- Home

- »

- Plastics, Polymers & Resins

- »

-

Low Profile Additives Market Size And Share Report, 2030GVR Report cover

![Low Profile Additives Market Size, Share & Trends Report]()

Low Profile Additives Market Size, Share & Trends Analysis Report By Product (PVAc, HDPE, PU), By Function (Anti-shrinkage, Pigmentation), By Application (SMC/BMC, Pultrusion), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-240-2

- Number of Report Pages: 116

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Low Profile Additives Market Size & Trends

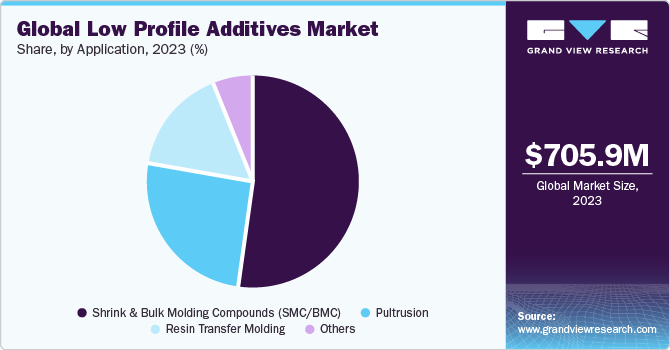

The global low profile additives market size was estimated at USD 705.94 million in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.2% from 2024 to 2030.Growing end-use industries, such as construction, automotive, and electronics, are expected to drive demand for low profile additives. Moreover, rising demand for sheet molding compoundsand bulk molding compounds (SMCs/BMCs) pultruded plastics and resin transfer molding(RTM) products in automobiles as well as construction and infrastructural activities is likely to propel product demand in coming years. Low-profile additives, such as polyvinyl acetate, polymethyl methacrylate, polystyrene, and high-density polyethylene, are used in a variety of applications, such as sheet and bulk molding compounds, pultrusion, and resin transfer molding.

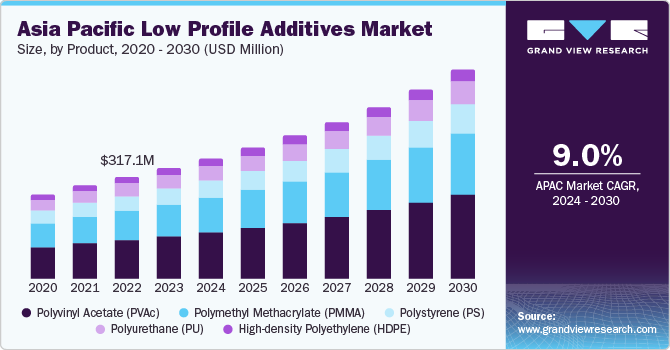

Growing end-use industries around the world, particularly in emerging nations, are likely to fuel market expansion. The Chinese automotive industry has witnessed rapid growth in past decade owing to rising demand for new energy vehicles supported by changing government policies. Growing middle-class population, coupled with a rise in the number of consumers willing to purchase new cars and pay for after-sales services, has increased the product consumption as they help achieve weight reduction and cost-saving in manufacturing process.

The market in India is anticipated to be largely affected by growing automotive industry in the country owing to a rise in disposable income levels of middle class population and growing young population. Moreover, growth in export demand and government taking constant initiatives to set up manufacturing plants in country are likely to propel product demand and utilization in India.

Market Concentration & Characteristics

Market growth stage is high and pace of its growth is accelerating owing to high consolidation. Low profile additive manufacturers are actively implementing challenging strategic initiatives, such as mergers & acquisitions, new product launches, and production expansion.

For instance, in September 2023, Wacker Chemie AG announced the development of its specialty silicone manufacturing capacities at its Jiangsu Province plant in Zhangjiagang, where silicone fluids, silicone emulsions, and silicone elastomer gels will be produced. New facilities are expected to open in second half of 2025. This expansion is aimed at boosting demand for low-profile additives used in silicone.

The market is marked by significant innovation, owing to the increased competition in the field due to electronics uprising, leading to huge investments and innovations. The use of polymethyl methacrylate copolymers leads to high heat deflection temperature in end products, while offering good mechanical properties. Such beneficial properties are likely to augment demand for polymethyl methacrylate low profile additives in end-use industries such as automotive and electronics.

Furthermore, the merger & acquisition activities have a moderate level on the market as the rise in investments for research and development (R&D), expansions, and acquisitions by key companies, such as LyondellBasell Industries NV, is also expected to boost the market in the country. The company is focusing on an inorganic growth strategy of mergers and acquisitions in order to broaden its reach and product portfolio, and thereby boost its footprint in end-use industries such as automotive, aerospace, and construction.

In addition to that, the level of impact of regulati0n on the market is high, owing to the presence of stringent regulations regarding the recyclability of low profile additives and the depletion of conventional materials, such as wood and metals, is expected to drive the usage of low profile additives in construction industry. As it offers high impact resistance, improved aesthetics, mildew resistance, scratch resistance, cabin insulation, vibration and noise control, and recyclability, they are preferred over metals in various applications.

Moreover, the manufacturers are continually seeking to enhance the sustainability of their operations, leading to a growing interest in recycling low profile additives, reducing waste, and exploring alternative feedstock sources. As the industry evolves, raw material trends are likely to reflect these sustainability efforts with a focus on reducing environmental impact and increasing resource efficiency.

Application Insights

The SMCs/BMCs dominated the market in 2023 and accounted for a revenue share above 52.0%. Low profile additive (LPA) is a necessary ingredient in resin mixture during SMC/BMC process as it helps in improving surface smoothness and controlling shrinkage resulting from molding of finished part. Growing demand for class A finish surfaces, which go into automotive body panels, is expected to drive market growth. Pultrusion is one of the methods that is used for fabrication of composites. Pultrusion is essentially deployed when one is dealing with a high-volume production process for composite profiles.

The pultrusion segment is anticipated to grow on account of increasing development in the construction sector. In the automobile sector, the pultrusion method is used for manufacturing of structural and complex parts of vehicles with enhanced stiffness, rigidity, and lightness. Other industries, wherein this technology is anticipated to gain acknowledgement in near future, are aerospace, sports, tourism, electrical power engineering, and commercial production. Rising construction activities in developed countries including the U.S., China, Japan, and Germany is expected to create need for renovation of old buildings, thus driving demand for pultrusion.

Regional Insights

Asia Pacific dominated global market in 2023 with a significant market share of above 48.0%. Asia Pacific is a highly diversified market for fastest-growing industries, such as automotive, construction, consumer goods, and others. Major contributors to emerging economies are China, India, Japan, and South Korea. Region is characterized by the presence of strong automotive, aviation, and construction industries, which witness high demand for low profile additives.

Steady growth of the construction industry, owing to rapid urbanization and a rise in renovation activities, in this region is expected to boost demand for plastics in roofing applications. China, India, and Japan are major producers of construction plastics. Increasing government support in the form of tax benefits and financial incentives in the Chinese and Indian petrochemicals markets to increase inflow of FDI is also expected to contribute to market growth.

Followed by Europe with a market share of above 23.0% in 2023. Rising product demand owing to growing end-use industries, particularly in developed countries, such as the UK and Germany, is expected to drive market demand. Favorable developments in the construction sector, positive implications for household income, corporate profits, and low interest rates are anticipated to drive growth of the construction sector, which, is likely to propel product demand.

Product Insights

The Polyvinyl Acetate (PVAc) resin segment dominated the industry in 2023 with a significant revenue share of above 38.0%. Advantageous properties of PVA as a low profile additive, such as improved surface finish, and nearly-zero shrinkage offered by it, are anticipated to drive its demand in various compounding techniques. Growing demand from applications, such as SMCs and BMCs, is expected to augment market growth. Moreover, rapidly growing global automotive industry is expected to be major driving factor behind segment growth.

The polymethyl methacrylate (PMMA) segment accounted for a revenue share of above 30.0% in 2023. Polymethyl methacrylate is one of the most important low profile additives, with excellent mechanical properties. Growing demand from electronics and automotive industries is anticipated to drive market growth over the forecast period. Moreover, rising demand from the construction industry and in SMCs and BMCs applications are expected to drive segment growth.

Function Insights

The anti-shrinkage segment dominated the market in 2023 with a revenue share of above 84.0%. Anti-shrinkage function of low profile additives is critical in many industries, especially polymer applications, such as plastics, composites, and coatings. These additives are intended to reduce or prevent shrinkage during curing or cooling process. Growth in end-use industries, such as automotive, building & construction, electrical & electronics, and consumer goods, is expected to boost product demand as they offer minimal shrinkage in precise and dimensionally-stable end products.

Pigmentation function of low profile additives involves coloring materials. The need for products with brilliant colors and visually pleasant appearances is increasing in several end-use industries including automotive, packaging, consumer goods, and construction. Low profile additives, which provide consistent, appealing, and long-lasting pigmentation solutions, are in high demand in a variety of industries, such as plastics, coatings, and textiles.

Key Companies & Market Share Insights

Wacker Chemie AG has a versatile product portfolio for low profile additives catering to industries including electrical & electronics, energy, automotive, building & construction, and household appliances, among others. Most of key players operating in this market have integrated their raw material and distribution operations to maintain additive quality and expand their regional presence. This provides companies a competitive advantage in the form of cost benefits, thus increasing profit margins. Manufacturers are focusing more on R&D activities for the development of new industrial plastics to sustain heavy competition and meet changing demands of end-users. Furthermore, active players implement strategic initiatives for maintaining competitive environment.

Key Low Profile Additives Companies:

- Wacker Chemie AG

- INEOS AG

- Polynt S.p.A.

- Vin Industries

- BASF SE

- ALTANA

- Polychem Ltd.

- SWANCOR

- LyondellBasell Industries Holdings B.V.

- Aromax Technology Corporation

- Interplastic Corporation.

- Synthomer PLC

- AOC, LLC

- Mechemco

- Taak Resin Co.

- NOF Corporation

Recent Developments

-

In August 2023, Dublin City Council signed an economic development agreement with INEOS Composites, a manufacturer and supplier of general-purpose and high-performance unsaturated polyester and vinyl ester resins, gel coats, and low-profile additives for plastics industry

-

In July 2023, INEOS AG announced the expansion of its business across North America to merge many North American business headquarters into a single office in Ohio to facilitate collaboration and business efficiencies

Low Profile Additives Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 760.26 million

Revenue forecast in 2030

USD 1,247.90 million

Growth rate

CAGR of 5.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report Updated

January 2024

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Product, function, application, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; The Netherlands; Spain; China,; India; Japan; South Korea; Australia; Malaysia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Wacker Chemie AG; INEOS AG; Polynt S.p.A.; Vin Industries; BASF SE; Altana; Polychem Ltd.; Swancor; LyondellBasell Industries Holdings B.V.; Aromax Technology Corp.; Interplastic Corp.; Synthomer PLC; AOC, LLC; Mechemco; Taak Resin Co.; NOF Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Low Profile Additives Market Report Segmentation

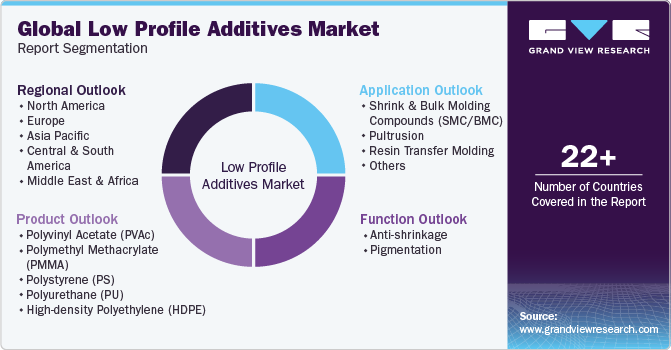

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the low profile additives market report based on product, function, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyvinyl Acetate (PVAc)

-

Polymethyl Methacrylate (PMMA)

-

Polystyrene (PS)

-

Polyurethane (PU)

-

High-density Polyethylene (HDPE)

-

-

Function Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Anti-shrinkage

-

Pigmentation

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Shrink & Bulk Molding Compounds (SMC/BMC)

-

Pultrusion

-

Resin Transfer Molding

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

France

-

The Netherlands

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

United Arab Emirates (UAE)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global low profile additives market size was estimated at USD 705.94 million in 2023 and is expected to reach USD 760.26 million in 2024.

b. The global low profile additives market is expected to grow at a compound annual growth rate of 8.6% from 2024 to 2030 to reach USD 1,247.90 million by 2030.

b. The Polyvinyl acetate (PVA) segment dominated the low profile additives market with a share of more than 38.0% in 2022. Properties such as improved surface finish and low shrinkage are fueling the product demand in applications such as automotive and construction industry.

b. Some key players operating in the low profile additives market include Wacker Chemie AG, INEOS, ALTANA divisions, Mechemco, BASF SE, ,Polynt S.p.A., Vin Industries, Polychem, SWANCOR, Synthomer PLC, Taak Resin Co., and LyondellBasell Industries Holdings B.V.

b. Growing end-use industries, such as construction, automotive, and electronics, are expected to drive the demand for low-profile additives. Moreover, the rising demand for SMC/BMC pultruded plastics and RTM products in automobiles as well as construction and infrastructural activities is likely to propel the product demand in the coming years.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."