- Home

- »

- Healthcare IT

- »

-

Luxury Smart Jewelry Market Size And Share Report, 2030GVR Report cover

![Luxury Smart Jewelry Market Size, Share And Trends Report]()

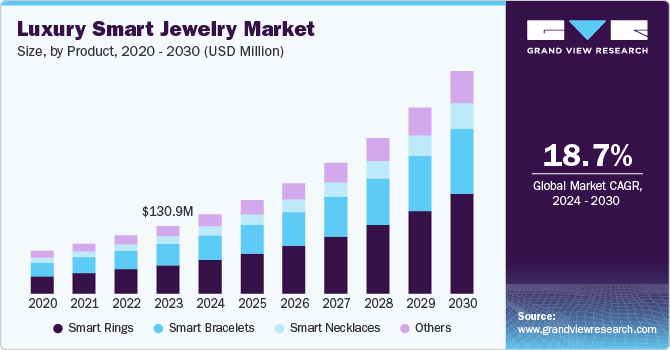

Luxury Smart Jewelry Market Size, Share And Trends Analysis Report By Product (Smart Rings, Smart Bracelets), By Application (Fitness Tracking, Heart Rate Monitoring), By Age Group, By Distribution Channels, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-479-8

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Luxury Smart Jewelry Market Size & Trends

The global luxury smart jewelry market size was valued at USD 130.96 million in 2023 and is projected to grow at a CAGR of 18.7% from 2024 to 2030. Increasing research and development activities in the field of smart jewelry is driving the demand for luxury smart jewelry. In February 2024, the Thermal Earring was unveiled by researchers at the University of Washington. This wireless wearable device is designed to continuously monitor the temperature of the user's earlobe. When tested on six individuals, the earring proved to be more effective than a smartwatch at detecting skin temperature during periods of rest. It also displayed potential for tracking indicators of stress, eating, exercise, and ovulation. The prototype of this intelligent earring is comparable in size and weight to a small paperclip and boasts a battery life of 28 days. Additionally, the earring can be customized with fashion designs crafted from resin (such as the shape of a flower) or with a gemstone, all without compromising its accuracy.

In 2023, the CDC reported approximately 19 maternal deaths per 100,000 live births. Similarly, the WHO report stated that approximately 287,000 women passed away during and after pregnancy and childbirth in 2020. Nearly 95% of all maternal deaths took place in low and lower middle-income countries in 2020, and most of these fatalities could have been avoided. To address this issue, Grameen Intel Social Business Ltd. created 'COEL' to ensure the well-being of expectant mothers and their unborn children. COEL, a smart wearable bangle, delivers prerecorded messages promoting maternal health. Additionally, it can detect and alert users to the presence and concentration of indoor air pollutants, particularly carbon monoxide, which is often released during activities like cooking with wood, charcoal, or animal dung. Exposure to high levels of toxic fumes can pose significant risks to both the mother and the child. Increasing launches of smart jewelry will drive the industry expansion.

Moreover, there has been a significant increase in investments in the development of luxury smart jewelry in recent years. For instance, in June 2024, Incora Health, a start-up specializing in smart earrings, receives funding from XRC Ventures. Smart earrings are designed as ‘wearable for managing fertility and wellness.' With the investment from XRC Ventures, the Incora Health team plans to conduct clinical trials and launch the product in the market. Similarly, in March 2024, Ultrahuman, a maker of wearable technology including a ring for tracking habits, a continuous glucose monitor (CGM), and an upcoming home health device, has obtained USD 35 million in a Series B funding round involving equity and debt to drive expansion and back cutting-edge research in health monitoring.

The demand for luxury smart jewelry is projected to increase due to the growing popularity of connected devices and the Internet of Things (IoT). Furthermore, the increasing acceptance of smart jewelry among the population is fostering market growth. In November 2023, Leevi Health, a startup based in Munich, created "Lilio". It's a smart bracelet equipped with small sensors that track important health metrics of babies and send the data directly to their parent's mobile devices. The company, Leevi Health, has concluded a successful seed funding round, securing USD 2.4 million. This investment is utilized to introduce the innovative product "Lilio" to the market.

Additionally, advancements in technology and design are fostering market growth. Innovations in sensors, materials, and battery life have made it possible to create sophisticated health monitoring devices that are both fashionable and functional. This combination of cutting-edge technology and luxurious design makes luxury smart jewelry an attractive option for consumers. Furthermore, the growing number of professional athletes seeking wellness and fitness products is expected to boost the market growth.

Market Concentration & Characteristics

The degree of innovation in the market is remarkably high, reflecting a fusion of cutting-edge technology with sophisticated design. This innovation shows in various forms, from the integration of advanced health-monitoring sensors capable of tracking vital signs such as heart rate, blood pressure, and even stress levels, to the incorporation of AI-driven algorithms that provide personalized health insights and recommendations. In September 2024, Movano Health revealed the immediate release of its Evie Ring, the initial smart ring tailored for women. The ring showcases the same innovative, prize-winning open design that adjusts to changes in finger size and comes with an updated app that improves users' capacity to monitor and comprehend crucial health and wellness metrics.

The market is characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to expand the business to cater to the growing demand for luxury smart jewelry. In September 2024, Oura revealed that it has agreed to acquire Veri, a Finnish company that provides customized metabolic health programs.

Regulations significantly impact the luxury smart jewelry market, particularly as it integrates health-monitoring capabilities. Compliance with health and safety standards is crucial, as these devices often collect sensitive health data. Stringent regulations concerning data privacy, such as the General Data Protection Regulation (GDPR), require brands to implement robust data protection measures, fostering consumer trust.

Other forms of wearable technology, such as smartwatches and fitness trackers, offer similar health-monitoring features and are the major competitors in the industry. Additionally, traditional luxury jewelry, which emphasizes craftsmanship and aesthetic appeal without technological integration, remains a strong competitor for consumers who prioritize style over functionality. These substitutes appeal to a broader audience due to their versatility and established market presence.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. Rising product approvals and funding create more opportunities for market players to enter new regions.

Product Insights

The smart rings segment dominated the market and accounted for the largest revenue share of 42.2% in 2023. The rising product launches and approvals are fostering industry expansion. In August 2023, Bonatra, a healthtech startup, revealed the release of Wearable Smart Rings. These smart rings are crafted to consistently track various health metrics, enabling individuals to lead extended and healthier lifestyles. The device can monitor important metrics like sleep score and readiness score. Advanced algorithms are used in the sleep score feature to analyze sleep duration, quality, and stages, leading to enhancements in sleep patterns and overall well-being.

The smart bracelets segment in the luxury smart jewelry market is anticipated to witness fastest expansion over the forecast period. Atrial fibrillation is the most common heart rhythm disorder, affecting 40 million people worldwide. If left untreated, it can have serious consequences. To tackle this issue, researchers have introduced a technology that aims to identify and manage individual factors contributing to atrial fibrillation. One notable achievement is a smart bracelet that contains an algorithm capable of detecting atrial fibrillation. The TriggersAF project, funded by the EU Structural Funds, has made use of smart bracelets as well as other monitoring devices. Such growing applications of smart jewelry are anticipated to spur market growth.

Application Insights

The fitness tracking segment dominated the market and accounted for the largest revenue share of 31.5% in 2023. The growing focus on health among the population is driving the demand for physical activities. According to Eurostat data, one third of Europeans engaged in at least 150 minutes of physical activity per week in 2019. As more people adopt fitness as a part of their lifestyle, there is an increasing need for stylish wearable technology that provides advanced health monitoring features without compromising aesthetics. This luxury smart jewelry allowed users to monitor their physical activity, heart rate, and sleep patterns. The integration of advanced algorithms and sensors enabled wearers to track their progress, set fitness goals, and make informed decisions about their well-being and health. Such factors are driving segmental growth.

The heart rate monitoring segment in the luxury smart jewelry market is anticipated to witness significant growth over the forecast period. Increasing cardiovascular diseases supplements segmental growth. An article in Europa Group states that approximately 620 million individuals worldwide have heart and circulatory diseases. Every year, approximately 60 million people worldwide are diagnosed with heart or circulatory disease. It is estimated that globally, 1 out of 13 individuals live with a heart or circulatory disease. Such surge in cases of heart diseases will increase the demand for real-time insights into heart rates, thereby fostering segmental growth. Additionally, the integration of AI and data analytics enhances the accuracy and personalization of fitness metrics.

Age Group Insights

The adult segment dominated the market and accounted for the largest revenue share of 47.8% in 2023. The willingness of adults to invest in high-quality, luxury products that enhance their lifestyle is accelerating segmental growth. As per the 2023 Morning Consult survey, the usage of health apps and wearables differed among different age groups. Among respondents aged 18 to 34, 47% used health apps and 40% used wearables, while the usage among adults over 65 was 30% for health apps and 25% for wearables. Furthermore, increasing prevalence of cardiovascular disorder among adults is escalating the demand for monitoring devices. As per the CDC report. in 2022, approximately 20% of deaths from cardiovascular diseases (CVDs) occurred in adults under the age of 65.

The pediatric segment in the luxury smart jewelry market is anticipated to witness significant growth over the forecast period. Increasing product launches for kids are driving segmental growth. In January 2022, a start-up based in Montreal revolutionized the method of administering medication to ill children by inventing a smart bracelet that automates the process. NURA Medical's innovation, known as the IV Assistant, consists of a bracelet equipped with a retractable tape measure that can accurately estimate a patient's weight based on their arm size and transmit this information to a companion web app created by the company for use on a tablet. When utilizing the device, a nurse logs into the app, and chooses the medication prescribed by the attending emergency physician, and NURA Medical's software will automatically calculate the correct dosage based on the patient's weight. Such advancements in smart jewelry will increase the popularity and awareness of luxury smart jewelry among the population.

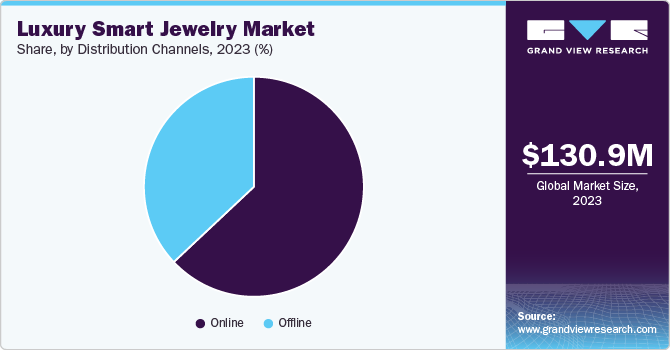

Distribution Channels Insights

The online segment dominated the luxury smart jewelry market and accounted for the largest revenue share of 63.0% in 2023. The growing preference for e-commerce among consumers is driving market expansion. Technological and logistical advancements are enhancing the online shopping experience. Features like augmented reality (AR) enable customers to virtually try on jewelry, creating a more immersive experience that increases confidence in their purchasing decisions. Moreover, industry leaders such as Motiv and Oura are refining their direct-to-consumer sales strategies to capitalize on the growing shift to online channels. Some market players are implementing strategic initiatives to boost online sales, including subscription-based models, targeted online advertising, and partnerships with fitness influencers.

The offline segment is anticipated to witness significant growth over the forecast period due to the widespread presence of physical electronics stores and consumer preferences for trying out wearables before buying. In-store purchases are encouraged through product demonstrations and immediate purchase options. Healthcare retailers are also becoming important offline distribution points as they enhance their expertise in this area. For instance, Walgreens and CVS HealthHUB offer smart wearables like medical rings to cater to health-conscious consumers. Furthermore, health-tech companies use conferences and trade shows as offline platforms to distribute wearables.

Regional Insights

North America luxury smart jewelry market dominated the global industry in 2023 and accounted for the largest revenue share of 41.4%. High disposable incomes and a growing consumer focus on health and wellness are driving regional market expansion. The region is experiencing a growing demand for wearable technology as consumers are increasingly looking for products that combine functionality with style.

U.S. Luxury Smart Jewelry Market Trends

The luxury smart jewelry market in the U.S. held the largest share of 77.6% in 2023. The presence of key market players coupled with the increasing adoption of wearable devices are fostering market growth. Furthermore, there is an increasing adoption of smart jewelry to monitor the fitness of pregnant women due to the rising number of maternal deaths. The CDC report stated that there were 1,205 maternal deaths among women in the U.S. in 2021, an increase from 861 in 2020 and 754 in 2019.

Canada luxury smart jewelry market is anticipated to register the fastest growth during the forecast period. The growth is fueled by a growing health-conscious consumer base that values innovation and sustainability. Canadians are increasingly prioritizing their health, creating a favorable environment for luxury smart jewelry that combines aesthetics with health-monitoring capabilities.

Europe Luxury Smart Jewelry Market Trends

The luxury smart jewelry market in Europe is anticipated to register significant growth during the forecast period. The region’s strong regulatory framework around health and safety is driving the industry expansion. Moreover, the growth of high-net-worth individuals creates a robust market for luxury smart jewelry.

Germany luxury smart jewelry market is anticipated to register a considerable growth rate during the forecast period. Increasing prevalence of cardiovascular disorder is fostering the industry growth. According to the Statistisches Bundesamt (Destatis) in 2021, CVDs accounted for 34.3 percent of all deaths in Germany in 2020, making them the leading cause of mortality.

The luxury smart jewelry market in the UK is anticipated to register a considerable growth rate during the forecast period. The presence of luxury department stores and boutiques in the region is driving market growth. Furthermore, increasing rates of chronic conditions are escalating market growth.

Asia Pacific Luxury Smart Jewelry Market Trends

The luxury smart jewelry market in Asia Pacific is anticipated to register the fastest growth rate during the forecast period. Increasing disposable incomes, growing health awareness, and rapid urbanization are escalating regional growth. Furthermore, increasing healthcare expenditure is anticipated to boost market growth.

China luxury smart jewelry market held the largest share in 2023. Growing product launches and approvals of smart jewelry will raise awareness for luxury smart jewelry in the region. In August 2024, KUMI revealed the introduction of the KUMI Ring H1. The KUMI Ring H1 comes with state-of-the-art temperature sensors, heart rate sensors, accelerometers, and touch sensors.

The luxury smart jewelry market in India is anticipated to register a considerable growth during the forecast period. Rising adoption of strategic initiatives by market players are driving market growth. In July 2023, Boat, a well-known brand of wearable devices in India, unveiled its newest product, the Boat Smart Ring. This signifies the brand's first venture into the smart ring market. Users can use this ring to effectively track their physical condition and fitness metrics.

Latin America Luxury Smart Jewelry Market Trends

The luxury smart jewelry market in Latin America is anticipated to register the fastest growth during the forecast period. Increasing awareness of lifestyle-related health issues is triggering consumers to invest in technology that enhances well-being.

Brazil luxury smart jewelry market is anticipated to register considerable growth during the forecast period. The increasing adoption of organic and inorganic strategies by key market players is supplementing industry growth. Furthermore, the growing prevalence of chronic pain is escalating market expansion.

MEA Luxury Smart Jewelry Market Trends

The luxury smart jewelry market in the Middle East & Africa is anticipated to register the fastest growth during the forecast period. South Africa, Saudi Arabia, and the UAE are some of the promising countries in the Middle East market. Advancements in healthcare systems are bringing luxury smart jewelry into action in these countries.

South Africa luxury smart jewelry market is anticipated to register considerable growth during the forecast period. The luxury smart jewelry industry in South Africa is experiencing rapid growth due to the increasing number of chronic diseases, and government initiatives promoting wearable devices adoption.

Key Luxury Smart Jewelry Company Insights

Key participants in the luxury smart jewelry market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Luxury Smart Jewelry Companies:

The following are the leading companies in the luxury smart jewelry market. These companies collectively hold the largest market share and dictate industry trends.

- Oura Health Oy.

- RINGLY

- Samsung

- Motiv, Inc.

- Boat

- Zepp Health Corporation, Ltd.

Recent Developments

-

In September 2024, Samsung launched the Galaxy Ring in Brazil. The company has also started accepting pre-orders, which will last until October 18.

-

In July 2024, The Amazfit Helio Ring, revealed at the Consumer Electronics Show (CES) 2024, is expected to be launched for the Indian market through Amazon soon. It provides various health and fitness tracking features and information.

-

In March 2024, Oura, a company that provides a smart ring for monitoring consumer health, started selling its products on Amazon. This strategy represents a shift from its previous direct-to-consumer sales model to a more extensive retail presence.

Luxury Smart Jewelry Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 153.58 million

Revenue forecast in 2030

USD 429.97 million

Growth rate

CAGR of 18.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue & Volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, age group, distribution channels, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, Spain, Italy, France, Norway, Denmark, Sweden, Japan, China, India, Australia, Thailand, South Korea, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Oura Health Oy. RINGLY, Samsung, Motiv, Inc., Boat, Zepp Health Corporation, Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Luxury Smart Jewelry Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global luxury smart jewelry market report on the basis of product, application, age group, distribution channels, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Fitness Tracking

-

Heart Rate Monitoring

-

Sleep Tracking

-

Stress And Mood Tracking

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Smart Rings

-

Smart Bracelets

-

Smart Necklaces

-

Others

-

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Pediatric

-

Adult

-

Geriatric

-

-

Distribution Channels Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global luxury smart jewelry market size was estimated at USD 130.96 million in 2023 and is expected to reach USD 153.58 million in 2024.

b. The global luxury smart jewelry market is expected to grow at a compound annual growth rate of 18.7% from 2024 to 2030 to reach USD 429.97 million by 2030.

b. Based on product, the fitness tracking segment dominated the luxury smart jewelry market in 2023 due to growing health and fitness awareness and rising internet and smartphone penetration.

b. Some key players operating in the market include Oura Health Oy., RINGLY, Samsung, and Motiv, Inc.

b. Factors such as the increasing demand for multifunctional and aesthetically appealing jewelry and the growing adoption of wearable technology fuel the market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."