Manual Resuscitators Market Size, Share & Trends Analysis Report By Type (Self Inflating, Flow Inflating), By Modality (Disposable, Reusable), By Material (PVC, Silicon), By Technology, By Patient Type, By Application, By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-012-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Manual Resuscitators Market Size & Trends

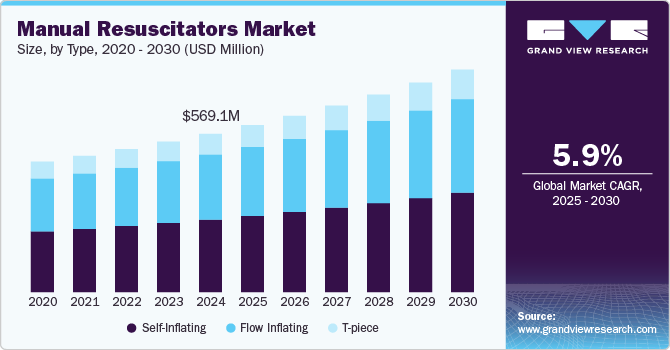

The global manual resuscitators market size was estimated at USD 569.07 million in 2024 and is expected to grow at a CAGR of 5.90% from 2025 to 2030. This is attributed to the rising prevalence of respiratory diseases, increasing adoption in emergency care settings, technological advancements, and increasing awareness. The need for effective and immediate resuscitation during emergencies, particularly in hospitals, ambulances, and clinics, pushes the demand for manual resuscitators. According to the National Centre for Biotechnology Information (NCBI), approximately 300 million people worldwide have asthma, and it is projected that an additional 100 million individuals are expected to be affected by 2025.

The rising incidence of respiratory emergencies, such as cardiac arrests and acute respiratory failure, significantly drives the market growth. According to the American Heart Association (AHA), nearly 350,000 out-of-hospital cardiac arrests occur annually in the U.S. alone. This increasing frequency of respiratory distress calls for quick interventions, with manual resuscitators being the go-to tool for providing immediate ventilation. The growing global prevalence of respiratory diseases, such as COPD and asthma, strengthens the urgent need for efficient emergency equipment.

Technological advancements in these devices are another major driver. Innovations focused on improving manual resuscitators' safety, ease of use, and portability. Advancements such as the development of self-expanding resuscitation bags and the incorporation of one-way valves have enhanced the efficiency and effectiveness of resuscitation efforts.

The COVID-19 pandemic significantly impacted the market, driving an increased demand for resuscitation equipment due to the surge in respiratory distress cases and the overwhelming need for emergency care. The pandemic caused a sharp rise in hospital admissions, particularly for patients with severe respiratory symptoms. This increased the need for manual resuscitators in both clinical and pre-hospital settings. The global shortage of ventilators also led to a greater reliance on manual resuscitators as an immediate, life-saving tool. This demand spike and supply chain disruptions led to an accelerated focus on manufacturing and distributing manual resuscitators, particularly in areas with strained healthcare systems.

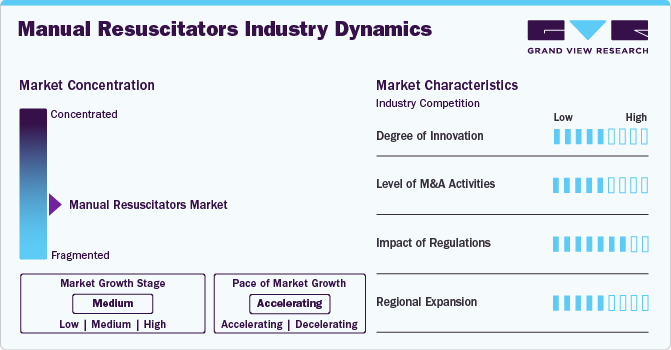

Market Concentration & Characteristics

The industry is seeing a moderate level of innovation, with manufacturers focusing on improving efficiency, portability, and ease of use. Innovations include the development of lightweight, durable designs and disposable products that reduce infection risks. For instance, companies such as Ambu have made advancements in one-way valve technology and ergonomic designs.

The industry experiences a moderate level of M&A activity, with strategic partnerships crucial for expanding market presence. Companies engage in M&A to strengthen product portfolios and broaden geographic reach. Staying up-to-date on technological advancements and regulatory changes is vital as the industry grows, with businesses focusing on expanding global outreach and reinforcing supply chains.

Regulations in the industry play a high role, as stringent safety and quality standards are critical. In the U.S., the FDA requires rigorous testing and approval processes for medical devices, including resuscitators. CE (Conformité Européene) marking in Europe ensures product compliance with safety regulations. For instance, in July 2022, Mercury Medical's manual resuscitation product line received MDR CE Mark Certification. This certification confirms that the quality system complies with Regulation (EU) 2017/745, enabling the company to sell its CPR products in the European market.

Regional expansion in the industry is medium due to increasing healthcare investments. Businesses are focusing on expanding their global outreach to capitalize on this growth. The rising demand for resuscitators in emerging economies is driven by improving healthcare infrastructure and awareness of emergency care.

Type Insights

The self-inflating segment held the largest revenue share of 45.84% in 2024, owing to their usability in hospital emergency departments such as delivery wards & neonatal units and the increasing launches of self-inflating resuscitators. For instance, in April 2020, the Vecna family of companies, including Vecna Healthcare, Vecna Robotics, and VecnaCares, collaborated with MIT CSAIL and 10XBeta, among others, to launch the automated manual resuscitator Ventiv. Ventiv automates the compression and relaxation of manual bags to offer constant pressure ventilation. It can be used with Ambu bags or any other self-inflating bag.

The flow-inflating bags segment is expected to grow with the fastest CAGR of 6.29% over the forecast period. Flow-inflating bags require an oxygen reservoir to ensure 100% oxygen flow. Flow-inflating resuscitators are majorly used in neonatal care and intensive units. According to a WHO report in 2022, approximately 47% of deaths of children under 5 years of age occur in the neonatal stage. The primary cause of death is birth asphyxia, inability to breathe at birth, or some congenital disabilities. Thus, the rising prevalence of asphyxia in neonates is expected to increase segment growth.

Modality Insights

The disposable segment held the largest revenue share of 65.51% in 2024 and is anticipated to witness the fastest CAGR during the forecast period. Patients and healthcare professionals prefer disposable resuscitators due to their low risk of infections. Rising cases of cardiopulmonary disorders are boosting the segment's growth. Based on modality, the market is segmented into reusable and disposable.

Single-use or disposable resuscitation bags are made of PVC, while reusable ones are crafted from silicone. Reusable bags are cleaned, sterilized, and reassembled, making them more cost-effective despite their higher initial price. Silicone resuscitation bags are environmentally friendly, latex-free, and odorless. In addition, they offer a softer, more comfortable feel. These benefits are anticipated to drive the growth of the reusable segment in the market.

Material Insights

The PVC segment held the largest revenue share in 2024 and is the fastest-growing market due to its cost-effectiveness, flexibility, and ease of manufacturing. PVC resuscitation bags are lightweight, durable, and disposable, making them ideal for emergency use in hospital and out-of-hospital settings. The increasing demand for affordable, single-use medical equipment and the rise in emergency response situations are key drivers for this segment. The widely used PVC Ambu bags are favored for their affordability and practical application in ambulances and emergency kits globally.

The silicone segment grew significantly and is anticipated to expand its growth from 2025 to 2030 due to its use in hospitals and outpatient settings for treating pediatric and adult patients suffering from heart and respiratory disease. Key manufacturers employ silicone-based manual resuscitators, and innovations are based on them. For instance, in September 2020, Aequs launched AQovent, a silicone-based, cost-effective, medical-grade, and mass-manufactured mechanical resuscitator. It is an emergency resuscitator driven by oxygen and automatically enables constant pressurized ventilated flow to the patients.

Technology Insights

The pop-off valve held the largest revenue share in 2024 and is anticipated to grow at the fastest CAGR, due to its critical role in preventing over-inflation and ensuring patient safety during ventilation. The pop-off valve automatically releases excess pressure, protecting the lungs from potential damage, making it an essential feature in resuscitation devices. The growing focus on reducing ventilator-associated injuries in critical care settings and the rise in emergency medical interventions for respiratory failure drive this segment's demand.

The PEEP valve segment witnessed a significant share in the market driven by its ability to enhance ventilation by maintaining positive pressure in the lungs and improving oxygenation during resuscitation. This technology is essential for treating acute respiratory distress syndrome (ARDS) and other respiratory failures, as it helps prevent alveolar collapse and facilitates better gas exchange.

Patient Type Insights

The adult held the largest revenue share of 44.09% in 2024, due to the high prevalence of respiratory and cardiac emergencies among adults. Factors such as the rising incidence of cardiovascular diseases, chronic respiratory conditions, and an aging population are key drivers. Adults experience out-of-hospital cardiac arrests, strokes, or respiratory failures, necessitating manual resuscitators for immediate ventilation. According to the Centers for Disease Control and Prevention (CDC) estimates published in March 2024, every day, emergency medical services in the U.S. evaluate around 1,000 out-of-hospital cardiac arrests (OHCAs), with nearly 90% of patients not surviving, resulting in a significant number of potential years of life lost (YPLL).

The pediatric segment is projected to grow at the fastest CAGR over the forecast period, driven by the increasing prevalence of neonatal and pediatric respiratory conditions, such as asthma, congenital anomalies, and infections. Advancements in neonatal care and the rising focus on improving pediatric emergency response systems further propel this growth. The increasing number of premature births and pediatric cardiac emergencies contribute to the growing demand for resuscitation devices designed specifically for children.

Application Insights

The Chronic Obstructive Pulmonary Disease (COPD) segment held the largest revenue share in 2024 due to the high demand for respiratory support in COPD patients. COPD’s increasing prevalence globally is driven by factors such as smoking, air pollution, and aging populations. According to the WHO 2024 estimates, COPD was the fourth leading cause of death globally in 2021, responsible for 3.5 million deaths, with nearly 90% of fatalities under 70 occurring in low- and middle-income countries. Patients require manual resuscitators during exacerbations, particularly in emergencies or when transitioning to mechanical ventilation.

The cardiopulmonary arrest segment is projected to grow at the fastest CAGR over the forecast period. Factors such as advancements in emergency care protocols, increased awareness regarding CPR, and improved survival rates in cardiac emergencies fuel this growth. The rising number of out-of-hospital cardiac arrests, coupled with growing investments in cardiopulmonary resuscitation training, raises the demand for manual resuscitators in cardiopulmonary emergencies globally. The Sudden Cardiac Arrest Foundation 2022 reports that over 356,000 out-of-hospital cardiac arrest (OHCA) incidents take place each year in the U.S., with nearly 90% resulting in death.

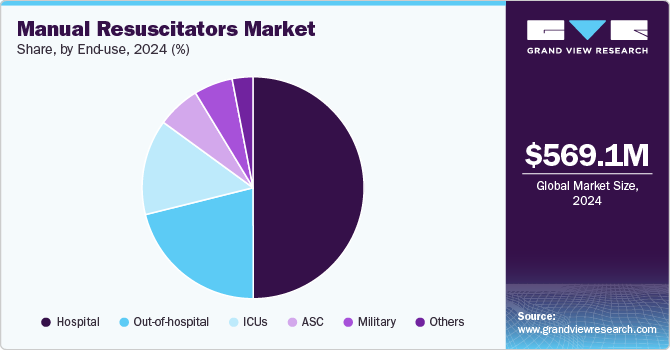

End Use Insights

The hospital segment held the largest revenue share of 49.98% in 2024 due to the high demand for reliable emergency medical equipment in critical care settings. Drivers include the growing prevalence of respiratory diseases, the increasing number of emergency procedures, and advancements in healthcare infrastructure. Hospitals require resuscitation devices for various situations, such as during surgery, trauma care, and neonatal resuscitation. Increasing hospital admissions for respiratory failures and cardiac arrests significantly drives the demand for manual resuscitators.

The ICU segment is estimated to expand at the fastest CAGR over the forecast period. This growth is attributed to the increasing number of critical care patients requiring respiratory support. The rising prevalence of severe conditions such as respiratory failure, cardiac arrest, and trauma, coupled with the growing demand for specialized care, accelerates the adoption of manual resuscitators in ICUs. Instances such as the rise in COVID-19 cases, which require intensive respiratory support and advancements in ICU care technologies further boost this growth.

Regional Insights

North America manual resuscitators market dominated global market with a revenue share of over 36.93% in 2024 due to the rising prevalence of COPD and higher infant mortality rates, primarily caused by birth asphyxia, congenital disabilities, infections, and other factors, which are significant concerns in the region.

In addition, various initiatives by research institutes to raise awareness about resuscitation in the country are expected to drive market growth during the forecast period. For instance, in April 2022, SBGHC introduced a new digital program for resuscitation education. Digital simulation stations can be placed within care settings for easy access, allowing learners to complete training on their schedule while adhering to cleaning guidelines.

U.S. Manual Resuscitators Market Trends

Manual resuscitators market in the U.S. held the largest revenue share in 2024 and is driven by several factors, including rising prevalence of chronic respiratory diseases such as COPD and asthma, and the growing number of pre-hospital and emergency care services. In addition, advancements in resuscitator designs, such as the integration of PEEP valves and disposable self-inflating bags to reduce infection risks, are enhancing product adoption.

Government initiatives to improve emergency response infrastructure, along with stringent regulations mandating the availability of resuscitation equipment in healthcare settings, are also propelling market growth. Furthermore, the increasing focus on training and awareness programs for first responders and healthcare professionals is expected to boost demand for manual resuscitators in hospitals, ambulatory care centers, and home healthcare settings.

Asia Pacific Manual Resuscitators Market Trends

The Asia Pacific manual resuscitators market is growing rapidly due to the rising demand for emergency medical equipment, especially in developing countries. The increasing adoption of advanced technologies, such as self-inflating resuscitators, provides more efficient ventilation and ease of use in emergencies. The growing prevalence of respiratory diseases and there is an emphasis on improving emergency care capabilities significantly drive the demand for manual resuscitators.

Manual resuscitators market in China is expected to grow rapidly owing to the government implemented reforms to improve medical services in rural areas, where the availability of emergency medical equipment is limited. Innovations, such as integrating digital monitoring in resuscitators, are gaining traction to improve patient outcomes. Moreover, China's manufacturing sector enables domestic production of high-quality resuscitation devices, lowering costs and increasing accessibility.

India manual resuscitators market is driven by expanding healthcare infrastructure, rising public awareness of emergency care, the increasing number of road accidents and cardiovascular diseases, and India's focus on emergency response systems. The growing emphasis is on affordable, portable resuscitation devices suitable for urban and rural settings.

India is improving its regulatory framework for medical devices, with the Drugs Controller General of India (DCGI) overseeing medical equipment approval. In September 2023, a mini cardiac medical and CPR awareness camp occurred in Madurai, India. The camp focused on educating the community about resuscitation techniques during emergencies to enhance public preparedness and potentially save lives.

Europe Manual Resuscitators Market Trends

Manual resuscitators market in Europe is growing due to increasing healthcare demands and innovations in emergency medical devices. Developing compact, lightweight, and user-friendly resuscitators aims to improve portability and effectiveness during emergencies. The European Union’s emphasis on enhancing emergency care services spurred this innovation, with several countries adopting advanced resuscitation techniques and devices. In addition, ongoing training programs in CPR and emergency response contribute to the growing need for high-quality manual resuscitators in hospitals and out-of-hospital settings.

Latin America Manual Resuscitators Market Trends

The Latin America manual resuscitators market witnessed significant growth driven by expanding healthcare infrastructure and increasing healthcare investments. Brazil saw rising demand for emergency medical devices due to a surge in respiratory conditions, pneumonia, and asthma. According to the NCBI, In Brazil, approximately 23% of adolescents and adults experience symptoms of asthma in 2024. Companies focus on improving the portability and cost-effectiveness of resuscitation equipment to cater to resource-constrained environments. In addition, the region benefits from growing public health awareness and governmental initiatives to enhance emergency care services.

Middle East & Africa Manual Resuscitators Market Trends

Manual resuscitators market in the MEA is influenced by expanding healthcare infrastructure, particularly in the Gulf Cooperation Council (GCC) countries, and increasing focus on improving emergency medical services. In the MEA region, the rapid adoption of advanced medical technologies is driven by healthcare reforms and substantial government investments. The area experienced a surge in health awareness, with a growing focus on training medical personnel in life-saving techniques such as CPR. In addition, the market is shaped by varying regulatory frameworks across countries, leading to a diverse landscape.

Key Manual Resuscitators Company Insights

Key players held significant market share through their diverse product portfolios and global presence. These companies focus on offering a range of resuscitation devices, from self-inflating resuscitators to bag-valve masks, with advanced features that cater to hospital and emergency care settings. Key strategies include partnerships, acquisitions, and innovations in product design to improve ease of use, durability, and efficiency. The market is characterized by continuous product development and expansion into emerging regions, as companies aim to meet the increasing demand for life-saving respiratory support devices across various healthcare environments.

Key Manual Resuscitators Companies:

The following are the leading companies in the manual resuscitators market. These companies collectively hold the largest market share and dictate industry trends.

- WEINMANN Emergency Medical Technology GmbH + Co. KG

- Laerdal Medical

- Ambu A/S

- Medline Industries, LP

- VYAIRE

- ResMed

- HUM GmbH

- CareFusion (Acquired by BD in 2014)

- Medtronic Plc

- Teleflex Inc.

- Hopkins Medical Products (marketlab)

- PerSys Medical (Safeguard)

Recent Developments

-

In September 2023, a mini cardiac medical and CPR awareness camp occurred in Madurai, India. The camp focused on educating the community about resuscitation techniques during emergencies to enhance public preparedness and potentially save lives.

-

In February 2022, Dr. Prathamesh Prabhudesai was awarded a USD 1 million grant by the U.S. National Science Foundation (NSF) to develop a user-friendly manual resuscitator that requires minimal training.

Manual Resuscitators Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 600.08 million |

|

Revenue forecast in 2030 |

USD 799.25 million |

|

Growth rate |

CAGR of 5.90% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

February 2025 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, modality, material, technology, patient type, application, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Sweden; Denmark; Norway; Asia Pacific; Japan; China; India; Australia; South Korea; Thailand; Latin America; Brazil; Argentina; Middle East & Africa; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

WEINMANN Emergency Medical Technology GmbH + Co. KG; Laerdal Medical; Ambu A/S; Medline Industries, LP; VYAIRE; ResMed; HUM GmbH; CareFusion (Acquired by BD in 2014); Medtronic Plc; Teleflex Inc.; Hopkins Medical Products (marketlab); PerSys Medical (Safeguard) |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Manual Resuscitators Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global manual resuscitators market report based on type, modality, material, technology, patient type, application, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Self-Inflating

-

Flow Inflating

-

T-piece

-

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Disposable

-

Reusable

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Silicon

-

PVC

-

Rubber

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Pop-off valve

-

PEEP Valve

-

Others

-

-

Patient Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Adult

-

Pediatric

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chronic Obstructive Pulmonary Disease

-

Cardiopulmonary Arrest

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Out-of-hospital

-

ICUs

-

ASC

-

Military

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018-2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global manual resuscitators market size was estimated at USD 569.07 million in 2024 and is expected to reach USD 600.08 million in 2025.

b. The global manual resuscitators market is expected to grow at a compound annual growth rate of 5.90% from 2025 to 2030 to reach USD 799.25 million by 2030.

b. North America dominated the manual resuscitators market with a share of 36.93% in 2024. The introduction of state-of-the-art resuscitation products and training kits to reduce the chances of delayed ventilation are the major drivers of the market.

b. Some key players operating in the manual resuscitators market include WEINMANN Emergency Medical Technology GmbH + Co. KG, Laerdal Medical, Ambu A/S, Medline Industries, LP, VYAIRE, ResMed, HUM GmbH, CareFusion (Acquired by BD in 2014), Medtronic Plc, Teleflex Inc., Hopkins Medical Products (marketlab), and PerSys Medical (Safeguard)

b. Key factors that are driving the manual resuscitators market growth include increasing incidence rates of cardiac arrest, increasing awareness initiatives and simulation websites, and the need for neonatal care.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."