- Home

- »

- Clothing, Footwear & Accessories

- »

-

Luxury Leather Goods Market Size And Share Report, 2030GVR Report cover

![Luxury Leather Goods Market Size, Share & Trends Report]()

Luxury Leather Goods Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Distribution Channel (Exclusive Brand Outlets, Specialty Stores, Online, Airports, Others), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-165-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Luxury Leather Goods Market Summary

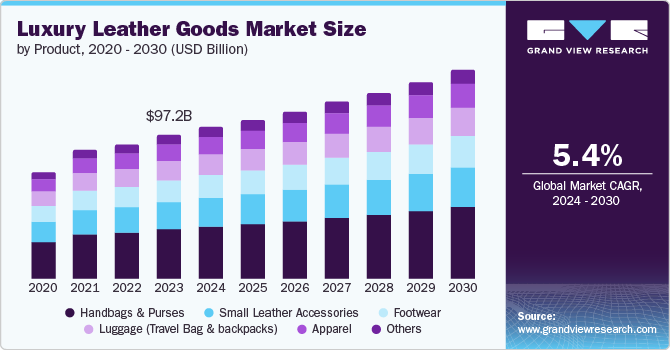

The global luxury leather goods market size was estimated at USD 97.20 billion in 2023 and is projected to reach USD 140.55 billion by 2030, growing at a CAGR of 5.4% from 2024 to 2030. Consumers increasingly value luxury items made from top-notch materials such as leather due to their durability, style, and status symbol.

Key Market Trends & Insights

- The luxury leather good market in Europe accounted for the largest revenue share of 32.4% in 2023.

- The UK luxury leather goods market is expected to grow significantly over the forecast period.

- By product, handbags & purses segment dominated the market and accounted for a share of 33.3% in 2023.

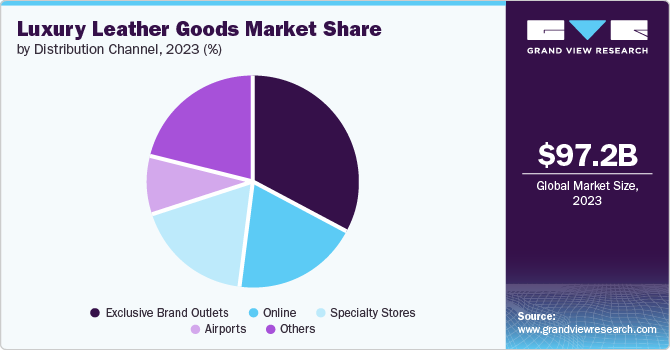

- By distribution channel, exclusive brand outlets segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 97.20 Billion

- 2030 Projected Market Size: USD 140.55 Billion

- CAGR (2024-2030): 5.4%

- Europe: Largest market in 2023

- Asia Pacific: Fastest growing market

This growing preference for luxury leather goods propels the market forward as more individuals seek these products for personal use or as gifts. The growing influence of social media and the desire for status symbols have fueled the demand for luxury leather goods as consumers seek to showcase their wealth and taste through these products. The evolving fashion trends and the growing preference for sustainable and ethically sourced products have expanded the luxury leather good market. Consumers are increasingly seeking products that are not only stylish and luxurious but also environmentally friendly and ethically produced. The increasing urbanization and the growing number of luxury retail outlets and e-commerce platforms have significantly propelled the growth of the luxury leather good market. Urbanization has led to a rise in affluent consumers living in metropolitan areas, where luxury retail stores are prevalent.

Furthermore, the proliferation of e-commerce platforms has provided consumers convenient access to a wide range of luxury leather goods, driving sales and expanding the market's reach. Consumers increasingly seek unique and customized products that reflect their individuality and style. This trend has prompted luxury leather goods brands to offer personalized services, enabling consumers to customize their products, thereby fueling the market's growth and differentiation. For instance, in November 2022, the leather brand, BY THE NAMESAKE, opened its first physical store in Toronto. The store showcased a range of small, customizable leather products and a fully personalized leather studio.

Product Insights

Handbags & purses dominated the market and accounted for a share of 33.3% in 2023. As economies develop and personal wealth rises, individuals are more willing to spend on luxury items such as high-end handbags and purses made from premium materials such as leather. This trend is particularly evident in emerging markets where a growing middle class drives demand for luxury goods. Owning a designer handbag or purse has become a status symbol for many individuals, reflecting their social standing and taste.

Small leather accessories is anticipated to grow significantly at a CAGR of 5.8% over the forecast period. The growing trend of minimalism and functionality has significantly boosted the demand for small leather accessories such as wallets, cardholders, and keychains. Consumers increasingly seek compact, versatile, high-quality leather accessories that complement their lifestyle. Furthermore, the increasing influence of social media and the rise of influencer culture have contributed to the growth of small leather accessories in the luxury market. Influencers and celebrities often showcase `their favorite small leather accessories on social media platforms, influencing consumer preferences and driving demand for these products.

Distribution Channel Insights

Exclusive brand outlets accounted for the largest market revenue share in 2023. Luxury consumers are drawn to the narrative and heritage of prestigious brands, and exclusive brand outlets serve as a platform to showcase the brand's history, craftsmanship, and unique value proposition. This storytelling aspect creates a compelling and immersive shopping environment, appealing to discerning consumers who seek a deeper connection with the brand and its products. As a result, exclusive brand outlets have become an essential channel for luxury leather goods, leveraging brand heritage to drive sales and customer loyalty.

The online distribution channel is expected to register the fastest CAGR during the forecast period. The increasing digitalization and technological advancements have played a crucial role in driving online sales growth in the luxury sector. With the proliferation of e-commerce platforms and mobile shopping apps, luxury brands have reached a wider audience globally, offering convenience and accessibility to consumers who prefer to shop online.

Regional Insights

The North America luxury leather goods market is anticipated to grow significantly over the forecast period. The emphasis on high-quality craftsmanship and various designs has fueled the demand for luxury leather goods in North America. Consumers in the region seek products that reflect superior craftsmanship and enduring style, driving the popularity of luxury leather goods such as handbags, suitcases, briefcases, and small leather accessories such as wallets.

U.S. Luxury Leather Goods Market Trends

The luxury leather good market in the U.S. was identified as a lucrative country in 2023. The demand for high-quality leather products, including handbags, wallets, shoes, and accessories, has increased due to increasing disposable income, changing consumer preferences towards premium and luxury items, and a growing fashion-conscious population in the country. The market is also driven by the strong presence of luxury brands offering a wide range of leather goods to cater to different consumer segments.

Europe Luxury Leather Goods Market Trends

The luxury leather good market in Europe accounted for the largest revenue share of 32.4% in 2023. The presence of fashion capitals cities such as Paris, Milan, London, and Madrid play a significant role in driving the growth of the luxury leather goods market in Europe. European consumers have shown a strong inclination to purchase luxury leather goods due to their status symbol value, durability, and timeless appeal.

The UK luxury leather goods market is expected to grow significantly over the forecast period. The UK plays a significant role in shaping trends and setting standards for luxury fashion globally. The country has renowned designers, luxury brands, and prestigious fashion events like London Fashion Week. This status as a fashion hub has elevated the profile of British-made luxury leather goods, attracting domestic and international consumers seeking sophisticated and elegant products.

Asia Pacific Luxury Leather Goods Market Trends

The luxury leather good market Asia Pacific is anticipated to register the fastest CAGR over the forecast period. The rising middle class, rapid urbanization, and rising disposable incomes in nations such as China and India have driven the need for luxury leather goods. Moreover, increased consumer demand for luxury and premium brands has significantly influenced the region's market growth.

The China luxury leather goods market is expected to grow rapidly in the coming years. This growth is fueled by young consumers, especially millennials and Generation Z, who are heavily influenced by digital marketing and social media. Luxury brands also utilize e-commerce platforms such as WeChat and Little Red Book for customer engagement. They incorporate local elements into their products and marketing to cater to Chinese cultural preferences.

Key Luxury Leather Goods Company Insights

Some of the key companies in the global luxury leather good market Louis Vuitton Malletier SAS, Guccio Gucci S.p.A., Hermès, PRADA S.P.A., Chanel S.A., and Burberry Group Plc. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Louis Vuitton Malletier SAS offers a wide range of luxury leather goods, such as handbags, wallets, belts, shoes, accessories, and ready-to-wear clothing. From the classic Monogram canvas to the elegant Epi leather and luxurious exotic skins such as crocodile and python, Louis Vuitton offers diverse leather options to cater to different tastes and preferences.

-

PRADA S.P.A offers various leather handbags in multiple styles, sizes, and colors to cater to different tastes and preferences. Prada also produces leather shoes, wallets, belts, and other premium leather accessories.

Key Luxury Leather Goods Companies:

The following are the leading companies in the luxury leather goods market. These companies collectively hold the largest market share and dictate industry trends.

- Louis Vuitton Malletier SAS

- Guccio Gucci S.p.A.

- Hermès

- Prada S.p.A.

- Chanel S.A.

- Burberry Group plc

- Tapestry, Inc.

- Michael Kors Holdings Limited

- Salvatore Ferragamo S.p.A.

- Fendi S.r.l.

Recent Developments

-

In April 2024, Hermes announced the expansion of its leather goods workshop in France, marking the company's 24th workshop. The new workshop will further strengthen Hermes' presence in the industry and allow for increased production of their iconic leather goods.

-

In July 2021, Burberry Group plc opened a flagship store in London. The new store is in a prime location in the city's heart and aims to provide customers with an immersive brand experience. This flagship store represents Burberry's commitment to offering a unique shopping environment that blends heritage with innovation.

Luxury Leather Goods Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 102.38 billion

Revenue forecast in 2030

USD 140.55 billion

Growth rate

CAGR of 5.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, New Zealand, Brazil, Saudi Arabia, UAE

Key companies profiled

Louis Vuitton Malletier SAS, Guccio Gucci S.p.A., Hermès, Prada S.p.A., Chanel S.A., Burberry Group plc, Tapestry, Inc., Michael Kors Holdings Limited, Salvatore Ferragamo S.p.A., Fendi S.r.l.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Luxury Leather Goods Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global luxury leather goods market report based on product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Luggage (Travel Bag & backpacks)

-

Handbags & Purses

-

Footwear

-

Apparel

-

Small Leather Accessories

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Exclusive Brand Outlets

-

Specialty Stores

-

Online

-

Airports

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.