Magnetic Resonance Imaging Market Size, Share & Trends Analysis Report By Architecture (Open Systems, Closed Systems), By Field Strength (Low, Mid, High) By Application, By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-370-6

- Number of Report Pages: 210

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Magnetic Resonance Imaging Market Trends

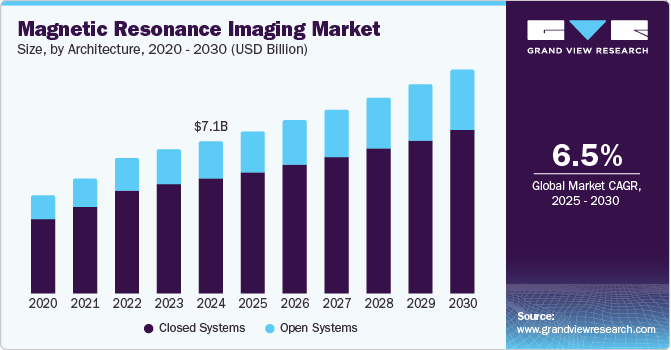

The global magnetic resonance imaging market size was valued at USD 7.1 billion in 2024 and is anticipated to grow at a CAGR of 6.5% from 2025 to 2030. Magnetic Resonance Imaging (MRI) is a highly effective diagnostic tool for identifying conditions such as spinal lesions, tumors, and stroke, which affect blood vessels and the brain. The increasing prevalence of these diseases is expected to play a significant role in market growth. For instance, according to the National Center for Health Statistics, in 2023, almost 1,958,310 new cancer cases and 609,820 cancer deaths were estimated to occur in the U.S. In addition, the growing demand for quick and effective diagnostic procedures is expected to contribute to the adoption of MRI machines.

As per OECD, in 2021, the number of MRI units installed in the U.S. was 38 per million population. Ongoing technological advancements, such as the integration of Artificial Intelligence (AI) in MRI, are further expected to contribute to the overall market growth. For instance, in August 2023, FUJIFILM Healthcare Americas Corporation received U.S. FDA clearance for its 1.5 Tesla MRI system, the ECHELON Synergy. The system utilizes Synergy DLR, a technology developed by Fujifilm that leverages AI for Deep Learning Reconstruction (DLR). This technology enhances image sharpness and accelerates scanning, improving throughput, image quality, and patient satisfaction. Most recent advancements in MRI technology are primarily focused on software improvements.

Furthermore, the introduction of MRI systems that are compatible with cardiac pacemakers is anticipated to drive market expansion within the cardiology segment. MRI manufacturers have continued to innovate with newer technology and AI-based solutions. This helped radiologists to effectively and efficiently understand COVID-19-related diseases and residual symptoms.

Moreover, advancements in MRI machines to enhance their usage for various applications are projected to drive market growth during the forecast period. Recent innovations, such as diffusion and diffusion tensor imaging with tractography; perfusion imaging; neuroimaging techniques, including MR spectroscopy; and functional imaging employing the Blood Oxygenation Level Dependent (BOLD) technique, are anticipated to significantly bolster magnetic resonance imaging industry growth in the coming years. In addition, the development of intraoperative MRI and its diverse applications in neurosurgery are expected to drive market growth during the forecast period. Diffusion-weighted MR imaging is primarily utilized to detect stroke within 30 minutes of onset rapidly.

Architecture Insights

The closed systems segment dominated the market with the largest revenue share of 75.6% in 2024, driven by its superior ability to offer enhanced safety, reduced contamination risks, and more controlled environments for imaging procedures. These systems operate within a sealed environment and ensure optimal conditions for accurate diagnostic imaging. The growing demand for enhanced image quality, patient safety, and infection control, particularly in hospitals and diagnostic centers, has driven their widespread adoption. Besides, advancements in closed system technology have improved operational efficiency, contributing to their dominance in the market.

The open systems segment is anticipated to emerge as the fastest-growing segment, with a CAGR of 7.8% from 2025 to 2030, propelled by increasing demand for patient comfort, versatility, and ease of access. Open MRI systems offer a more spacious design, reducing claustrophobia and improving patient experience. Moreover, advancements in technology are enhancing the imaging capabilities of open systems, making them more attractive for various clinical applications. The focus of healthcare facilities on patient-centered care is driving an increase in demand for open MRI systems, which in turn fosters innovation and expands the market share of this segment.

Field Strength Insights

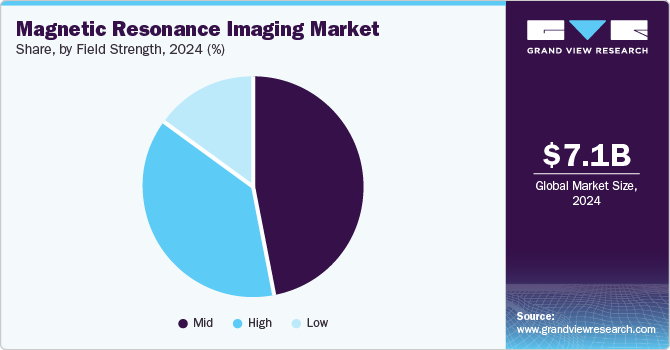

MRI machines are categorized based on their field strength, with low-field strength MRI machines having a field strength lower than 1.5T, mid-field MRI machines ranging from 1.5T up to 3T, and high-field MRI machines with a field strength exceeding 3T. The mid-segment held the largest revenue share in 2024, which can be attributed to its balanced performance, affordability, and versatility. These MRI machines, typically operating at 1.5 Tesla, offer high-quality imaging while being more cost-effective than high-field alternatives. They are widely used in routine diagnostics, including neuroimaging, musculoskeletal imaging, and cancer imaging, making them popular in hospitals and clinics. Their lower operational costs and efficiency in delivering accurate results have contributed significantly to their dominant market position, attracting a broad range of healthcare providers.

The high segment is projected to grow at the fastest CAGR during the forecast period due to advancements in MRI technology and increasing demand for higher-resolution imaging. High-field MRI systems, typically operating at 3 Tesla and above, offer superior image quality, enabling more accurate diagnosis, particularly in neurology, oncology, and orthopedics. Healthcare providers' focus on early disease detection and precision medicine is expected to boost the demand for high-field strength MRI systems, fueling market growth and innovation in this segment.

Application Insights

The brain & neurological segment accounted for the largest revenue share in 2024, owing to the rising prevalence of neurological disorders such as Alzheimer's, Parkinson's, and multiple sclerosis. The ability of MRI to provide detailed, noninvasive imaging of the brain and spinal cord makes it an essential tool for diagnosing and monitoring these conditions. In addition, technological advancements in MRI, such as higher resolution imaging and functional MRI (fMRI), have further expanded its application in neurology, propelling growth of this segment of the magnetic resonance imaging industry.

The breast segment is set to witness notable expansion over the forecast period, fueled by increasing breast cancer awareness, early detection initiatives, and advancements in MRI technology. The growing adoption of MRI for breast imaging, particularly among high-risk patients, is expected to drive substantial growth in the segment. MRI provides superior soft tissue contrast and helps detect early-stage breast cancer, offering better accuracy compared to traditional mammography. The rising demand for noninvasive diagnostic methods further fuels the expansion of this segment.

End Use Insights

The hospitals segment held the largest market share in 2024, attributed to their critical role in providing comprehensive healthcare services. Hospitals are equipped with advanced MRI technologies to diagnose a wide range of medical conditions, from neurological to musculoskeletal disorders. The increasing volume of patients and the growing demand for accurate and noninvasive diagnostic procedures drive hospitals to invest in state-of-the-art MRI systems. Furthermore, hospitals benefit from skilled radiologists and specialists, enhancing their ability to offer high-quality imaging services and further solidifying their dominant market position.

The imaging centers segment is projected to be the fastest-growing segment from 2025 to 2030, propelled by the increasing demand for noninvasive diagnostic procedures. These centers are becoming increasingly popular as healthcare providers seek to offer affordable and accessible MRI services to patients. The rising prevalence of chronic diseases, along with advancements in MRI technology, drives the demand for more specialized imaging services. Furthermore, the growth of outpatient imaging centers and partnerships with hospitals is set to propel the magnetic resonance imaging industry, offering greater convenience and improved patient outcomes.

Regional Insights

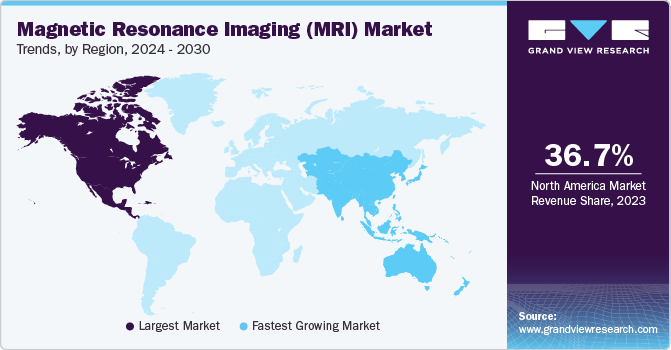

North America magnetic resonance imaging market dominated the market with the largest revenue share of 36.4% in 2024. This share is attributable to the high prevalence of chronic diseases and the integration of AI in imaging. The increasing incidence of conditions such as cancer, cardiovascular diseases, and neurological disorders in the region has heightened the demand for advanced diagnostic tools, particularly, MRI. Moreover, the adoption of AI in imaging enhances the accuracy, speed, and efficiency of MRI scans, leading to better patient outcomes. These factors, coupled with advancements in technology, are accelerating the growth of the magnetic resonance imaging industry in North America.

U.S. Magnetic Resonance Imaging Market Trends

TheU.S. magnetic resonance imaging market accounted for the largest share in 2024, fueled by the growing preference for noninvasive diagnostic methods and a strong focus on patient comfort. MRI offers a safe, noninvasive alternative to traditional diagnostic methods such as biopsies or surgeries, making it highly sought after for early disease detection. In addition, advancements in MRI technology, such as quieter and more compact machines, are improving patient comfort and accessibility. This shift toward less invasive procedures and enhanced patient experience is fueling the demand for MRI services across the U.S. healthcare system.

Europe Magnetic Resonance Imaging Market Trends

Europe magnetic resonance imaging market is projected to witness significant expansion over the forecast period, owing to the shift toward open MRI systems and remote diagnostic imaging. Open MRI systems offer improved patient comfort, particularly for those with claustrophobia or mobility issues, while providing high-quality imaging. Moreover, the rise of remote diagnostic imaging enables healthcare providers to offer services in underserved regions, helping overcome the shortage of radiologists and enhancing access to healthcare. These advancements are anticipated to boost the adoption of MRI technologies, expanding market size and improving patient care across Europe.

Asia Pacific Magnetic Resonance Imaging Market Trends

Asia Pacific magnetic resonance imaging market is set to grow at a significant CAGR of 7.2% from 2025 to 2030 due to increasing healthcare investments and the rising incidence of chronic diseases. Governments and the private sector are enhancing healthcare spending and improving access to advanced medical technologies. In addition, the growing prevalence of chronic conditions, such as cancer, cardiovascular diseases, and neurological disorders, fuels the demand for early and accurate diagnostic tools, including MRI. The development of healthcare infrastructure is expected to enable more patients to access advanced imaging solutions, thereby driving the expansion of the MRI market in the region.

India Magnetic Resonance Imaging Market Trends

India magnetic resonance imaging market is projected to grow at the fastest CAGR from 2025 to 2030, driven by the development of advanced technologies, such as micro-MRI technology. Micro-MRI offers higher resolution imaging and more precise diagnosis, making it ideal for early-stage detection of diseases, especially in small and intricate body areas. Furthermore, innovations such as portable MRI machines, faster imaging processes, and reduced costs are expected to increase accessibility and adoption across healthcare facilities in India, further expanding the market and improving patient outcomes nationwide.

Key Magnetic Resonance Imaging Company Insights

Some of the key companies in the magnetic resonance imaging industry include GE HealthCare; Siemens Healthineers AG; Koninklijke Philips N.V.; CANON MEDICAL SYSTEMS CORPORATION; Hitachi Healthcare (Hitachi High-Tech Corporation); Hologic, Inc.; Bruker; Esaote SPA; Fujifilm Holdings Corporation; Shimadzu Corporation; and Aurora Imaging Technologies, Inc. (AURORA HEALTHCARE US CORP).

-

GE HealthCare provides innovative medical technologies and services, including imaging solutions, monitoring systems, and diagnostics. Its products support healthcare professionals in improving patient outcomes through advanced imaging, ultrasound, anesthesia, and medical data management tools.

-

Siemens Healthineers AG offers innovative medical technology and healthcare solutions, including imaging systems, laboratory diagnostics, and advanced therapies. It focuses on enhancing healthcare outcomes through cutting-edge technologies in areas such as radiology, oncology, and personalized medicine.

Key Magnetic Resonance Imaging Companies:

The following are the leading companies in the magnetic resonance imaging market. These companies collectively hold the largest market share and dictate industry trends.

- GE Healthcare

- Siemens Healthineers

- Koninklijke Philips N.V.

- Canon Medical Systems

- Hitachi Healthcare (Hitachi High-Tech Corporation)

- Hologic Inc.

- Bruker Corporation

- Esaote SPA

- Fujifilm Holdings Corporation

- Shimadzu Corporation

- Aurora Imaging Technologies, Inc.

Recent Developments

-

In March 2025, Polarean Imaging plc expanded its Xenon MRI imaging platform to support pharma-sponsored research. This expansion, in partnership with VIDA Diagnostics, included the introduction of a new service model to enable the use of the device in enhanced research applications.

-

In October 2023, Siemens Healthineers and Cardiff University formed a strategic partnership to advance medical technologies, building on their decade-long collaboration in diagnostics. The partnership focuses on imaging research and precision diagnostics, with Cardiff’s Brain Research Imaging Centre (CUBRIC) driving innovation in MR technology and brain mapping.

-

In June 2023, Imagion Biosystems Limited expanded its collaboration with Siemens Healthineers, extending its existing agreement with Siemens Healthcare Pty Ltd in Australia for 2 more years. The partnership now includes collaboration in the U.S. through Siemens Medical Solutions USA.

-

In April 2023, Siemens Healthineers expanded its manufacturing presence in India by launching an MRI facility in Bengaluru, supported by the Government of India’s PLI scheme. The company has also introduced a new production line at the Bengaluru facility for manufacturing MRI machines.

Magnetic Resonance Imaging Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 7.5 billion |

|

Revenue forecast in 2030 |

USD 10.3 billion |

|

Growth Rate |

CAGR of 6.5% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Architecture, field strength, application, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

|

Country scope |

U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, Thailand, South Korea, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

GE HealthCare; Siemens Healthineers AG; Koninklijke Philips N.V.; CANON MEDICAL SYSTEMS CORPORATION; Hitachi Healthcare (Hitachi High-Tech Corporation); Hologic, Inc.; Bruker; Esaote SPA; Fujifilm Holdings Corporation; Shimadzu Corporation; and Aurora Imaging Technologies, Inc. (AURORA HEALTHCARE US CORP). |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Magnetic Resonance Imaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global magnetic resonance imaging market report on the basis of architecture, field strength, application, end use, and region:

-

Architecture Outlook (Revenue, USD Million, 2018 - 2030)

-

Open Systems

-

Closed Systems

-

-

Field Strength Outlook (Revenue, USD Million, 2018 - 2030)

-

Low

-

Mid

-

High

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Obstructive Sleep Apnea

-

Brain & Neurological

-

Spine & Musculoskeletal

-

Vascular

-

Abdominal

-

Cardiac

-

Breast

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Imaging Centers

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Segment Definitions

1.2.1. Architecture

1.2.2. Field Strength

1.2.3. Application

1.2.4. End Use

1.2.5. Regional Scope

1.2.6. Estimates and Forecasts Timeline

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased Database

1.4.2. GVR’s Internal Database

1.4.3. Secondary Sources

1.4.4. Primary Research

1.4.5. Details of Primary Research

1.5. Information or Data Analysis

1.5.1. Data Analysis Models

1.6. Market Formulation & Validation

1.7. Model Details

1.8. List of Secondary Sources

1.9. List of Primary Sources

1.10. Objectives

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Architecture Outlook

2.2.2. Field Strength Outlook

2.2.3. Application Outlook

2.2.4. End Use Outlook

2.2.5. Regional Outlook

2.3. Competitive Insights

Chapter 3. Magnetic Resonance Imaging Market Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Related/Ancillary Market Outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.2. Market Restraint Analysis

3.3. Magnetic Resonance Imaging Market Analysis Tools

3.3.1. Industry Analysis – Porter’s Five Forces Analysis

3.3.1.1. Supplier Power

3.3.1.2. Buyer Power

3.3.1.3. Substitution Threat

3.3.1.4. Threat of New Entrant

3.3.1.5. Competitive Rivalry

3.3.2. PESTLE Analysis

3.3.2.1. Political Landscape

3.3.2.2. Technological Landscape

3.3.2.3. Economic Landscape

Chapter 4. Magnetic Resonance Imaging Market: Architecture Estimates & Trend Analysis

4.1. Architecture Segment Dashboard

4.2. Magnetic Resonance Imaging Market: Architecture Movement Analysis

4.3. Global Magnetic Resonance Imaging Market Size & Trend Analysis, by Architecture, 2018 to 2030 (USD Million)

4.4. Open Systems

4.4.1. Market Estimates and Forecasts 2018 to 2030 (USD Million)

4.5. Closed Systems

4.5.1. Market Estimates and Forecasts 2018 to 2030 (USD Million)

Chapter 5. Magnetic Resonance Imaging Market: Field Strength Estimates & Trend Analysis

5.1. Field Strength Segment Dashboard

5.2. Magnetic Resonance Imaging Market: Field Strength Movement Analysis

5.3. Global Magnetic Resonance Imaging Market Size & Trend Analysis, by Field Strength, 2018 to 2030 (USD Million)

5.4. Low

5.4.1. Market Estimates and Forecasts 2018 to 2030 (USD Million)

5.5. Mid

5.5.1. Market Estimates and Forecasts 2018 to 2030 (USD Million)

5.6. High

5.6.1. Market Estimates and Forecasts 2018 to 2030 (USD Million)

Chapter 6. Magnetic Resonance Imaging Market: Application Estimates & Trend Analysis

6.1. Application Segment Dashboard

6.2. Magnetic Resonance Imaging Market: Application Movement Analysis

6.3. Global Magnetic Resonance Imaging Market Size & Trend Analysis, by Application, 2018 to 2030 (USD Million)

6.4. Obstructive Sleep Apnea

6.4.1. Market Estimates and Forecasts 2018 to 2030 (USD Million)

6.5. Brain & Neurological

6.5.1. Market Estimates and Forecasts 2018 to 2030 (USD Million)

6.6. Spine & Musculoskeletal

6.6.1. Market Estimates and Forecasts 2018 to 2030 (USD Million)

6.7. Vascular

6.7.1. Market Estimates and Forecasts 2018 to 2030 (USD Million)

6.8. Abdominal

6.8.1. Market Estimates and Forecasts 2018 to 2030 (USD Million)

6.9. Cardiac

6.9.1. Market Estimates and Forecasts 2018 to 2030 (USD Million)

6.10. Breast

6.10.1. Market Estimates and Forecasts 2018 to 2030 (USD Million)

6.11. Others

6.11.1. Market Estimates and Forecasts 2018 to 2030 (USD Million)

Chapter 7. Magnetic Resonance Imaging Market: End Use Estimates & Trend Analysis

7.1. End Use Segment Dashboard

7.2. Magnetic Resonance Imaging Market: End Use Movement Analysis

7.3. Global Magnetic Resonance Imaging Market Size & Trend Analysis, By End Use, 2018 to 2030 (USD Million)

7.4. Hospitals

7.4.1. Market Estimates and Forecasts 2018 to 2030 (USD Million)

7.5. Imaging Centers

7.5.1. Market Estimates and Forecasts 2018 to 2030 (USD Million)

7.6. Ambulatory Surgical Centers

7.6.1. Market Estimates and Forecasts 2018 to 2030 (USD Million)

7.7. Others

7.7.1. Market Estimates and Forecasts 2018 to 2030 (USD Million)

Chapter 8. Magnetic Resonance Imaging Market: Regional Estimates & Trend Analysis

8.1. Regional Market Dashboard

8.2. Regional Market Share Analysis, 2024 & 2030

8.3. Magnetic Resonance Imaging Market by Region: Key Takeaways

8.4. North America

8.4.1. U.S.

8.4.1.1. Key Country Dynamics

8.4.1.2. Regulatory Framework/ Reimbursement Structure

8.4.1.3. Competitive Scenario

8.4.1.4. U.S. Market Estimates and Forecasts 2018 to 2030 (USD Million)

8.4.2. Canada

8.4.2.1. Key Country Dynamics

8.4.2.2. Regulatory Framework/ Reimbursement Structure

8.4.2.3. Competitive Scenario

8.4.2.4. Canada Market Estimates and Forecasts 2018 to 2030 (USD Million)

8.4.3. Mexico

8.4.3.1. Key Country Dynamics

8.4.3.2. Regulatory Framework/ Reimbursement Structure

8.4.3.3. Competitive Scenario

8.4.3.4. Mexico Market Estimates and Forecasts 2018 to 2030 (USD Million)

8.5. Europe

8.5.1. U.K.

8.5.1.1. Key Country Dynamics

8.5.1.2. Regulatory Framework/ Reimbursement Structure

8.5.1.3. Competitive Scenario

8.5.1.4. U.K. Market Estimates and Forecasts 2018 to 2030 (USD Million)

8.5.2. Germany

8.5.2.1. Key Country Dynamics

8.5.2.2. Regulatory Framework/ Reimbursement Structure

8.5.2.3. Competitive Scenario

8.5.2.4. Germany Market Estimates and Forecasts 2018 to 2030 (USD Million)

8.5.3. France

8.5.3.1. Key Country Dynamics

8.5.3.2. Regulatory Framework/ Reimbursement Structure

8.5.3.3. Competitive Scenario

8.5.3.4. France Market Estimates and Forecasts 2018 to 2030 (USD Million)

8.5.4. Italy

8.5.4.1. Key Country Dynamics

8.5.4.2. Regulatory Framework/ Reimbursement Structure

8.5.4.3. Competitive Scenario

8.5.4.4. Italy Market Estimates and Forecasts 2018 to 2030 (USD Million)

8.5.5. Spain

8.5.5.1. Key Country Dynamics

8.5.5.2. Regulatory Framework/ Reimbursement Structure

8.5.5.3. Competitive Scenario

8.5.5.4. Spain Market Estimates and Forecasts 2018 to 2030 (USD Million)

8.5.6. Denmark

8.5.6.1. Key Country Dynamics

8.5.6.2. Regulatory Framework/ Reimbursement Structure

8.5.6.3. Competitive Scenario

8.5.6.4. Denmark Market Estimates and Forecasts 2018 to 2030 (USD Million)

8.5.7. Sweden

8.5.7.1. Key Country Dynamics

8.5.7.2. Regulatory Framework/ Reimbursement Structure

8.5.7.3. Competitive Scenario

8.5.7.4. Sweden Market Estimates and Forecasts 2018 to 2030 (USD Million)

8.5.8. Norway

8.5.8.1. Key Country Dynamics

8.5.8.2. Regulatory Framework/ Reimbursement Structure

8.5.8.3. Competitive Scenario

8.5.8.4. Norway Market Estimates and Forecasts 2018 to 2030 (USD Million)

8.6. Asia Pacific

8.6.1. Japan

8.6.1.1. Key Country Dynamics

8.6.1.2. Regulatory Framework/ Reimbursement Structure

8.6.1.3. Competitive Scenario

8.6.1.4. Japan Market Estimates and Forecasts 2018 to 2030 (USD Million)

8.6.2. China

8.6.2.1. Key Country Dynamics

8.6.2.2. Regulatory Framework/ Reimbursement Structure

8.6.2.3. Competitive Scenario

8.6.2.4. China Market Estimates and Forecasts 2018 to 2030 (USD Million)

8.6.3. India

8.6.3.1. Key Country Dynamics

8.6.3.2. Regulatory Framework/ Reimbursement Structure

8.6.3.3. Competitive Scenario

8.6.3.4. India Market Estimates and Forecasts 2018 to 2030 (USD Million)

8.6.4. Australia

8.6.4.1. Key Country Dynamics

8.6.4.2. Regulatory Framework/ Reimbursement Structure

8.6.4.3. Competitive Scenario

8.6.4.4. Australia Market Estimates and Forecasts 2018 to 2030 (USD Million)

8.6.5. Thailand

8.6.5.1. Key Country Dynamics

8.6.5.2. Regulatory Framework/ Reimbursement Structure

8.6.5.3. Competitive Scenario

8.6.5.4. Thailand Market Estimates and Forecasts 2018 to 2030 (USD Million)

8.6.6. South Korea

8.6.6.1. Key Country Dynamics

8.6.6.2. Regulatory Framework/ Reimbursement Structure

8.6.6.3. Competitive Scenario

8.6.6.4. South Korea Market Estimates and Forecasts 2018 to 2030 (USD Million)

8.7. Latin America

8.7.1. Latin America Market Estimates and Forecasts 2018 to 2030 (USD Million)

8.7.2. Brazil

8.7.2.1. Key Country Dynamics

8.7.2.2. Regulatory Framework/ Reimbursement Structure

8.7.2.3. Competitive Scenario

8.7.2.4. Brazil Market Estimates and Forecasts 2018 to 2030 (USD Million)

8.7.3. Argentina

8.7.3.1. Key Country Dynamics

8.7.3.2. Regulatory Framework/ Reimbursement Structure

8.7.3.3. Competitive Scenario

8.7.3.4. Argentina Market Estimates and Forecasts 2018 to 2030 (USD Million)

8.8. Middle East and Africa

8.8.1. Middle East and Africa Market Estimates and Forecasts 2018 to 2030 (USD Million)

8.8.2. South Africa

8.8.2.1. Key Country Dynamics

8.8.2.2. Regulatory Framework/ Reimbursement Structure

8.8.2.3. Competitive Scenario

8.8.2.4. South Africa Market Estimates and Forecasts 2018 to 2030 (USD Million)

8.8.3. Saudi Arabia

8.8.3.1. Key Country Dynamics

8.8.3.2. Regulatory Framework/ Reimbursement Structure

8.8.3.3. Competitive Scenario

8.8.3.4. Saudi Arabia Market Estimates and Forecasts 2018 to 2030 (USD Million)

8.8.4. UAE

8.8.4.1. Key Country Dynamics

8.8.4.2. Regulatory Framework/ Reimbursement Structure

8.8.4.3. Competitive Scenario

8.8.4.4. UAE Market Estimates and Forecasts 2018 to 2030 (USD Million)

8.8.5. Kuwait

8.8.5.1. Key Country Dynamics

8.8.5.2. Regulatory Framework/ Reimbursement Structure

8.8.5.3. Competitive Scenario

8.8.5.4. Kuwait Market Estimates and Forecasts 2018 to 2030 (USD Million)

Chapter 9. Competitive Landscape

9.1. Recent Developments & Impact Analysis, By Key Market Participants

9.2. Company/ Competition Categorization

9.3. Vendor Landscape

9.3.1. Key company heat map analysis, 2024

9.4. Company Profiles

9.4.1. GE HealthCare

9.4.1.1. Company Overview

9.4.1.2. Financial Performance

9.4.1.3. Product Benchmarking

9.4.1.4. Strategic Initiatives

9.4.2. Siemens Healthineers AG

9.4.2.1. Company Overview

9.4.2.2. Financial Performance

9.4.2.3. Product Benchmarking

9.4.2.4. Strategic Initiatives

9.4.3. Koninklijke Philips N.V.

9.4.3.1. Company Overview

9.4.3.2. Financial Performance

9.4.3.3. Product Benchmarking

9.4.3.4. Strategic Initiatives

9.4.4. CANON MEDICAL SYSTEMS CORPORATION

9.4.4.1. Company Overview

9.4.4.2. Financial Performance

9.4.4.3. Product Benchmarking

9.4.4.4. Strategic Initiatives

9.4.5. Hitachi Healthcare (Hitachi High-Tech Corporation)

9.4.5.1. Company Overview

9.4.5.2. Financial Performance

9.4.5.3. Product Benchmarking

9.4.5.4. Strategic Initiatives

9.4.6. Hologic, Inc.

9.4.6.1. Company Overview

9.4.6.2. Financial Performance

9.4.6.3. Product Benchmarking

9.4.6.4. Strategic Initiatives

9.4.7. Bruker

9.4.7.1. Company Overview

9.4.7.2. Financial Performance

9.4.7.3. Product Benchmarking

9.4.7.4. Strategic Initiatives

9.4.8. Esaote SPA

9.4.8.1. Company Overview

9.4.8.2. Financial Performance

9.4.8.3. Product Benchmarking

9.4.8.4. Strategic Initiatives

9.4.9. Fujifilm Holdings Corporation

9.4.9.1. Company Overview

9.4.9.2. Financial Performance

9.4.9.3. Product Benchmarking

9.4.9.4. Strategic Initiatives

9.4.10. Shimadzu Corporation

9.4.10.1. Company Overview

9.4.10.2. Financial Performance

9.4.10.3. Product Benchmarking

9.4.10.4. Strategic Initiatives

9.4.11. Aurora Imaging Technologies, Inc. (AURORA HEALTHCARE US CORP)

9.4.11.1. Company Overview

9.4.11.2. Financial Performance

9.4.11.3. Product Benchmarking

9.4.11.4. Strategic Initiatives

List of Tables

Table 1 List of Secondary Sources

Table 2 List of Abbreviations

Table 3 Global Magnetic Resonance Imaging Market, by Region, 2018 - 2030 (USD Million)

Table 4 Global Magnetic Resonance Imaging Market, by Architecture, 2018 - 2030 (USD Million)

Table 5 Global Magnetic Resonance Imaging Market, by Field Strength, 2018 - 2030 (USD Million)

Table 6 Global Magnetic Resonance Imaging Market, by Application, 2018 - 2030 (USD Million)

Table 7 Global Magnetic Resonance Imaging Market, by End Use, 2018 - 2030 (USD Million)

Table 8 North America Magnetic Resonance Imaging Market, by Country, 2018 - 2030 (USD Million)

Table 9 North America Magnetic Resonance Imaging Market, by Architecture, 2018 - 2030 (USD Million)

Table 10 North America Magnetic Resonance Imaging Market, by Field Strength, 2018 - 2030 (USD Million)

Table 11 North America Magnetic Resonance Imaging Market, by Application, 2018 - 2030 (USD Million)

Table 12 North America Magnetic Resonance Imaging Market, by End Use, 2018 - 2030 (USD Million)

Table 13 U.S Magnetic Resonance Imaging Market, by Architecture, 2018 - 2030 (USD Million)

Table 14 U.S Magnetic Resonance Imaging Market, by Field Strength, 2018 - 2030 (USD Million)

Table 15 U.S Magnetic Resonance Imaging Market, by Application, 2018 - 2030 (USD Million)

Table 16 U.S Magnetic Resonance Imaging Market, by End Use, 2018 - 2030 (USD Million)

Table 17 Canada Magnetic Resonance Imaging Market, by Architecture, 2018 - 2030 (USD Million)

Table 18 Canada Magnetic Resonance Imaging Market, by Field Strength, 2018 - 2030 (USD Million)

Table 19 Canada Magnetic Resonance Imaging Market, by Application, 2018 - 2030 (USD Million)

Table 20 Canada Magnetic Resonance Imaging Market, by End Use, 2018 - 2030 (USD Million)

Table 21 Mexico Magnetic Resonance Imaging Market, by Architecture, 2018 - 2030 (USD Million)

Table 22 Mexico Magnetic Resonance Imaging Market, by Field Strength, 2018 - 2030 (USD Million)

Table 23 Mexico Magnetic Resonance Imaging Market, by Application, 2018 - 2030 (USD Million)

Table 24 Mexico Magnetic Resonance Imaging Market, by End Use, 2018 - 2030 (USD Million)

Table 25 Europe Magnetic Resonance Imaging Market, by Country, 2018 - 2030 (USD Million)

Table 26 Europe Magnetic Resonance Imaging Market, by Architecture, 2018 - 2030 (USD Million)

Table 27 Europe Magnetic Resonance Imaging Market, by Field Strength, 2018 - 2030 (USD Million)

Table 28 Europe Magnetic Resonance Imaging Market, by Application, 2018 - 2030 (USD Million)

Table 29 Europe Magnetic Resonance Imaging Market, by End Use, 2018 - 2030 (USD Million)

Table 30 UK Magnetic Resonance Imaging Market, by Architecture, 2018 - 2030 (USD Million)

Table 31 UK Magnetic Resonance Imaging Market, by Field Strength, 2018 - 2030 (USD Million)

Table 32 UK Magnetic Resonance Imaging Market, by Application, 2018 - 2030 (USD Million)

Table 33 UK Magnetic Resonance Imaging Market, by End Use, 2018 - 2030 (USD Million)

Table 34 Germany Magnetic Resonance Imaging Market, by Architecture, 2018 - 2030 (USD Million)

Table 35 Germany Magnetic Resonance Imaging Market, by Field Strength, 2018 - 2030 (USD Million)

Table 36 Germany Magnetic Resonance Imaging Market, by Application, 2018 - 2030 (USD Million)

Table 37 Germany Magnetic Resonance Imaging Market, by End Use, 2018 - 2030 (USD Million)

Table 38 France Magnetic Resonance Imaging Market, by Architecture, 2018 - 2030 (USD Million)

Table 39 France Magnetic Resonance Imaging Market, by Field Strength, 2018 - 2030 (USD Million)

Table 40 France Magnetic Resonance Imaging Market, by Application, 2018 - 2030 (USD Million)

Table 41 France Magnetic Resonance Imaging Market, by End Use, 2018 - 2030 (USD Million)

Table 42 Italy Magnetic Resonance Imaging Market, by Architecture, 2018 - 2030 (USD Million)

Table 43 Italy Magnetic Resonance Imaging Market, by Field Strength, 2018 - 2030 (USD Million)

Table 44 Italy Magnetic Resonance Imaging Market, by Application, 2018 - 2030 (USD Million)

Table 45 Italy Magnetic Resonance Imaging Market, by End Use, 2018 - 2030 (USD Million)

Table 46 Spain Magnetic Resonance Imaging Market, by Architecture, 2018 - 2030 (USD Million)

Table 47 Spain Magnetic Resonance Imaging Market, by Field Strength, 2018 - 2030 (USD Million)

Table 48 Spain Magnetic Resonance Imaging Market, by Application, 2018 - 2030 (USD Million)

Table 49 Spain Magnetic Resonance Imaging Market, by End Use, 2018 - 2030 (USD Million)

Table 50 Denmark Magnetic Resonance Imaging Market, by Architecture, 2018 - 2030 (USD Million)

Table 51 Denmark Magnetic Resonance Imaging Market, by Field Strength, 2018 - 2030 (USD Million)

Table 52 Denmark Magnetic Resonance Imaging Market, by Application, 2018 - 2030 (USD Million)

Table 53 Denmark Magnetic Resonance Imaging Market, by End Use, 2018 - 2030 (USD Million)

Table 54 Sweden Magnetic Resonance Imaging Market, by Architecture, 2018 - 2030 (USD Million)

Table 55 Sweden Magnetic Resonance Imaging Market, by Field Strength, 2018 - 2030 (USD Million)

Table 56 Sweden Magnetic Resonance Imaging Market, by Application, 2018 - 2030 (USD Million)

Table 57 Sweden Magnetic Resonance Imaging Market, by End Use, 2018 - 2030 (USD Million)

Table 58 Norway Magnetic Resonance Imaging Market, by Architecture, 2018 - 2030 (USD Million)

Table 59 Norway Magnetic Resonance Imaging Market, by Field Strength, 2018 - 2030 (USD Million)

Table 60 Norway Magnetic Resonance Imaging Market, by Application, 2018 - 2030 (USD Million)

Table 61 Norway Magnetic Resonance Imaging Market, by End Use, 2018 - 2030 (USD Million)

Table 62 Asia Pacific Magnetic Resonance Imaging Market, by Country, 2018 - 2030 (USD Million)

Table 63 Asia Pacific Magnetic Resonance Imaging Market, by Architecture, 2018 - 2030 (USD Million)

Table 64 Asia Pacific Magnetic Resonance Imaging Market, by Field Strength, 2018 - 2030 (USD Million)

Table 65 Asia Pacific Magnetic Resonance Imaging Market, by Application, 2018 - 2030 (USD Million)

Table 66 Asia Pacific Magnetic Resonance Imaging Market, by End Use, 2018 - 2030 (USD Million)

Table 67 Japan Magnetic Resonance Imaging Market, by Architecture, 2018 - 2030 (USD Million)

Table 68 Japan Magnetic Resonance Imaging Market, by Field Strength, 2018 - 2030 (USD Million)

Table 69 Japan Magnetic Resonance Imaging Market, by Application, 2018 - 2030 (USD Million)

Table 70 Japan Magnetic Resonance Imaging Market, by End Use, 2018 - 2030 (USD Million)

Table 71 China Magnetic Resonance Imaging Market, by Architecture, 2018 - 2030 (USD Million)

Table 72 China Magnetic Resonance Imaging Market, by Field Strength, 2018 - 2030 (USD Million)

Table 73 China Magnetic Resonance Imaging Market, by Application, 2018 - 2030 (USD Million)

Table 74 China Magnetic Resonance Imaging Market, by End Use, 2018 - 2030 (USD Million)

Table 75 India Magnetic Resonance Imaging Market, by Architecture, 2018 - 2030 (USD Million)

Table 76 India Magnetic Resonance Imaging Market, by Field Strength, 2018 - 2030 (USD Million)

Table 77 India Magnetic Resonance Imaging Market, by Application, 2018 - 2030 (USD Million)

Table 78 India Magnetic Resonance Imaging Market, by End Use, 2018 - 2030 (USD Million)

Table 79 Australia Magnetic Resonance Imaging Market, by Architecture, 2018 - 2030 (USD Million)

Table 80 Australia Magnetic Resonance Imaging Market, by Field Strength, 2018 - 2030 (USD Million)

Table 81 Australia Magnetic Resonance Imaging Market, by Application, 2018 - 2030 (USD Million)

Table 82 Australia Magnetic Resonance Imaging Market, by End Use, 2018 - 2030 (USD Million)

Table 83 Thailand Magnetic Resonance Imaging Market, by Architecture, 2018 - 2030 (USD Million)

Table 84 Thailand Magnetic Resonance Imaging Market, by Field Strength, 2018 - 2030 (USD Million)

Table 85 Thailand Magnetic Resonance Imaging Market, by Application, 2018 - 2030 (USD Million)

Table 86 Thailand Magnetic Resonance Imaging Market, by End Use, 2018 - 2030 (USD Million)

Table 87 South Korea Magnetic Resonance Imaging Market, by Architecture, 2018 - 2030 (USD Million)

Table 88 South Korea Magnetic Resonance Imaging Market, by Field Strength, 2018 - 2030 (USD Million)

Table 89 South Korea Magnetic Resonance Imaging Market, by Application, 2018 - 2030 (USD Million)

Table 90 South Korea Magnetic Resonance Imaging Market, by End Use, 2018 - 2030 (USD Million)

Table 91 Latin America Magnetic Resonance Imaging Market, by Country, 2018 - 2030 (USD Million)

Table 92 Latin America Magnetic Resonance Imaging Market, by Architecture, 2018 - 2030 (USD Million)

Table 93 Latin America Magnetic Resonance Imaging Market, by Field Strength, 2018 - 2030 (USD Million)

Table 94 Latin America Magnetic Resonance Imaging Market, by Application, 2018 - 2030 (USD Million)

Table 95 Latin America Magnetic Resonance Imaging Market, by End Use, 2018 - 2030 (USD Million)

Table 96 Brazil Magnetic Resonance Imaging Market, by Architecture, 2018 - 2030 (USD Million)

Table 97 Brazil Magnetic Resonance Imaging Market, by Field Strength, 2018 - 2030 (USD Million)

Table 98 Brazil Magnetic Resonance Imaging Market, by Application, 2018 - 2030 (USD Million)

Table 99 Brazil Magnetic Resonance Imaging Market, by End Use, 2018 - 2030 (USD Million)

Table 100 Argentina Magnetic Resonance Imaging Market, by Architecture, 2018 - 2030 (USD Million)

Table 101 Argentina Magnetic Resonance Imaging Market, by Field Strength, 2018 - 2030 (USD Million)

Table 102 Argentina Magnetic Resonance Imaging Market, by Application, 2018 - 2030 (USD Million)

Table 103 Argentina Magnetic Resonance Imaging Market, by End Use, 2018 - 2030 (USD Million)

Table 104 Middle East & Africa Magnetic Resonance Imaging Market, by Country, 2018 - 2030 (USD Million)

Table 105 Middle East & Africa Magnetic Resonance Imaging Market, by Architecture, 2018 - 2030 (USD Million)

Table 106 Middle East & Africa Magnetic Resonance Imaging Market, by Field Strength, 2018 - 2030 (USD Million)

Table 107 Middle East & Africa Magnetic Resonance Imaging Market, by Application, 2018 - 2030 (USD Million)

Table 108 Middle East & Africa Magnetic Resonance Imaging Market, by End Use, 2018 - 2030 (USD Million)

Table 109 South Africa Magnetic Resonance Imaging Market, by Architecture, 2018 - 2030 (USD Million)

Table 110 South Africa Magnetic Resonance Imaging Market, by Field Strength, 2018 - 2030 (USD Million)

Table 111 South Africa Magnetic Resonance Imaging Market, by Application, 2018 - 2030 (USD Million)

Table 112 South Africa Magnetic Resonance Imaging Market, by End Use, 2018 - 2030 (USD Million)

Table 113 Saudi Arabia Magnetic Resonance Imaging Market, by Architecture, 2018 - 2030 (USD Million)

Table 114 Saudi Arabia Magnetic Resonance Imaging Market, by Field Strength, 2018 - 2030 (USD Million)

Table 115 Saudi Arabia Magnetic Resonance Imaging Market, by Application, 2018 - 2030 (USD Million)

Table 116 Saudi Arabia Magnetic Resonance Imaging Market, by End Use, 2018 - 2030 (USD Million)

Table 117 UAE Magnetic Resonance Imaging Market, by Architecture, 2018 - 2030 (USD Million)

Table 118 UAE Magnetic Resonance Imaging Market, by Field Strength, 2018 - 2030 (USD Million)

Table 119 UAE Magnetic Resonance Imaging Market, by Application, 2018 - 2030 (USD Million)

Table 120 UAE Magnetic Resonance Imaging Market, by End Use, 2018 - 2030 (USD Million)

Table 121 Kuwait Magnetic Resonance Imaging Market, by Architecture, 2018 - 2030 (USD Million)

Table 122 Kuwait Magnetic Resonance Imaging Market, by Field Strength, 2018 - 2030 (USD Million)

Table 123 Kuwait Magnetic Resonance Imaging Market, by Application, 2018 - 2030 (USD Million)

Table 124 Kuwait Magnetic Resonance Imaging Market, by End Use, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Market Research Process

Fig. 2 Data Triangulation Techniques

Fig. 3 Primary Research Pattern

Fig. 4 Primary interviews

Fig. 5 Market Research Approaches

Fig. 6 Value-Chain-Based Sizing & Forecasting

Fig. 7 QFD modeling for market share assessment

Fig. 8 Market Formulation & Validation

Fig. 9 Magnetic Resonance Imaging Market: Market Outlook

Fig. 10 Magnetic Resonance Imaging Competitive Insights

Fig. 11 Parent Market Outlook

Fig. 12 Related/ancillary market outlook

Fig. 13 Penetration and Growth Prospect Mapping

Fig. 14 Industry Value Chain Analysis

Fig. 15 Magnetic Resonance Imaging Market Driver Impact

Fig. 16 Magnetic Resonance Imaging Market Restraint Impact

Fig. 17 Magnetic Resonance Imaging Market Strategic Initiatives Analysis

Fig. 18 Magnetic Resonance Imaging Market: Architecture Movement Analysis

Fig. 19 Magnetic Resonance Imaging Market: Architecture Outlook and Key Takeaways

Fig. 20 Open Systems Market Estimates and Forecast, 2018 - 2030

Fig. 21 Closed Systems Market Estimates and Forecast, 2018 - 2030

Fig. 22 Magnetic Resonance Imaging Market: Field Strength Movement Analysis

Fig. 23 Magnetic Resonance Imaging Market: Field Strength Outlook and Key Takeaways

Fig. 24 Low Market, 2018 - 2030 (USD Million)

Fig. 25 Mid Market, 2018 - 2030 (USD Million)

Fig. 26 High Market, 2018 - 2030 (USD Million)

Fig. 27 Magnetic Resonance Imaging Market: Application Movement Analysis

Fig. 28 Magnetic Resonance Imaging Market: Application Outlook and Key Takeaways

Fig. 29 Obstructive Sleep Apnea Market, 2018 - 2030 (USD Million)

Fig. 30 Brain & Neurological Market, 2018 - 2030 (USD Million)

Fig. 31 Spine & Musculoskeletal Market, 2018 - 2030 (USD Million)

Fig. 32 Vascular Market, 2018 - 2030 (USD Million)

Fig. 33 Abdominal Market, 2018 - 2030 (USD Million)

Fig. 34 Cardiac Market, 2018 - 2030 (USD Million)

Fig. 35 Breast Market, 2018 - 2030 (USD Million)

Fig. 36 Others Market, 2018 - 2030 (USD Million)

Fig. 37 Magnetic Resonance Imaging Market: End Use Movement Analysis

Fig. 40 Magnetic Resonance Imaging Market: End Use Outlook and Key Takeaways

Fig. 41 Hospitals Market, 2018 - 2030 (USD Million)

Fig. 42 Imaging Centers Market, 2018 - 2030 (USD Million)

Fig. 43 Ambulatory Surgical Centers Market, 2018 - 2030 (USD Million)

Fig. 44 Others Market, 2018 - 2030 (USD Million)

Fig. 45 Global Magnetic Resonance Imaging Market: Regional Movement Analysis

Fig. 46 Global Magnetic Resonance Imaging Market: Regional Outlook and Key Takeaways

Fig. 47 North America Market Estimates and Forecasts, 2018 - 2030

Fig. 48 U.S. Market Estimates and Forecasts, 2018 - 2030

Fig. 49 Canada Market Estimates and Forecasts, 2018 - 2030

Fig. 50 Mexico Market Estimates and Forecasts, 2018 - 2030

Fig. 51 Europe Market Estimates and Forecasts, 2018 - 2030

Fig. 52 U.K. Market Estimates and Forecasts, 2018 - 2030

Fig. 53 Germany Market Estimates and Forecasts, 2018 - 2030

Fig. 54 France Market Estimates and Forecasts, 2018 - 2030

Fig. 55 Italy Market Estimates and Forecasts, 2018 - 2030

Fig. 56 Spain Market Estimates and Forecasts, 2018 - 2030

Fig. 57 Denmark Market Estimates and Forecasts, 2018 - 2030

Fig. 58 Sweden Market Estimates and Forecasts, 2018 - 2030

Fig. 59 Norway Market Estimates and Forecasts, 2018 - 2030

Fig. 60 Asia Pacific Market Estimates and Forecasts, 2018 - 2030

Fig. 61 Japan Market Estimates and Forecasts, 2018 - 2030

Fig. 62 China Market Estimates and Forecasts, 2018 - 2030

Fig. 63 India Market Estimates and Forecasts, 2018 - 2030

Fig. 64 Australia Market Estimates and Forecasts, 2018 - 2030

Fig. 65 South Korea Market Estimates and Forecasts, 2018 - 2030

Fig. 66 Thailand Market Estimates and Forecasts, 2018 - 2030

Fig. 67 Latin America Market Estimates and Forecasts, 2018 - 2030

Fig. 68 Brazil Market Estimates and Forecasts, 2018 - 2030

Fig. 69 Argentina Market Estimates and Forecasts, 2018 - 2030

Fig. 70 Middle East & Africa Market Estimates and Forecasts, 2018 - 2030

Fig. 71 South Africa Market Estimates and Forecasts, 2018 - 2030

Fig. 72 Saudi Arabia Market Estimates and Forecasts, 2018 - 2030

Fig. 73 UAE Market Estimates and Forecasts, 2018 - 2030

Fig. 74 Kuwait Market Estimates and Forecasts, 2018 - 2030

Market Segmentation

- Magnetic Resonance Imaging Architecture Outlook (Revenue, USD Million; 2018 - 2030)

- Open Systems

- Closed Systems

- Magnetic Resonance Imaging Field Strength Outlook (Revenue, USD Million; 2018 - 2030)

- Low

- Mid

- High

- Magnetic Resonance Imaging Application Outlook (Revenue, USD Million; 2018 - 2030)

- Obstructive Sleep Apnea

- Brain & Neurological

- Spine & Musculoskeletal

- Vascular

- Abdominal

- Cardiac

- Breast

- Others

- Magnetic Resonance Imaging End Use Outlook (Revenue, USD Million; 2018 - 2030)

- Hospitals

- Imaging Centers

- Ambulatory Surgical Centers

- Others

- Magnetic Resonance Imaging Regional Outlook (Revenue, USD Million; 2018 - 2030)

- North America

- North America Magnetic Resonance Imaging Market, By Architecture

- Open Systems

- Closed Systems

- North America Magnetic Resonance Imaging Market, By Field Strength

- Low

- Mid

- High

- North America Magnetic Resonance Imaging Market, By Application

- Obstructive Sleep Apnea

- Brain & Neurological

- Spine & Musculoskeletal

- Vascular

- Abdominal

- Cardiac

- Breast

- Others

- North America Magnetic Resonance Imaging Market, By End Use

- Hospitals

- Imaging Centers

- Ambulatory Surgical Centers

- Others

- U.S.

- U.S. Magnetic Resonance Imaging Market, By Architecture

- Open Systems

- Closed Systems

- U.S. Magnetic Resonance Imaging Market, By Field Strength

- Low

- Mid

- High

- U.S. Magnetic Resonance Imaging Market, By Application

- Obstructive Sleep Apnea

- Brain & Neurological

- Spine & Musculoskeletal

- Vascular

- Abdominal

- Cardiac

- Breast

- Others

- U.S. Magnetic Resonance Imaging Market, By End Use

- Hospitals

- Imaging Centers

- Ambulatory Surgical Centers

- Others

- U.S. Magnetic Resonance Imaging Market, By Architecture

- Canada

- Canada Magnetic Resonance Imaging Market, By Architecture

- Open Systems

- Closed Systems

- Canada Magnetic Resonance Imaging Market, By Field Strength

- Low

- Mid

- High

- Canada Magnetic Resonance Imaging Market, By Application

- Obstructive Sleep Apnea

- Brain & Neurological

- Spine & Musculoskeletal

- Vascular

- Abdominal

- Cardiac

- Breast

- Others

- Canada Magnetic Resonance Imaging Market, By End Use

- Hospitals

- Imaging Centers

- Ambulatory Surgical Centers

- Others

- Canada Magnetic Resonance Imaging Market, By Architecture

- Mexico

- Mexico Magnetic Resonance Imaging Market, By Architecture

- Open Systems

- Closed Systems

- Mexico Magnetic Resonance Imaging Market, By Field Strength

- Low

- Mid

- High

- Mexico Magnetic Resonance Imaging Market, By Application

- Obstructive Sleep Apnea

- Brain & Neurological

- Spine & Musculoskeletal

- Vascular

- Abdominal

- Cardiac

- Breast

- Others

- Mexico Magnetic Resonance Imaging Market, By End Use

- Hospitals

- Imaging Centers

- Ambulatory Surgical Centers

- Others

- Mexico Magnetic Resonance Imaging Market, By Architecture

- North America Magnetic Resonance Imaging Market, By Architecture

- Europe

- Europe Magnetic Resonance Imaging Market, By Architecture

- Open Systems

- Closed Systems

- Europe Magnetic Resonance Imaging Market, By Field Strength

- Low

- Mid

- High

- Europe Magnetic Resonance Imaging Market, By Application

- Obstructive Sleep Apnea

- Brain & Neurological

- Spine & Musculoskeletal

- Vascular

- Abdominal

- Cardiac

- Breast

- Others

- Europe Magnetic Resonance Imaging Market, By End Use

- Hospitals

- Imaging Centers

- Ambulatory Surgical Centers

- Others

- U.K.

- UK Magnetic Resonance Imaging Market, By Architecture

- Open Systems

- Closed Systems

- UK Magnetic Resonance Imaging Market, By Field Strength

- Low

- Mid

- High

- UK Magnetic Resonance Imaging Market, By Application

- Obstructive Sleep Apnea

- Brain & Neurological

- Spine & Musculoskeletal

- Vascular

- Abdominal

- Cardiac

- Breast

- Others

- UK Magnetic Resonance Imaging Market, By End Use

- Hospitals

- Imaging Centers

- Ambulatory Surgical Centers

- Others

- UK Magnetic Resonance Imaging Market, By Architecture

- Germany

- Germany Magnetic Resonance Imaging Market, By Architecture

- Open Systems

- Closed Systems

- Germany Magnetic Resonance Imaging Market, By Field Strength

- Low

- Mid

- High

- Germany Magnetic Resonance Imaging Market, By Application

- Obstructive Sleep Apnea

- Brain & Neurological

- Spine & Musculoskeletal

- Vascular

- Abdominal

- Cardiac

- Breast

- Others

- Germany Magnetic Resonance Imaging Market, By End Use

- Hospitals

- Imaging Centers

- Ambulatory Surgical Centers

- Others

- Germany Magnetic Resonance Imaging Market, By Architecture

- France

- France Magnetic Resonance Imaging Market, By Architecture

- Open Systems

- Closed Systems

- France Magnetic Resonance Imaging Market, By Field Strength

- Low

- Mid

- High

- France Magnetic Resonance Imaging Market, By Application

- Obstructive Sleep Apnea

- Brain & Neurological

- Spine & Musculoskeletal

- Vascular

- Abdominal

- Cardiac

- Breast

- Others

- France Magnetic Resonance Imaging Market, By End Use

- Hospitals

- Imaging Centers

- Ambulatory Surgical Centers

- Others

- France Magnetic Resonance Imaging Market, By Architecture

- Italy

- Italy Magnetic Resonance Imaging Market, By Architecture

- Open Systems

- Closed Systems

- Italy Magnetic Resonance Imaging Market, By Field Strength

- Low

- Mid

- High

- Italy Magnetic Resonance Imaging Market, By Application

- Obstructive Sleep Apnea

- Brain & Neurological

- Spine & Musculoskeletal

- Vascular

- Abdominal

- Cardiac

- Breast

- Others

- Italy Magnetic Resonance Imaging Market, By End Use

- Hospitals

- Imaging Centers

- Ambulatory Surgical Centers

- Others

- Italy Magnetic Resonance Imaging Market, By Architecture

- Spain

- Spain Magnetic Resonance Imaging Market, By Architecture

- Open Systems

- Closed Systems

- Spain Magnetic Resonance Imaging Market, By Field Strength

- Low

- Mid

- High

- Spain Magnetic Resonance Imaging Market, By Application

- Obstructive Sleep Apnea

- Brain & Neurological

- Spine & Musculoskeletal

- Vascular

- Abdominal

- Cardiac

- Breast

- Others

- Spain Magnetic Resonance Imaging Market, By End Use

- Hospitals

- Imaging Centers

- Ambulatory Surgical Centers

- Others

- Spain Magnetic Resonance Imaging Market, By Architecture

- Denmark

- Denmark Magnetic Resonance Imaging Market, By Architecture

- Open Systems

- Closed Systems

- Denmark Magnetic Resonance Imaging Market, By Field Strength

- Low

- Mid

- High

- Denmark Magnetic Resonance Imaging Market, By Application

- Obstructive Sleep Apnea

- Brain & Neurological

- Spine & Musculoskeletal

- Vascular

- Abdominal

- Cardiac

- Breast

- Others

- Denmark Magnetic Resonance Imaging Market, By End Use

- Hospitals

- Imaging Centers

- Ambulatory Surgical Centers

- Others

- Denmark Magnetic Resonance Imaging Market, By Architecture

- Sweden

- Sweden Magnetic Resonance Imaging Market, By Architecture

- Open Systems

- Closed Systems

- Sweden Magnetic Resonance Imaging Market, By Field Strength

- Low

- Mid

- High

- Sweden Magnetic Resonance Imaging Market, By Application

- Obstructive Sleep Apnea

- Brain & Neurological

- Spine & Musculoskeletal

- Vascular

- Abdominal

- Cardiac

- Breast

- Others

- Sweden Magnetic Resonance Imaging Market, By End Use

- Hospitals

- Imaging Centers

- Ambulatory Surgical Centers

- Others

- Sweden Magnetic Resonance Imaging Market, By Architecture

- Norway

- Norway Magnetic Resonance Imaging Market, By Architecture

- Open Systems

- Closed Systems

- Norway Magnetic Resonance Imaging Market, By Field Strength

- Low

- Mid

- High

- Norway Magnetic Resonance Imaging Market, By Application

- Obstructive Sleep Apnea

- Brain & Neurological

- Spine & Musculoskeletal

- Vascular

- Abdominal

- Cardiac

- Breast

- Others

- Norway Magnetic Resonance Imaging Market, By End Use

- Hospitals

- Imaging Centers

- Ambulatory Surgical Centers

- Others

- Norway Magnetic Resonance Imaging Market, By Architecture

- Europe Magnetic Resonance Imaging Market, By Architecture

- Asia Pacific

- Asia Pacific Magnetic Resonance Imaging Market, By Architecture

- Open Systems

- Closed Systems

- Asia Pacific Magnetic Resonance Imaging Market, By Field Strength

- Low

- Mid

- High

- Asia Pacific Magnetic Resonance Imaging Market, By Application

- Obstructive Sleep Apnea

- Brain & Neurological

- Spine & Musculoskeletal

- Vascular

- Abdominal

- Cardiac

- Breast

- Others

- Asia Pacific Magnetic Resonance Imaging Market, By End Use

- Hospitals

- Imaging Centers

- Ambulatory Surgical Centers

- Others

- Japan

- Japan Magnetic Resonance Imaging Market, By Architecture

- Open Systems

- Closed Systems

- Japan Magnetic Resonance Imaging Market, By Field Strength

- Low

- Mid

- High

- Japan Magnetic Resonance Imaging Market, By Application

- Obstructive Sleep Apnea

- Brain & Neurological

- Spine & Musculoskeletal

- Vascular

- Abdominal

- Cardiac

- Breast

- Others

- Japan Magnetic Resonance Imaging Market, By End Use

- Hospitals

- Imaging Centers

- Ambulatory Surgical Centers

- Others

- Japan Magnetic Resonance Imaging Market, By Architecture

- China

- China Magnetic Resonance Imaging Market, By Architecture

- Open Systems

- Closed Systems

- China Magnetic Resonance Imaging Market, By Field Strength

- Low

- Mid

- High

- China Magnetic Resonance Imaging Market, By Application

- Obstructive Sleep Apnea

- Brain & Neurological

- Spine & Musculoskeletal

- Vascular

- Abdominal

- Cardiac

- Breast

- Others

- China Magnetic Resonance Imaging Market, By End Use

- Hospitals

- Imaging Centers

- Ambulatory Surgical Centers

- Others

- China Magnetic Resonance Imaging Market, By Architecture

- India

- India Magnetic Resonance Imaging Market, By Architecture

- Open Systems

- Closed Systems

- India Magnetic Resonance Imaging Market, By Field Strength

- Low

- Mid

- High

- India Magnetic Resonance Imaging Market, By Application

- Obstructive Sleep Apnea

- Brain & Neurological

- Spine & Musculoskeletal

- Vascular

- Abdominal

- Cardiac

- Breast

- Others

- India Magnetic Resonance Imaging Market, By End Use

- Hospitals

- Imaging Centers

- Ambulatory Surgical Centers

- Others

- India Magnetic Resonance Imaging Market, By Architecture

- Australia

- Australia Magnetic Resonance Imaging Market, By Architecture

- Open Systems

- Closed Systems

- Australia Magnetic Resonance Imaging Market, By Field Strength

- Low

- Mid

- High

- Australia Magnetic Resonance Imaging Market, By Application

- Obstructive Sleep Apnea

- Brain & Neurological

- Spine & Musculoskeletal

- Vascular

- Abdominal

- Cardiac

- Breast

- Others

- Australia Magnetic Resonance Imaging Market, By End Use

- Hospitals

- Imaging Centers

- Ambulatory Surgical Centers

- Others

- Australia Magnetic Resonance Imaging Market, By Architecture

- Thailand

- Thailand Magnetic Resonance Imaging Market, By Architecture

- Open Systems

- Closed Systems

- Thailand Magnetic Resonance Imaging Market, By Field Strength

- Low

- Mid

- High

- Thailand Magnetic Resonance Imaging Market, By Application

- Obstructive Sleep Apnea

- Brain & Neurological

- Spine & Musculoskeletal

- Vascular

- Abdominal

- Cardiac

- Breast

- Others

- Thailand Magnetic Resonance Imaging Market, By End Use

- Hospitals

- Imaging Centers

- Ambulatory Surgical Centers

- Others

- Thailand Magnetic Resonance Imaging Market, By Architecture

- South Korea

- South Korea Magnetic Resonance Imaging Market, By Architecture

- Open Systems

- Closed Systems

- South Korea Magnetic Resonance Imaging Market, By Field Strength

- Low

- Mid

- High

- South Korea Magnetic Resonance Imaging Market, By Application

- Obstructive Sleep Apnea

- Brain & Neurological

- Spine & Musculoskeletal

- Vascular

- Abdominal

- Cardiac

- Breast

- Others

- South Korea Magnetic Resonance Imaging Market, By End Use

- Hospitals

- Imaging Centers

- Ambulatory Surgical Centers

- Others

- South Korea Magnetic Resonance Imaging Market, By Architecture

- Asia Pacific Magnetic Resonance Imaging Market, By Architecture

- Latin America

- Latin America Magnetic Resonance Imaging Market, By Architecture

- Open Systems

- Closed Systems

- Latin America Magnetic Resonance Imaging Market, By Field Strength

- Low

- Mid

- High

- Latin America Magnetic Resonance Imaging Market, By Application

- Obstructive Sleep Apnea

- Brain & Neurological

- Spine & Musculoskeletal

- Vascular

- Abdominal

- Cardiac

- Breast

- Others

- Latin America Magnetic Resonance Imaging Market, By End Use

- Hospitals

- Imaging Centers

- Ambulatory Surgical Centers

- Others

- Brazil

- Brazil Magnetic Resonance Imaging Market, By Architecture

- Open Systems

- Closed Systems

- Brazil Magnetic Resonance Imaging Market, By Field Strength

- Low

- Mid

- High

- Brazil Magnetic Resonance Imaging Market, By Application

- Obstructive Sleep Apnea

- Brain & Neurological

- Spine & Musculoskeletal

- Vascular

- Abdominal

- Cardiac

- Breast

- Others

- Brazil Magnetic Resonance Imaging Market, By End Use

- Hospitals

- Imaging Centers

- Ambulatory Surgical Centers

- Others

- Brazil Magnetic Resonance Imaging Market, By Architecture

- Argentina

- Argentina Magnetic Resonance Imaging Market, By Architecture

- Open Systems

- Closed Systems

- Argentina Magnetic Resonance Imaging Market, By Field Strength

- Low

- Mid

- High

- Argentina Magnetic Resonance Imaging Market, By Application

- Obstructive Sleep Apnea

- Brain & Neurological

- Spine & Musculoskeletal

- Vascular

- Abdominal

- Cardiac

- Breast

- Others

- Argentina Magnetic Resonance Imaging Market, By End Use

- Hospitals

- Imaging Centers

- Ambulatory Surgical Centers

- Others

- Argentina Magnetic Resonance Imaging Market, By Architecture

- Latin America Magnetic Resonance Imaging Market, By Architecture

- Middle East & Africa

- Middle East & Africa Magnetic Resonance Imaging Market, By Architecture

- Open Systems

- Closed Systems

- Middle East & Africa Magnetic Resonance Imaging Market, By Field Strength

- Low

- Mid

- High

- Middle East & Africa Magnetic Resonance Imaging Market, By Application

- Obstructive Sleep Apnea

- Brain & Neurological

- Spine & Musculoskeletal

- Vascular

- Abdominal

- Cardiac

- Breast

- Others

- Middle East & Africa Magnetic Resonance Imaging Market, By End Use

- Hospitals

- Imaging Centers

- Ambulatory Surgical Centers

- Others

- South Africa

- South Africa Magnetic Resonance Imaging Market, By Architecture

- Open Systems

- Closed Systems

- South Africa Magnetic Resonance Imaging Market, By Field Strength

- Low

- Mid

- High

- South Africa Magnetic Resonance Imaging Market, By Application

- Obstructive Sleep Apnea

- Brain & Neurological

- Spine & Musculoskeletal

- Vascular

- Abdominal

- Cardiac

- Breast

- Others

- South Africa Magnetic Resonance Imaging Market, By End Use

- Hospitals

- Imaging Centers

- Ambulatory Surgical Centers

- Others

- South Africa Magnetic Resonance Imaging Market, By Architecture

- Saudi Arabia

- Saudi Arabia Magnetic Resonance Imaging Market, By Architecture

- Open Systems

- Closed Systems

- Saudi Arabia Magnetic Resonance Imaging Market, By Field Strength

- Low

- Mid

- High

- Saudi Arabia Magnetic Resonance Imaging Market, By Application

- Obstructive Sleep Apnea

- Brain & Neurological

- Spine & Musculoskeletal

- Vascular

- Abdominal

- Cardiac

- Breast

- Others

- Saudi Arabia Magnetic Resonance Imaging Market, By End Use

- Hospitals

- Imaging Centers

- Ambulatory Surgical Centers

- Others

- Saudi Arabia Magnetic Resonance Imaging Market, By Architecture

- UAE

- UAE Magnetic Resonance Imaging Market, By Architecture

- Open Systems

- Closed Systems

- UAE Magnetic Resonance Imaging Market, By Field Strength

- Low

- Mid

- High

- UAE Magnetic Resonance Imaging Market, By Application

- Obstructive Sleep Apnea

- Brain & Neurological

- Spine & Musculoskeletal

- Vascular

- Abdominal

- Cardiac

- Breast

- Others

- UAE Magnetic Resonance Imaging Market, By End Use

- Hospitals

- Imaging Centers

- Ambulatory Surgical Centers

- Others

- UAE Magnetic Resonance Imaging Market, By Architecture

- Kuwait

- Kuwait Magnetic Resonance Imaging Market, By Architecture

- Open Systems

- Closed Systems

- Kuwait Magnetic Resonance Imaging Market, By Field Strength

- Low

- Mid

- High

- Kuwait Magnetic Resonance Imaging Market, By Application

- Obstructive Sleep Apnea

- Brain & Neurological

- Spine & Musculoskeletal

- Vascular

- Abdominal

- Cardiac

- Breast

- Others

- Kuwait Magnetic Resonance Imaging Market, By End Use

- Hospitals

- Imaging Centers

- Ambulatory Surgical Centers

- Others

- Kuwait Magnetic Resonance Imaging Market, By Architecture

- Middle East & Africa Magnetic Resonance Imaging Market, By Architecture

- North America

Report content

Qualitative Analysis

- Industry overview

- Industry trends

- Market drivers and restraints

- Market size

- Growth prospects

- Porter’s analysis

- PESTEL analysis

- Key market opportunities prioritized

- Competitive landscape

- Company overview

- Financial performance

- Product benchmarking

- Latest strategic developments

Quantitative Analysis

- Market size, estimates, and forecast from 2018 to 2030

- Market estimates and forecast for product segments up to 2030

- Regional market size and forecast for product segments up to 2030

- Market estimates and forecast for application segments up to 2030

- Regional market size and forecast for application segments up to 2030

- Company financial performance

Research Methodology

Grand View Research employs comprehensive and iterative research methodology focused on minimizing deviance in order to provide the most accurate estimates and forecast possible. The company utilizes a combination of bottom-up and top-down approaches for segmenting and estimating quantitative aspects of the market. In Addition, a recurring theme prevalent across all our research reports is data triangulation that looks market from three different perspectives. Critical elements of methodology employed for all our studies include:

Preliminary data mining

Raw market data is obtained and collated on a broad front. Data is continuously filtered to ensure that only validated and authenticated sources are considered. In addition, data is also mined from a host of reports in our repository, as well as a number of reputed paid databases. For comprehensive understanding of the market, it is essential to understand the complete value chain and in order to facilitate this; we collect data from raw material suppliers, distributors as well as buyers.

Technical issues and trends are obtained from surveys, technical symposia and trade journals. Technical data is also gathered from intellectual property perspective, focusing on white space and freedom of movement. Industry dynamics with respect to drivers, restraints, pricing trends are also gathered. As a result, the material developed contains a wide range of original data that is then further cross-validated and authenticated with published sources.

Statistical model

Our market estimates and forecasts are derived through simulation models. A unique model is created customized for each study. Gathered information for market dynamics, technology landscape, application development and pricing trends is fed into the model and analyzed simultaneously. These factors are studied on a comparative basis, and their impact over the forecast period is quantified with the help of correlation, regression and time series analysis. Market forecasting is performed via a combination of economic tools, technological analysis, and industry experience and domain expertise.

Econometric models are generally used for short-term forecasting, while technological market models are used for long-term forecasting. These are based on an amalgamation of technology landscape, regulatory frameworks, economic outlook and business principles. A bottom-up approach to market estimation is preferred, with key regional markets analyzed as separate entities and integration of data to obtain global estimates. This is critical for a deep understanding of the industry as well as ensuring minimal errors. Some of the parameters considered for forecasting include:

• Market drivers and restrains, along with their current and expected impact

• Raw material scenario and supply v/s price trends

• Regulatory scenario and expected developments

• Current capacity and expected capacity additions up to 2030

We assign weights to these parameters and quantify their market impact using weighted average analysis, to derive an expected market growth rate.

Primary validation

This is the final step in estimating and forecasting for our reports. Exhaustive primary interviews are conducted, on face to face as well as over the phone to validate our findings and assumptions used to obtain them. Interviewees are approached from leading companies across the value chain including suppliers, technology providers, domain experts and buyers so as to ensure a holistic and unbiased picture of the market. These interviews are conducted across the globe, with language barriers overcome with the aid of local staff and interpreters. Primary interviews not only help in data validation, but also provide critical insights into the market, current business scenario and future expectations and enhance the quality of our reports. All our estimates and forecast are verified through exhaustive primary research with Key Industry Participants (KIPs) which typically include:

• Market leading companies

• Raw material suppliers

• Product distributors

• Buyers

The key objectives of primary research are as follows:

• To validate our data in terms of accuracy and acceptability

• To gain an insight in to the current market and future expectations

Data Collection Matrix

|

Perspective |

Primary research |

Secondary research |

|

Supply side |

|

|

|

Demand side |

|

|

Industry Analysis Matrix

|

Qualitative analysis |

Quantitative analysis |

|

|

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."