- Home

- »

- Next Generation Technologies

- »

-

M-commerce Payment Market Size & Share Report, 2030GVR Report cover

![M-commerce Payment Market Size, Share & Trends Report]()

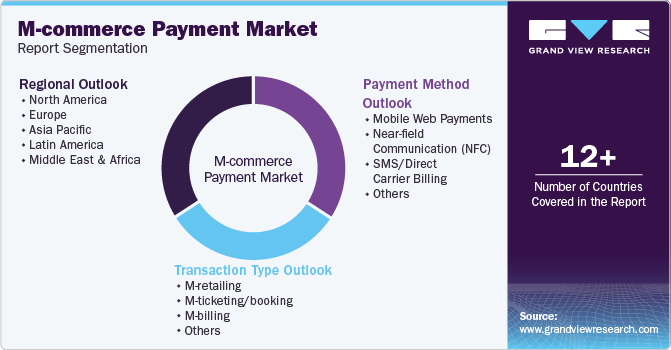

M-commerce Payment Market (2024 - 2030) Size, Share & Trends Analysis Report By Payment Method (Mobile Web, Near-field Communication), By Transaction Type (M-retailing, M-billing), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-468-4

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

M-commerce Payment Market Size & Trends

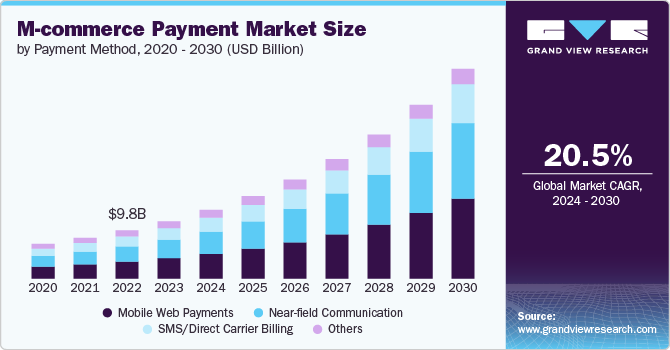

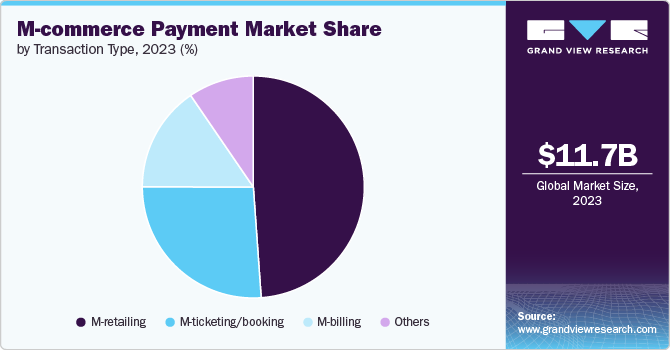

The global M-commerce payment market size was estimated at USD 11.66 billion in 2023 and is expected to grow at a CAGR of 20.5% from 2024 to 2030. The increasing adoption of mobile devices and the growing popularity of online shopping are major factors behind the market's growth. As more consumers use smartphones and tablets to purchase, the need for secure and convenient mobile payment options has surged. The rise of mobile applications and mobile-optimized websites has made it easier for consumers to browse and buy products on the go, further fueling the market's growth.

As mobile device ownership continues to rise globally, more consumers use these devices for online shopping and financial transactions. High-speed internet connectivity and the proliferation of affordable smartphones have made it easier for people to access e-commerce platforms and payment gateways on-the-go. This trend is further driven by advancements in mobile technology, such as improved processing power and better user interfaces, which enhance the overall shopping experience. Thus, with the increasing penetration of mobile devices, the volume of M-commerce transactions is expected to increase, thereby propelling the market’s growth.

Another trend driving the market's growth is integrating artificial intelligence (AI) and chatbots in mobile payment systems. These technologies enhance customer experiences by providing personalized recommendations, facilitating transactions, and offering real-time support. AI-driven analytics can help businesses understand consumer behavior and preferences, allowing for targeted marketing strategies that increase conversion rates. As more companies leverage AI and chatbots to improve their mobile payment offerings, this trend is expected to contribute to market growth.

Furthermore, innovations in mobile payment technologies are further expected to boost the market's growth. The introduction of secure and convenient payment solutions, such as digital wallets, contactless payments, and biometric authentication, has transformed how consumers conduct transactions. Technologies such as Near Field Communication (NFC), Wireless Application Protocol (WAP), and QR codes have made mobile payments faster and more secure, enhancing user convenience and reducing friction in the payment process. These advancements boost consumer confidence and encourage more frequent use of M-commerce payment methods, thereby expanding the market.

Data breaches and security concerns could hamper the growth of the market. High-profile data breaches and the risk of fraud can erode consumer trust in mobile payment systems. However, to address these concerns, businesses are prioritizing robust security measures and transparency around data protection, which, in turn, is expected to contribute to the market’s growth. In addition, businesses are focusing on offering cost-effective and globally accessible payment options, optimizing mobile performance applications, and working to expand technology access in underserved regions, which is further expected to improve market growth.

Payment Method Insights

The mobile web payments segment dominated the market in 2023 and accounted for a 35.61% share of global revenue. In this M-commerce payment method, consumers use web pages, the internet, or dedicated applications installed on their phones. The technology supporting these transactions is Wireless Application Protocol (WAP). Many mobile network operators are increasingly adopting this method. A prominent example is PayPal Holdings, Inc.’s PayPal Express Checkout service.

The Near-field Communication (NFC) segment is projected to grow significantly from 2024 to 2030. NFC technology is transforming the M-commerce payment landscape by enabling contactless transactions. This technology allows smartphones and other devices to communicate with payment terminals wirelessly, making transactions faster and more efficient. The convenience of tapping a phone to make a payment appeals to consumers, particularly in fast-paced environments such as retail stores and public transportation. As NFC-enabled devices become more widespread and payment infrastructure adapts to accommodate this technology, the market is expected to witness significant growth driven by consumer preference for speed and convenience.

Transaction Type Insights

The M-retailing segment dominated the market in 2023. The surge in mobile retail transactions is largely driven by the widespread adoption of smartphones and improved mobile internet connectivity. Consumers increasingly use their mobile devices to browse, compare, and purchase products, leveraging the convenience of shopping from anywhere at any time. The rise of mobile-optimized websites and user-friendly shopping applications has further accelerated this shift, providing seamless and engaging shopping experiences. Furthermore, most retail stores are offering their M-commerce applications, allowing users to purchase goods directly from their mobile phones, which, in turn, drives the segment’s growth.

The M-billing segment is projected to witness significant growth from 2024 to 2030. This growth can be attributed to the increasing consumer reliance on mobile devices for managing various aspects of their financial lives. M-billing provides benefits such as the convenience of paying bills directly from mobile phones, reducing the need for physical payments, and streamlining the payment process. Thus, increasing demand for greater convenience and efficiency in managing financial transactions drives more demand for M-billing solutions.

Regional Insights

The Asia Pacific M-commerce payment market dominated in 2023 and accounted for a 36.41% global revenue share. The market growth is driven by rapidly expanding smartphone adoption and a young, tech-savvy population. Countries such as China and India are major contributors, with significant advancements in mobile payment technologies and widespread use of digital wallets. The region's diverse and dynamic market is characterized by a high volume of mobile transactions, supported by increasing internet penetration and e-commerce. In addition, the growth of mobile banking and innovative payment solutions tailored to local preferences are fueling the market's growth.

North America M-commerce Payment Market Trends

The M-commerce payment market in North Americais expected to grow steadily from 2024 to 2030. Factors such as high smartphone penetration, advanced technological infrastructure, and a strong emphasis on digital innovation are major factors behind the market's growth. The U.S. and Canada have well-established mobile payment ecosystems, with widespread adoption of digital wallets and contactless payment solutions. Major tech companies and financial institutions in North America continually enhance mobile payment technologies, offering a range of secure and convenient options for consumers, thereby driving the market's growth.

The U.S. M-commerce payment market is expected to grow at a significant CAGR from 2024 to 2030. The market's growth can be attributed to the increasing adoption of mobile payment technologies such as Apple Pay, Google Pay, and Samsung Pay, rising smartphone usage, and consumer demand for advanced payment methods. In addition, the rise of mobile banking and the increasing number of digital-only banks contribute to the market expansion.

Europe M-commerce Payment Market Trends

The M-commerce payment market in Europe is expected to grow at a moderate CAGR from 2024 to 2030. The market growth in Europe can be attributed to the vast presence of a diverse and tech-forward consumer base. The region benefits from high smartphone penetration and a strong focus on digital transformation across various industries. European consumers are increasingly adopting mobile payment solutions, such as digital wallets and contactless payments, supported by stringent security standards and regulations. Moreover, the rise of cross-border e-commerce and the increasing popularity of mobile banking contribute to market growth.

Key M-commerce Payment Company Insights

Key players operating in the market include Amazon.com Inc., Apple Inc., and Google LLC, among others. The vendors focus on various strategies to gain a competitive advantage over their rivals, including partnerships and collaborations, agreements, and new product development.

Key M-commerce Payment Companies:

The following are the leading companies in the M-commerce payment market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon.com Inc.

- Apple Inc.

- Google LLC

- ACI Worldwide, Inc.

- Fiserv, Inc.

- FIS

- Mastercard

- PayPal Holdings, Inc.

- Visa, Inc.

- Square, Inc.

Recent Development

-

In July 2024, Open Payment Technologies Ltd., a prominent provider of advanced FinTech solutions, unveiled a digital wallet application, Kuady. The launch of Kuady is designed to advance financial inclusion and revolutionize the management of finances for merchants and users.

-

In April 2024, Mastercard introduced a mobile virtual card application that effortlessly integrates virtual commercial cards into digital wallets. This innovative application aims to provide financial institutions greater flexibility in delivering sustainable and secure contactless payment solutions, meeting companies' growing expectations.

M-commerce Payment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.95 billion

Revenue forecast in 2030

USD 42.68 billion

Growth rate

CAGR of 20.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Payment method, transaction type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Amazon.com Inc.; Apple Inc.; Google LLC; ACI Worldwide, Inc.; Fiserv, Inc.; FIS; Mastercard; PayPal Holdings, Inc.; Visa, Inc.; Square, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global M-commerce Payment Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global M-commerce payment market based on payment method, transaction type, and region.

-

Payment Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Mobile Web Payments

-

Near-field Communication (NFC)

-

SMS/Direct Carrier Billing

-

Others

-

-

Transaction Type Outlook (Revenue, USD Million, 2018 - 2030)

-

M-retailing

-

M-ticketing/booking

-

M-billing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global M-commerce payment market size was estimated at USD 11.66 billion in 2023 and is expected to reach USD 13.95 billion in 2024.

b. The global M-commerce payment market is expected to grow at a compound annual growth rate of 20.5% from 2024 to 2030 to reach USD 42.68 billion by 2030.

b. Asia Pacific dominated the M-commerce payment market with a share of 36.41% in 2023. The market growth is driven by rapidly expanding smartphone adoption and a young, tech-savvy population in the region.

b. Some key players operating in the M-commerce payment market include Amazon.com Inc., Apple Inc., Google LLC, ACI Worldwide, Inc., Fiserv, Inc., FIS, Mastercard, PayPal Holdings, Inc., Visa, Inc., and Square, Inc.

b. Key factors that are driving the market growth include the increasing adoption of mobile devices and the growing popularity of online shopping.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.