- Home

- »

- Clothing, Footwear & Accessories

- »

-

Luggage Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Luggage Market Size, Share & Trends Report]()

Luggage Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Travel Bags, Business Bags, Casual Bags), By Material (Soft-sided, Hard-sided), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-481-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Luggage Market Summary

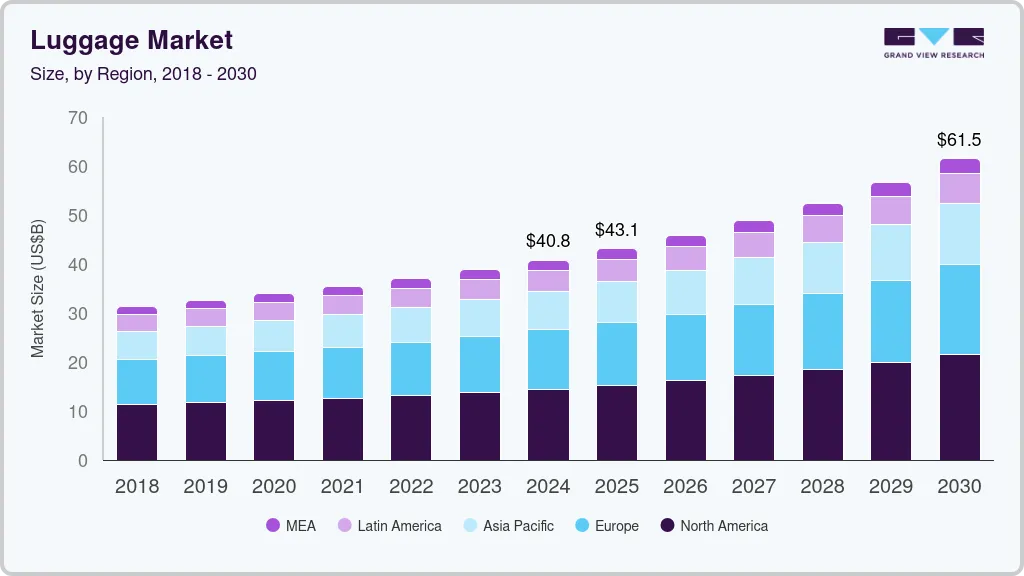

The global luggage market size was estimated at USD 38.80 billion in 2023 and is projected to reach USD 61.49 billion by 2030, growing at a CAGR of 7.1% from 2024 to 2030. The demand for luggage has been steadily increasing due to several key factors and trends that reflect changes in consumer behavior and lifestyle preferences.

Key Market Trends & Insights

- The luggage market in North America counted for a revenue share of 35.5% in 2023.

- The luggage market in the U.S. is facing intense competition and innovation.

- By type, travel luggage bags segment accounted for a revenue share of 76.5% in 2023.

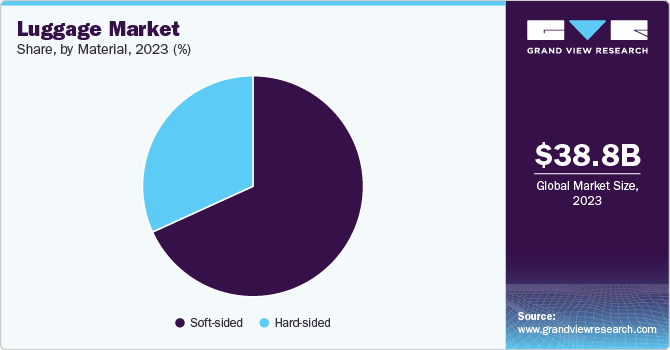

- By material, soft-sided luggage segment accounted for a revenue share of 68.2% in 2023.

- By distribution channel, sales through offline channels segment accounted for a revenue share of 59.8% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 38.80 billion

- 2030 Projected Market Size: USD 61.49 billion

- CAGR (2024-2030): 7.1%

- North America: Largest market in 2023

One of the primary drivers is the resurgence of the global travel and tourism industry. As travel has picked up again after the pandemic, more people are embarking on vacations, business trips, and family visits, leading to a higher demand for luggage. Domestic travel, in particular, has surged as more people explore local destinations, boosting sales of luggage suited for short trips.

E-commerce and online shopping have also played a significant role in the growth of the luggage market. The convenience of purchasing luggage online, with access to a wide range of options, competitive pricing, and detailed customer reviews, has made it easier for consumers to find products that meet their needs. Moreover, the rise of direct-to-consumer luggage brands has provided consumers with innovative designs and value-for-money options, further stimulating demand.

Technological advancements is another important trend in the market. Smart luggage equipped with features such as GPS tracking, built-in chargers, and biometric locks has gained popularity, especially among tech-savvy travelers. Additionally, there is a growing interest in sustainable luggage made from recycled materials, aligning with the rising consumer demand for environmentally friendly products.

Changing consumer preferences are also shaping the market. People now prioritize high-quality, durable luggage that can withstand frequent travel. Personalization has become a popular trend, with many brands offering custom designs and monogrammed luggage to cater to consumers' desire for individuality. This trend mirrors the broader rise of customization seen across other consumer goods, like premium sportswear.

Type Insights

Travel luggage bags accounted for a revenue share of 76.5% in 2023. The global increase in tourism and business travel has fueled the demand for travel luggage bags. As more people take vacations, business trips, and weekend getaways, there is a higher need for durable and functional luggage to meet their travel needs. Consumers are increasingly opting for lightweight, durable luggage that can withstand frequent travel. Newer materials like polycarbonate for hard-sided luggage and reinforced nylon for soft-sided bags offer both strength and weight reduction, catering to modern travel requirements.

The casual luggage bags segment is expected to grow at a CAGR of 7.1% from 2024 to 2030. Casual luggage bags, such as backpacks, tote bags, and duffel bags, are highly versatile and suitable for various activities like daily commutes, weekend trips, or gym visits. Their multifunctionality appeals to consumers who want a single bag for different purposes. Casual luggage bags come in a wide variety of designs, colors, and styles, allowing consumers to express their personal taste while maintaining functionality. With the rise of athleisure and casual fashion trends, these bags have become popular as both practical and stylish accessories.

Material Insights

Soft-sided luggage accounted for a revenue share of 68.2% in 2023. Soft-sided luggage is typically made from materials like nylon or polyester, which offer more flexibility. This allows travelers to fit more items or expand the bag to accommodate last-minute packing, making them ideal for trips that require additional storage capacity. Soft-sided bags are generally lighter than hard-sided ones, making them easier to carry and maneuver. Their lightweight nature appeals to travelers who prioritize mobility, especially for shorter trips or as carry-on luggage.

The hard-sided luggage segment is expected to grow at a CAGR of 7.3% from 2024 to 2030. Hard-sided luggage bags, often made from materials like polycarbonate or ABS, provide superior protection for belongings, especially fragile items. Their rigid structure is more resistant to impact and damage during rough handling at airports or in transit. Advances in material technology have made hard-sided luggage bags lighter while maintaining their durability. These modern designs appeal to travelers who want a balance of strength, style, and ease of mobility without adding too much weight.

Distribution Channel Insights

Sales through offline channels accounted for a revenue share of 59.8% in 2023. Many consumers prefer to visit brick-and-mortar stores to physically inspect luggage bags before purchasing. Being able to test the weight, durability, material, and size in person gives buyers greater confidence in their purchase, especially for high-ticket items like luggage. Purchasing luggage from an offline store allows for immediate possession of the product. This is particularly appealing to last-minute travelers or those who need luggage quickly and cannot wait for delivery, which may take days in online purchases.

Sales through online channels is expected to grow at a CAGR of 7.5% from 2024 to 2030. Online shopping offers consumers the ability to browse, compare, and purchase luggage bags from the comfort of their homes. The ease of access to a wide range of products and brands has made online stores a preferred choice for many travelers. Online platforms often provide a broader selection of luggage types, styles, and price ranges compared to physical stores. Consumers can also find exclusive designs or limited-edition products online, catering to personalized preferences and making it easier to find bags that suit individual needs.

Regional Insights

The luggage market in North America counted for a revenue share of 35.5% in 2023 of the global market. With more people traveling for both leisure and business, the demand for luggage bags has surged. The growth of domestic travel, as well as international vacations, has significantly boosted the need for durable and reliable luggage in North America. Many North Americans are opting for short, frequent trips, which has led to higher demand for compact luggage, such as carry-ons and duffel bags. This shift in travel behavior has driven the market for versatile and easy-to-handle travel bags.

U.S. Luggage Market Trends

The luggage market in the U.S. is facing intense competition and innovation. Consumers in the U.S. are increasingly seeking luggage bags that offer innovative features such as lightweight materials, smart tracking technology, and TSA-approved locks. The demand for durable, long-lasting luggage that meets both practical and security needs is contributing to the market's growth.

Europe Luggage Market Trends

The luggage market in Europe is expected to grow at a CAGR of 7.2% during the forecast period. Europe is a major travel hub, both for domestic and international tourism. The rise in intra-European travel, business trips, and international vacations has driven the demand for luggage bags, with travelers seeking durable and stylish options for their journeys. With more people living in urban areas and relying on public transportation, there is a greater need for versatile, lightweight, and compact luggage for commuting, business trips, and short holidays. This has fueled the demand for convenient and easily portable luggage bags.

Asia Pacific Luggage Market Trends

The luggage market in Asia Pacific is expected to grow at a CAGR of 7.9% from 2024 to 2030. Tourism in the Asia Pacific region has been on the rise, both domestically and internationally. Increasing travel rates, driven by the availability of low-cost airlines and improved travel infrastructure, have fueled the demand for luggage among frequent travelers. The rapid economic growth in countries like China, India, and Southeast Asian nations has led to a growing middle class with higher disposable incomes. This has increased the ability and desire of consumers to spend on travel and related products like luggage bags.

Key Luggage Company Insights

The luggage market is characterized by dynamic competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality product.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising consumer awareness of the ambiguity of the ingredients used while strictly adhering to international regulatory standards.

Key Luggage Companies:

The following are the leading companies in the luggage market. These companies collectively hold the largest market share and dictate industry trends.

- Rimowa

- Samsonite

- Tumi

- American Tourister

- Delsey

- Travelpro

- Briggs & Riley

- Victorinox

- Thule

- Heys

Recent Developments

-

In September 2024, Saute Verdiater launched a new laptop backpack designed to cater to both students and professionals, emphasizing unmatched durability and a sleek design. This innovative backpack is crafted from high-quality materials, ensuring it withstands daily wear and tear while providing a stylish appearance suitable for various environments, from classrooms to boardrooms. The backpack features multiple compartments for organization, padded sections for laptop protection, and ergonomic straps for comfort.

Luggage Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 40.81 billion

Revenue forecast in 2030

USD 61.49 billion

Growth rate

CAGR of 7.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, material, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Samsonite; Tumi; American Tourister; Delsey; Travelpro; Briggs & Riley; Victorinox; Thule; Heys

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Luggage Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global luggage market report based on type, material, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Travel Bags

-

Business Bags

-

Casual Bags

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Soft-sided

-

Hard-sided

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

Supermarkets & hypermarkets

-

Specialty Stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global luggage market size was estimated at USD 38.80 billion in 2023 and is expected to reach USD 40.81 billion in 2024.

b. The global luggage market is expected to grow at a compounded growth rate of 7.1% from 2024 to 2030 to reach USD 61.49 billion by 2030.

b. Casual luggage bags are expected to growth with a CAGR of 7.3% from 2024 to 2030. Casual luggage bags are often designed with user comfort in mind, featuring padded straps, ergonomic designs, and lightweight materials. This makes them easy to carry for long periods, making them popular for travelers and everyday use.

b. Some key players operating in luggage market include Samsonite, Tumi, American Tourister, Delsey, and others.

b. Key factors that are driving the market growth include increased outstation travel and rising disposable income among consumers

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.