- Home

- »

- Organic Chemicals

- »

-

Magnesium Chloride Market Size And Share Report, 2030GVR Report cover

![Magnesium Chloride Market Size, Share & Trends Report]()

Magnesium Chloride Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Anhydrous, Hexahydrate), By End-use (Healthcare, Construction, Textile, Wastewater Treatment Chemicals), By Region (North America, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68040-141-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Magnesium Chloride Market Size & Trends

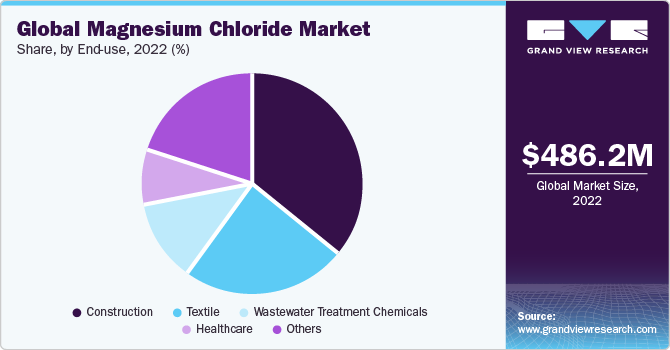

The global magnesium chloride market size was estimated at USD 486.2 million in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. This is attributed to the wide product usage in the cement industry. It is used as an additive in cement production as the addition of magnesium chloride to cement can improve its performance in various ways. It can enhance the workability of the cement, making it easier to mix and apply. It can also improve the setting time and early strength development of the cement, allowing for faster construction processes. The product usage in cement production can also have environmental benefits. It helps reduce the carbon footprint of cement by lowering the clinker content, which is a key component of cement responsible for a significant amount of carbon dioxide emissions during its production.

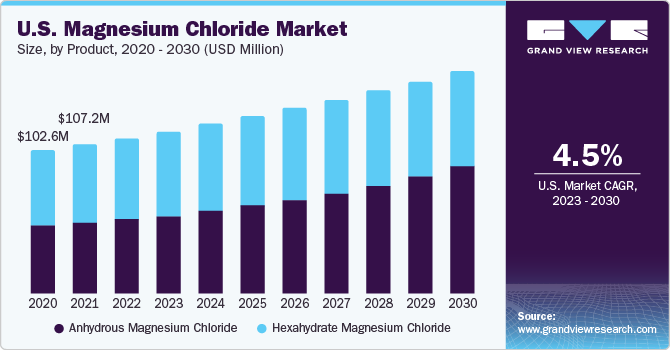

The product demand in the U.S. is influenced by a variety of factors and end-use industries. One significant driver of the market growth in the U.S. is the high demand from the pharmaceutical industry. Magnesium chloride plays a crucial role in the production of pharmaceuticals and dietary supplements, making it an essential ingredient in this sector. In addition, it finds application in the cement industry as an additive. Its addition to cement enhances its performance and durability, making it a preferred choice in construction projects.

Its usage can improve the resistance to freeze-thaw cycles and chemical attacks. Furthermore, the product’s salts are extensively used for de-icing purposes in regions with cold climates, particularly in North America. During winter, magnesium chloride is commonly used as a de-icer on roads and highways to prevent ice formation and enhance road safety. These various applications highlight the product versatility and its importance in different industries.

Product Insights

The anhydrous magnesium chloride segment accounted for the largest revenue share of around 61.36% in 2022. This is attributed to the usage of magnesium chloride in industries, such as oil & gas, construction, and chemical manufacturing. The wide usage of brine in the oil & gas industry and its applications in various chemical processes contribute to the market demand. Magnesium chloride brine is used as a component for drilling fluids or mud. It helps control the viscosity and density of the mud, preventing blowouts and facilitating the drilling process. It can be used as a completion fluid in well-stimulation operations. It helps maintain wellbore stability and prevents formation damage during the completion process.

Hexahydrate is widely used as a de-icing agent in winter maintenance operations. When spread on roads, highways, and bridges, it helps accelerate the melting process of ice and snow as hexahydrate has a lower freezing point than water, which allows it to dissolve in moisture and create a brine solution. The brine lowers the freezing point of water, preventing ice from forming or melting existing ice and snow. By melting the ice and snow, hexahydrate improves road conditions and enhances safety for motorists. It helps prevent slippery and hazardous conditions that can lead to accidents. In addition, it improves traction and provides better grip for vehicles, reducing the risk of skidding or sliding.

End-use Insights

The construction segment accounted for a significant share of 35.64% in 2022 due to the fact that the product finds application in the construction industry as an additive in cement and concrete. It is used to enhance the performance and durability of these materials. The product demand in the construction sector is driven by its ability to improve workability, setting time, early strength development, and resistance to freeze-thaw cycles and chemical attacks. It is used in the textile industry for various purposes. It is used as a catalyst in the production of synthetic fibers, such as nylon and polyester. The product helps in the polymerization process and improves the quality and strength of the fibers. It is also used as a dye fixative, which helps enhance color fastness in textiles.

The product is also utilized in wastewater treatment processes as a coagulant to remove suspended particles and impurities from water. It helps in the flocculation process, where it binds with contaminants and forms larger particles that can be easily separated from the water. It is also used in the treatment of sludge and odor control in wastewater treatment plants. In the healthcare industry, the product is used for various purposes. It is used as a supplement to provide magnesium to the body, as magnesium plays a vital role in many physiological processes. It is also used in medical treatments, such as magnesium sulfate injections, for conditions like eclampsia and pre-eclampsia during pregnancy. Moreover, it is used in the food & beverage industry as a flavor enhancer and food additive. It is used in the production of certain food products, such as tofu, as a coagulant; in sports drinks as a mineral supplement; and in dietary supplements, as a source of magnesium.

Regional Insights

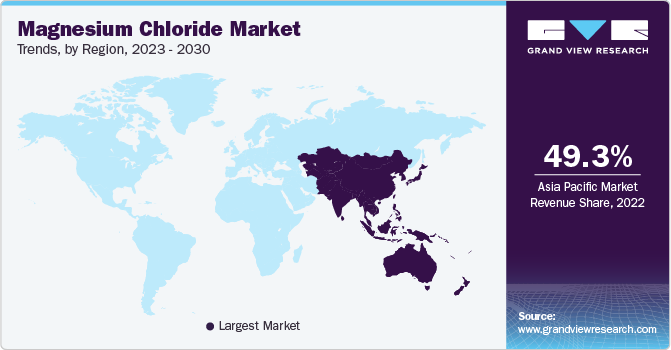

Asia Pacific accounted for the largest revenue share of around 43.9% in 2022 due to the strong economic development and population expansion in countries like China and India, which are anticipated to drive construction spending in the region. The Organization for Economic Co-operation and Development (OECD) predicts that emerging Asia, including Southeast Asia, India, and China, will experience an average GDP growth rate of 6.3% from 2018 to 2022. This growth is expected to fuel large-scale construction projects aimed at infrastructure development and meeting the increasing demand for residential properties. In line with the Indian government’s "Make in India" program, there is a projected investment of USD 650 billion in urban infrastructure projects over the next two decades. This initiative aims to boost the manufacturing sector and promote the development of smart cities, which will further contribute to the demand for construction materials.

Magnesium chloride, as a versatile compound, has numerous applications in the construction industry. It is commonly used as a de-icer for roads and highways during winter, as it effectively melts snow and ice, improving safety and accessibility. Moreover, the product is utilized in dust control for construction sites, as it helps suppress dust and stabilize soil. Magnesium chloride has significant demand in Europe across various industries. In the textile industry, it is used as a dye fixative and flame retardant. In wastewater treatment, the product is employed for coagulation and flocculation processes. It also finds applications in healthcare, particularly in pharmaceutical production. In construction, it is used as a de-icing agent and dust suppressant. The product demand in North America varies across different industries.

Key Companies & Market Share Insights

With the growing product demand from various end-use industries, market players are actively investing in expanding their production capacities. In addition, key participants are strategically enhancing their global presence through initiatives, such as mergers, acquisitions, expansions, partnerships, and collaborations. For instance, in June 2022, Nedmag B. V’s magnesium chloride garnered significant interest across multiple industries owing to its enhanced characteristics, including flame resistance and cost-effectiveness. Consequently, it has experienced substantial demand within the fire-retardant sector.

Key Magnesium Chloride Companies:

- Compass Minerals International, Inc. E.

- K+S Aktiengesellschaft

- Israel Chemicals Ltd.

- Shandong Haihua Group Co, Ltd.

- Huitai Investment Group Co., Ltd.

- Interpid Postah, Inc.

- Tianjin Changlu Haiging Group Co., Ltd.

- DEUSA International GmbH

- Nedmag B.V.

- Nikomag OJSC

Magnesium Chloride Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 506.4 million

Revenue forecast in 2030

USD 680 million

Growth rate

CAGR of 4.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD Million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Compass Minerals International, Inc. E.; K+S Aktiengesellschaft; Israel Chemicals Ltd.; Shandong Haihua Group Co., Ltd.; Huitai Investment Group Co., Ltd.; Interpid Postah, Inc.; Tianjin Changlu Haiging Group Co., Ltd.; DEUSA international GmbH; Nedmag B.V.; Nikomag OJSC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

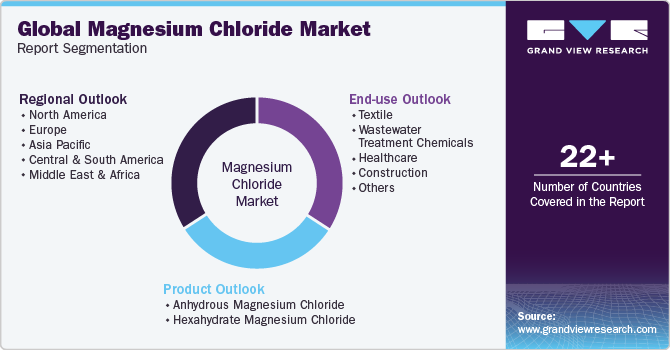

Global Magnesium Chloride Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the magnesium chloride market report on the basis of product, end-use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Anhydrous Magnesium Chloride

-

Hexahydrate Magnesium Chloride

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Textile

-

Wastewater Treatment Chemicals

-

Healthcare

-

Construction

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global magnesium chloride market size was estimated at USD 486.2 million in 2022 and is expected to reach USD 506.4 million in 2030.

b. The global magnesium chloride market is expected to grow at a compound annual growth rate of 4.3% from 2023 to 2030 to reach USD 680 million in 2030.

b. Asia Pacific dominated the magnesium chloride market with a share of 43.9% in 2022. This is attributed to the demand for the market in the Asia Pacific region being influenced by various factors. It is used as a sizing agent and flame retardant for fabrics in the textile industry.

b. Some key players operating in the magnesium chloride market include Compass Minerals International, Inc. E., K+S Aktiengesellschaft, Israel Chemicals Ltd., Shandong Haihua Group Co, Ltd., Huitai Investment Group Co, Ltd, Interpid Postah, Inc, Tianjin Changlu Haiging Group Co, Ltd, DEUSA international GmbH, Nedmag B.V, Nikomag OJSC.

b. Key factors that are driving the market growth include, the use of magnesium chloride in the cement industry is a primary driving factor for the growth of the market. Magnesium chloride is used as an additive in cement production, which enhances its performance and durability.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.