Managed Detection And Response Market Size, Share & Trends Analysis Report By Security Type, By Deployment (Cloud-based, On-premises), By Enterprise Size, By Vertical, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-273-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

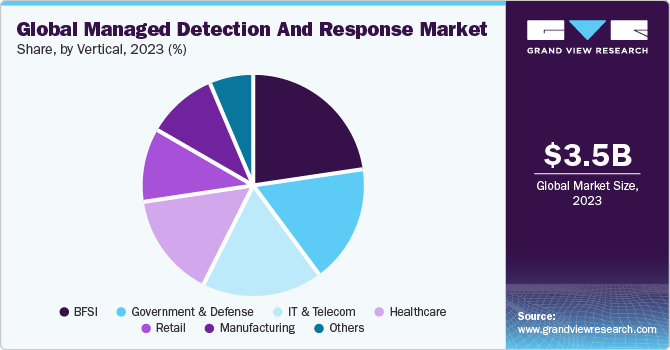

The global managed detection and response market size was estimated at USD 3.50 billion in 2023 and is projected to grow at a CAGR of 23.5% from 2024 to 2030. The market is expanding rapidly due to increasing cyber threats, regulatory compliance requirements, and the complexity of security landscapes. Organizations are turning to MDR services to augment their security positions, control advanced threat detection capabilities, and access constant monitoring and response expertise, thereby driving managed detection and response (MDR) market growth. In addition, the rise of cloud-based environments and the adoption of remote work models to safeguard critical assets and mitigate evolving cybersecurity risks further fuel the demand for MDR solutions.

Cyber threats targeting organizations worldwide are increasingly refined and frequent. Therefore, businesses are recognizing the need for proactive security measures that are beyond traditional antivirus and firewall solutions. MDR services offer a comprehensive approach to cybersecurity. They combine advanced threat detection technologies with skilled analysts and incident response capabilities. This approach enables organizations to detect, investigate, and respond to security incidents in real time, thus mitigating potential breaches and minimizing the impact on their operations. For instance, in May 2023, a ransomware group exploited a zero-day vulnerability to breach the security of more than 2,000 organizations globally, including New York City’s public school system, British Airways, and BBC, as per a report by Emisoft.

Cyber attackers are refining their strategies to bypass conventional security protocols and remain undetected. Emerging threats such as ransomware, zero-day exploits, and polymorphic malware present considerable hurdles for businesses, necessitating sophisticated threat detection tools and immediate response protocols. MDR solutions leverage technologies such as machine learning, behavioral analytics, and threat intelligence to identify and counteract threats that traditional security measures may overlook.

The market faces restraints such as the reluctance of some organizations to fully adopt managed services due to concerns about data privacy, control, and regulatory compliance. Moreover, the cost associated with MDR services is a barrier for smaller organizations with limited budgets. Integrating MDR solutions with existing security infrastructure and processes is complex and time-consuming, hindering adoption for some businesses. These market restraints highlight the need for MDR providers to address concerns around data protection, affordability, and ease of integration to drive further market penetration and adoption.

The COVID-19 pandemic had a positive impact on the MDR market. The shift towards remote work and the surge in cyber threats exploiting pandemic-related vulnerabilities led to an unprecedented increase in demand for MDR services. The rapid transition to remote work environments made businesses more vulnerable to cybersecurity risks such as phishing, ransomware, and insider threats.

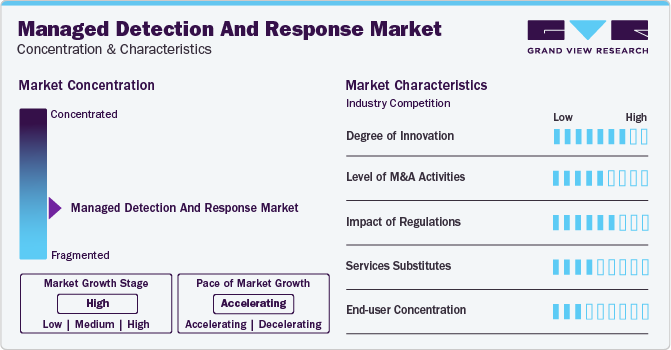

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating. The industry is characterized by an active and rapidly evolving landscape driven by technological advancements, diverse applications, and a supportive ecosystem. Regulatory mandates such as the General Data Protection Regulation (GDPR), Health Insurance Portability and Accountability Act (HIPAA), and Payment Card Industry Data Security Standard (PCI DSS) exert considerable influence on the uptake of MDR services. Entities under regulatory scrutiny are increasingly turning to MDR solutions to bolster their security measures and showcase diligent efforts in safeguarding sensitive data, thereby meeting and sustaining compliance requirements.

The industry is fragmented, featuring several global and regional players. The market players are investing in research & development (R&D) to develop advanced solutions and gain a competitive edge in the industry. Moreover, they are entering into partnerships and mergers & acquisitions as the market is characterized by innovation, disruption, and rapid change. For instance, in November 2023, SonicWall, a cybersecurity provider, acquired Solutions Granted, Inc. (SGI), a managed security service provider (MSSP) that delivers cybersecurity solutions to MSPs. This acquisition focuses on SonicWall's commitment to its partners. It expands its portfolio to include services such as MDR, U.S.-based security operations center (SOCaaS), and other managed services specifically designed for MSPs and MSSPs.

Artificial intelligence (AI) brought about a significant transformation in cybersecurity, particularly in endpoint security. Cybersecurity systems detect threats more efficiently and accurately using AI and machine learning algorithms. This helps detect more breaches and reduces the time taken to identify them. AI technology also helps reduce false positives and provides more precise alerts. In addition, AI-assisted Managed Endpoint Detection and Response (MEDR) accelerates threat response by automating remediation processes and response times.

Security Type Insights

The cloud detection and response segment accounted for the largest revenue share of 34.1% in 2023 and expected to grow at the fastest CAGR over the forecast period as organizations increasingly migrate their operations and data to the cloud, the need for robust cybersecurity measures increases. Cloud environments introduce security challenges, including the need to protect data stored in cloud repositories and applications accessed via the internet. For instance, according to the European Union, in 2023, 45.2% of businesses in the EU purchased cloud computing services, which is a 4.2% increase from 2021.

The Managed Endpoint Detection and Response (MEDR) segment is anticipated to witness a significant growth during the forecast period. The growing adoption of endpoint security solutions, such as antivirus software, firewalls, and endpoint detection and response (EDR) tools, reflects organizations' recognition of the importance of protecting their endpoints from cyber threats. Endpoints, which include devices such as desktops, laptops, mobile phones, and tablets, serve as entry points for cybercriminals to penetrate networks and steal sensitive data or disrupt operations.

Deployment Insights

The cloud-based segment accounted for the largest revenue share in 2023 and is expected to grow at the fastest CAGR over the forecast period. Cloud-based MDR solutions offer scalability, flexibility, and cost-effectiveness compared to traditional on-premises alternatives. They provide real-time monitoring, threat detection, and incident response capabilities across cloud environments, including infrastructure as a service (IaaS), platform as a service (PaaS), and software as a service (SaaS). In addition, the shift towards remote work and the proliferation of endpoints accessing corporate resources from various locations have further accelerated the demand for cloud-based MDR solutions. For instance, in October 2023, IBM launched the latest version of its managed detection and response services, featuring new AI technologies. These new technologies automatically escalate or shut up to 85% of alerts and help to respond to security threats faster.

The on-premises segment is anticipated to witness significant growth during the forecast period. Various industries, such as finance and healthcare, have stringent latency and performance requirements that necessitate local processing and analysis of security data. On-premises MDR solutions enable organizations to deploy security monitoring and detection capabilities closer to their network infrastructure, minimizing latency and ensuring optimal performance.

Enterprise Size Insights

The SMEs segment accounted for the largest revenue share in 2023 as SMEs often work with multiple vendors and partners, increasing their attack surface and the complexity of managing security across different environments. MDR services integrate with existing security tools and platforms, providing centralized visibility and control over the entire security infrastructure. In May 2023, EY Ireland launched a Managed Cyber Security Service to help SMEs and other businesses globally defend against cyber threats. The service aims to reduce the cost and expertise barriers as smaller businesses increasingly face challenges in dealing with the constantly shifting cyber threat landscape.

The large enterprises segment is expected to witness the fastest CAGR during the forecast period as organizations support intricate IT infrastructures encompassing various endpoints, applications, and interconnected systems, which increases vulnerability to cyber threats. Large enterprises represent targets for malicious actors due to the potentially profitable data they possess. In response to these increased risks, an increasing number of large enterprises are turning to MDR providers for comprehensive security solutions. For instance, in March 2021, Telefónica Tech launched NextDefense. It is a next-generation cybersecurity services brand providing large enterprises with modern, effective, intelligent detection and response capabilities against cyber-attacks. NextDefense unites and extends the security solutions to date to address sophisticated cyber-attacks since the COVID-19 pandemic.

Vertical Insights

The BFSI segment accounted for the largest revenue share in 2023 as BFSI organizations handle vast amounts of sensitive financial data and conduct numerous transactions daily, making them crucial targets for cyber threats. The increasing frequency and complexity of cyber-attacks, along with stringent regulatory requirements, have compelled BFSI companies to boost their cybersecurity defenses to avoid loss of consumer truth and penalties.

The IT & telecom segment is expected to witness the fastest CAGR during the forecast period due to growing dependence on technology and the development of multi-cloud infrastructure, which increases exposure to cyber-attacks. According to the 2023 cloud security study, in 2022, there was a 4-point increase in the percentage of businesses experiencing data breaches in their cloud environments compared to 2021, reaching 39%. A significant majority of companies, 75%, store a substantial portion (over 40%) of their sensitive data in the cloud.

Regional Insights

North America dominated the market with a revenue share of 34.4% in 2023. The widespread adoption of cloud computing in the region transformed the organizations’ mode of storage and management of data. However, it has also introduced new security challenges related to data privacy, compliance, and access control. MDR services offer cloud-native security solutions that help organizations secure their cloud environments and protect against cloud-based threats.

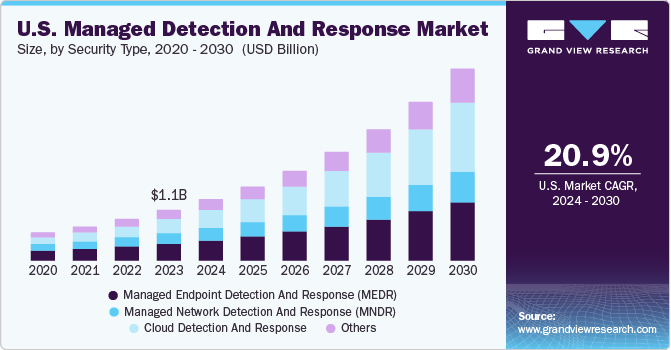

U.S. Managed Detection And Response Market Trends

The U.S. accounted for a market share of 30.4% of the global managed detection and response market. The regulatory landscape in the U.S., including laws such as the Health Insurance Portability and Accountability Act (HIPAA), the Gramm-Leach-Bliley Act (GLBA), and the Sarbanes-Oxley Act (SOX), is a significant driver for the adoption of Managed Detection and Response (MDR) services among organizations. These regulations impose stringent requirements on organizations to protect sensitive data, ensure privacy, and maintain compliance with industry-specific standards.

Asia Pacific Managed Detection And Response Market Trends

Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period.The growing integration of Internet of Things (IoT) devices and operational technology (OT) systems in industries such as manufacturing, healthcare, and energy introduces new cybersecurity challenges, including device vulnerabilities, data privacy concerns, and integration issues. MDR services offer specialized solutions for securing IoT and OT environments, providing asset discovery, vulnerability management, and threat detection capabilities to protect against cyber threats targeting connected devices and industrial control systems.

The managed detection and response market in China is expected to grow over the forecast period as the Chinese government implements stringent cybersecurity regulations, which impose strict requirements on organizations to protect sensitive data and ensure compliance with regulatory standards. For instance, in January 2023, China's Ministry of Industry and Information Technology (MIIT) implemented the Measures for Data Security Management in the Field of Industry and Information Technology. These measures define data security requirements for companies in the industry and IT sectors, including varying degrees of protection measures for data based on risk classification and a security assessment for exporting important or core data outside the country.

The India managed detection and response market is expected to grow over the forecast period. India faces persistent threats from state-sponsored actors seeking to infiltrate government agencies, critical infrastructure, and private sector organizations to gather intelligence, disrupt operations, or engage in cyber espionage. These attacks, often arranged by foreign governments or state-affiliated entities, pose serious risks to India's national security. For instance, the 2023 India Threat Landscape Report reveals that India receives the most cyber-attacks worldwide, accounting for 13.7% of all attacks. There was a 278% increase in state-sponsored cyber-attacks in India between 2021 and September 2023, which included information technology (IT) companies and business process outsourcing (BPO) firms receiving the highest share of attacks.

Middle East And Africa Managed Detection And Response Market Trends

The managed detection and response market in MEA is expected to grow over the forecast period as telecommunications companies in the region continue to innovate and expand their networks to meet the growing demand for connectivity. They increasingly rely on digital technologies and online platforms to deliver services and manage operations. However, the digitization of telecommunications infrastructure also exposes these companies to a wide range of cyber threats, including distributed denial-of-service (DDoS) attacks, data breaches, and network intrusions.

Key Managed Detection And Response Market Company Insights

Some of the key players operating in the market include CrowdStrike, SentinelOne, and withsecure.

-

CrowdStrike, Inc. offers cybersecurity products and services to protect against targeted attacks. Its endpoint protection and threat intelligence solutions help customers prevent damage, detect and attribute advanced malware, and search all endpoints. The company specializes in cloud-based cybersecurity services, including next-generation endpoint and cloud workload protection.

-

SentinelOne is a cybersecurity company that provides endpoint protection solutions powered by artificial intelligence and machine learning. Their autonomous platform offers real-time threat detection, prevention, and response capabilities to defend against advanced cyber-attacks across endpoints, cloud environments, and IoT devices.

Deepwatch, Rapid7 are some of the other market participants in the managed detection and response market:

-

Deepwatch provides a managed detection and response service that is fast and comprehensive. They offer advanced security technology, human-led security expertise, and operational processes to ensure the safety of clients' systems. Their platform combines security experts, threat management capabilities, and precise automated actions to reduce risk and enable cyber resiliency.

Key Managed Detection And Response Companies:

The following are the leading companies in the managed detection and response market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- Arctic Wolf Networks Inc.

- CrowdStrike

- Deepwatch

- FORESCOUT

- Fortra, LLC

- LMNTRIX

- Rapid7

- Red Canary

- Secureworks

Recent Developments

-

In June 2023, Secureworks, a cybersecurity provider, and SentinelOne, a security platform company, partnered to launch Secureworks Taegis integration. This integration aims to transform threat prevention and response by combining the power of Taegis XDR and SentinelOne's Singularity Complete. The joint solution is expected to provide comprehensive visibility across endpoints, identity systems, and cloud applications, enhancing the cybersecurity infrastructure's detection and response capabilities.

-

In April 2023, Accenture and Google Cloud announced the expansion of their partnership to offer businesses enhanced security against cyber threats. They aim to provide technology and security expertise to build resilient security programs and maintain confidence in readiness. The partnership will focus on powering Accenture's Managed Extended Detection and Response (MxDR) service with Google Cloud's security-specific generative AI.

-

In March 2022, CrowdStrike Holdings launched the Falcon Identity Threat Protection Complete, a security solution that is fully managed and designed to tackle identity threats. The solution combines the Falcon Identity Threat Protection program with the Falcon Complete management service to offer identity risk prevention, IT policy enforcement, expert administration, monitoring, and remediation.

Managed Detection And Response Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 4.32 billion |

|

Revenue forecast in 2030 |

USD 15.31 billion |

|

Growth rate |

CAGR of 23.5% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Security type, deployment, enterprise size, vertical region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; China; India; Japan; South Korea; Australia; Brazil; Mexico;; Argentina; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Accenture; Arctic Wolf Networks Inc.; CrowdStrike; Deepwatch; FORESCOUT; Fortra, LLC; LMNTRIX; Rapid7; Red Canary; Secureworks |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Managed Detection And Response Market Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global managed detection and response marketreport based on security type, deployment, enterprise size, vertical, and region:

-

Security Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Managed Endpoint Detection And Response (MEDR)

-

Managed Network Detection And Response (MNDR)

-

Cloud Detection And Response

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud-based

-

On-premises

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Retail

-

IT & Telecom

-

Healthcare

-

Manufacturing

-

Government & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global managed detection and response market size was estimated at USD 3.50 billion in 2023 and is expected to reach USD 4.32 billion in 2024

b. The global managed detection and response market is expected to grow at a compound annual growth rate of 23.5% from 2023 to 2030 to reach USD 15.31 billion by 2030

b. North America dominated the managed detection and response market, with a share of 34.4% in 2023. It is attributed to the region's widespread adoption of cloud computing transformed organizations' data storage and management practices.

b. Some key players operating in the managed detection and response market include Accenture, Arctic Wolf Networks Inc., CrowdStrike, Deepwatch, FORESCOUT, Fortra, LLC, LMNTRIX, Rapid7, Red Canary, Secureworks, SentinelOne, Sophos Ltd., WithSecure

b. Factors such as increasing cyber threats, regulatory compliance requirements, and the complexity of security landscapes are driving the managed detection and response market growth

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."