- Home

- »

- Communications Infrastructure

- »

-

Global Logistics Insurance Market Size & Share Report, 2030GVR Report cover

![Logistics Insurance Market Size, Share & Trends Report]()

Logistics Insurance Market (2023 - 2030) Size, Share & Trends Analysis Report By Coverage Type (Cargo Insurance, Marine Services Liability), By Industry (Transportation, Marine), By End User, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-844-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

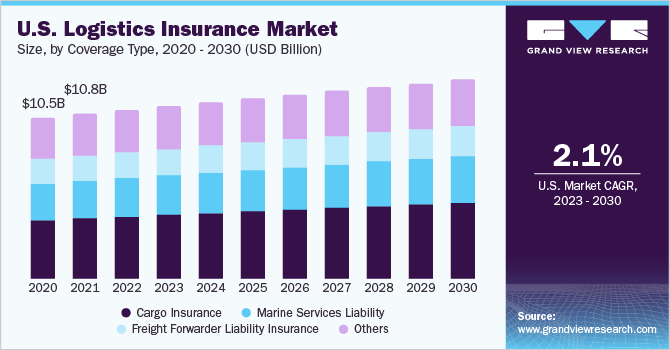

The global logistics insurance market size was estimated at USD 56.42 billion in 2022 and is projected to reach USD 70.46 billion by 2030, growing at a CAGR of 2.8% from 2023 to 2030. The transportation industry's rapid growth in emerging economies is expected to favorably impact the logistics insurance market. As the transportation industry expands, the volume of goods transported also increases, leading to a higher risk of damage or loss during transit. The increased risk makes logistics insurance important for both shippers and carriers. Additionally, the transportation infrastructure may be less developed in emerging economies than in established markets, creating additional cargo risks during transit. For instance, poorly maintained roads, inadequate security, and limited access to technology can increase the risk of cargo theft, damage, or loss. In such scenarios, logistics insurance becomes critical to protect the interests of all parties involved.

Additionally, the growing trend of digital insurance has significantly impacted the logistics insurance market, leading to increased competition, improved efficiency, increased customer satisfaction, more personalized products, and reduced costs. Data analytics plays a crucial role in enabling logistics insurance companies to tailor their products to meet the specific needs of individuals or enterprises. With vast amounts of data, logistics insurance companies can analyze customers' behaviors and preferences, identify their specific risks and insurance needs, and develop products that provide the right coverage at the right price. For instance, an insurance provider can analyze a logistics company's shipping patterns, cargo types, and destinations to identify their risks and develop a tailored insurance policy covering their specific needs.

Fintech has had a positive impact on the logistics insurance market. Fintech companies have introduced new technologies, such as big data analytics, machine learning, and artificial intelligence, improving risk management in the logistics insurance market. This has enabled insurers to assess risks better and provide the best-suited insurance policies. In the logistics insurance market, big data analytics is used to collect data on various factors such as transportation routes, types of cargo, weather conditions, and other factors that could affect the likelihood of a loss. By analyzing this data, insurers can identify risk factors and take appropriate measures to reduce the risk of losses.

Regulatory compliance has a significant impact on the logistics insurance market. It ensures that insurance products and services meet specific quality standards, protect consumers, promote fair competition, and require insurers to have robust risk management policies and procedures. Insurance companies are required to be licensed and registered by regulatory bodies. These bodies oversee insurers' operations to ensure they comply with regulatory requirements. For instance, the National Association of Insurance Commissioners (NAIC) is a regulatory body that oversees the insurance industry in the U.S. It comprises state insurance commissioners who work to promote uniformity in insurance regulation across states.

One major restraint of the logistics insurance market is the lack of awareness regarding logistics insurance policies. A major factor for the lack of awareness is the perception that logistics insurance is an unnecessary expense. Many businesses or individuals assume that the risk of loss or damage is low and that they can absorb any possible losses. Also, the logistics industry is prone to high claims frequency owing to the nature of the risks involved. As a result, this can put pressure on insurers to effectively manage claims while maintaining profitability.

COVID-19 Impact Analysis

The COVID-19 pandemic has had a slightly negative impact on the logistics insurance market. With the slowdown in global trade and supply chain disruptions caused by the pandemic, there has been a reduced demand for logistics insurance. The pandemic disrupted the global supply chains caused by a significant reduction in the volume of goods being transported and delays and cancellations of shipments. With fewer goods being transported, the demand for logistics insurance has decreased. Additionally, many businesses have had to reduce their operations or even shut down temporarily due to the pandemic, reducing the demand for logistics insurance.

Coverage Type Insights

The cargo insurance segment dominated the market in 2022 and accounted for a revenue share of more than 36.0%. The growth of cargo insurance is driven by increasing demand among transport owners, cargo owners, and charterers. These stakeholders are becoming aware of the potential risks involved in transporting goods and the need to protect their assets from potential losses and damages. Cargo owners and transport companies face various risks, including damage to cargo during transit, theft, accidents, and natural disasters. The costs associated with such risks can be significant and can severely impact the profitability of businesses. As a result, many companies are seeking to mitigate their risks by investing in cargo insurance.

The freight forwarder liability insurance segment is anticipated to register significant growth over the forecast period. The rise in demand for freight forwarder liability insurance can be attributed to the complexity of modern supply chains, the handling of high-value shipments, and the need for companies to safeguard themselves against the potential risk of legal claims or lawsuits. The complexity of supply chains has increased with the global expansion of trade, involving multiple stakeholders and transportation modes. Freight forwarders are responsible for managing these supply chains, which can expose them to greater liability risks in the event of shipment delays, damage, or loss.

Industry Insights

The marine segment dominated the market in 2022 and accounted for a revenue share of over 55.0%. The marine industry is responsible for transporting high-value goods such as oil, gas, and raw materials, making it an essential component of international trade. As a result, marine cargo insurance is critical for protecting the financial interests of shippers, insurers, and other stakeholders involved in the supply chain. According to the Review of Marine Transport 2021 published by the United Nations, maritime trade grew by 3.2% to 10.96 billion tons in 2021. Gas, containerized cargo, and dry bulk shipping cargo expanded, while crude oil shipments declined from 16.0% to 15.5% of maritime trade.

The transportation segment is anticipated to register significant growth over the forecast period. With the increasing number of consumers shopping online, businesses need to transport their products across different regions and countries to reach their customers. This has led to an increase in the number of trucks and railroads used to transport goods, resulting in more risks that need to be insured. Accidents, theft, and damage to goods during transit are some risks that need to be insured. As a result, transportation companies are increasingly investing in logistics insurance to protect themselves from these risks.

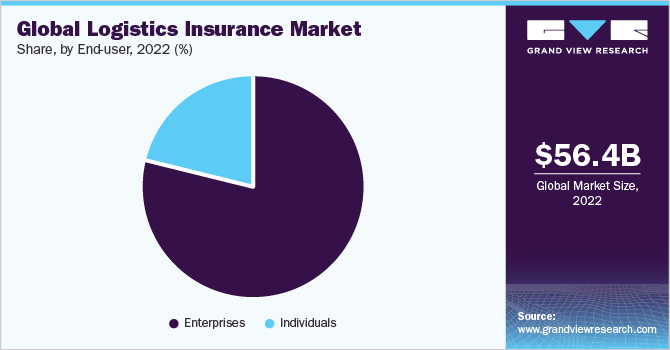

End User Insights

The enterprises segment dominated the market in 2022 and accounted for a global revenue share of over 79.0%. This can be attributed to their large volumes of goods and higher risk profiles in transportation. Enterprises need logistics insurance to effectively protect their business assets and operations from potential damages and losses that may occur during the transportation of goods. Businesses are legally responsible for the safety of their goods during transportation. Logistics insurance provides coverage for legal liabilities that may arise due to damages or injuries caused to third parties during transportation.

The individuals segment is anticipated to register significant growth over the forecast period. With the rise of e-commerce, more people are shopping online and having their purchases delivered to their homes. This has increased the need for logistics insurance to protect against any loss or damage that may occur during transit. Moreover, the logistics industry constantly evolves, with new technologies and delivery methods introduced to improve efficiency and speed. While these advancements bring many benefits, they also bring new risks that need to be insured, such as cyber-attacks, supply chain disruptions, and product liability claims.

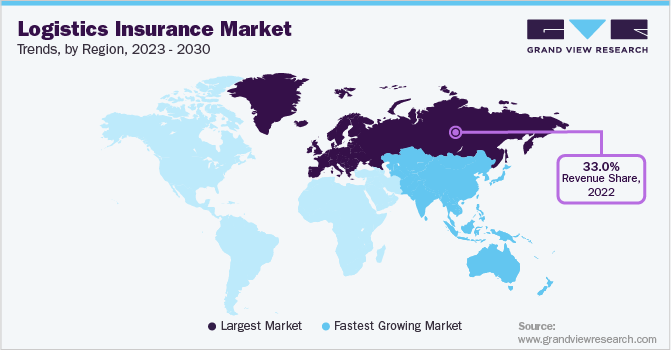

Regional Insights

Europe dominated the logistics insurance market in 2022 and accounted for a revenue share of more than 33.0%. The region's growth can be attributed to the region's strategic location at the crossroads of major global trade routes, including the North Atlantic, the Mediterranean, and the Asia Pacific region, which has facilitated the development of a highly sophisticated logistics and transportation network. This network includes a vast array of modes of transportation, such as seaports, airports, railroads, and highways. The development of this logistics and transportation network has created a significant demand for logistics insurance products in the region.

The Asia Pacific regional market is expected to emerge as the fastest-growing market over the forecast period. The Asia Pacific region has witnessed remarkable economic growth, particularly in countries such as China and India. This expansion has resulted in a surge of international trade and logistics operations in these countries. This has consequently led to an augmented requirement for logistics insurance products to mitigate potential risks and safeguard businesses.

Key Companies & Market Share Insights

Prominent logistics insurance companies are aggressively investing in strategic initiatives, such as partnerships, mergers and acquisitions, and product launches to stay ahead of the competition and offer innovative solutions to their customers. Logistics insurance companies are also focusing on investing in research and development in areas such as supply chain optimization, risk assessment, and claims processing. The main purpose of the companies to invest in research & development activities is to improve service and thereby enhance their efficiency. This type of investment help companies in staying competitive and provide innovative solutions to their customers.

Furthermore, companies are also focusing on mergers and acquisitions for improving their services. For instance, in October 2021, Allianz acquired 66% of Jubilee Insurance Company of Uganda Limited, an insurance company based in Uganda that offers a variety of insurance including marine insurance, health insurance, and life insurance. Through this strategic initiative, Allianz would be able to serve customers in East Africa, thus resulting in increased market share. Some of the prominent players in the logistics insurance market include:

-

American International Group, Inc.

-

Allianz

-

DB Schenker

-

Peoples Insurance Agency

-

United Parcel Service of America, Inc.

-

AXA SA

-

Thomas Miller Group.

-

Concord

-

AsstrA-Associated Traffic AG

-

Arch Group

Logistics Insurance Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 58.12 billion

Revenue forecast in 2030

USD 70.46 billion

Growth rate

CAGR of 2.8% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Coverage type, industry, end user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; India; China; Japan; Singapore; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

American International Group, Inc.; Allianz; DB Schenker; Peoples Insurance Agency; United Parcel Service of America, Inc.; AXA SA; Thomas Miller Group; Concord; AsstrA-Associated Traffic AG; Arch Group

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Logistics Insurance Market Report Segmentation

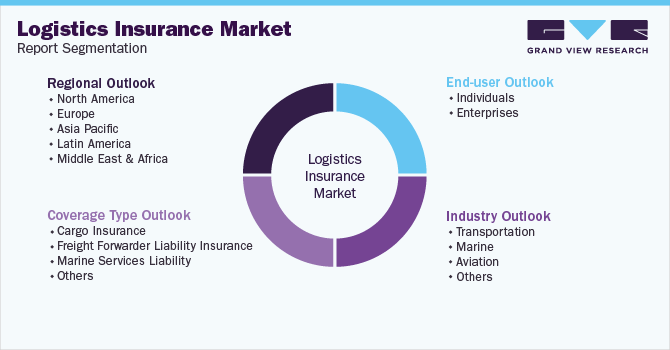

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global logistics insurance market report based on coverage type, industry, end user, and region.

-

Coverage Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cargo Insurance

-

Freight Forwarder Liability Insurance

-

Marine Services Liability

-

Others

-

-

Industry Outlook (Revenue, USD Billion, 2017 - 2030)

-

Transportation

-

Marine

-

Aviation

-

Others

-

-

End User Outlook (Revenue, USD Billion, 2017 - 2030)

-

Individuals

-

Enterprises

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Singapore

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global logistics insurance market size was estimated at USD 56.42 billion in 2022 and is expected to reach USD 58.12 billion in 2023.

b. The global logistics insurance market is expected to grow at a compound annual growth rate of 2.8% from 2023 to 2030 to reach USD 70.46 billion by 2030.

b. Europe dominated the logistics insurance market with a share of 33.61% in 2022. This is attributable to the well-established logistics infrastructure, large consumer base, and increasing regional manufacturing sector.

b. Some key players operating in the logistics insurance market include American International Group, Inc.; Allianz; DB Schenker; Peoples Insurance Agency; United Parcel Service of America, Inc.; AXA SA; Thomas Miller Group; Concord; AsstrA-Associated Traffic AG; and Arch Group.

b. Key factors that are driving the market growth include the rapid growth of the transportation industry in emerging economies and the growing trend of digital insurance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.