- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Lutein Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Lutein Market Size, Share & Trends Report]()

Lutein Market (2024 - 2030) Size, Share & Trends Analysis Report By Source (Natural, Synthetic), By Form (Powder, Beadlet), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-351-4

- Number of Report Pages: 115

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Lutein Market Summary

The global lutein market size was estimated at USD 357.55 million in 2023 and is projected to reach USD 527.2 million by 2030, growing at a CAGR of 5.8% from 2024 to 2030. Increasing awareness of the health benefits associated with this carotenoid coupled with rising use in functional foods and beverages are major factors driving the market.

Key Market Trends & Insights

- In terms of region, Europe was the largest revenue generating market in 2023.

- The lutein market in the U.S. is expected to grow at a CAGR of 5.5% from 2024 to 2030

- By source, the natural lutein segment accounted for a revenue share of 72.88% in 2023.

- By form, the powder segment accounted for a revenue share of 42.47% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 357.6 Million

- 2030 Projected Market Size: USD 527.2 Million

- CAGR (2024-2030): 5.8%

- Europe: Largest market in 2023

Notably, the rising prevalence of age-related macular degeneration (AMD) is a significant driver, as lutein and zeaxanthin are recognized for their role in protecting the macula, the central part of the retina responsible for sharp central vision. This has led to a surge in demand for lutein supplements as individuals seek to safeguard their vision and delay or prevent AMD progression.Consumers are increasingly seeking out products derived from natural sources, prompting manufacturers to explore innovative methods of extracting lutein from plant-based ingredients. The focus on sustainability also encourages the use of eco-friendly practices in lutein production and packaging, minimizing environmental impact. Moreover, growing consumer interest in natural and preventive healthcare solutions is fueling the demand for lutein-rich foods and supplements. This trend is further amplified by the increasing popularity of functional foods and beverages fortified with lutein, catering to the desire for products that offer health benefits beyond basic nutrition.

Beyond vision health, lutein is gaining recognition for its potential role in promoting cognitive function, cardiovascular health, and skin health. Research suggests that lutein may enhance brain health, potentially reducing the risk of cognitive decline and Alzheimer's disease. Additionally, its antioxidant properties are believed to contribute to cardiovascular health by protecting against oxidative stress and inflammation. The increasing awareness of these multifaceted benefits is expanding the market appeal of lutein beyond its initial focus on vision health, leading to new applications in diverse product categories. The growing body of scientific evidence supporting these health claims is further solidifying consumer confidence in lutein and driving demand.

Technological advancements in lutein extraction and purification are playing a crucial role in driving market growth. The development of innovative extraction methods, such as supercritical fluid extraction, is enabling the production of high-quality lutein with improved bioavailability and stability. This enhanced efficiency and purity are further contributing to the expansion of lutein applications in various sectors, including food, beverage, nutraceutical, and pharmaceutical industries. Moreover, the development of encapsulated and microencapsulated forms of lutein is facilitating its incorporation into diverse food and beverage products, making it easier for consumers to incorporate this beneficial carotenoid into their daily diets.

Source Insights

The natural lutein segment accounted for a revenue share of 72.88% in 2023 driven by increasing consumer awareness of its health benefits and rising demand for natural ingredients in the food and nutraceutical industries. The primary sources of natural lutein are marigold flowers (Tagetes erecta), which contain high concentrations of the carotenoid. The increasing demand for natural lutein has led to a rise in the cultivation of marigold flowers, particularly in countries like India and China, where the climate and land availability are suitable for large-scale production. Moreover, the increasing adoption of healthy lifestyles and a growing preference for natural remedies are contributing to the market growth.

The synthetic lutein segment is anticipated to witness a growth rate of 5.1% from 2024 to 2030. Synthetic lutein is typically less expensive to produce than natural lutein, which is derived from marigold flowers. This cost advantage has made synthetic lutein an attractive option for manufacturers of dietary supplements, functional foods, and beverages. By using synthetic lutein, these manufacturers can produce high-quality products at a lower cost, which can help them remain competitive in the market. Additionally, synthetic lutein is more stable and consistent in quality than natural lutein, which can vary depending on growing conditions and other factors.

Form Insights

The powder segment accounted for a revenue share of 42.47% in 2023. The powder form of lutein offers numerous advantages over other forms, such as its stability, extended shelf life, and convenient handling. Its fine particle size facilitates efficient dispersion and absorption, ensuring optimal bioavailability. Furthermore, its high purity and standardized composition guarantee consistent quality and efficacy. Its ease of incorporation into functional foods, beverages, supplements, and pharmaceuticals makes it a highly sought-after ingredient.

The beadlet segment is estimated to grow at a CAGR of 6.4% from 2024 to 2030. Lutein beadlets are microencapsulated particles designed for controlled release and enhanced stability, ensuring the integrity of the lutein throughout its shelf life. This form is particularly advantageous for applications requiring precise dosage, such as dietary supplements and pharmaceuticals. The beadlet format offers improved bioavailability, reduced degradation, and controlled release of lutein, making it a preferred choice for targeted delivery and specific health benefits. Over the past few years, there has been increasing usage of beadlets in dietary supplements, providing a controlled and sustained release of lutein, maximizing its absorption and efficacy.

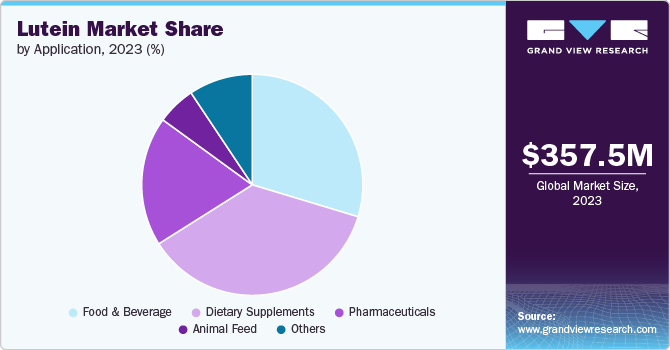

Application Insights

The dietary supplements segment accounted for a revenue share of 36.38% in 2023. Lutein has been found to improve visual acuity, reduce glare, and protect the eyes from UV radiation. These benefits have made lutein supplements an attractive option for individuals seeking to maintain optimal eye health and prevent age-related eye diseases. Moreover, the increasing availability of these supplements in online retail channels and pharmacies has made it easier for consumers to access and purchase these products.

The food and beverage segment is estimated to grow at a CAGR of 6.0% from 2024 to 2030. In the food industry, lutein is commonly used as a natural food colorant in products such as pasta, noodles, and bakery items. Its vibrant yellow color adds visual appeal to these products while simultaneously providing consumers with a healthy dose of antioxidants. Manufacturers are incorporating lutein into a wide range of food and beverage products to enhance their nutritional value and cater to the growing demand for functional foods. Moreover, consumers seek healthier alternatives to sugary drinks, thereby driving the demand for lutein-enriched beverages, such as juices, soft drinks, and sports drinks. In addition, lutein is being increasingly added to dairy products like milk, yogurt, and cheese to fortify them with essential nutrients. This trend is driven by the growing popularity of fortified dairy products among health-conscious consumers who seek convenient ways to improve their nutritional intake.

Regional Insights

The lutein market in North America held over 5.8% revenue share of the global market in 2023. The well-established dietary supplement market, characterized by a high per capita consumption of vitamins and minerals is driving the demand for lutein-based products in this region. Moreover, the increasing focus on healthy aging and preventative healthcare measures is fueling the demand for lutein. In addition, the use of lutein in nutraceutical formulations, as well as its incorporation into functional foods and beverages, is further bolstering market growth.With a rising awareness of lutein's benefits and a robust demand for natural health solutions, the North American lutein market is poised for continued growth in the coming years

U.S. Lutein Market Trends

The lutein market in the U.S. is expected to grow at a CAGR of 5.5% from 2024 to 2030, driven byits high per capita income, strong healthcare infrastructure, and a growing focus on preventive healthcare. Moreover, the aging population in the U.S. and the rising prevalence of eye diseases, including AMD are positively driving the market growth. Furthermore, the growing consumer interest in natural and organic products has led to an increased preference for lutein supplements, derived from naturally occurring sources such as marigold flowers.

Europe Lutein Market Trends

The lutein market in Europe held over 34% of the global revenue in 2023. Growing awareness of the health benefits associated with lutein, particularly its role in maintaining eye health and supporting cognitive function is driving the regional demand. Moreover, the increasing prevalence of age-related macular degeneration (AMD) and rising concerns about overall well-being, have propelled demand for lutein supplements. Furthermore, the region's robust food and beverage industry is incorporating lutein into functional foods and beverages, further boosting market growth.

Asia Pacific Lutein Market Trends

The lutein market in the Asia Pacific is set to grow at a CAGR of about 6.4% from 2024 to 2030. The growth of the middle-income population with increased disposable income and a growing preference for natural health solutions has led to a rise in the adoption of lutein-enriched products. Moreover, factors such as the aging population and increasing awareness of the benefits of lutein for eye and brain health are further bolstering market growth. Besides, the adoption of lutein in functional foods, dietary supplements, and pharmaceuticals is gaining traction, particularly in countries like China, Japan, India and South Korea.

Key Lutein Company Insights

BASF SE, Chr. Hansen Holding A/S, Kemin Industries, Inc., Allied Biotech Corporation, Koninklijke DSM N.V., Xi'an Green Spring Technology Co.,Ltd, Synthite Industries Ltd., Bio Actives Japan Corporation, Santen Pharmaceutical Co., Ltd., and Xi'an Healthful Biotechnology Co.,Ltd. are some dominant players operating in the market.

The global market is characterized by intense competition. Key players are focusing on product innovation to differentiate themselves, launching new formulations and delivery methods to cater to specific consumer needs. This includes incorporating lutein into functional foods, beverages, and nutraceutical products, offering convenient and palatable ways to incorporate lutein into daily diets. Moreover, companies are employing a variety of competitive strategies to gain market share, including product innovation, product launches, mergers and acquisitions, and strategic partnerships.

Key Lutein Companies:

The following are the leading companies in the lutein market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Chr. Hansen Holding A/S

- Kemin Industries, Inc.

- Allied Biotech Corporation

- Koninklijke DSM N.V.

- Xi'an Green Spring Technology Co., Ltd

- Synthite Industries Ltd.

- Bio Actives Japan Corporation

- Santen Pharmaceutical Co., Ltd.

- Xi'an Healthful Biotechnology Co., Ltd

Recent Developments

-

In May 2024, OmniActive Health Technologies and the Council of Responsible Nutrition (CRN) formed a strategic partnership to emphasize the importance of lutein and zeaxanthin isomers for prenatal nutrition at the American College of Obstetrics and Gynecology's (ACOG) annual meeting. This collaboration aims to raise awareness and highlight the benefits of these essential nutrients for expectant mothers.

-

In November 2023, HELM and Allied Biotech forged a groundbreaking partnership, revolutionizing the natural color industry. This collaboration unlocked the transformative potential of natural crystal-clear colors, derived from the purest lutein, a vital carotenoid renowned for its exceptional properties. These vibrant pigments offer unparalleled clarity and stability, enabling food and beverage manufacturers to create visually stunning and nutritionally enriched products that meet consumer demands for clean-label, natural ingredients.

-

In March 2021, Ashland expanded its nutraceutical offerings with the introduction of a soy-free GPM lutein. This strategic move aligns with the growing consumer demand for plant-based and allergen-friendly supplements. Ashland's soy-free GPM lutein is a targeted solution for eye health, providing a convenient and effective way for consumers to support their vision. The addition of this innovative product to Ashland's portfolio demonstrates its commitment to meeting the evolving needs of the nutraceutical market.

Lutein Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 376.51 million

Revenue forecast in 2030

USD 527.20 million

Growth rate

CAGR of 5.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, form, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; South Africa

Key companies profiled

BASF SE; Chr. Hansen Holding A/S; Kemin Industries, Inc.; Allied Biotech Corporation; Koninklijke DSM N.V.; Xi'an Green Spring Technology Co.,Ltd; Synthite Industries Ltd.; Bio Actives Japan Corporation; Santen Pharmaceutical Co., Ltd.; Xi'an Healthful Biotechnology Co.,Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lutein Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global lutein market report based on the source, form, application, and region:

-

Source Outlook (Revenue in USD Million, 2018 - 2030)

-

Natural

-

Synthetic

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Powder

-

Oil Suspension

-

Emulsion

-

Beadlet

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food and Beverage

-

Dietary Supplements

-

Pharmaceuticals

-

Animal Feed

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global lutein market size was estimated at USD 357.55 million in 2023 and is expected to reach USD 376.51 million in 2024.

b. The global lutein market is expected to grow at a compound annual growth rate of 5.8% from 2024 to 2030 to reach USD 527.20 million by 2030.

b. Europe dominated the lutein market with a share of 34.5% in 2023. This is attributable to growing awareness of the health benefits associated with lutein, particularly its role in maintaining eye health and supporting cognitive function

b. Some key players operating in the lutein market include BASF SE, Chr. Hansen Holding A/S, Kemin Industries, Inc., Allied Biotech Corporation, Koninklijke DSM N.V., Xi'an Green Spring Technology Co.,Ltd, Synthite Industries Ltd., Bio Actives Japan Corporation, Santen Pharmaceutical Co., Ltd., and Xi'an Healthful Biotechnology Co.,Ltd.

b. Key factors that are driving the market growth include increasing awareness of the health benefits associated with this carotenoid coupled with rising use in functional foods and beverages

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.