- Home

- »

- Automotive & Transportation

- »

-

Luxury SUV Market Size, Share And Growth Report, 2030GVR Report cover

![Luxury SUV Market Size, Share & Trends Report]()

Luxury SUV Market (2024 - 2030) Size, Share & Trends Analysis Report By Vehicle Type (Compact, Mid Size, Full Size), By Propulsion Type (ICE, Electric), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-4-68040-368-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Luxury SUV Market Summary

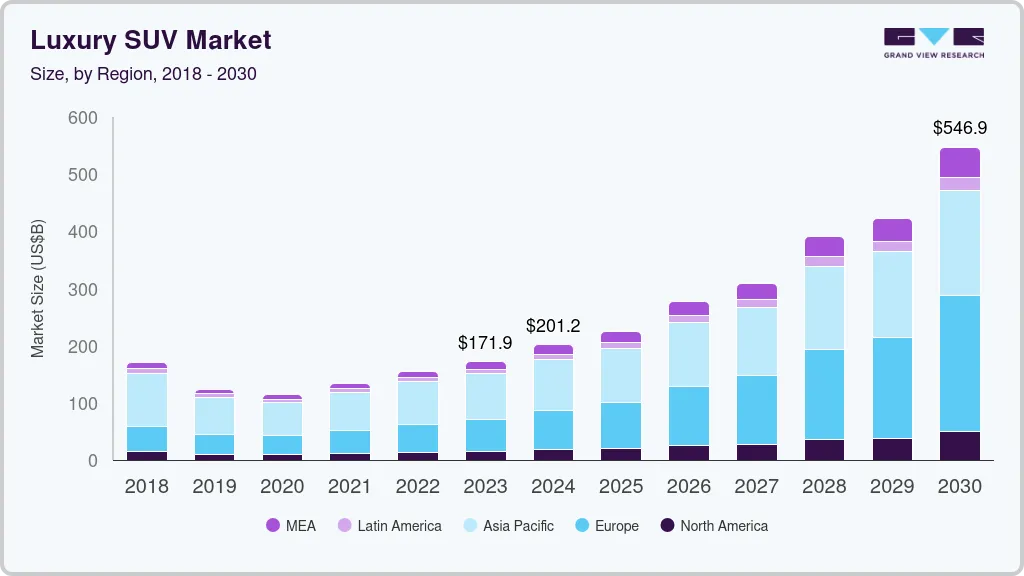

The global luxury SUV market size was estimated at USD 171.88 billion in 2023 and is expected to reach USD 546.91 billion by 2030, growing at a CAGR of 18.1% from 2024 to 2030. The market growth can be attributed to a combination of advanced technology, superior comfort, and enhanced performance.

Key Market Trends & Insights

- Asia Pacific dominated in 2023 and accounted for a 46.18% share of global revenue.

- By vehicle type, the mid-size SUV segment dominated the market in 2023 and accounted for a 44.29% share of global revenue.

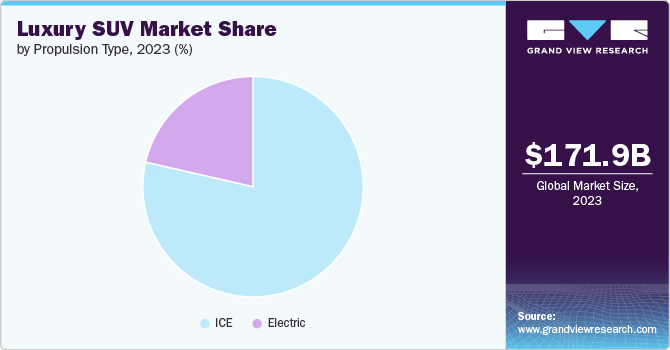

- By propulsion type, the ICE segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 171.88 Billion

- 2030 Projected Market Size: USD 546.91 Billion

- CAGR (2024-2030): 18.1%

- Asia Pacific: Largest market in 2023

Luxury SUVs have become a preferred choice for consumers seeking utility and opulence. The shift towards sustainability has led to a significant rise in the production and sales of electric and hybrid luxury SUVs.Luxury SUVs are at the forefront of automotive technology, integrating features such as advanced driver assistance systems (ADAS), autonomous driving capabilities, and state-of-the-art infotainment systems. Furthermore, the rising demand for advanced safety features within SUVs to minimize accidents is further driving the demand for the market over the forecast period. For instance, a report published by the National Highway Traffic Safety Administration (NHTSA) stated that the adoption of ADAS in SUVs has reduced accident rates by 23%, underscoring the safety benefits of these technologies.

Consumers in the market are increasingly seeking customized and personalized options. Manufacturers are offering bespoke services, allowing customers to tailor their vehicles to their specific requirements. This trend is particularly evident in markets such as the U.S. and Europe, where affluence and individualism drive demand for unique, high-end vehicles. Furthermore, state-of-the-art connectivity and infotainment systems are a significant selling point for luxury SUVs. Features such as large touchscreen infotainment, voice-activated controls, and seamless smartphone integration are now standard in this segment. According to a report published by the European Commission, the integration of 5G technology further enhances the connectivity features in luxury vehicles.

While luxury SUVs are often associated with urban use, a growing trend is towards enhancing their off-road capabilities. Brands such as Land Rover and Mercedes-Benz are incorporating advanced four-wheel-drive systems and rugged design elements to appeal to adventure-seeking consumers. Furthermore, owning a luxury SUV is often associated with higher social status and prestige. Brands such as Lexus, Land Rover, and Mercedes-Benz symbolize success and affluence. A U.S. Bureau of Labor Statistics survey indicated that spending on luxury goods, including high-end vehicles, remains strong among affluent consumers.

Stringent environmental regulations and government incentives for electric vehicles are shaping the market. Policies to reduce carbon emissions encourage manufacturers to develop cleaner, more efficient luxury vehicles. For instance, in September 2023, Mercedes-Benz India Pvt. Ltd. launched an electric luxury SUV named EQE SUV in India. The SUV has an electric range of up to 465 to 550 Km on a single charge.

Vehicle Type Insights

The mid-size SUV segment dominated the market in 2023 and accounted for a 44.29% share of global revenue. The mid-size SUV segment is increasingly catering to consumers seeking a balance between advanced features and luxury. Manufacturers are focusing on high-quality materials, ergonomic design, and advanced climate control systems to provide a luxurious cabin experience, which is anticipated to drive the segment growth. Furthermore, buyers can personalize their vehicles with trims, color options, and accessory packages, enhancing the appeal of mid-size SUVs. Such factors are driving the growth of the mid-size SUV segment over the forecast period.

The compact SUV segment is projected to grow significantly from 2024 to 2030. Compact SUVs are increasingly equipped with cutting-edge technology, including ADAS, connectivity features, and infotainment systems. These technological advancements enhance the driving experience and appeal to tech-savvy consumers who value innovation. Furthermore, the integration of IoT and connected car technologies is rising. Features like remote diagnostics, over-the-air updates, and in-car internet connectivity to enhance the driving experience drive the demand for compact SUVs.

Propulsion Type Insights

The ICE segment dominated the market in 2023. One of the primary segment drivers is the superior performance and power these vehicles offer. Consumers in the luxury segment often prioritize robust engine performance and high horsepower. ICE luxury SUVs, such as the Porsche Cayenne and Mercedes-Benz G-Class, are known for their powerful engines, providing an exhilarating driving experience that electric counterparts have yet to replicate fully.

The electric segment is projected to witness significant growth from 2024 to 2030. Stringent government regulations and government incentives for electric vehicles are shaping the market. Policies aimed at reducing carbon emissions are encouraging manufacturers to develop cleaner, more efficient luxury SUVs. The increasing regulatory pressures and incentives drive the adoption of electric and hybrid vehicles globally. A European Environment Agency (EEA) report stated that the transition to electric and hybrid vehicles has significantly reduced greenhouse gas emissions. Adopting these vehicles is part of broader efforts to achieve the EU’s climate goals, with electric SUVs alone reducing CO2 emissions by an estimated twenty million tons annually.

Regional Insights

The luxury SUV market in North America is expected to grow steadily from 2024 to 2030. The cultural preference for larger vehicles, particularly SUVs, is strong in North America. Consumers favor luxury SUVs for their spacious interiors, advanced features, and versatility, catering to both family needs and personal preferences.

The U.S. Luxury SUV Market Trends

The luxury SUV market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030. The U.S. market is characterized by diverse consumer demographics, including young professionals, families, and retirees, each with specific preferences. Luxury SUVs cater to these varied needs, offering a range of models and features.

Asia Pacific Luxury SUV Market Trends

The luxury SUV market in Asia Pacific dominated in 2023 and accounted for a 46.18% share of global revenue. The rapid rise in affluence and the expansion of the middle class in countries like China and India are significant market drivers. Furthermore, the aspiration of global brands and the influence of Western lifestyles boost the appeal of luxury SUVs. High-end brands are perceived as status symbols, driving demand for luxury SUVs among affluent consumers.

Key Luxury SUV Company Insights

Key players operating in the luxury SUV market include AB Volvo, Tata Motors Limited, Volkswagen Group, Mercedes-Benz Group AG, Isuzu Motors Ltd., Aston Martin Holdings UK Ltd, Toyota Motor Corporation, Bayerische Motoren Werke AG, Nissan Motor Corporation, General Motors. The companies focus on various strategic initiatives, including new product launches, agreements, business expansions, partnerships & collaborations, and mergers & acquisitions to gain a competitive advantage over their rivals.

Key Luxury SUV Companies:

The following are the leading companies in the luxury SUV market. These companies collectively hold the largest market share and dictate industry trends.

- AB Volvo

- Tata Motors Limited

- Volkswagen Group

- Mercedes-Benz Group AG

- Isuzu Motors Ltd.

- Aston Martin Holdings UK Ltd

- Toyota Motor Corporation

- Bayerische Motoren Werke AG

- Nissan Motor Corporation

- General Motors

Recent Developments

-

In June 2024, Volvo Car Corporation started production of the EX90 SUV, a fully electric SUV, in a factory located in Charleston, South Carolina. The plant has a capacity to build up to 150 thousand cars per year.

-

In May 2024, Cadillac, a manufacturer of luxury vehicles introduced OPTIQ, an electric luxury SUV. The vehicle will be available in 2025 and will have around 300 miles of range, dual motor all-wheel drive, DC fast charging, advanced radar, camera & ultrasonic sensor technology, among others.

-

In April 2023, Lexus, a subsidiary of Toyota Motor Corporation, launched Lexus RX, a hybrid electric luxury SUV in India. The SUV has a 2.5-liter inline-four engine and a self-charging electric motor. It has a Tazuna concept-based cockpit with cutting-edge technologies, including a color TFT multi-information display, wireless charger, pre-collision System (PCS), lane tracing assist, lane departure alert, and blind spot monitoring, among others.

Luxury SUV Market Report Scope

Attribute

Details

Market size value in 2024

USD 201.21 billion

Revenue forecast in 2030

USD 546.91 billion

Growth rate

CAGR of 18.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Propulsion type, vehicle type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

AB Volvo; Tata Motors Limited; Volkswagen Group; Mercedes-Benz Group AG; Isuzu Motors Ltd.; Aston Martin Holdings UK Ltd; Toyota Motor Corporation; Bayerische Motoren Werke AG; Nissan Motor Corporation; General Motors

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Luxury SUV Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global luxury SUV market based on vehicle type, propulsion type, and region:

-

Vehicle Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Compact

-

Mid Size

-

Full Size

-

-

Propulsion Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

ICE

-

Electric

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global luxury SUV market size was estimated at USD 171.88 billion in 2023 and is expected to reach USD 201.21 billion in 2024.

b. The global luxury SUV market is expected to grow at a compound annual growth rate of 18.1% from 2024 to 2030, reaching USD 546.91 billion by 2030.

b. The mid-size SUV segment dominated the market in 2023 and accounted for a 44.29% share of global revenue. The mid-size SUV segment is increasingly catering to consumers seeking a balance between advanced features and luxury. Manufacturers are focusing on high-quality materials, ergonomic design, and advanced climate control systems to provide a luxurious cabin experience.

b. Some of the players operating in the luxury SUV market include AB Volvo, Tata Motors Limited, Volkswagen Group, Mercedes-Benz Group AG, Isuzu Motors Ltd., Aston Martin Holdings UK Ltd, Toyota Motor Corporation, Bayerische Motoren Werke AG, Nissan Motor Corporation, General Motors.

b. The rising demand for advanced safety features within SUVs to minimize accidents is further driving the demand for the market over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.