Lung Cancer Screening Software Market Size, Share & Trends Analysis Report By Region (North America (U.S., Canada, Mexico), APAC, Europe, Latin America, MEA), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-303-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

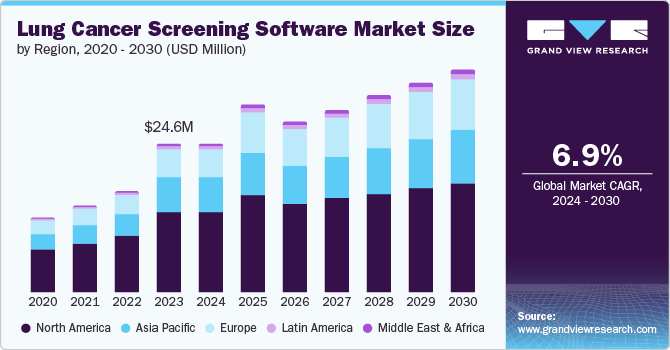

The global lung cancer screening software market size was valued at USD 24.6 million in 2023 and is projected to grow at a CAGR of 6.9% from 2024 to 2030. Technological advancements in medical imaging and software development have significantly improved the accuracy and efficiency of lung cancer screening. Innovations such as 3D imaging, computer-aided detection (CAD), and machine learning algorithms have enhanced the capabilities of screening software, leading to more precise and reliable results. These advancements have fueled the demand for advanced screening tools, driving the growth of the lung cancer screening software market.

According to the World Health Organization (WHO), lung cancer remains one of the most prevalent and deadly forms of cancer, accounting for approximately 18% of all cancer deaths. As awareness about the disease increases and more individuals are diagnosed, there is a growing demand for effective screening solutions. This trend is particularly pronounced in high-risk populations, such as smokers and those with a family history of lung cancer, who require regular screenings to facilitate early detection and improve treatment outcomes.

Public health initiatives to increase awareness about lung cancer risks and the importance of early detection have also contributed to the growth of screening software. Organizations such as the American Cancer Society and the U.S. Preventive Services Task Force have established guidelines recommending annual screenings for high-risk individuals aged 50-80 years who have a significant smoking history. These guidelines encourage healthcare providers to implement routine screenings and promote patient engagement in their health management, leading to an increased demand for robust screening solutions.

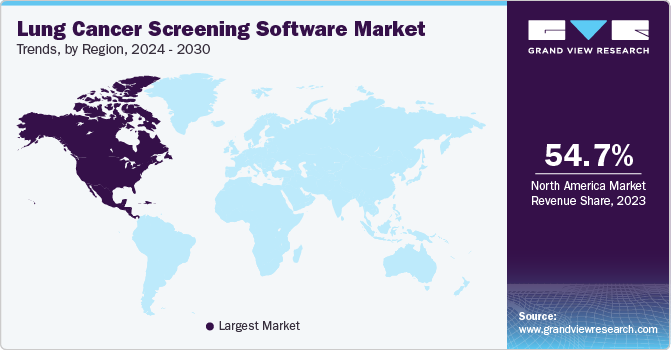

Regional Insights

North America lung cancer screening software market accounted for the largest market revenue share of 54.7% in 2023. North America is at the forefront of technological innovation in the healthcare industry, and this has significantly contributed to the growth of lung cancer screening software. The region boasts advanced medical imaging technologies and a strong focus on research and development, leading to the creation of sophisticated screening software with improved accuracy and efficiency.

U.S. Lung Cancer Screening Software Market Trends

The U.S. lung cancer screening software market held the highest market share in North America. According to the American Cancer Society, lung cancer remains one of the most common and deadliest cancers in the country, with over 200,000 new cases diagnosed annually. This alarming statistic has heightened awareness among healthcare providers and patients regarding early detection methods. As more individuals are diagnosed with lung cancer, there is an increasing demand for effective screening solutions that can facilitate early diagnosis and improve patient outcomes.

Europe Lung Cancer Screening Software Market Trends

Europe lung cancer screening software market was identified as a lucrative region in 2023. As European countries face increasing cancer cases, there is a growing recognition that early detection through advanced screening methods can lead to better patient outcomes and survival rates. European Society for Medical Oncology reports that lung cancer is responsible for more cancer deaths than breast, prostate, and colorectal cancers combined. This has spurred a concerted effort to improve early detection capabilities, driving the demand for sophisticated lung cancer screening software that can provide early and accurate diagnoses.

The UK lung cancer screening software market is accounted for the largest market revenue share in Europe. The UK government has recognized the importance of early detection in combating lung cancer, leading to various initiatives to improve screening rates. Programs such as the NHS Lung Health Checks initiative aim to identify individuals at high risk for lung cancer through targeted screenings.

The lung cancer screening software market in Germany is anticipated to grow significantly over the forecast period. In 2021, Germany introduced a national lung cancer screening program for individuals at high risk, particularly those aged 55 to 74 with a significant smoking history. Established by the German Federal Joint Committee (G-BA), this program aims to offer low-dose CT (LDCT) screenings to detect lung cancer at an earlier, more treatable stage. The program’s implementation has driven increased demand for advanced lung cancer screening software to support nationwide screening efforts.

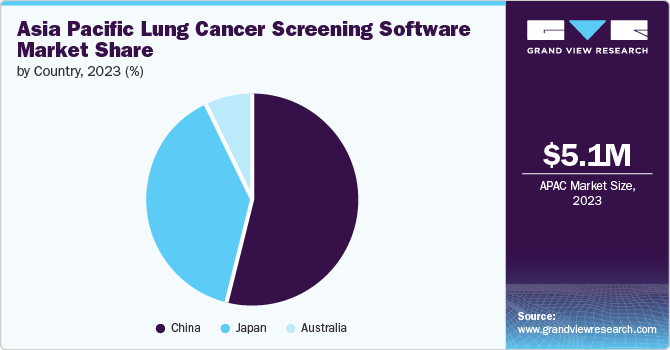

Asia Pacific Lung Cancer Screening Software Market Trends

Asia Pacific lung cancer screening software market is anticipated to witness significant growth over the forecast period. The demographic shift towards an aging population in many Asia Pacific countries fuels the demand for the market. Older adults are at a higher risk for developing various types of cancers, including lung cancer. Thus, there is an increasing need for targeted screening programs tailored specifically for this demographic group.

China lung cancer screening software market accounted for the largest market revenue share in Asia Pacific in 2023. The Chinese government has taken several steps to address the high incidence of lung cancer through organized screening initiatives. For instance, the "China National Lung Cancer Screening Trial" (NLST) demonstrated the effectiveness of low-dose CT (LDCT) in the early detection of lung cancer, leading to increased policy support for screening programs.

The lung cancer screening software market in Japan is expected to grow significantly over the forecast period. The nation's continuous advancements in medical technology, including high-resolution imaging and artificial intelligence (AI) algorithms, have significantly improved the accuracy and efficiency of lung cancer screening software.

Latin America Lung Cancer Screening Software Market Trends

Latin America lung cancer screening software market is anticipated to witness significant growth over the forecast period. The healthcare landscape in Latin America has seen significant advancements in medical imaging technology and software development. These technological innovations have created sophisticated lung cancer screening software with improved accuracy and efficiency. The integration of advanced imaging modalities and computer-aided detection (CAD) systems has bolstered screening software's capabilities, driving the growth of the lung cancer screening software market in Latin America.

Middle East & Africa Lung Cancer Screening Software Market Trends

Middle East & Africa lung cancer screening software market is anticipated to register the fastest CAGR over the forecast period. The development of regional health policies and strategic partnerships proliferates the market in the region. Countries in the area are increasingly collaborating on health policies and forming strategic alliances to improve cancer care. For instance, the Middle East Cancer Consortium (MECC) is a collaborative effort among several MEA countries to advance cancer research, improve cancer care, and implement effective screening programs.

Key Lung Cancer Screening Software Company Insights

Key companies in the market include Nuance Communications, Inc., Eon, Koninklijke Philips N.V., Siemens Healthineers AG, PenRad Technologies, Inc, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Nuance Communications, Inc. has developed specialized software for lung cancer screening, which is crucial in early detection and diagnosis. This software leverages advanced machine learning algorithms to analyze medical imaging data, particularly low-dose computed tomography (CT) scans, which are pivotal in identifying potential lung nodules indicative of cancer.

-

Siemens Healthineers AG offers advanced lung cancer screening software designed to improve early detection and diagnosis of lung cancer, which is one of the leading causes of cancer-related deaths worldwide. The software integrates seamlessly with imaging modalities such as computed tomography (CT) scans, employing sophisticated algorithms that analyze images for potential malignancies.

Key Lung Cancer Screening Software Companies:

The following are the leading companies in the lung cancer screening software market. These companies collectively hold the largest market share and dictate industry trends.

- Nuance Communications, Inc.

- Eon

- Koninklijke Philips N.V.

- Siemens Healthineers AG

- Voxel Cloud

- MRS

- PENRAD

- MagView

- FUJIFILM Holdings Corporation

- Medtronic

Recent Developments

- In July 2024, Bon Secours Mercy Health collaborated with Koninklijke Philips N.V. to enhance clinical workflows through integrated solutions, including advanced imaging technologies and analytics platforms tailored for lung cancer detection. The collaboration focuses on implementing advanced imaging technologies and sophisticated analytics platforms explicitly designed for the early detection and management of lung cancer.

Lung Cancer Screening Software Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 30.1 million |

|

Revenue forecast in 2030 |

USD 45.0 million |

|

Growth rate |

CAGR of 6.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

September 2024 |

|

Quantitative units |

Revenue in USD Thousands and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico Germany, UK, France, Italy, Spain, Russia, China, Japan, Australia, Brazil, South Africa |

|

Key companies profiled |

Nuance Communications, Inc.; Eon; Koninklijke Philips N.V.; MRS; Voxel Cloud; Siemens Healthineers AG; PENRAD; MagView; FUJIFILM Holdings Corporation; Medtronic |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Lung Cancer Screening Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global lung cancer screening software market report based on region:

-

Regional Outlook (Revenue, USD Thousand, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the lung cancer screening software market include Nuance Communications, Inc.; Eon; Koninklijke Philips N.V.; Siemens Healthineers AG; PenRad Technologies, Inc.; MRS Systems, Inc.; and Magview.

b. Key factors that are driving the market growth include increasing incidence of lung cancer and also due to growing awareness about early-stage diagnosis of lung cancer.

b. The global lung cancer screening software market size was estimated at USD 13.05 million in 2019 and is expected to reach USD 15.03 million in 2020.

b. The global lung cancer screening software market is expected to grow at a compound annual growth rate of 19.5% from 2019 to 2025 to reach USD 37.9 million by 2025.

b. North America dominated the lung cancer screening software market with a share of 58.9% in 2019. This is attributable to the presence of a large number of screening programs, which in turn aid in the adoption of these software solutions for patient management.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."