- Home

- »

- Distribution & Utilities

- »

-

LPG Vaporizer Market Size & Share, Industry Report, 2030GVR Report cover

![LPG Vaporizer Market Size, Share & Trends Report]()

LPG Vaporizer Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Electric, Direct Powered, Water/Steam), By End-use (Industrial, Agricultural, Commercial), By Region (North America, Asia Pacific, Europe, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-2-68038-778-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

LPG Vaporizer Market Size & Trends

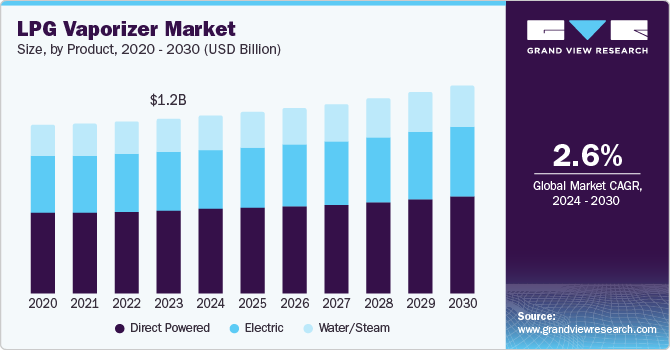

The global LPG vaporizer market size was valued at USD 1.24 billion in 2023 and is projected to grow at a CAGR of 2.6% from 2024 to 2030. Factors driving market growth include growing demand for clean energy sources, expansion of LPG distributor networks, technological advancements in vaporizer efficiency, increased adoption across various sectors, favorable government policies promoting environmentally friendly energy, and rising urbanization contributing to higher energy demands.

Governments and industries are increasingly turning to LPG as a cleaner fuel alternative to traditional fossil fuels, driven by efforts to reduce carbon emissions and meet environmental standards. This shift is evident in the growing demand for LPG vaporizers from sectors such as petrochemical, pharmaceutical, and food processing industries, which require efficient energy solutions.

Another key driver of the market is the increasing awareness of energy savings and the need for efficient energy utilization. As a result, there is a growing preference for equipment that employs low-loss, high-return vaporizers. Furthermore, governments are adopting LPG as part of their ambitious energy transformation policies, which is driving demand for vaporizers. The market is also being driven by technological advancements in vaporizer technology, including improvements in efficiency and safety, which are expanding the applications of LPG vaporizers.

The development of natural gas infrastructure and LPG distribution networks, particularly in emerging economies, is also facilitating greater access to LPG and increasing demand for vaporizers. Furthermore, the cost-effectiveness of LPG vaporizers, which offer lower operating costs and higher fuel conversion efficiency compared to other heating methods, is making them an attractive option for industries looking to optimize operational costs while maintaining performance. Overall, the drivers for the LPG vaporizer market are diverse and multifaceted, and are expected to continue to drive growth in the industry as industrialization and urbanization create new opportunities for the market.

Product Insights

Direct powered LPG vaporizers led the market with a revenue share of 47.7% in 2023. Direct powered vaporizers exhibit superior efficiency compared to indirect powered counterparts, effectively converting liquid LPG to gas form. Ideal for applications requiring immediate gas supply, they are compact, portable, and easy to install, making them suitable for use in residential, commercial, and industrial settings.

The water/steam segment is expected to register the fastest CAGR of 3.0% over the forecast period. Water or steam vaporizers leverage water’s exceptional heat conductivity to achieve rapid vaporization rates, making them suitable for high-demand applications. Characterized by low operating temperatures and pressures, these vaporizers ensure a safer and more controlled environment, minimizing the risk of explosions or hazardous emissions.

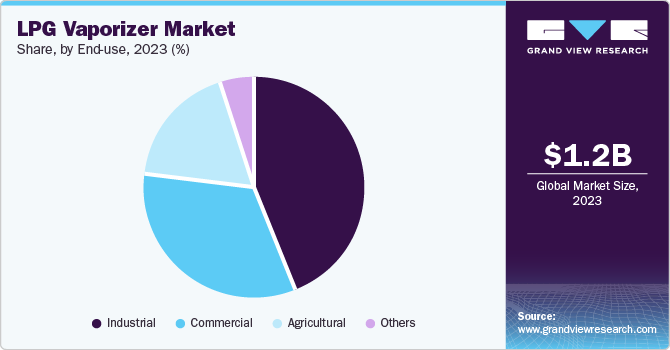

End-use Insights

Industrial end use held the largest market share of 43.4% in 2023. LPG is a primary energy source for various industries, including manufacturing, chemicals, and food processing. These sectors require substantial gas quantities for heating, drying, and machinery operation. The demand for efficient vaporization systems has driven the market, driven by LPG’s affordability in most regions, making it a cost-effective alternative to other energy sources.

The agricultural segment is expected to register the fastest CAGR of 3.2% during the forecast period. LPG’s versatility and efficiency make it a preferred choice in various agricultural processes, including heating, irrigation, crop drying, and tractor fuel. Its cleaner combustion profile compared to diesel or coal makes it an environmentally friendly option. Governments and organizations support LPG adoption through funding initiatives, driving the demand for LPG vaporizers and promoting sustainable farming practices.

Regional Insights

North America LPG vaporizer market is expected to register the fastest CAGR of 2.9% during the forecast period. The region boasts a well-established infrastructure for LPG distribution and storage, driven by the region’s significant market demand. Pipelines and storage facilities facilitate efficient supply chain management, catering to the energy needs of various industries and residential areas, ensuring a reliable and consistent supply of LPG products.

U.S. LPG Vaporizer Market Trends

The LPG vaporizer market in the U.S. held substantial market share in 2023. The U.S. regulatory environment emphasizes the importance of safety and environmental considerations in high-quality vaporizers. Compliance with regulations enables manufacturers to adapt production processes to meet stringent standards, ensuring the production of safe and reliable products. Strong demand across residential, commercial, and industrial sectors, particularly for cooking purposes, drives the market for LPG vaporizers in the region.

Asia Pacific LPG Vaporizer Market Trends

Asia Pacific LPG vaporizer market dominated the global LPG vaporizer market with a revenue share of 43.3% in 2023. The Asia Pacific region has witnessed enhanced LPG promotion through government policies and legislations. Notably, India’s “Pradhan Mantri Ujjwala Yojana” aims to provide 103.5 million households with LPG connections by 2025-26, driving demand for vaporizers and increasing the use of LPG as a clean energy source.

The LPG vaporizer market in China dominated the Asia Pacific LPG vaporizer market with a revenue share of 34.1% in 2023. The country’s dominant position in the LPG vaporizer market is largely attributed to its manufacturing strength. China’s robust industrial infrastructure enables high-volume production of vaporizers at competitive prices, leveraging economies of scale to maintain quality while reducing costs. This drives competitiveness among Chinese manufacturers and fuels the industry’s growth.

Europe LPG Vaporizer Market Trends

Europe LPG vaporizer market held a substantial revenue share in 2023, driven by ongoing technological innovations. Major European LPG users have invested heavily in research and development to enhance efficiency, safety, and competitiveness. Advances in electronic control systems, heat exchange, and safety features have positioned European products for success in both domestic and export markets.

The LPG vaporizer market in Germany is projected to experience growth during the forecast period. Germany’s reputation for producing high-quality, innovative products in the engineering and energy sectors is well-established. The country’s well-equipped manufacturing facilities, skilled workforce, and emphasis on quality enable German manufacturers to produce vaporizers of exceptional quality, giving them a competitive edge in the market.

Key LPG Vaporizer Company Insights

Some key companies in the LPG vaporizer market include Standby Systems, Inc.; Alternate Energy Systems, Inc.; TransTech Energy, LLC; and others. Market players have responded to intensifying competition by implementing strategies such as new product launches, enhanced distribution, and geographical expansion.

-

Algas-SDI is a manufacturer of products and systems for deploying clean fuels, particularly LPG vaporizers. The company offers a comprehensive range of solutions, including synthetic natural gas systems and industrial process heating burners, backed by ISO 9001 certification.

-

Alternate Energy Systems, Inc. is a provider of innovative LPG vaporization solutions and energy systems. The company designs and manufactures a range of vaporization products, serving commercial, industrial, and utility sectors with efficient and safe fuel gas deployment.

Key LPG Vaporizer Companies:

The following are the leading companies in the LPG vaporizer market. These companies collectively hold the largest market share and dictate industry trends.

- Standby Systems, Inc.

- Alternate Energy Systems, Inc.

- TransTech Energy, LLC

- Meeder Equipment

- PEGORARO GAS TECHNOLOGIES Srl

- ADCENG Gas Equipment (Pty) Ltd.

- SHV Energy

- Algas-SDI

- PSG

Recent Developments

-

In August 2024, Pune Gas inaugurated Tamil Nadu’s first exclusive LPG systems experience center in Chennai, featuring the flagship Smart LPG System, LPGenius, and other solutions for commercial gas users.

-

In January 2024, PEGORARO GAS TECHNOLOGIES Srl and PALLADIO implemented a Finnish biogas treatment project, deploying a 700 Nm3/h system with a -20°C design temperature.

-

In November 2023, SHV Energy and Furukawa Electric Co., Ltd. collaborated through Futuria Fuels, a new business unit, to develop bioLPG production solutions internationally, marking a significant partnership in the development of sustainable energy solutions.

-

In August 2023, PSG, a Dover company, announced the opening of its expanded Grand Rapids facility, achieved through a strategic expansion aimed at increasing manufacturing capacity, entering new markets, and introducing additional product lines to the location.

-

In June 2023, TransTech acquired Metalforms, enhancing its capabilities in engineered and fabricated heat exchangers and ASME pressure vessels.

LPG Vaporizer Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.26 billion

Revenue forecast in 2030

USD 1.46 billion

Growth rate

CAGR of 2.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Russia, China, India, Japan, Australia, Brazil, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

Standby Systems, Inc.; Alternate Energy Systems, Inc.; TransTech Energy, LLC; Meeder Equipment; PEGORARO GAS TECHNOLOGIES Srl; ADCENG Gas Equipment (Pty) Ltd.; SHV Energy; Algas-SDI; PSG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global LPG Vaporizer Market Report Segmentation

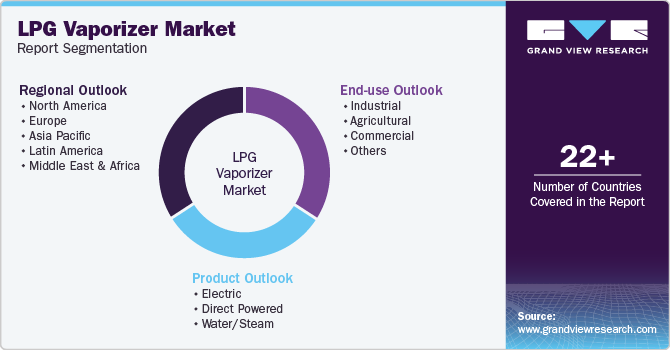

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global LPG vaporizer market report based on product, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Electric

-

Direct Powered

-

Water/Steam

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Agricultural

-

Commercial

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.