- Home

- »

- Electronic & Electrical

- »

-

Major Appliances Market Size, Share, Industry Report, 2030GVR Report cover

![Major Appliances Market Size, Share & Trends Report]()

Major Appliances Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Washing Machines, Cooktops), By Type (Conventional Appliances, Smart Appliances), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-490-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Major Appliances Market Summary

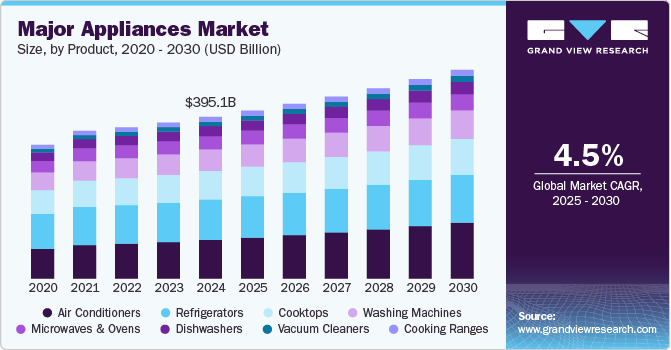

The global major appliances market size was estimated at USD 395.1 billion in 2024 and is projected to reach USD 510.18 billion by 2030, growing at a CAGR of 4.5% from 2025 to 2030. The U.S. Bureau of Labor Statistics' Producer Price Index (PPI) for Major Household Appliance Manufacturing indicated a significant surge in industry prices from mid-2021 to mid-2022, followed by stabilization through the end of 2022.

Key Market Trends & Insights

- The North America major appliances industry is expected to grow at a CAGR of 2.9% from 2025 to 2030.

- The major appliances industry in the U.S. is expected to grow at a CAGR of 2.7% from 2025 to 2030.

- Based on product, refrigerators segment held a revenue share of 25.01% in 2024.

- Based on type, conventional appliances segment held a revenue share of 93.38% in 2024.

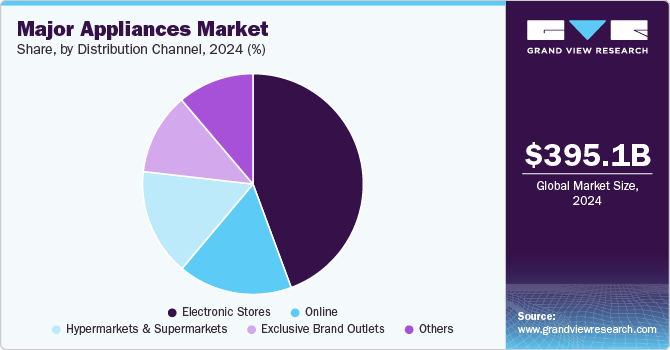

- Based on distribution channel, sales through electronic stores segment held a revenue share of 44.37% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 395.1 Billion

- 2030 Projected Market Size: USD 510.18 Billion

- CAGR (2025-2030): 4.5%

- Asia Pacific: Largest market in 2024

Over the last 18 months, manufacturing costs for major household appliances have shown a consistent upward trend. Dominant players in this industry, including Samsung, LG, General Electric, and Whirlpool, are experiencing these shifts. According to the Home Improvement Research Institute's (HIRI) June 2024 Retail Sector report, major domestic appliances have emerged as the highest spending category in home improvement projects in 2024. The median expenditure for a single purchase is approximately USD 1,000, surpassing costs associated with kitchen remodeling, flooring, and windows or doors. The growing integration of smart devices within residential settings is driving consumer interest, particularly as these appliances become more user-friendly and interconnected.

Energy efficiency is a key consideration for homeowners and property managers alike, given the substantial impact that major household appliances have on a residence's energy consumption. This focus on energy optimization is expected to fuel market growth as individuals look to replace older, less efficient models with newer, energy-saving options. According to APPLiA’s 2022-2023 statistical report, innovation in the appliances sector has been robust, with the number of patents granted for home appliances doubling over the past decade in Europe. Notably, the energy consumption of home appliances has decreased by 50% over the past 20 years, with modern refrigerators now using only a quarter of the energy they once used.

Furthermore, appliances like refrigerators, which can account for up to 14% of a home's energy use, have seen substantial efficiency improvements, with new models consuming less than a third of the energy of older ones. As a result, global standards such as Energy Star have become key indicators for consumers. These standards are continually updated to reflect technological advancements, leading to increased adoption. While energy-efficient appliances may have a higher upfront cost, they offer long-term savings on electricity bills, making them highly attractive in markets worldwide.

Despite the rise of online shopping, most customers still prefer purchasing major appliances in physical stores, with home centers being the most popular retail choice, as per The Home Improvement Research Institute. However, the future of appliance purchasing offers various avenues, with online channels like Amazon, Best Buy, and Costco attracting customers through convenience and delivery options. For smaller local and regional distributors, maintaining a competitive online presence is crucial. By offering features like product comparison tools and superior customer service, they can stand out in a crowded market. In addition, some brands, such as Samsung, are enhancing the in-store experience by opening experiential retail locations where customers can physically interact with products before purchasing.

Consumer Insights

Consumers are increasingly prioritizing energy efficiency in major appliances, driven by the growing emphasis on sustainability and environmental responsibility. The introduction of new energy labels in Europe has rejuvenated the market, making high-performing, energy-efficient appliances more prominent and desirable. Consumers are now more likely to choose appliances that promise significant energy savings, even if it means paying a premium. This shift reflects a broader trend where sustainability is becoming a key factor in purchasing decisions, with eco-conscious buyers seeking appliances that reduce their environmental impact without compromising on performance. Brands that emphasize energy efficiency are well-positioned to meet this rising demand.

Furthermore, consumers increasingly prefer compact and space-saving designs in major appliances due to the growing trend of urban living and smaller home spaces. These appliances optimize limited areas without sacrificing functionality or style, making them ideal for apartments, tiny homes, and modern kitchens. Compact appliances also offer energy efficiency, reducing both environmental impact and utility costs. Their versatility allows multiple functions within a single unit, such as toaster ovens that can bake, roast, and toast. The sleek and seamless design of built-in compact appliances enhances aesthetics, improving the overall look and feel of living spaces while adding value to the home.

Production Data

Globally, the Asia-Pacific region leads the production of major appliances, driven by its cost advantages, strong supply chain, and the presence of industry giants like Haier Group Corporation, Midea Group Co., Ltd., Samsung Electronics Co., Ltd., and LG Electronics Inc.

Within Asia Pacific, China dominates global appliance production, followed by manufacturing hubs in South Korea, India, Vietnam, and Thailand. South Korea is particularly known for high-tech appliances, with LG Electronics Inc. and Samsung Electronics Co., Ltd. at the forefront, while India and Vietnam are emerging as cost-effective production centers.

Production volumes vary across different appliance categories. Refrigerators have the highest annual production, fueled by growing demand for energy-efficient and smart cooling solutions from manufacturers such as Haier Group Corporation, LG Electronics Inc., Samsung Electronics Co., Ltd., Whirlpool Corporation, and Robert Bosch GmbH. Washing machines follow, with innovations in AI-powered and front-load models enhancing their appeal. The major players in air conditioner production include Gree Electric Appliances Inc. of Zhuhai, Daikin Industries, Ltd., Midea Group Co., Ltd., and Panasonic Corporation, which focuses on inverter technology and eco-friendly refrigerants.

Product Insights

Refrigerators held a revenue share of 25.01% in 2024. Refrigerators are a key segment due to their integral role in modern lifestyles, especially in developed regions like North America and Europe. The widespread adoption of refrigeration has transformed diets by increasing fresh food consumption and reducing reliance on preservation methods like fermentation. However, this shift has also introduced challenges, such as increased food waste at the household level and environmental concerns linked to refrigerants like HFCs. As countries worldwide develop cold chains, refrigerators continue to be crucial, both as essential household items and as targets for innovation to mitigate their environmental impact.

Furthermore, in developing regions like Bangladesh, the demand for refrigerators is rising significantly, driven by increased electrification, growing purchasing power, and the availability of affordable, locally manufactured options (The Business Standard, 2024).

The air conditioners segment is expected to grow at a CAGR of 6.5% from 2025 to 2030. Record-breaking summer temperatures in the U.S. have significantly increased the demand for air conditioners, especially in heatwave-prone areas like Washington DC. As triple-digit temperatures persist, HVAC contractors are overwhelmed with a surge in air-conditioning replacements and emergency repairs, often struggling with supply-chain issues and extended work hours. The global air conditioning industry has grown, and in the U.S., aging units from the post-2008 housing boom are now failing, further fueling demand. In addition, the push for energy-efficient cooling solutions and upcoming EPA regulations are driving sustained growth, as hotter summers are expected to continue.

Moreover, the demand for air conditioners in the African region is rapidly increasing, too, driven by factors such as population growth, urbanization, rising disposable incomes, and improving economic conditions. As air conditioning shifts from a luxury to a necessity in the face of a hotter climate, countries like Ghana, Kenya, Nigeria, and Tanzania are witnessing strong growth in the market. Despite challenges such as economic fluctuations and import restrictions, the region's appeal to investors remains strong, particularly from Chinese and South Korean manufacturers. The air conditioning industry in Africa is poised for significant expansion, with a growing focus on training and specialist knowledge to support the adoption of more advanced HVAC systems.

Type Insights

Conventional appliances held a revenue share of 93.38% in 2024. Conventional appliances remain popular due to their affordability, simplicity, and reliability. They provide straightforward functionality without the added cost and complexity of smart features, making them a cost-effective choice for many households. These appliances are valued for their ease of use, as they do not rely on firmware updates or tech support, offering a no-fuss experience. While they may lack the sleek aesthetics and advanced features of smart models, conventional appliances deliver dependable performance and durability. For those who prioritize practicality and budget, traditional appliances offer a solid, time-tested solution that continues to meet everyday needs efficiently.

The smart appliances segment is expected to grow at a CAGR of 5.9% from 2025 to 2030. The rising demand for smart major appliances is driven by a growing desire for convenience, efficiency, and connectivity in managing household tasks. As technology advances, consumers increasingly seek appliances that integrate seamlessly into their busy lifestyles, offering remote control and automation through smartphone apps. Smart appliances, such as refrigerators, cooking ranges, washing machines, and air conditioners, provide enhanced features like energy consumption tracking, predictive maintenance, and real-time performance monitoring, which appeal to those looking for both practicality and sustainability. The ability to control and monitor these devices remotely not only simplifies daily routines but also supports energy efficiency and cost savings, making them an attractive choice for modern consumers. As technology continues to evolve, the appeal of smart appliances is expected to grow, reflecting a broader trend toward embracing innovative solutions for a more connected and efficient home.

Distribution Channel Insights

Sales through electronic stores held a revenue share of 44.37% in 2024. Electronic stores have emerged as a prominent distribution channel due to their unique ability to blend traditional retail strengths with modern technological advancements. Established Indian retailers like Vijay Sales, Croma, and Reliance Digital have demonstrated resilience and adaptability in the face of rising e-commerce competition. These stores offer a comprehensive shopping experience that combines the tactile benefits of in-store shopping with the convenience of online access. With an extensive range of high-quality appliances, expert staff, and personalized customer service, they provide a more immersive and informative shopping experience than many online platforms. The physical presence of these stores allows consumers to interact with the products, receive immediate assistance, and benefit from instant purchases and services.

Sales of major appliances through online channels are expected to grow at a CAGR of 5.4% from 2025 to 2030. The major household appliances market is witnessing significant growth in the online channel, driven by a shift in consumer behavior toward digital shopping. According to Adtaxi's 2024 E-commerce Survey, 78% of Americans are now comfortable purchasing major appliances online, an increase from 73% reported the previous year. This growing acceptance reflects broader trends in online shopping, where convenience and the ability to compare products and prices easily have become paramount. With 93% of American adults engaging in online shopping and a notable increase in daily online shoppers, the online channel has become a critical platform for major appliances, offering an efficient way to reach a vast audience.

Regional Insights

The North America major appliances industry is expected to grow at a CAGR of 2.9% from 2025 to 2030. The North America market is characterized by its maturity and homogeneity, primarily driven by demand from a growing housing industry and increasing disposable incomes. In the U.S., the high costs associated with manufacturing have prompted many companies to offshore their production to other countries. This shift has been further influenced by the strengthening of the U.S. dollar, resulting in a market that relies more on imports than exports. Despite these challenges, the rise in disposable income and the robust housing industry have helped offset some of the adverse effects of the stronger dollar.

U.S. Major Appliances Market Trends

The major appliances industry in the U.S. is expected to grow at a CAGR of 2.7% from 2025 to 2030. The growing number of households in the U.S. significantly contributes to the rising demand for major appliances such as washing machines, dishwashers, refrigerators, air conditioners, and microwaves & ovens and thus, driving the overall major domestic appliances market. According to data released by the U.S. Census Bureau and the Department of Housing and Urban Development, the sales of new single‐family houses were at a seasonally adjusted annual rate of 662,000 in February 2024, 14.3% above the revised rate of 625,000 in February 2023.

Asia Pacific Major Appliances Market Trends

The Asia Pacific major appliances industry held a revenue share of 44.61% in 2024. The region is home to some of the fastest-growing cities globally, with countries such as China, India, Indonesia, and Vietnam experiencing substantial urban expansion. This urban growth is often accompanied by a surge in housing and infrastructure development, which in turn drives demand for household appliances. As more people move to urban areas, the need for modern homes equipped with essential appliances increases. Newly built apartments and houses are often designed to accommodate contemporary lifestyles, requiring appliances that offer convenience, efficiency, and space-saving solutions. This trend is particularly evident in densely populated cities where living spaces are often smaller, necessitating the use of compact and multifunctional appliances.

Europe Major Appliances Market Trends

The Europe major appliances industry is expected to grow at a CAGR of 3.2% from 2025 to 2030.European consumers are becoming increasingly conscious of energy efficiency and environmental impact. This awareness has fueled demand for energy-efficient appliances that reduce electricity consumption and lower carbon footprint. The European Union's stringent regulations on energy efficiency, such as the Energy Labeling Regulation and the Ecodesign Directive, have further encouraged the adoption of energy-efficient appliances.

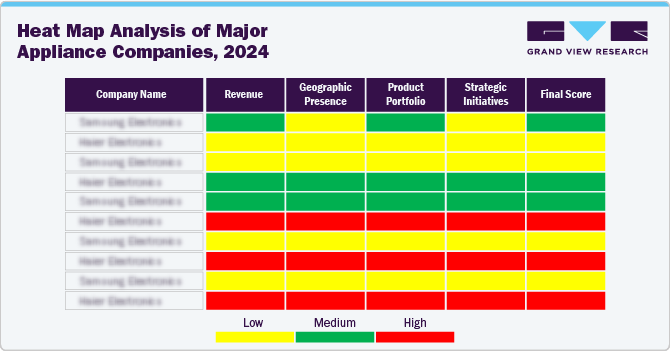

Key Major Appliances Company Insights

Many manufacturers are integrating IoT technology to develop smart appliances that connect with mobile apps or virtual assistants (like Amazon Alexa and Google Assistant). This allows users to control appliances remotely, monitor energy consumption, and receive maintenance alerts. Furthermore, to appeal to design-conscious consumers, companies are offering customizable options, such as interchangeable panels and color options. Modular designs allow consumers to upgrade parts of their appliances without needing to replace the entire unit.

Key Major Appliances Companies:

The following are the leading companies in the major appliances market. These companies collectively hold the largest market share and dictate industry trends.

- Whirlpool Corporation

- Electrolux AB

- Samsung Electronics Co., Ltd.

- LG Electronics Inc.

- Haier Smart Home Co., Ltd.

- Panasonic Corporation

- Miele & Cie. KG

- Bosch (BSH Hausgeräte)

- Daikin Industries Ltd.

- Sharp Corporation

- iRobot Corporation

- Midea Group

- Gree Electric Appliances Inc.

Recent Developments

-

In September 2023, LG Electronics launched the Wi-Fi Convertible Side by Side Refrigerator, which allows users to transform the freezer into a fridge through the LG ThinQ app. These refrigerators feature Smart Learner AI technology that monitors usage patterns and adjusts cooling for optimal performance.

-

In August 2024, SAMSUNG launched a new refrigerator line in India as part of its Bespoke AI Double Door series. This cutting-edge appliance includes features like SmartThings AI Energy Mode, Convertible 5-in-1, and Twin Cooling Plus, all designed to cater to the changing demands of Indian consumers.

-

In July 2024, Bosch home appliances introduced its new 300 Series dishwasher, priced at $699, which comes with a full stainless-steel tub. This model features two racks and incorporates Bosch's PrecisionWash cleaning system along with PureDry drying technology for efficient dish cleaning and drying. Its design boasts a modern edge-to-edge recessed handle with integrated controls, offering both practicality and style.

-

In April 2024, Whirlpool Corporation announced the successful completion of its transaction with Arcelik, a Turkish home appliance manufacturer. Arcelik acquired Whirlpool's operations in the MENA (Middle East and North Africa) region through subsidiaries in the UAE and Morocco. In the future, Arcelik will oversee Whirlpool’s MENA operations.

-

In March 2024, Miele Professional, a global provider of cutting-edge, commercial-grade appliances, launched MasterLine, an innovative series of dishwashers tailored to cater to the varied requirements of both residential and commercial clientele. MasterLine redefines benchmarks for hygiene assurance, efficiency, and convenience, offering robust cleaning capabilities across dual levels, swift cycle times, and a wide range of optional accessories.

Major Appliances Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 410.22 billion

Revenue forecast in 2030

USD 510.18 billion

Growth Rate (Revenue)

CAGR of 4.5% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Report updated

February 2025

Quantitative units

Revenue in USD million/billion, Volume in Thousand Units, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Benelux, Nordics, China, Japan, India, Australia & New Zealand, South Korea, Southeast Asia Brazil, Argentina, South Africa

Key companies profiled

Whirlpool Corporation; Samsung Electronics Co. Ltd.; Robert Bosch GmbH; LG Electronics Inc.; Electrolux AB; Haier Smart Home Co., Ltd.; Panasonic Corporation; Sharp Corporation; Miele & Cie. KG; Midea Group; Daikin Industries Ltd.; iRobot Corporation; and Gree Electric Appliances Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

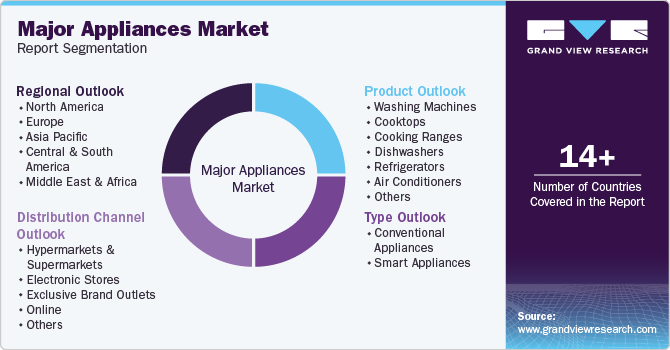

Global Major Appliances Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global major appliances market report based on product, type, distribution channel, and region.

-

Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Washing Machines

-

Cooktops

-

Cooking Ranges

-

Dishwashers

-

Refrigerators

-

Air Conditioners

-

Microwaves & Ovens

-

Vacuum Cleaners

-

-

Type Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Conventional Appliances

-

Smart Appliances

-

-

Distribution Channel Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Electronic Stores

-

Exclusive Brand Outlets

-

Online

-

Others

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Refrigerators dominated the major appliance market with a share of 25.01% in 2024. Trends in the major appliances market highlight a strong focus on energy efficiency and advanced technology, making refrigerators a key segment. Factors driving their prominence include rising consumer demand for smart features, enhanced food preservation capabilities, and space-saving designs.

b. Some key players operating in the major appliance market include Whirlpool Corporation; Samsung Electronics Co. Ltd.; Robert Bosch GmbH; LG Electronics Inc.; Electrolux AB; Haier Smart Home Co., Ltd.; Panasonic Corporation; Sharp Corporation; Miele & Cie. KG; Midea Group; Daikin Industries Ltd.; iRobot Corporation; and Gree Electric Appliances Inc.

b. The major appliance market is driven by technological advancements, energy efficiency trends, and increasing consumer focus on smart home integration. Rising disposable incomes and urbanization fuel demand for high-performance appliances, particularly in developing economies.

b. The global major appliance market size was estimated at USD 395.09 billion in 2024 and is expected to reach USD 410.22 billion in 2025.

b. The global major appliance market is expected to grow at a compounded growth rate of 4.5% from 2025 to 2030 to reach USD 510.18 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.