- Home

- »

- Communications Infrastructure

- »

-

Location Intelligence Market Size And Share Report, 2030GVR Report cover

![Location Intelligence Market Size, Share, & Trends Report]()

Location Intelligence Market (2025 - 2030) Size, Share, & Trends Analysis Report By Component (Software, Service), By Location Type (Indoor, Outdoor), By Deployment, By Application, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-401-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Location Intelligence Market Summary

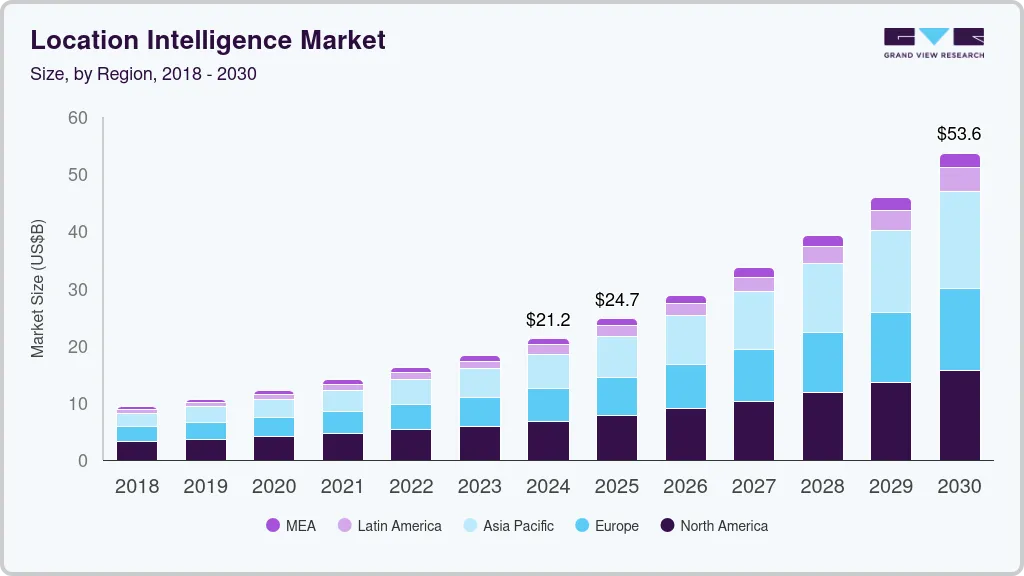

The Global Location Intelligence Market size was estimated at USD 21.21 billion in 2024 and is projected to reach USD 53.62 billion by 2030, growing at a CAGR of 16.8% from 2025 to 2030. The market's growth can be attributed to the increasing penetration of smart devices and rising investments in IoT and network services, which enable smarter applications and enhance network connectivity.

Key Market Trends & Insights

- The location intelligence market in North America held a share of over 32.0% in 2024.

- The location intelligence market in the U.S. is expected to grow significantly at a CAGR of 14.7% from 2025 to 2030.

- By component, the software segment accounted for the largest revenue share of over 60.0% in 2024.

- By location type, the outdoor segment accounted for the largest revenue share of over 61.0% in 2024.

- By deployement, the on-premise segment accounted for the largest revenue share of over 54.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 21.21 Billion

- 2030 Projected Market Size: USD 53.62 Billion

- CAGR (2025-2030): 16.8%

- North America: Largest market in 2024

The COVID-19 pandemic accelerated the adoption of location intelligence solutions as businesses leveraged these tools to navigate evolving market dynamics, optimize operations, and improve customer experience through data analysis, mapping, and location-based insights. In addition, retail, transportation, and healthcare industries are increasingly adopting location intelligence to improve supply chain management, asset tracking, and personalized marketing, further propelling market growth.

The market expansion is also driven by the increasing penetration of smart devices, including smartphones, tablets, and IoT-connected devices, which are becoming integral to both consumer and enterprise ecosystems. As these devices become more widespread, they generate vast amounts of location-based data that businesses can harness to gain insights into customer behavior, optimize operations, and improve decision-making. Moreover, the ongoing adoption of advanced network services enhances connectivity, making real-time location intelligence more accessible and effective.

IoT devices, connected via high-speed networks, provide rich data streams that can be analyzed to produce location-based insights. This capability is beneficial for industries such as logistics, retail, and healthcare, where understanding the movement of assets, products, or patients can lead to improved efficiency and customer satisfaction. As IoT infrastructure grows and networks improve, the ability to capture and analyze location data in real time is expected to become even more sophisticated, fueling further adoption of location intelligence solutions.

Government agencies, including defense departments, rely on location intelligence to improve national security and safeguard public welfare. By integrating geographic information systems (GIS) and advanced spatial analytics, these sectors can better analyze, interpret, and respond to various threats, from border security challenges to natural disasters. Moreover, the COVID-19 pandemic also had a profound impact on the location intelligence market, accelerating adoption as companies sought solutions to manage rapidly changing business scenarios. Location intelligence tools helped businesses adapt by enabling them to track shifts in consumer behavior, respond to changing market demands, and manage their workforce and assets more effectively.

Component Insights

The software segment accounted for the largest revenue share of over 60.0% in 2024. The integration of AI and machine learning technologies within location intelligence software is also accelerating the segment growth. By leveraging these technologies, software can analyze data more precisely, detect patterns, predict trends, and offer proactive solutions. For example, retail businesses use predictive analytics to determine ideal store locations, while logistics companies utilize these insights for route optimization. As AI-enabled software solutions evolve, they allow companies to move from reactive to predictive and prescriptive insights, improving operational efficiencies and customer engagement strategies.

The service segment is expected to grow at a CAGR of 17.0% over the forecast period, driven by the rising complexity of location intelligence technologies, which often require specialized expertise to implement, maintain, and scale effectively. Organizations are turning to service providers for support with the integration of location intelligence systems into their existing infrastructure, ensuring seamless data collection and analysis. These services often include training for in-house teams and customizing dashboards, analytics, and reporting tools. The demand for such services is amplified by the rapid evolution of technologies such as artificial intelligence (AI), machine learning (ML), and real-time analytics, which enhance the predictive capabilities of location intelligence platforms but require skilled professionals for optimal deployment and use.

Location Type Insights

The outdoor segment accounted for the largest revenue share of over 61.0% in 2024, owing to the proliferation of GPS-enabled devices and the increased use of real-time data in outdoor applications. With GPS technology embedded in almost every smartphone and a significant rise in IoT-connected devices in sectors like agriculture, logistics, and construction, there is a substantial increase in outdoor data points that organizations can leverage. Businesses are increasingly relying on these data points to improve location-based insights for outdoor applications, such as optimizing fleet routes, enhancing resource management, and improving public safety initiatives.

The indoor segment is expected to grow at a significant CAGR over the forecast period, driven by advancements in indoor positioning technologies and the increasing demand for location-based services within indoor environments. Indoor spaces, such as shopping malls, airports, hospitals, and large corporate campuses, present unique challenges for traditional GPS-based solutions due to their structural complexities. Technologies such as Wi-Fi, Bluetooth Low Energy (BLE) beacons, ultra-wideband (UWB), and LiDAR are addressing these limitations by enabling precise indoor navigation and location tracking. As these technologies evolve and become more affordable, they are opening up new opportunities for businesses to implement location intelligence solutions that cater specifically to indoor settings, enhancing customer experience and operational efficiency.

Deployment Insights

The on-premise segment accounted for the largest revenue share of over 54.0% in 2024. Many industries, particularly those in finance, healthcare, and government, prioritize on-premise solutions due to the need to safeguard sensitive information. These sectors often operate under strict regulatory guidelines, which mandate robust data protection measures. On-premise deployments give organizations direct control over their infrastructure and data storage, allowing them to maintain compliance with industry regulations.

The cloud segment is expected to grow at a significant CAGR over the forecast period due to the need for operational efficiency and cost reduction in transportation and logistics. Cloud-based location intelligence is increasingly used for route optimization, fleet management, and asset tracking. With cloud deployment, logistics companies gain real-time visibility into supply chains, helping them reduce fuel costs, improve delivery times, and manage inventory effectively. By using cloud services, companies avoid the need for heavy infrastructure, gaining flexibility and scalability, which are crucial for adapting to fluctuating demand. This not only supports faster decision-making but also helps companies reduce their environmental footprint by minimizing unnecessary travel and optimizing resource usage.

Application Insights

The sales and marketing optimization segment accounted for the largest revenue share of over 19.0% in 2024. With consumers increasingly using mobile phones to browse and make purchases, businesses can leverage mobile location data to understand customer journeys, anticipate needs, and interact with customers in real time. Mobile applications often collect geolocation data, providing companies with rich insights into consumer habits and preferences. This data can be used to develop hyperlocal marketing strategies, such as sending push notifications with discounts to customers near a physical store, thus increasing the likelihood of conversion. Such location-based marketing tactics have proven highly effective, particularly in retail, dining, and hospitality, where customer proximity plays a key role in purchasing decisions.

The remote monitoring segment is expected to grow at a significant CAGR over the forecast period. The transportation and logistics industries are leveraging telematics solutions to monitor vehicles in real time. These systems use GPS and location data to track vehicle movements, optimize routes, and monitor driver behavior. This not only improves operational efficiency but also enhances safety and compliance with regulations. The growing demand for efficient fleet management solutions is a significant driver for remote monitoring technologies within the location intelligence market.

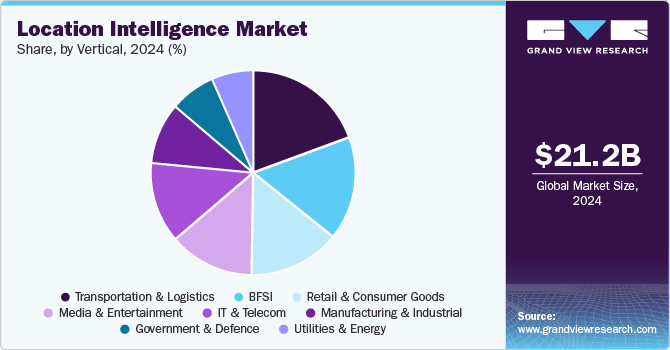

Vertical Insights

The transportation and logistics segment accounted for the largest revenue share of over 19.0% in 2024 due to the increasing demand for efficient supply chain management. As global trade expands and consumer expectations rise for faster delivery times, companies are seeking ways to optimize their logistics operations. Location intelligence provides real-time insights into transportation routes, inventory levels, and shipment statuses, enabling businesses to make informed decisions that enhance efficiency and reduce costs. By leveraging geographic data, logistics firms can analyze traffic patterns, predict delays, and adjust routes dynamically, leading to improved service levels and customer satisfaction.

The retail and consumer goods segment is expected to grow at a significant CAGR over the forecast period due to the rise of omnichannel retailing, where consumers expect a seamless shopping experience across various platforms, online, mobile, and in-store. Location intelligence plays a crucial role in this transformation by enabling retailers to track customer interactions and preferences across channels. For example, location data can help retailers optimize delivery routes, manage stock levels based on foot traffic patterns, and implement targeted promotions based on the geographic location of their customers.

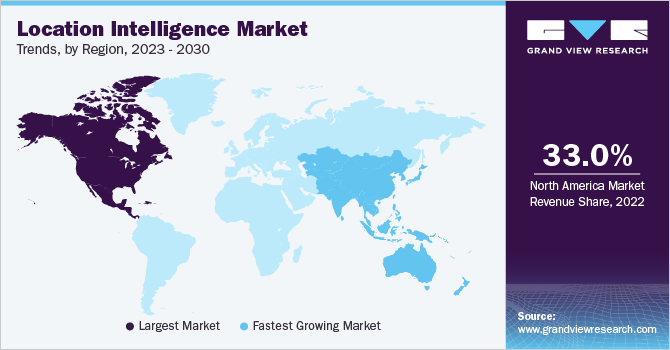

Regional Insights

The location intelligence market in North America held a share of over 32.0% in 2024 owing to the growing integration of the Internet of Things (IoT) and edge computing. Businesses are investing in IoT devices to gather real-time location data from various sources, enabling them to enhance operational efficiency and improve decision-making. Edge computing allows for the processing of data closer to the source, reducing latency and enabling faster responses to location-based insights.

U.S. Location Intelligence Trends

The location intelligence market in the U.S. is expected to grow significantly at a CAGR of 14.7% from 2025 to 2030 driven by the integration of artificial intelligence (AI) and machine learning (ML) into location-based analytics. These technologies enable businesses to analyze vast amounts of location data more effectively, uncovering patterns and trends that were previously difficult to identify. By leveraging AI and ML, companies can enhance predictive analytics capabilities, allowing for more accurate demand forecasting, personalized marketing, and improved operational efficiencies. This integration is particularly valuable in sectors like retail, where understanding customer behavior can lead to more tailored shopping experiences.

Europe Location Intelligence Trends

The location intelligence market in Europe is growing with a significant CAGR from 2025 to 2030. European consumers and businesses are placing a strong emphasis on sustainability and environmental responsibility. Location intelligence solutions are being employed to support green initiatives, such as optimizing supply chains, reducing transportation emissions, and improving resource management. Companies are using location data to identify more sustainable logistics routes and make informed decisions about site selection, contributing to broader sustainability goals.

The UK location intelligence market is expected to grow rapidly in the coming years.The use of Geographic Information Systems (GIS) is gaining traction across various industries in the U.K., particularly in retail, transportation, and urban planning. Businesses are leveraging GIS technology to analyze spatial data, visualize trends, and make data-driven decisions. For instance, retailers are utilizing GIS to identify optimal store locations based on demographic and geographic data, ensuring they target the right audience effectively.

Location intelligence market in Germany held a substantial market share in 2024 owing to the growing adoption of Industry 4.0 and smart manufacturing across various sectors, including logistics, transportation, and retail. Businesses are leveraging location data to optimize supply chains, improve asset management, and enhance operational efficiency. The trend is supported by the integration of IoT devices, which provide real-time location tracking and data analytics capabilities.

Asia Pacific Location Intelligence Trends

Asia Pacific is growing significantly at a CAGR of 19.0% from 2025 to 2030. The rapid growth of e-commerce, particularly accelerated by the COVID-19 pandemic, has led to a heightened demand for location intelligence in retail. Retailers in the Asia Pacific region are increasingly adopting omnichannel strategies to provide seamless shopping experiences across online and offline platforms. Location intelligence allows retailers to analyze customer interactions and optimize inventory management, delivery logistics, and targeted marketing campaigns, contributing to enhanced customer engagement and satisfaction.

The Japan location intelligence market is expected to grow rapidly in the coming years. Japan is heavily investing in smart city projects, leveraging location intelligence to enhance urban planning and improve public services. Cities like Tokyo and Osaka are integrating geospatial data with IoT technologies to optimize traffic management, energy consumption, and waste management. These initiatives aim to create more efficient urban environments and improve the quality of life for residents.

Location intelligence market in China held a substantial market share in 2024. The integration of AI and big data analytics with location intelligence is a significant trend in China. Companies are harnessing vast amounts of location data generated by mobile devices, IoT devices, and other sources to derive actionable insights. AI algorithms can analyze this data to predict consumer behavior, optimize logistics, and enhance decision-making processes.

Key Location Intelligence Company Insights

Key players operating in the Location Intelligence market IBM Corporation, Microsoft, Qualcomm Technologies, Inc.,LocationIQ, Trimble, Inc., and Foursquare. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In October 2024, Qualcomm Technologies, Inc. and Sensitech, a U.S.-based subsidiary of Carrier Global Corporation partnered with to enhance real-time monitoring solutions for the cold chain industry. This strategic collaboration aims to combine the expertise of both companies to deliver innovative visibility and analytics solutions on a global scale. By leveraging advanced technologies, the partnership focuses on improving real-time monitoring, intelligence, and responsiveness within supply chains, ensuring faster connectivity, accuracy, and optimized energy consumption for devices. This initiative is part of their broader mission to create more connected, automated, and sustainable supply chains, ultimately ensuring that food and pharmaceuticals reach their destinations safely while reducing waste and contributing to a net-zero future.

-

In May 2024, MDA introduced an innovative vessel detection onboard processing system (VDOP) that aims to transform the dissemination of intelligence information at sea. This new direct satellite-to-ship service will be a crucial component of MDA CHORUS, providing defense and intelligence organizations worldwide with swift access to vital data and insights necessary for executing critical maritime defense and security missions. The VDOP will play a significant role in addressing urgent issues such as narcotics smuggling, piracy, illegal fishing, and human trafficking.

-

In November 2023, Esri is enhancing its strategic partnership with by integrating its spatial analytics capabilities with Microsoft Fabric. This collaboration aims to meet the increasing demand for spatial analytics by accelerating the time to insights and uncovering new patterns, trends, and connections using Esri’s ArcGIS software. With this integration, data will seamlessly flow across organizations, whether users are working in Microsoft OneLake, Microsoft Power BI, or their ArcGIS environment, enabling more comprehensive analysis and decision-making.

Key Location Intelligence Companies:

The following are the leading companies in the location intelligence market. These companies collectively hold the largest market share and dictate industry trends.

- Autodesk, Inc.

- Bosch Software Innovations GmbH

- Comp11

- ESRI

- Foursquare.

- HERE Technologies

- IBM Corporation

- LocationIQ

- MDA

- Microsoft

- Pitney Bowes, Inc.

- Qualcomm Technologies, Inc.

- Supermap Software Co., Ltd.

- Tibco Software, Inc.

- Trimble, Inc.

- Wireless Logic

Location Intelligence Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 24.70 billion

Revenue forecast in 2030

USD 53.62 billion

Growth rate

CAGR of 16.8% from 2025 to 2030

Historical data

2018 - 2023

Base year for estimation

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report component

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, location type, deployment, application, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico U.K.; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; and South Africa

Key companies profiled

Autodesk; Inc.; Bosch Software Innovations GmbH; ESRI; Foursquare.; HERE Technologies; IBM Corporation; LocationIQ; MDA; Microsoft; Pitney Bowes, Inc.; Qualcomm Technologies, Inc.; Supermap Software Co., Ltd.; Tibco Software, Inc.; Trimble, Inc.; Wireless Logic

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Location Intelligence Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the location intelligence market report based on component, location type, deployment, application, vertical, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Service

-

Consulting

-

System Integration

-

Others

-

-

-

Location Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Indoor

-

Outdoor

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Workforce Management

-

Asset Management

-

Facility Management

-

Risk Management

-

Remote Monitoring

-

Sales and Marketing Optimization

-

Customer management

-

Others

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail and Consumer goods

-

Government and Defence

-

Manufacturing and Industrial

-

Transportation and Logistics

-

BFSI

-

IT & Telecom

-

Utilities & Energy

-

Media & Entertainment

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global location intelligence market size was estimated at USD 21.21 billion in 2024 and is expected to reach USD 24.70 billion in 2025.

b. The global location intelligence market is expected to grow at a compound annual growth rate of 16.8% from 2025 to 2030 to reach USD 53.62 billion by 2030.

b. The location intelligence market in North America held a share of over 32.0% in 2024 owing to the growing integration of the Internet of Things (IoT) and edge computing. Businesses are investing in IoT devices to gather real-time location data from various sources, enabling them to enhance operational efficiency and improve decision-making.

b. Some key players operating in the location intelligence market include Autodesk, Inc.; Bosch Software Innovations GmbH; ESRI; Foursquare.; HERE Technologies; IBM Corporation; LocationIQ; MDA; Microsoft; Pitney Bowes, Inc.; Qualcomm Technologies, Inc.; Supermap Software Co., Ltd.; Tibco Software, Inc.; Trimble, Inc.; Wireless Logic

b. Key factors driving the location intelligence market growth include the increasing penetration of smart devices and rising investments in IoT and network services, which enable smarter applications and enhance network connectivity.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.