- Home

- »

- Advanced Interior Materials

- »

-

Marine Scrubber Market Size & Share, Industry Report, 2030GVR Report cover

![Marine Scrubber Market Size, Share & Trends Report]()

Marine Scrubber Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Wet, Dry), By Installation (New Builds, Retrofit), By Application (Bulk Containers, Container Ships, Oil Tankers, Chemical Tankers, Cruises), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-389-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Marine Scrubber Market Summary

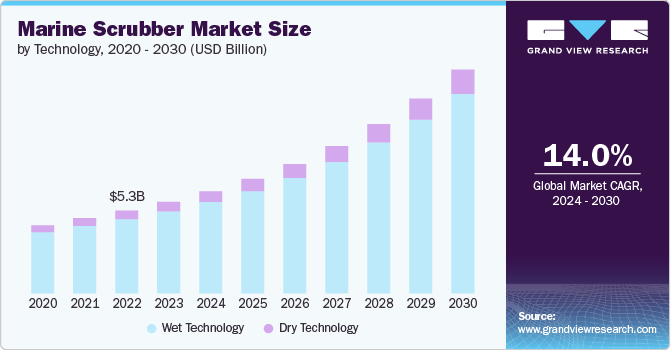

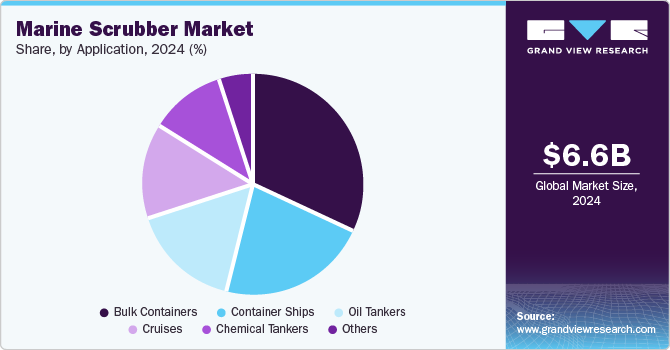

The global marine scrubber market size was estimated at USD 6,565.7 million in 2024 and is projected to reach USD 14,385.3 million by 2030, growing at a CAGR of 14.3% from 2025 to 2030. The environmental regulations are primarily driving market growth. The international maritime organization (IMO) regulations mandate a significant reduction in sulfur emissions from ships.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, China is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, wet scrubber accounted for a revenue of USD 6,367.5 million in 2024.

- Dry Scrubber is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 6,565.7 Million

- 2030 Projected Market Size: USD 14,385.3 Million

- CAGR (2025-2030): 14.3%

- Asia Pacific: Largest market in 2024

Marine scrubbers, which remove sulfur oxides (SOx) from ship exhaust gases, offer a compliant solution for vessel operators aiming to meet these stringent emission standards without switching to low-sulfur fuels, thereby fostering market growth.

A marine scrubber, also known as an exhaust gas cleaning system (EGCS), is a pollution control device installed on ships to reduce harmful emissions from exhaust gases. It primarily removes sulfur oxides (SOx) and nitrogen oxides (NOx) produced during fuel combustion. Using seawater or chemical solutions, the scrubber neutralizes pollutants through chemical reactions. There are open-loop, closed-loop, and hybrid systems, allowing flexibility in operation. Marine scrubbers help ships comply with stringent environmental regulations while minimizing their ecological impact.

Cost efficiency is another significant factor boosting demand for marine scrubbers or exhaust gas cleaning systems (ESGS). While switching to low-sulfur fuels is an alternative compliance method, it often involves higher operational costs due to the price differential between low-sulfur marine and traditional heavy fuels. Marine scrubbers provide a cost-effective solution by allowing ships to continue using economical high-sulfur fuels while achieving compliance with emissions regulations. Over time, this can result in substantial cost savings for ship owners and operators.

The growing awareness of environmental sustainability among stakeholders in the maritime industry has driven the adoption of scrubber technologies. Ship-owners and operators are increasingly focused on reducing their environmental footprint and demonstrating corporate responsibility. Marine scrubbers, by reducing air pollutants such as sulfur and particulate matter, contribute to cleaner air quality and support sustainability goals within the maritime sector.

The expansion of Emission Control Areas (ECAs) and stricter emission regulations in key maritime regions, such as Europe and North America, create opportunities for scrubber installations. Ship-owners operating in these areas may opt for scrubber systems to comply with local regulations and avoid higher fuel costs associated with low-sulfur fuels.

Type Insights

The wet scrubber segment led the market and accounted for the largest revenue share of 86.6% in 2024. Advancements in wet scrubber designs, including hybrid systems combining open-loop and closed-loop configurations, enhance operational flexibility and adaptability to different environmental conditions and regulatory requirements. As environmental regulations continue to evolve, wet scrubber technology is expected to play a crucial role in supporting sustainable shipping practices and reducing the maritime industry's environmental footprint.

Dry scrubber is expected to grow at a CAGR of 14.8% over the forecast period, owing to its versatility and efficiency in reducing sulfur emissions from ship exhaust gases. Unlike wet scrubbers that use liquid mediums, dry scrubbers employ solid sorbents, such as limestone or sodium bicarbonate, to chemically react with sulfur oxides and other pollutants in the exhaust stream. One of the primary drivers for the adoption of dry scrubbers is their ability to operate independently of seawater availability, making them suitable for vessels operating in areas with limited access to clean water or strict discharge regulations.

Installation Insights

The retrofit segment dominated the global marine scrubber market and held the largest revenue share of 78.8% in 2024. Retrofit installations of marine scrubbers are driven by ship owners extending the operational lifespan of their fleets by retrofitting scrubber systems onto older vessels that were originally designed to operate on high-sulfur fuels. This approach offers significant economic benefits compared to switching to more expensive low-sulfur fuels, as scrubbers enable vessels to continue using economical high-sulfur fuels while achieving compliance with emissions regulations.

New Builds installations are expected to grow at a significant CAGR of 15.0% over the forecast period. The demand for marine scrubbers in New Builds installations is driven by factors that cater to the evolving regulatory landscape sand industry trends. In addition, shipbuilders and owners are increasingly incorporating scrubber systems into new vessel designs to ensure compliance with stringent emissions regulations, such as the IMO 2020 sulfur cap and regional emission control areas (ECAs).

Application Insights

The bulk containers segment held the dominant position in the market and accounted for the largest revenue share of 32.1% in 2024, driven by ongoing research and development in scrubber technology. Advancements in hybrid scrubbers and other innovative technologies provide more options and flexibility for ship operators, making scrubbers an attractive solution for emission reduction. Moreover, the need to comply with emission regulations is another factor contributing to a growing demand for marine scrubbers for bulk containers.

Container ships are expected to grow at a lucrative CAGR of 15.0% from 2025 to 2030. The growth of the global economy and increasing trade volumes contribute to higher demand for maritime transportation, including container ships. As trade volumes continue to rise, there is a need for container ships to meet the growing operational needs, which include compliance with emission regulations. This drives the adoption of marine scrubbers to reduce emissions and ensure compliance.

Regional Insights

North America marine scrubber market is expected to witness a significant growth over the forecast period, owing to intense competitiveness in the region. Scrubber-equipped vessels gain a competitive edge by offering cost-effective compliance solutions compared to vessels relying solely on low-sulfur fuels or alternative technologies. Ship owners and operators in the region are increasingly investing in scrubber systems to enhance operational efficiency, reduce fuel costs, and maintain compliance with evolving regulatory requirements.

U.S. Marine Scrubber Market Trends

The marine scrubber market growth in the U.S., dominated the North American market and held the largest revenue share in 2024, owing to strict emission control regulations and the increasing presence of Emission Control Areas (ECAs) along its coastlines. In addition, shipping companies are adopting scrubbers to meet IMO sulfur cap requirements while maintaining cost efficiency.

Asia Pacific Marine Scrubber Market Trends

The Asia Pacific marine scrubber market dominated the global market and accounted for the largest revenue share of 30.0% in 2024. This growth is attributed to the rising shipbuilding activities in the region. This is a hub for shipbuilding, with major shipyards located in countries such as South Korea and China. As new vessels are constructed, shipbuilders and owners are increasingly integrating scrubber systems during the New Builds phase to ensure compliance with global emission standards. This trend drives the demand for scrubber technologies and installations across the region.

The marine scrubber market in China led the Asia Pacific market and accounted for the largest revenue share in 2024, due to supportive government policies and incentives. The Chinese government has introduced policies and incentives to promote the adoption of clean technologies and reduce environmental impact across industries, including shipping. These initiatives encourage investments in scrubber technology and facilitate compliance with emissions regulations through financial support, subsidies, and favorable regulatory frameworks, thereby fostering market growth. Furthermore, technological advancements and innovations in automation play a significant role in driving the growth of the HIPPS market in China. Moreover, the integration of smart sensors, data analytics, and real-time monitoring capabilities enhances the performance and reliability of HIPPS systems, enabling proactive management of operational risks and predictive maintenance practices.

Europe Marine Scrubber Market Trends

Europe marine scrubber market is expected to grow at the fastest CAGR of 13.9% over the forecast period, primarily driven by stringent regulatory frameworks. The European Union (EU) has implemented stringent emissions regulations, including the Sulphur Directive and the EU Monitoring, Reporting, and Verification (MRV) Regulation, aimed at reducing sulfur emissions from ships operating in European waters and ports. Marine scrubbers enable vessels to comply with these regulations by removing sulfur oxides (SOx) from exhaust gases, thereby supporting EU efforts to improve air quality and public health.

The growth of the marine scrubber market in Germany is driven by stringent environmental regulations and government incentives promoting eco-friendly shipping practices. Germany's robust port infrastructure, including major hubs like Hamburg and Bremerhaven, supports the adoption of scrubber systems. The country's focus on decarbonizing its maritime sector aligns with International Maritime Organization (IMO) standards, encouraging ship owners to retrofit vessels with advanced technologies. Investments in hybrid scrubbers further enhance compliance capabilities, positioning Germany as a leader in sustainable maritime solutions.

Key Marine Scrubber Company Insights

Key players in the global marine scrubber market include ANDRITZ, Wärtsilä, Valmet, and others. These companies employ diverse strategies to strengthen their market position and drive growth. They focus on continuous innovation to enhance product efficiency and compliance with stringent environmental regulations. In addition, strategic collaborations and partnerships enable technological advancements and broaden market reach. Furthermore, players emphasize expanding manufacturing capabilities and optimizing cost structures to cater to increasing demand.

-

ANDRITZ specializes in the manufacture and provision of plants, equipment, systems, and services across various industries. The company operates in sectors such as hydropower, pulp and paper, metalworking, solid/liquid separation, and environmental technologies, including flue gas cleaning and recycling. It has over 280 locations in more than 80 countries and offers advanced solutions such as the ANDRITZ SeaSOx, the company’s marine scrubber.

-

Wärtsilä specializes in smart technologies and complete lifecycle solutions for the marine and energy markets. With a large workforce, the company operates in more than 200 locations worldwide. It offers marine industry products such as marine scrubbers, propulsion systems, hybrid technology, and integrated powertrains.

Key Marine Scrubber Companies:

The following are the leading companies in the marine scrubber market. These companies collectively hold the largest market share and dictate industry trends.

- ALFA LAVAL

- ANDRITZ

- Fuji Electric Co., Ltd.

- KWANG SUNG

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- Pacific Green (Pacific Green Group of companies)

- Valmet

- Wärtsilä

- Yara (Okapi Energy Group)

- Drizgas Tech

- CR Ocean Engineering

Recent Developments

-

In August 2024, BW LPG, announced the acquisition of 12 Very Large Gas Carriers (VLGCs) from Avance Gas for USD 1.05 billion. The acquisition includes four dual-fuel VLGCs and eight VLGCs, six of which are equipped with marine scrubbers to reduce emissions.

-

In July 2024, Wärtsilä signed a Lifecycle Agreement with Nautica Ship Management to ensure the optimal efficiency of the marine scrubber systems on the MTT Senari and MTT Saisunee vessels. These feeder container vessels are equipped with hybrid scrubber systems of Wärtsilä.

-

In November 2021, Wärtsilä introduced its new IQ Series scrubber, designed to be lighter and more compact than previous models, representing a significant advancement in exhaust gas treatment technology. This innovative scrubber features a modular design, allowing for easier installation and maintenance, while also optimizing space on vessels. The IQ Series is equipped with advanced monitoring capabilities, ensuring compliance with environmental regulations and enhancing operational efficiency. By reducing the overall footprint and weight, the new scrubber aims to improve vessel performance and fuel efficiency, making it a valuable addition to the maritime industry's efforts to reduce emissions.

-

In July 2021, ANDRITZ acquired parts of GE Steam Power's Air Quality Control Systems (AQCS) business, enhancing its portfolio in environmental technologies. The acquisition includes industrial dedusting systems, such as electrostatic precipitators and fabric filters, as well as multi-pollutant treatment solutions and industrial scrubbing technologies. This deal also encompasses the technology center in Växjö, Sweden, and the associated workforce in Europe, South America, and Asia. With this expansion, ANDRITZ aims to strengthen its capabilities in providing innovative and optimized air pollution control solutions and new build projects along with continuing to offer comprehensive services for existing equipment from various manufacturers.

Marine Scrubber Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.36 billion

Revenue forecast in 2030

USD 14.39 billion

Growth rate

CAGR of 14.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, installation, application, region.

Regional scope

North America; Asia Pacific; Europe; Latin America; Middle East & Africa.

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; and South Africa.

Key companies profiled

ALFA LAVAL; ANDRITZ; Fuji Electric Co., Ltd.; KWANG SUNG; MITSUBISHI HEAVY INDUSTRIES, LTD.; Pacific Green (Pacific Green Group of companies); Valmet; Wärtsilä; Yara (Okapi Energy Group); Drizgas Tech; CR Ocean Engineering.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Marine Scrubber Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global marine scrubber market report based on type, installation, application, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Wet Scrubber

-

Open Loop

-

Closed Loop

-

Hybrid

-

-

Dry Scrubber

-

-

Installation Outlook (Revenue, USD Million, 2018 - 2030)

-

New Builds

-

Retrofit

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bulk Containers

-

Container Ships

-

Oil Tankers

-

Chemical Tankers

-

Cruises

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.