- Home

- »

- Advanced Interior Materials

- »

-

Low Rolling Resistance Tire Market, Industry Report, 2030GVR Report cover

![Low Rolling Resistance Tire Market Size, Share & Trends Report]()

Low Rolling Resistance Tire Market (2025 - 2030) Size, Share & Trends Analysis Report By Vehicle (LCV, HCV), By Width (Dual Width, Wide Band), By Sales Channel (OEM, Aftermarket), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-543-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Low Rolling Resistance Tire Market Summary

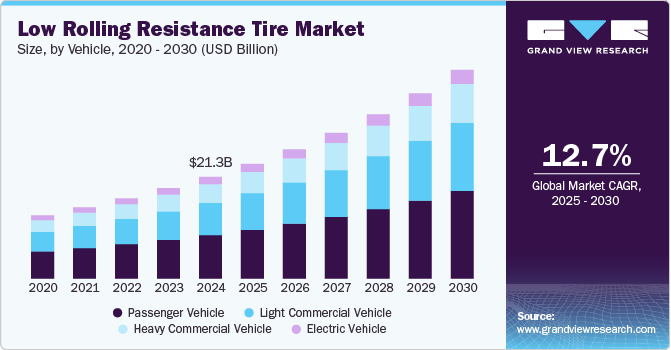

The global low rolling resistance tire market size was estimated at USD 21.25 billion in 2024 and is projected to reach USD 43.57 billion by 2030, growing at a CAGR of 12.7% from 2025 to 2030. The growth of low rolling resistance (LRR) tires can be attributed to several key factors, primarily technological advancements, environmental concerns, and consumer demand for efficiency.

Key Market Trends & Insights

- The Asia Pacific market accounted for largets share of 26.9% in 2024.

- By vehicle, passenger cars segment dominated the market, accounting for approximately 41.1% of the revenue share in 2024.

- By width, wide-band segment dominated the market in 2024.

- By sales channel, OEMs segment accounted for a substantial portion of the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 21.25 Billion

- 2030 Projected Market Size: USD 43.57 Billion

- CAGR (2025-2030): 12.7%

- Asia Pacific: Largest market in 2024

One of the most significant advantages of low rolling resistance tires is their ability to enhance fuel efficiency. These tires are designed to reduce the energy loss caused by tire deformation during rolling, leading to improved fuel economy. Studies indicate that vehicles with low rolling resistance tires can achieve a 5% to 10% increase in fuel efficiency, making them particularly appealing to consumers and businesses looking to lower fuel costs amid rising energy prices.

Environmental impact is another crucial factor driving the adoption of low-rolling-resistance tires. Governments worldwide are implementing stringent regulations to reduce vehicle carbon emissions, and low-rolling-resistance tires are an effective solution to meet these standards. These tires decrease greenhouse gas emissions by lowering fuel consumption, aligning with global efforts to combat climate change and promote sustainability.

Technological advancements have also significantly contributed to the growth of LRR tires. The development of advanced materials such as silica and graphene has enabled manufacturers to create tires that exhibit lower hysteresis losses without compromising safety or traction. These innovations allow low rolling resistance tires to perform effectively on various road surfaces, ensuring better performance in wet and dry conditions. In addition, their lighter weight and optimized tread designs further enhance their efficiency.

The rising demand for fuel-efficient vehicles has further fueled the popularity of low rolling resistance tires. As consumers increasingly prioritize fuel efficiency, particularly with the growing adoption of hybrid and electric cars, low rolling resistance tires are a complementary technology that maximizes energy efficiency. This trend is evident in the automotive market, where manufacturers focus on producing vehicles that align with consumer preferences for sustainability.

Consumer awareness has also significantly contributed to the growth of LRR tires. As more individuals become informed about the benefits of these tires-such as cost savings at the pump and their positive impact on the environment-they are more inclined to invest in them despite their higher initial costs compared to conventional tires. Marketing campaigns emphasizing long-term savings and environmental benefits have also played a crucial role in driving consumer adoption.

Despite their advantages, low rolling resistance tires face challenges like higher upfront costs and potential trade-offs in areas like wet traction or durability. Manufacturers must balance reducing rolling resistance and maintaining essential safety features like grip and handling. However, ongoing research suggests that these trade-offs are becoming less significant due to continuous technological improvements. In summary, the growth of low rolling resistance tires is propelled by consumer demand for efficiency, regulatory pressures, technological innovations, and environmental considerations-all contributing to their increasing popularity in the automotive market.

Vehicle Insights

Passenger cars dominated the market, accounting for approximately 41.1% of the revenue share in 2024. This segment's growth is driven by the increasing demand for fuel-efficient vehicles among eco-conscious consumers. Low rolling resistance tires significantly improve fuel economy, reducing energy loss during rolling and translating into cost savings for drivers. Stricter government regulations on emissions have further incentivized automakers to incorporate low rolling resistance tires into their models to meet these standards. In addition, advancements in tire technology have enhanced performance, making LRR tires a preferred choice for passenger vehicles.

Light commercial vehicles (LCVs) represent another significant segment of the market. These vehicles are widely used for urban deliveries and short-haul transportation, where fuel efficiency is critical to reducing operational costs. The adoption of LRR tires in this segment is fueled by the growing awareness of their ability to enhance mileage and reduce carbon emissions. Businesses operating fleets of LCVs benefit from lower fuel consumption and compliance with environmental regulations, making these tires an attractive investment.

Heavy commercial vehicles (HCVs), such as trucks for long-distance freight transportation, are experiencing rapid growth in LRR tire adoption. This segment benefits from the substantial fuel savings these tires provide, as rolling resistance constitutes a significant portion of fuel costs-up to 33% for Class 8 trucks in the U.S. The durability and efficiency of low rolling resistance tires make them ideal for long-haul applications, aligning with fleet operators' goals to minimize expenses and meet sustainability targets.

Electric vehicles (EVs) are emerging as one of the fastest-growing segments for LRR tires. EV manufacturers prioritize extending driving range per charge, and LRR tires play a crucial role in achieving this by reducing energy loss during rolling. The eco-friendly image of EVs complements the sustainability benefits offered by these tires, driving their popularity among environmentally conscious consumers.

Width Insights

Wide-band low rolling resistance tires are increasingly popular due to their ability to distribute vehicle load over a larger surface area, reducing frictional heat and minimizing tire wear. This characteristic makes them particularly suitable for heavy commercial vehicles (HCVs) and long-haul applications, where durability and fuel efficiency are critical. The rising adoption of these tires is further supported by their compatibility with electric vehicles (EVs), as they help maximize range by reducing energy loss during rolling. In addition, advancements in tire technology have enhanced the structural integrity and performance of wide-band tires, making them a preferred choice across multiple vehicle segments. The growth of wide-band tires is further fueled by stringent government regulations to reduce carbon emissions and improve fuel economy. These regulations have prompted fleet operators and automakers to adopt wide-band LRR tires as part of their sustainability strategies. The increasing penetration of EVs, which benefit significantly from the energy-saving properties of wide-band tires, also contributes to this segment's rapid expansion.

Dual-type low rolling resistance tires also hold a significant share in the market, primarily due to their application in light commercial vehicles (LCVs) and passenger cars. These tires are designed for vehicles that require enhanced stability and load-carrying capacity without compromising fuel efficiency. Their relatively lower cost than wide-band tires makes them an attractive option for price-sensitive markets, particularly in regions with high demand for LCVs in urban logistics. On the other hand, dual-type low rolling resistance tires continue to grow steadily due to their versatility and affordability. They cater to many vehicles, including smaller passenger cars for daily commuting. The rising awareness among consumers about the benefits of low rolling resistance technology-such as cost savings on fuel and reduced environmental impact-has further boosted demand for dual-type tires.

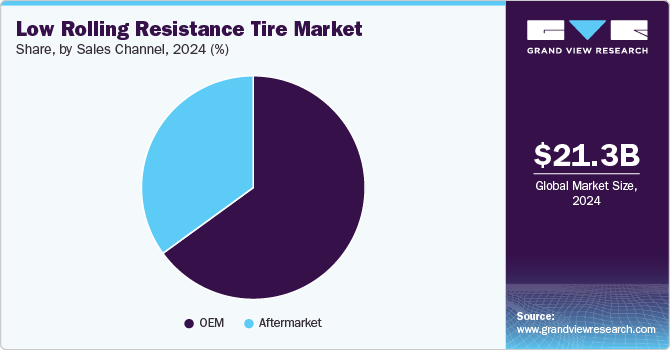

Sales Channel Insights

OEMs account for a substantial portion of the market, driven by their integration into new vehicles during production. Automakers are increasingly adopting LRR tires to meet stringent government fuel efficiency and carbon emissions regulations. These tires are often included as standard equipment in hybrid and electric vehicles (EVs), where energy efficiency is a key selling point. In addition, partnerships between tire manufacturers and OEMs ensure that low rolling resistance tires are tailored to specific vehicle models, enhancing their performance and appeal. The rising production of fuel-efficient vehicles globally further supports the dominance of OEMs in this market. The growth of the OEM segment is closely tied to advancements in automotive technology and the rising demand for EVs and hybrid vehicles. Automakers are under pressure to comply with emission norms and offer sustainable mobility solutions, making low rolling resistance tires a critical component of their strategies. Meanwhile, the aftermarket segment benefits from a broader customer base, encompassing both individual consumers and fleet operators aiming to reduce operational costs.

The aftermarket segment is growing rapidly due to increasing consumer awareness about the benefits of LRR tires, such as improved fuel economy and reduced environmental impact. Vehicle owners seeking to replace their conventional tires are increasingly opting for low rolling resistance alternatives, driven by long-term cost savings on fuel. Expanding e-commerce platforms have also made it easier for consumers to access aftermarket low rolling resistance tires, boosting sales. Moreover, as older vehicles remain in use, owners are upgrading to LRR tires to align with modern efficiency standards without purchasing new cars. The aftermarket segment is expanding rapidly as consumers increasingly prioritize fuel efficiency and environmental benefits when replacing tires.

Regional Insights

The North America low rolling resistance tire industry was valued at USD 7.85 billion in 2024. North America holds a significant share of the global market, driven primarily by the United States. The region benefits from a well-established automotive industry and a growing awareness of the economic advantages associated with LRR tires. Fleet operators are increasingly adopting these tires to reduce fuel costs, as rolling resistance accounts for a substantial portion of overall fuel consumption in heavy-duty vehicles. In addition, stringent environmental regulations encourage using low rolling resistance tires to meet emissions standards, further propelling market growth in this region.

U.S. Low Rolling Resistance Tire Market Trends

The U.S. low rolling resistance tire industry is expected to exceed USD 13.3 billion by 2030 and grow at a CAGR of 12.4% from 2025 to 2030. One of the most significant drivers is implementing stringent environmental regulations to reduce fuel consumption and greenhouse gas emissions. The Corporate Average Fuel Economy (CAFE) standards encourage automakers to adopt technologies that enhance fuel efficiency, including low rolling resistance tires. This regulatory framework compels manufacturers to integrate LRR tires into their vehicles to comply with these standards, thereby boosting demand in the market. Economic factors also play a crucial role in the growth of low rolling resistance tires in the U.S. With rising fuel prices, consumers and fleet operators are increasingly seeking solutions to lower their overall fuel costs. low rolling resistance tires are known to improve fuel efficiency by minimizing energy loss during rolling, which can lead to savings of 10% to 15% on fuel consumption for some vehicles. This potential for cost savings makes LRR tires attractive for vehicle owners looking to reduce their long-term expenses.

Asia Pacific Low Rolling Resistance Tire Market Trends

The Asia Pacific low rolling resistance tire industry is expected to grow at a CAGR of 13.8% from 2025 to 2030. Asia-Pacific accounts for a substantial global revenue share due to the rapid growth in automotive production and the increasing demand for electric vehicles (EVs). Countries like China and India are key contributors, with China leading in vehicle sales and production. The region's strong automotive industry is bolstered by public and private sector investments to develop advanced tire technologies. The growing emphasis on sustainability and fuel efficiency further fuels the demand for low rolling resistance tires as consumers and manufacturers seek solutions that reduce environmental impact while enhancing vehicle performance.

Europe Low Rolling Resistance Tire Market Trends

Europe low rolling resistance tire industry is expected to experience robust growth in the coming years due to its stringent regulations regarding vehicle emissions and fuel efficiency. The European Union has implemented policies that promote sustainable transportation solutions, making low-rolling resistance tires an attractive option for automakers and consumers. Countries like Germany and France are at the forefront of this trend, with manufacturers focusing on integrating low rolling resistance technology into their vehicles to comply with regulatory requirements. The increasing consumer demand for environmentally friendly products also supports the growth of this segment.

Key Low Rolling Resistance Tire Company Insights

Major players such as Bridgestone, Michelin, Goodyear, Continental, and Pirelli dominate the market due to their strong brand reputation, extensive product portfolios, and robust research and development (R&D) capabilities. These companies leverage cutting-edge technologies to develop advanced LRR tires catering to traditional internal combustion engine (ICE) vehicles and EVs. For example, Bridgestone's Ecopia line and Michelin's Primacy low rolling resistance HP tires are designed to enhance fuel efficiency without compromising safety or performance. Their global presence and ability to cater to diverse vehicles give them a significant competitive edge. The competitive landscape is expected to intensify as demand for LRR tires grows alongside EV adoption and stricter emission regulations. Companies that adapt quickly to evolving consumer preferences, regulatory requirements, and technological advancements will likely dominate the market. Sustainability, product diversification, and strategic collaborations will remain key differentiators in this dynamic industry.

Key Low Rolling Resistance Tire Companies:

The following are the leading companies in the low rolling resistance tire market. These companies collectively hold the largest market share and dictate industry trends.

- Bridgestone Corporation

- Michelin

- Goodyear Tire & Rubber Company

- Continental AG

- Pirelli & C. S.p.A.

- Hankook Tire

- Yokohama Rubber Co. Ltd.

- Apollo Tyres Ltd.

- Cheng Shin Rubber Industry Co. (Maxxis)

- Kumho Tire

- Zhongce Rubber Group Co., Ltd. (ZC-Rubber)

- Nokian Tyres plc

- MRF Tyres

- Sumitomo Rubber Industries, Ltd.

- Firestone Tire and Rubber Company

- Cooper Tire & Rubber Company

- Toyo Tire & Rubber Company

Low Rolling Resistance Tire Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 23.95 billion

Revenue forecast in 2030

USD 43.57 billion

Growth Rate (Revenue)

CAGR of 12.7% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vehicle, width, sales channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S, Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, UAE

Key companies profiled

Bridgestone Corporation; Michelin; Goodyear Tire & Rubber Company; Continental AG; Pirelli & C. S.p.A.; Hankook Tire; Yokohama Rubber Co. Ltd.; Apollo Tyres Ltd.; Cheng Shin Rubber Industry Co. (Maxxis); Kumho Tire; Zhongce Rubber Group Co., Ltd. (ZC-Rubber); Nokian Tyres plc; MRF Tyres; Sumitomo Rubber Industries, Ltd.; Firestone Tire and Rubber Company; Cooper Tire & Rubber Company; Toyo Tire & Rubber Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Low Rolling Resistance Tire Market Report Segmentation

This report forecasts revenue growth globally, regionally, and country-wide and analyzes the latest industry trends and opportunities in each sub-segment from 2018 to 2030. Grand View Research has segmented the global low rolling resistance tire market report based on vehicle, width, sales channel, and region:

-

Vehicle Outlook (Revenue, USD Billion, 2018 - 2030)

-

Passenger Vehicle

-

Light Commercial Vehicle

-

Heavy Commercial Vehicle

-

Electric Vehicle

-

-

Width Outlook (Revenue, USD Billion, 2018 - 2030)

-

Dual Width

-

Wide Band

-

-

Sales Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

OEM

-

Aftermarket

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global low rolling resistance tire market size was estimated at USD 21.25 billion in 2024 and is expected to reach USD 23.95 billion in 2025.

b. The global low rolling resistance tire market is expected to grow at a compound annual growth rate of 12.7% from 2025 to 2030 to reach USD 43.57 billion by 2030.

b. The OEM segment led the market and accounted for the largest revenue share of 60.7% in 2024. Automakers are increasingly adopting LRR tires to meet stringent government fuel efficiency and carbon emissions regulations. These tires are often included as standard equipment in hybrid and electric vehicles (EVs), where energy efficiency is a key selling point

b. Some of the key players operating in the low rolling resistance tire market include Bridgestone Corporation; Michelin; Goodyear Tire & Rubber Company; Continental AG; Pirelli & C. S.p.A.; Hankook Tire; Yokohama Rubber Co. Ltd.; Apollo Tyres Ltd.; Cheng Shin Rubber Industry Co. (Maxxis); Kumho Tire; Zhongce Rubber Group Co., Ltd. (ZC-Rubber); Nokian Tyres plc; MRF Tyres; Sumitomo Rubber Industries, Ltd.; Firestone Tire and Rubber Company; Cooper Tire & Rubber Company; Toyo Tire & Rubber Company

b. The key factors that are driving the low rolling resistance tire market include is their ability to enhance fuel efficiency. These tires are designed to reduce the energy loss caused by tire deformation during rolling, leading to improved fuel economy.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.