- Home

- »

- Clinical Diagnostics

- »

-

Lung Cancer Liquid Biopsy Market Size & Share Report 2030GVR Report cover

![Lung Cancer Liquid Biopsy Market Size, Share & Trends Report]()

Lung Cancer Liquid Biopsy Market Size, Share & Trends Analysis Report By Sample Type, By Biomarker, By Technology, By End-use, By Clinical Application, By Product, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-267-0

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Lung Cancer Liquid Biopsy Market Trends

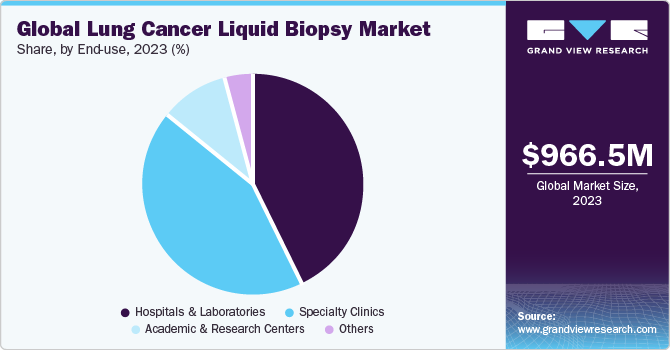

The global lung cancer liquid biopsy market size was estimated at USD 966.5 million in 2023 and is projected to grow at a CAGR of 13.3% from 2024 to 2030. The rise in the prevalence of lung cancer is one of the main factors fueling the market growth. Lung cancer is observed as one of the leading causes of death caused by cancer worldwide. Lifestyle changes involving active and passive smoking, pollution, and genetic abnormalities are majorly contributing to the prevalence of lung cancer.

Liquid biopsy eliminates the need for expensive, invasive procedures as it helps doctors to detect diseases and make decisions using a patient’s blood sample. Moreover, it is a non-invasive alternative to surgical biopsies for detecting molecular biomarkers. Increased awareness among patients and health professionals has increased the number of lung cancer cases diagnosed in Asia, especially in China and India. Growth is expected to be driven by factors such as an increase in reported lung cancer cases and significant investment in R&D to invent effective treatment options.

According to the National Library of Medicine, in January 2023, lung cancer was observed as one of the cancers with the highest incidence rate and the second-highest mortality rate in the world. Factors such as its late detection and high mortality rates lead to its late detection and diagnosis, which leads to a decrease in overall survival rates. Lifestyle habits such as smoking and other habits that involve tobacco exposure are one of the significant risk factors, and it is associated with approximately 80% of the total lung cancer cases worldwide. For instance, according to a 2023 update by the World Health Organization (WHO), in 2020, 22.3% of the world’s population consumed tobacco, which constituted 36.7% of men and 7.8% of women. Moreover, tobacco causes the deaths of more than 8 million people each year, including an estimated 1.3 million passive smokers.

There has been a significant increase in regulatory approvals in the healthcare industry for lung cancer liquid biopsy treatments. For instance, in December 2022, Agilent Technologies Inc. received FDA approval for Agilent Resolution ctDx FIRST as a companion diagnostic used to identify advanced non-small lung cancer in patients. This increase in approvals for the products leads to the entry of more advanced products thereby drives market growth.

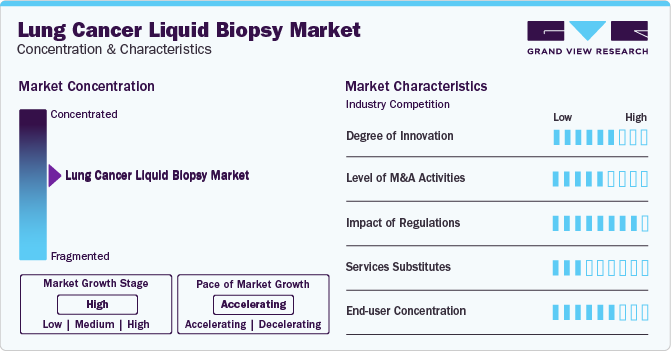

Market Concentration & Characteristics

The market growth stage is high and the pace of growth is accelerating. Technological advancements, including personalized medicine, targeted therapies, and early detection and monitoring, characterize the lung cancer liquid biopsy market. Subsequently, innovative technologies and applications are emerging, disrupting existing industries and creating new ones.

The market is also characterized by the leading players' high level of merger and acquisition (M&A) activity. This is due to several factors, including the need to gain novel treatment technologies in a rapidly growing market and the increasing importance of early disease detection.

Liquid biopsies allow the identification of specific genetic mutations and biomarkers associated with lung cancer. This helps to tailor treatment plans according to the patient's unique genetic profile, leading to more effective therapies and better patient outcomes.

Sample Type Insights

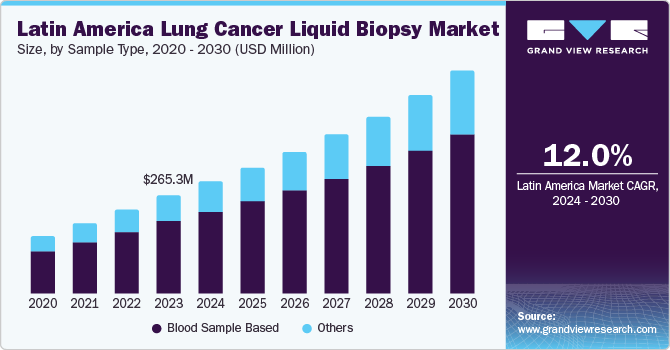

The blood sample-based segment dominated the market with a revenue share of more than 70% in 2023. This high percentage can be attributed to its non-invasive nature, repeatability, real-time monitoring capabilities, early detection, and cost-effectiveness. Blood sample-based biopsy tests can be repeated multiple times throughout a patient's treatment journey without causing additional harm or discomfort. Moreover, liquid biopsies provide real-time information about the patient's condition, as they can be performed at any stage of the disease and during treatment.

The companies operating in the market are launching new technologies and products for screening lung cancers. For instance, Delfi Diagnostics launched its blood test to screen for lung cancer in October 2023. This increasing number of launches involving newer launches are anticipated to propel the market.

End-use Insights

The hospitals and laboratories segment accounted for the largest revenue share in 2023. Hospitals and laboratories have specialized medical professionals, such as oncologists, pathologists, and radiologists, with the necessary expertise to accurately perform and interpret biopsies. Moreover, they can access advanced equipment and technologies required for biopsy procedures and subsequent analysis. These facilities adhere to strict quality control measures and safety protocols to ensure accurate and reliable results. They have well-established protocols for handling biological samples, minimizing contamination risks, and maintaining the integrity of the samples.

The specialty clinics segment is expected to register the fastest CAGR from 2024 to 2030. Specialty clinics are dedicated to specific diseases or medical conditions such as lung cancer. This allows them to develop a deep understanding of the disease, its diagnosis, and treatment options. They prioritize patient needs and preferences, providing personalized care and support tailored to individual patients. This patient-centric approach can lead to increased patient satisfaction and improved adherence to treatment plans, contributing to the growth of specialty clinics.

Biomarker Insights

The circulating nucleic acids segment accounted for the largest revenue share in 2023. Circulating nucleic acids, particularly ctDNA, can be detected at very low concentrations in blood samples, even at early stages of cancer. This is crucial as early detection of lung cancer increases the chances of successful treatment and improves patient survival rates. By analyzing these circulating nucleic acids, healthcare providers can make informed decisions about treatment adjustments and monitor the patient's response to therapy more effectively. Moreover, ctDNA carry valuable genetic and molecular information about cancer that can be used to identify specific mutations and biomarkers associated with lung cancer, guiding healthcare professionals to advise personalized treatment strategies and targeted therapies.

The exosomes/microvesicles segment is expected to register the fastest CAGR from 2024 to 2030. Exosomes and microvesicles can be isolated from a simple blood sample, making them ideal sources for liquid biopsy applications. These biomarkers can reflect changes in the tumor microenvironment and cancer progression. Monitoring the levels of these vesicles in blood samples can help healthcare providers track the disease progression and response to treatment, enabling timely adjustments to the treatment plans. As the scientific community gains a better understanding of the role of exosomes and microvesicles in cancer biology, more research is being directed towards their potential as diagnostic and prognostic tools. This growing interest in this field is expected to drive the development of new tests and technologies, further increasing their demand for lung cancer screening.

Technology Insights

The multi-gene-parallel analysis (NGS) segment dominated the market in 2023 and is projected to grow at the fastest CAGR from 2024 to 2030. This is attributed to its ability to analyze multiple genes comprehensively, detect various mutations, identify actionable targets for personalized treatment, enable early detection, and monitor disease progression and treatment response. NGS allows simultaneous analysis of multiple genes, providing a more comprehensive understanding of the genetic and molecular alterations involved in lung cancer. It can detect genetic alterations, including single nucleotide variations, insertions, deletions, and copy number variations. Experts often recommend multi-gene parallel analysis for lung screening treatments. According to the National Library of Medicine, this technique is used to calculate a high number of biomarkers in a short time, making it the most preferred method to develop clinical tests using liquid biopsy.

The single gene analysis (PCR Microarrays) segment is anticipated to witness growth during the forecast period. An increase in the utilization in lung cancer screening is anticipated to bode well for the growth of this segment. PCR microarrays are cost-effective compared to other genetic analysis methods, such as Sanger or next-generation sequencing (NGS). This makes them more accessible to patients and healthcare systems.

Clinical Application Insights

The therapy selection segment accounted for the largest revenue share in 2023. Different therapies have varying degrees of risk and potential side effects. Healthcare professionals can minimize the risks associated with the biopsy procedure by selecting the most suitable treatment for a specific patient. Therapy selection in lung cancer screening for biopsy is crucial for ensuring accurate diagnosis, minimizing risks, providing personalized treatment, optimizing resource allocation, and prioritizing patient comfort.

The early cancer screening segment is expected to register the fastest CAGR from 2024 to 2030. Detecting lung cancer at an early stage significantly increases the chances of successful treatment and better survival rates. Early-stage lung cancer is more likely to be curable, and patients often have more treatment options available to them.

Product Insights

The instruments segment accounted for the largest revenue share in 2023 and is expected to register the fastest CAGR during the forecast period. Instruments such as biopsy needles and bronchoscopes enables precise targeting of suspicious lesions within the lung, increasing the chances of obtaining representative tissue samples for diagnosis. Instruments offer a safer approach, as they minimize the risk of damage to surrounding healthy lung tissue and other vital organs. Moreover, instrument-based biopsies are often less expensive than open surgical biopsies, making them a more cost-effective option for lung cancer screening.

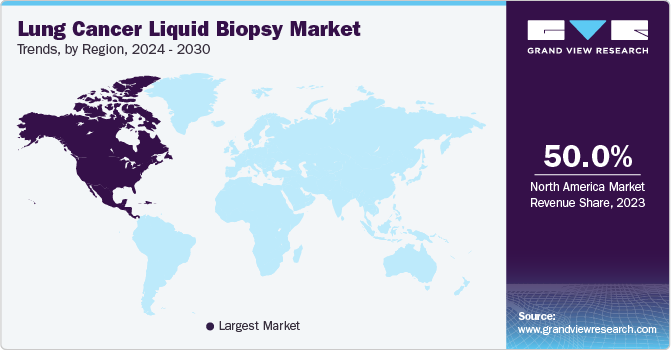

Regional Insights

North America dominated the market and accounted for a revenue share of approximately 50% in 2023. North America faces a higher prevalence of smoking compared to other regions. Smoking is a major risk factor for lung cancer, leading to a higher incidence of the disease. The region has an advanced medical infrastructure, which includes specialized equipment and well-trained professionals capable of performing lung cancer biopsies. North America generally has better access to healthcare services, including lung cancer screening and diagnostic procedures such as biopsies. This could result in an increased detection of lung cancer cases. These factors combined contribute to a higher need for lung cancer biopsies in North America compared to other regions.

U.S. Lung Cancer Liquid Biopsy Market Trends

The lung cancer liquid biopsy in the U.S. dominated the revenue share in North America. The country has a well-established healthcare system with cutting-edge technology, allowing for early detection and diagnosis of lung cancer. Liquid biopsies, which involve analyzing circulating tumor DNA (ctDNA) in the blood, are less invasive than traditional tissue biopsies and can be performed more frequently. Moreover, there is a higher level of awareness about lung cancer and its early detection due to various public health campaigns, medical conferences, and educational programs. This increased awareness leads to more patients and healthcare providers opting for liquid biopsies as a diagnostic tool.

Asia Pacific Lung Cancer Liquid Biopsy Market Trends

Asia Pacific is anticipated to witness significant growth from 2024 to 2030. Lung cancer is one of the most common cancers in this region, with high incidence rates in countries such as China, India, and Japan. This increased prevalence naturally leads to a higher demand for diagnostic procedures such as biopsy. Tobacco use, particularly smoking, increases the risk of lung cancer, necessitating more biopsies for diagnosis and treatment. Air pollution in the region is a significant concern, with high levels of particulate matter and other pollutants contributing to respiratory issues and lung cancer risk. This further increases the need for lung cancer screening and biopsies.

The China lung cancer liquid biopsy market is expected to grow from 2024 to 2030. China has faced severe air pollution issues in recent years, which has been linked to an increased risk of lung cancer due to exposure to toxic particles and chemicals. Moreover, China has an aging population, which increases the risk of various types of cancer, including lung cancer. According to WHO, in 2023, there is an upsurge of respiratory disorders among children in China, which, in turn, drives the need for biopsies for screening procedures.

The lung cancer liquid biopsy market in Japan is expected to grow at a significant CAGR from 2024 to 2030. The country has an aging population, with many individuals over 80. According to the World Economic Forum data released in 2023, more than 1 in 10 people in Japan are now 80 or older. Older adults are at a higher risk of developing lung cancer due to factors like long-term smoking habits, occupational exposure to carcinogens, and other age-related health issues. The country has a well-developed healthcare system, which may contribute to a higher rate of lung cancer diagnosis and subsequent biopsies. Due to the availability of advanced infrastructure and resources, the country's healthcare professionals may be more proactive in identifying and treating lung cancer cases. There is a strong emphasis on health and well-being, which may lead to a higher rate of individuals seeking medical attention for potential health issues, including lung cancer symptoms.

Europe Lung Cancer Liquid Biopsy Market Trends

In Europe, there is a trend of growing partnerships for collaborative research endeavors to advance lung cancer liquid biopsy technologies. Academic institutions, pharmaceutical companies, and diagnostic firms are increasingly joining forces to pool resources, expertise, and data to accelerate developing and validating novel liquid biopsy assays. These partnerships leverage interdisciplinary collaboration to tackle the complexities of lung cancer diagnosis and monitoring, aiming to enhance the sensitivity, specificity, and clinical utility of liquid biopsy methods. By fostering partnerships among stakeholders across the research and healthcare sectors, these growing partnerships are poised to drive innovation and ultimately improve patient outcomes in the fight against lung cancer.

In September 2022, in Europe, DELFI, a company specializing in advanced liquid biopsy tests for early cancer detection, was chosen as the partner for the lung cancer screening trial, 4-IN-THE-LUNG-RUN (4ITLR). This multi-national initiative, led by European investigators, aims to determine the optimal frequency of CT screening for individuals with negative initial scans. Delfi's technology aligns closely with the trial's objectives, as it seeks to identify those in Europe's eligible population who would benefit most from CT scans. The collaboration, facilitated by the Netherlands Cancer Institute (NKI) and the Institute for Diagnostic Accuracy (iDNA), involves Delfi analyzing data from the first 9,000 participants in the Netherlands and France, providing crucial insights to guide further research and eventual implementation of Delfi's technology across the European Union.

The UK lung cancer liquid biopsy market is expected to grow over the forecast period. The UK has a high prevalence of smoking, which is a significant risk factor for lung cancer. For instance, according to the American Cancer Society Journals, in 2022, 1,918,030 new cancer cases occurred and approximately 350 deaths were recorded each day due to lung cancer, the leading cause of cancer death in the U.S.

The market for lung cancer liquid biopsy in Germany held a considerable share in 2023. Lung cancer incidence and prevalence may vary across different countries due to differences in genetic factors, lifestyle, and environmental exposures. Germany is known for its advanced medical research and technology. The availability and adoption of cutting-edge instruments and techniques for lung cancer biopsies are more prevalent in Germany, leading to an increased demand for these procedures. The extent and scope of health insurance coverage for lung cancer screening and biopsies is more comprehensive in Germany, making it easier for patients to access these procedures.

MEA Lung Cancer Liquid Biopsy Market Trends

Tobacco smoking and air pollution are significant risk factors for lung cancer. In Saudi Arabia, while smoking rates have been declining, air pollution levels in urban areas are anticipated to contribute to an increased risk of lung cancer. Saudi Arabia has a large population, and with an aging population, the prevalence of lung cancer is expected to increase, leading to a higher demand for biopsies.

Key Lung Cancer Liquid Biopsy Company Insights

Some key players operating in the market include Eurofins Scientific; MDx Health, CareDx; and Immucor

- Eurofins Genomics provides liquid biopsy-based assays with a better flexibility of blood-based tumor characterization for any stage or any project. It has interpreted a definite protocol for efficient extraction of minute quantities of cDNA from plasma.

Thermo Fisher Scientific Inc., Menarini Silicon Biosystems, Qiagen, Guardant Health are some of the other players in the lung cancer liquid biopsy market.

Key Lung Cancer Liquid Biopsy Companies:

The following are the leading companies in the lung cancer liquid biopsy market. These companies collectively hold the largest market share and dictate industry trends.

- Eurofins Scientific

- MDxHealth

- CareDx

- Immucor

- Thermo Fisher Scientific Inc.

- Menarini Silicon Biosystems

- Qiagen

- Guardant Health

- Exact Sciences Corporation

- Myriad Genetics, Inc.

- LungLife AI, Inc.

- Bio-Rad Laboratories

- Agilent Technologies

Recent Developments

-

In November 2023, Illumina launched an advanced liquid biopsy assay for the detection of non-small-cell lung cancer. This launch helped them to make it easier to get easier insights for cancer research.

-

In October 2023, Delfi Diagnostics launched its first biopsy test for the screening of lung cancer. This launch offered a new addition to the blood-based tools for cancer screening.

-

In July 2023, Menarini Silicon Biosystems launched its new CellSearch CTC test with the biomarker- DLL3 for the treatment of small cell lung cancer. This launch helped the organization to expand its development of liquid-biopsy assays.

Lung Cancer Liquid Biopsy Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.12 billion

Revenue forecast in 2030

USD 2.35 billion

Growth rate

CAGR of 13.3% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Sample type, biomarker, technology, end-use, clinical application, product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; KSA; UAE; South Africa

Key companies profiled

Eurofins Scientific; MDxHealth; CareDx; Immucor; Thermo Fisher Scientific Inc.; Menarini Silicon Biosystems; Qiagen; Guardant Health; Exact Sciences Corporation; Myriad Genetics, Inc.; LungLife AI, Inc.; Bio-Rad Laboratories; Agilent Technologies

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lung Cancer Liquid Biopsy Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global lung cancer liquid biopsy market report based on sample type, biomarker, technology, end-use, clinical application, product, and region:

-

Sample Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood Sample Based

-

Others

-

-

Biomarker Outlook (Revenue, USD Million, 2018 - 2030)

-

Circulating Nucleic Acids

-

CTC

-

Exosomes/Microvesicles

-

Circulating Proteins

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Multi-gene-parallel Analysis (NGS)

-

Single Gene Analysis (PCR Microarrays)

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Laboratories

-

Specialty Clinics

-

Academic & Research Centers

-

Others

-

-

Clinical Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Therapy Selection

-

Treatment Monitoring

-

Early Cancer Screening

-

Recurrence Monitoring

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Consumables Kits and Reagents

-

Software and Services

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global lung cancer liquid biopsy market size was valued at USD 966.5 million in 2023.

b. The global lung cancer liquid biopsy market size is projected to grow at a compound annual growth rate (CAGR) of 13.3% from 2024 to 2030.

b. The blood sample-based segment dominated the market with a share of more than 70.0% in 2023 owing to its non-invasive nature, repeatability, real-time monitoring capabilities, early detection, and cost-effectiveness.

b. Some of the key players operating in the market include Eurofins Scientific; MDx Health, CareDx, Immucor, Thermo Fisher Scientific Inc., Menarini Silicon Biosystems, Qiagen, and Guardant Health.

b. The rise in the prevalence of lung cancer is one of the main reasons for the growth of the lung cancer liquid biopsy market. This type of cancer is observed as one of the leading causes of death caused by cancer worldwide. The changes in lifestyles that involve smoking, passive smoking, pollution, and genetic abnormalities are the main causes that lead to its prevalence.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."