- Home

- »

- Medical Devices

- »

-

Low Temperature Sterilization Market, Industry Report, 2030GVR Report cover

![Low Temperature Sterilization Market Size, Share & Trends Report]()

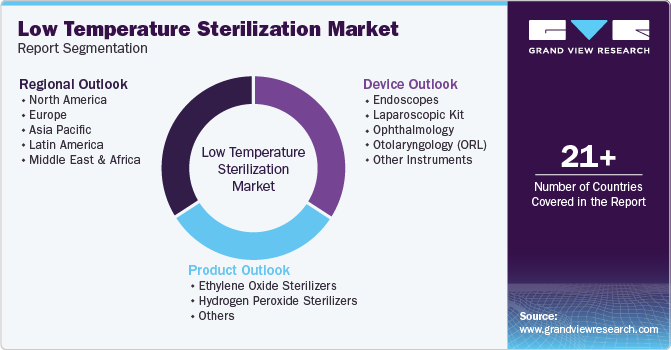

Low Temperature Sterilization Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Ethylene Oxide Sterilizers, Hydrogen Peroxide Sterilizers), By Device (Endoscopes, Ophthalmology, Laparoscopic Kit), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-488-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Low Temperature Sterilization Market Summary

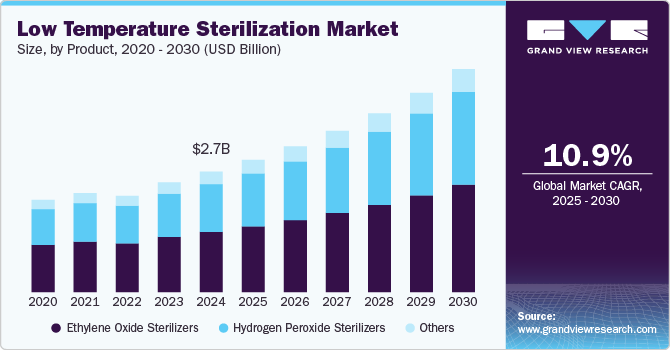

The global low temperature sterilization market size was estimated at USD 2.74 billion in 2024 and is projected to reach USD 5.07 billion by 2030, growing at a CAGR of 10.99% from 2025 to 2030. The market is likely to be driven by the increasing demand for sterilization methods that are safe for heat-sensitive medical instruments and devices.

Key Market Trends & Insights

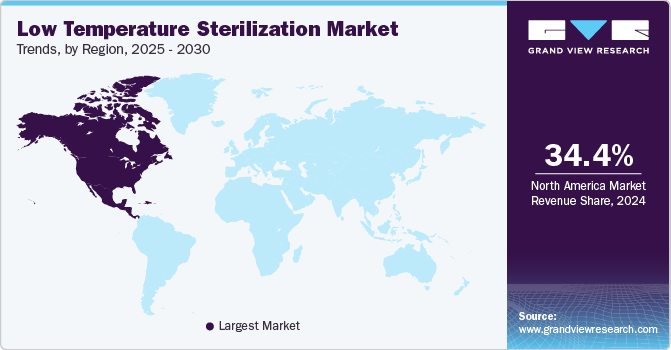

- North America low temperature sterilization market dominated the global market with a share of 34.44% in 2024.

- The low temperature sterilization market in the U.S. held a significant share of the market in 2024.

- By product, ethylene oxide (EtO) sterilizers segment held the largest revenue share of around 50.01% in 2024.

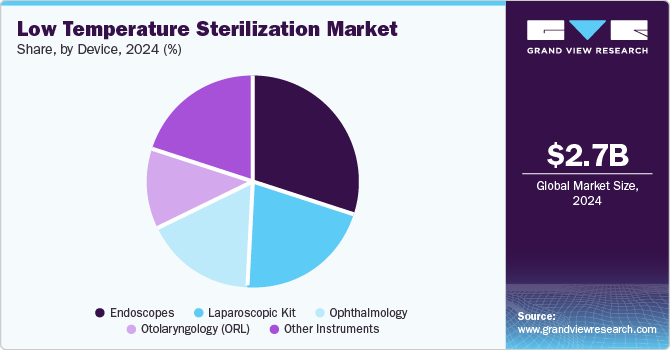

- By device, endoscopes segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.74 Billion

- 2030 Projected Market Size: USD 5.07 Billion

- CAGR (2025-2030): 10.99%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Healthcare facilities are increasingly turning to low temperature sterilization technologies like hydrogen peroxide plasma and ethylene oxide sterilization as minimally invasive surgeries and advanced medical equipment become more common. These methods offer effective sterilization without damaging delicate devices.

The rising incidence of healthcare-associated infections (HAIs) is expected to drive the demand for low temperature sterilization solutions in the coming years, as these methods effectively sanitize delicate medical instruments such as thermometers and endoscopes. In May 2022, data published by the World Health Organization (WHO) revealed that in acute-care settings, 15 out of every 100 patients in low- and middle-income countries, and 7 out of 100 patients in high-income countries, are likely to acquire at least one HAI during their hospital stay. On average, one in ten patients affected by an HAI may succumb to the infection, emphasizing the urgent need for stringent infection control measures and reinforcing the future demand for advanced sterilization technologies.

Common types of HAIs include methicillin-resistant Staphylococcus aureus (MRSA), central line-associated bloodstream infections (CLABSI), ventilator-associated pneumonia (VAP), catheter-associated urinary tract infections (CAUTI), Clostridium difficile infections, and surgical site infections (SSI). These infections pose serious risks to patient safety, underscoring the critical importance of effective sterilization and infection prevention strategies in healthcare facilities globally.

The growing number of surgical procedures is projected to further drive market growth, as surgeries require the sterilization of medical instruments and equipment, including endoscopes, defibrillators, laryngoscopes, and surgical power drills. The increasing demand for low temperature sterilizers corresponds to the need for safely sterilizing these temperature-sensitive devices. Surgeries of various types, such as orthopedic, cardiovascular, and cosmetic procedures, are being performed worldwide. Furthermore, the increasing number of hip and knee replacement surgeries that use surgical power drills is anticipated to propel market growth over the forecast period. According to the data published by the American College of Rheumatology in February 2024, about 544,000 hip and 790,000 total knee replacements are performed annually in the U.S.

Advancements in medical devices are expected to present lucrative opportunities for the low temperature sterilization market. Companies are introducing innovative devices such as endoscopes, ophthalmic lenses, dialysis machines, thermometers, surgical power drills, and laryngoscopes. In June 2022, Exergen Corporation launched the TAT-2000C for consumers and the TAT-2000 for professionals at a medical fair in Mumbai, India. Moreover, in February 2024, Johnson & Johnson Medtech launched the TECNIS PureSee Intraocular Lens (IOL) in European and Middle Eastern markets. Furthermore, an article by TDK Corporation, published in March 2024, highlighted that precision medical devices, such as dialysis machines, require low temperature sterilization to prevent damage from exposure to high temperatures.

Market Concentration & Characteristics

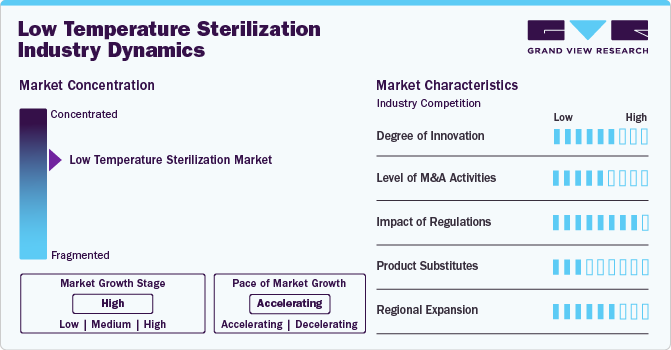

The market growth stage is moderate, and the pace of growth is accelerating. The low temperature sterilization market is characterized by a high degree of growth due to increasing prevalence of rising incidence of HAIs, hospital acquired infection.

The market is experiencing high levels of innovation driven by continuous advancements in sterilization technologies. Companies are focusing on developing more efficient, faster, and environmentally friendly sterilization methods to meet the growing demand for safer and more effective sterilization of temperature-sensitive medical devices. In addition, technological innovations in low temperature sterilization methods, such as hydrogen peroxide gas plasma, ethylene oxide, and ozone sterilization, have enhanced the efficacy and safety of sterilizing sensitive devices used in otolaryngology. These methods are particularly suitable for sterilizing heat-sensitive equipment, such as endoscopes, surgical instruments, and implantable devices, ensuring their safety for patient use.

Regulatory bodies, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), play a significant role in shaping the market. Compliance with stringent safety standards and sterilization guidelines is essential for product approvals, creating both challenges and opportunities for market participants to innovate and ensure regulatory compliance.

The market is poised to experience robust mergers and acquisitions (M&A) activity as companies seek to expand their product portfolios and strengthen their market position. Consolidation strategies are also being employed to enhance operational capabilities, access new technologies, and broaden geographic presence. In August 2024, STERIS plc announced the completion of its previously disclosed acquisition of the surgical instrumentation, laparoscopic instrumentation, and sterilization container assets from BD.

The availability of product substitutes impacts the market, with the presence of techniques such as high-temperature sterilization methods and chemical-based sterilization, influencing the market dynamics. However, the rising demand for sterilization solutions that are compatible with heat-sensitive medical devices limits the substitution potential, maintaining steady demand for low temperature sterilizers.

Industry players in the market are actively pursuing regional expansion to capitalize on emerging market opportunities. This strategy allows companies to leverage unmet demand, gain access to new customer bases, and increase their global footprint, contributing to the market’s overall growth potential.

Product Insights

Ethylene oxide (EtO) sterilizers held the largest revenue share of around 50.01% in 2024. EtO sterilizers are widely utilized for sterilizing medical devices, particularly those composed of materials sensitive to high temperatures and moisture. The growing volume of surgical procedures and the increasing demand for sterile medical instruments are key drivers of EtO sterilization. Critical medical devices such as catheters, pacemakers, and syringes, which require low temperature sterilization, further bolster demand for EtO sterilizers. Regulatory authorities are enforcing stricter emission control standards for EtO sterilization processes, prompting manufacturers to develop advanced, compliant solutions. Companies are focusing on creating EtO sterilizers that align with regulations set by bodies such as the U.S. Environmental Protection Agency (EPA).

The hydrogen peroxide sterilizers segment is expected to grow at the highest CAGR from 2025 to 2030. Concerns surrounding the environmental and health risks associated with EtO sterilization are driving the shift toward hydrogen peroxide as a safer alternative. Regulatory actions, including the EPA's proposed 2024 restrictions on EtO emissions, have accelerated the adoption of hydrogen peroxide sterilizers. Leading manufacturers, such as Steris and Getinge, have introduced hydrogen peroxide plasma sterilizers offering shorter cycle times and enhanced penetration capabilities, making them ideal for use in busy hospital environments.

Device Insights

Endoscopes held the largest revenue share in 2024 and is expected to experience significant growth over the forecast period. The increasing use of endoscopes in surgical procedures has contributed to a rise in healthcare-associated infections (HAIs) linked to these instruments. According to ASP International GmbH, the U.S. FDA received 450 medical device reports related to patient infections or contamination involving urological endoscopes between January 2017 and February 2021, with three fatalities resulting from subsequent bacterial infections. The growing focus on infection prevention highlights the need for advanced sterilization technologies to address contamination risks associated with reusable endoscopes.

Ophthalmology is expected to grow at the highest CAGR from 2025 to 2030. The growth of this segment is driven by the increasing demand for advanced ophthalmic instruments, which are both delicate and highly sensitive to heat. Healthcare providers are increasingly adopting low temperature sterilization methods to prevent damage to these instruments, particularly those made from polymers or containing complex electronic components. Traditional steam sterilization can compromise the integrity of such materials, reinforcing the need for low temperature solutions in ophthalmic practices.

Regional Insights

North America low temperature sterilization market dominated the global market with a share of 34.44% in 2024. This growth can be attributed to the increasing demand for minimally invasive surgeries, which rely on highly sensitive instruments unsuitable for traditional high-temperature sterilization methods. This has elevated the need for low temperature sterilization technologies, which are gentler on delicate instruments. Technological advancements, including vaporized hydrogen peroxide, ozone, and nitrogen dioxide sterilization methods, enhance efficiency and reduce cycle times, making them more attractive to healthcare providers focused on increasing patient throughput. Regulatory frameworks established by entities like the U.S. FDA and Health Canada further influence market expansion by setting stringent safety and quality standards.

U.S. Low Temperature Sterilization Market Trends

The low temperature sterilization market in the U.S. held a significant share of the market in 2024. The increased utilization of surgical procedures, the high incidence of Hospital-acquired Infections (HAIs), and the benefits linked to low temperature sterilization are some of the major factors fueling market expansion. According to the WHO, over 1.4 million patients worldwide are affected by HAIs at any given time, with the U.S. reporting over one million annual cases, contributing to significant morbidity and mortality. Regulatory approvals ensure that sterilization technologies comply with strict safety standards, further promoting market growth. Regulatory approval in the U.S. is important in driving the low temperature sterilization market by ensuring that sterilization technologies meet strict safety, efficacy, and quality standards

Canada low temperature sterilization marketheld a significant share of the market in 2024. The rise in acute inpatient hospitalizations in Canada, as reported by the Canadian Institute for Health Information (CIHI), directly influences the demand for effective sterilization practices, driving the low temperature sterilization market. Increased hospitalizations, particularly for surgeries and invasive procedures, necessitate effective sterilization practices, driving demand for low temperature sterilization solutions.

Europe Low Temperature Sterilization Market Trends

The low temperature sterilization market in Europe is experiencing significant growth. The market is driven by the European Union implementing strict sterilization and infection control guidelines in healthcare settings. These regulations ensure that medical instruments meet high hygiene standards, boosting the adoption of advanced sterilization methods. The growing preference for minimally invasive procedures, which use delicate instruments, requires low temperature sterilization to avoid heat damage to surgical tools.

The UK low temperature sterilization market is likely to show significant growth propelled by tangent infection control regulations implemented by the European Union to ensure high hygiene standards. These regulations promote the adoption of advanced sterilization technologies, particularly for minimally invasive procedures that utilize delicate instruments requiring low temperature sterilization to prevent heat damage. In the U.K., the growing elderly population is fueling demand for surgical interventions and sterilization solutions. As reported by the Centre for Ageing Better, England had 11 million individuals aged 65 or older in 2024, with a projected increase of 10% within five years and 32% by 2043. This demographic shift is expected to drive market growth, as the elderly are more susceptible to chronic illnesses requiring surgical care.

The low temperature sterilization market in Germany is experiencing significant growth. The prevalence of hospital-acquired infections in Germany significantly drives the market. Healthcare institutions, under economic and regulatory pressure, are investing in advanced sterilization solutions to improve patient outcomes and minimize infection risks. As the focus on patient safety intensifies, the demand for reliable low temperature sterilization methods is expected to grow, establishing them as essential components of modern healthcare infrastructure.

Asia Pacific Low Temperature Sterilization Market Trends

The Asia Pacific low temperature sterilization market is experiencing rapid growth due to the rising healthcare budgets and government initiatives aimed at enhancing healthcare infrastructure in countries such as China, India, and Japan. Investments in advanced medical technologies, including low temperature sterilization equipment, are facilitating the modernization of healthcare facilities across the region.

The low temperature sterilization market in China is growing at a lucrative growth rate, with the rise in Methicillin-resistant Staphylococcus aureus (MRSA) cases as a significant driver of China's market. MRSA is a hospital-acquired infection that poses serious challenges for healthcare facilities due to its resistance to common antibiotics. The increasing prevalence of MRSA in China has prompted healthcare institutions to adopt stringent sterilization practices, creating a higher demand for reliable low temperature sterilization solutions to ensure the safety of medical instruments and reduce infection risks.

Latin America Low Temperature Sterilization Market Trends

The Latin America low temperature sterilization market is experiencing significant growth, primarily driven by modernization efforts across healthcare facilities, along with the adoption of advanced medical technologies, are driving demand for low temperature sterilization equipment to maintain infection control standards. Brazil has one of the most extensive hospital infrastructures in Latin America.

Middle East and Africa Low Temperature Sterilization Market Trends

The low temperature sterilization market in MEA is experiencing growth driven by the well-established healthcare infrastructure is a major driver in improving the adoption of low temperature sterilization in the country. Furthermore, the increase in medical tourism and the availability of advanced treatments at affordable costs are driving market growth. Similarly, the market in the Middle East and Africa (MEA) is growing, underpinned by well-developed healthcare infrastructure and the increasing availability of advanced treatments. Additionally, the rise of medical tourism and affordable access to advanced medical care are contributing to market expansion in the region.

Saudi Arabia low temperature sterilization market is driven by the Saudi government has significant investment in healthcare infrastructure, including hospitals, clinics, and medical facilities. This expansion increases the need for sterilization processes to maintain safety and prevent infections

Key Low Temperature Sterilization Company Insights

Key market players are focusing on the launch of innovative types of ultrasonic cleaning technologies, growth strategies, and technological advancements. For instance, in March 2024, Getinge announced the complete acquisition of Ultra Clean Systems Inc., a leading U.S. manufacturer of ultrasonic cleaning technologies. These technologies are widely used in hospitals and surgery centers for the decontamination of surgical instruments. These advancements in the market are anticipated to boost thegrowth over the forecast period.

Key Low Temperature SterilizationCompanies:

The following are the leading companies in the low temperature sterilization market. These companies collectively hold the largest market share and dictate industry trends.

- ASP Global (Fortive Corporation)

- Getinge

- STERIS

- Stryker

- TDK Corporation

- 3M

- Steelco S.p.A.

- Bionics Scientific (a Unit of Kartal Projects Pvt Ltd.)

- DE LAMA S.P.A.

- Genist Technocracy Pvt. Ltd.

- Andersen Sterilizers

- Labotronics Scientific

- Labtron Equipment Ltd

- Qingdao Antech Scientific Co., Ltd.

- Renosem

- Scitek Global Co., Ltd.

- SOLSTEO

- Sterile Safequip And Chemicals Llp

- Tuttnauer

- HUMAN MEDITEK CO., LTD.

- MMM Group

- Canon Singapore Pte. Ltd.

- INSTECH SYSTEMS

- Biobase Biodusty (Shandong), Co., Ltd.

- Telstar (Azbil Group)

- Shinva Medical Instrument Co., Ltd.

Recent Developments

-

In August 2024, Mudanjiang Plasma Physics Application Technology Co., Ltd. announced that it has successfully obtained CE certification for its agent used in hydrogen peroxide low temperature plasma sterilizers. This milestone underscores the company's commitment to ensuring the highest standards of quality and safety in medical device sterilization.

-

In June 2024, Getinge introduced the Poladus 150, its newest advancement in low temperature sterilization, specifically designed for heat-sensitive surgical instruments. Featuring advanced cross-contamination barrier technology, the Poladus 150 is instrumental in reducing the risk of healthcare-associated infections (HCAIs).

- In May 2024, MATACHANA obtained MDR certification for its extensive range of steam and low temperature sterilizers.

Low Temperature Sterilization Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.0 billion

Revenue forecast in 2030

USD 5.07 billion

Growth rate

CAGR of 10.99% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue, competitive landscape, growth factors, and trends

Segments covered

Product, device, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

ASP Global (Fortive Corporation); Getinge; STERIS; Stryker; TDK Corporation; 3M; Steelco S.p.A.; Bionics Scientific (a Unit of Kartal Projects Pvt Ltd.); DE LAMA S.P.A.; Genist Technocracy Pvt. Ltd.; Andersen Sterilizers; Labotronics Scientific; Labtron Equipment Ltd; Qingdao Antech Scientific Co., Ltd.; Renosem, Scitek Global Co., Ltd.; SOLSTEO; Sterile Safequip And Chemicals LLP; Tuttnauer; HUMAN MEDITEK CO., LTD.; MMM Group; Canon Singapore Pte. Ltd.; INSTECH SYSTEMS; Biobase Biodusty (Shandong), Co., Ltd.; Telstar (Azbil Group); Shinva Medical Instrument Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Low Temperature Sterilization Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global low temperature sterilization market report based on the product, device and region:

-

Product Outlook (Revenue USD Million, 2018 - 2030)

-

Ethylene Oxide Sterilizers

-

Hydrogen Peroxide Sterilizers

-

Others

-

-

Device Outlook (Revenue USD Million, 2018 - 2030)

-

Endoscopes

-

Flexible Endoscopes

-

Single-channel Flexible Endoscopes

-

Dual-channel Flexible Endoscopes

-

Triple-channel Flexible Endoscopes

-

-

Rigid Endoscopes

-

Single-channel Rigid Endoscopes

-

Dual-channel Rigid Endoscopes

-

-

-

Laparoscopic Kit

-

Ophthalmology

-

Otolaryngology (ORL)

-

Other Instruments

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global low temperature sterilization market size was estimated at USD 2.74 billion in 2024 and is expected to reach USD 3.00 billion in 2025.

b. The global low temperature sterilization market is expected to grow at a compound annual growth rate of 10.99% from 2025 to 2030 to reach USD 5.07 billion by 2030.

b. North America dominated the low temperature sterilization market with a share of 34.81% in 2024. This is attributable to the increasing demand for minimally invasive surgeries, which rely on highly sensitive instruments unsuitable for traditional high-temperature sterilization methods. This has elevated the need for low temperature sterilization technologies, which are gentler on delicate instruments. Technological advancements, including vaporized hydrogen peroxide, ozone, and nitrogen dioxide sterilization methods, enhance efficiency and reduce cycle times, making them more attractive to healthcare providers focused on increasing patient throughput.

b. Some key players operating in the low temperature sterilization market include ASP Global (Fortive Corporation), Getinge, STERIS, Stryker, TDK Corporation, 3M, Steelco S.p.A., Bionics Scientific (a Unit of Kartal Projects Pvt Ltd.), DE LAMA S.P.A., Genist Technocracy Pvt. Ltd., Andersen Sterilizers, Labotronics Scientific, Labtron Equipment Ltd, Qingdao Antech Scientific Co., Ltd., Renosem, Scitek Global Co., Ltd., SOLSTEO, Sterile Safequip And Chemicals LLP, Tuttnauer, HUMAN MEDITEK CO., LTD., MMM Group, Canon Singapore Pte. Ltd., INSTECH SYSTEMS, Biobase Biodusty (Shandong), Co., Ltd., Telstar (Azbil Group), Shinva Medical Instrument Co., Ltd.

b. Key factors that are driving the market growth include developments in medical devices, increasing investment in sterilization devices and infrastructure, and expansion into emerging economies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.