Malaria Diagnostics Market Size, Share & Trends Analysis Report By Technology (Microscopy, Rapid Diagnostic Tests), By End Use (Clinics, Hospitals), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-711-7

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Malaria Diagnostics Market Size & Trends

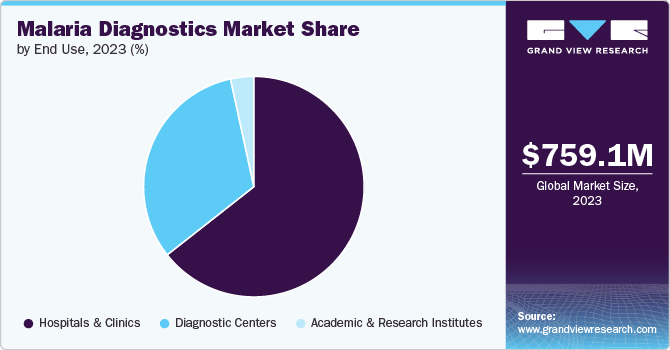

The global malaria diagnostics market size was estimated at USD 759.1 million in 2023 and is projected to grow at a CAGR of 2.6% % from 2024 to 2030. The market is being propelled by an increasing need for malaria diagnostics and the advent of innovative diagnostic methods. Malaria, a pervasive and life-threatening disease, is prevalent in tropical and subtropical regions, influenced by shifting climates, limited economic growth, underdeveloped healthcare infrastructure, and insufficient access to advanced treatment.

The global malaria scenario witnessed a notable surge in 2022, surpassing pre-pandemic levels in 2019. During the period from 2000 to 2019, global malaria cases declined from 243 million to 233 million. However, in 2020, an additional 11 million cases emerged, with no change in 2021. In 2022, there was a further increase of 5 million cases, bringing the total to approximately 249 million. This rise underscores the urgency in advancing malaria diagnostics to effectively address the growing number of cases.

Approximately half of the global population faces malaria risk, with an estimated 249 million cases and 608,000 deaths reported worldwide in 2022. Sub-Saharan Africa bears the heaviest burden of this disease. The impact of the COVID-19 pandemic has been profound, leading to a surge in malaria cases and deaths, surpassing pre-pandemic levels. In FY 2023, U.S. funding for malaria control and research rose to approximately $1 billion, compared to $822 million in FY 2013. The U.S. stands as the primary contributor to the Global Fund to Fight AIDS, Tuberculosis, and Malaria, which, in turn, is the largest overall funder of global malaria initiatives. The 2021 President's Malaria Initiative Strategy outlines ambitious goals, including reducing mortality, achieving substantial reductions, and aiding in the elimination of malaria in specific regions. These initiatives align with broader global priorities and contribute to market growth through increased government funding.

In addition, In March 2023, Noul Co. Ltd announced a partnership with the RIGHT Foundation. The agreement aims to validate the marketability of Noul's miLab platform in malaria-endemic regions of Africa and Asia through a clinical performance evaluation. Over the next three years, Noul will utilize the 3.1 million USD grant received from the RIGHT Foundation for the evaluation and cost-effectiveness analysis of miLab. With over 200 million people affected by malaria annually, the demand for accurate diagnosis is crucial. Challenges, including gene mutations impacting conventional rapid diagnostic tests (RDT) and drug resistance, necessitate innovative solutions. Through this collaboration, Noul and The RIGHT Foundation plan to assess miLab's diagnostic accuracy against the gold standard method of microscopy.

In the realm of malaria technology, significant advancements in diagnostics have played a pivotal role in improving detection methods. Modern molecular diagnostic techniques, such as Loop-Mediated Isothermal Amplification (LAMP) and nucleic acid amplification tests (NAATs), offer increased sensitivity and specificity compared to traditional methods. Moreover, the development of highly efficient rapid diagnostic tests (RDTs) has streamlined point-of-care diagnosis, enabling quick and accurate identification of malaria parasites. These technological breakthroughs have revolutionized the speed and precision of malaria diagnosis, crucial for prompt treatment and effective control of the disease, particularly in resource-limited settings where access to sophisticated laboratory facilities may be limited.

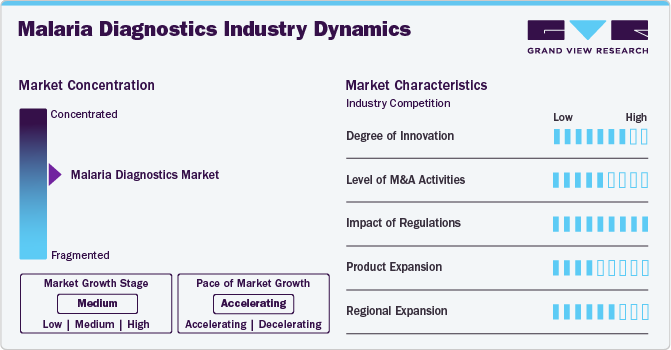

Market Concentration & Characteristics

Recent technological advancements have propelled a high degree of innovation in the malaria diagnostics industry. The Centre for Artificial Intelligence and Cyber Security Research, under the National Research and Innovation Agency (BRIN), is presently engaged in a research initiative focused on integrating Artificial Intelligence (AI) algorithms into malaria diagnosis. The objective is to create a computer-based diagnostic system empowered by AI algorithms, enhancing the capability to assess the health status of individuals in relation to malaria.

Mergers and acquisitions are shaping the market, exemplified by strategic alliances and consolidations among key players. Such initiatives aim to foster innovation, enhance research capabilities, and broaden product portfolios, ultimately contributing to the growth and development of advanced diagnostic solutions in the fight against malaria.

Regulatory frameworks profoundly impact the market, ensuring product safety and efficacy. Stringent regulations can pose challenges but also enhance credibility. Compliance requirements drive innovation, improve diagnostic accuracy, and foster a market environment focused on delivering reliable and effective solutions for the detection and management of malaria.

In the malaria diagnostics industry, substitutes are limited due to the specificity of diagnostic methods. Traditional microscopy, rapid diagnostic tests (RDTs), and molecular techniques remain the primary approaches, with minimal substitutes. This reflects the specialized nature of malaria diagnostics, where accuracy and reliability are paramount.

The market's regional expansion is driven by increasing prevalence in regions like Africa and Southeast Asia, rising governmental initiatives for disease control, and improved healthcare infrastructure. Strategic collaborations, enhanced diagnostic technologies, and funding from global health organizations are further accelerating the market's growth in these regions, ensuring better access to malaria detection and treatment.

Technology Insights

The Rapid Diagnostic Tests (RDT) segment dominated the market in 2023 and accounted for the largest revenue share of 67.8%. Rapid Diagnostic Tests (RDTs) have played a pivotal role in global malaria diagnostics, with 3.9 billion units sold by manufacturers from 2010 to 2022. Notably, 82% of these sales occurred in sub-Saharan African countries. During the same period, National Malaria Programs (NMPs) distributed 2.9 billion RDTs, with 90% allocated to sub-Saharan Africa. In 2022 alone, manufacturers sold 415.5 million RDTs, while NMPs distributed 345 million. The driving factors behind the widespread use of RDTs include their simplicity, quick results, and their instrumental role in enabling efficient and accessible malaria diagnosis, particularly in regions heavily burdened by the disease.

Furthermore, the molecular diagnostic tests segment is expected to grow at a steady CAGR during the forecast period. Polymerase chain reaction (PCR) and Loop-Mediated Isothermal Amplification (LAMP) are prominent examples offering high sensitivity and specificity. The driving factors behind the adoption of molecular diagnostics include their ability to detect low parasite levels and identify specific Plasmodium species, essential for targeted treatment. These tests contribute significantly to malaria control efforts by aiding in early and precise diagnosis, facilitating prompt treatment interventions, and supporting surveillance programs. The continuous advancements in molecular diagnostic technologies further enhance their role in combating malaria on a global scale.

End Use Insights

The clinics segment accounted for the largest market revenue share of 64.4% in 2023. Increasing focus on the use of RDTs for quick turnaround time, lower cost of diagnosis, and easy accessibility are some of the factors responsible for the dominance. Early diagnosis and treatment are crucial for malaria management and reducing complications. Clinics typically have smaller patient loads compared to hospitals, facilitating timely administration of appropriate antimalarial medications and improving patient outcomes.

The diagnostics centers segment is estimated to grow at a steady CAGR of 2.2% over the forecast years. Rising awareness amongst the target population has shifted focus on diagnosing the disease from healthcare providers with specialized expertise. Higher testing capacity, well-equipped laboratories, and assurance of accurate quality control processes and results are some of the other factors responsible for segment growth in the foreseeable future. The rise in the number of initiatives undertaken by the government to provide services, such as reimbursement, is another major factor anticipated to drive market growth.

Regional Insights

Africa Malaria Diagnostics Market Trends

Africa malaria diagnostics market dominated the overall global market and accounted for the 89.15% share in 2023. The market for malaria diagnostics in Africa is experiencing significant growth due to the region’s high malaria burden, which accounts for over 90% of global cases. Increased governmental efforts and international support, such as funding from organizations like the World Health Organization (WHO) and the Global Fund, are driving initiatives for early detection and treatment. Expanding healthcare infrastructure, combined with technological advancements in rapid diagnostic tests (RDTs) and molecular diagnostics, is further enhancing accessibility and accuracy in malaria detection. Public-private partnerships and collaboration between local governments and international organizations are improving diagnostic availability in rural and underserved areas. In addition, rising awareness about the importance of early diagnosis, particularly in endemic regions, is fueling demand. Ongoing research and development aimed at improving diagnostic sensitivity and specificity, along with efforts to lower costs, are also contributing to market growth in Africa, making the fight against malaria more effective across the continent.

Africa is expected to lead the market owing to the highest disease burden. The African region had the highest revenue share of 89.15% in 2023. P. falciparum is the most prevalent malarial parasite in the region, accounting for an estimated 99% of all cases in Africa. According to the WHO, an estimated 92.0% of global malaria cases and 93% of global malarial deaths were recorded in this region. These facts are indicative of the rising prevalence of malaria in Africa.

The Nigeria malaria diagnostics market held a significant share of Africa market in 2023. Nigeria, bearing the highest malaria burden globally, is a key market for malaria diagnostics in Africa. Government initiatives like the National Malaria Elimination Programme (NMEP) and international partnerships are driving the demand for improved diagnostics. The widespread adoption of rapid diagnostic tests (RDTs) is increasing access to early detection, especially in rural areas. Ongoing investment in healthcare infrastructure, along with efforts to enhance diagnostic accuracy and reduce costs, is further boosting market growth. Collaborations between local and international health organizations are critical in supporting Nigeria’s goal of reducing malaria cases and improving health outcomes across the country.

South East Asia Malaria Diagnostics Market Trends

The South East Asia malaria diagnostics market is experiencing significant growth. The malaria diagnostics market in Southeast Asia is growing due to the region's diverse malaria burden, particularly in countries like India, Myanmar, and Indonesia. Governments, along with international organizations like the World Health Organization (WHO), are actively working to eliminate malaria through improved diagnostics and treatment strategies. The adoption of rapid diagnostic tests (RDTs) and molecular diagnostics has expanded access to reliable, cost-effective malaria detection, especially in remote and rural areas.

In Southeast Asia, the market is estimated to hold the second position, with India accounting for the second largest share of the regional market. The Southeast Asian region is expected to grow at a CAGR of 2.3%. The disease diagnostic testing, in terms of volume, in India is majorly led by microscopy testing. With the rising awareness about the disease and increasing funding from the private sector, the need for diagnostic testing and care-based surveillance systems is anticipated to increase, thereby propelling the market growth.

The India malaria diagnostics market is experiencing significant growthdue to healthcare improvements and technological advancements. India, with its diverse malaria transmission zones, is a key market for malaria diagnostics in Southeast Asia. Government initiatives like the National Framework for Malaria Elimination (NFME) and partnerships with global health organizations are driving efforts to eradicate malaria by 2030. The widespread use of rapid diagnostic tests (RDTs) and increasing adoption of molecular diagnostic technologies have improved access to early and accurate detection, particularly in rural and high-risk areas.

The Myanmar malaria diagnostics market is experiencing significant growth. Myanmar, one of Southeast Asia's high-risk malaria zones, is seeing increased growth in its market due to government-led efforts and international support aimed at malaria elimination. The National Malaria Control Program, along with global partners like the World Health Organization (WHO) and the Global Fund, is driving initiatives for early diagnosis and treatment. The widespread deployment of rapid diagnostic tests (RDTs) in remote and underserved areas has greatly improved access to malaria detection.

Western Pacific Malaria Diagnostics Market Trends

The Western Pacific malaria diagnostics marketis experiencing rapid growth. The Western Pacific region, including countries like Papua New Guinea, the Solomon Islands, and Cambodia, faces a significant malaria burden, particularly in rural and remote areas. The market in this region is growing due to concerted efforts by national governments and global health organizations like the World Health Organization (WHO) to eliminate malaria. Widespread adoption of rapid diagnostic tests (RDTs), especially in resource-limited areas, has improved access to early and accurate detection.

The Papua New Guinea malaria diagnostics market is growing, driven by the high prevalence of malaria. Papua New Guinea has one of the highest malaria transmission rates in the Western Pacific, making it a critical market for malaria diagnostics. The country's tropical climate and remote, underserved areas create challenges for malaria control. However, government-led initiatives, supported by international organizations like the World Health Organization (WHO) and the Global Fund, are focused on improving malaria detection and treatment.

Europe Malaria Diagnostics Market Trends

The Europe malaria diagnostics market is experiencing significant growth due to the rising number of cases due to travel. Countries like the UK, France, and Germany see malaria diagnoses primarily among travelers, immigrants, and military personnel returning from malaria-endemic areas in Africa, Asia, and Latin America. As a result, advanced diagnostic tools such as rapid diagnostic tests (RDTs) and polymerase chain reaction (PCR) tests are in demand to ensure quick and accurate detection.

Key Malaria Diagnostics Company Insights

The competitive scenario in the malaria diagnostics industry is high, with key players such as Abbott; bioMérieux; Beckman Coulter Inc.; Siemens Healthineers; Leica Microsystems GmbH; and Bio-Rad Laboratories, Inc. and others holding significant positions. The major companies are undertaking various strategies such as regional expansion, acquisitions, mergers, collaborations, and new product development, for serving the unmet needs of their customers.

Key Malaria Diagnostics Companies:

The following are the leading companies in the malaria diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- Access Bio., Inc.

- Abbott Laboratories

- Premier Medical Corporation Pvt. Ltd.

- Sysmex Partec GmbH

- bioMérieux

- Beckman Coulter, Inc.

- Siemens Healthineers

- Leica Microsystems GmbH

- Nikon Corporation

- Olympus Corporation

- Bio-Rad Laboratories, Inc.

Recent Developments

-

In July 2022, Mylab Discovery Solutions announced the launch of the first combined PCR test, which can differentiate between Chikungunya, Zika, malaria, dengue, Salmonellosis bacterial species, Leptospirosis, and Leishmaniasis parasites

-

In February 2024, Researchers at Rice University created a new malaria diagnostic test that is quicker and simpler to use compared to conventional methods. This breakthrough has the potential to enhance patient outcomes, particularly in rural areas where healthcare resources are limited.

Malaria Diagnostics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 774.2 million |

|

Revenue forecast in 2030 |

USD 900.5 million |

|

Growth Rate |

CAGR of 2.6% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Technology, end use, region |

|

Regional scope |

Africa; Eastern Mediterranean; America; Europe; South-East Asia; Western Pacific |

|

Country scope |

Nigeria; Democratic Republic of The Congo; United Republic of Tanzania; Uganda; South Africa; Mozambique; Angola; Ghana; Botswana; Namibia; China; Papua New Guinea; Cambodia; Venezuela; Brazil; Colombia; Turkey; France; UK; Germany; India; Myanmar; Indonesia; Saudi Arabia; Pakistan |

|

Key companies profiled |

Access Bio., Inc.; Abbott Laboratories; Premier Medical Corporation Pvt. Ltd.; Sysmex Partec GmbH; bioMérieux; Beckman Coulter, Inc.; Siemens Healthineers; Leica Microsystems GmbH; Nikon Corporation; Olympus Corporation; Bio-Rad Laboratories, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Malaria Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global malaria diagnostics market report based on technology, end use, and region.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Molecular Diagnostic Tests

-

Conventional PCR

-

Modernized PCR

-

-

Microscopy

-

Rapid Diagnostic Tests (RDT)

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Diagnostic Centers

-

Academic and Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Africa

-

Nigeria

-

Democratic Republic of The Congo

-

United Republic of Tanzania

-

Uganda

-

South Africa

-

Mozambique

-

Angola

-

Ghana

-

Botswana

-

Namibia

-

-

Southeast Asia

-

India

-

Myanmar

-

Indonesia

-

-

Eastern Mediterranean

-

Saudi Arabia

-

Pakistan

-

-

Western Pacific

-

China

-

Papua New Guinea

-

Cambodia

-

-

Americas

-

Venezuela

-

Brazil

-

Colombia

-

-

Europe

-

Turkey

-

France

-

UK

-

Germany

-

-

Frequently Asked Questions About This Report

b. The global malaria diagnostics market size was estimated at USD 759.1 million in 2023 and is expected to reach USD 774.2 million in 2024.

b. The global malaria diagnostics market is expected to witness a compound annual growth rate of 2.6% from 2024 to 2030 to reach USD 900.5 million in 2030.

b. Based on technology, Rapid Diagnostic Tests (RDT) segment held the largest share of 67.8% in 2023, owing to the higher usage and sales volume of products along with increasing distributions by National Malaria Programmes (NMPs).

b. Some key players operating in the malaria diagnostics market include Abbott; bioMérieux; Beckman Coulter Inc.; Siemens Healthineers; Leica Microsystems GmbH; and Bio-Rad Laboratories, Inc., amongst others.

b. Key factors driving the malaria diagnostics market growth include increasing demand for diagnostic tools in malaria-endemic countries, the development of technologically advanced and efficient diagnostics, and market players and private investors to curb the prevalence of malaria.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."