- Home

- »

- Food Additives & Nutricosmetics

- »

-

Lycopene Market Size, Share, Growth Analysis Report, 2030GVR Report cover

![Lycopene Market Size, Share & Trends Report]()

Lycopene Market (2024 - 2030) Size, Share & Trends Analysis Report By Form (Powder, Others), By Nature (Synthetic, Natural), By Application (Dietary Supplements, Personal Care), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-393-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Lycopene Market Summary

The global lycopene market size was estimated at USD 161,000.0 million in 2023 and is projected to reach USD 227,718.3 million by 2030, growing at a CAGR of 5.1% from 2024 to 2030. Lycopene is a powerful carotenoid commonly derived from tomatoes, renowned for its numerous medicinal properties that have surged its demand in the nutraceutical market.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

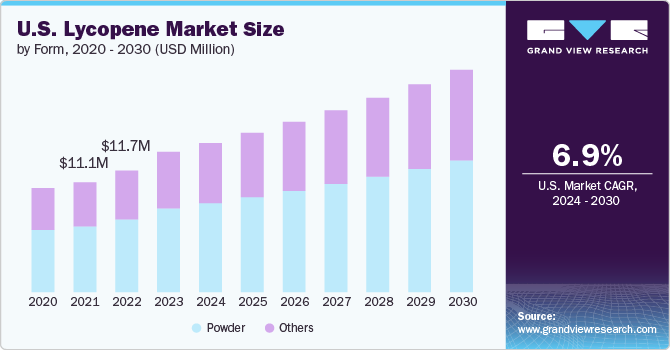

- In terms of segment, powder accounted for a revenue of USD 161,000.0 million in 2023.

- Powder is the most lucrative form segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 161,000.0 Million

- 2030 Projected Market Size: USD 227,718.3 Million

- CAGR (2024-2030): 5.1%

- North America: Largest market in 2023

With its rich antioxidants, lycopene effectively combats free radicals, known for causing cell damage.

Additionally, lycopene is linked to reducing heart-related diseases, lowering the risk of diabetes, and preventing various cancers such as lung, bone, and prostate cancers. Notably, it also contributes to maintaining cardiovascular health. While fruits and vegetables are primary sources of lycopene, the rise in fast food consumption has led to increased uptake of lycopene through nutraceutical supplements.

With the expanding global population and the increasing consumption of meat products, the demand for animal feed is projected to rise significantly. The Food and Agriculture Organization (FAO) highlights the beneficial impact of supplementing livestock and poultry feed with natural fruit and plant materials and extracts containing bioactive components. These additives have demonstrated the ability to enhance feed efficiency, antioxidant status, nutrient digestion, animal health, and growth performance.

A primary focus within the livestock industry is the prevalence of epidemiological diseases, particularly those affecting the immune systems and digestion. Lycopene has been proven to enhance antioxidant capacity, immune function, and lipid metabolism regulation in chickens. Furthermore, the addition of lycopene to the diet has been associated with a reduction in the cholesterol content of broiler meat. Given the antioxidant advantages of lycopene, a surge in demand for this compound is anticipated in the animal feed market.

Drivers, Opportunities & Restraints

Consumers are actively seeking natural and organic ingredients in their food and dietary supplements, which is significantly boosting the demand for lycopene derived from natural sources like tomatoes. This surge is propelled by a heightened awareness of the health benefits linked to natural compounds. Lycopene, renowned for its potent antioxidant capabilities, is rapidly gaining popularity for its potential in promoting heart health, shielding the skin, and contributing to overall well-being.

The lycopene market is experiencing increased use in the nutraceutical and cosmeceutical industries. As researchers continue to find more health benefits, lycopene is being added to dietary supplements, functional foods, and skincare products. Its antioxidant properties make it a valuable ingredient for improving skin health and preventing issues related to oxidative stress. This dual application in both the health and beauty sectors is driving the market's growth.

The ongoing research and development activities are laser-focused on enhancing the stability, bioavailability, and formulation of lycopene. Cutting-edge innovations such as microencapsulation techniques and novel delivery systems are actively being explored to significantly improve lycopene's effectiveness and absorption. These advancements are effectively addressing challenges related to lycopene's stability in various formulations, ultimately ensuring that consumers can more efficiently harness its health benefits. As a result, the market is witnessing a powerful and dynamic landscape with relentless efforts to optimize lycopene-based products.

Form Insights & Trends

“Powder emerged as the fastest growing end use with a CAGR of 5.6%”

Other form dominated the market with a market and accounted for a revenue share of 60.71% in 2023.Other form of lycopene market includes oil, beadles, capsules etc. These forms offer enhanced bioavailability and stability, making them suitable for formulations such as capsules, tablets, and gels. The oil suspension and emulsion segments are expected to witness steady growth, driven by the increasing demand for lycopene-based products in these sectors.

The powder form of lycopene has emerged as the most dominant and versatile form in the market. It is widely used in the nutraceutical, food, and beverage industries due to its ease of incorporation into various products. Its popularity stems from its ability to be seamlessly integrated into dietary supplements, breakfast cereals, infant formulas, and meal replacements.

Nature Insights & Trends

“Natural emerged as the fastest growing form with a CAGR of 6.2%”

Natural segment dominated the market and accounted for a revenue share of 59.51% in 2023. Natural lycopene is derived from various fruits and vegetables, primarily tomatoes, which are rich sources of this powerful antioxidant. Tomatoes and tomato-based products are the primary sources of natural lycopene, accounting for a significant portion of the market. Other natural sources include watermelons, pink grapefruits, and certain citrus fruits, as well as vegetables like asparagus and parsley.

The demand for natural lycopene has witnessed a surge in recent years, driven by consumer preferences for clean-label and plant-based ingredients. Consumers are increasingly seeking natural and organic products due to the perceived health benefits and concerns over synthetic additives. This shift in consumer perception has led to a wider adoption of natural lycopene by various stakeholders in the food, nutraceutical, and cosmetic industries.

Synthetic lycopene is produced through chemical synthesis processes and serves as a viable alternative to natural sources. The synthetic form is generally more affordable and easier to manufacture, making it an attractive option for various applications. While synthetic lycopene may not have the same perceived health benefits as its natural counterpart, it offers a cost-effective solution for industries seeking to incorporate lycopene into their products.

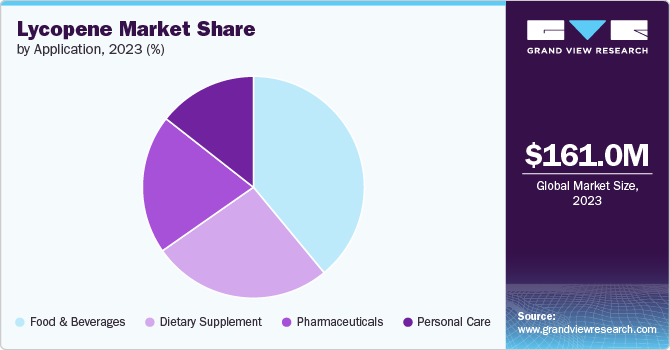

Application Insights & Trends

“Personal Care emerged as the fastest growing mode of application with a CAGR of 5.9%”

Food & beverage dominated the market with a market and accounted for a revenue share of 39.02% in 2023. Lycopene finds its extensive use in the food and beverage industry, serving as a natural coloring agent and potent antioxidant. Its vivid hue makes it an attractive choice for imparting color to various products like tomato-based sauces, soups, and juices. Moreover, it is utilized in formulating dietary supplements and functional foods due to its potential health benefits.

In food applications, it is available in various forms such as beadlets, oil suspensions, emulsifiers, and powders. The powder form is particularly popular owing to its ease of incorporation into various food matrices and stability during processing. Its antioxidant properties also contribute to extending the shelf life of food products by preventing oxidation and rancidity.

The pharmaceutical industry has recognized the potential health benefits of this pigment, leading to its incorporation into various drug formulations and nutraceutical products. Its antioxidant and anti-inflammatory properties have been studied for their potential roles in preventing or managing chronic conditions like cardiovascular diseases, certain cancers, and age-related macular degeneration. Pharmaceutical products containing this pigment may be formulated as capsules, tablets, or liquid preparations, leveraging the bioavailability and stability of different forms. Additionally, its ability to protect against oxidative stress and improve endothelial function has garnered interest in its potential applications for cardiovascular health.

Regional Insights & Trends

“U.S. is expected to dominate the North America market with a market share of 42.95% in 2030”

North America dominated the market and accounted for a 30.08% share in 2023. The U.S.'s large internal market, high per capita consumption, and well-established trade patterns contribute to its leading position in the regional market.

U.S. Lycopene Market Trends

U.S. dominated the market and accounted for a market share of 42.95% in 2023. This growth is attributed to Consumers in the U.S. are increasingly seeking natural, clean-label, and premium-quality products, which is expected to drive the demand for natural lycopene sources. This trend aligns with the growing preference for organic and plant-based ingredients in various industries, including food, beverages, and personal care.

Asia Pacific Lycopene Market Trends

The food and beverage industry in Asia-Pacific is a significant consumer of lycopene, primarily as a natural coloring agent and an antioxidant.

The region's large population and increasing disposable incomes have led to a surge in demand for processed and convenience foods, driving the need for natural and clean-label ingredients like lycopene.

Europe Lycopene Market Trends

The plant-based meat industry in Europe is witnessing a surge in demand, driven by consumer preferences for sustainable and environmentally-friendly products. Lycopene is increasingly being used as a natural coloring agent in plant-based meat alternatives, contributing to the market's growth.

Key Lycopene Company Insights

Some of the key players operating in the global lycopene market include

-

Lycored is a global company that operates in the field of nutritional supplements and develops added-value nutrients for use in dietary supplements, functional food and beverages, and nutricosmetics. The company offers a range of products including cardiomato, carotenoids, lumenato, vitamins, real food, wellness extracts, and beverages. Lycored extracts carotenoids and other vitamins and minerals from marigolds, fragrant rosemary, palm fruits, and curcumin, and has developed a unique microencapsulation technique that keeps ingredients stable and releases them slowly into the body

-

DSM is a global company based in the Netherlands that specializes in health, nutrition, and materials. They offer a range of products and solutions that address various challenges while creating economic, environmental, and societal value. DSM Nutritional Products, a division of DSM, is known for its expertise in carotenoid production, including lycopene. They have developed a lycopene product called "redivivo Lycopene" that offers superior stability, greater nutrient absorption, and low extrusion losses in food and beverage applications, such as confectionery. DSM's lycopene is available in various forms and can be formulated into applications to produce a wide range of color tones and shades

Key Lycopene Companies:

The following are the leading companies in the lycopene market. These companies collectively hold the largest market share and dictate industry trends.

- Lycored

- DSM

- Wellgreen Technology Co Ltd

- Divi’s Laboratories

- San-Ei Gen F.F.I., Inc

- Dangshang Sannuo Limited

- EID Parry

- BASF SE

- Archer-Daniels-Midland Company

- LyondellBasell Industries

Recent Developments

-

In 2024, OZiva launched OZiva Bioactive Gluta Fizzy. This formulation offers a multi-targeted solution, supporting repairing skin cell damage, evening out the complexion, lessening pigmentation, and promoting even-toned, and smooth skin. The formulation of the product includes several potent antioxidants, such as glutathione, hyaluronic acid, astaxanthin, lycopene, and collagen builders.

-

In September 2022, Lycopene International acquired LycoRed Ltd., a leading supplier of lycopene ingredients. This acquisition was aimed at expanding Lycopene International's product portfolio and reaching new markets.

Lycopene Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 168.95 million

Revenue forecast in 2030

USD 227.72 million

Growth rate

CAGR of 5.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume and Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, nature, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, Saudi Arabia, South Africa.

Key companies profiled

Lycored, DSM, Wellgreen Technology Co Ltd, Divi’s Laboratories, San-Ei Gen F.F.I., Inc, Dangshang Sannuo Limited, EID Parry, BASF SE, Archer-Daniels-Midland Company, LyondellBasell Industries

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lycopene Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global lycopene market report based on form, nature, application, and region.

-

Form Outlook (Volume, Kilotons, Revenue, USD Billion, 2018 - 2030)

-

Powder

-

Others

-

-

Nature Outlook (Volume, Kilotons, Revenue, USD Billion, 2018 - 2030)

-

Synthetic

-

Natural

-

-

Application Outlook (Volume, Kilotons, Revenue, USD Billion, 2018 - 2030)

-

Dietary supplements

-

Food & Beverages

-

Personal Care

-

Pharmaceuticals

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global lycopene market size was valued at USD 161.0 million in 2023 and is expected to reach USD 168.95 million in 2024.

b. The global lycopene market is expected to grow at a compound annual growth rate of 5.1% from 2024 to 2030 to reach USD 227.72 million by 2030.

b. North America dominated the market and accounted for a 30.08% share in 2023. The U.S.'s large internal market, high per capita consumption, and well-established trade patterns contribute to its leading position in the regional market.

b. Some key players operating in the lycopene market include Lycored, DSM, Wellgreen Technology Co Ltd, Divi’s Laboratories, San-Ei Gen F.F.I., Inc, Dangshang Sannuo Limited, EID Parry, BASF SE, Archer-Daniels-Midland Company, LyondellBasell Industries

b. Key factors that are driving the market growth include lycopene is a powerful carotenoid commonly derived from tomatoes, renowned for its numerous medicinal properties that have surged its demand in the nutraceutical market. With its rich antioxidants, lycopene effectively combats free radicals, known for causing cell damage.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.