- Home

- »

- Beauty & Personal Care

- »

-

Mannequin Market Size, Share And Trends Report, 2030GVR Report cover

![Mannequin Market Size, Share & Trends Report]()

Mannequin Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Fiberglass, Plastic), By Type (Women, Men, Infant & Toddlers), By End-user (Retailers, Fashion Designers & Boutiques, Beauticians, Hair Professionals), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-151-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Mannequin Market Summary

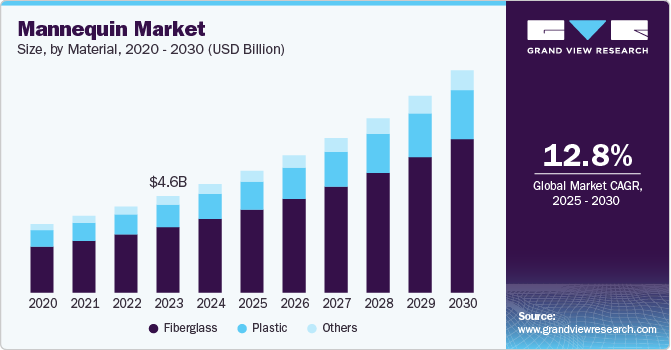

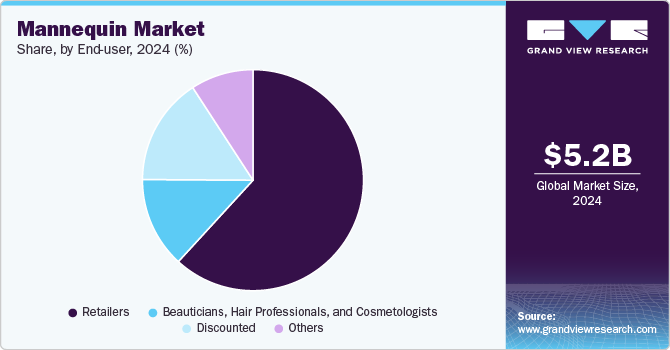

The global mannequin market size was estimated at USD 5,174.9 million in 2024 and is expected to reach USD 10,612.1 million by 2030, growing at a CAGR of 12.8% from 2025 to 2030. The continuous expansion of the global retail industry, coupled with fashion industry growth, is driving the demand for mannequins, which serve as vital tools for physical stores.

Key Market Trends & Insights

- Europe accounted for a share of over 26% of the global market revenue in 2024.

- U.S. is expected to grow at a CAGR of 12.1% from 2025 to 2030.

- By material, fiberglass mannequins segment contributed to a revenue share of 67.9% in the global market in 2024.

- By type, women mannequin sales segment accounted for a share of 57% in the global market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5,174.9 Million

- 2030 Projected Market Size: USD 10,612.1 Million

- CAGR (2025-2030): 12.8%

- Europe: Largest market in 2024

In addition, changing store layouts and emphasizing experiential shopping necessitate innovative and aesthetically pleasing mannequins, further contributing to the market's growth. The mannequin market is undergoing a crucial evolution beyond mere fashion displays. Initially, mannequins were only used to display fashion apparel as a part of a larger merchandising strategy, but now they serve as powerful tools for retailers to reinforce brand values and create customer loyalty. Retailers realize that mannequins are more than just a way to showcase clothing; they are storytelling vehicles that help customers see themselves reflected in the brand. Therefore, there is a growing preference for mannequins in different body forms. There is a growing demand for more representative mannequin figures than unrealistic models which drives a positive shopping experience for customers.

Mannequins play a pivotal role in the retail industry due to their ability to attract customers and boost the sell-through rate of apparel. According to industry experts, mannequins provide visual cues about style, demonstrate outfit combinations, and help shoppers envision how clothes will fit without trying them on. Retailers, recognizing the importance of body diversity, are incorporating various mannequin types to cater to a wider audience.

The growing trade in mannequins is projected to contribute to market growth positively. Between 2020 and 2021, the global mannequin market experienced significant growth, with exports increasing by 35.1%. China was the leading exporter, followed by Italy, Spain, Germany, and Mexico, while the U.S. was the largest importer, followed by Japan, Malaysia, Germany, and France. The fashion industry globally is thriving, which is supporting the increasing trade of mannequins. Retailers are also investing in visual merchandising tools such as mannequins to enhance their sales strategies and customer experience. For instance, retailers, such as Target, are dedicating significant store space to mannequins, indicating commitment to enhancing their merchandising efforts.

Material Insights

In 2024, fiberglass mannequins contributed to a revenue share of 67.9% in the global market. Fiberglass mannequins are favored for their durability, lightweight nature, and versatility in design, making them a preferred choice for retailers and visual merchandisers worldwide. In addition, the ease of customization associated with the material, allowing for intricate detailing and realistic postures, has further contributed to its growth. Fiberglass mannequins is a key material choice among retailers emphasizing unique and attractive displays to capture consumer attention. The retail stores such as Forever 21, Gap, H&M, Levi's, Victoria's Secret, etc. use fiberglass mannequins in their stores.

Plastic mannequin sales is anticipated to witness a CAGR of 11.9% from 2025 to 2030. Plastic mannequins offer a cost-effective alternative to other counterparts, making them highly appealing to budget-conscious retailers. In addition, advancements in manufacturing technologies have led to the production of high-quality, aesthetically pleasing plastic mannequins that cater to diverse retail needs. Its lightweight nature makes it easy to handle and transport, addressing practical concerns for retailers looking for versatile display options. The retail stores such as Old Navy, Uniqlo, and others use plastic mannequins in their stores.

Type Insights

In 2024, women mannequin sales accounted for a share of 57% in the global market. As the women’s apparel sector is witnessing constantly changing trends, it highlights the demand for updated and appealing displays. Women mannequins, available in various poses and styles, play a crucial role in showcasing the latest fashion trends and helping customers visualize outfits. The growing demand for apparel among female consumers coupled with increased purchase rate of apparel on visually appealing displays is projected to drive the market growth of women mannequins. The growing diversity in body types and comfort is also projected to drive the demand for various shapes and sizes of women’s mannequins.

Men’s mannequin sales are projected to witness a CAGR of 13.2% during the forecast period. One significant driver is the expanding men's fashion industry, driven by changing style preferences and increasing awareness of fashion trends among male consumers. Retailers are investing in sophisticated and realistic men's mannequins to effectively showcase apparel such as tailored suits, casual wear, and accessories, to enhance the overall shopping experience.

End-user Insights

In 2024, mannequins in the retail industry accounted for a revenue share of over 61% in the global market. This is mainly attributed to mannequins being considered as essential tools for visual merchandising, helping retailers showcase their products in a visually appealing manner, thereby attracting more customers. According to key opinion leaders in the industry, mannequins significantly impact sales by enhancing the visual appeal of products, increasing sales by 20% to 40%.

Retailers are focused on using relatable displays to enhance product sales. For instance, mannequin manufacturers such as Gender Mannequins, a prominent supplier of mannequins in Canada emphasizes inclusivity by providing mannequin heads representing diverse ethnic backgrounds. According to industry experts, mannequins are not just display tools, but they serve as the face of a brand, enhancing the overall shopping experience and making apparel look their best, thereby boosting sales for retailers.

Revenue from mannequins used by fashion designers and boutiques is projected to witness a CAGR of 11.7% from 2025 to 2030. There is a growing demand for innovative and expressive mannequins among fashion designers and boutiques. Luxury fashion retailers are collaborating with mannequin manufacturers to showcase their garment collections. In March 2021, Bonaveri featured its Schläppi female mannequin collections, including the recently launched Schläppi 8000 'Obsession,' showcased at Euroshop 2020 in a new exhibition at BonaveriMilano, the company’s creative exhibition space and showroom in Milan, Italy. Fashion designer Naira Khachatryan utilized BonaveriMilano's space and Schläppi mannequins to present wool garments by Linea Più in collaboration with Italian yarn creator, Progetto 62.

Regional Insights

The mannequin market in North America accounted for a share of 21.58% of the global market revenue in 2024. Retailers in the region are recognizing the importance of body diversity, are incorporating various mannequin types to cater to a wider audience in the region, driving market growth. For instance, in January 2021, Athleta a U.S. activewear brand under Gap Inc., made significant improvements in the U.S. mannequin market by expanding its inclusive sizing options. The brand introduced 350 styles in sizes 1X-3X (or 18-26) and increased this number to over 500 styles in March 2021. The brand featured size-inclusive mannequins in all its 200 stores, showcasing garments from XXS to 3X.

U.S. Mannequin Market Trends

The mannequin market in the U.S. is expected to grow at a CAGR of 12.1% from 2025 to 2030. Retailers in the country are introducing mannequins of different sizes in their stores to provide a more inclusive and equitable shopping experience to women of all sizes. The U.S. mannequin market is projected to witness rapid growth owing to retailers in the region increasingly incorporating diverse body type mannequins. For instance, Old Navy, a sister company of Athleta under Gap Inc., joined the size inclusive movement with its Bodequality venture. The company introduced mannequins available in sizes four, 12, and 18 in its stores, to showcase diversity in body sizes.

Europe Mannequin Market Trends

The mannequin market in Europe accounted for a share of over 26% of the global market revenue in 2024. Europe is home to many renowned fashion capitals, such as Paris, Milan, and London, which host numerous high-end retail stores and boutiques that prioritize visual merchandising to attract consumers. For instance, leading fashion brands such as Gucci and Chanel utilize sophisticated mannequins in their storefronts to create enticing displays that reflect the latest trends.

Asia Pacific Mannequin Market Trends

The Asia Pacific mannequin market is expected to grow at a CAGR of 13.7% from 2025 to 2030. This is attributed to the region's flourishing retail sector, rapid urbanization, and the increasing demand for visually appealing and innovative store displays. In addition, the rise in fashion-conscious consumers and expanding retail infrastructure across countries such as China and India in Asia Pacific further drives the demand for mannequins.

Key Mannequin Company Insights

The mannequin market is moderately fragmented and highly competitive. Acquisitions and new product launches are some of the key strategic approaches adopted by the key market participants in order to gain a competitive edge. For instance, in February 2020, Bonaveri, a renowned mannequin and bust forms specialist, launched a new collection inspired by 1960s British icon Twiggy, following their acquisition of the Adel Rootstein brand in 2019. The realistic mannequin represents the aesthetics and culture of the 1960s, with matching height and size to the renowned model. This collection was showcased at the Euroshop triennial fair for retail innovations in Düsseldorf.

Key Mannequin Companies:

The following are the leading companies in the mannequin market. These companies collectively hold the largest market share and dictate industry trends.- Bonaveri

- Cofrad

- Genesis Display GmbH

- Hans Boodt Mannequins

- Noa Brands

- Bonami BV

- Mondo Mannequins

- Manex USA

- La Rosa srl

- Bernstein Display

Recent Developments

-

At Euroshop 2023 in Düsseldorf, Hans Boodt Mannequins unveiled an innovative sustainable collection crafted from repurposed materials, showcasing their commitment to sustainability and ethical aesthetics. The booth featured a striking "under construction" warehouse theme, blending harsh scaffolding with soft materials in a unique "digital lavender" color. This setup aimed to create an engaging experience, integrating smart technology to enhance visitor interaction. Among the highlights were three contemporary collections: Untitled, Printing on Demand, and the newly launched Nobs, all designed to resonate with modern retail aesthetics and values.

-

In August 2021, Genesis Mannequins introduced the BionicV collection, which features mannequins crafted from a combination of bioresin and viscose. This innovative material not only offers flexibility and durability but also results in lightweight mannequins, each weighing approximately 16.5 pounds. The BionicV mannequins can be easily painted or dyed in various colors, enhancing their versatility for retail displays. This development highlights a growing trend in the mannequin market towards sustainable and adaptable design solutions.

Mannequin Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5,818.3 million

Revenue forecast in 2030

USD 10,612.1 million

Growth rate (Revenue)

CAGR of 12.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, type, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Brazil; South Africa; UAE

Key companies profiled

Bonaveri, Cofrad; Genesis Display GmbH; Hans Boodt Mannequins; Noa Brands; Bonami BV; Mondo Mannequins; Manex USA; La Rosa srl; Bernstein Display

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mannequin Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the mannequin market on the basis of material, type, end-user, and region.

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Fiberglass

-

Plastic

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Women

-

Men

-

Infant & Toddlers

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Retailers

-

Fashion Designers and Boutiques

-

Beauticians, Hair Professionals, and Cosmetologists

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global mannequin market was valued at USD 5,174.9 million in 2024 and is expected to reach USD 5,818.3 million in 2025.

b. The global mannequin market is expected to grow at a compound annual growth rate of 12.8% from 2025 to 2030 to reach USD 10,612.1 million by 2030.

b. Asia Pacific dominated the mannequin market with a share of over 38% in 2024. The growth of the regional market is driven on account of the region's growing retail industry and fashion industry.

b. Some of the key players operating in the mannequin market include Bonaveri, Cofrad, Genesis Display GmbH, Hans Boodt Mannequins, and Bonami BV.

b. Key factors that are driving the mannequin market growth include a surge in the number of shopping centers, a growing apparel industry with evolution in styles, and the growing demand for diversity and inclusivity of mannequins.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.