Marine Battery Market Size, Share & Trends Analysis Report By Ships, By Sales Channel, By Battery, By Nominal Capacity, By Propulsion Type, By Ship Power, By Battery Design, By Battery Type, By Energy Density, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-268-4

- Number of Report Pages: 220

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Marine Battery Market Size & Trends

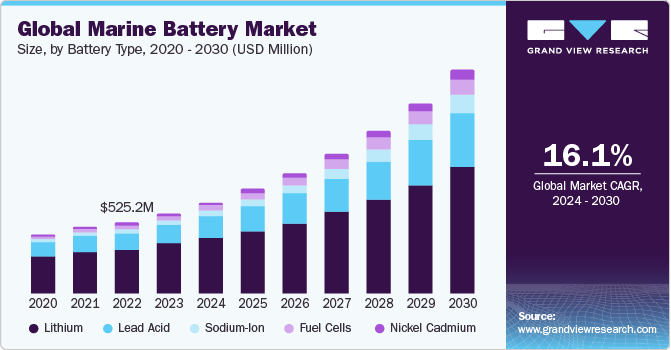

The global marine battery market size was estimated at USD 595.15 million in 2023 and is projected to grow at a CAGR of 16.1% from 2024 to 2030. The global market is experiencing significant growth driven by increasing environmental concerns and the demand for cleaner, more sustainable energy solutions in the maritime industry. As regulatory bodies impose stricter emissions standards, shipowners are turning to advanced battery technologies to reduce their carbon footprint and comply with regulations. This shift towards cleaner energy sources is fostering innovation in marine battery technology, leading to the development of more efficient and high-performance batteries tailored specifically for marine applications.

The rising adoption of electric propulsion systems in ships and vessels is one of the market's driving factors. Electric propulsion offers numerous advantages, including reduced emissions, lower fuel consumption, and quieter operation compared to traditional combustion engines. As a result, shipbuilders and operators are increasingly integrating battery systems into their vessels to leverage the benefits of electric propulsion, driving the demand for marine batteries across various maritime segments, including passenger ships, ferries, yachts, and commercial vessels.

Furthermore, advancements in battery chemistry and design are enhancing the performance and reliability of marine batteries, enabling them to withstand harsh marine environments and deliver optimal power output over extended periods. Lithium-ion batteries have emerged as the preferred choice for marine applications due to their high energy density, fast charging capabilities, and longer cycle life. In addition, ongoing research and development efforts are focused on improving the safety, efficiency, and sustainability of marine batteries, further bolstering market growth.

Despite the promising outlook, challenges such as high initial costs and concerns over battery safety and reliability remain significant hurdles for widespread adoption. However, as technology continues to mature and economies of scale drive down costs, the marine battery industry is expected to witness substantial growth in the coming years, supported by increasing investments in infrastructure, government initiatives to promote sustainable shipping practices, and growing awareness of the environmental benefits of electric propulsion systems.

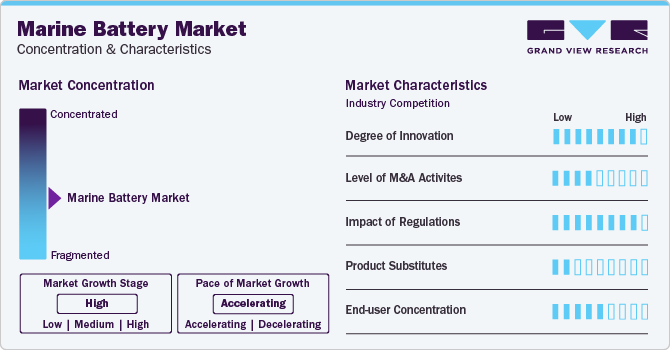

Market Concentration & Characteristics

The marine battery industry is dynamic and competitive, with established players and innovative newcomers vying for dominance. In addition, the industry is facing fierce competition from established players in various sectors. Leading companies like Siemens, Leclanché S.A., Saft SA, Corvus Energy, and Exide Technologies have been in the industry for years, boasting extensive experience and established customer bases. Startups and smaller companies are entering the fray with innovative technologies and disruptive business models.

Companies are increasingly focusing on expanding marine battery facilities to increase their foothold in the market. For instance, in January 2023, Leclanché SA was selected as the battery technology provider for two hybrid vessels, which will be constructed for Brittany Ferries and Stena RoRo. Each battery system will have a capacity of 11.3 MWh.

Ships Insights

The commercial ships segment emerged as the dominant segment in 2023, with a market share of about 81.51%, and it is expected to witness robust growth over the forecast period. Commercial vessels, including container ships, bulk carriers, and tankers, are increasingly adopting battery systems to enhance operational efficiency, reduce fuel consumption, and comply with stringent emissions regulations. Electric propulsion systems powered by marine batteries offer commercial ship operators a viable solution to mitigate environmental impact while optimizing performance and reducing operating costs.

The adoption of marine batteries in commercial ships is particularly notable in short-sea shipping and coastal routes, where vessels frequently operate in emission control areas (ECAs) and face pressure to reduce air pollution and greenhouse gas emissions. By integrating battery systems into their fleets, shipping companies can achieve substantial reductions in emissions, improve energy efficiency, and enhance overall environmental sustainability. Moreover, advancements in battery technology, such as increased energy density and faster charging capabilities, are further driving the uptake of marine batteries in commercial shipping, signaling a shift towards cleaner and more sustainable maritime transportation solutions.

Battery Insights

The deep-cycle batteries segment dominated the market in 2023 with a revenue share of 46.55% in 2023 and is expected to witness robust growth over the forecast period. These batteries are engineered with thick plates and robust construction to withstand repeated deep discharges, making them ideal for providing sustained power over extended periods. Deep-cycle batteries find widespread use in marine vessels for various applications, including powering trolling motors, navigation systems, lighting, and onboard electronics, ensuring reliable operation and performance on the water.

With advancements in battery technology, deep-cycle batteries have become more efficient, durable, and reliable, offering enhanced energy density and longer cycle life. Manufacturers are continuously innovating to develop deep-cycle batteries capable of meeting the evolving needs of the marine industry, such as improved charge acceptance, faster charging times, and better resistance to vibration and shock.

Nominal Capacity Insights

The > 250 AH segment emerged as the largest nominal capacity segment, with a market share of 45.96% in 2023, and is expected to witness robust growth over the forecast period. These batteries offer a robust solution for powering various onboard systems, including propulsion, navigation, and auxiliary equipment, in vessels such as commercial ships, ferries, and offshore platforms. With capacities > 250 AH, these batteries provide ample energy reserves to support extended voyages and demanding operational conditions at sea.

As the maritime industry continues to embrace electrification and sustainability initiatives, the demand for >250 AH marine batteries is poised for considerable growth. Manufacturers are investing in research and development to enhance the performance, efficiency, and durability of these high-capacity batteries, aiming to meet the stringent requirements of marine applications while ensuring reliability and safety. The >250 AH battery sub-segment is expected to play a crucial role in powering the next generation of eco-friendly and energy-efficient marine vessels, driving innovation and advancements in the global market.

Propulsion Type Insights

The conventional propulsion type segment dominated the market in 2023 with a share of 85.04% and is expected to witness robust growth over the forecast period. While electric propulsion systems are gaining traction, many marine vessels still utilize conventional power sources such as diesel engines or gas turbines. In such cases, marine batteries serve as auxiliary power sources, providing backup power for essential systems, as well as supporting functions like lighting, navigation, and communication onboard.

Despite the increasing interest in alternative propulsion technologies, the conventional segment remains relevant due to the widespread use of combustion engines in various marine applications, including commercial shipping, offshore operations, and naval vessels.

Ship Power Insights

The 150 - 745 KW ship power segment dominated the market in 2023 with a revenue share of 32.87% and is expected to witness robust growth over the forecast period. Marine vessels within this power range encompass a diverse range of applications, including ferries, workboats, offshore support vessels, and smaller cargo ships. Battery systems in this category provide sufficient power to propel vessels through various marine environments while also supporting onboard systems and equipment essential for safe and efficient operations.

As the maritime industry increasingly focuses on reducing emissions and as it transitions towards cleaner energy sources, the demand for battery systems within the 150 - 745 kW power range is expected to surge. These batteries play a crucial role in enabling hybrid and electric propulsion systems, contributing to lower fuel consumption, reduced greenhouse gas emissions, and improved environmental sustainability. In addition, advancements in battery technology, such as higher energy densities and faster charging capabilities, are further driving the adoption of marine batteries in this power range, paving the way for a more efficient and eco-friendly future for marine transportation.

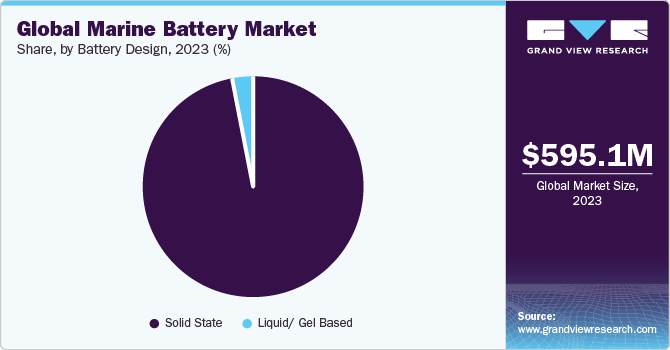

Battery Design Insights

In terms of battery design, the solid state segment emerged as the largest with a market share of about 96.96% in 2023 and is expected to witness robust growth over the forecast period. These batteries utilize solid electrolytes instead of traditional liquid or gel electrolytes, offering improved safety, stability, and energy density. With their inherently safer design and reduced risk of thermal runaway, solid-state batteries are gaining traction in marine applications where reliability and safety are paramount concerns.

The adoption of solid-state batteries in the marine industry promises to revolutionize onboard power storage and propulsion systems, driving efficiency and sustainability. Their potential for faster charging, increased energy efficiency, and longer lifespan positions solid-state batteries as a key enabler of cleaner and more reliable marine transportation solutions.

Battery Type Insights

Lithium emerged as the largest battery type segment, with a market share of about 62.69% in 2023, and is expected to witness robust growth over the forecast period. As a preferred choice for marine propulsion and onboard systems, lithium batteries provide reliable performance, fast charging capabilities, and longer cycle life compared to traditional lead-acid batteries. Their lightweight and compact design makes them ideal for space-constrained marine environments, contributing to overall vessel efficiency and performance.

The adoption of lithium batteries in the marine industry is driven by their ability to support electric propulsion systems, hybrid configurations, and auxiliary power requirements across a wide range of vessel types, including yachts, ferries, and commercial ships. With ongoing advancements in lithium battery technology, such as improved safety features and higher energy densities, this sub-segment is poised for continued growth. It offers marine operators a sustainable and cost-effective solution to meet their power storage needs while reducing environmental impact.

Sales Channel Insights

OEM emerged as the largest sales channel segment, with a market share of about 63.04% in 2023, and is expected to witness robust growth over the forecast period. OEMs seek to meet increasingly stringent emissions regulations and cater to the growing demand for eco-friendly marine solutions. They are shifting to advanced battery technologies to power electric propulsion systems and onboard electronics. By partnering with battery manufacturers, OEMs can offer complete vessel solutions equipped with high-performance batteries, ensuring seamless integration and optimal performance for end-users.

The OEM sales channel plays a pivotal role in driving innovation and adoption of marine batteries across the maritime industry. As OEMs collaborate with battery manufacturers to develop custom solutions tailored to specific vessel requirements, they enable the widespread adoption of electric propulsion and hybrid power systems, contributing to a greener and more sustainable future for marine transportation. Through strategic partnerships and investments in research and development, OEMs are poised to shape the trajectory of the global marine battery industry, facilitating the transition towards cleaner and more efficient marine propulsion technologies.

Energy Density Insights

The 100 - 500 WH/Kg energy density segment emerged as the largest, with a market share of about 69.76% in 2023, and is expected to witness robust growth over the forecast period. Batteries within this range provide sufficient energy density to support various marine vessels, including smaller boats, yachts, and some commercial ships. With advancements in battery technology, batteries in this energy density range offer improved performance, allowing vessels to operate efficiently while minimizing weight and space constraints.

Marine batteries within the 100 - 500 WH/Kg energy density range play a crucial role in enabling electric propulsion systems and supporting onboard electronics, navigation systems, and auxiliary equipment. Their ability to provide a favorable balance between energy density, power output, and weight makes them well-suited for powering marine vessels across different sizes and applications.

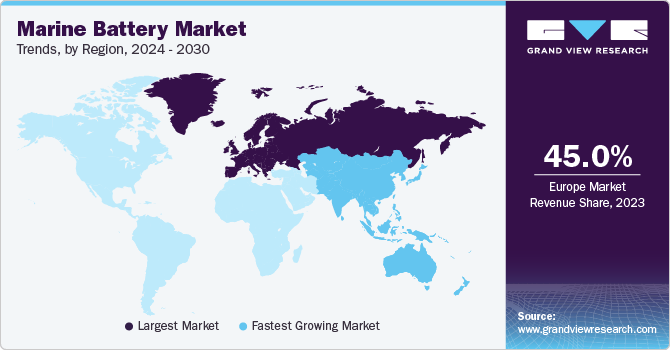

Regional Insights

The marine battery market in North America has experienced steady growth driven by factors such as increasing demand for electric propulsion systems in marine vessels, the rising popularity of recreational boating activities, and a growing focus on environmental sustainability. Advancements in battery technology, including improved energy density and longer lifespans, have also contributed to market expansion. In addition, government initiatives promoting the adoption of electric and hybrid marine propulsion systems have further boosted market growth. Despite challenges such as high initial costs and concerns regarding battery disposal and recycling, the North America marine battery industry is poised for continued expansion in the coming years, driven by ongoing innovation and evolving regulatory frameworks.

U.S. Marine Battery Market Trends

The marine battery market in the U.S. is projected to grow at a CAGR of 11.5% from 2024 to 2030. Key factors contributing to the market's growth are increasing demand for electric propulsion systems in marine vessels to meet stringent emissions regulations, rising investments in renewable energy infrastructure, and growing awareness of the environmental benefits of battery-powered marine transportation. In addition, advancements in battery technology and government initiatives supporting sustainable shipping practices are expected to accelerate market growth in the U.S. further.

Europe Marine Battery Market Trends

The Europe marine battery market is expected to witness significant growth over the forecast period as the region has a strong shipbuilding and maritime industry presence and is witnessing growing adoption of electric and hybrid propulsion systems for various marine applications. Europe dominated the market in 2023 and accounted for the largest revenue share of 45.0%. The region is likely to dominate the industry globally over the forecast period. Governments in regions such as Germany, the UK, France, Italy, and Spain are at the forefront of this growth, driven by stringent emissions regulations enforced by European Union directives, driving the adoption of cleaner propulsion technologies such as electric and hybrid systems. In addition, the region's focus on sustainable maritime practices, coupled with significant investments in research and development, infrastructure, and government incentives for eco-friendly shipping, further solidify Europe's position as a leader in the marine industry.

The marine battery market in France is anticipated to grow at a CAGR of over 15.5%. This growth can be attributed to the country’s strong leisure boating industry, which is increasingly adopting electric and hybrid technology that requires advanced marine batteries. Moreover, French companies like Saft SA are one of the prominent players in the global market, further propelling the domestic market.

Asia Pacific Marine Battery Market Trends

The marine battery market in Asia Pacific is poised for significant growth, exceeding a projected CAGR of 20.8% between 2024 and 2030. The Asia Pacific region is a hub for international trade, which aids in the rise in commercial vessels that require efficient and reliable batteries.

The China marine battery market held a significant share of about 40.09% in the Asia Pacific region in 2023. This surge is driven by Chinese government policies promoting clean maritime technologies, creating a favorable environment for domestic manufacturers, and incentivizing the use of electric and hybrid vessels powered by marine batteries.

Middle East & Africa Marine Battery Market Trends

The marine battery market in the Middle East and Africa is expected to grow at a CAGR of approximately 15.8% over the forecast period. This growth is fueled by the growing focus on offshore renewable energy projects, such as wind farms and floating solar installations, which is leading to increased demand for marine batteries to store and manage energy generated from these sources.

The Saudi Arabia marine battery market held a dominant share of about 37.08% in the Middle East & Africa region in 2023. This dominance shows Saudi Arabia's significant influence in the regional maritime industry, driven by substantial investments in infrastructure and renewable energy. With its strategic location and growing maritime sector, Saudi Arabia continues to lead the demand for marine batteries, solidifying its position as a key player in the Middle East & Africa market.

Key Marine Battery Company Insights

The marine battery industry is moderately fragmented, with a sizable number of medium-and large-sized companies. Key players mainly cater to maritime shipping, offshore oil and gas, marine tourism, and naval and defense industries. To maintain and expand their market share, key companies are adopting several organic and inorganic growth strategies, such as facility expansion, mergers and acquisitions, and joint ventures.

-

In February 2024, one of the leading manufacturers of marine battery systems, EST-Floattech B.V., received an investment of USD 4.35 million from Energy Transition Fund Rotterdam and its existing shareholders, PDENH, Rotterdam Port Fund, Yard Energy, and Ponooc.

-

In January 2023, Leclanché SA was selected as a battery technology provider for two hybrid vessels, which will be constructed for Brittany Ferries and Stena RoRo. Each battery system will be installed with a capacity of 11.3 MWh.

Key Marine Battery Companies:

The following are the leading companies in the marine battery market. These companies collectively hold the largest market share and dictate industry trends.

- Corvus Energy

- Leclanché S.A.

- Siemens AG

- Saft SA

- Shift Clean Energy

- Echandia Marine AB

- EST Floattech

- Sensata Technolgies Inc.

- Powertech Systems

- Lifeline Batteries

Marine Battery Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 677.82 million |

|

Revenue forecast in 2030 |

USD 1,662.20 million |

|

Growth rate |

CAGR of 16.1% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Ships, battery, nominal capacity, propulsion type, ship power, battery design, battery type, sales channel, energy density, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; Brazil; Argentina; Saudi Arabia; South Africa; UAE |

|

Key companies profiled |

Corvus Energy; Leclanché S.A.; Siemens AG; Saft SA; Shift Clean Energy; Echandia Marine AB; EST Floattech; Sensata Technolgies Inc.; Powertech Systems; Lifeline Batteries |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Marine Battery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global marine battery market report based on ships, battery, nominal capacity, propulsion type, ship power, battery design, battery type, sales channel, energy density, and region:

-

Ships Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Defense

-

Unmanned

-

-

Battery Outlook (Revenue, USD Million, 2018 - 2030)

-

Starting Batteries

-

Deep-Cycle Batteries

-

Dual Purpose Batteries

-

-

Nominal Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

< 100 AH

-

100 - 250 AH

-

> 250 AH

-

-

Propulsion Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional

-

Hybrid

-

Fully Electric

-

-

Ship Power Outlook (Revenue, USD Million, 2018 - 2030)

-

< 75 KW

-

75 - 150 KW

-

150 - 745 KW

-

77 - 150 KW

-

-

Battery Design Outlook (Revenue, USD Million, 2018 - 2030)

-

Solid State

-

Liquid/ Gel Based

-

-

Battery Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Lithium

-

Lead Acid

-

Nickel Cadmium

-

Sodium-Ion

-

Fuel Cells

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

OEM

-

After Market

-

-

Energy Density Outlook (Revenue, USD Million, 2018 - 2030)

-

<100 WH/Kg

-

100 - 500 WH/Kg

-

>500 WH/Kg

-

-

Regional Outlook (Volume, Million Nm3/hr, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global marine battery market size was estimated at USD 595.15 million in 2023 and is expected to reach USD 677.82 million in 2024.

b. The global marine battery market is expected to grow at a compound annual growth rate of 16.1% from 2024 to 2030 to reach USD 1,662.20 million by 2030.

b. Based on battery type, lithium was the dominant segment in 2023 with a revenue share of about 62.69% in 2023. This is attributable to to their high energy density, efficiency, and reliability, making them ideal for powering marine vessels and onboard systems. Additionally, advancements in lithium battery technology have further bolstered their popularity, driving their widespread adoption across various segments of the maritime industry.

b. Some of the key players operating in this industry include Corvus Energy, Leclanché S.A., Siemens AG, Saft SA, Shift Clean Energy, Echandia Marine AB, EST Floattech, Sensata Technolgies Inc., Powertech Systems, Lifeline Batteries.

b. The growing demand for electric and hybrid propulsion systems in the maritime industry drives the marine battery market by increasing the need for high-performance batteries to power these eco-friendly propulsion technologies. This trend reflects a broader shift towards sustainability and emissions reduction in the marine sector, fueling innovation and growth in marine battery solutions.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."