- Home

- »

- Automotive & Transportation

- »

-

Locomotive Market Size, Share And Growth Report, 2030GVR Report cover

![Locomotive Market Size, Share & Trends Report]()

Locomotive Market Size, Share & Trends Analysis Report By Type (Diesel, Electric), By Technology (IGBT Module, GTO Thyristor), By Component, By End-use (Freight, Passengers, Switcher), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-100-4

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

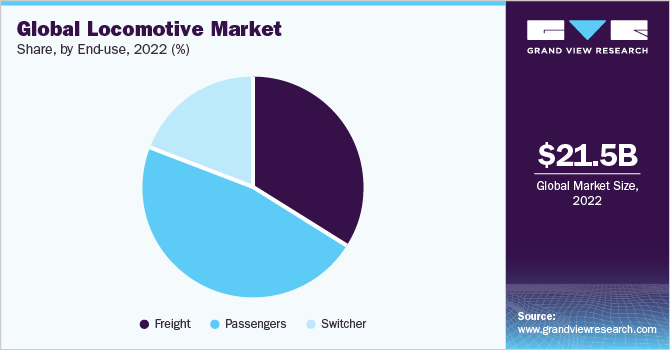

The global locomotive market size was estimated at USD 21.54 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.8% from 2023 to 2030. The growth of the locomotive industry is majorly attributed to the increasing investment in the infrastructure of rail networks planned by the public and private players. Additionally, growing developments in the urban and metropolitan areas, owing to the rise in population are further anticipated to increase the demand for improved rail networks, thereby driving the market growth. Moreover, a growing number of government initiatives in improving railway infrastructure and deploying new-age locomotives that travel faster are expected to drive the locomotive industry growth over the forecast period.

The growing focus of government agencies in optimizing the railway infrastructure to ease the travel experience of commuters has been one of the major factors contributing to the market growth. For instance, in November 2021, the U.S. government announced a USD 1.2 trillion infrastructure investment plan, wherein funds will be provided by the Federal Transportation Administration (FTA) over a period of five years.

Also, several locomotive manufacturers are partnering with government agencies to invest and develop advanced locomotives beneficial for economic development. In February 2023, Alstom, a smart and sustainable mobility manufacturer, partnered with the Government of Quebec, Charlevoix Railway, Train de Charlevoix, Harnois Energies, and HTEC to develop a hydrogen-powered passenger demonstration train, the Coradia iLint. Harnois Energies will manufacture the green hydrogen-powered train in Quebec City.

Additionally, investments in advanced locomotive technologies, such as high-speed rail and electric/hybrid locomotives that are poised to reduce carbon emissions and promote sustainable transportation, have further contributed immensely to the growth of the locomotive market. For instance, in November 2021, Wabtec Corp entered into a contractual agreement with Egyptian National Railways (ENR) to provide 100 ES30ACI Evolution Series Locomotives and a comprehensive, multi-year service agreement for ongoing fleet maintenance. The locomotive supply contract, financially supported by the European Bank for Development and Reconstruction, underscores their commitment to providing the necessary funding for this substantial project.

Locomotive Market Size, Share & Growth Insights:

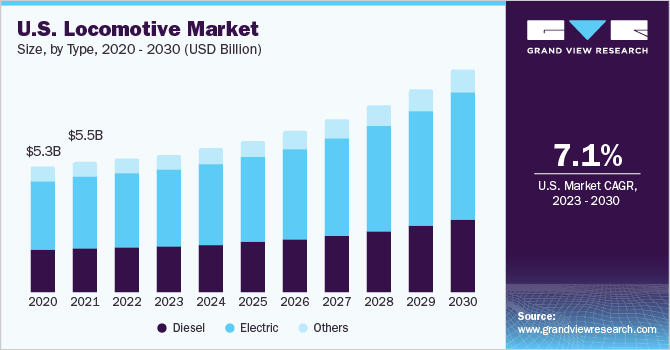

- The U.S. locomotive market size was estimated at USD 5.5 billion in 2021.

- The global market size is expected to grow at a CAGR of 8.8% from 2023 to 2030.

- The electric locomotive segment accounted for the largest market share of 54% in 2022.

The growing concerns regarding fuel emission and environmental sustainability have been creating considerable demand for low-carbon and emission-free locomotives. In June 2022, the transportation sector in the U.S. and Canada accounted for approximately 27% of greenhouse gas emissions in 2020, with the movement of freight by rail contributing just over 2.3% to that total. It is worth noting that rail transit consumes only a quarter of the fuel required for automobile travel and emits significantly lower greenhouse gases, with reductions of up to 75%. This focuses attention on the environmental advantages of rail transportation as an eco-friendly freight movement alternative.

Several locomotive players plan to help railroad transition and develop diesel-electric locomotives to cut and eventually eliminate greenhouse gas emissions. In October 2022, Union Pacific, North America's rail-road franchise, unveiled a collaboration with green technology provider, ZTR Control Systems, LLC, to develop cutting-edge hybrid-electric locomotives set to be delivered by 2023 in the U.S. Also, an additional five hybrid-electric locomotives are projected to be delivered in 2024 as per the collaboration. This initiative by Union Pacific involves replacing a single diesel locomotive with a pair of locomotives, referred to as 'mother-slug' sets, thereby enhancing operational efficiency and sustainability.

Type Insights

Based on type, the electric segment accounted for the largest share of over 54% of the locomotive market in 2022. The growth of this segment is attributed to the increasing focus of public & private manufacturers on environmental sustainability. Electric locomotives produce lower emissions, reducing air pollution and greenhouse gas emissions. Thus, rising inclination toward electric mobility and the use of renewable resources, the segment is poised to grow considerably over the forecast period. Additionally, the increasing concerns by governments and regulatory bodies to increase the adoption of electric locomotives as part of their efforts to combat climate change are also contributing to the growth of the locomotive industry.

The diesel-type segment is expected to grow at a considerable CAGR over the forecast period. The growth of this segment is due to diesel-powered locomotives’ ability to provide high-power, minimum infrastructure requirements for deployment and performance. The diesel locomotive segment growth is also due to advancements with engine upgrades, emission control systems, and fuel efficiency improvements, contributing to reduced emissions and operating costs for diesel locomotives, contributing to locomotive industry growth.

Technology Insights

By technology, the IGBT module segment accounted for the largest share of over 56% of the global locomotive market in 2022. The growth of this segment is attributed to the growing demand for efficient and reliable power electronics solutions for traction, propulsion, and control systems in modern rail transportation. The demand for IGBT modules is increasing in long-distance locomotives.

The SiCpower module segment is expected to grow at the highest CAGR over the forecast period. The growth of this segment is owing to the growing demand for lightweight traction converters with high efficiency, smaller sizes, lower thermal loss, and improved power. Moreover, the increasingly stringent emissions and energy efficiency regulations are driving the adoption of advanced technologies in the locomotive industry. SiC power modules contribute to reducing energy consumption and improving efficiency, aligning with these regulatory requirements and environmental concerns.

Component Insights

By component, the rectifier segment accounted for the largest share of over 27% of the global locomotive market in 2022. The growth of the segment is attributed to the growing demand for electric locomotives to convert AC to DC supply for the DC traction motors. Moreover, the rising demand for more efficient and reliable power conversion solutions helps reduce energy consumption and operating costs for locomotives.

The traction motor segment is expected to grow with the highest CAGR over the forecast period. There is a rising demand for traction motors in locomotives for high efficiency through loss of reduction. Many locomotive manufacturers produce traction motors to fulfill the growing demand in the locomotive industry. For instance, in June 2022, ŠKODA Transportation A.S, a Czech-based engineering company, received a contract from Wabtec Corporation, a rail technology provider, for the production and delivery of an additional 26 locomotives in Kazakhstan. The contract is worth over EUR 12 million (USD 13.36 million) and covers the delivery of 156 mechanical traction drives, including gearboxes, traction motors, and wheelsets.

End-use Insights

By end-use, the passenger segment accounted for the largest share of over 47% of the global locomotive market in 2022. The segment growth is attributed to a rising number of vehicles on the road; the public is shifting toward rail transport options for daily and last-mile commutes. In developing countries with a high density of middle-income population, public transport is preferred over private commutes. Moreover, many governments worldwide are investing in expanding and modernizing their railway networks to improve passenger transportation. Governments provide financial support, subsidies, and incentives to promote the development of passenger rail systems, thus boosting market growth.

The freight segment is expected to witness considerable growth over the forecast period. The growth of this segment is due to the rise in the e-commerce industry. The growth of the economy, global trade, energy efficiency, cost savings, capacity and scale advantages, intermodal transportation, infrastructure development, and safety considerations are key driving factors in the locomotive industry. Moreover, the need for efficient, reliable, and cost-effective freight transportation solutions contributes to the growth of the segment.

Regional Insights

In 2022, North America held a substantial market share of over 34% in terms of revenue due to the growing adoption of electric and autonomous locomotives in countries across the U.S. and Canada. The rising concerns of greenhouse gas emissions led to the growing usage of battery electric power, reducing greenhouse gas and improving local air quality. The government is investing in advanced electric locomotives to reduce green gas emissions.

For instance, in January 2022, Union Pacific Railroad announced the purchase of 20 battery-electric freight locomotives from Wabtec Corporation, a rail technology provider, and Progress Rail, a subsidiary of Caterpillar. With a valuation exceeding USD 100 million, the contract entails the acquisition of battery-electric locomotives, which will be initially deployed for train carriage sorting activities in rail yards of California and Nebraska. This substantial investment underlines the company's commitment to leveraging environmentally friendly technologies and optimizing operational efficiency within the rail industry. These initiatives are further encouraging locomotive industry growth.

Asia Pacific is projected to emerge as one of the most lucrative regions for the market in terms of revenue during the forecast period, growing at a significant CAGR. The region's dominance can be attributed to various factors, such as the increasing advancement of rail infrastructure, investment by the government in the development of the railway industry, and the widespread use of affordable public transport for daily commuting and last-mile travel.

For instance, in February 2022, the Indian government announced an investment of USD 32.7 billion for the rail sector. The investment includes the development of railway infrastructure and the development of rolling stocks. In addition, about 400 Vande Bharat trains are to be received and 100 new multimodal freights are to be built over the period of three years. This development and advancement in developing countries drive the growth of the locomotive industry.

Key Company & Market Share Insights

The locomotive market is considerably fragmented, with numerous large and medium-sized players in the market. Prominent market players are making investments in research and development (R&D) to expand their offerings, thereby fostering further growth in the locomotive market. These market players also pursue diverse strategic initiatives to enhance their global presence, such as launching new products, entering into contractual agreements, engaging in mergers and acquisitions, ramping up investments, exploring market developments, and forging collaborations with other organizations.

For instance, in September 2022, Siemens Mobility and Akiem, a leading rolling stock leasing specialist, announced the expansion of their partnership agreement. As per the agreement, Siemens Mobility will supply Akiem with 65 Vectron AC and Vectron MS locomotives. These locomotives boast a maximum power capacity of 6.4MWs which would achieve high speeds of up to 200km/h or 230km/h, enabling swift and efficient freight and passenger services across multiple European countries. This strategic collaboration between Siemens Mobility and Akiem further solidifies their commitment to delivering advanced locomotive solutions and expanding their market presence in the European rail industry. Some prominent players in the global locomotive market include:

-

AEG Power Solutions B.V.

-

Alstom

-

Bharat Heavy Electricals Limited

-

CRRC Corporation Limited

-

Hitachi, Ltd.

-

Mitsubishi Heavy Industries, Ltd.

-

Siemens AG

-

Strukton

-

Toshiba Corporation

-

Wabtec Corporation

Locomotive Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 22.50 billion

Revenue forecast in 2030

USD 40.70 billion

Growth rate

CAGR of 8.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, technology, component, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; Russia; China; India; Japan; Australia; Brazil; Mexico; Argentina

Key companies profiled

CRRC Corporation Limited; Alstom; Siemens AG; Strukton; AEG Power Solutions B.V.; Wabtec Corporation; Toshiba Corporation; Bharat Heavy Electricals Limited; Hitachi; Ltd.; Mitsubishi Heavy Industries; Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Locomotive Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global locomotive market report based on type, technology, component, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Diesel

-

Electric

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

IGBT Module

-

GTO Thyristor

-

SiC Power Module

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Rectifier

-

Inverter

-

Traction Motor

-

Alternator

-

Auxiliary Power Unit (APU)

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Freight

-

Passengers

-

Switcher

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global locomotive market size was estimated at USD 21.54 billion in 2022 and is expected to reach USD 22.50 billion in 2023.

b. The global locomotive market is expected to grow at a compound annual growth rate of 8.8% from 2023 to 2030 to reach USD 40.70 billion by 2030.

b. The electric segment is estimated to account for the largest share of over 54% of the locomotive market in 2022. The growth of this segment is attributed to the increasing focus of public & private manufacturers on environmental sustainability.

b. Some key players operating in the locomotive market include CRRC Corporation Limited, Alstom, Siemens AG, Wabtec Corporation, and Strukton.

b. Key factors driving the locomotive market growth include the increasing investment in the infrastructure of rail networks planned by the public and private players, along with growing developments in the urban and metropolitan areas owing to the rise in population are further anticipated to increase the demand for improved rail networks.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."