Logistics Market Size, Share & Trends Analysis Report By Service, By Category (Conventional Logistics, E-Commerce Logistics), By Model, By Type, By Operation, By Mode of Transport, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-323-8

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Logistics Market Size & Trends

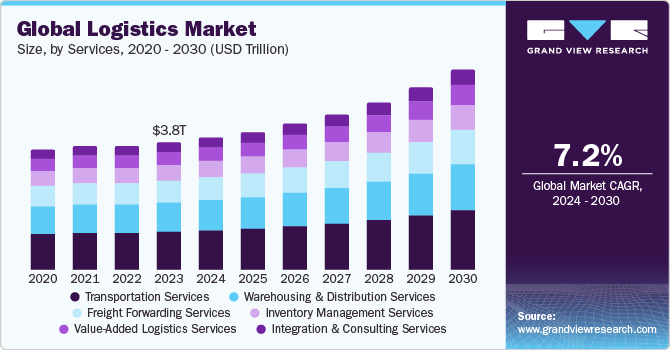

The global logistics market size was estimated at USD 3,794.4 billion in 2023 and is expected to expand at a CAGR of 7.2% from 2024 to 2030. The market represents a dynamic and rapidly evolving sector that plays a crucial role in global trade and commerce. It encompasses a wide range of services and technologies aimed at efficiently managing the flow of goods, from production to consumption, across various industries and geographical regions.

The market is growing due to the rapid expansion of online retail, driving demand for efficient services in last-mile delivery and warehousing, as well as increasing customer expectations for faster deliveries. Additionally, improvements in transportation infrastructure and the complexity of international trade are further boosting the demand for supply chain services, requiring more efficient and agile supply chains.

The rapid growth of online retail has significantly influenced the target market, driving the need for efficient services, especially in last-mile delivery. This segment, crucial for transporting goods from distribution centers to consumers, has seen innovations like drones and autonomous vehicles to meet the demand for faster and more reliable deliveries. Warehousing has also evolved to accommodate the needs of online retailers, with larger and automated warehouses becoming essential for managing inventory and fulfilling orders promptly.

The growth of online retail has propelled the logistics industry towards more efficient and technologically advanced solutions. This transformation aims to meet the evolving demands of modern consumers for faster and more convenient delivery options. The logistics sector plays a critical role in the global economy by facilitating the movement of goods across various industries and geographical regions. Moreover, as online shopping continues to grow, the target market is expected to innovate further and adapt to meet the increasing demand for efficient and reliable services. This evolution is likely to lead to further advancements in technology and supply chain practices, driving the industry toward greater efficiency and sustainability.

Customer demand for faster deliveries is a significant driver of growth in the target market. As consumers increasingly expect quick and reliable delivery of goods, logistics companies are compelled to innovate and optimize their operations to meet these expectations. This demand has led to the development of new delivery models, such as same-day and next-day delivery services, which require more efficient supply chain processes.

To fulfill these demands, logistics companies are investing in technologies like route optimization software, automated warehouses, and advanced tracking systems. Meeting customer expectations for faster deliveries not only drives the growth of the target market but also fosters customer loyalty and satisfaction. These factors are crucial for repeat business.

However, inadequate transportation infrastructure can limit supply chain efficiency by constraining the capacity of transportation networks and operations. This limitation can lead to delays in the movement of goods, increased transportation costs, and difficulties in accessing certain locations. Moreover, inadequate infrastructure can hinder the ability of logistics companies to meet customer demands for timely deliveries, impacting customer satisfaction. Addressing these infrastructure challenges is crucial for improving supply chain efficiency and ensuring the smooth flow of goods within supply chains.

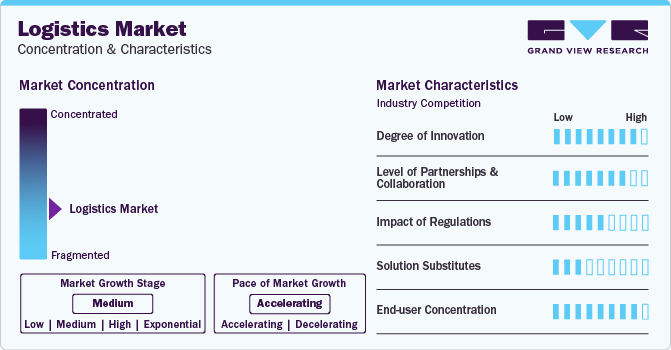

Market Concentration & Characteristics

The degree of innovation in the target market is high. The target market exhibits a high degree of innovation due to several transformative factors, such as the integration of cutting-edge technologies like artificial intelligence, IoT, and blockchain, which enhances operational efficiency and transparency. Automation and robotics are revolutionizing warehouse operations and delivery systems, reducing costs and increasing speed. Companies are investing heavily in automation technologies to stay ahead of the competition and drive production cycles.

For instance, in April 2024, Agility Robotics and Manhattan Associates announced a partnership to integrate Agility's bipedal robot, Digit, into warehouse operations, enhancing efficiency and addressing labor shortages. The collaboration aims to streamline the deployment and management of Digit through Manhattan's Active Warehouse Management solution and Agility's cloud automation platform. Moreover, Data analytics and predictive modeling improve decision-making, demand forecasting, and route optimization, driving overall efficiency.

Sustainability initiatives, such as the adoption of electric vehicles and green logistics practices, address environmental concerns and regulatory requirements. The exponential growth of e-commerce demands innovative last-mile delivery solutions to meet consumer expectations for speed and flexibility. Customization and personalization of supply chain services cater to diverse industry needs, fostering continuous innovation. Additionally, advancements in transportation technologies, such as autonomous vehicles and drones, further propel the target market forward. Furthermore, enhanced connectivity and real-time tracking systems improve supply chain visibility and customer satisfaction.

The level of partnership and collaboration is high in the target market. The complexity and scale of supply chain operations often require collaboration among multiple entities to ensure smooth operations. The rapid growth of technological advancements necessitates partnerships to leverage specialized expertise and resources. Moreover, globalization has increased the need for partnerships to navigate international regulations and supply chain complexities. Additionally, the rise of e-commerce has led to strategic partnerships to meet growing customer demands for fast and efficient delivery.

Furthermore, partnerships allow companies to access new markets, expand their service offerings, and achieve mutual benefits through shared resources and capabilities. For instance, in April 2024, Vitesco Technologies and DHL Supply Chain announced a strategic partnership, with DHL becoming the Lead Logistics Partner for Vitesco Technologies in Europe. This partnership aims to enhance the sustainability, resilience, and efficiency of supply chain operations in the automotive industry. By centralizing freight management through DHL's LLP Center of Excellence in Warsaw, Poland, Vitesco Technologies expects to optimize around 100,000 transport movements, accounting for about a third of its total freight volume.

The impact of regulations is moderate in the target market. While there are regulations governing aspects such as safety standards, emissions, and driver hours, these are generally well-established and do not undergo frequent drastic changes. For instance, the International Maritime Organization's new global shipping regulation, IMO 2023, aims to reduce carbon emissions in international shipping by 70% by 2050 compared to 2008 levels. This regulation mandates reductions in carbon emissions for all ships, promoting sustainability but potentially leading to supply chain slowdowns and increased costs for companies.

Furthermore, regulations vary significantly by region and country, leading to a fragmented regulatory landscape that can be challenging but manageable for logistics companies. Many regulations are focused on ensuring fair competition and preventing monopolistic practices rather than imposing stringent operational constraints. Additionally, advancements in technology and automation help companies adapt to regulatory changes more efficiently, mitigating their overall impact. Moreover, the logistics industry's ability to influence regulatory decisions through lobbying and advocacy also plays a role in keeping the impact moderate.

The impact of solution substitutes is low in the target market. The specialized nature of logistics services, including transportation, warehousing, and freight management, requires specific expertise and infrastructure that is not easily replaced by substitutes. Furthermore, there is no substitute for logistics when it comes to transporting components and goods. The specialized expertise and infrastructure required for efficient transportation and warehousing are unmatched by alternative solutions.

Logistics providers ensure reliable and timely delivery, which is crucial for maintaining supply chain continuity. Additionally, their advanced technologies and global networks offer efficiency and scale that substitutes cannot replicate. Moreover, the integration of logistics services with supply chain management systems offers seamless operations that substitutes cannot easily match.

The end-user concentration is high in the target market due to the critical role logistics plays across various industries. Major sectors such as retail and e-commerce, automotive, healthcare, and food and beverages heavily rely on efficient logistics for their operations. The surge in e-commerce has particularly heightened the demand for supply chain services, making it a vital component for timely deliveries and customer satisfaction.

Additionally, industries like healthcare and automotive require precise and reliable logistics to manage complex supply chains and meet stringent regulations. This high dependency creates a concentrated demand from key end-users, driving innovation and tailored solutions within the logistics sector. Moreover, the need for specialized logistics services in these industries further increases their reliance on expert providers. Consequently, logistics companies continuously invest in technology and infrastructure to meet the specific needs of these concentrated end-user segments.

Service Insights

The transportation services segment dominated the target market and accounted for the largest revenue share of 29.5% in 2023 due to its critical role in the supply chain. Efficient transportation services ensure timely delivery of goods, which is essential for meeting customer expectations. The rise of e-commerce has significantly increased the demand for rapid and reliable transportation solutions. Additionally, globalization has led to a surge in international trade, further boosting the need for comprehensive transportation services.

Advances in technology, such as GPS tracking and route optimization, have enhanced the efficiency and reliability of transportation services. Investments in infrastructure, including roadways, ports, and airports, have also supported the growth of this segment. Moreover, transportation services provide a vital link between different segments of the supply chain, from manufacturers to end consumers. Furthermore, the growing emphasis on same-day and next-day delivery has reinforced the importance of robust transportation services in the target market.

The warehousing and distribution services segment is expected to register the highest CAGR of 7.8% over the forecast period due to the increasing complexity of supply chains. E-commerce growth has driven demand for efficient warehousing solutions to handle a high volume of diverse products. Businesses are investing in advanced warehousing and distribution technologies, such as robotics and automation, to improve operational efficiency. The rise of omnichannel retailing has necessitated the need for strategic distribution centers to ensure quick and accurate order fulfillment.

For instance, in April 2024, A.P. Moller-Merks opened a new 30,000 square meter warehouse in Tijuana, Mexico, to enhance cross-border trade capabilities for customers in the technology, automotive, retail, and lifestyle sectors. The facility, strategically located near major commercial ports and certified LEED Gold, offers a range of services, including storage, cross-docking, and value-added logistics, and aims to capitalize on the growing trend of nearshoring between Mexico and the U.S. Additionally, the growing trend of just-in-time inventory management has increased reliance on warehousing and distribution services.

The expansion of global trade has also led to a greater need for sophisticated warehousing solutions to manage cross-border shipments. Furthermore, the emphasis on reducing lead times and improving customer satisfaction has driven companies to optimize their warehousing and distribution strategies. Lastly, the integration of data analytics and IoT in warehousing operations has enhanced inventory management and distribution processes, contributing to the rapid growth of this segment.

End-use Insights

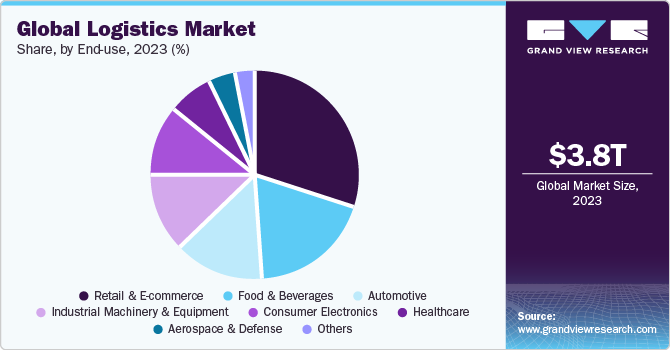

The retail & e-commerce segment held the largest market share of 29.5% in 2023 in the target market due to several key factors, such as the significant growth of the e-commerce sector. It has driven increased demand for supply chain services to fulfill online orders and manage the complex supply chains associated with online retail. The shift towards omnichannel retailing, where retailers integrate their online and physical store operations, has also contributed to the segment's growth.

Additionally, the rise of direct-to-consumer models has increased the need for efficient last-mile delivery services, further boosting demand within the retail & e-commerce segment. The segment's growth is further supported by factors such as increasing consumer preference for online shopping, the convenience of home delivery, and the expansion of online marketplaces. Furthermore, the competitive nature of the retail industry has led companies to invest in efficient logistics solutions to enhance customer satisfaction and maintain competitiveness, driving further growth in this segment.

The consumer electronics segment registered the fastest compound annual growth rate of 7.9% in the logistics market. The rapid pace of technological advancements and innovation in the consumer electronics industry has led to frequent product launches and updates, increasing the need for efficient and timely logistics services. Additionally, the growing demand for consumer electronics products, such as smartphones, tablets, and laptops, especially in emerging markets, has boosted the segment's growth. Moreover, the rise of e-commerce has significantly impacted the consumer electronics segment, driving the need for streamlined logistics operations to fulfill online orders and manage returns effectively.

The segment's growth is also influenced by factors such as increasing disposable income, changing consumer preferences, and the trend toward smart devices, all of which contribute to a higher demand for consumer electronics and, consequently, logistics services tailored to this sector. Lastly, the competitive nature of the consumer electronics market compels companies to focus on efficient supply chain management and logistics to gain a competitive edge, further fueling the growth of this segment in the logistics market.

Category Insights

The conventional logistics segment dominated the target market and accounted for the largest revenue share of 73.9% in 2023 due to its long-standing presence and established infrastructure. Traditional supply chain models have relied heavily on conventional logistics for transportation, warehousing, and distribution. Many industries, such as manufacturing, retail, and automotive, have well-established relationships with conventional logistics providers, contributing to their market dominance. Moreover, certain types of goods, such as large machinery or bulk commodities, are better suited for conventional logistics due to their size or nature.

While e-commerce logistics has grown rapidly, conventional logistics still dominates in terms of overall volume and revenue. Additionally, the complexity of some supply chains requires the specialized services and expertise offered by conventional logistics providers. The widespread availability of conventional logistics services, especially in remote or underdeveloped regions, also contributes to their market leadership. Furthermore, the integration of digital technologies and automation has helped conventional logistics providers improve efficiency and remain competitive in the market.

The e-commerce logistics segment is expected to register the fastest CAGR of 8.2% from 2024 to 2030 due to the rapid growth of online shopping. E-commerce has transformed the retail landscape, increasing the demand for specialized logistics services tailored to the needs of online retailers. The convenience of online shopping has resulted in a higher frequency of smaller, individual shipments, driving the need for efficient last-mile delivery solutions. The global reach of e-commerce has also fueled demand for cross-border logistics services, including customs clearance and international shipping. The increasing competition among e-commerce companies has led to a focus on fast and reliable delivery, further driving the growth of this segment.

Additionally, the integration of technology, such as real-time tracking and route optimization, has enhanced the efficiency of e-commerce logistics operations. The rise of omnichannel retailing, where customers expect seamless shopping experiences across online and offline channels, has further boosted the demand for e-commerce logistics services. For instance, in June 2024, Kuehne+Nagel began construction of a new e-commerce fulfillment and distribution center near Dubai's Al Maktoum Airport, scheduled to be operational by Q2 of 2025. The facility, located in EZDubai, will offer over 23,000 square meters of warehousing space and accommodate approximately 45,000 pallet positions, with a focus on sustainability and providing value-added services to customers.

Model Insights

The 3PL/contract logistics segment held the largest market share of 71.4% in 2023. Many companies prefer to outsource their logistics functions to third-party providers to reduce costs and improve efficiency. Third-party logistics providers offer specialized services and expertise, which can be more cost-effective than managing logistics in-house. Additionally, 3PLs often have a global network of warehouses and distribution centers, allowing them to offer comprehensive logistics solutions to businesses of all sizes. For instance, in July 2023, CJ Logistics, South Korea's largest 3PL group, announced its expansion in North America by investing USD 57 million to build logistics centers in Elwood, Des Plaines, and Secaucus. The aim was to accommodate the increasing volumes of South Korean exports to the U.S., particularly in secondary batteries, electric vehicles, and microchips, and to enhance its logistical capabilities with automation, big data, and AI technologies.

The growth of e-commerce has also contributed to the expansion of the 3PL segment, as online retailers require sophisticated logistics services to manage their supply chains. Furthermore, 3PLs are able to leverage technology and data analytics to optimize supply chain operations, further enhancing their appeal to businesses. The increasing complexity of supply chains and the need for greater flexibility and scalability have also driven companies to rely on 3PLs for their logistics needs. Lastly, 3PLs offer a wide range of services, including transportation, warehousing, inventory management, and freight forwarding, making them a one-stop solution for many businesses' logistics requirements.

The 4PL/Lead Logistics segment registered the fastest CAGR of 7.5% in the target market due to its unique value proposition and ability to offer comprehensive supply chain solutions. Unlike 3PLs, which primarily focus on specific supply chain functions, 4PLs act as a single point of contact and accountability for managing an entire supply chain. This holistic approach appeals to companies seeking to streamline their operations and achieve greater efficiency.

Additionally, the complexity of modern supply chains, driven by globalization and e-commerce, has increased the demand for integrated and scalable supply chain solutions, which 4PLs are well-equipped to provide. The rise of digital technologies has also played a significant role, as 4PLs leverage data analytics, AI, and IoT to optimize supply chain processes and enhance visibility. Furthermore, the flexibility and adaptability of 4PLs allow them to respond quickly to changing market conditions and customer demands, further fueling their growth.

Type Insights

The forward logistics segment held the largest market share of 68.3% in the logistics market. It encompasses the entire process of moving goods from manufacturers to end consumers, including transportation, warehousing, and distribution, which is the core of traditional supply chain services. The continuous growth of e-commerce has significantly increased the demand for efficient forward logistics to handle the rising volume of consumer deliveries. Advancements in supply chain technology and automation have optimized forward logistics operations, making them more efficient and cost-effective.

Additionally, businesses prioritize forward logistics to ensure customer satisfaction through timely and accurate deliveries, directly impacting their revenue and competitiveness. Furthermore, the global expansion of trade and manufacturing industries has bolstered the need for robust forward logistics networks to support international supply chains. Moreover, the focus on improving delivery speed and service quality to meet consumer expectations has driven investments in forward logistics infrastructure and capabilities.

The reverse logistics segment registered a significant CAGR of 6.8% in the target market due to the rapid growth of e-commerce, which has significantly increased the volume of returns and exchanges. Consumers' rising expectations for hassle-free return processes have driven companies to invest in efficient reverse logistics solutions. Additionally, growing environmental concerns and regulatory pressures have encouraged businesses to adopt sustainable practices, including recycling and refurbishing returned products. Advancements in technology, such as tracking systems and automated processing, have also enhanced the efficiency of reverse logistics operations. Furthermore, businesses have recognized that effective reverse logistics can improve customer satisfaction and loyalty, making it a crucial component of their overall supply chain strategy.

Operation Insights

The domestic segment held the largest market share of 73.6% in the market as the sheer volume of goods transported domestically is significantly higher compared to international shipments. Moreover, the domestic segment has advantages due to the well-developed infrastructure and network, which make it more accessible and navigable compared to the international supply chain. Additionally, shorter transit times, reduced costs, and simplified regulatory processes all contribute to the domestic segment's dominance in the target market. The surge in e-commerce and the escalating consumer preference for swift and dependable domestic delivery services have also played significant roles in driving the growth of this segment.

The international segment registered the fastest compound annual growth rate of 7.9% in the target market. Globalization has led to increased trade volumes between countries, resulting in a higher demand for international supply chain services. Additionally, advancements in transportation and communication technologies have made it easier and more cost-effective to conduct international trade, further boosting the growth of this segment. Furthermore, the rise of e-commerce has expanded the reach of businesses beyond domestic markets, leading to a greater need for efficient international logistics solutions. Moreover, the trend towards outsourcing logistics functions to third-party providers for cost-efficiency and expertise has also contributed to the growth of the international segment.

Mode of Transport Insights

The roadways segment held the largest market share of 43.3% in the market as road transportation is more flexible and accessible compared to other modes, allowing for door-to-door delivery and easy access to remote locations. Additionally, roadways offer a cost-effective solution for short to medium-distance transportation, making them a preferred choice for many businesses. Furthermore, the extensive road network in many regions ensures connectivity between major cities and industrial hubs, facilitating efficient transportation of goods.

The roadways segment also benefits from faster transit times compared to other modes, which is crucial for time-sensitive deliveries. Moreover, the growth of e-commerce and the need for last-mile delivery services have further boosted the demand for road transportation. Lastly, the ability of trucks and other vehicles to carry a wide range of goods, from perishable items to large machinery, makes road transportation a versatile and widely used option in the supply chain industry.

The waterways segment registered the fastest CAGR of 7.5% from 2024 to 2030. Water transportation is often more cost-effective for bulk goods and long-distance shipments compared to other modes of transport. Additionally, improvements in port infrastructure and the expansion of navigable waterways have increased the efficiency and capacity of water transportation, driving its growth. Additionally, growing environmental awareness has intensified the pursuit of sustainable transportation alternatives, making water transportation a more environmentally friendly option compared to road or air transport.

Moreover, the waterway's transportation can transport oversized and heavy cargo, critical for industries like construction and manufacturing, further enhancing its appeal. Moreover, the growth of international trade and the increasing demand for goods from emerging markets have further boosted the demand for water transportation. Lastly, advancements in technology and automation have improved the efficiency and safety of water transportation, making it an attractive option for businesses looking to optimize their supply chains.

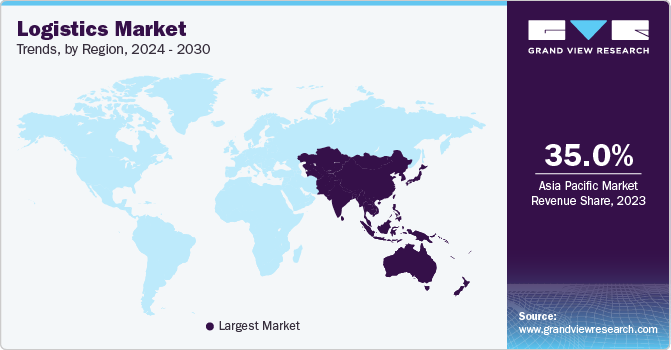

Regional Insights

North America maintained a notable 23.9% market share in the logistics sector in 2023, primarily driven by its advanced transportation infrastructure and established logistics industry. The region's strong economic performance fueled demand for logistics services, while its emphasis on technological innovation, including automation and digitalization, boosted operational efficiency. Additionally, North America's strategic geographical position and well-developed trade networks played a significant role in maintaining its significant market share in the global logistics industry.

U.S. Logistics Market Trends

The logistics market in the U.S. growth is propelled by various factors, including its robust economy, large consumer population, and sophisticated infrastructure. Key market participants like United Parcel Service of America, Inc., FedEx, and XPO Logistics are pivotal in stimulating this growth, utilizing their expansive networks and technological advancements to improve efficiency and adapt to changing market demands. These firms consistently invest in broadening their capacities and offerings, bolstering the overall expansion and competitiveness of the U.S. logistics sector.

Asia Pacific Logistics Market Trends

Asia Pacific logistics market asserted its dominance in 2023, capturing the largest revenue share at 35.0%. The Asia Pacific region also registered the fastest CAGR of 7.6% in the target market. This region's rapid economic growth, particularly in countries like China, India, and Southeast Asian nations, has driven increased demand for efficient supply chain services. Additionally, government initiatives aimed at improving transportation infrastructure and promoting trade have further fueled the growth of the logistics sector in Asia Pacific. The region's expanding middle class and the surge in e-commerce activities have also contributed to the increased demand for logistics services. Furthermore, the Asia Pacific region's strategic location as a gateway between the East and the West has made it a crucial hub for global trade, further boosting its market growth.

The logistics market in China held the largest market share of 26.1% in the target market in Asia due to its robust manufacturing sector and extensive transportation infrastructure. Furthermore, China's substantial investments in technology and innovation have strengthened its logistics capabilities, facilitating efficient supply chain management and prompt delivery of goods. These factors, combined with China's status as a global trade center, have led to its dominant position in the Asian logistics market. Moreover, China's large consumer base and growing e-commerce sector have also played a role in driving its market growth.

Europe Logistics Market Trends

Europe logistics market recorded the second fastest CAGR of 7.3% in the target market over the forecast period due to its advanced infrastructure and strategic geographical position, which facilitate efficient transportation and supply chain operations. The increasing demand for e-commerce has driven the need for more robust logistics solutions. Additionally, technological advancements, including automation and digitalization, have enhanced operational efficiency and reduced costs. Sustainability initiatives aimed at reducing carbon footprints have also played a significant role in driving market growth.

The logistics market in Germany is growing due to the country's strategic location in Europe, which facilitates efficient transportation and trade across the continent. The rise of e-commerce and increasing demand for fast, reliable delivery services have significantly boosted the logistics sector. Additionally, advancements in technology and automation are enhancing operational efficiency and driving growth in the industry.

Key Logistics Company Insights

Some of the key companies operating in the market include United Parcel Service of America, Inc. (UPS) and FedEx, among others.

-

United Parcel Service of America, Inc. provides supply chain management solutions globally. The company's services include transportation, contract logistics, distribution, third-party logistics, ocean freight, air freight, ground freight, and customs brokerage and insurance.

-

FedEx provides comprehensive transportation, logistics, warehousing, and courier delivery services, ensuring fast and reliable deliveries globally. With an extensive network, the company transports an average of 5.3 million packages daily, enhancing efficiency and customer experience through various support services.

Kerry Logistics and Toll Group are some of the emerging market companies in the target market.

-

Kerry Logistics Network Limited is an Asia-based 3PL provider with the core competency of providing customized solutions to international brands and multinational corporations to reduce overall costs, enhance their supply chain efficiency, and improve response time to the market. Kerrey Logistics Network Limited operates under two master brands namely Kerry Logistics and Kerry Express. The company delivers its solutions to key industry areas, including electronics & technology, fashion & lifestyle, food & beverage, pharmaceutical & healthcare, automotive, industrial & material science, and FMCG.

-

Toll Group is a provider of integrated logistics services. The company offers transport and logistics solutions globally and specializes in freight forwarding, warehousing, distribution, and supply chain management, catering to various industries such as retail, automotive, healthcare, and government. Toll Group utilizes an extensive network of vehicles, warehouses, and facilities to ensure efficient and reliable delivery of goods. Toll Group operates in Asia Pacific, EMEA, and the Americas, providing integrated logistics services globally.

Key Logistics Companies:

The following are the leading companies in the logistics market. These companies collectively hold the largest market share and dictate industry trends.

- Deutsche Post AG

- United Parcel Service of America, Inc.

- FedEx

- Maersk

- CEVA Logistics (The CMA CGM Group)

- DB Schenker

- Kuehne + Nagel

- Nippon Express

- Expeditors International

- DSV

- Kerry Logistics

- XPO Logistics

- Toll Group

- J.B. Hunt Transport Services

- C.H. Robinson Worldwide, Inc.

Recent Developments

-

In May 2024, A.P. Moller-Maersk announced the opening of a new air freight in-transit gateway in Miami, Florida, to enhance connectivity between Asia, Latin America, and the U.S., providing a strategic node in its global air freight network. The 90,000-square-foot facility, fully staffed by Maersk professionals, aims to support transhipping European and Asian cargo to Latin America, improving transit times, connectivity, and reliability for customers.

-

In November 2023, United Parcel Service of America, Inc. completed the acquisition of MNX Global Logistics, enhancing its capabilities in time-critical logistics, particularly for healthcare customers in the US, Europe, and Asia. This acquisition strengthened UPS's ability to handle radiopharmaceuticals and temperature-sensitive products, supporting its strategy to provide reliable and efficient logistics solutions.

-

In November 2023, A.P. Moller-Maersk signed a memorandum of understanding with Kumho Tire to provide multi-year logistics solutions. Maersk's fourth-party logistics visibility solution and domestic intermodal services would be leveraged to manage over 40,000 FFE volumes annually. This partnership aimed to enhance Kumho Tire's supply chain management, improve operational efficiency, generate cost savings, and optimize routes to reduce supply chain bottlenecks.

Logistics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3,931.8 billion |

|

Revenue forecast in 2030 |

USD 5,951.0 billion |

|

Growth rate |

CAGR of 7.2% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Service, category, model, type, operation, mode of transport, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Deutsche Post AG; United Parcel Service of America, Inc.; FedEx; Maersk; CEVA Logistics (The CMA CGM Group); DB Schenker; Kuehne + Nagel; Nippon Express; Expeditors International; DSV; Kerry Logistics; XPO Logistics; Toll Group; J.B. Hunt Transport Services; C.H. Robinson Worldwide, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Logistics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global logistics market report based on service, category, model, type, operation, mode of transport, end use, and region.

-

Service Outlook (Revenue, USD Billion, 2017 - 2030)

-

Transportation Services

-

Warehousing and Distribution Services

-

Freight Forwarding Services

-

Inventory Management Services

-

Value-Added Logistics Services

-

Integration & Consulting Services

-

-

Category Outlook (Revenue, USD Billion, 2017 - 2030)

-

Conventional Logistics

-

E-Commerce Logistics

-

-

Model Outlook (Revenue, USD Billion, 2017 - 2030)

-

3PL/Contract Logistics

-

4PL/Lead Logistics

-

Others

-

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Forward Logistics

-

Reverse Logistics

-

-

Operation Outlook (Revenue, USD Billion, 2017 - 2030)

-

Domestic

-

International

-

-

Mode of Transport Outlook (Revenue, USD Billion, 2017 - 2030)

-

Roadways

-

Waterways

-

Airways

-

Railways

-

-

End Use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Retail & E-commerce

-

Food & Beverages

-

Automotive

-

Industrial Machinery and Equipment

-

Consumer Electronics

-

Healthcare

-

Aerospace & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Mexico

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global logistics market size was estimated at USD 3,794.4 billion in 2023 and is expected to reach USD 3,931.8 billion in 2024.

b. The global logistics market is expected to grow at a compound annual growth rate of 7.2% from 2024 to 2030 to reach USD 5,951.0 billion by 2030.

b. The transportation services segment dominated the target market with a 29.5% revenue share in 2023, driven by its essential role in ensuring timely delivery of goods, the rise of e-commerce, increased international trade, technological advancements, and infrastructure investments.

b. Key players in the logistics market include Deutsche Post AG, United Parcel Service of America, Inc., FedEx, Maersk, CEVA Logistics (The CMA CGM Group), DB Schenker, Kuehne + Nagel, Nippon Express, Expeditors International, DSV, Kerry Logistics, XPO Logistics, Toll Group, J.B. Hunt Transport Services, C.H. Robinson Worldwide, Inc.

b. The logistics market is growing due to the rapid expansion of online retail, driving demand for efficient services in last-mile delivery and warehousing, as well as increasing customer expectations for faster deliveries. Additionally, improvements in transportation infrastructure and the complexity of international trade are further boosting the demand for supply chain services, requiring more efficient and agile supply chains.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."