthcare, biotechnology, and others, resulting in a low end-user concentration, reducing dependence on any particular sector and making the market resilient to fluctuations in specific industries. However, manufacturers develop their products to meet different end-users' varying requirements and applications.

Type Insights

The thermal mass flow controller led the market with a share of 37.7% in 2023. Thermal mass flow controllers provide accurate and stable gas flow measurements. Industries that demand high accuracy, such as semiconductor manufacturing and research laboratories, drive the segment's demand. The thermal MFC segment offers a significant advantage in its adaptability, enabling it to accommodate various gases and flow rates effectively. Thermal MFC is widely used across pharmaceuticals, biotechnology, and chemical processing industries.

The coriolis mass flow controller segment is anticipated to grow at the fastest CAGR over the forecast period. Coriolis MFCs offer direct mass measurement, providing an advantage in applications where the mass of the fluid is critical. Coriolis MFCs are applicable in various industries, such as oil and gas, where accurate mass flow control is essential for various processes, including custody transfer and blending, thus driving the segment.

Flow Element Insights

Based on fluid element, the gas segment held the largest revenue share in 2023 and is expected to witness the fastest CAGR over the forecast period. Gas MFCs play a critical role in semiconductor manufacturing processes, contributing significantly to the production of integrated circuits. The semiconductor industry's steady growth fuels the demand for gas flow elements, particularly in applications that require precise control of various gases.

They are also used in environmental monitoring systems, supporting applications such as air quality measurement, and find uses in multiple applications. For instance, in January 2024, Alicat Scientific, a pressure and flow devices producer, launched BASIS 2 electronic MFC and mass flow meter (MFM) featuring ±1.5% reading accuracy for automation in chemical analysis and gas chromatography, bioreactor gas regulation, and industrial burner control.

The liquid segment is expected to witness considerable growth over the forecast period, owing to the increasing usage of chemical injection. The growing demand for process automation and Industry 4.0 initiatives fuels the adoption of liquid mass flow controllers in smart manufacturing environments. Integrated with digital communication protocols such as Profibus, Modbus, EtherNet/IP, and Foundation Fieldbus, liquid MFCs enable seamless integration with process control systems, Supervisory Control and Data Acquisition (SCADA) systems, and industrial Internet of Things (IIoT) platforms. This integration facilitates real-time monitoring, remote diagnostics, predictive maintenance, and data analytics, enabling companies to optimize process performance, improve operational efficiency, and reduce downtime in liquid-based manufacturing processes.

Flow Rate Insights

The low flow segment led the market with the largest revenue sharein 2023 and is projected to grow at the fastest CAGR over the forecast period. This can be attributed to the growing adoption of gas chromatography and spectroscopy. Gas chromatography (GC) and spectroscopy are fundamental analytical techniques widely used in various scientific fields, including chemistry, biology, environmental science, and materials science. These techniques are employed for qualitative and quantitative analysis of compounds in complex mixtures, identification of substances, and characterization of chemical properties. Low flow MFCs aid these analytical techniques by providing accurate gas flow control, calibration and standardization, sample introduction and dilution, and compatibility with analytical instruments.

The high flow segment is expected to grow at a substantial CAGR over the forecast period. High flow rate MFCs regulate the flow of gases, such as oxygen, natural gas, and pulverized coal, injected into the blast furnace to maintain optimal combustion conditions and temperature control. In gas injection for alloying and decarburization, it is utilized to inject gases such as carbon monoxide (CO), carbon dioxide (CO2), nitrogen (N2), and hydrogen (H2) into the steel melt for alloying, decarburization, and desulfurization. In annealing and heat treatment, it is utilized to regulate the flow of protective atmospheres (e.g., nitrogen, hydrogen, or argon) used to prevent oxidation and control the cooling rate of steel products.

End-user Insights

The semiconductor segment dominated the market in 2023 owing to the emergence of Industry 4.0 and the advent of artificial intelligence (AI). The technologies needed for these are based on semiconductor chipsets that provide the computing power to perform essential tasks, leading to an increase in the manufacturing and sales of semiconductors. According to the Semiconductor Industry Association (SIA), sales of the global semiconductor sector increased by 5.3% from November 2023 to November 2022.

Mass flow controllers play a critical role in semiconductor fabrication processes such as chemical vapor deposition (CVD), physical vapor deposition (PVD), etching, ion implantation, and thermal processing. These processes require precise control of gas flow rates to deposit thin films, pattern semiconductor wafers, remove materials, and modify surface properties, ensuring the quality and reliability of semiconductor devices.

The water and wastewater segment is anticipated to witness significant growth during the forecast period. The rising need for water in commercial, non-commercial, and agricultural sectors propels the segment. Water and wastewater treatment is expected to grow considerably during the forecast period. The increasing demand for water in commercial, non-commercial, and agricultural sectors primarily drives this growth.

Ozone is generated using MFCs to disinfect wastewater by controlling the flow of oxygen or air to ozone generators, which ensures precise ozone production for effective disinfection. In addition to ozone and chlorine, other disinfectants are commonly used for water disinfection and microbial control. MFCs regulate the flow of chlorine gas or chlorine solution during chlorination processes and control the flow of reducing agents, such as sulfur dioxide, for dechlorination to ensure water quality and safety.

Regional Insights

North America held a significant share of 21.8% in the market in 2023. The region has leading semiconductor manufacturers, biotechnology firms, research laboratories, and aerospace companies that rely on precise gas flow control for their processes. As these industries continue to advance and incorporate cutting-edge technologies, the demand for MFCs grows to meet their stringent requirements for accuracy, reliability, and efficiency.

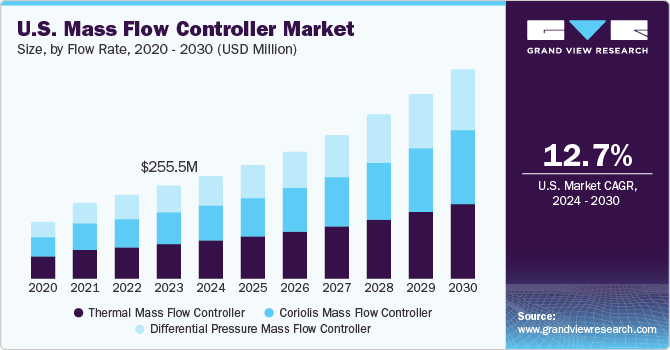

U.S. Mass Flow Controller Market Trends

The mass flow controller in the U.S. market held a market share of 17.2% of the global market in 2023. The U.S. dominates the global semiconductor manufacturing landscape, with Silicon Valley operating as a prominent hub for semiconductor companies, research institutions, and technological innovation. The semiconductor industry relies heavily on MFCs for controlling the flow of process gases in fabrication processes such as chemical vapor deposition (CVD), plasma etching, and thermal processing. As semiconductor technology advances and chip designs become more complex, the demand for precise gas flow control provided by MFCs continues to increase.

Asia Pacific Mass Flow Controller Market Trends

The Asia Pacific mass flow controller market is anticipated to grow at the fastest CAGR during the forecast period. As the population in Asia Pacific countries continues to grow and age, there is a rising demand for healthcare services, pharmaceuticals, and medical devices. MFCs are essential for controlling gas flow in medical applications such as anesthesia delivery systems, respiratory therapy equipment, and laboratory analysis, contributing to the growth of the MFC market in the healthcare sector.

The mass flow controller market in China is expected to grow at a significant CAGR over the forecast period. The Chinese government is actively supporting the development of high-tech industries, including semiconductor manufacturing, biotechnology, and clean energy. Through initiatives such as the "Made in China 2025" strategy and significant investments in research and development, China aims to strengthen its position as a global leader in advanced manufacturing and technology innovation, driving the demand for MFCs in key industries.

The India mass flow controller market is expected to grow significantly over the forecast period. India's pharmaceutical and biotechnology sectors are experiencing robust growth, driven by increasing healthcare expenditures, government initiatives, and a growing focus on research and development. Indian pharmaceutical companies conduct drug manufacturing, laboratory analysis, and research activities that require precise gas flow control for processes such as fermentation, synthesis, and purification.

Middle East and Africa Mass Flow Controller Market Trends

The mass flow controller market in MEA region is driven by industrial growths such as pharmaceuticals, biotechnology, and analytical instrumentation. Mass flow controllers are integral components in sectors where precise gas flow control is essential for research, development, and production processes. In biotechnology, mass flow controllers are necessary for controlling gas flow in bioreactors and fermentation tanks. Expanding these industries in the MEA region fuels the demand for mass flow controllers, supporting market growth.

The UAE mass flow controller market is expected to grow significantly over the forecast period. The UAE is a major player in the global oil and gas industry, with significant investments in upstream exploration, midstream transportation, and downstream refining and petrochemicals. The UAE's oil and gas companies rely on MFCs for precise control of gas flows in various processes, including well drilling, production optimization, gas treatment, and refining operations. Additionally, the UAE's focus on economic diversification and investments in semiconductor manufacturing, aerospace, and healthcare drive the demand for MFCs in other sectors, contributing to the region's overall market growth.

Key Mass Flow Controller Company Insights

Some of the key players operating in the market include Brooks Instrument, Bronkhorst High-Tech B.V., Aalborg Instruments & Controls, Inc., and others

-

Brooks Instrument offers a comprehensive range of mass flow controllers for various industrial applications, including semiconductor manufacturing, biotechnology, pharmaceuticals, and research laboratories. Their MFC product line includes thermal mass flow controllers (T-MFCs) and pressure-based MFCs with digital or analog communication protocol options.

-

Bronkhorst specializes in high-precision mass flow controllers and meters for gas and liquid applications. Bronkhorst's mass flow controllers (MFCs) offer compact design, fast response times, and a wide range of flow options. Their product portfolio includes thermal and Coriolis mass flow controllers designed for precise gas flow control in semiconductors, food and beverage industries, chemical processing, and environmental monitoring.

-

Aalborg offers a wide range of mass flow controllers for a variety of applications, including research and development, semiconductor manufacturing, and environmental monitoring. They offer GFC MFC, DPC MFC, and DFC Digital MFC, which feature various specifications regarding accuracy, construction quality, flow range, pressure, and voltage.

-

Omega manufactures a wide range of industrial instrumentation, including mass flow controllers. They offer a variety of models to meet the needs of different applications and budgets. Some of their products include gas MFCs, low-pressure MFCs, economical MFCs, and multi-gas selection MFCs.

Key Mass Flow Controller Companies:

The following are the leading companies in the mass flow controllers market. These companies collectively hold the largest market share and dictate industry trends.

- Brooks Instrument

- MKS Instruments

- Bronkhorst High-Tech B.V.

- Sierra Instruments

- Alicat Scientific

- Teledyne Hastings Instruments

- HORIBA STEC

- Sensirion AG

- Aalborg Instruments & Controls, Inc.

- Tokyo Keiso Co., Ltd.

- Thermal Instrument Company

- Omega Engineering

- Teledyne Tekmar

- Sensyflow

Recent Developments

-

In January 2024, Tokyo Keiso Co., Ltd. launched the BIOMAG Electromagnetic Flowmeter and BIOSONIC Ultrasonic Flowmeter, two unique flowmeters designed explicitly for single-use processes in biopharmaceutical applications. These flowmeters are equipped with a disposable flow sensor designed with biocompatibility and gamma-ray sterilization capabilities, all manufactured in a cleanroom. They are also compatible with single-use systems and feature a single-barb fitting that meets the requirements of biopharmaceutical manufacturing.

-

In October 2023, Brooks Instrument launched a new production plant in Penang, Malaysia, to produce mass flow controllers (MFCs) while expanding its market in the Malaysian region. The new facility, spanning 57,000 square feet, is the fourth production area operated by Brooks globally. The Malaysian plant is currently focused on producing its GF100 MFC series of MFCs. The plant incorporates Brooks' largest Class 100 cleanroom manufacturing area.

-

In June 2023, Brooks Instrument launched a new line of elastomer-sealed thermal MFCs, the SLAMf series. These MFCs are specifically designed for hazardous environments and are equipped with extended Class I/Division 2 & Zone 2 approvals. With high-speed EtherNet/IP and PROFINET communication protocols, the SLAMf MFCs offer advanced control and precision. Furthermore, they have undergone rigorous safety tests and have received certifications from UL, ATEX, KOSHA, IECEx, and CE.

Mass Flow Controller Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.65 billion |

|

Revenue forecast in 2030 |

USD 3.50 billion |

|

Growth rate |

CAGR of 13.3% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, flow element, flow rate, end-user,region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; U.K.; Germany; France; Italy; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Brooks Instrument; MKS Instruments; Bronkhorst High-Tech B.V.; Sierra Instruments; Alicat Scientific; Teledyne Hastings Instruments; HORIBA STEC; Sensirion AG; Aalborg Instruments & Controls, Inc.; Tokyo Keiso Co., Ltd.; Thermal Instrument Company; Omega Engineering; Teledyne Tekmar; Sensyflow |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Mass Flow Controller Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 - 2030. For this report, Grand View Research has segmented the global mass flow controller market research report based on the type, flow element, flow rate, end-user, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Thermal Mass Flow Controller

-

Coriolis Mass Flow Controller

-

Differential Pressure Mass Flow Controller

-

-

Flow Element Outlook (Revenue, USD Million, 2017 - 2030)

-

Liquid

-

Gas

-

-

Flow Rate Outlook (Revenue, USD Million, 2017 - 2030)

-

Low Flow

-

Medium Flow

-

High Flow

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Oil & Gas

-

Semiconductor

-

Life Sciences

-

Chemical

-

Water and Wastewater

-

Food & Beverage

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global mass flow controller market size was estimated at USD 1.49 billion in 2023 and is expected to reach USD 1.65 billion in 2024

b. The global mass flow controller market is expected to grow at a compound annual growth rate of 13.3% from 2024 to 2030, reaching USD 3.50 billion by 2030

b. North America dominated the mass flow controller market with a revenue share of 21.8% in 2023. Regional growth is attributed to the presence of leading semiconductor manufacturers, biotechnology firms, research laboratories, and aerospace companies that rely on precise gas flow control for their processes.

b. Some key players operating in the mass flow controller market include Brooks Instrument; MKS Instruments; Bronkhorst High-Tech B.V.; Sierra Instruments; Alicat Scientific; Teledyne Hastings Instruments; HORIBA STEC; Sensirion AG; Aalborg Instruments & Controls, Inc.; Tokyo Keiso Co., Ltd.; Thermal Instrument Company; Omega Engineering; Teledyne Tekmar; Sensyflow

b. Factors such as the rising demand for automation and the globalization of industries, along with the increasing investment in technological advancements are driving the growth of the mass flow controller market

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."