- Home

- »

- Next Generation Technologies

- »

-

Manufacturing Automation Market Size & Share Report, 2030GVR Report cover

![Manufacturing Automation Market Size, Share & Trends Report]()

Manufacturing Automation Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology, By Component, By Deployment, By End-use, By Industry Vertical, By Application, By Solution, By Enterprise Size, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-465-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Manufacturing Automation Market Summary

The global manufacturing automation market size was estimated at USD 12.28 billion in 2023 and is projected to reach USD 23.96 billion by 2030, growing at a CAGR of 9.7% from 2024 to 2030. The growing adoption of Industry 4.0, the commercialization of next-generation networks (NGNs), and the growing emphasis on optimum resource utilization and improved efficiency drive higher adoption rates of industrial automation services.

Key Market Trends & Insights

- The manufacturing automation market in Europe accounted for the highest revenue share of over 30% in 2023.

- The manufacturing automation market in the U.S. accounted for a revenue share of over 63% in 2023.

- By component, Hardware accounted for the largest market share of over 52% in 2023.

- By End-use, The discrete manufacturing segment accounted for the largest share in 2023.

- By technology, The PLC segment accounted for the largest market share in 2023

Market Size & Forecast

- 2023 Market Size: USD 12.28 Billion

- 2030 Projected Market Size: USD 23.96 Billion

- CAGR (2024-2030): 9.7%

- Europe: Largest market in 2023

- Asia Pacific: Fastest growing market

In addition, rapid technological advancements and the adoption of new systems and networking architectures are expected to further fuel the market growth in the coming years. The growing demand for operational efficiency and productivity improvement drives market growth. Automation technologies, such as robotics, artificial intelligence (AI), and machine learning (ML), help manufacturers streamline processes, reduce manual intervention, and minimize human errors. By optimizing production lines, these solutions contribute to faster production cycles, cost savings, and consistent quality. This trend is expected to enhance the market expansion in the coming years.

In addition, manufacturers worldwide face rising labor costs and a shortage of skilled workers, driving them to invest in automation technologies. The integration of advanced technologies into manufacturing processes, characterized by the increasing demand for interconnected systems that facilitate real-time data analysis and decision-making, which is essential for optimizing production processes, is driving the market expansion.

Furthermore, the increasing adoption of sustainable manufacturing practices is accelerating market growth. Companies are adopting automation to reduce energy consumption, minimize waste, and optimize resource use, aligning with global efforts toward greener production. Automation technologies help monitor energy usage and improve resource efficiency, thus supporting the shift toward more eco-friendly manufacturing processes and driving growth in markets with strict regulatory requirements.

Moreover, rising labor costs and workforce shortages are expected to drive market growth in the coming years. This ongoing trend is compelling companies to invest in automation technologies. In addition, the rising consumer demand for customized products necessitates flexible manufacturing systems that can quickly adapt to changing market demands, thereby fueling market expansion.

Technology Insights

The PLC segment accounted for the largest market share in 2023, owing toits widespread adoption across various sectors, including automotive, food processing, and pharmaceuticals. Their ability to withstand harsh industrial environments while offering flexibility in programming makes them an essential component of modern manufacturing systems. As manufacturers upgrade their facilities with advanced automation technologies, the segment is expected to grow significantly in the coming years.

The robotics segment is expected to witness the fastest CAGR from 2024 to 2030, driven by the growing demand for robotic automation in enhancing productivity and safety in manufacturing environments. Robots can perform repetitive tasks with high precision, reducing human error and workplace injuries. In addition, the rapid advancements in robotics technology-including collaborative robots (cobots) that work alongside human operators-are expected to drive adoption rates higher across various industries.

Component Insights

Hardware accounted for the largest market share of over 52% in 2023. The demand for hardware solutions is driven by ongoing investments in upgrading existing infrastructure with state-of-the-art technology that supports complex automation tasks. As manufacturers strive for enhanced operational efficiency through integrated hardware-software ecosystems, the segment is expected to contribute significantly to market growth. Furthermore, ongoing investments in smart factories and Industry 4.0 initiatives drive the robust demand for advanced hardware solutions, prioritizing automation and connectivity, thereby driving segmental growth.

The services segment is expected to witness the fastest CAGR of 11.0% from 2024 to 2030. The increasing need for specialized services such as system integration, maintenance, and support for automation technologies fuels this growth. As manufacturers implement more complex automated systems, the demand for expert services that ensure optimal performance and uptime will rise. Furthermore, the shift towards subscription-based service models in automation solutions will likely enhance customer engagement and satisfaction, contributing to this segment's rapid expansion.

Deployment Insights

The on-premises segment accounted for the largest share in 2023. This growth can be attributed to several factors, including data security concerns and regulatory compliance requirements that necessitate local data storage. Many organizations prefer on-premises solutions because they offer greater control over their systems and data management processes. Furthermore, industries with stringent compliance mandates often find on-premises systems more suitable for meeting their specific needs, further fueling segmental growth.

The cloud-based segment will record the fastest growth from 2024 to 2030. This growth can be attributed to the increasing adoption of cloud technologies across various industries, enabling companies to enhance operational efficiency, reduce costs, and improve scalability. As organizations increasingly rely on cloud solutions for data management and analytics, the demand for cloud-based manufacturing automation is expected to surge in the coming years. This trend aligns with the broader digital transformation initiatives many businesses undertake to remain competitive in a rapidly evolving market.

End-use Insights

The discrete manufacturing segment accounted for the largest share in 2023. This growth can be attributed to its reliance on advanced technologies that enhance efficiency and productivity. Integrating automation solutions in discrete manufacturing allows for precise control over production processes, reducing waste and improving quality. As industries increasingly adopt smart manufacturing practices driven by Industry 4.0 initiatives, the demand for automation solutions in discrete manufacturing is expected to grow rapidly.

The process manufacturing segment is anticipated to grow fastest from 2024 to 2030.The increasing complexity of regulatory requirements and the need for consistent product quality drive investments in process automation solutions. Furthermore, technological advancements such as IoT (Internet of Things) and AI (Artificial Intelligence) enable real-time monitoring and control of processes, further enhancing operational efficiencies and driving segmental growth.

Industry Vertical Insights

The automotive segment accounted for the largest share in 2023. This growth is largely attributed to its reliance on automated processes for vehicle assembly and production efficiency. Major automotive manufacturers are investing extensively in robotics on assembly lines, which has led to improved output and enhanced safety standards within factories. This is expected to contribute to segmental growth in the coming years.

The healthcare segment is anticipated to record the fastest growth from 2024 to 2030, driven by the increasing demand for efficient and high-quality healthcare services, which necessitates the adoption of advanced automation technologies to streamline operations, reduce human error, and enhance patient outcomes. In addition, the rise of personalized medicine and complex drug formulations requires sophisticated manufacturing processes that can be optimized through automation and investments in robotics, artificial intelligence (AI), and Internet of Things (IoT) technologies, which are expected to surge in the coming years, thereby driving segmental growth.

Application Insights

The assembly line segment in the market accounted for the largest share in 2023. This growth can be attributed to its foundational role in mass production processes across numerous industries, such as automotive and electronics. Assembly lines enable high-volume production with consistent quality by streamlining workflows through mechanization and automation techniques. Companies have invested heavily in modernizing their assembly lines with smart technologies that enhance productivity while reducing waste.

The material handling segment is anticipated to record the fastest growth from 2024 to 2030. Organizations increasingly recognize its importance in optimizing supply chain operations. Automated solutions such as Automated Guided Vehicles (AGVs) and conveyor systems are widely adopted for their ability to enhance efficiency in transporting materials within facilities. E-commerce has also propelled demand for effective material handling solutions accommodating fast-paced order fulfillment processes.

Solution Insights

Control systems accounted for the largest revenue market share in 2023. This growth can be attributed to its critical role in managing automated processes across various industries. Control systems ensure precision and reliability in manufacturing operations, allowing companies to monitor performance metrics and make real-time adjustments. Industries increasingly focus on optimizing production lines through data-driven decision-making, driving segmental growth.

The robotics and autonomous segment is anticipated to record significant growth from 2024 to 2030, driven by advancements in AI and machine learning technologies. The increasing demand for flexible automation solutions that adapt quickly to changing production requirements pushes manufacturers toward robotic systems capable of performing complex tasks with minimal human intervention. Furthermore, as labor shortages become more pronounced across various sectors, companies are turning towards robotics as a viable solution for maintaining productivity levels while ensuring safety in hazardous environments.

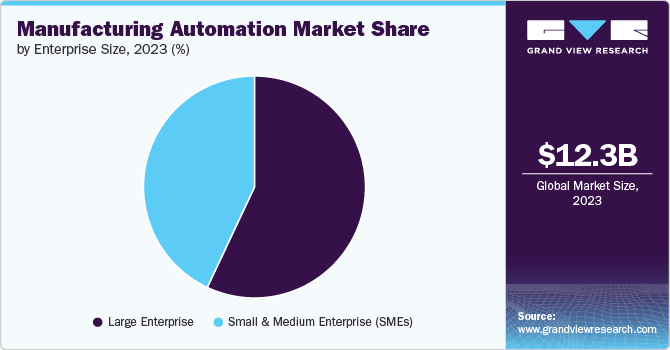

Enterprise Size Insights

The large enterprise segment accounted for the largest share in 2023. This growth can be attributedto the substantial investments made by large corporations in advanced technologies. These enterprises typically have more resources for automation solutions, enabling them to enhance efficiency, reduce operational costs, and improve product quality. Adopting Industry 4.0 principles has further propelled large enterprises to integrate sophisticated automation systems into their operations.

The small and medium enterprise segment (SME’s) is anticipated to record the fastest growth from 2024 to 2030. This growth can be attributed to several factors, including increased accessibility of automation technologies that were previously only affordable for larger firms. Advances in cloud computing and IoT have enabled SMEs to implement cost-effective automation solutions without significant upfront investment. Moreover, government initiatives promoting digital transformation among SMEs are expected to expand this segment further as these businesses strive for greater efficiency and competitiveness.

Regional Insights

The North America region is projected to grow at a CAGR of over 8% from 2024 to 2030, driven by the increasing demand for operational efficiency and productivity improvements across various industries. Adopting advanced technologies such as robotics, artificial intelligence (AI), and the Internet of Things (IoT) has been a significant trend, enabling manufacturers to optimize their processes and reduce labor costs. The push towards smart factories and Industry 4.0 initiatives has also accelerated investments in automation solutions.

U.S. Manufacturing Automation Market Trends

The manufacturing automation market in the U.S. accounted for a revenue share of over 63% in 2023. In the U.S., there is a growing emphasis on sustainability and energy efficiency, prompting manufacturers to adopt automated solutions that minimize waste and optimize resource utilization, thereby driving market growth. In addition, the ongoing trade tensions and supply chain disruptions have also led companies in the U.S. to reconsider their operational strategies, further driving the demand for automation.

Europe Manufacturing Automation Market Trends

The manufacturing automation market in Europe accounted for the highest revenue share of over 30% in 2023. In Europe, the trend towards digital transformation is growing, with many companies implementing Industry 4.0 practices to enhance connectivity between machines and systems. Furthermore, the aging workforce in Europe has created a pressing need for automation to fill skill gaps while maintaining production levels. Innovations in robotics technology, particularly collaborative robots (cobots), are gaining traction as they allow human workers to work alongside machines safely.

Asia Pacific Manufacturing Automation Market Trends

The manufacturing automation market in the Asia Pacific region is expected to grow at the highest CAGR of 11% from 2024 to 2030. Countries in the region are at the forefront of adopting advanced manufacturing technologies such as AI-driven robotics and smart sensors. The trend toward digitalization in manufacturing processes is fueled by government initiatives to enhance competitiveness through innovation.

Key Manufacturing Automation Company Insights

Some key players operating in the market include ABB Ltd. and Rockwell Automation, Inc..

-

ABB Ltd. is one of the key players in electrification and automation technologies and specializes in providing innovative solutions that enhance productivity and efficiency across various industries, including manufacturing, utilities, transportation, and infrastructure. Their portfolio includes robotics, industrial automation systems, and digital solutions that leverage artificial intelligence and machine learning to optimize operations.

-

Rockwell Automation Inc. offers a wide range of products, including programmable logic controllers (PLCs), human-machine interfaces (HMIs), sensors, and data analytics software. The company emphasizes innovation, which enables real-time data access for better decision-making. With a strong focus on smart manufacturing and Industry 4.0 initiatives, the company aims to empower businesses to achieve greater agility and competitiveness.

Omron Corporation and Honeywell International, Inc. are some of the emerging market participants.

-

Omron Corporation is a player in automation technology and manufacturing solutions. The company specializes in various products, including industrial automation equipment, electronic components, and healthcare devices. It focuses on integrating advanced technologies such as artificial intelligence and IoT into its automation solutions.

-

Honeywell International, Inc. operates in various sectors, including aerospace, building technologies, performance materials and technologies, and safety and productivity solutions. The company focuses on enhancing operational efficiency and safety for its clients across diverse industries such as oil and gas, manufacturing, healthcare, and logistics. With a strong commitment to sustainability and innovation, the company aims to provide smart solutions that optimize processes while reducing environmental impact.

Key Manufacturing Automation Companies:

The following are the leading companies in the manufacturing automation market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- FANUC CORPORATION

- Honeywell International, Inc.

- Mitsubishi Electric Corporation

- Motoman (Yaskawa America, Inc.)

- Omron Corporation

- Reko Automation Inc.

- Rockwell Automation Inc.

- Schneider Electric

- Teradyne, Inc.

Recent Developments

-

In June 2024, Honeywell International, Inc. launched its Battery Manufacturing Excellence Platform (Battery MXP), an AI-powered software solution aimed at revolutionizing large-scale battery manufacturing, designed to optimize giga factory operations from the outset by improving battery cell yields and accelerating facility startups.

-

In April 2024, Honeywell International, Inc. announced several key developments in its automation solutions, highlighting advancements in digital transformation and sustainability initiatives. The company unveiled new products designed to enhance operational efficiency and safety across various industries, including manufacturing and logistics.

-

In September 2023, ABB Ltd. announced a significant investment of $280 million to expand its manufacturing footprint in Europe and build a new state-of-the-art ABB Robotics European Campus in Sweden. The investment aims to enhance ABB's ability to meet the growing demand for robotics and automation solutions close to its European customers.

Manufacturing Automation Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.73 billion

Revenue forecast in 2030

USD 23.96 billion

Growth rate

CAGR of 9.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report Component

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, technology, end-use, application, industry vertical, solution, enterprise size, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

ABB Ltd.; FANUC CORPORATION; Honeywell International, Inc.; Mitsubishi Electric Corporation; Motoman (Yaskawa America, Inc.); Omron Corporation; Reko Automation Inc.; Rockwell Automation Inc.; Schneider Electric; Teradyne, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Manufacturing Automation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global manufacturing automation market report based on component, technology, deployment, end use, industry vertical, application, solution, enterprise size, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

Professional Services

-

Managed Services

-

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

PLC

-

Robotics

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premises

-

Cloud-based

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Discrete Manufacturing

-

Process Manufacturing

-

-

Industry Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Consumer Electronics

-

Healthcare

-

Transportation and Logistics

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Assembly Line Automation

-

Material Handling Automation

-

Welding and Fabrication Automation

-

Transportation and Logistics

-

Packaging Automation

-

Others

-

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Control Systems

-

Monitoring and Diagnostics

-

Robotics and Autonomous Systems

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Australia

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global manufacturing automation market size was estimated at USD 12.28 billion in 2023 and is expected to reach USD 13.73 billion in 2024.

b. The global manufacturing automation market is expected to grow at a compound annual growth rate of 9.7% from 2024 to 2030 to reach USD 23.96 billion by 2030.

b. North America dominated the manufacturing automation market with a share of around 27% in 2023, driven by the increasing demand for operational efficiency and productivity improvements across various industries.

b. Some key players operating in the manufacturing automation market include ABB Ltd., FANUC CORPORATION, Honeywell International, Inc., Mitsubishi Electric Corporation, Motoman (Yaskawa America, Inc.), Omron Corporation, Reko Automation Inc., Rockwell Automation Inc., Schneider Electric, and Teradyne, Inc.

b. Key factors that are driving the manufacturing automation market growth include the growing adoption of Industry 4.0, the commercialization of next-generation networks (NGNs) and the growing emphasis on optimum utilization of resources along with improved efficiency.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.