- Home

- »

- Next Generation Technologies

- »

-

Marine & Marine Management Software Market Report, 2030GVR Report cover

![Marine And Marine Management Software Market Size, Share & Trends Report]()

Marine And Marine Management Software Market (2024 - 2030) Size, Share & Trends Analysis Report By Component, By Deployment, By Organization Size, By Location (Onboard, Onshore), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-351-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Marine And Marine Management Software Market Summary

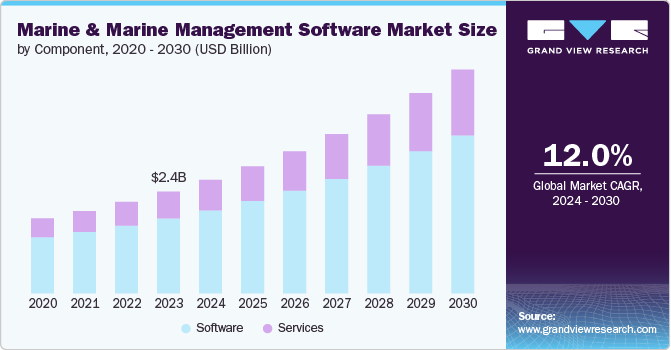

The global marine and marine management software market size was estimated at USD 2.4 billion in 2023 and is projected to reach USD 5.25 billion by 2030, growing at a CAGR of 12.0% from 2024 to 2030. This growth is driven by the need for efficient maritime operations, rising global trade and logistics, and stricter environmental regulations.

Key Market Trends & Insights

- North America represented a significant market share of over 43% in 2023.

- The marine and marine management software market in the U.S. is expected to grow substantially over the forecast period.

- By component, the software segment led the market and accounted for over 73% of the global revenue in 2023.

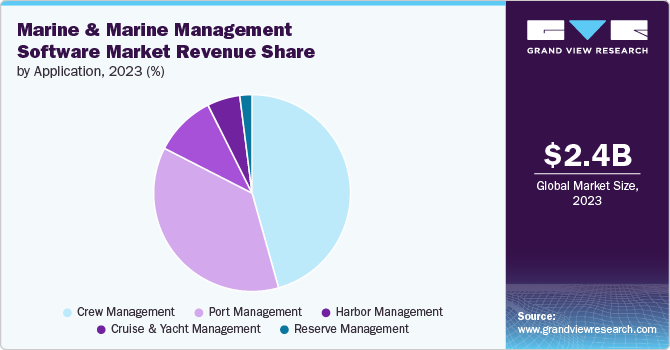

- By application, the crew management segment led the market revenue share in 2023.

- By end-use, the commercial segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.4 Billion

- 2030 Projected Market Size: USD 5.25 Billion

- CAGR (2024-2030): 12.0%

- North America: Largest market in 2023

Marine management software optimizes vessel operations, reduces fuel consumption, and enhances overall efficiency, addressing the complexities of fleet management, cargo handling, and route optimization. The push for sustainable maritime practices and regulatory compliance further boosts the adoption of these solutions.

Technological advancements, including AI, IoT, and big data analytics, are significantly enhancing the capabilities of marine management software, enabling predictive maintenance, real-time monitoring, and data-driven decision-making. The shift towards cloud-based solutions offers scalability, flexibility, and cost-effectiveness, facilitating easier implementation and upgrades. In addition, the growing focus on cybersecurity is crucial as the industry digitizes, ensuring robust protection against cyber threats. The expansion of smart ports, which utilize advanced technologies for automation and efficiency, further drives the demand for integrated marine management software solutions.

The integration of blockchain technology, remote monitoring capabilities, and the development of autonomous vessels are revolutionizing the maritime industry by enhancing transparency, security, and efficiency in transactions, supply chain management, and logistics. Marine management software supports these advancements by streamlining processes such as documentation, cargo tracking, and payments and enabling remote monitoring of vessel performance and autonomous operations. As globalization increases the complexity of maritime logistics, the demand for real-time data and analytics grows, aiding in decision-making, fleet management, and operational efficiency.

Component Insights

The software segment led the market and accounted for over 73% of the global revenue in 2023. Marine management software provides essential functionalities such as fleet management, voyage planning, and regulatory compliance, which are essential for optimizing operations and ensuring safety in maritime activities. Advancements in AI, IoT, big data analytics, and cloud computing strengthen these solutions, enabling real-time data processing, predictive maintenance, and seamless integration with existing systems. Customizable and adaptable to various vessel types and operational needs, these software solutions enhance efficiency through optimized route planning, improved fuel consumption, and better resource allocation. Moreover, they ensure compliance with stringent regulatory standards, mitigate operational risks and support complex supply chain management in the globalized maritime environment. Their scalability and flexibility further enhance their role as indispensable tools for modern maritime operations and long-term investment.

The services segment within the marine management software market is experiencing significant growth, driven by the increasing adoption of advanced software solutions by maritime companies. Key service offerings include implementation, integration, and customization services, ensuring seamless deployment and alignment with existing systems. Consulting and advisory services play a vital role in guiding organizations through digital transformation and regulatory compliance, providing strategic insights and roadmap development. Training programs and support services are essential for equipping maritime personnel with the skills needed to maximize software effectiveness, improve productivity, and enhance operational safety. In addition, managed services and outsourcing options offer avenues for offloading IT management responsibilities, optimizing operational efficiency, and focusing resources on core business activities in the dynamic maritime sector.

Deployment Insights

The cloud segment led the market in 2023, offering scalability and flexibility for varying fleet sizes and operational demands without significant upfront infrastructure investments. Cloud-based marine management software is cost-effective, operating on a subscription model that eliminates on-premises hardware maintenance costs, making it affordable for smaller operators. It enables remote access to essential data and applications, facilitating real-time decision-making and enhancing collaboration among stakeholders. Cloud solutions prioritize security and compliance, with robust measures to protect sensitive data while also providing disaster recovery capabilities to ensure business continuity.

The on-premises segment is experiencing substantial growth driven by data security and privacy concerns in the maritime sector. Organizations prefer on-premises solutions to maintain strict control over sensitive data and comply with regulatory requirements tailored to their specific needs. These deployments offer extensive customization and integration capabilities, accommodating unique operational workflows and legacy systems within existing IT infrastructure investments. On-premises solutions also ensure high reliability and performance, crucial for mission-critical operations in remote or low-connectivity environments, where continuous software operation is imperative.

Organization Size Insights

The large enterprises segment dominated the market in 2023 due to their extensive operations, financial capacity, and global presence. These companies require scalable software solutions capable of managing complex fleets, diverse supply chains, and varying regulatory environments across multiple global locations. Investing in advanced marine management software enables them to streamline operations, enhance efficiency, and reduce costs through optimized fleet management, voyage planning, and regulatory compliance. By leveraging technologies such as AI, IoT, big data analytics, and cloud computing, large enterprises innovate their operations with real-time data insights and predictive analytics, gaining a competitive advantage in the market.

The Small & Medium Enterprises (SMEs) segment in the maritime sector is poised for significant growth as these companies embrace digital transformation through advanced marine management software. This software helps SMEs streamline operations, enhance efficiency, and boost competitiveness by offering scalable solutions that grow with their business needs. Cloud-based and subscription-based pricing models make marine management software affordable and accessible for SMEs, eliminating upfront infrastructure costs. By optimizing resource allocation and improving processes such as fleet management and compliance management, SMEs can reduce operational costs, minimize downtime, and ensure regulatory adherence.

Location Insights

The onboard segment dominated the market in 2023, focusing on essential operational functions directly managed on vessels. Onboard marine management software integrates navigation systems, real-time monitoring, fuel management, and weather forecasting to enhance operational efficiency and safety while minimizing downtime. This software enables real-time data collection and analysis, empowering captains and crew members with actionable insights for quick decision-making in dynamic maritime environments. Seamless integration with onboard systems and sensors ensures comprehensive data management and operational oversight from a centralized platform, facilitating efficient communication and connectivity across vessels.

The onshore segment is positioned for significant growth by offering centralized management and control over fleet operations, logistics, and regulatory compliance from onshore locations. These solutions integrate seamlessly with enterprise systems such as ERP and supply chain platforms, enabling data synchronization and comprehensive analytics for real-time insights and strategic planning. Onshore software also automates compliance monitoring and regulatory reporting, ensuring adherence to maritime regulations while reducing administrative overhead. Leveraging advanced analytics, AI, and machine learning, these solutions provide predictive maintenance, anomaly detection, and performance optimization, enhancing operational efficiency and reducing costs.

Application Insights

The crew management segment led the market revenue share in 2023, emphasizing its vital role in ensuring efficient vessel operations, safety, and regulatory compliance in the maritime industry. Dedicated marine management software for crew management streamlines tasks such as scheduling, payroll, certification tracking, and training, optimizing crew resources based on skills and operational needs. This software supports compliance with international regulations governing crew qualifications, rest hours, and safety protocols through automated monitoring and reporting, reducing administrative burdens and compliance risks. Integration with operational systems onboard and onshore enables real-time data exchange and holistic management of crew-related processes, while digital solutions such as cloud computing and AI-driven analytics further enhance efficiency, cost savings, and decision-making capabilities in maritime operations.

The reserve management segment is poised for significant growth as marine companies prioritize environmental compliance and sustainability. Reserve management software plays a vital role in monitoring and managing marine reserves and protected areas, ensuring adherence to global regulations and minimizing ecological impacts. By optimizing resource utilization through data-driven approaches and predictive modeling, these solutions enhance sustainability practices and support the health and resilience of marine ecosystems. Effective reserve management also mitigates operational risks associated with habitat destruction and biodiversity loss, fostering operational resilience and sustainable development.

End-use Insights

The commercial segment accounted for the largest market revenue share in 2023, driven by the extensive scope and scale of operations in shipping, logistics, freight forwarding, port management, and maritime tourism. Marine management software tailored for commercial use enhances operational efficiency, cost reduction, and regulatory compliance by optimizing cargo handling, route planning, and fleet management. These solutions support global trade by facilitating the smooth flow of goods, ensuring safety, and meeting stringent international regulations. In addition, the software helps commercial maritime companies deliver high-quality services, improving customer satisfaction through real-time monitoring and accurate scheduling.

The defense segment is poised for significant growth in maritime operations, focusing on enhancing operational efficiency, regulatory compliance, and customer service quality. Marine management software tailored for defense applications automates tasks, optimizes resource allocation, and ensures adherence to stringent safety and environmental standards. Integration with supply chain systems enables seamless coordination and enhances supply chain efficiency, which is essential for defense logistics and operations. Technological advancements, including IoT, AI analytics, blockchain, and digital twins, further enhance software capabilities in areas such as predictive maintenance and risk management, supporting operational excellence and strategic advantages in defense maritime activities.

Regional Insights

North America represented a significant market share of over 43% in 2023, driven by a robust maritime industry, mainly in the U.S. and Canada. The region's extensive commercial shipping, naval operations, and port infrastructure necessitate advanced marine management software to improve efficiency, safety, and regulatory compliance. Technological advancements in software development, AI, IoT, and big data analytics enhance real-time monitoring, predictive maintenance, and data-driven decision-making capabilities, attracting maritime companies. In addition, the strong defense sector, especially the U.S. naval forces, significantly invests in marine management software for fleet management and cybersecurity. Stringent environmental and safety regulations further drive the demand for solutions that ensure compliance with standards set by the International Maritime Organization and the U.S. Coast Guard.

U.S. Marine and Marine Management Software Market Trends

The marine and marine management software market in the U.S. is expected to grow substantially over the forecast period. Technological advancements in AI, IoT, big data analytics, and cloud computing are pivotal for enhancing the capabilities of marine management software, enabling real-time data integration, predictive analytics, and automation. Stringent regulatory requirements from agencies such as the U.S. Coast Guard, EPA, and MARAD mandate the adoption of software solutions that ensure compliance with safety, environmental, and security standards, boosting demand among maritime companies and defense sectors. The diverse range of maritime activities in the U.S., from commercial shipping to offshore energy and cruise tourism, fuels the need for advanced software solutions optimizing fleet management, logistics, and port operations.

Europe Marine and Marine Management Software Market Trends

Marine and marine management software is gaining significant traction in Europe. The region's stringent environmental regulations, mainly focused on emissions and pollution control, necessitate the adoption of software solutions that enable compliance with sustainability initiatives such as the European Green Deal and IMO 2020 sulfur cap. Europe's leadership in digitalization initiatives, supported by strategies like the Digital Single Market, promotes the integration of advanced technologies such as real-time data analytics, predictive maintenance, and automation within the maritime sector. Port modernization efforts across major European ports such as Rotterdam and Hamburg emphasize the role of marine management software in optimizing operations, managing logistics, and enhancing competitiveness in global trade.

Asia Pacific Marine and Marine Management Software Market Trends

The Asia Pacific marine and marine management software market is poised for significant growth. The region's pivotal role in global maritime trade, with major ports in countries such as China, Singapore, Japan, South Korea, and India, emphasizes the need for efficient port operations and logistics management, spurring demand for advanced marine management software solutions. Technological advancements in AI, IoT, and big data analytics across countries such as China and South Korea are enhancing the capabilities of marine management software, enabling real-time data analysis, predictive maintenance, and operational optimization across diverse maritime operations. Government initiatives like China's Belt and Road Initiative (BRI), India's Sagarmala Project, and Singapore's Maritime and Port Authority (MPA) initiatives are driving investments in infrastructure development and digitalization of maritime operations.

Key Marine and Marine Management Software Company Insights

Key players in the industry have strengthened their market presence through a strategic mix of product launches, expansions, mergers and acquisitions, contracts, partnerships, and collaborations. These initiatives serve as vital tools for enhancing market penetration and strengthening their competitive edge within the industry. For instance, In March 2023, the U.S. Marine Corps established the Marine Corps Software Factory to develop a premier Marine-led software development capability. To meet the demands of future operating environments, Marines will need to design and deploy software solutions at the battlefield's edge, independent of centralized or contracted support. The Marine Corps Software Factory advances modernization efforts by enabling Marines to create applications rapidly, providing commanders with timely and relevant solutions.

Key Marine And Marine Management Software Companies:

The following are the leading companies in the marine and marine management software market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Chetu Inc.

- Dockmaster

- Lloyd's Register Group Services Limited.

- MARINA MASTER Ltd.

- Marine Cloud Ltd

- MESPAS AG

- Oracle

- Scribble Software Inc.

- TIMEZERO

Recent Developments

-

In July 2024, CII Simulator digital systems and NAPA's Voyage Optimization will be implemented on an initial 55 bulk carriers within the fleet handled by Union Marine Management Services (UMMS), following a new contract between the Singapore-based ship management company and Finnish maritime software provider. The new system can potentially decrease greenhouse gas emissions by an estimated 5-10% on average for this fleet of bulk carriers, which range from 25,000 to 180,000 deadweight tonnage (DWT) and operate globally.

-

In January 2024, ABB acquired DTN Shipping's business in Europe and the Philippines, expanding its maritime software offerings. This acquisition positions ABB as a market leader in ship route optimization, encompassing vessel routing software, analytics, reporting, and modeling applications. The acquisition allows ABB to integrate electric, automated, and digital marine solutions, providing current DTN customers with enhanced efficiency, fuel savings, and emission reductions.

-

In December 2023, NASH Maritime, a recognized expert in port marine safety and compliance, announced the launch of DigiSMS, an online marine safety management system. DigiSMS is designed to alleviate the complexities of managing and maintaining such systems by procedures, consolidating policies, checklists, and forms into a single, integrated planning and management tool. This new online system streamlines the process, bringing all necessary elements together for improved efficiency and compliance.

Marine and Marine Management Software Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.66 billion

Revenue forecast in 2030

USD 5.25 billion

Growth rate

CAGR of 12.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, organization size, location, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; UAE; KSA; South Africa

Key companies profiled

ABB; Chetu Inc.; Dockmaster; Lloyd's Register Group Services Limited.; MARINA MASTER Ltd.; Marine Cloud Ltd; MESPAS AG; Oracle; Scribble Software Inc.; TIMEZERO

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Marine and Marine Management Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global marine and marine management software market report based on component, deployment, organization size, location, application, end-use, and region.

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Software

-

Tracking & Monitoring

-

Navigation & Routing

-

Supply Chain & Logistics

-

Finance & Accounting

-

System Testing

-

Others

-

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cloud

-

On-premises

-

-

Organization Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises (SMEs)

-

-

Location Outlook (Revenue, USD Billion, 2017 - 2030)

-

Onboard

-

Onshore

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Crew Management

-

Port Management

-

Harbor Management

-

Reserve Management

-

Cruise & Yacht Management

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Commercial

-

Defense

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global marine and marine management software market size was estimated at USD 2.39 billion in 2023 and is expected to reach USD 2.66 billion in 2024.

b. The global marine and marine management software market is expected to grow at a compound annual growth rate of 12.0% from 2024 to 2030 to reach USD 5.25 billion by 2030.

b. North America dominated the market in 2023, accounting for over 43% share of the global revenue driven by a robust maritime industry, mainly in the U.S. and Canada. The region's extensive commercial shipping, naval operations, and port infrastructure necessitate advanced marine management software to improve efficiency, safety, and regulatory compliance.

b. Some key players operating in the marine and marine management software market include ABB; Chetu Inc.; Dockmaster; Lloyd's Register Group Services Limited.; MARINA MASTER Ltd.; Marine Cloud Ltd; MESPAS AG; Oracle; Scribble Software Inc.; TIMEZERO

b. Key factors driving the marine and marine management software market growth include technological advancements and digital transformation initiatives and rising need to efficiently manage complex supply chain operations

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.