- Home

- »

- Electronic Devices

- »

-

Low Voltage Motor Control Centers Market Size Report, 2030GVR Report cover

![Low Voltage Motor Control Centers Market Size, Share & Trends Report]()

Low Voltage Motor Control Centers Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Conventional, Intelligent), By Component, By End Use (Industrial, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-383-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Low Voltage Motor Control Centers Market Summary

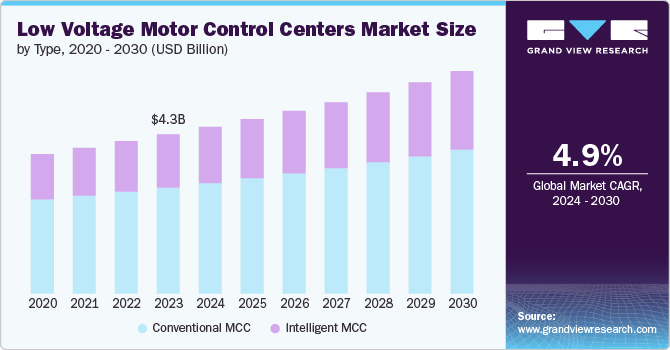

The global low voltage motor control centers market size was estimated at USD 4.28 billion in 2023 and is projected to reach USD 5.97 billion by 2030, growing at a CAGR of 4.9% from 2024 to 2030. Low-voltage motor control centers (MCCs) are factory-assembled enclosures that house and manage the starting, stopping, and protection of individual electric motors.

Key Market Trends & Insights

- The low voltage motor control centers market in North America is expected to witness at a steady CAGR from 2024 to 2030.

- Asia Pacific dominated the low voltage motor control centers market with the revenue share of 40.4% in 2023.

- Based on type, the conventional MCC segment led the market with the largest revenue share of 66.6% in 2023.

- Based on component, the busbars segment led the market with the largest revenue share of 23.3% in 2023.

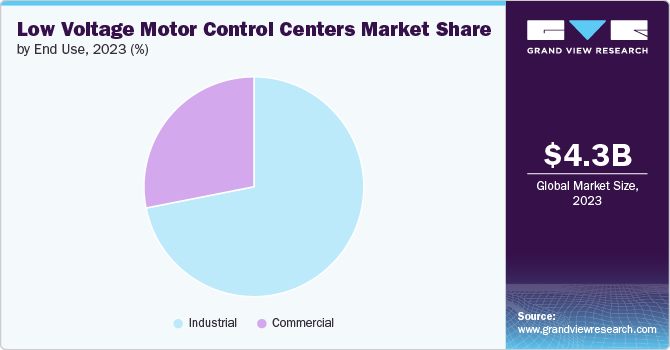

- Based on end use, the industrial segment led the market with the largest revenue share of 71.9% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 4.28 Billion

- 2030 Projected Market Size: USD 5.97 Billion

- CAGR (2024-2030): 4.9%

- Asia Pacific: Largest market in 2023

They typically cater to low-voltage (up to 600V) three-phase AC motors, prevalent in various industrial and commercial applications. MCCs integrate various components like motor starters, circuit breakers, fuses, meters, and control devices within a single, organized structure. This centralized control facilitates efficient power distribution, motor operation monitoring, and safety measures within a facility.

The market is on track for steady growth. Fueled by the rise of industrial automation, MCCs provide a centralized and reliable solution for managing electric motors in sectors like manufacturing, oil & gas, and food & beverage. In addition, the growing focus on energy efficiency aligns perfectly with features like variable frequency drives (VFDs) that modern MCCs offer, optimizing motor speed and power consumption. Finally, rapid urbanization and infrastructure development worldwide are driving the demand for reliable power distribution solutions, including MCCs, for various commercial and public buildings. These factors combined paint a promising picture for the future of the low-voltage motor control center market.

Stringent regulations play a crucial role in ensuring the safety and efficacy of low-voltage motor control centers. To guarantee safe and efficient operation, MCCs must adhere to a multitude of national and international safety and performance standards. Prominent examples include the National Electrical Code (NEC) established in the United States, which sets the baseline for electrical safety. In addition, the International Electro technical Commission (IEC) 60439 provides international guidelines for the construction and testing of low-voltage switchgear and control gear assemblies. Furthermore, Underwriters Laboratories (UL), a non-profit organization in North America, offers product safety certifications. By complying with these regulations, proper design, construction, and maintenance practices for MCCs are ensured, minimizing electrical hazards and fostering a safe operational environment.

The market is experiencing significant growth fueled by several key factors. A heightened focus on safety is propelling the adoption of modern MCCs equipped with features like arc flash protection and ground fault detection. This emphasis on operator and equipment well-being is a major driver. In addition, the growing preference for modular designs by manufacturers caters to the evolving needs of diverse industrial applications. These modular MCCs offer greater flexibility for customization, expansion, and maintenance. Furthermore, advanced MCCs can integrate with Building Management Systems (BMS), enabling centralized monitoring and control of facility motors. This integration translates to optimized energy consumption and improved operational efficiency. These drivers, coupled with the increasing focus on industrial automation and energy conservation, are creating a highly favorable market landscape for low-voltage motor control centers.

Despite a promising future, the low-voltage motor control center market grapples with several challenges. A significant hurdle lies in the shortage of skilled electrical personnel. Proper installation, operation, and maintenance of MCCs necessitate qualified labor, and deficiencies in this area can hinder market growth, particularly in some regions. In addition, the initial investment cost of MCCs presents a barrier for budget-conscious facilities. Compared to basic motor starters, MCCs carry a higher price tag due to their complex design and functionalities. Finally, the rapid evolution of motor control technology and automation can render older MCC models obsolete faster, necessitating frequent upgrades, which can strain budgets and resources. These challenges demand innovative solutions from manufacturers and service providers to ensure the continued success of the global market.

The market presents exciting opportunities for manufacturers and service providers. A key focus should be on developing "smart MCCs" equipped with features like internet connectivity, remote monitoring, and predictive maintenance. These capabilities align perfectly with the growing demand for smart industrial solutions. In addition, the burgeoning industrial sectors in developing nations represent a vast potential market for MCCs, creating a demand for cost-effective and reliable solutions. Finally, providing comprehensive aftermarket services such as maintenance, repair, and modernization for existing MCC installations can be a lucrative revenue stream. By addressing the current challenges and capitalizing on these emerging opportunities, the low-voltage motor control center market is well positioned for sustained growth and innovation.

Type Insights

Based on type, the conventional MCC segment led the market with the largest revenue share of 66.6% in 2023. Conventional MCCs offer a reliable and cost-effective solution for motor control, making them popular across various industries. Their established design and functionality are well-understood by electrical personnel, facilitating ease of installation, operation, and maintenance. However, they may lack the advanced features and data-driven capabilities increasingly sought after in modern industrial settings.

The intelligent MCC segment is projected to expand at the fastest CAGR during the forecast period. Intelligent MCCs integrate advanced features like communication protocols, remote monitoring, and motor diagnostics. This allows for centralized control, real-time data collection, and predictive maintenance, optimizing operational efficiency and minimizing downtime. The growing focus on industrial automation and the Industrial Internet of Things (IIoT) is driving the demand for intelligent MCCs, which can seamlessly integrate with broader automation systems.

Component Insights

Based on component, the busbars segment led the market with the largest revenue share of 23.3% in 2023. Busbars are the core component of an MCC, responsible for distributing power throughout the system. They are expected to remain the dominant segment due to their crucial role in ensuring safe and reliable power delivery. Advancements in busbar design, such as phase segregation and insulated enclosures, are further solidifying their position.

The circuit breakers & fuses segment is projected to witness at a significant CAGR from 2024 to 2030. Circuit breakers and fuses offer vital protection against overcurrent and short circuits, safeguarding motors and electrical equipment. As motor control systems become more complex, the demand for sophisticated circuit breakers and fuses with advanced features like adjustable tripping settings and selective fault protection is rising. In addition, the increasing focus on safety regulations is driving the adoption of these components.

End Use Insights

Based on end use, the industrial segment led the market with the largest revenue share of 71.9% in 2023. Industries like manufacturing, oil & gas, and power generation rely heavily on electric motors for various processes. MCCs play a critical role in managing these motors efficiently and safely. The continuous expansion of these industries, coupled with the growing adoption of automation, is expected to sustain the dominance of the industrial segment.

The commercial segment is projected to grow at the fastest CAGR during the forecast period. The rising demand for reliable power distribution solutions in commercial buildings like offices, shopping centers, and hospitals is driving the market growth. In addition, the increasing focus on energy efficiency in these buildings is making MCCs with features like variable frequency drives more attractive. As urbanization and infrastructure development progress, the commercial segment is poised for significant market growth.

Regional Insights

The low voltage motor control centers market in North America is expected to witness at a steady CAGR from 2024 to 2030. The U.S. and Canada are key contributors, with substantial investments in manufacturing, oil & gas, and infrastructure sectors. The increasing adoption of automation and smart manufacturing practices necessitates advanced motor control solutions to enhance efficiency and productivity. The region's focus on energy efficiency and sustainability also promotes the integration of modern MCC systems to optimize energy usage and reduce costs. North America's robust power distribution infrastructure and the growing deployment of renewable energy sources further drive the demand for sophisticated motor control centers. In addition, the presence of leading MCC manufacturers and technological advancements in IoT and AI facilitate the development of next-generation motor control solutions with enhanced monitoring, control, and predictive maintenance features. These factors collectively ensure North America's continued growth and leadership in the global MCC market.

U.S. Low Voltage Motor Control Centers Market Trends

The low voltage motor control centers market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030. The country's manufacturing, automotive, and oil & gas sectors are major consumers of MCC systems, seeking to improve operational efficiency and reduce energy consumption. The U.S. government's initiatives to modernize infrastructure and promote energy efficiency further drive market demand. The increasing adoption of smart manufacturing practices and Industry 4.0 technologies necessitates advanced motor control solutions with real-time monitoring and predictive maintenance capabilities. In addition, the growing focus on renewable energy projects, such as wind and solar power, requires reliable MCC systems for effective energy management. The presence of leading MCC manufacturers and the rapid integration of digital technologies such as IoT and AI into motor control systems enhance the performance and functionality of these solutions. These factors, combined with supportive regulatory frameworks, ensure the sustained market growth in the U.S.

Asia Pacific Low Voltage Motor Control Centers Market Trends

Asia Pacific dominated the low voltage motor control centers market with the revenue share of 40.4% in 2023. Countries such as China, India, and Japan are significant contributors to this dominance, supported by substantial investments in infrastructure and manufacturing sectors. The increasing adoption of automation and advanced motor control solutions in various industries, including automotive, chemicals, and oil & gas, further fuels market growth. Moreover, the region's commitment to energy efficiency and sustainability initiatives promotes the integration of advanced MCC systems to optimize energy usage. The presence of numerous local and international players intensifies market competition, fostering innovation and reducing costs, which benefits end-users. Favorable government policies and incentives aimed at modernizing industrial infrastructure also play a crucial role in accelerating market expansion. As industries increasingly embrace smart manufacturing practices, the demand for sophisticated MCC systems with enhanced monitoring and control capabilities is expected to rise, ensuring the Asia Pacific's continued leadership and rapid growth in this market.

The low voltage motor control centers market in India is expected to grow at a significant CAGR from 2024 to 2030. This growth is propelled by the country's ambitious industrial and infrastructure development plans, including the "Make in India" initiative, which aims to boost domestic manufacturing. The rising demand for reliable and efficient motor control solutions across various sectors such as automotive, cement, and steel further fuels this market expansion. In addition, the government's focus on enhancing power distribution networks and promoting energy efficiency drives the adoption of advanced MCC systems. The proliferation of smart grid projects and renewable energy installations also contributes to the increasing need for sophisticated motor control solutions. Indian manufacturers are increasingly incorporating state-of-the-art technologies such as IoT and AI into MCC systems to offer better operational efficiency and predictive maintenance capabilities. The competitive landscape, characterized by a mix of local and global players, fosters continuous innovation and cost competitiveness, ensuring robust market growth in the coming years.

Europe Low Voltage Motor Control Centers Market Trends

The low voltage motor control centers market in Europe is expected to grow at a significant CAGR from 2024 to 2030. Countries like Germany, France, and the UK are at the forefront, with substantial investments in renewable energy projects and industrial automation. The region's well-established automotive, manufacturing, and chemical industries are key end-users of advanced MCC systems, seeking to enhance operational efficiency and reduce energy consumption. The European Union's policies promoting smart manufacturing and Industry 4.0 initiatives further stimulate market demand for technologically advanced motor control solutions. Moreover, the growing adoption of electric vehicles and the expansion of charging infrastructure necessitate reliable motor control systems, contributing to market growth. European manufacturers prioritize innovation, integrating cutting-edge technologies such as IoT, AI, and digital twin solutions into MCC systems to offer enhanced performance and predictive maintenance. This focus on advanced technologies and sustainability ensures Europe's continued growth and competitiveness in the global MCC market.

The France low voltage motor control centers market is expected to grow at a significant CAGR from 2024 to 2030. The government's initiatives to modernize industrial infrastructure and promote the adoption of advanced automation technologies are key drivers of market expansion. France's strong automotive, aerospace, and chemical industries demand reliable and efficient motor control solutions to enhance productivity and reduce operational costs. In addition, the country's emphasis on renewable energy projects, including wind and solar power, requires sophisticated MCC systems for efficient energy management and distribution. The implementation of smart grid technologies and the increasing adoption of electric vehicles also contribute to the rising demand for advanced motor control centers. French manufacturers focus on integrating digital technologies such as IoT and AI into MCC systems to offer real-time monitoring, control, and predictive maintenance capabilities. This technological advancement, coupled with supportive government policies, ensures sustained market growth in France.

Key Low Voltage Motor Control Centers Company Insights

The market features both established global firms and emerging players. Key industry leaders prioritize product innovation, differentiation, and distinctive designs in line with evolving consumer preferences.

Key Low Voltage Motor Control Centers Companies:

The following are the leading companies in the low voltage motor control centers market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Allis Electric Co., Ltd.

- Boerstn Electric Co.,Ltd

- Cape Electrical Supply Integration

- EAMFCO

- Eaton

- GT Engineering

- Ingeteam SA

- Mitsubishi Electric Corporation

- Powell Industries

- Rockwell Automation

- Schneider Electric

- Siemens

- WEG

- Zhejiang Zhegui Electric Co., Ltd.

Recent Developments

-

In June 2024, Siemens partnered with Electro George, a leading Egyptian company, to provide state-of-the-art low voltage power distribution solutions. This collaboration will offer advanced LV technology to the Egyptian market, improving efficiency and reliability for various applications. Electro George will become a technology partner for Siemens' SIVACON Main Distribution Board and Motor Control Center

-

In May 2024, Eaton, a US power management company, acquired Exertherm, a UK firm specializing in thermal monitoring solutions. Exertherm's technology monitors temperature in electrical components like switchgear and transformers, providing early warnings of potential failures. Eaton plans to integrate this technology with their Brightlayer software, allowing customers to optimize operations and improve business performance

-

In April 2024, Rockwell Automation launched a new low-voltage motor control center (MCC) called FLEXLINE 3500 at the Hannover Messe trade fair. This MCC helps manufacturers improve production by leveraging data and integrating with smart devices for real-time monitoring and diagnostics. The modular design caters to various industries and footprints, while also offering reduced power consumption when combined with smart variable frequency drives. Additionally, FLEXLINE 3500 meets global IEC standards and boasts features like reduced downtime, improved safety, and lower costs

Low Voltage Motor Control Centers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.48 billion

Revenue forecast in 2030

USD 5.97 billion

Growth rate

CAGR of 4.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, component, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; United Arab Emirates (UAE); Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

ABB; Allis Electric Co., Ltd.; Boerstn Electric Co.,Ltd; Cape Electrical Supply Integration; EAMFCO; Eaton; GT Engineering; Ingeteam SA; Mitsubishi Electric Corporation; Powell Industries; Rockwell Automation; Schneider Electric; Siemens; WEG; Zhejiang Zhegui Electric Co., Ltd.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Low Voltage Motor Control Centers Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global low voltage motor control centers market report based on type, component, end use, and region.

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Conventional MCC

-

Intelligent MCC

-

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Busbars

-

Circuit Breakers & Fuses

-

Overload Relays

-

Variable Speed Drives

-

Soft Starters

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Industrial

-

Oil & Gas

-

Metals & Mining

-

Power Utilities

-

Chemicals

-

Food & Beverages

-

Others

-

-

Commercial

-

- Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

United Arab Emirates (UAE)

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global low voltage motor control centers market size was estimated at USD 4,283.1 million in 2023 and is expected to reach USD 4.48 billion in 2024.

b. The global low voltage motor control centers market is expected to grow at a compound annual growth rate of 4.9% from 2024 to 2030, reaching USD 5.97 billion by 2030.

b. The Asia Pacific region dominated the low voltage motor control centers market in 2023 and accounted for a 40.4% share of the global revenue. Countries such as China, India, and Japan are significant contributors to this dominance, supported by substantial investments in infrastructure and manufacturing sectors. The increasing adoption of automation and advanced motor control solutions in various industries, including automotive, chemicals, and oil & gas, further fuels market growth.

b. Some key players operating in the low voltage motor control centers market include ABB, Allis Electric Co., Ltd., Boerstn Electric Co.,Ltd, Cape Electrical Supply Integration, EAMFCO, Eaton, GT Engineering, Ingeteam SA, Mitsubishi Electric Corporation, Powell Industries, Rockwell Automation, Schneider Electric, Siemens, WEG, and Zhejiang Zhegui Electric Co., Ltd.

b. The low voltage motor control center market is experiencing significant growth fueled by several key factors. A heightened focus on safety is propelling the adoption of modern MCCs equipped with features like arc flash protection and ground fault detection. This emphasis on operator and equipment well-being is a major driver. Additionally, the growing preference for modular designs by manufacturers caters to the evolving needs of diverse industrial applications. These modular MCCs offer greater flexibility for customization, expansion, and maintenance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.