- Home

- »

- Digital Media

- »

-

Lottery Market Size, Share & Trends, Industry Report, 2030GVR Report cover

![Lottery Market Size, Share & Trends Report]()

Lottery Market (2025 - 2030) Size, Share & Trends Analysis Report By Category (Draw-based Games, Instant Games, Sports Games), By Application (Online, Offline), By Region (North America, Asia Pacific, Europe), And Segment Forecasts

- Report ID: GVR-4-68040-478-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Lottery Market Summary

The global lottery market size was estimated at USD 353.29 billion in 2024 and is expected to reach USD 483.93 billion in 2030, growing at a CAGR of 5.3% from 2025 to 2030. The lottery industry is experiencing dynamic trends driven by technological advancements, changing consumer behaviors, and evolving regulatory environments.

Key Market Trends & Insights

- The Asia Pacific lottery industry dominated with a revenue share of over 38% in 2024.

- The U.S. lottery industry accounted for the largest market share of 70% in 2024.

- Based on category, the draw-based lottery game category segment accounted for the largest market share of over 45% in 2024.

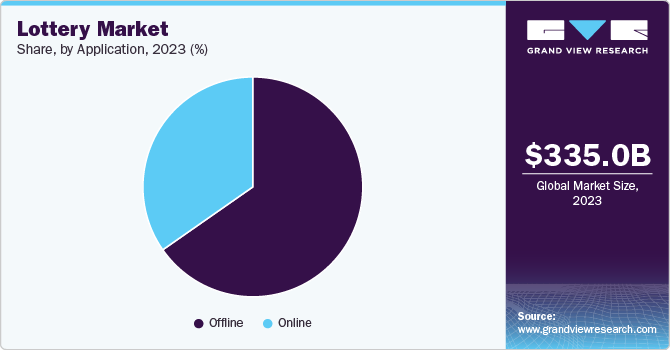

- Based on application, the offline lottery segment accounted for the largest share of the lottery industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 353.29 Billion

- 2030 Projected Market Size: USD 483.93 Billion

- CAGR (2025-2030): 5.3%

- Asia Pacific: Largest market in 2024

- Europe: Fastest growing market

One of the key factors driving growth is the rising popularity of online lotteries, which have revolutionized the way people interact with lottery games. The widespread use of smartphones, along with enhanced internet access, has significantly simplified the process for users to buy tickets and join games from virtually any location, at any time This shift towards online platforms is also backed by better security, including encryption and digital tools, which help protect transactions and build trust among users, which is expected to drive the lottery industry expansion in the coming years.

The growing shift towards digital platforms is transforming how lottery services are delivered, as operators embrace online and mobile solutions to meet the changing preferences of modern consumers. Traditional paper-based lotteries are being replaced with digital alternatives that offer greater accessibility, especially for tech-savvy users and younger audiences. Online lottery platforms are integrating user-friendly interfaces, secure payment options, and real-time result updates to enhance the user experience. This digital evolution is making participation more convenient while simultaneously expanding the reach of the lottery industry, fueled by growing internet access and widespread smartphone usage across global markets.

Additionally, evolving government regulations are significantly influencing the lottery market’s growth, as many countries are moving towards legalizing and formalizing lottery systems, especially in the digital space. This shift is creating new revenue opportunities for authorities while bringing more structure and transparency to the industry. The increasing recognition by governments of the benefits of controlled lottery systems, including tax revenue and reduced illegal gambling, is driving regulatory efforts that fuel the expansion of the global market.

There is a clear shift in lottery participation patterns, driven by evolving consumer preferences across different age groups. Younger generations are increasingly drawn to digital and mobile-friendly lottery formats, such as instant-win games and gamified experiences. Meanwhile, older consumers still prefer traditional methods, such as in-store ticket purchases. This generational shift is influencing the types of games offered and how they are delivered, leading to a more diverse and dynamic lottery industry landscape.

Moreover, lottery companies are forming strategic alliances with industries like sports, e-commerce, and entertainment to broaden their audience base. These collaborations often take shape through co-branded games, joint promotions, or sponsorship deals that blend lottery industry experiences with popular culture. Aligning with trending events or widely recognized platforms, such partnerships help drive engagement and attract newer customer segments. Such strategies by key companies are expected to drive the lottery industry’s growth in the coming years.

Category Insights

The draw-based lottery game category accounted for the largest market share of over 45% in 2024. The rising popularity of draw-based lotteries can be attributed to several factors that boost both their appeal and accessibility. One of the major contributors to this trend is the widespread use of modern technology, especially the growing prevalence of smartphones and high-speed internet connections. Additionally, the ease of buying tickets online and exploring a range of lottery options via mobile apps has proven especially attractive to a younger, more tech-oriented audience that favors digital experiences, thereby driving the segmental growth.

The sports game lottery segment is expected to witness the fastest CAGR of over 5% from 2025 to 2030, driven by several factors, including the excitement associated with sports events contributes to the fascination of sports lotteries. When global tournaments like the Olympics or the World Cup take place, they spark a surge of enthusiasm and involvement from fans, which often leads to a rise in lottery participation. The chance to win significant prizes during these high-profile events also serves as a strong motivation for people to purchase lottery tickets.

Application Insights

The offline lottery segment accounted for the largest share of the lottery industry in 2024, owing to the strong level of consumer trust in traditional lottery systems. The strong consumer trust in traditional lottery systems, particularly among older demographics, who value the security of in-person transactions, is driving the segmental growth. Government regulations and licensing provide a structured and secure environment, further enhancing consumer confidence. In regions with limited digital access, offline lotteries continue to be the primary mode of participation, which is expected to present lucrative growth opportunities for the segment.

The online lottery segment is expected to witness the fastest CAGR from 2025 to 2030, primarily driven by the increasing penetration of the internet and the widespread adoption of smartphones. High-speed internet access enables users to take part in lottery games anytime and from virtually any location, removing the need to buy physical tickets or visit traditional retail outlets. This shift towards digital platforms has democratized lottery participation, allowing a wider demographic to engage with lottery offerings.

Regional Insights

The North America lottery market is expected to grow at a CAGR of over 3% from 2025 to 2030. The region is experiencing a noticeable move towards digital lottery platforms, leading to greater market penetration. The introduction of fresh game types and formats tailored to a wide range of player preferences has played a key role in driving market growth. Lottery operators are consistently introducing new ideas to maintain user interest, blending traditional draw-based games with more modern alternatives. The rising popularity of instant-win scratch cards and interactive gaming options is also helping to boost overall market demand.

U.S. Lottery Market Trends

The U.S. lottery industry accounted for the largest market share of 70% in 2024, driven by creative marketing strategies, technological advancements, increased accessibility through digital platforms, social responsibility initiatives, and a strong focus on security measures. High penetration of smartphones and internet connectivity in the U.S. is transforming how consumers interact with lottery games, thereby broadening the market reach.

Europe Product Lottery Market Trends

European lottery industry is expected to grow at the fastest CAGR of over 7% from 2025 to 2030. This growth is driven by updated gambling regulations, high internet penetration, and widespread smartphone usage. Increasing interest in digital entertainment and mobile-based lotteries is attracting younger audiences. Additionally, innovative formats and purpose-driven lotteries supporting public causes are boosting participation and trust, contributing to the region’s expanding market.

The UK lottery market is expected to grow at the fastest CAGR of over 8% in the coming years. Key drivers include increasing digital adoption, high smartphone usage, and strong internet access. Government support and clear regulations provide a stable environment for growth. The rise of mobile lottery platforms, instant-win games, and charity-linked lotteries, along with partnerships with sports and entertainment sectors, are expanding the market’s reach and appealing to a broader audience.

The lottery market in Germany is fueled by strong digital infrastructure, high smartphone penetration, and a well-regulated gambling environment. Increasing consumer preference for online gaming, combined with secure payment systems and widespread internet access, is driving market growth. Additionally, Germany’s focus on responsible gaming and the popularity of instant-win and charity-based lotteries are boosting participation across diverse age groups.

Asia Pacific Lottery Market Trends

The Asia Pacific lottery industry dominated with a revenue share of over 38% in 2024, driven by rising disposable income and the expanding middle class across the region. As more consumers have the financial flexibility to spend on entertainment, lotteries are becoming a popular leisure activity. Technological progress, especially the emergence of online lottery sites and mobile apps, has greatly simplified access to lottery games, drawing in a wider audience. The ease of buying tickets and joining draws remotely has particularly appealed to younger, tech-oriented users.

The China lottery market is gaining traction, driven by rising disposable income, urbanization, and strong government regulation. The widespread adoption of digital platforms and mobile apps has boosted accessibility and engagement. Additionally, government-backed initiatives and the popularity of online and instant-win games are fueling market growth across urban and rural areas.

The lottery market in India is rapidly expanding, fueled by increasing smartphone penetration, rising disposable income, and digital transformation. The shift towards online platforms has made lottery games more accessible, especially in smaller towns and rural areas. Cities. Government efforts to regulate and formalize the sector, along with demand for instant-win games, are further driving growth.

Key Lottery Company Insights

Some of the key players operating in the lottery market include International Game Technology (IGT) and Scientific Games Corporation

-

International Game Technology (IGT) is a multinational gaming and lottery company headquartered in London, UK, with major operations in Rome. IGT specializes in providing technology and services for lotteries, slot machines, and digital gaming solutions. IGT is a key player, offering systems, terminals, and game content to national and state lotteries worldwide. The company is known for its innovation in central lottery systems and its broad portfolio of licensed game content and player management platforms.

-

Scientific Games Corporation is a global leader in lottery and gaming solutions. The company provides a comprehensive suite of lottery services, including instant ticket manufacturing, lottery systems, digital platforms, and sports betting technology. Scientific Games supports government-regulated lotteries around the world with innovative, secure, and scalable technology. It is known for advancing digital lottery solutions and enhancing player engagement through interactive and omnichannel experiences.

Lotto.com and Sazka Group are some of the emerging participants in the lottery market.

-

Lotto.com is an emerging player in the U.S. lottery market, offering a fully digital platform for purchasing official state lottery tickets online. The company is focused on simplifying the lottery experience through a user-friendly website and mobile application. The company allows users to buy tickets, check results, and manage winnings without visiting a physical store. By targeting a younger, tech-savvy audience, Lotto.com aims to modernize lottery participation and expand access to state-run games. Its innovative approach positions it as a key disruptor in the traditional lottery space.

-

Sazka Group is a prominent European lottery and gaming operator based in the Czech Republic. It has rapidly expanded its footprint across Central and Eastern Europe through ownership and partnerships with national lottery operators. The company focuses on both retail and digital lottery services, combining traditional ticket sales with modern iLottery platforms. Sazka Group is known for its innovation and investment in digital transformation, positioning itself as a major player in Europe’s regulated lottery market. Its strategic growth reflects the rising demand for convenient, tech-driven lottery experiences.

Key Lottery Companies:

The following are the leading companies in the lottery market. These companies collectively hold the largest market share and dictate industry trends.

- International Game Technology (IGT)

- Scientific Games Corporation

- Française des Jeux (FDJ)

- Lottomatica S.p.A.

- Camelot Group

- China Welfare Lottery

- China Sports Lottery

- Hong Kong Jockey Club

- New York State Lottery

- California Lottery

- Florida Lottery

- Singapore Pools

- Ontario Lottery and Gaming Corporation (OLG)

- Mizuho Bank Ltd.

- The Government Lottery Office

- Sazka Group

- INTRALOT

- BCLC (British Columbia Lottery Corporation)

- Loto-Quebec

- Lotto.com

Recent Developments

-

In April 2025, the British Columbia Lottery Corporation (BCLC) partnered with SCCG Management to evaluate and improve its operations. The advisory firm will conduct a full review of BCLC’s technology systems, market strategies, and gaming offerings to support future growth and innovation.

-

In February 2025, Scientific Games was awarded a 10-year contract to become the full-line provider for the New Mexico Lottery. This deal expands their role from just Scratchers to now include gaming systems through the Scientific Games Enhanced Partnership program. The company continues to grow rapidly, with recent lottery system wins in both the U.S. and Europe.

-

In January 2025, International Game Technology (IGT) signed a 10-year deal with Luxembourg’s national lottery, Loterie Nationale. As part of the agreement, IGT will provide its OMNIA™ solution, including a cloud-based iLottery system, remote game server, upgraded central system, and new retail terminals.

Lottery Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 374.01 billion

Revenue forecast in 2030

USD 483.93 billion

Growth rate

CAGR of 5.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Category, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil

Key companies profiled

International Game Technology (IGT); Scientific Games Corporation; Française des Jeux (FDJ); Lottomatica S.p.A.; Camelot Group; China Welfare Lottery; China Sports Lottery; Hong Kong Jockey Club; New York State Lottery; California Lottery; Florida Lottery; Singapore Pools; Ontario Lottery and Gaming Corporation (OLG); Mizuho Bank Ltd.; The Government Lottery Office; Sazka Group; INTRALOT; BCLC (British Columbia Lottery Corporation); Loto-Quebec; Lotto.com

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lottery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global lottery market report based on category, application, and region:

-

Category Outlook (Revenue, USD Billion, 2018 - 2030)

-

Draw-based lottery

-

Instant games

-

Sports game

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global lottery market size was estimated at USD 353.29 billion in 2024 and is expected to reach USD 374.01 billion in 2025.

b. The global lottery market is expected to grow at a compound annual growth rate of 5.3% from 2025 to 2030 to reach USD 483.93 billion by 2030.

b. The offline lottery segment dominated the industry with the highest revenue share of over 62% in 2024. The highest revenue share can be attributed to the wider reach and accessibility of physical lottery in rural as well as urban areas across the counties worldwide.

b. The key players in the lottery market include International Game Technology (IGT), Scientific Games Corporation, Française des Jeux (FDJ), Lottomatica S.p.A., Camelot Group, China Welfare Lottery, China Sports Lottery, Hong Kong Jockey Club, New York State Lottery, California Lottery, Florida Lottery, Singapore Pools, Ontario Lottery and Gaming Corporation (OLG), Mizuho Bank Ltd., The Government Lottery Office, Sazka Group, INTRALOT, BCLC (British Columbia Lottery Corporation), Loto-Quebec, and Lotto.com.

b. Key factors that are driving the market growth include increased digitalization and online platforms, growing disposable income, expansion of lottery types, and government initiatives to support lotteries to generate revenue for public welfare projects like education, healthcare, and infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.