- Home

- »

- Automotive & Transportation

- »

-

Marine Turbochargers Market Size And Share Report, 2030GVR Report cover

![Marine Turbochargers Market Size, Share & Trends Report]()

Marine Turbochargers Market Size, Share & Trends Analysis Report By Type (Axial Turbocharger, Radial Turbocharger), By Technology, By Application (Military, Cargo Ships, Tankers), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-390-9

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Marine Turbochargers Market Size & Trends

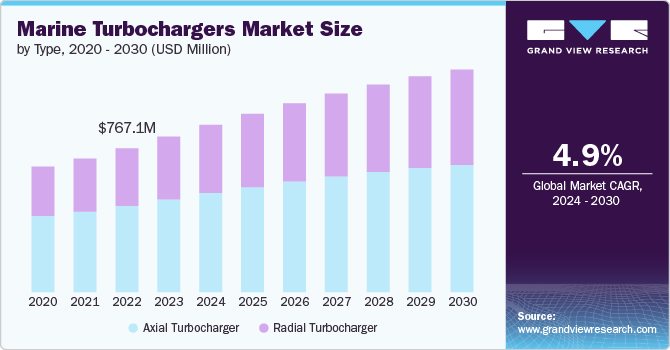

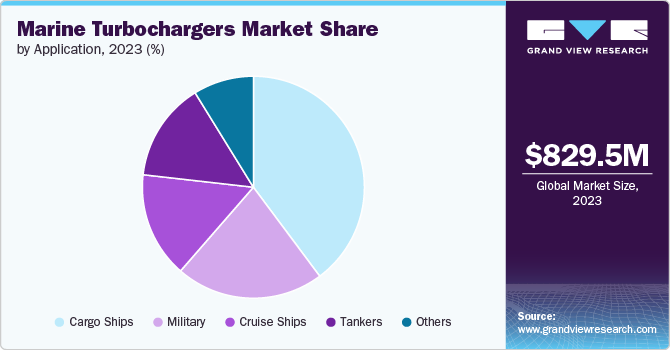

The global marine turbochargers market size was estimated at USD 829.5 million in 2023 and is expected to grow at a CAGR of 4.9% from 2024 to 2030. The increasing demand for fuel efficiency, growing emphasis on reducing emissions, and the expansion of shipping industry, particularly in emerging economies is fueling the need for more efficient and powerful marine engines, thereby boosting the demand for marine turbochargers. Furthermore, the increasing trend towards retrofitting older vessels with modern turbocharging solutions to meet new regulatory standards is expected to fuel market growth in coming years.

The market is witnessing rapid technological advancements aimed at enhancing performance and reducing emissions. Innovations such as variable geometry turbochargers (VGT), twin-turbo systems, and electro-assist turbochargers are gaining traction, allowing for better optimization of engine power and fuel consumption. The integration of advanced simulation tools such as ANSYS and finite element analysis (FEA) methodologies has enabled manufacturers to refine turbocharger designs, improving their operational efficiency and adaptability to various marine applications. These trends are expected to accelerate market growth in the coming years.

Turbochargers recycle exhaust gases to enhance engine performance, thereby improving overall efficiency. As shipping companies are seeking to lower operational costs while adhering to strict environmental regulations, the demand for advanced turbocharging technologies that offer better fuel economy is expected to continue to rise in coming years, thereby fueling the demand of marine turbochargers.

Furthermore, the maritime industry is increasingly shifting towards liquefied natural gas (LNG) as a cleaner alternative to traditional marine fuels. LNG-powered vessels require specialized turbochargers to optimize engine performance and efficiency. This trend is expected to boost the demand for marine turbochargers designed for LNG engines, as ship owners aim to comply with environmental regulations and reduce operating costs.

Moreover, the integration of digital monitoring and diagnostic systems in marine turbochargers is an emerging trend in the market. These systems provide real-time data on turbocharger performance and condition, enabling predictive maintenance and reducing downtime. By leveraging advanced sensors and analytics, ship operators can optimize maintenance schedules, enhance vessel reliability, and reduce operational costs. This trend aligns with the broader adoption of digitalization in the maritime industry.

Market Concentration & Characteristics

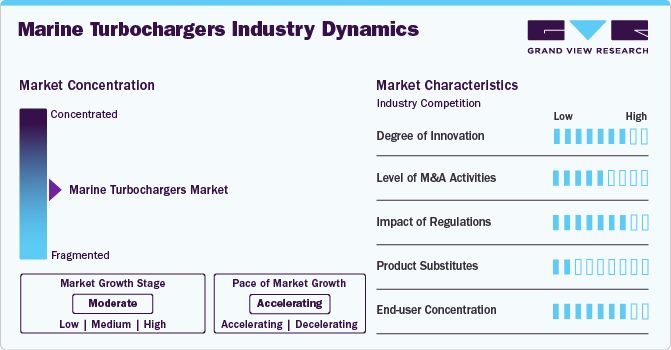

The market is characterized by a moderate to high degree of innovation. Companies are constantly investing in research and development to improve the efficiency, reliability, and environmental performance of their turbochargers. Innovations focused on enhancing fuel efficiency, reducing emissions, and increasing the durability of turbochargers is driving the market growth. Key innovation areas in marine turbocharger market include advanced materials, improved aerodynamics, and the integration of digital monitoring systems.

The level of mergers & acquisition activities in the market is expected to be moderate. Companies operating in this market are acquiring advanced technologies and expertise from innovative firms allows these companies to enhance their product offerings and stay competitive.

The impact of regulations on the market is expected to be moderate to high. Regulations play a significant role in shaping the marine turbocharger market. Environmental regulations, such as the International Maritime Organization's (IMO) impose strict limits on emissions from ships, driving the demand for more efficient and lower-emission turbochargers. Regulatory frameworks also impact the adoption of alternative fuels and green technologies, influencing the direction of market development.

The competition from product substitutes in the market is expected to be low. Turbochargers are essential components in marine engines, providing the necessary boost for efficient engine performance and fuel economy. While there are alternative methods for improving engine efficiency, such as engine modifications or the use of auxiliary systems, the critical role of turbochargers in enhancing engine power and reducing fuel consumption makes them indispensable.

The end use concentration in the market is high, with a significant portion of demand coming from large shipping companies, shipyards, and marine engine manufacturers. These end-users require high-performance turbochargers to ensure the efficiency and reliability of their fleets. The market also serves a diverse range of vessels, including container ships, tankers, bulk carriers, and cruise ships, each with specific performance and regulatory requirements.

Type Insights

The axial turbocharger segment accounted for the largest market share of over 59% in 2023.This growth can be attributed to the superior efficiency and performance characteristics of axial turbochargers, which are particularly well-suited for large marine engines found in cargo ships, tankers, and large passenger vessels. Axial turbochargers are designed to handle high airflow rates and pressures, making them ideal for applications requiring substantial power output and fuel efficiency.

The airborne segment is expected to witness a significant CAGR of over 5% from 2024 to 2030, driven by the increasing adoption of advanced turbocharging technologies in unmanned aerial vehicles (UAVs) and other airborne systems used for maritime applications. These systems, which include drones for surveillance, mapping, and logistics, benefit from the enhanced power and efficiency provided by marine turbochargers. The need for reliable and high-performance propulsion systems in UAVs used in harsh marine environments necessitates the adoption of advanced turbocharging solutions.

Technology Insights

The single turbocharger segment registered the largest revenue share in 2023. This growth can be attributed to its widespread application and cost-effectiveness. Single turbochargers are a preferred choice for a variety of marine vessels, including small to mid-sized cargo ships, fishing vessels, and recreational boats. The robust demand for efficient and reliable marine engines in both commercial and private sectors has bolstered the adoption of single turbochargers.

The variable geometry turbocharger (VGT) segment is expected to grow at a significant CAGR from 2024 to 2030, owing to its superior performance and adaptability in marine applications. VGTs offer enhanced efficiency by adjusting the turbocharger's geometry to optimize airflow and boost pressure across a wide range of engine speeds. This capability allows for better fuel efficiency, reduced emissions, and improved engine response, making them ideal for modern marine engines that need to meet stringent environmental regulations. As the marine industry increasingly shifts towards greener and more efficient technologies, the demand for VGTs is expected to rise in the coming years.

Application Insights

The cargo ships in the market registered the largest share in 2023. The push towards modernization and upgrading of existing cargo fleets with advanced turbocharging technology is propelling the market share of cargo ships. The continuous investment in maritime infrastructure and the expansion of shipping routes have also contributed to the dominance of this segment in the marine turbocharger market.

The cruise ships segment is anticipated to record the significant growth from 2024 to 2030, owing to the burgeoning demand for luxury travel and leisure activities. The cruise industry is experiencing a resurgence post-pandemic, with increasing consumer interest in unique travel experiences and vacations at sea.Additionally, the trend towards greener and more energy-efficient marine propulsion systems is driving the adoption of advanced turbochargers and enhancing the segmental growth.

Regional Insights

North America marine turbochargers market accounted for the highest revenue share of over 33% in 2023. There is a growing trend of retrofitting and upgrading existing marine vessels with advanced turbochargers in North America. Shipping companies are looking to modernize their fleets to comply with new regulations and improve efficiency. Retrofit projects often involve replacing older, less efficient turbochargers with newer, more advanced models. This trend is driven by the need to enhance vessel performance, reduce environmental impact, and extend the operational life of ships. Such retrofit and upgrade activities are expected to contribute significantly to market growth in the region.

U.S. Marine Turbochargers Market Trends

The marine turbochargers market in U.S. is projected to grow at a CAGR of over 2% from 2024 to 2030. The integration of digital and smart technologies in marine turbochargers is gaining momentum in the U.S. market. These technologies include advanced monitoring and diagnostic systems that enable real-time performance tracking and predictive maintenance. By leveraging data analytics and the Internet of Things (IoT), shipping companies can optimize the performance of their turbochargers, reduce downtime, and lower maintenance costs. This trend towards digitalization is expected to drive the market growth in U.S.

Europe Marine Turbochargers Market Trends

Europe marine turbochargers market is anticipated to grow at a CAGR of over 3% from 2024 to 2030.This growth is driven by the focus on energy efficiency and fuel savings in the European marine turbocharger market. Rising fuel costs and the need to improve overall vessel efficiency are driving the demand for turbochargers that offer significant fuel savings.The emphasis on energy efficiency aligns with Europe’s broader goals of reducing greenhouse gas emissions and promoting sustainable maritime practices, further driving regional growth.

The marine turbochargers market in the UK is anticipated to grow at a CAGR from 2024 to 2030. The UK government’s policies supporting green technologies and innovation in the maritime sector are further boosting the market. Additionally, the UK’s strong engineering and manufacturing capabilities is contributing to the development and production of cutting-edge marine turbocharger solutions.

Germany marine turbochargers market is expected to grow at a CAGR from 2024 to 2030. Germany’s strong emphasis on technological innovation and environmental sustainability is driving the market growth in the country. German manufacturers are at the forefront of developing advanced turbocharger technologies that focus on improving fuel efficiency and reducing emissions.

The marine turbochargers market in France is projected to grow at a CAGR from 2024 to 2030. The stringent environmental regulations in France, aligned with the European Union's directives, is driving the adoption of eco-friendly and energy-efficient marine turbochargers in the country.

Asia Pacific Marine Turbochargers Market Trends

Asia Pacific marine turbochargers marketregion is expected to grow at the fastest CAGR of over 7% from 2024 to 2030. This region's dominance in shipbuilding is driving the significant demand for marine turbochargers, as new vessels require advanced turbocharging solutions to enhance engine performance and fuel efficiency. The rapid expansion of commercial and naval fleets in the region further propels the market for marine turbochargers, as ship owners seek to equip their vessels with the latest technology.

The marine turbochargers market in China is projected to grow at a CAGR from 2024 to 2030.China's marine turbocharger market is heavily influenced by the country's rapid industrialization and expansion of its shipbuilding industry. As the largest shipbuilding nation in the world, China's demand for high-performance marine turbochargers is significant. The government's push to modernize the maritime fleet and enhance global competitiveness drives the adoption of advanced turbocharger technologies.

Japan marine turbochargers market is expected to grow at a CAGR from 2024 to 2030.Japanese manufacturers are developing eco-friendly turbocharger technologies that align with global efforts to combat climate change and promote sustainable maritime practices, which is further expected to drive market growth in the region.

The marine turbochargers market in India is expected to grow at a CAGR from 2024 to 2030. India's marine turbocharger market is driven by the growth of maritime trade and the need for fleet modernization. As a major player in global shipping and trade, India is focused on enhancing the efficiency and reliability of its maritime fleet. The demand for advanced turbochargers is increasing as ship owners and operators seek to upgrade their vessels to meet international standards and improve fuel efficiency.

Middle East And Africa Marine Turbochargers Market Trends

Middle East and Africa marine turbochargers market is expected to grow at a CAGR of over 6% from 2024 to 2030.Major port expansions and investments in maritime logistics are driving the demand for high-performance marine turbochargers. Countries of MEA are focusing on enhancing their maritime infrastructure to become key logistics hubs, which in turn is increasing the demand for efficient and reliable marine turbochargers to support larger and more advanced fleets.

The marine turbochargers market in Saudi Arabia is anticipated to grow at a CAGR from 2024 to 2030. The expansion of offshore oil and gas exploration and production activities is a significant trend in Saudi Arabia's marine turbocharger market. The country's vast offshore reserves require a robust fleet of support vessels equipped with reliable and efficient turbochargers. The growing investment in offshore projects is driving the demand for advanced turbocharger solutions that can operate efficiently in harsh offshore conditions.

Key Marine Turbochargers Company Insights

Some of the key players operating in the market include Honeywell International, Inc., and Siemens AG among others.

-

ABB Ltd. is a leading global technology company specializing in electrification, automation, robotics, and motion products. The company offers advanced turbocharging solutions designed to enhance engine performance, improve fuel efficiency, and reduce emissions. Their turbochargers are known for their reliability, durability, and cutting-edge technology, serving a wide range of marine applications from small vessels to large commercial ships.

-

Mitsubishi Heavy Industries Marine Machinery & Engine Co. Ltd., a subsidiary of Mitsubishi Heavy Industries (MHI) based in Japan, is a provider of marine engines and machinery, including high-performance turbochargers. The company focuses on delivering state-of-the-art turbocharging solutions that enhance the efficiency and environmental performance of marine engines. MHI's turbochargers are renowned for their robust design, advanced engineering, and capability to meet stringent emission regulations.

BorgWarner Turbo Systems GmbH, Rolls-Royce plc are some of the emerging market participants in the marine turbochargers market.

-

BorgWarner Turbo Systems GmbH offers advanced turbocharger solutions for various applications, including marine engines. The company leverages its extensive expertise in turbocharging technology and commitment to research and development to deliver reliable and durable products that meet the stringent demands of the maritime industry, supporting both commercial and recreational marine sectors.

-

Rolls-Royce plc is a leading provider of power systems and services for the marine industry. The company offers state-of-the-art turbocharging solutions designed to optimize engine performance, fuel efficiency, and emission control for a wide range of vessels, from commercial ships to luxury yachts.

Key Marine Turbochargers Companies:

The following are the leading companies in the marine turbochargers market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- Mitsubishi Heavy Industries Marine Machinery & Engine Co. Ltd.

- Cummins Inc.

- Akil Corporation

- BorgWarner Turbo Systems GmbH

- Rolls-Royce plc

- Wabtec Corporation

- PBST

- Hedemora Turbo & Diesel AB

- Kompressorenbau Bannewitz GmbH

Recent Developments

-

In June 2023 Mitsubishi Heavy Industries Marine Machinery & Equipment (MHI-MME) has received an order for a MET-53MB turbocharger for a J-ENG 2-stroke engine equipped with a low-pressure EGR system.

-

In August 2022, Cummins Inc. announced that the company aimed to launch its 8th generation Holset Series 400 variable geometry turbocharger in 2024, aimed at enhancing efficiency and reducing emissions in commercial diesel engines. This new turbocharger is designed specifically for the 10-15L heavy-duty truck market, offering top-class performance, reliability, and durability.

-

In February 2022, ABB's Turbocharging division rebranded as Accelleron, a name derived from "Access," "Accelerate," "Excel," and "on and on." This new brand reflects ABB's ambition to continue as a global leader in heavy-duty turbocharging for diesel and gas engines, focusing on sustainable and reliable power solutions for marine, energy, rail, and off-highway sectors.

Marine Turbochargers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 892.4 million

Revenue forecast in 2030

USD 1.18 billion

Growth rate

CAGR of 4.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report Deployment

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

ABB Ltd.; Mitsubishi Heavy Industries Marine Machinery & Engine Co. Ltd.; Cummins Inc.; Akil Corporation; BorgWarner Turbo Systems; Rolls-Royce plc; Wabtec Corporation; PBST; Hedemora Turbo & Diesel AB; Kompressorenbau Bannewitz GmbH

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Marine Turbochargers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global marine turbochargers market report based on type, technology, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Axial Turbocharger

-

Radial Turbocharger

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Single Turbocharger

-

Twin Turbocharger

-

Variable Geometry Turbocharger (VGT)

-

Electric Assisted Turbocharger

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Military

-

Cargo Ships

-

Cruise Ships

-

Tankers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Australia

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Turkey

-

-

Frequently Asked Questions About This Report

b. The global marine turbochargers market size was estimated at USD 829.5 billion in 2023 and is expected to reach USD 892.4 million in 2024.

b. The global marine turbochargers market is expected to grow at a compound annual growth rate of 4.9% from 2024 to 2030 to reach USD 1.18 billion by 2030.

b. The marine turbochargers market in North America accounted for a significant revenue share of over 33% in 2023, owing to the growing trend of retrofitting and upgrading existing marine vessels with advanced turbochargers in North America.

b. Some key players operating in the marine turbochargers market include ABB Ltd., Mitsubishi Heavy Industries Marine Machinery & Engine Co. Ltd., Cummins Inc., Akil Corporation, BorgWarner Turbo Systems GmbH, Rolls-Royce plc, Wabtec Corporation, PBST, Hedemora Turbo & Diesel AB, Kompressorenbau Bannewitz GmbH

b. Key factors that are driving marine turbochargers market growth include the increasing demand for fuel efficiency, growing emphasis on reducing emissions, and the expansion of shipping industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."