- Home

- »

- Consumer F&B

- »

-

Malt Beverages Market Size, Share & Growth Report, 2030GVR Report cover

![Malt Beverages Market Size, Share & Trends Report]()

Malt Beverages Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Alcoholic Malt Beverages, Non-Alcoholic Malt Beverages), By Distribution Channel (On-Trade, Off-Trade), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-397-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Malt Beverages Market Summary

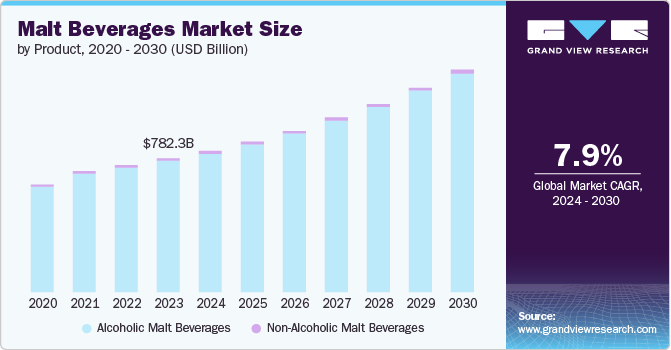

The global malt beverages market size was estimated at USD 782.25 billion in 2023 and is projected to reach USD 1,300.60 billion by 2030, growing at a CAGR of 7.9% from 2024 to 2030. The demand for malt beverages is growing due to several key trends. Consumers are increasingly seeking out diverse and innovative flavors, which brands are delivering through new product launches such as flavored malt beverages (FMBs) and hard seltzers.

Key Market Trends & Insights

- North America accounted for a revenue share of around 21% in 2023.

- The U.S. malt beverages market accounted for a revenue share of around 73% of the North American market in 2023.

- Based on product, the alcoholic malt beverages segment accounted for about 98% of the market in 2023.

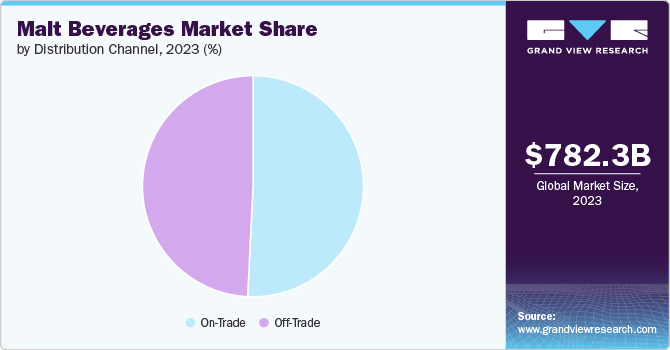

- Based on distribution channel, the malt beverage sales through the on-trade channel segment accounted for approximately 50% of the total market share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 782.25 Billion

- 2030 Projected Market Size: USD 1,300.60 Billion

- CAGR (2024-2030): 7.9%

- North America: Largest market in 2023

Health-conscious consumers are also drawn to malt beverages that offer no/low sugar options and lower calories. Additionally, the convenience of ready-to-drink (RTD) formats and the rising popularity of premium, branded products with strong market presence contribute to the overall growth in this segment. These factors collectively drive consumer interest and market expansion in the malt beverage industry. A study by the Business of Drinks podcast published in December 2023 found that when it comes to regular consumption, millennials tend to favor beer and spirits, while Gen Z shows a greater preference for non-alcoholic cocktails. Hard seltzers are popular across both groups, appealing due to their low-alcohol content and fruit flavors.

Malt beverages like hard seltzers have gained immense popularity shortly after its mainstream emergence in 2016, rapidly becoming a multibillion-dollar industry with over 300 brands by 2020. Its future remains promising, with higher-ABV options and niche flavors driving continued consumer interest. Many companies have been investing in this lucrative segment over the years. In May 2021 for instance, Molson Coors invested USD 100 million to boost its production of spirit significantly and malt-based hard seltzers in Canada, aiming to more than quadruple capacity at its Toronto site by early 2022. The investment included advanced technology installations, enabling a 300% increase in production capacity. This expansion supports the company's strategy to dominate the fast-growing Canadian hard seltzer market with brands like Vizzy and Coors Seltzer.

Malt-based ready-to-drink drinks, like Cayman Jack Margaritas and Clubtails drinks, are equally noteworthy as hard teas, sodas, and seltzers. Due to their high cost and stringent laws governing the locations in which spirit-based RTD cocktails may be served, customers still prefer malt-based cocktails. Constant product launches have been propelling this category. In February 2024, Captain Morgan introduced a new line of malt-based ready-to-drink (RTD) beverages, offering four "cocktail-inspired" flavors: Pineapple Daiquiri, Strawberry Margarita, Passionfruit Hurricane, and Mango Mai Tai, each with an ABV of 5.8%.

Hard teas have gained immense popularity, with numerous brands entering the market. Twisted Tea, a pioneer since 2001, launched its "Extreme" line featuring 8% ABV in 2023. New contenders like Lipton and Arizona also launched their own 5% ABV versions in 2023, offering various flavors such as peach, lemon, and green tea. Other notable names include White Claw, Peace, Monster, and Deep Eddy Vodka’s Hard Tea Seltzers. The trend is also embraced by craft brewers like Cape May and restaurants such as Bojangles with their Hard Sweet Tea, reflecting a dynamic expansion in the ready-to-drink hard tea segment.

The rise in popularity of non-alcoholic beer in the reflects a significant shift in consumer habits and preferences towards healthier lifestyles and mindful drinking. Technological advancements in brewing have enabled the production of non-alcoholic beers that closely mimic the taste and experience of traditional beers, catering to a diverse audience including athletes, pregnant women, and individuals abstaining from alcohol for health or personal reasons. This trend is further fueled by the growing health consciousness among social movements like sober curiosity, especially among younger generations. As a result, non-alcoholic beer is becoming a staple, which bodes well for malt beverages market.

Product Insights

Alcoholic malt beverages accounted for about 98% of the market in 2023. Products such as beer and seltzers, dominate the malt beverages industry due to several factors. These have a long-standing cultural and social presence globally, making it a staple at social gatherings and events. Additionally, advancements in brewing technology have diversified malt flavors and types, catering to a wide range of consumer preferences. The marketing and distribution infrastructure for beer is well-established, providing extensive accessibility and visibility. For instance, in the 52 weeks following its launch in 2022, the Corona Hard Seltzer brand had the greatest media spend (USD 113.8 million), followed by High Noon (USD 103.4 million), Truly Iced Tea (USD 90.5 million), and Michelob Ultra Organic Seltzer (USD 87.2 million).

Demand for non-alcoholic malt beverages is expected to increase at a CAGR of about 8.8% from 2024 to 2030. The demand for non-alcoholic malt beverages is growing due to evolving social and cultural attitudes, such asthe desire for inclusivity in social settings. Health-conscious consumers, including younger generations and older adults, are increasingly seeking alternatives that offer the social experience of beer without alcohol. These shifts, coupled with seasonal trends like Dry January, are driving and will continue to drive the popularity of non-alcoholic malt beverages in the future.Lagunitas’ IPNA and Athletic Brewing’s non-alcoholic offerings are popular brands operating in this segment.

Distribution Channel Insights

The malt beverage sales through the on-trade channel accounted for approximately 50% of the total market share in 2023. According to data from the British Beer and Pub Association and UKHospitality, the increase in beer sales was predominantly driven by pubs. Sales through food pubs rose by 4%, while community pubs saw a 2% increase. On-trade sales often experience significant spikes during major sporting events, with an average uplift of 23% in beer sales noted during the Rugby World Cup in the UK. This trend suggests that bars, pubs, and similar venues that capitalize on such events are well-positioned to benefit from the growth of the on-trade malt beverage sector.

Sales of malt beverages through the off-trade channel is set to grow at a CAGR of about 7.0% from 2024 to 2030.The off-trade channel for malt beverages is set to grow due to several emerging trends. The increasing shift towards eCommerce has expanded access and convenience, appealing to a broader audience. Additionally, the rising popularity of purchasing alcohol alongside other groceries has made it easier for consumers to include malt beverages in their regular shopping. According to a January 2023 CivicScience poll, 47% of non-alcoholic beer users get their beer mostly from grocery or convenience stores, with a startling 29% following closely behind internet retailers like Drizly.

Regional Insights

The malt beverages market in North America accounted for a revenue share of around 21% in 2023. This region remains a major market for malt beverages due to its vibrant beer culture and diverse consumer preferences. The region's love for beer brands like Corona and Budweiser highlights the enduring popularity of both domestic and international options. The growing interest in craft beers, driven by innovative breweries like AleSmith Brewing Co. and BrewDog, reflects evolving tastes, especially among millennials and Gen Z. Additionally, strategic acquisitions by industry giants like Anheuser Busch InBev and Carlsberg are expanding market presence and catering to the increasing demand for unique flavors and high-quality brews, ensuring North America's continued prominence in the malt beverage market.

U.S. Malt Beverages Market Trends

The U.S. malt beverages market accounted for a revenue share of around 73% of the North American market in 2023. The rise of health-conscious lifestyles has bolstered the popularity of non-alcoholic and low-calorie options like hard seltzers, perceived as cleaner and healthier alternatives. Additionally, the inclusive appeal of malt beverages, offering diverse flavors and gender-neutral branding, attracts a broad audience. Innovations by major brands like Budweiser and Corona, alongside the entry of soft drink companies into the hard seltzer market, further stimulate consumer interest and expand product variety, ensuring sustained growth in the malt beverage segment.

Asia Pacific Malt Beverages Market Trends

The malt beverages market in Asia Pacific is anticipated to grow at a CAGR of about 8.2% from 2024 to 2030. Demand for malt beverages in Asia Pacific is set to rise due to several key factors. Increased consumption in emerging markets like Vietnam and India, where beer holds a significant share of alcohol consumption, drives growth. The region's burgeoning population and rising GDP, coupled with a shift towards premiumization and quality over quantity, further bolster demand. Government support, such as easing regulations and providing incentives for craft breweries, also plays a crucial role. Additionally, the expanding number of bars, pubs, and craft beer events across Asia contributes to the rising popularity and consumption of malt beverages.

Europe Malt Beverages Market Trends

Europe malt beverages market accounted for a share of about 26% in the global malt beverages market. Demand in Europe is high due to a growing appreciation for diverse beer styles and flavors, including non-alcoholic options. The resurgence of social activities post-pandemic has also fueled consumption. Additionally, beer's cultural significance and its integration into social and dining experiences bolster its popularity. Innovations within the industry continue to attract consumers seeking variety and quality.

Key Malt Beverages Company Insights

The market is fragmented. Many brands have recognized the presence of untapped opportunities in their product offerings and have been adopting strategies such as marketing campaigns, mergers & acquisitions, and product launches to gain market share. Asahi Europe & International, the global arm of Asahi Group Holdings, for example, announced in January 2024 that it had acquired Octopi Brewing, a renowned contract beverage production and co-packing facility situated in Waunakee, Wisconsin. In addition to helping Asahi achieve its goal of becoming carbon neutral throughout its entire supply chain by 2050, the establishment of a production plant in North America will enable the company to increase sales in the U.S. and Canada.

Key Malt Beverages Companies:

The following are the leading companies in the malt beverages market. These companies collectively hold the largest market share and dictate industry trends.

- Boston Beer Company, Inc.

- Anheuser-Busch InBev

- Heineken N.V.

- Carlsberg Group

- Molson Coors Beverage Company

- Diageo plc

- Kirin Holdings Company, Limited

- Asahi Group Holdings, Ltd.

- BrewDog plc

- Constellation Brands, Inc.

Recent Developments

-

In April 2024, Boston Beer Company, Inc. introduced General Admission, a non-alcoholic ready-to-drink (RTD) fruit brew in the U.S. This new offering blends fruit-infused seltzer water with low-alcohol beer. Initially available in select markets such as New York, Albany, Raleigh, North Carolina, and Indiana, the product can also be purchased online for direct-to-consumer shipping across various states.

-

In July 2024, Carlsberg Group expanded its partnership with Foodpanda to enhance consumer access to its range of beverages through digital transformation and e-commerce. This collaboration included campaigns such as exclusive gifts, special promotions, and bundles, leveraging Foodpanda’s cloud grocery stores and extensive retail network. By integrating Carlsberg’s offerings into Foodpanda’s platform, the initiative aims to provide consumers with personalized recommendations and swift delivery, ensuring a seamless and enjoyable beer-purchasing experience.

-

In November 2023, United Breweries, part of the HEINEKEN group launched Heineken Silver Draught Beer in India, marking the brand's first entry into the draught beer market in the country. Initially available in premium bars and pubs across selected cities. This beer features a smooth, refreshing taste crafted from 100% malt and natural ingredients. The launch aims to cater to evolving consumer preferences and enhance the beer experience for a new generation of enthusiasts in India.

Malt Beverages Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 824.65 billion

Revenue forecast in 2030

USD 1,300.60 Billion

Growth rate

CAGR of 7.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Australia; Brazil; Argentina; South Africa

Key companies profiled

The Boston Beer Company, Inc.; Anheuser-Busch InBev; Heineken N.V.; Carlsberg Group; Molson Coors Beverage Company; Diageo plc; Kirin Holdings Company, Limited; Asahi Group Holdings, Ltd.; BrewDog plc; Constellation Brands, Inc.

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Malt Beverages Market Report Segmentation

This report forecasts revenue growth at the global, regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global malt beverages market report based on the product, distribution channel, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Alcoholic Malt Beverages

-

Beer

-

Ale

-

Lager

-

Stout

- Others

-

Flavored Alcoholic Malt Beverages

-

Hard Seltzers

-

Malt-Based Cocktails

-

Hard Tea

-

RTD Malt Drinks

-

-

Non-Alcoholic Malt Beverages

-

Non-Alcoholic Beer

-

Flavored Non-Alcoholic Malt Beverages

-

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-Trade

-

Off-Trade

-

Liquor Stores

-

Hypermarkets/Supermarkets

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the malt beverages market growth include rising consumer preference for premium and craft beers, innovative flavor offerings, increased disposable income, expanding global beer markets, and the growth of social drinking culture.

b. The global malt beverages market was estimated at USD 782.25 billion in 2023 and is expected to reach USD 824.65 billion in 2024.

b. The global malt beverages market is expected to grow at a compound annual growth rate of 7.9% from 2024 to 2030 to reach USD 1,300.60 billion by 2030.

b. Asia Pacific dominated the malt beverages market with a share of around 35% in 2023. This is due to an increasing interest in diverse and niche flavors, with global brewers expanding their presence to capitalize on the region's evolving tastes.

b. Key players in the malt beverages market are The Boston Beer Company, Inc.; Anheuser-Busch InBev; Heineken N.V.; Carlsberg Group; Molson Coors Beverage Company; Diageo plc; Kirin Holdings Company, Limited; Asahi Group Holdings, Ltd.; BrewDog plc; Constellation Brands, Inc.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.