- Home

- »

- Clothing, Footwear & Accessories

- »

-

Luxury Watch Market Size, Share & Trends Report, 2030GVR Report cover

![Luxury Watch Market Size, Share & Trends Report]()

Luxury Watch Market Size, Share & Trends Analysis Report By Product (Mechanical, Electronic), By Distribution Channel (Offline, Online), By Region (Asia Pacific, Europe, North America), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-234-1

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

The global luxury watch market size was valued at USD 42.21 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.0% from 2023 to 2030. The growing inclination for using luxury watches as a status sign amongst adults is an important factor driving the industry. New product launches by key players, such as Titan, Sonata, and Rolex, are anticipated to have a positive impact on the industry growth. In addition, companies are offering limited edition watches with various designs as well as features to increase their revenue. Companies target the wealthy as well as the middle-class section of the population, which is being repealed by their pricing strategy. This acts as one of the restraining factors for market growth.

Moreover, the innovation of a luxurious watch with the addition of precious rare elements like a diamond, sapphire, gold, or ruby in its body acts as a growth-driving factor. The COVID-19 pandemic has had a negative impact on the industry. The pandemic impacted America and other large countries in Europe as well as Asia, which were the key consumers of luxury watches. Thus, the market saw a decline in demand and slow development due to the restrictions on movement and careful expenditure habits of people. It is observed that the majority of first-time buyers of luxury goods opt for top variants. Most of the time, this converts into brand loyalty and as a result, they do not mind spending an extra amount.

Recognized luxury brands have some consistency in the quality of their products and take extra care of consumer sentiments. This contributes to the evolution of the brand name. Word-of-mouth publicity also plays a key role in promoting luxury watches. A smartwatch is generally used as a companion product and needs to be paired with a smartphone through Bluetooth and Near-field Communication (NFC) among other technologies. Shifting perception among consumers regarding luxury goods, as they contribute to great social acceptance, is expected to remain a key growth-driving factor. Increasing disposable income in emerging economies including China, India, and Brazil due to the improvement of economic indicators on a domestic level will also promote product demand.

The demand for women's luxury watches is also increasing significantly. It has been observed that women are becoming more interested in upgrading their watches as compared to men, which is driving the companies to expand their product line for the women segment. Some of the recent women's luxury product launches include TIFFANY & CO AND PATEK PHILIPPE TWENTY, BULGARI SERPENTI INCANTATI, and A. LANGE & SOHNE SAXONIA THIN. The shifting trend from conventional to golden and diamond watches is also playing a crucial role in expanding the customer reach. It has been observed that these products are giving tough competition to the hand jewelry market.

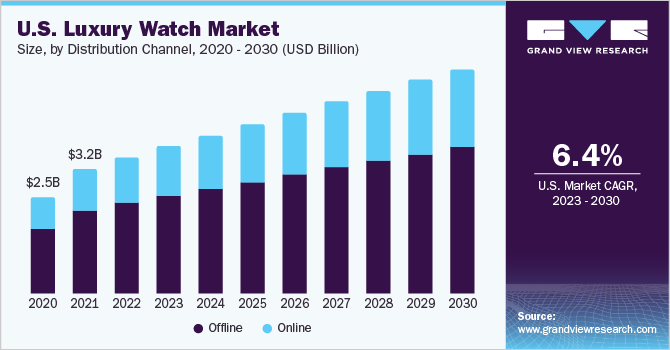

Distribution Channel Insights

The online channel segment is projected to expand at the fastest CAGR of more than 5.5% from 2023 to 2030. Consumers use online channels to purchase premium products on account of favorable value-added services including cash-on-delivery, easy return option, safe transactions, and integrated and centralized customer services. Key players are adopting online retail schemes to cut operational costs and increase their profits. Companies, such as Rolex Inc., Fossil Group, and Ralph Lauren, have a solid presence in offline retail stores and also offer their products online to increase their market reach.

It is also convenient for manufacturers to sell their products at a global level through this distribution channel. The offline category dominated the industry in 2021 and will remain dominant throughout the forecast period, in terms of revenue share. The major factor contributing to the growth of this segment is the growing consumer preference for purchasing high-end products from retail stores. Furthermore, it becomes easy for consumers to understand the exact size and weight of the product from offline channels including convenience stores, supermarkets, and company-owned brand retail outlets.

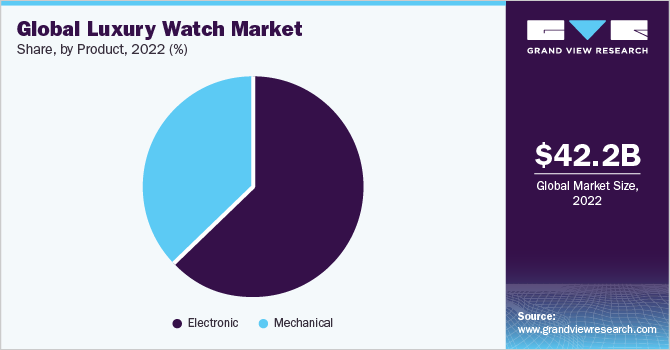

Product Insights

On the basis of products, the global industry has been further categorized into electronic and mechanical. The electronic product segment dominate the global industry in 2022 and accounted for the largest share of more than 62.9% of the overall revenue in the same year. The segment is likely to expand further at a steady CAGR retaining its leading position throughout the forecast period. Key companies are expanding their product offerings on smartwatches fitted out with advanced functionality, such as heart rate monitors, GPS capabilities, and multisport tracking. These watches help consumers track their distance and speed.

Moreover, vendors, such as Apple Inc., offer an option of customized watches that allow consumers to choose color, material, and features. On the other hand, the mechanical product segment is expected to expand at the fastest growth rate from 2022 to 2230. A large business-class population prefers this type of luxury watch as it can be used as a style statement. The use of titanium ceramic coatings along with PVD coatings enhances the lifespan of mechanical luxury watches. Some of the key players offering mechanical products are Rolex SA, A. Lange & Söhne, Apple Inc., and The Swatch Group Ltd.

Regional Insights

On the basis of geographies, the industry has been further categorized into Asia Pacific, North America, Middle East & Africa, Central & South America, and Europe. Asia Pacific was the largest regional market in 2022 and accounted for the maximum share of more than 49.0% of the overall revenue. Changing consumer behavior and growing disposable income, especially in major countries, such as China, India, and Japan, are the factors that propelled the market growth in Asia Pacific. Global luxury brands are entering countries like Japan, China, and India by understanding the potential of the market.

China is the largest market for luxury watches in the region owing to the presence of a high-net-worth population. Thus, Asia Pacific generated the highest revenue for the market. North America is projected to expand at a steady CAGR from 2023 to 2030. This is owing to the presence of major players in the region, along with high per capita income as well as the increasing status of the upper-middle class. In addition, luxury watches' position as a status symbol amongst the young generation is estimated to boost the region’s growth.

Key Companies & Market Share Insights

Key players are working on new product development to get a competitive advantage in the industry. For instance, in April 2021, Hermes revealed the Hermes H08 New Men's Watch Collection. There are 5 unique 39 mm places in the collection. Four pieces are made of titanium, while one is made of a graphene-filled composite casing. The original cushion-shaped collection had a sporting-inspired design that combined taut and flowing lines, with a softened-edged case framing the circular dials. Some of the prominent players in the global luxury watch market include:

-

Apple Inc.

-

The Swatch Group Ltd

-

Audemars Piguet Holding S.A.

-

Fossil Group, Inc.

-

Citizen Watch Company of America, Inc.

-

Seiko Watch Corporation

-

Compagnie Financiere Richemont SA

-

LVMH Moet Hennessy -Louis Vuitton

-

Movado Group Inc.

-

Ralph Lauren Corp.

Luxury Watch Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 45.00 billion

Revenue forecast in 2030

USD 62.25 billion

Growth rate

CAGR of 5.2% from 2022 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; South Korea; Indonesia; Turkey; Brazil

Key companies profiled

Apple Inc.; The Swatch Group Ltd.; Audemars Piguet Holding SA; Fossil Group, Inc.; Citizen Watch Company Of America, Inc.; Seiko Watch Corp.; Compagnie Financiere Richemont SA; LVMH Moet Hennessy Louis Vuitton; Movado Group Inc.; Ralph Lauren Corp.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Luxury Watch Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global luxury watch market report on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Electronic

-

Mechanical

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Turkey

-

-

Frequently Asked Questions About This Report

b. The global luxury watch market size was estimated at USD 42.21 billion in 2022 and is expected to reach USD 45.00 billion in 2023.

b. The global luxury watch market is expected to grow at a compound annual growth rate of 5.0% from 2023 to 2030 to reach USD 62.25 billion by 2030.

b. Asia Pacific dominated the luxury watch market with a share of 49.0% in 2022. This is attributable to rapidly changing consumer behavior and rising disposable incomes among consumers, most notably in emerging economies such as China and Japan.

b. Some key players operating in the luxury watch market include Rolex SA, A. Lange & Söhne, Apple Inc., The Swatch Group Ltd, Bernard Watch Co., FOSSIL GROUP, INC., CITIZEN WATCH COMPANY OF AMERICA, INC., and Seiko Watch Corporation.

b. Key factors that are driving the market growth include rising preference for luxury watches as a status symbol among adults worldwide, and increasing new product launches by internationally-reputed brands, including Titan, Sonata, and Rolex.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."