- Home

- »

- Advanced Interior Materials

- »

-

Marble Market Size, Share & Trends, Industry Report, 2030GVR Report cover

![Marble Market Size, Share & Trends Report]()

Marble Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Tiles Or Slabs, Blocks), By Application (Building & Construction, Statues & Monuments, Furniture), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68040-141-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Marble Market Summary

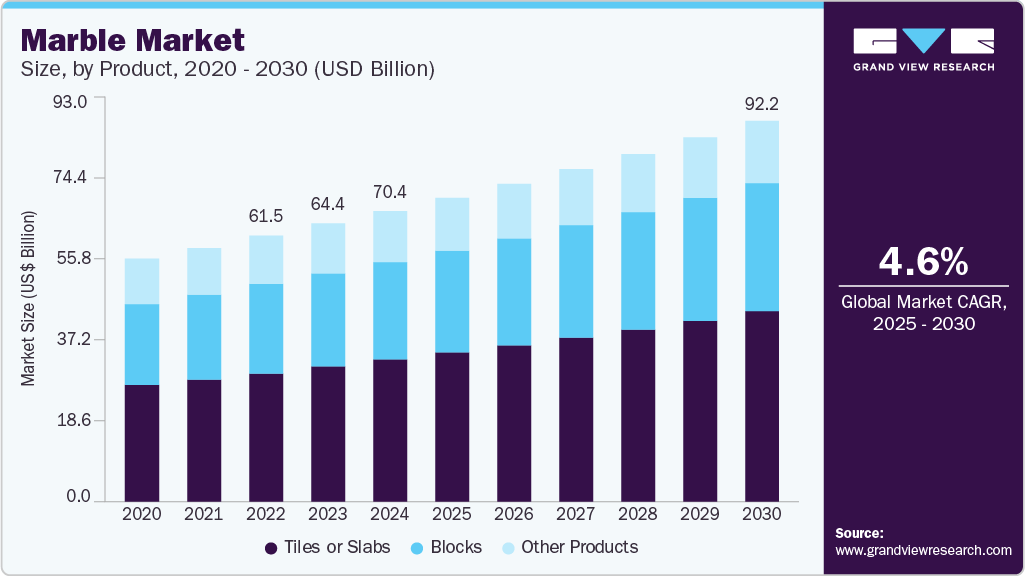

The global marble market size was estimated at USD 70.42 billion in 2024 and is projected to reach USD 92.23 billion by 2030, growing at a CAGR of 4.6% from 2025 to 2030. The market is anticipated to witness growth till 2030 on account of the rise in the construction of residential and commercial buildings around the world.

Key Market Trends & Insights

- The marble market in Asia Pacific dominated the global market and accounted for approximately 45% of the overall revenue in 2024.

- The U.S. decentralized finance market held a dominant position in 2024.

- Based on product, the tiles or slabs segment dominated with more than 45% of the overall market in 2024 in terms of revenue.

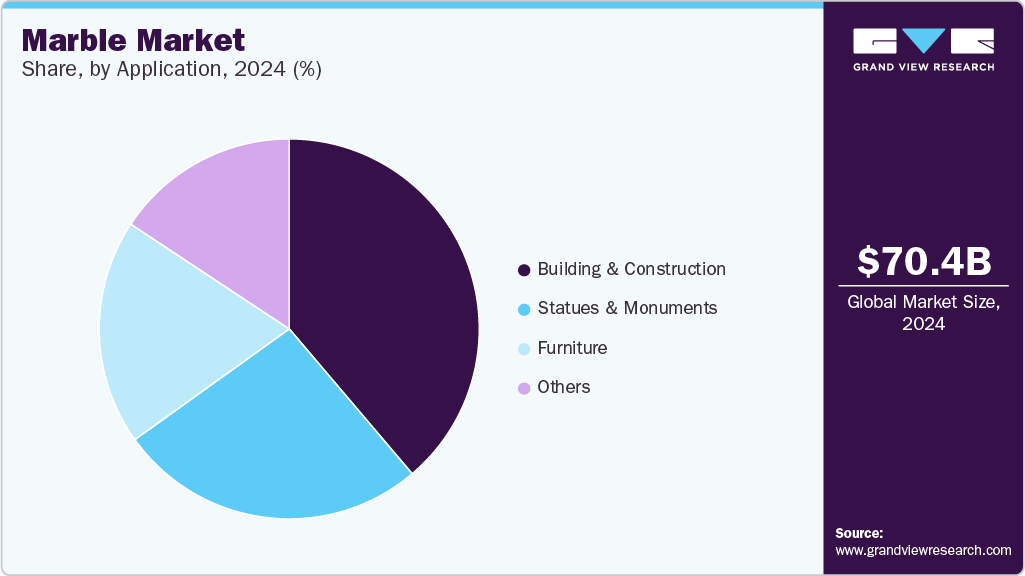

- Based on application, the building and construction segment accounted for the largest revenue share of 38.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 70.42 Billion

- 2030 Projected Market Size: USD 92.23 Billion

- CAGR (2025-2030): 4.6%

- Asia Pacific: Largest market in 2024

The adoption of natural stone has gained popularity as a result of the increasing purchasing power of the population around the world and increased customer readiness to pay for natural and long-lasting stone floorings for residential and commercial premium structures. The market is projected to grow substantially during the forecast period due to the rising use of marble in the interior decoration of venues like religious centers, hotels, museums, and others. The product is becoming increasingly popular with consumers around the globe owing to its durability, strength, and polished finish.

The U.S. is one of the major markets for marble on account of its highly developed economy, growing construction spending, combined with a highly skilled workforce, and R&D initiatives to encourage product innovation. Major cities, including Atlanta, Augusta, Columbus, and Macon, are witnessing a surge in residential and commercial building construction. For instance, the construction of quarry yards in Atlanta, a mixed-use development program for retail buildings, apartments, and hotel construction, is expected to add growth to the marble market.

The first step in the supply chain is extracting raw marble blocks from quarries. These quarries may be found all over the world, each with its distinct color, texture, and quality. The retrieved blocks are subsequently transferred to processing plants, where they are sliced, polished, and finished. After being turned into slabs or tiles, these products are distributed to end-users such as construction firms, interior designers, and individual customers via wholesalers and retailers.

Marble is a rock generated from the metamorphism of calcite with additional impurities such as quartz, graphite, mica, and clay. China, Italy, Turkey, India, and Spain are among the leading marble-producing countries, accounting for a substantial share of the global production. In contrast, the United States and China are major importers of marble products.

However, due to the strong demand for marble and limited deposits of high-quality material, several areas are concerned about resource depletion. Moreover, quarrying and processing processes can have negative environmental consequences such as habitat damage, deforestation, and landscape distortion. Along with that, the energy-intensive nature of marble processing adds to carbon emissions causing environmental degradation.

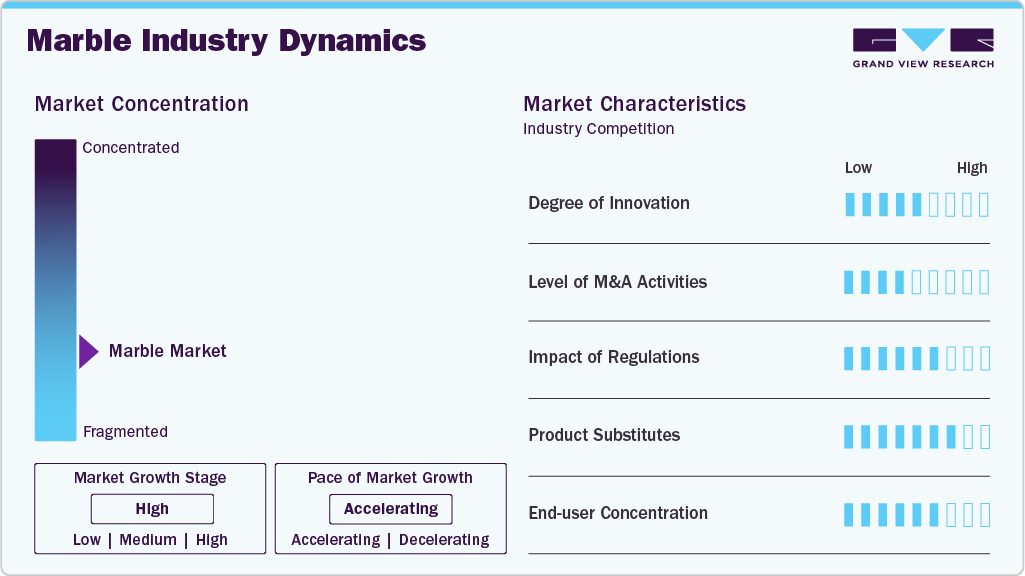

Market Concentration & Characteristics

Innovation in the marble market is centered around enhanced quarrying techniques, precision cutting technologies, and sustainable processing methods that reduce waste and environmental impact. Digital tools such as 3D modeling and CNC machines are enabling customized designs and finishes, expanding marble’s application in modern architecture and interior design. Additionally, advancements in surface treatments are making marble more durable, stain-resistant, and suitable for high-traffic areas, increasing its appeal in both residential and commercial sectors.

The marble market faces increasing competition from substitutes such as engineered quartz, porcelain tiles, granite, and even high-quality vinyl and laminate surfaces. These alternatives often offer greater durability, lower maintenance, and more consistent color patterns at a lower cost, making them attractive to budget-conscious consumers and commercial builders. The growing focus on sustainability is also encouraging the adoption of recycled or composite materials, posing a long-term threat to natural marble demand.

Product Insights

Tiles or slabs dominated the product segment with more than 45% of the overall market in 2024 in terms of revenue. Slabs have a distinct aesthetic with a variety of color combinations and decorative patterns compared to their counterparts. As marble is not man-made, the patterns seen in each tile or slab vary somewhat, allowing producers to provide end-users with customized goods.

Tiles or slabs are durable, easy to clean, provide heat conduction, eco-friendly, and easy to customize. Furthermore, marble tiles are allergen resistant owing to their low porosity and density making them ideal for residential, commercial, or hotel end-uses. Marble kitchen slabs are ideal for both residential and commercial kitchens as they do not conduct heat, making them ideal for cooking keeping the kitchen from getting hot while cooking.

Blocks are extensively used in construction as well as in the carving & arts industries. Large blocks are used for carving out statues and art pieces for museums or art galleries owing to their ability to easily cut and carve. Blocks are often mined from the quarry and a large-diameter diamond saw cuts a block of marble into dimension stone at a factory. The geometric measurements of the marble block and other stones are normally in rectangular cubes. Blocks are used for stair treads, facing stones, cemetery stones, window sills, ashlars, sculptures, benches, and paving stones among others.

Application Insights

The building and construction segment accounted for the largest application with a revenue share of 38.8% in 2024. The segment is inclusive of residential, commercial, industrial, and institutional buildings. Marble is commonly utilized in construction for flooring, wall cladding, facades, and ornamental features. Due to its natural beauty and durability, it is the ideal material for high-end commercial and residential structures.

For generations, sculptors have preferred marble as a medium. Because of its workability, artists may make detailed masterpieces, adding to cultural legacy and craftsmanship. As marble is more expensive compared to other materials, it has been used for making rare statues and sculptures. The high durability, high-quality finish, and easy-to-cut properties of marble are projected to drive the market growth for the statues and monuments application segment over the forecast period.

Marble furniture is expected to grow at a substantial CAGR over the forecast period as it is used in the creation of furniture, tabletops, worktops, and ornamental items. Marble furniture is aesthetically pleasing, durable, elegant, and eco-friendly. In addition, the furniture items are available in variant colors and designs leading to higher growth of the market over the forecast period.

Other application segment includes landscaping and religious and historical buildings. Marble is utilized in outdoor settings for walks, fountains, and garden ornaments, increasing the attractiveness of gardens and public places. Furthermore, the usage of marble may be found in many prominent religious and historical structures, like the Taj Mahal and the Parthenon owing to their moisture-resistant properties.

Regional Insights

The marble market in Asia Pacific dominated the global market and accounted for approximately 45% of the overall revenue in 2024. The Asia Pacific market is experiencing robust growth due to rapid urbanization, industrial development, and a surge in residential and commercial construction across countries like India, Japan, South Korea, and Southeast Asian nations. Rising disposable incomes and the increasing adoption of luxury lifestyles are pushing demand for premium interior materials like marble. Additionally, government infrastructure initiatives and growing foreign direct investments in real estate and hospitality are further driving market expansion in this region.

China marble market is the world’s largest producer and consumer of marble, driven by massive infrastructure development, urbanization, and government-led construction. The booming real estate sector and the increasing use of marble in commercial and residential interiors further bolster the demand. Moreover, China’s growing middle class has driven a shift toward luxury home décor, where marble is viewed as a status symbol, thereby fueling demand.

Europe Marble Market Trends

Europe holds a significant share in the global marble market, with countries like Italy, Spain, and Greece leading in production and exports. The demand is primarily driven by high-end architectural and restoration projects, particularly in heritage and historic buildings. Increasing investments in luxury real estate and tourism infrastructure are also enhancing marble consumption, especially in Mediterranean countries known for classical aesthetics.

Germany marble market known for its precision in engineering and construction, shows a steady demand for marble, particularly in commercial real estate, upscale interiors, and urban redevelopment projects. The growing trend of sustainable and aesthetic building materials is pushing demand for natural stones like marble. Moreover, rising consumer preference for premium finishes in kitchens and bathrooms further supports the market.

North America Marble Market Trends

The North American marble market is growing due to a resurgence in residential construction, renovation activities, and an increasing focus on luxurious and eco-friendly interior materials. The use of marble in countertops, flooring, and bathroom vanities is rising. Technological advancements in quarrying and processing are also making marble more accessible and customizable, expanding its application across modern architecture.

U.S. Marble Market Trends

In the U.S., marble demand is driven by both residential and commercial construction, especially in high-end home remodeling. The trend of open kitchens and spa-like bathrooms fuels the popularity of marble surfaces. Additionally, increasing disposable income and consumer inclination toward premium aesthetics in interior design contribute significantly to market growth.

Latin America Marble Market Trends

Marble market in the Latin America is expanding gradually due to urban development, rising middle-class income, and increased investments in commercial real estate and tourism infrastructure. Countries like Brazil and Mexico are witnessing growing demand for marble in luxury hotels, resorts, and modern residential buildings, where natural stone is valued for its durability and visual appeal.

Middle East & Africa Marble Market Trends

The Middle East & Africa region is witnessing rapid growth in the marble market due to large-scale construction and infrastructure projects, particularly in the Gulf countries. Iconic real estate developments, religious structures, and luxury hospitality projects are major demand drivers. The cultural affinity for opulent architectural styles that heavily use marble further supports market growth in this region.

Key Marble Company Insights

Some of the key players operating in market include Fox Marble and Kangli Stone Group

-

Fox Marble is a London-based company specializing in quarrying and processing high-quality marble and limestone. Operating quarries in Kosovo and North Macedonia, it offers a diverse range of marble varieties, including the premium Alexandrian White from its Prilep quarry. Fox Marble caters to both domestic and international markets, supplying marble in block, slab, and cut-to-size formats

-

Established in 1989, Kangli Stone Group is one of China's leading stone manufacturers, with extensive operations across the country. The company operates multiple production bases and has supplied stone for over 500 building projects globally. Kangli's product portfolio includes marble, granite, and quartz, serving markets in Europe, America, the Middle East, and Southeast Asia.

China Kingstone Mining Holdings Limited & Daltile are some of the emerging market participants in marble market.

-

Headquartered in Mianyang, Sichuan, China Kingstone Mining Holdings Limited is engaged in the production and sale of marble. The company owns and operates the Zhangjiaba and Tujisi mines, producing premium beige marble slabs and blocks. Additionally, it offers design and construction services for curtain wall engineering and building decoration through its subsidiaries.

-

Daltile is a prominent U.S.-based manufacturer and distributor of ceramic, porcelain, and natural stone tiles, including marble. Its marble offerings encompass a wide range of products such as mosaics, decorative tiles, and large slabs suitable for countertops and flooring. Daltile's collections feature popular marble varieties like Carrara White and Calacatta Gold, catering to both residential and commercial markets.

Key Marble Companies:

The following are the leading companies in the marble market. These companies collectively hold the largest market share and dictate industry trends.

- Antolini Luigi & C SpA

- BC Marble Products Ltd

- Levantina y Asociados de Minerales, S.A.

- Fox Marble

- Kangli stone group

- Best Cheer Stone

- Kingstone Mining Holdings Ltd.

- China Kingstone Mining Holdings Ltd.

- Daltile

- HELLENIC GRANITE Co.

- Topalidis SA

- Santucci Group Srl

Recent Developments

-

In June 2023, Fox Marble completed a reverse takeover by Eco Buildings Group Ltd., transitioning into a modular housing company listed on the AIM market in London. This strategic shift aims to expand production capacity and fulfill existing sales contracts, leveraging Fox Marble's marble and limestone quarries in Kosovo.

Marble Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 73.66 billion

Revenue forecast in 2030

USD 92.23 billion

Growth rate

CAGR of 4.6% from 2025 to 2030

Base year for estimation

2024

Actual estimates/Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; Brazil; Argentina

Segments covered

Product, application, region

Key companies profiled

Antolini Luigi & C SpA; BC Marble Products Ltd; Levantina y Asociados de Minerales S.A; Fox Marble; Kangli stone group; Best Cheer Stone; Kingstone Mining Holdings Limited; China Kingstone Mining Holdings Limited; Daltile; Hellenic Granite Co.; Topalidis SA; Santucci Group Srl

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Marble Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the marble market based on product, application, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Tiles or Slabs

-

Blocks

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Building and Construction

-

Statues and Monuments

-

Furniture

-

Other Applications

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global marble market size was estimated at USD 70.42 billion in 2024 and is expected to reach USD 73.66 billion in 2025.

b. The global marble market is expected to grow at a compound annual growth rate of 4.6% from 2025 to 2030 to reach USD 92.23 billion by 2030.

b. Among products, tiles or slabs dominated the marble market with approximately 50% share in 2024 owing to their application in flooring, countertops, fireplace, among others.

b. Some of the key players operating in the marble market include Antolini Luigi & C SpA, BC Marble Products Ltd, Levantina y Asociados de Minerales, S.A, Fox Marble, and Kangli stone group.

b. The key factor which is driving marble market is growing construction expenditures of economies around the globe and rise in industrial and commercial activities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.