Low Foam Surfactants Market Size, Share & Trends Analysis Report By Product (Non-Ionic, Amphoteric), By Application (Agriculture, Household Detergents, Pharmaceuticals), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-384-1

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Low Foam Surfactants Market Size & Trends

“2030 Low Foam Surfactants Market value to reach USD 22,090.5 million”

The global low foam surfactants market size was estimated at USD 15287.1 million in 2023 and is projected to grow at a CAGR of 5.4% from 2024 to 2030. The market driven by driven by extensive application in the home and personal care sector. They are used in products like laundry detergents, dishwashing liquids, fabric softeners, and personal care products. Low foam surfactants, being biodegradable and environmentally friendly, are gaining popularity as a sustainable alternative to conventional surfactants, further driving the market.

One of the primary characteristics of low foam surfactants is their ability to effectively suppress foam formation. They contain special additives that reduce the surface tension of the liquid, preventing the formation of stable bubbles. This characteristic is particularly valuable in industries such as food and beverage production, where excessive foam can interfere with processing operations. For instance, in breweries, they are used during the fermentation process to minimize the foam generated by yeast and other substances, ensuring smooth and efficient production.

A major driver for the global low foam surfactants market is the increasing demand for environmentally friendly products. As consumers become more conscious of the environmental impact of their choices, there is a growing preference for products that are sustainable and have minimal ecological footprints. These products, with their reduced levels of volatile organic compounds (VOCs) and biodegradable properties, align with this demand for greener alternatives. For instance, in the personal care industry, there is a rising demand for these products in the formulation of shampoos, body washes, and other cleansing products. These products offer essential cleansing properties while being environmentally friendly.

A restraint for the global market is the price and availability of raw materials. The key raw materials used in the production of surfactants, such as benzene, toluene, polyol, and phosgene, are petroleum-based derivatives and are susceptible to price fluctuations. The cost structure of these products is influenced by the price and availability of these raw materials. Fluctuations in the prices of raw materials can impact the overall production costs of low foam surfactants, which may then be passed on to the consumers. This can make these products relatively more expensive compared to conventional surfactants, posing a challenge for market growth.

While these products are commonly associated with household cleaning and personal care products, their usage extends to various industrial sectors as well. Industries such as food and beverages, textiles, paints, pulp and paper, cement, and metal cleaning utilize low foam surfactants for specific purposes like cleaning, emulsifying, or dispersing. For example, in the food and beverage industry, they are used to minimize foam formation during processing operations.

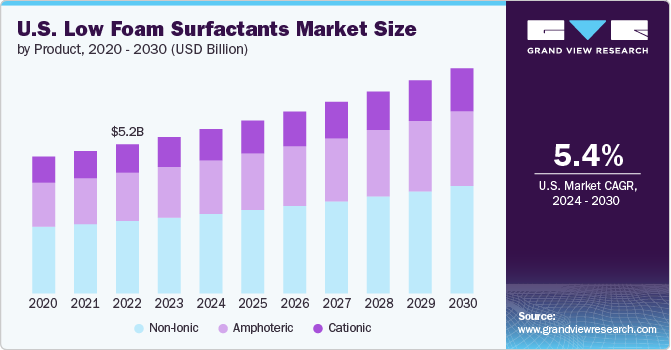

Product Insights

“Amphoteric emerged as the fastest growing additive with a CAGR of 5.7%”

Non-Ionic dominated the market and accounted for a revenue share of approximately 48.5% in 2023. These surfactants do not carry any electrical charge and are highly versatile in their applications. They are known for their excellent compatibility with other chemicals and their ability to reduce surface tension effectively. Non-ionic surfactants are widely used in various industries, including cleaning products, paints and coatings, agrochemicals, and personal care products.

In the cleaning industry, these products are commonly used in laundry detergents, dishwashing liquids, and all-purpose cleaners. They help to remove dirt and stains by lowering the surface tension of water, allowing it to penetrate the fabric or surface more effectively. Non-ionic surfactants are also gentle on sensitive materials, making them suitable for use in cleaning products for delicate fabrics or surfaces.

Amphoteric surfactants are another important product segment in the global low foam surfactants market. They have both positive and negative charges, making them highly effective at reducing surface tension and stabilizing foams. Amphoteric surfactants are commonly used in products that require excellent foam stability and compatibility with other ingredients. These products help to create a stable foam, enhance the cleansing performance of the shampoo, and provide conditioning properties. Amphoteric surfactants are also used in personal care products like facial cleansers and bath gels, where they contribute to a rich and luxurious lather.

Cationic surfactants carry a positive charge and are widely used in applications that require excellent conditioning and antimicrobial properties. They are commonly used in fabric softeners, hair conditioners, and disinfectants. In fabric softeners, cationic surfactants help to reduce static cling, improve fabric softness, and provide a pleasant fragrance. They adhere to the fabric fibers, creating a soft and smooth feel. These products are also used in hair conditioners to enhance detangling, reduce frizz, and improve manageability.

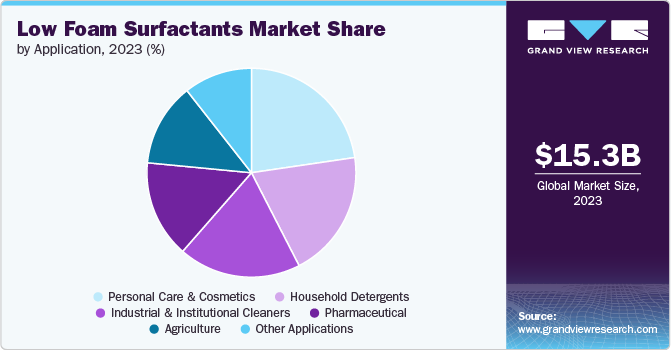

Application Insights

“Pharmaceutical emerged as the fastest growing crop type with a CAGR of 7.1%”

Personal Care & Cosmetics dominated the market and accounted for a revenue share of 22.7% in 2023. Low foam surfactants are widely used in the formulation of various personal care products, including shampoos, body washes, facial cleansers, and skincare products. In shampoos and body washes, these products help to create a rich and luxurious lather while effectively cleansing the hair and skin. They remove dirt, oil, and impurities without stripping away the natural moisture, leaving the hair and skin clean and refreshed. They also contribute to the overall sensory experience of these products, providing a smooth and silky feel.

Household detergents are another important application segment in the global low foam surfactants market. These products are widely used in the formulation of laundry detergents, dishwashing liquids, and all-purpose cleaners. They provide excellent cleaning performance while minimizing foam generation. In laundry detergents, these products help to remove stains and dirt from fabrics effectively. They penetrate the fabric fibers, lifting and suspending the soil in the wash water. They also aid in preventing excessive foam formation during the washing process, ensuring efficient cleaning and rinsing.

The industrial and institutional cleaning sector is a significant application segment in the global low foam surfactants market. These products are widely used in various industries, including manufacturing facilities, commercial buildings, healthcare facilities, and food processing plants. In industrial cleaning, these products are used in the formulation of degreasers, metal cleaners, and industrial detergents. These surfactants help to remove tough stains, grease, and oil from surfaces and equipment. They also aid in preventing foam interference in industrial processes, ensuring optimal performance and efficiency. In institutional cleaning, low foam surfactants are used in products for janitorial services, hospitality, and healthcare facilities. They provide effective cleaning and disinfection properties while minimizing foam generation.

Regional Insights

“Asia Pacific emerged as the fastest growing market with a CAGR of 5.9% from 2024 - 2030”

North America dominated the market and accounted for a 44.8% share in 2023. The region is characterized by a strong focus on research and development, emerging end user segments such as personal care & cosmetics, and the presence of major market players. The demand for low foam surfactants in North America is driven by factors such as the rise in bio-based surfactants, changes in customer preferences, and the growth of various industries.

U.S. Low Foam Surfactants Market Trends

In the U.S., the demand for low foam surfactants is particularly high due to the presence of global giants in the detergent market, such as Procter & Gamble. The country also has a strong focus on research and development, leading to the emergence of new and innovative surfactant formulations. In addition, the country has witnessed an increase in the demand for personal care and home care products, further driving the market for low foam surfactants.

Europe Low Foam Surfactants Market Trends

Europe low foam surfactants market has shown a growing interest in bio-based products, including surfactants. Rising consumer awareness and government support towards bio-based product manufacturing and consumption have fostered the growth of the market in the region. The demand for these products in Europe is expected to be driven by the increasing preference for sustainable and environmentally friendly products.

Asia Pacific Low Foam Surfactants Market Trends

The Asia Pacific region is expected to be the fastest regional segment in the global low foam surfactants market in terms of value during the forecast period. The region has witnessed significant growth in recent years, driven by factors such as the growing population, urbanization, and increasing disposable income. Countries such as China and India have experienced rapid urbanization and rising disposable income, leading to increased demand for personal care and home care products. The Asia Pacific region is also known for its low manufacturing and labor costs, making it an attractive destination for surfactant production. The demand for these products in Asia Pacific is driven by various industries, including agriculture, textiles, personal care, and industrial cleaning.

Key Low Foam Surfactants Company Insights

The competitive landscape of the global low foam surfactants market is characterized by key players and their strategic initiatives, market trends, consolidation, and other major effects. Many companies are focusing on expanding their production capacities to meet the growing demand for low foam surfactants. This includes investing in new manufacturing facilities, upgrading existing plants, and increasing production capabilities. With increasing environmental concerns, companies are also placing a strong emphasis on developing sustainable and eco-friendly products. They are investing in research and development to create surfactants derived from renewable sources, reduce carbon footprint, and minimize environmental impact.

Some of the key players operating in the global low foam surfactants market include

-

Stepan Company is a global manufacturer of specialty chemicals, including low foam surfactants. They have a wide product portfolio that caters to various industries, including household care, personal care, industrial, and institutional cleaning. Stepan Company acquired BASF Mexicana's surfactant business in 2018, which further expanded their product offerings.

-

Clariant is a specialty chemical company that offers a wide range of products, including low foam surfactants. They provide solutions for various industries, including personal care, household care, and industrial applications. Clariant is known for its commitment to sustainability and offers eco-friendly offerings that meet the growing demand for environmentally friendly products

-

Nouryon, formerly known as AkzoNobel Specialty Chemicals, is a global specialty chemicals company that manufactures low foam surfactants. They offer a diverse range of surfactant products for various applications, including personal care, household detergents, and industrial cleaning.

Key Low Foam Surfactants Companies:

The following are the leading companies in the low foam surfactants market. These companies collectively hold the largest market share and dictate industry trends.

- Stepan Company

- CLARIANT

- Colonial Chemical

- Innospec

- Nouryon

- The Lubrizol Corporation

- Vantage Leuna GmbH

- Verdant Specialty Solutions US LLC

- PCC Group

- Hebei Sancolo Chemicals Co., Ltd.

- GALAXY SURFACTANTS

- Anshika Polysurf Limited

Recent Developments

-

In January 2024, Evonik announced the manufacturing of first bio-surfactant product from its production facility in Slovakia. The product, low surfactants ‘Rhamnolipids’ draw Evonik’s biotechnology platform form its life sciences business segment, Nutrition and Care.

-

In February 2022, Clariant launched its range of Vita 100% bio-based surfactants, helping to remove fossil carbon from the value chain in manufacturing of products. These products are based on renewable feedstock and score 98% Renewable Carbon Index (RCI).

Low Foam Surfactants Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 16,066.8 million |

|

Revenue forecast in 2030 |

USD 22.09 billion |

|

Growth rate |

CAGR of 5.4% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Volume and revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada, Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

Stepan Company; CLARIANT; Colonial Chemical; Innospec; Nouryon; The Lubrizol Corporation; Vantage Leuna GmbH; Verdant Specialty Solutions US LLC; PCC Group; Hebei Sancolo Chemicals Co., Ltd.; GALAXY SURFACTANTS; Anshika Polysurf Limited |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Low Foam Surfactants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global low foam surfactants market report based on product, application and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Non-Ionic

-

Amphoteric

-

Cationic

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Personal Care & Cosmetics

-

Household Detergents

-

Industrial and Institutional Cleaners

-

Pharmaceutical

-

Agriculture

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global low foam surfactants market was valued at 15287.14 million in 2023 and is expected to reach USD 16066.79 million in 2024.

b. The global low foam surfactants market is anticipated to grow at a high CAGR of 5.4% from 2024 to reach USD 22.09 billion by 2030

b. North America dominated the market and accounted for a 44.8% share in 2023. The region is characterized by a strong focus on research and development, emerging end-user segments such as personal care & cosmetics, and the presence of major market players.

b. Some of the key players operating in the global low foam surfactants market include Clariant, Nouryon, Stepan Company, Innospec, The Lubrizol Corporation, PCC Group, among others.

b. The market driven by driven by extensive application in the home and personal care sector. They are used in products like laundry detergents, dishwashing liquids, fabric softeners, and personal care products. Low foam surfactants, being biodegradable and environmentally friendly, are gaining popularity as a sustainable alternative to conventional surfactants, further driving the market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."