- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Malted Wheat Flour Market Size, Share, Industry Report 2030GVR Report cover

![Malted Wheat Flour Market Size, Share & Trends Report]()

Malted Wheat Flour Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Food & Beverage, Bakery & Confectionery, Others), By Product (Diastatic, Non-diastatic), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-476-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Malted Wheat Flour Market Summary

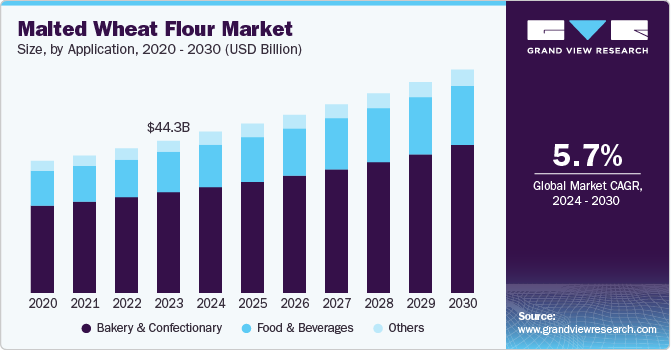

The global malted wheat flour market size was valued at USD 44.30 billion in 2023 and is projected to reach USD 64.98 billion by 2030, growing at a CAGR of 5.7% from 2024 to 2030. Malted wheat flour is rich in vitamins, minerals, and enzymes, which makes it a prevalent ingredient in health-focused food products.

Key Market Trends & Insights

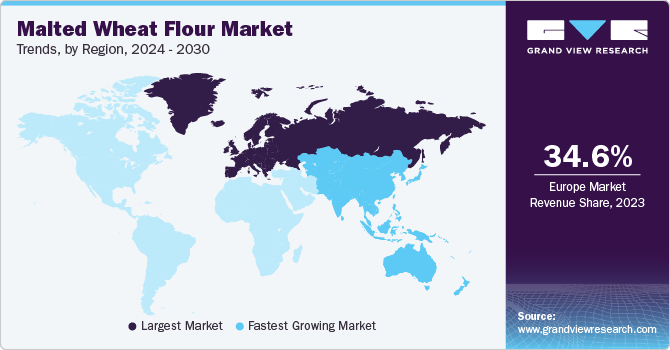

- Europe malted wheat flour market accounted for the largest revenue share of 34.6% in 2023.

- The UK malted wheat flour market is expected to witness significant growth over the forecast period.

- By application, the bakery & confectionary segment dominated the market and accounted for a revenue share of 66.1% in 2023.

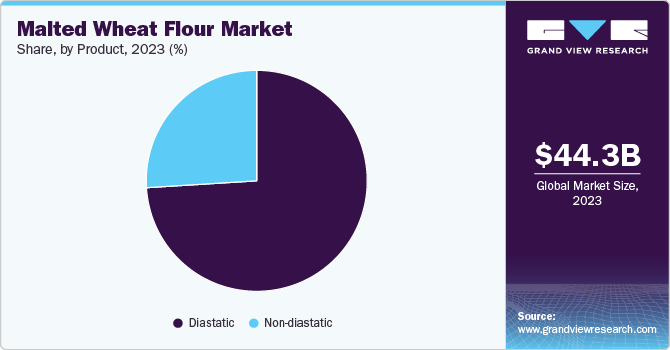

- By product, the diastatic segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 44.30 Billion

- 2030 Projected Market Size: USD 64.98 Billion

- CAGR (2024-2030): 5.7%

- Europe: Largest market in 2023

As consumers become more aware of the health benefits of whole grains and naturally processed foods, the demand for malted wheat flour products has risen. This trend is growing in developed markets with well-established health and wellness trends.

The bakery and confectionery industries are significant consumers of malted wheat flour, using it to enhance the flavor, texture, and nutritional profile of various products such as bread, cakes, biscuits, and pastries. The global expansion of these industries, fueled by urbanization, increased disposable income, and changing eating habits, has led to higher demand for specialized ingredients such as malted wheat flour. In addition, the growing popularity of artisanal and craft baking, which often emphasizes the use of traditional and high-quality ingredients, is driving the market's growth.

Functional foods offering additional health benefits beyond essential nutrition are becoming prevalent worldwide. Malted wheat flour is increasingly used in the production of functional foods due to its rich content of bioactive compounds, including vitamins, minerals, and antioxidants. Consumers' growing interest in proactive health management and the desire to prevent lifestyle-related diseases through diet drive the demand for functional foods.

Expanding distribution channels, including the rise of e-commerce and direct-to-consumer models, make malted wheat flour more accessible to consumers. Online platforms allow consumers to easily access specialty and health-focused products unavailable in retail stores. Additionally, the globalization of supply chains means that malted wheat flour reaches international markets more efficiently, supporting its growth.

Application insights

The bakery & confectionary segment dominated the market and accounted for a revenue share of 66.1% in 2023. Malted wheat flour contains active enzymes, particularly amylase, which breaks down starches into fermentable sugars. This activity improves dough handling by making it more extensible and easier to work with, leading to better volume and texture in baked goods. The enhanced fermentation process shortens the baking time and results in products with a more uniform crumb structure and an appealing crust. These functional benefits are essential for commercial bakeries that require consistency and efficiency in large-scale production.

The food & beverages segment is expected to witness the fastest CAGR over the forecast period. As consumers pursue quick, easy-to-prepare meals that do not compromise taste or nutritional value, manufacturers increasingly incorporate malted wheat flour into products such as instant oatmeal, snack foods, and pre-packaged meals. Malted wheat flour's ability to improve texture, extend shelf life, and enhance flavor makes it an ideal ingredient for these types of products. The growth of the convenience food market, particularly in urban areas with fast-paced lifestyles, continues to increase the demand for malted wheat flour.

Product Insights

The diastatic segment accounted for the largest market revenue share in 2023. The amylase enzymes in diastatic malted wheat flour convert starches into fermentable sugars, providing yeast with more food to produce carbon dioxide. This results in better leavening, which enhances the volume and crumb structure of bread and other baked goods. The improved fermentation process also contributes to a softer texture, a finer crumb, and a more uniform product, making diastatic malted wheat flour an essential ingredient for artisanal and commercial bakeries. Its ability to improve dough fermentation and overall baking quality drives demand in the market.

The non-diastatic segment is expected to witness the fastest CAGR over the forecast period. The malting process develops complex flavors, including sweet, nutty, and caramel-like notes, which are highly valued in baking and confectionery applications. Non-diastatic malted wheat flour imparts these rich flavors to products such as bread, cookies, cakes, and pastries. Additionally, it contributes to the Maillard reaction during baking, enhancing the final product's browning and overall appearance. This flavor and color enhancement is essential in premium and artisanal products, where sensory qualities are critical selling points.

Regional Insights

North America malted wheat flour market is expected to witness significant growth over the forecast period. The U.S. and Canada have a tradition of consuming baked goods, including bread, pastries, cookies, and cakes. Many incorporate malted wheat flour to enhance flavor, texture, and appearance. Malted wheat flour is valued for improving dough fermentation, creating crust color, and imparting a sweet, nutty flavor to baked products. The baking industry's continued growth, driven by artisanal and commercial bakeries, supports the demand for malted wheat flour in the region.

U.S. Malted Wheat Flour Market Trends

The U.S. malted wheat flour market is expected to witness significant growth over the forecast period. There is a growing consumer interest in whole grain and nutrient-rich products in the U.S., driven by a broader focus on health and wellness. Malted wheat flour is rich in vitamins, minerals, and dietary fiber. It is utilized to produce whole-grain bread, cereals, and other baked goods marketed as healthier alternatives. The increasing awareness of the nutritional benefits of whole grains drives the demand for malted wheat flour as a necessary ingredient in health-focused food products.

Europe Malted Wheat Flour Market Trends

Europe malted wheat flour market accounted for the largest revenue share of 34.6% in 2023. The convenience food market in Europe is expanding rapidly, driven by busy lifestyles and the need for quick, easy-to-prepare meals and snacks. Malted wheat flour is an essential ingredient in many convenience foods, including instant oatmeal, snack bars, and pre-packaged baked goods, where it is used to enhance flavor, texture, and shelf life. The ability of malted wheat flour to improve the quality of convenience foods makes it a suitable option for manufacturers looking to meet consumer demand for tasty, convenient, and nutritious products. The growth of the convenience food market continues to support the demand for malted wheat flour in Europe.

The UK malted wheat flour market is expected to witness significant growth over the forecast period. Culinary trends, such as home baking and the popularity of DIY food preparation, have significantly impacted the malted wheat flour market in the UK. This trend has turned to baking as a hobby and a way to create comforting, homemade meals. Malted wheat flour, which improves the flavor and texture of baked goods, has become a prevalent ingredient among home bakers pursuing to replicate quality products at home. This trend is expected to continue, driven by social media platforms such as Instagram, Facebook, and others, where homebakers share their creations and inspire others to experiment with different ingredients.

Asia Pacific Malted Wheat Flour Market Trends

Asia Pacific malted wheat flourmarket is anticipated to witness the fastest CAGR over the forecast period. The rise of e-commerce and online grocery shopping in the Asia Pacific region has increased the distribution of malted wheat flour and related products. With more consumers purchasing groceries online, including specialty ingredients such as malted wheat flour, there is greater accessibility and convenience in acquiring these products. E-commerce platforms allow smaller producers to reach a wider audience, including consumers in remote areas requiring access to specialty flours in local stores. The growth of online shopping also facilitates the purchase of malted wheat flour in bulk, catering to home bakers and small businesses requiring larger quantities for their baking needs, driving its demand in the Asia Pacific region.

The China malted wheat flour market is expected to witness significant growth over the forecast period. Food safety and quality standards in China are strict, and consumers expect transparency and high quality in their products. Malted wheat flour producers must adhere to these standards, ensuring their products are safe, consistent, and high-quality. The emphasis on food safety and quality drives the demand for trusted, reliable ingredients such as malted wheat flour used in various food applications. Manufacturers demonstrating their commitment to quality and safety gain a competitive advantage in the market, driving the demand for their products.

Key Malted Wheat FlourCompany Insights

Key players in the malted wheat flour market include Cargill, Incorporated., King Arthur Baking Company, Inc., IREKS GmbH, PMV Maltings Pvt. Ltd. And others

-

IREKS GmbH is a prominent German company specializing in producing high-quality baking ingredients, including malted wheat flour, bread mixes, improvers, and malt extracts. Their offerings include various baking ingredients designed to enhance the flavor, texture, and shelf life of baked goods, alongside customized solutions customized to meet specific customer needs.

-

Malteurop Group is a leading malt producer in the international market. Its product offerings include a diverse range of malt types, such as base malts, specialty malts, and roasted malts, designed to meet the specific needs of brewers and food manufacturers.

Key Malted Wheat Flour Companies:

The following are the leading companies in the malted wheat flour market. These companies collectively hold the largest market share and dictate industry trends.

- Cargill, Incorporated.

- ADM

- Malteurop Group

- Crisp Malt

- Bairds Malt Ltd.

- Imperial Malts Ltd.

- King Arthur Baking Company, Inc.

- IREKS GmbH

- GrainCorp.

- PMV Maltings Pvt. Ltd.

Malted Wheat FlourMarket Report Scope

Report Attribute

Details

Market size value in 2024

USD 46.66 billion

Revenue forecast in 2030

USD 64.98 billion

Growth Rate

CAGR of 5.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, product, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Australia & New Zealand, South Korea, Brazil, South Africa

Key companies profiled

Cargill, Incorporated., ADM, Malteurop Group, Crisp Malt, Bairds Malt Ltd., Imperial Malts Ltd., King Arthur Baking Company, Inc., IREKS GmbH, GrainCorp., PMV Maltings Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Malted Wheat Flour Market Report Segmentation

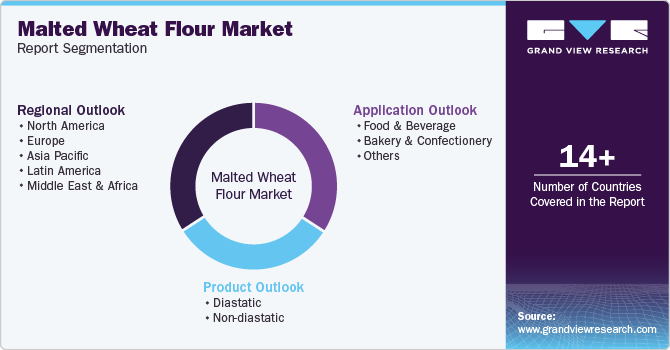

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the malted wheat flour market report based on application, product, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Bakery & Confectionery

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Diastatic

-

Non-diastatic

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S

-

Canada

-

Mexico.

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.