Luxury Electric Vehicles Market Size, Share & Trends Analysis Report By Propulsion Type (BEV, PHEV, FCEV), By Vehicle Type, By Region And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-074-6

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Luxury EVs Market Size & Trends

The global luxury electric vehicles market size was valued at USD 158.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 17.7% from 2023 to 2030. Rising demand for emission-free, air combating fuel efficient, and technologically advanced vehicles is driving the growth of the luxury electric vehicle in the market. In addition, the increasing consumer inclination towards entertainment, safety and comfort features has positively impacted the market growth. Besides, the growing number of high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs) in the emerging economies of the Asia Pacific region has propelled the demand for luxury electric vehicles.

The prominent players in the luxury electric vehicle industry are majorly investing in building lightweight, cost-effective, and high-density batteries. For instance, General Motors Company is working on testing the different combinations of propulsion chemistries to slash the existing cost of electric batteries. General Motors is experimenting with the combination of silicon-rich and lithium metal anode to produce its next-generation Ultium batteries to reduce the propulsion cell price to $100/kwh by the year 2025. In addition, the company has plans to enhance battery life for high-speed electric vehicles with a driving range of 805 to 965km.

Government initiatives to increase electric vehicle penetration across developing nations is catalyzing the growth of luxury electric vehicle in the market. Several governments are providing tax subsidies on the purchase of luxury and economy electric vehicles, which is encouraging consumers to switch towards electric models over gasoline-powered vehicles. In addition, the fluctuating crude oil prices due to a pandemic, geopolitical events, harsh climatic conditions, and up-surge in the existing fluctuation influence consumers automobile purchase decisions. Since the rise in fuel price increases the overall cost of owning the vehicles during the overall lifespan of the vehicle; thus, consumers are shifting towards technologically advanced, secured, and luxury electric vehicles.

Moreover, the sales of luxury electric vehicles are hindered due to the limited number of charging stations, charging points, and it’s supporting charging infrastructure across the globe. For instance, the developing nations of the world, such as Mexico, have around 1,069 propulsion charging stations by the year 2021, of which 1002 are public charging stations, and 67 are fast charging stations. Thus, the lack of availability of fast charging stations in Mexico limits the sales of luxury electric vehicles in the country.

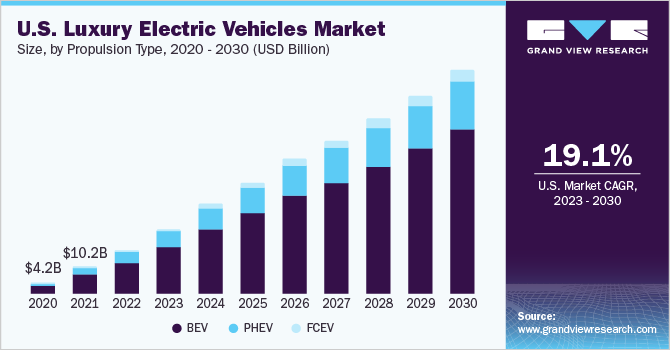

Propulsion Type Insights

Based on the propulsion type, the luxury electric vehicles industry has been segmented into the Battery Electric Vehicle (BEV), Plug-in-Hybrid Electric Vehicle (PHEV), and Fuel cell Electric Vehicle (FCEV). The battery electric vehicle segment accounted for over 65% of the market share in the global market. Rising environmental concerns, and government policies to increase the electric vehicle penetration globally is driving the battery electric vehicle segment growth in the global market. In addition, the rising inclination of vehicle manufacturers towards producing a wide range of electric vehicles with advanced features pertaining to artificial intelligence and the Internet of Things (IoT) is contributing to the growth of the segment. For instance, one of the prominent players of the electric vehicle market Audi AG plans to launch the 2023 Audi e-tron® GT in the year 2023, the model has Matrix-design LED headlights, X-frame trim and laser lights. Besides, the 2023 Audi e-tron® GT is high performance, has fast charging batteries, and offers batteries with more than 250 KW. Thus, on similar lines, the segment is expected to offer numerous opportunities to the stakeholders in the market.

The fuel cell luxury electric vehicle segment is estimated to grow at a CAGR of 21.8% from 2023 to 2030. The exponential growth of the fuel cell luxury electric vehicle segment is attributed to the shift in trend towards clean energy fuels and rising investments in the development of fuel cell technology for vehicles. Additionally, the increasing inclination towards producing the essential materials used for building and operation of the hydrogen refueling fuel cell infrastructure, and battery charging infrastructure is expected to propel the growth of hydrogen-powered fuel cell luxury electric vehicles in the market.

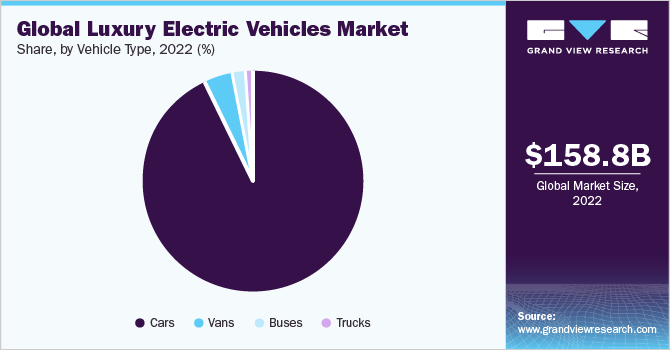

Vehicle Type Insights

Based on vehicle type, the market has been segmented into cars, buses, vans, and trucks. The car segment dominated the overall market in 2022 and accounted for over 90% of the global market share in the year. The share of the segment is attributed to the higher integration of advanced technologies such as e-torque vectoring plus technology and systems such as; virtual cockpit plus, advanced driver assistance, infotainment system, advanced lighting system, and others in the upcoming luxury electric vehicle.

The vans segment is estimated to grow at a CAGR of 21.7 % from 2023 to 2030. The growth of the luxury vans segment is attributed to the rising consumer traction towards luxury pickup trucks for traveling and sightseeing purposes. Furthermore, electric vehicle manufacturers are producing luxury pick-up variants to fulfill the rising demand. For instance, in April 2022, Ford Motor Company started the production of an electric F-150 Lightning pickup truck in Michigan. The electric pick-up truck is one of the fastest accelerating luxury electric pickup trucks/vans with a low price range the pickup- truck is available for customers based in America.

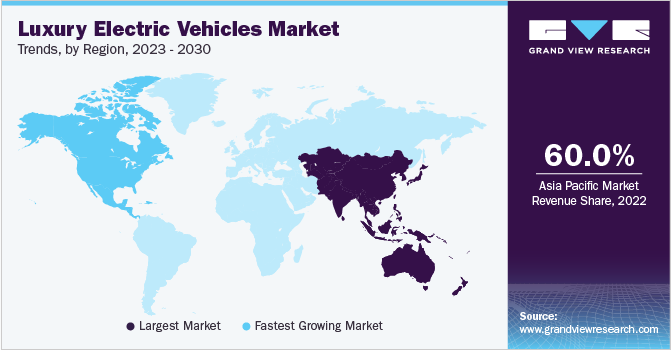

Regional Insights

The Asia Pacific region dominated the luxury electric vehicles industry and accounted for over 60% of the market share in the year 2022. The region is expected to continue its dominance during the forecast period due to increasing government focus towards building battery charging infrastructure and hydrogen fueling stations in developing nations such as China and India. For instance, the growing focus of the Chinese government on replacing existing fleets with hydrogen fuel cell vehicles. The goal is to have one million fuel-cell electric vehicles on the road and install 1,000 hydrogen fueling stations by 2030. Therefore, government initiatives are expected to increase the penetration of battery electric and fuel cell electric luxury variants in the market.

North America is anticipated to witness a significant CAGR of 19.3% from 2023 to 2030. The high growth pace is attributed to high paying capacities of the consumers based in the region. The consumers in the region started spending more on comfort, entertainment and luxury, thus there is increase in sales of luxury electric vehicle variants over the economy vehicles. In addition, the government tax rebate on electric vehicle purchases encourages consumers to opt the luxury electric vehicle and over petrol and diesel vehicle in the market.

Key Companies & Market Share Insights

Key market players have adopted strategies such as business expansion, acquisitions, joint ventures, and mergers, to strengthen their global footprints. Organic growth remains the key strategy for most of the market's incumbents. As such, luxury electric vehicle manufacturers are focused on widening their existing product portfolio to meet their existing needs and address the upcoming luxury vehicle demands in the market.

For instance, in April 2022, BYD Auto Co., Ltd., has launched the Han EV series, which includes a wide range of vehicles mid-level vehicles to luxury sedans. The series includes both battery-electric vehicles and plug-in hybrid vehicles. The luxury electric vehicle offered by the company has the integration of advanced technologies, this integration enhances the safety features, overall vehicle performance, and comfort. Besides, the vehicle series is equipped with ultra-safe blade batteries, which reduces the possibility of catching fires even in case of the vehicle getting severely damaged. Prominent players in the global luxury electric vehicles market include:

-

Tesla, Inc.

-

BYD Auto Co., Ltd.

-

Volkswagen AG

-

BMW AG

-

AB Volvo

-

Ford Motor Company

-

Hyundai Motor Company

-

Toyota Motor Corporation

-

Kia Corporation

-

Audi AG

Luxury Electric Vehicles Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 232.57 billion |

|

Revenue forecast in 2030 |

USD 726.9 billion |

|

Growth rate |

CAGR of 17.7% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, volume in units, and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Propulsion type, vehicle type, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; UK; Germany; France; Netherlands; China; India; Japan; Australia; Brazil; Mexico |

|

Key companies profiled |

Tesla, Inc.; BYD Auto Co., Ltd.; Volkswagen AG; BMW AG; AB Volvo; Ford Motor Company; Hyundai Motor Company; Toyota Motor Corporation; Kia Corporation; Audi AG. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

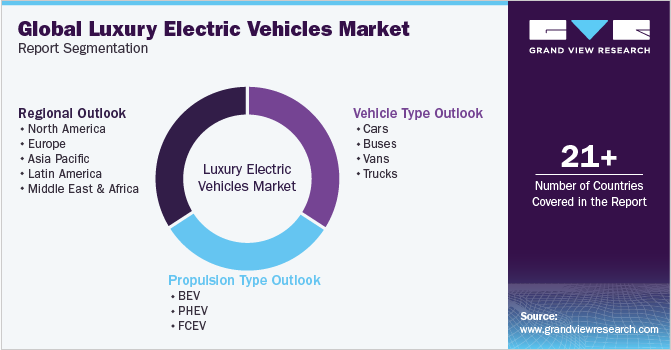

Global Luxury Electric Vehicles Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global luxury electric vehicles market report based on propulsion type, vehicle type, and region:

-

Propulsion Type Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

-

BEV

-

PHEV

-

FCEV

-

-

Vehicle Type Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

-

Cars

-

Buses

-

Vans

-

Trucks

-

-

Regional Outlook (Revenue, USD Million; Volume, Units, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

- Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. Some key players operating in the luxury electric vehicle market include Mercedes-Benz Group AG, Tesla, BMW Group, Volvo Car Corporation, Volkswagen AG, Hyundai Motor Company, BYD COMPANY LIMITED, and Ford Motor Company

b. Key factors driving the luxury electric vehicle market growth include the continued increase in the number of ultra-high-net-worth individuals and increasing disposable income in the Asia Pacific region.

b. The global luxury electric vehicle market size was estimated at USD 158.8 billion in 2022 and is expected to reach USD 232.57 billion in 2023.

b. The global luxury electric vehicle market is expected to grow at a compound annual growth rate of 17.7% from 2023 to 2030 to reach USD 726.9 billion by 2030.

b. Asia Pacific dominated the luxury electric vehicle market with a share of 45.9% in 2022. This can be attributed to the supportive government initiatives in the region.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."